Economic policy of Donald Trump

| ||

|---|---|---|

|

Incumbent Controversies involving Russia Business and personal  |

||

The economic policies of Donald Trump, which were outlined in his campaign pledges, include trade protectionism, immigration reduction, individual and corporate tax reform, the dismantling of the Dodd–Frank Wall Street Reform and Consumer Protection Act,[1][2] and the repeal of the Patient Protection and Affordable Care Act ("Obamacare").[3]

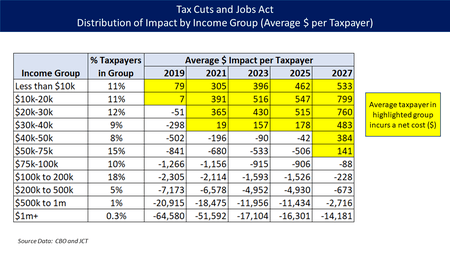

Bills to repeal and replace the Affordable Care Act ("Obamacare") did not pass Congress in mid-2017. However, Trump's tax reform plan was signed into law in December 2017, which included substantial tax cuts for higher income taxpayers and corporations as well as repeal of a key Obamacare element, the individual mandate. The Joint Committee on Taxation (JCT) reported that the new tax law would slightly increase the size of the economy (level of GDP, not growth rate) by 0.7% total over a decade.[4] The Congressional Budget Office (CBO) estimated in April 2018 that implementing the Tax Act would add an estimated $2.289 trillion to the national debt over ten years,[5] or about $1.891 trillion ($15,000 per household) after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt. Debt held by the public as a percentage of GDP would rise from around 77% GDP in 2017 to as much as 105% GDP by 2028.[6]

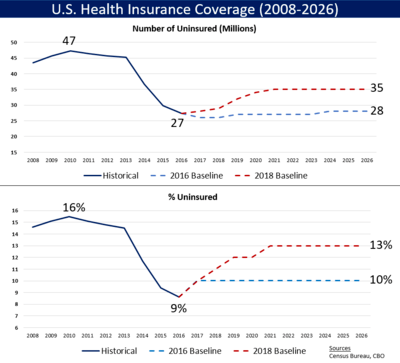

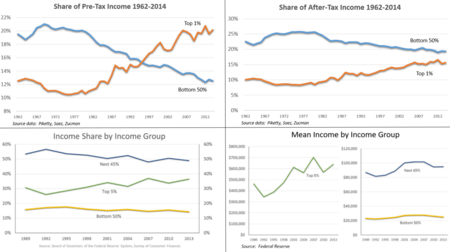

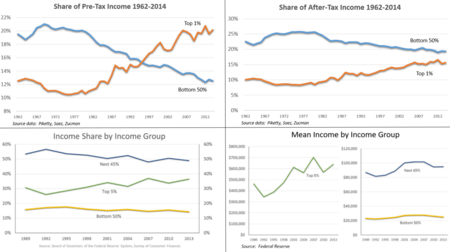

The CBO reported that lower-income groups would incur net costs under the tax plan, either paying higher taxes or receiving fewer government benefits: those under $20,000 by 2019; those under $40,000 from 2021–2025; and those under $75,000 in 2027 and beyond. Up to 13 million fewer persons would be covered by health insurance relative to prior law, due to repealing the individual mandate to have health insurance.[7] As a result, critics argued the tax bill unfairly benefited higher-income taxpayers and corporations at the expense of lower-income taxpayers, and therefore would significantly increase income inequality.[8][9][10][11][12]

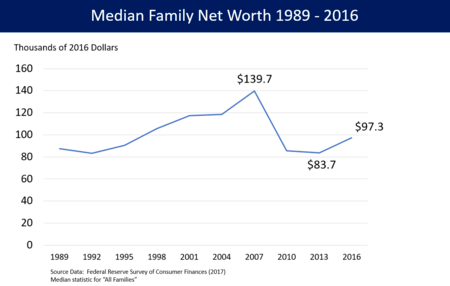

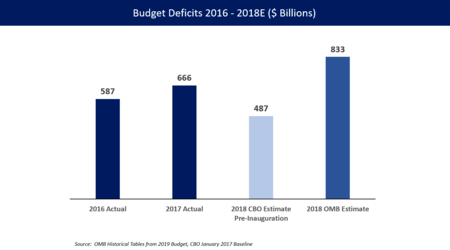

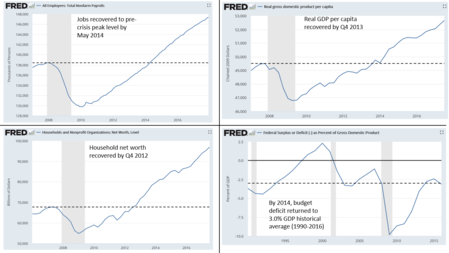

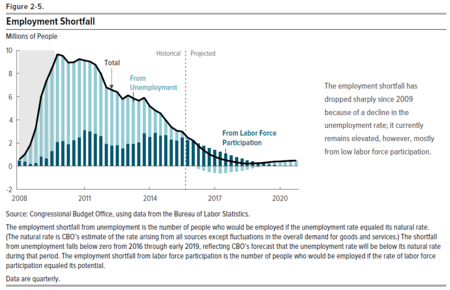

President Trump's 2017 economic results were mixed, with some variables improving and others worsening relative to recent years. Real gross domestic product, a measure of both production and income, grew by 2.3% in 2017, vs. 1.5% in 2016 and 2.9% in 2015.[13][14] Job creation averaged 182,000/month in 2017, which was the lowest level since 2013.[15] The unemployment rate declined for the eighth straight year[16] and labor force participation among prime-aged workers (age 25–54) increased for the fourth straight year.[17] The average real working-class hourly wage grew at the slowest pace since 2012.[18] The budget deficit increased from $587 billion in 2016 to $665 billion in 2017, an increase of $78 billion or 12%, the highest level since 2013.[19] The trade deficit increased 12.6% in calendar year 2017, resulting in the largest trade gap since 2008.[20] The Census Bureau reported that the number of uninsured persons rose from 27.3 million in 2016 to 28.0 million in 2017. The uninsured rate rose from 8.6% in 2016 to 8.7% in 2017. This was the first increase in the number and rate of uninsured since 2010.[21] After-tax corporate profits declined 6.0% in 2017.[22] Following four consecutive years of declines, gasoline prices increased in 2017.[23]

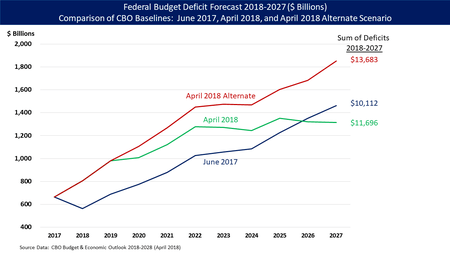

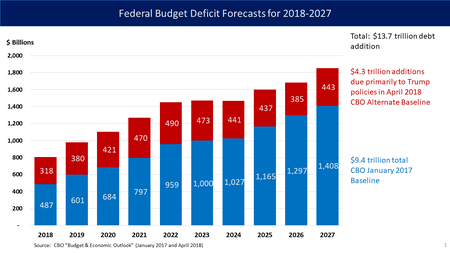

One July 2018 study indicated Trump's policies have had little impact on the U.S. economy in terms of GDP or employment.[24] For example, more jobs were created in President Obama's last 20 months (4.15 million) than in President Trump's first 20 months (3.80 million), through September 2018.[25][26] However, the fiscal year 2018 budget deficit was up $117 billion or 18% vs. 2017,[27] and the debt additions projected by CBO for the 2018-2027 period have increased from the $9.4 trillion that Trump inherited from Obama (January 2017 CBO baseline[28]) to $13.7 trillion (CBO current policy baseline[29]), a $4.3 trillion or 46% increase.

Economic strategy

The economic policy positions of United States President Donald Trump prior to his election had elements from across the political spectrum.[30] However, once in office his actions indicated a politically rightward shift towards more conservative economic policies.[31][32]

Prior to election, then-candidate Trump proposed sizable income tax cuts and deregulation consistent with conservative (Republican Party) policies, along with significant infrastructure investment and status-quo protection for entitlements for the elderly, typically considered liberal (Democratic Party) policies. His anti-globalization policies of trade protectionism and immigration reduction cross party lines.[30] This combination of policy positions from both parties could be considered "populist" and likely succeeded in converting some of the 2012 Obama voters who became Trump voters in 2016.[31]

Economists generally agree that the aging and retirement of "baby boomers" pose a challenge to strong economic growth in future years, relative to prior decades when boomers were entering and advancing in the labor force. As boomers exit the labor force, new workers need to enter the labor force to replace them in order to maintain and grow the economic output of prior decades. Many economists see immigration as a key to providing such new workers, suggesting that Trump's immigration reduction policies run counter to his promises of robust economic growth.[33][34][35]

President Trump's 2018 United States federal budget was a statement of his administration's economic priorities for the following decade and indicated a rightward shift relative to the January 2017 current law baseline:

- Republican agenda elements: Nearly $2 trillion in healthcare spending reductions (primarily from Medicaid, a program for lower-income persons), about $1.5 trillion in non-defense discretionary spending cuts, and about $1 trillion in corporate and income tax cuts (mainly benefiting upper-income persons), representing a net deficit reduction of $2.5 trillion.

- Democratic agenda elements: A net reduction in defense spending of $300 billion, and about $200 billion more for infrastructure, for a net deficit reduction of $100 billion.[36]

President Trump's efforts to repeal the Affordable Care Act (ACA) did not pass a Republican-controlled Senate during the summer of 2017, although they did pass the more conservative House of Representatives. The proposals were highly unpopular, as they were expected to reduce insurance coverage and increase insurance premium costs on the ACA exchanges.[37] However, a variety of efforts to hinder the implementation of the ACA were implemented through executive order or by other means.[38] These actions also were expected to reduce coverage and increase costs relative to the current law baseline.[39] These efforts were mainly an appeal to the conservative Republican base, which favors repealing and replacing the ACA.[37]

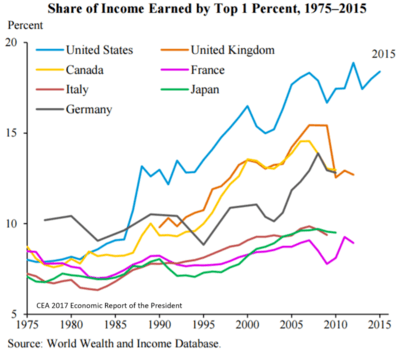

President Trump's comprehensive tax reform plan, the $1.5 trillion Tax Cuts and Jobs Act of 2017, was successfully passed by Congress and signed into law by President Trump on December 22, 2017. The tax reform package included across-the-board tax cuts for both individuals and businesses. U.S. corporations and pass-through businesses received significant tax relief. The new law also repealed the individual mandate of the ACA that imposed taxes on individuals who did not purchase health insurance, indirectly reducing subsidies to lower-income persons by an estimated $330 billion over a decade. This indicated a further rightward shift towards capital (business owners) and away from labor (workers). The Tax Policy Center estimated that the bottom 80% of taxpayers would receive approximately 35% of the benefit from the law initially and none of the benefit after 2027,[40] indicating it would significantly worsen income and wealth inequality.[41] At the time of its passage, this legislation was among the most unpopular of any tax bill since the 1980s—including the tax increases of 1990 and 1993.[42]

Journalist Matthew Yglesias wrote in December 2017 that while Trump campaigned as a populist, much of his post-election economic agenda has been consistent with far-right economic policy: "His decision to refashion himself in office as a down-the-line exponent of hard-right policies has been the key strategic decision of the Trump presidency." Yglesias hypothesized this was a bargain to reduce Congressional oversight of the executive branch.[31]

Health care reform efforts

Health care coverage and cost results

On January 15, 2017, president-elect Trump said he was nearing completion of a new health insurance program to replace Obamacare, stating, "We're going to have insurance for everybody."[44] One year later, Gallup reported that the percentage of uninsured adults rose from a record low of 10.9% in Q4 2016 to 12.2% in Q4 2017; the 1.3 percentage point increase represented 3.2 million more Americans without insurance.[45] Combining the Kaiser Family Foundation estimate of 28 million uninsured in 2016 with the 3.2 million increase in the Gallup poll would indicate there were about 31 million without insurance in Q4 2017.[46] The Washington Post cited research indicating that 3.2 million more uninsured represents 4,000 avoidable deaths.[47]

The New York Times reported in December 2017 that about 8.8 million persons signed up for ACA coverage via the marketplace exchanges for the 2018 policy period, roughly 96% of the 9.2 million who signed-up for the 2017 policy period. An estimated 2.4 million were new customers and 6.4 million returned. These figures represent the national Healthcare.gov exchanges in 39 states and not 11 states that operate their own exchanges and also reported strong enrollment. The enrollment numbers "essentially defied President Trump's assertion that 'Obamacare is imploding'".[48]

About 80% of persons who buy insurance through the marketplaces qualify for subsidies to help pay premiums. The Trump Administration reported in October 2017 that the average subsidy would rise to $555 per month in 2018, up 45% from 2017. This increase was due significantly to the actions it took to hinder ACA implementation.[48] Prior to Trump taking office, several insurance companies estimated there would be a 10% increase in premiums and related subsidies for 2017.[39]

Gains in healthcare coverage under President Obama began to reverse under President Trump. The Census Bureau reported that the number of uninsured persons rose from 27.3 million in 2016 to 28.0 million in 2017. The uninsured rate rose from 8.6% in 2016 to 8.7% in 2017. This was the first increase in the number and rate of uninsured since 2010.[21] Further, the Commonwealth Fund estimated in May 2018 that the number of uninsured increased by 4 million from early 2016 to early 2018. The rate of those uninsured increased from 12.7% in 2016 to 15.5%. This was due to two factors: 1) Not addressing specific weaknesses in the ACA; and 2) Actions by the Trump administration that exacerbated those weaknesses. The impact was greater among lower-income adults, who had a higher uninsured rate than higher-income adults. Regionally, the South and West had higher uninsured rates than the North and East. Further, those 18 states that have not expanded Medicaid had a higher uninsured rate than those that did.[49]

Legislation

President Trump advocated repealing and replacing the Affordable Care Act (ACA or "Obamacare"). The Republican-controlled House passed the American Health Care Act (AHCA) in May 2017, handing it to the Senate, which decided to write its own version of the bill rather than voting on the AHCA.[50] The Senate bill, called the "Better Care Reconciliation Act of 2017" (BCRA), failed on a vote of 45–55 in the Senate during July 2017. Other variations also failed to gather the required support, facing unanimous Democratic Party opposition and some Republican opposition.[51] The Congressional Budget Office estimated that the bills would increase the number of uninsured by over 20 million persons while reducing the budget deficit marginally.[52]

Actions to hinder implementation of ACA

President Trump continued Republican attacks on the ACA while in office, according to the New York Times,[38] including steps such as:

- Weakening the individual mandate through his first executive order, which resulted in limiting enforcement of mandate penalties by the IRS. For example, tax returns without indications of health insurance ("silent returns") will still be processed, overriding instructions from the Obama administration to the IRS to reject them.[53]

- Reducing funding for advertising for the 2017 and 2018 exchange enrollment periods by up to 90%, with other reductions to support resources used to answer questions and help people sign-up for coverage. This action could reduce ACA enrollment.[54]

- Cutting the enrollment period for 2018 by half, to 45 days. The NYT editorial board referred to this as part of a concerted "sabotage" effort.[55]

- Issuing public statements that the exchanges are unstable or in a death spiral.[56] CBO reported in May 2017 that the exchanges would remain stable under current law (ACA), but would be less stable if the AHCA were passed.[52]

Several insurers and actuary groups cited uncertainty created by President Trump, specifically non-enforcement of the individual mandate and not funding cost sharing reduction subsidies, as contributing 20–30 percentage points to premium increases for the 2018 plan year on the ACA exchanges. In other words, absent Trump's actions against the ACA, premium increases would have averaged 10% or less, rather than the estimated 28–40% under the uncertainty his actions created.[39] The Center on Budget and Policy Priorities (CBPP) maintains a timeline of many "sabotage" efforts by the Trump Administration.[57]

Ending cost-sharing reduction (CSR) payments

President Trump announced in October 2017 he would end the smaller of the two types of subsidies under the ACA, the cost-sharing reduction (CSR) subsidies. This controversial decision significantly raised premiums on the ACA exchanges (as much as 20 percentage points) along with the premium tax credit subsidies that rise with them, with the CBO estimating a $200 billion increase in the budget deficit over a decade.[58] CBO also estimated that initially up to one million fewer would have health insurance coverage, although more might have it in the long run as the subsidies expand. CBO expected the exchanges to remain stable (e.g., no "death spiral") as the premiums would increase and prices would stabilize at the higher (non-CSR) level.[59]

President Trump's argument that the CSR payments were a "bailout" for insurance companies and therefore should be stopped, actually results in the government paying more to insurance companies ($200B over a decade) due to increases in the premium tax credit subsidies. Journalist Sarah Kliff therefore described Trump's argument as "completely incoherent."[58]

Repeal of the ACA individual mandate

President Trump signed the Tax Cuts and Jobs Act into law in December 2017, which included the repeal of the individual mandate of the Affordable Care Act (ACA). This removed the requirement that all persons purchase health insurance or pay a penalty. The Congressional Budget Office estimated that up to 13 million fewer persons would be covered by health insurance by 2027 relative to prior law and insurance premiums on the exchanges would increase by about 10 percentage points. This is because removing the mandate encourages younger and typically healthier persons to opt out of health insurance on the ACA exchanges, increasing premiums for the remainder. The non-group insurance market (which includes the ACA exchanges) would continue to be stable (i.e., no "death spiral"). CBO estimated this would reduce government spending for healthcare subsidies to lower income persons by up to $338 billion in total during the 2018–2027 period compared to the prior law baseline.[60][61] Trump stated in an interview with The New York Times in December 2017: "I believe we can do health care in a bipartisan way, because we've essentially gutted and ended Obamacare."[62]

The CBO released an analysis on May 23, 2018 indicating that repeal of the individual mandate will increase the number of uninsured by 3 million and increase individual healthcare insurance premiums by 10% through 2019. The CBO projected that another 3 million would become uninsured over the following two years due to repeal of the mandate.[63]

On June 7, 2018 the Trump Justice Department notified a federal court that the ACA provisions that prohibit insurers from denying coverage or charging higher rates to people with pre-existing conditions were inextricably linked to the individual mandate and so must be struck down, hence the Department would no longer defend those provisions in court.[64] Polls have consistently shown that the pre-existing conditions provisions have been the most popular aspect of ACA.[65]

Federal budget deficit and debt

President Trump's policies have significantly increased the budget deficits and U.S. debt trajectory over the 2018-2027 time periods.

- President Trump's Office of Management and Budget estimated that the FY2018 budget deficit would be $890 billion, an increase of $225 billion (34%) versus the FY2017 deficit of $665 billion and an increase of $403 billion (83%) vs. the CBO January 2017 forecast for FY2018 of $487 billion at the start of the Trump Administration.[66]

- The debt additions projected by CBO for the 2018-2027 period have increased from the $9.4 trillion that Trump inherited from Obama (January 2017 CBO baseline[28]) to $13.7 trillion (CBO current policy baseline[29]), a $4.3 trillion or 46% increase.

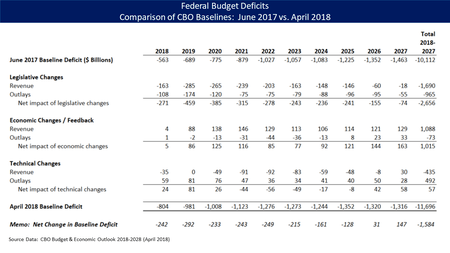

As a presidential candidate, Trump pledged to eliminate $19 trillion in federal debt in eight years.[67] Trump and his economic advisers initially pledged to radically decrease federal spending in order to reduce the country's budget deficit. A first estimate of $10.5 trillion in spending cuts over 10 years was reported on January 19, 2017,[68] although cuts of this size did not appear in Trump's 2018 budget. However, the CBO forecast in the April 2018 baseline for the 2018–2027 period includes much larger annual deficits than the January 2017 baseline he inherited from President Obama, due to the Tax Cuts and Jobs Act and other spending bills.[29]

Wells Fargo Economics reported in May 2018 that: "Despite stronger predicted economic growth in the short term, a combination of tax cuts and surging spending have led the budget deficit to widen as a share of GDP, with more deterioration expected over the next year or two. This pattern is historically unusual, as budget deficits typically expand during recession, gradually close during the recoveries and then begin widening again at the next onset of economic weakness."[69]

CBO baseline projections

In January 2017, the Congressional Budget Office reported its baseline budget projections for the 2017–2027 time periods, based on laws in place as of the end of the Obama administration. CBO forecasted that "debt held by the public" would increase from $14.2 trillion in 2016 to $24.9 trillion by 2027, an increase of $10.7 trillion. The sum of deficits (debt addition) for the 2018-2027 period would be $9.4 trillion. These increases are primarily driven by an aging population, which impacts the costs of Social Security and Medicare, along with interest on the debt.[28]

As President Trump introduces his budgetary policies, the impact can be measured against the January 2017 baseline. For example, the CBO April 2018 current law baseline included a debt increase of $11.7 trillion for 2018-2027, a $2.3 trillion increase ($18,200/household) versus the January 2017 baseline of $9.4 trillion, mainly due to the Tax Cuts and Jobs Act. The CBO April 2018 current policy or alternate baseline included a debt increase of $13.7 trillion for 2018-2027, a $4.3 trillion increase ($34,000/household) versus the January 2017 baseline. The current policy baseline assumes the tax cuts are extended beyond their scheduled expiration date. The per-household figures are computed using the 2017 figure of about 126.2 million households.[6]

CBO also estimated that if policies in place as of the end of the Obama administration continued over the following decade, real GDP would grow at approximately 2% per year, the unemployment rate would remain around 5%, inflation would remain around 2%, and interest rates would rise moderately.[28] President Trump's economic policies can also be measured against this baseline.

CBO scoring of the 2018 budget

A budget document is a statement of goals and priorities, but requires separate legislation to achieve them. As of January 2018, the Tax Cuts and Jobs Act was the primary legislation passed that moved the budget closer to the priorities set by Trump.

Trump released his first budget, for FY2018, on May 23, 2017. It proposed unprecedented spending reductions across most of the federal government, totaling $4.5 trillion over ten years,[70] including a 33% cut for the State Department, 31% for the EPA, 21% each for the Agriculture Department and Labor Department, and 18% for the Department of Health and Human Services, with single-digit increases for the Department of Veterans Affairs, Department of Homeland Security and the Defense Department.[71] The Republican-controlled Congress promptly rejected the proposal.[72] Instead, Congress pursued an alternative FY2018 budget[73] linked to their tax reform agenda; this budget was adopted in late 2017, after the 2018 fiscal year had begun.[74] The budget agreement included a resolution specifically providing for $1.5 trillion in new budget deficits over ten years to accommodate the Tax Cuts and Jobs Act that would be enacted weeks later.[75] Trump released his second budget, for FY2019, on February 23, 2018; it also proposed major spending reductions, totaling $3 trillion over ten years, across most of the federal government.[76] This budget was also largely ignored by the Republican-controlled Congress.[70] One month later, Trump signed a $1.3 trillion bipartisan, omnibus spending bill to fund the government through the end of FY2018, hours after he had threatened to veto it. The bill increased both defense and domestic expenditures, and Trump was sharply criticized by his conservative supporters for signing it.[77][78] Trump then vowed, "I will never sign another bill like this again."[79]

The Congressional Budget Office reported its evaluation of President Trump's FY2018 budget on July 13, 2017, including its effects over the 2018–2027 period.

- Mandatory spending: The budget cuts mandatory spending by a net $2,033 billion (B) over the 2018–2027 period. This includes reduced spending of $1,891B for healthcare, mainly due to the proposed repeal and replacement of the Affordable Care Act (ACA/Obamacare); $238B in income security ("welfare"); and $100B in reduced subsidies for student loans. This savings would be partially offset by $200B in additional infrastructure investment.

- Discretionary spending: The budget cuts discretionary spending by a net $1,851 billion over the 2018–2027 period. This includes reduced spending of $752 billion for overseas contingency operations (defense spending in Afghanistan and other foreign countries), which is partially offset by other increases in defense spending of $448B, for a net defense cut of $304B. Other discretionary spending (cabinet departments) would be reduced by $1,548B.

- Revenues would be reduced by $1,000B, mainly by repealing the ACA, which had applied higher tax rates to the top 5% of income earners. Trump's budget proposal was not sufficiently specific to score other tax proposals; these were simply described as "deficit neutral" by the Administration.

- Deficits: CBO estimated that based on the policies in place as of the start of the Trump administration, the debt increase over the 2018–2027 period would be $10,112B. If all of President Trump's proposals were implemented, CBO estimated that the sum of the deficits (debt increases) for the 2018–2027 period would be reduced by $3,276B, resulting in $6,836B in total debt added over the period.

- CBO estimated that the debt held by the public, the major subset of the national debt, would rise from $14,168B (77.0% GDP) in 2016 to $22,337B (79.8% GDP) in 2027 under the President's budget, versus 91.2% GDP under the pre-Trump policy baseline.[36]

Actual results FY2017

Fiscal year 2017 (FY2017) ran from October 1, 2016 to September 30, 2017; President Trump was inaugurated in January 2017, so he began office in the fourth month of the fiscal year, which was budgeted by President Obama. In FY2017, the actual budget deficit was $666 billion, $80 billion more than FY2016. FY2017 revenues were up $48 billion (1%) vs. FY2016, while spending was up $128 billion (3%). The deficit was $107 billion more than the CBO January 2017 baseline forecast of $559 billion. The deficit increased to 3.5% GDP, up from 3.2% GDP in 2016 and 2.4% GDP in 2015.[80]

FY2018 results

Fiscal year 2018 (FY 2018) ran from October 1, 2017 through September 30, 2018. It was the first fiscal year budgeted by President Trump. The CBO reported on October 5, 2018 that the budget deficit rose from $665 billion in FY2017 to $782 billion in FY2018, an increase of $117 billion or 18%. Tax receipts increased 0.4%, while outlays increased 3.2%. The 2018 deficit was an estimated 3.9% of GDP, up from 3.5% GDP in 2017.[81]

During January 2017, just prior to President Trump's inauguration, CBO forecast that the FY 2018 budget deficit would be $487 billion if laws in place at that time remained in place. The $782 billion actual result represents a $295 billion or 61% increase versus that forecast.[29] This difference was mainly due to the Tax Cuts and Jobs Act, which took effect in 2018, and other spending legislation.[81]

Ten year forecasts 2018–2028

The CBO estimated the impact of Trump's tax cuts and separate spending legislation over the 2018–2028 period in their annual "Budget & Economic Outlook", released in April 2018:

- CBO forecasts a stronger economy over the 2018–2019 periods than do many outside economists, blunting some of the deficit impact of the tax cuts and spending increases.

- Real (inflation-adjusted) GDP, a key measure of economic growth, is expected to increase 3.3% in 2018 and 2.4% in 2019, versus 2.6% in 2017. It is projected to average 1.7% from 2020–2026 and 1.8% in 2027–2028. Over 2017–2027, real GDP is expected to grow 2.0% on average under the April 2018 baseline, versus 1.9% under the June 2017 baseline.

- The non-farm employment level would be about 1.1 million higher on average over the 2018–2028 period, about 0.7% level higher than the June 2017 baseline.

- The budget deficit in fiscal 2018 (which runs from October 1, 2017 to September 30, 2018, the first year budgeted by President Trump) is forecast to be $804 billion, an increase of $139 billion (21%) from the $665 billion in 2017 and up $242 billion (39%) over the previous baseline forecast (June 2017) of $580 billion for 2018. The June 2017 forecast was essentially the budget trajectory inherited from President Obama; it was prepared prior to the Tax Act and other spending increases under President Trump.

- For the 2018–2027 period, CBO projects the sum of the annual deficits (i.e., debt increase) to be $11.7 trillion, an increase of $1.6 trillion (16%) over the previous baseline (June 2017) forecast of $10.1 trillion.

- The $1.6 trillion debt increase includes three main elements: 1) $1.7 trillion less in revenues due to the tax cuts; 2) $1.0 trillion more in spending; and 3) Partially offsetting incremental revenue of $1.1 trillion due to higher economic growth than previously forecast. The $1.6 trillion figure is approximately $12,700 per family or $4,900 per person total.

- Debt held by the public is expected to rise from 78% of GDP ($16 trillion) at the end of 2018 to 96% GDP ($29 trillion) by 2028. That would be the highest level since the end of World War Two.

- CBO estimated under an alternative scenario (in which policies in place as of April 2018 are maintained beyond scheduled initiation or expiration) that deficits would be considerably higher, rising by $13.7 trillion over the 2018–2027 period, an increase of $3.6 trillion (36%) over the June 2017 baseline forecast. Maintaining current policies for example would include extending the individual Trump tax cuts past their scheduled expiration in 2025, among other changes. The $3.6 trillion figure is approximately $28,500 per household or $11,000 per person total.[29]

The Committee for a Responsible Federal Budget (CRFB) estimated that the legislation passed by the Donald Trump Administration would add significantly to the national debt over the 2018–2028 window, relative to a baseline without that legislation:

- Debt held by the public in 2028 would increase from $27.0 trillion to $29.4 trillion, an increase of $2.4 trillion.

- Debt held by the public as a percent of GDP in 2028 would increase from 93% GDP to 101% GDP.

- Deficits would begin to exceed $1 trillion each year starting with 2019, reaching $1.7 trillion by 2028.

- Deficits would rise from 3.5% GDP in 2017 to 5.3% GDP in 2019 and 5.7% GDP by 2028.

- Under an alternate scenario where the Trump tax cuts for individuals are extended (among other assumptions), the debt would reach $33.0 trillion or 113% GDP in 2028.[82]

Federal corporate income tax receipts

Federal corporate tax receipts fell from an annualized level of $409 billion in Q1 2017 to $269 billion in Q1 2018, a direct result of the Trump tax cuts.[83][84]

Taxation

2017 proposal

In late September 2017, the Trump administration proposed a tax overhaul. The proposal would reduce the corporate tax rate to 20% (from 35%) and eliminate the estate tax. On individual tax returns it would change the number of tax brackets from seven to three, with tax rates of 12%, 25%, and 35%; apply a 25% tax rate to business income reported on a personal tax return; eliminate the alternative minimum tax; eliminate personal exemptions; double the standard deduction; and eliminate many itemized deductions (specifically retaining the deductions for mortgage interest and charitable contributions).[87][88] It is unclear from the details offered whether a middle-class couple with children would see tax increase or tax decrease.[89]

In October 2017 the Republican-controlled Senate and House passed a resolution to provide for $1.5 trillion in deficits over ten years to enable enactment of the Trump tax cut. As Reuters reported:[90]

Republicans are traditionally opposed to letting the deficit grow. But in a stark reversal of that stance, the party's budget resolution, previously passed by the Senate, called for adding up to $1.5 trillion to federal deficits over the next decade to pay for the tax cuts.

In December 2017, the Trump Treasury Department released a one-page summary of the nearly 500-page Senate tax bill that suggested the tax cut would more than pay for itself, based on an assumption of higher economic growth than any independent analysis had forecast.[91] Every detailed, independent analysis found that the enacted tax cut would increase budget deficits.[92]

The House passed its version of the Trump tax plan on November 16, 2017, and the Senate passed its version on December 2, 2017. Important differences between the bills were reconciled by a conference committee on December 15, 2017.[93] The President signed the bill into law on December 22, 2017.[94]

Major elements of the new tax law include reducing tax rates for businesses and individuals; a personal tax simplification by increasing the standard deduction and family tax credits, but eliminating personal exemptions and making it less beneficial to itemize deductions; limiting deductions for state and local income taxes (SALT) and property taxes; further limiting the mortgage interest deduction; reducing the alternative minimum tax for individuals and eliminating it for corporations; reducing the number of estates impacted by the estate tax; and repealing the individual mandate of the Affordable Care Act (ACA).[95]

Just prior to signing the bill, Trump asserted the new tax law might generate GDP growth as high as 6%.[96]

On numerous occasions, Trump has falsely asserted the tax cut was the largest in history.[97][98][99][100][101]

Impact on the economy, deficit and debt

The non-partisan Joint Committee on Taxation of the U.S. Congress published its macroeconomic analysis of the Senate version of the Act, on November 30, 2017:

- Gross domestic product would be 0.7% higher on average each year during the 2018–2027 period relative to the CBO baseline forecast, a cumulative total of $1,895 billion, due to an increase in labor supply and business investment. This is the level of GDP, not annual growth rate, so the economic impact is relatively minor.

- Employment would be about 0.6% higher each year during the 2018–2027 period than otherwise. The lower marginal tax rate on labor would provide "strong incentives for an increase in labor supply."

- Personal consumption, the largest component of GDP, would increase by 0.6%.[4]

The CBO estimated in April 2018 that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years,[5] or about $1.891 trillion ($15,000 per household) after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt.[6]

Both the CBO and the JCT economic models assumed positive GDP growth in each year of their 10-year projections, thereby excluding any effect of recessions that typically cause federal tax receipts to decline, resulting in higher deficits.[102]

As Trump celebrated the six-month anniversary of the tax cut on June 29, 2018, National Economic Council director Larry Kudlow asserted that the tax cut was generating such growth that "it's throwing off enormous amount[s] of new tax revenues" and "the deficit, which was one of the other criticisms, is coming down—and it's coming down rapidly." Both assertions were incorrect. Since the tax cut was enacted, federal tax receipts increased 1.9% on a year-on-year basis, while they increased 4.0% during the comparable period in 2017. By the same method, the federal budget deficit increased 37.8% while it increased 16.4% during the comparable period in 2017. Kevin Hassett, chairman of Trump's Council of Economic Advisers, noted days earlier that the deficit was "skyrocketing," which is consistent with the analysis of every reputable budget analyst.[103][104] Kudlow later asserted he was referring to future deficits, although every credible budget forecast indicates increasing deficits in coming years, made worse by the Trump tax cut if not offset by major spending cuts. Barring such spending cuts, the CBO projected the tax cut would add $1.27 trillion in deficits over the next decade, even after considering any economic growth the tax cut might generate.[105]

Distribution of benefits and costs

The distribution of impact from the final version of the Act by individual income group varies significantly based on the assumptions involved and point in time measured. In general, businesses and upper income groups will mostly benefit regardless, while lower income groups will see the initial benefits fade over time or be adversely impacted. CBO reported on December 21, 2017 that: "Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits (primarily stemming from reductions in spending) allocated to lower-income tax filing units and to increase deficits (primarily stemming from reductions in taxes) allocated to higher-income tax filing units."[7] For example:

- During 2019, incomes groups earning under $20,000 (about 23% of taxpayers) would contribute to deficit reduction (i.e., incur a cost), mainly by receiving fewer subsidies due to the repeal of the individual mandate of the Affordable Care Act. Other groups would contribute to deficit increases (i.e., receive a benefit), mainly due to tax cuts.

- During 2021, 2023, and 2025, income groups earning under $40,000 (about 43% of taxpayers) would contribute to deficit reduction, while income groups above $40,000 would contribute to deficit increases.

- During 2027, income groups earning under $75,000 (about 76% of taxpayers) would contribute to deficit reduction, while income groups above $75,000 would contribute to deficit increases.[7]

The Tax Policy Center (TPC) reported its distributional estimates for the Act on December 18, 2017. This analysis excludes the impact from repealing the ACA individual mandate, which would apply significant costs primarily to income groups below $40,000. It also assumes the Act is deficit financed and thus excludes the impact of any spending cuts used to finance the Act, which also would fall disproportionally on lower income families as a percentage of their income.[86]

- Compared to current law, 5% of taxpayers would pay more in 2018, 9% in 2025, and 53% in 2027.

- The top 1% of taxpayers (income over $732,800) would receive 8% of the benefit in 2018, 25% in 2025, and 83% in 2027.

- The top 5% (income over $307,900) would receive 43% of the benefit in 2018, 47% in 2025, and 99% in 2027.

- The top 20% (income over $149,400) would receive 65% of the benefit in 2018, 66% in 2025 and all of the benefit in 2027.

- The bottom 80% (income under $149,400) would receive 35% of the benefit in 2018, 34% in 2025 and none of the benefit in 2027, with some groups incurring costs.

- The third quintile (taxpayers in the 40th to 60th percentile with income between $48,600 and $86,100, a proxy for the "middle class") would receive 11% of the benefit in 2018 and 2025, but would incur a net cost in 2027.

The TPC also estimated the amount of the tax cut each group would receive, measured in 2017 dollars:

- Taxpayers in the second quintile (incomes between $25,000 and $48,600, the 20th to 40th percentile) would receive a tax cut averaging $380 in 2018 and $390 in 2025, but a tax increase averaging $40 in 2027.

- Taxpayers in the third quintile (incomes between $48,600 and $86,100, the 40th to 60th percentile) would receive a tax cut averaging $930 in 2018, $910 in 2025, but a tax increase of $20 in 2027.

- Taxpayers in the fourth quintile (incomes between $86,100 and $149,400, the 60th to 80th percentile) would receive a tax cut averaging $1,810 in 2018, $1,680 in 2025, and $30 in 2027.

- Taxpayers in the top 1% (income over $732,800) would receive a tax cut of $51,140 in 2018, $61,090 in 2025, and $20,660 in 2027.[86]

If the tax cuts are paid for

The scoring by the organizations above assumes the tax cuts are deficit-financed, meaning that over ten years the deficit rises by $1.4 trillion relative to the current law baseline; or $1.0 trillion after economic feedback effects. However, if one assumes the tax cuts are paid for by spending cuts, the distribution is much more unfavorable to lower- and middle-income persons, as most government spending is directed to them; the higher income taxpayers tend to get tax breaks, not direct payments. According to the Tax Policy Center, if the Senate bill were financed by a $1,210 per household cut in government spending per year (a more likely scenario than focusing cuts proportionally by income or income taxes paid), then during 2019:

- The bottom 72% would be worse off than current law, meaning benefits from tax cuts would be more than offset by reduced spending on their behalf.

- The bottom 60% of taxpayers would have lower after-tax income, paying a higher average federal tax rate.

- The benefits to the 60th to 80th percentiles would be minimal, a $350 net benefit on average or 0.3% lower effective tax rate.

- Significant tax benefits would only accrue to the top 20% of taxpayers.[106]

Republican politicians such as Paul Ryan have advocated for spending cuts to help finance the tax cuts, while the President Trump's 2018 budget includes $2.1 trillion in spending cuts over ten years to Medicaid, Affordable Care Act subsidies, food stamps, Social Security disability insurance, Supplemental security income, and cash welfare (TANF).[106]

Criticism

A FiveThirtyEight average of November 2017 surveys showed that 32% of voters approved of the legislation while 46% opposed it.[107] This made the 2017 tax plan less popular than any tax proposal since 1981, including the tax increases of 1990 and 1993.[107] Trump has claimed the tax cuts on the wealthy and corporations would be "paid for by growth", although 37 economists polled by the University of Chicago unanimously rejected the claim.[108] The Washington Post's fact-checker has found that Trump's claims that his economic proposal and tax plan would not benefit wealthy persons like himself are provably false.[109] The elimination of the estate tax (which only applies to inherited wealth greater than $11 million for a married couple) benefits only the heirs of the very rich (such as Trump's children), and there is a reduced tax rate for people who report business income on their individual returns (as Trump does).[110][89][111] If Trump's tax plan had been in place in 2005 (the one recent year in which his tax returns were leaked), he would have saved $31 million in taxes from the alternative minimum tax cut alone.[89] If the most recent estimate of the value of Trump's assets is correct, the repeal of the estate tax could save his family about $1.1 billion.[112]

Treasury Secretary Steven Mnuchin argued that the corporate income tax cut will benefit workers the most; however, the nonpartisan Joint Committee on Taxation and Congressional Budget Office estimate that owners of capital benefit vastly more than workers.[113]

Economist Paul Krugman summarized what he called ten lies modern Republicans and conservatives tell about their tax plans, many of which have been deployed in this case: "But the selling of tax cuts under Trump has taken things to a whole new level, both in terms of the brazenness of the lies and their sheer number." These range from "America is the most highly taxed country in the world" (the OECD reported the U.S. is in fact one of the lowest-taxed in the OECD) to "Cutting [corporate] profits taxes really benefits workers" (corporate tax cuts mainly benefit wealthy stockholders) to "Tax cuts won't increase the deficit" (they significantly increase the deficit). Krugman referred to a Tax Policy Center estimate that by 2027, the majority of the tax cut would go to the top 1%; but only 12% to the middle class.[114]

Economist and former Treasury Secretary Larry Summers referred to the analysis provided by the Trump administration of its tax proposal as "... some combination of dishonest, incompetent, and absurd." Summers continued that "... there is no peer-reviewed support for [the Administration's] central claim that cutting the corporate tax rate from 35 percent to 20 percent would raise wages by $4,000 per worker. The claim is absurd on its face."[115][116]

On the day Trump signed the tax bill, polls showed that 30% of Americans approved of the new law. While its popularity has increased somewhat since, through August 2018 a plurality of Americans still dislike the law.[117]

Despite every independent economic analysis concluding that the tax cut would increase deficits, a June 2018 survey found that 22% of Republicans agreed with that conclusion, while nearly 70% of Democrats agreed.[118]

Employment

Job creation

As a candidate in 2016, Trump promised to create 25 million new jobs over the next decade.[122] However, job creation has been somewhat slower under President Trump relative to the end of the Obama Administration.

- During Trump's first 20 months in office (through September 2018), 3.80 million jobs were created, versus 4.15 million in the last 20 months of the Obama administration.[119] This is an average of 190,000 jobs per month created under Trump versus 208,000 under Obama during those periods.[123]

- Job creation of 2.19 million (182,000 per month on average) during 2017 was below 2016 levels of 2.34 million (195,000 per month).[119]

- Discussing the economy on July 27, 2018, Trump stated, "We have added 3.7 million new jobs since the election, a number that is unthinkable if you go back to the campaign. Nobody would have said it." While this figure was accurate for the 19 months following the election, during the 19 months prior to the election, 3.9 million jobs were created.[124]

The Bureau of Labor Statistics (BLS) reported the number of jobs added or lost by industry group in 2017, some of which included: Professional and business services added 527,000 jobs (+2.6%), Education and Health Services added 438,000 (+1.9%), Construction added 210,000 (+3.1%), Manufacturing added 196,000 (+1.6%) and Mining and Logging added 59,000 (+8.8%).[125] The additions in Mining and Logging were primarily in "support activities for mining" while coal mining jobs, a focus during the Trump campaign, were essentially unchanged.[126]

An August 2018 analysis by the Associated Press found that during the year ended May, 58.5% of job creation was in counties that Trump did not carry in the 2016 election, similar to the results during the months prior to Trump's presidency. Over 35% of counties Trump carried showed job losses, compared to 19.2% of counties carried by Clinton.[127]

Other labor market variables

While job creation (non-farm payrolls) in 2017 was below 2013–2016 levels, other labor market variables continued to improve as the economy approached full employment:[119]

- The unemployment rate fell from 4.8% in January 2017 to 4.1% in December 2017, continuing the trend that began in 2009.[128]

- The labor force participation rate among prime-aged workers (aged 25–54) rose from 81.4% in December 2016 to 81.9% in December 2017,[129] marking the fourth consecutive year of increase.[130]

- The number of persons working part-time for economic reasons (i.e., would prefer to work full-time) declined from 5.8 million in January 2017 to 5.0 million in January 2018,[131] continuing a downward trend that began in 2010.[132]

The BLS reported a US unemployment rate of 3.8 percent in May 2018, the lowest it has been since April 2000.[133][134] During May 2018, black American and Asian American unemployment hit its lowest level since record-keeping began in 1972 and 2003, respectively.[135]

Wages

Trump ran on a campaign to improve wages for the working-class, and as president he falsely asserted on several occasions that wages were rising for the first time in as many as 22 years.[136][137][138][139][140] However, the average real (inflation-adjusted) hourly wage for private sector production and nonsupervisory workers (loosely, "working-class" workers) began steadily rising in November 2012, and that wage growth slowed under Trump compared to prior years, mainly due to increases in energy prices. Trump and Republicans have asserted that the corporate tax cut in the Tax Cuts and Jobs Act would cause employers to pass their tax savings on to workers in the form of wage increases, while critics predicted companies would spend most of the savings on stock repurchases and dividends to shareholders. Early evidence appeared to confirm the latter.[141][142][143]

For example, average hourly earnings (for all employees on private nonfarm payrolls) rose from $26.26 in June 2017 to $26.98 in June 2018, an increase of $0.72 or 2.74%.[144] However, inflation (CPI-U, for all items) rose 2.8% for the 12 months ending May 2018, indicating that workers' real (inflation-adjusted) hourly earnings were essentially unchanged over that mid-2017 to mid-2018 period.[145] Real wage growth turned negative in June 2018, as the inflation rate was higher than nominal wage growth, continuing into July.[120][146]

On September 5, 2018, Trump's top economist Kevin Hassett released new analysis indicating that real wage growth under Trump was higher than previously reported. However, the new analysis also showed that real wage growth under Trump was lower than in 2015 and 2016.[147]

A September 2018 analysis by Reuters found that wage growth over the year ended March 2018 substantially lagged the national average in the 220 counties that flipped from voting for Obama in 2012 to voting for Trump in 2016.[148]

Eighteen states increased their minimum wage effective January 1, 2018—including California, Florida, New York, New Jersey and Ohio—which the Economic Policy Institute estimated would provide $5 billion in additional wages to 4.5 million workers. The average increase over the 18 states was 4.4%.[149]

Labor protection

Prior to the election, Trump proposed "Seven actions to protect American workers" in his first 100 days through his Contract with the American Voter. As of April 2017 (after 100 days) he had fulfilled three of seven.[150] One other was partially fulfilled thereafter:

- Renegotiate NAFTA: Unfulfilled as of April 2018.

- Withdraw from Trans Pacific Partnership (TPP): Fulfilled by April 2017.

- Label China a currency manipulator: Unfulfilled as of April 2018.

- Direct study to identify foreign trading abuses: Fulfilled by April 2017 (study begun).

- Lift restrictions on $50 trillion worth of energy reserves: Unfulfilled as of April 2017. However, the Tax Cuts and Jobs Act will open additional land for development. In early January 2017, the Trump Administration also reversed an Obama ban on offshore drilling in a significant portion of U.S. coastal waters.[151]

- Lift restrictions on infrastructure projects (Keystone pipeline): Fulfilled by April 2017.

- Cancel payments to U.N. for climate change programs: Unfulfilled as of April 2017.[150] While the overall U.N. budget was cut for 2018–2019, this is routine and it was unclear how much the U.S. contribution would be reduced as of December 2017, despite confusing press releases from the Trump Administration.[152]

As part of the Contract with the American Voter, Trump also pledged to impose tariffs to discourage companies from laying off workers or relocating to other countries, through an "End the Offshoring Act". This was also unfulfilled as of December 2017.[150]

Economic growth

Annual

The BEA reported that real gross domestic product, a measure of both production and income, grew by 2.3% in 2017, vs. 1.5% in 2016 and 2.9% in 2015.[13] Real GDP per capita increased in 2017 for the eighth consecutive year, its fifth consecutive record high.[153]

Discussing the second quarter 2018 GDP report, Trump stated, "We're on track to hit the highest annual average growth rate in over 13 years."[154] The Federal Reserve median forecast for the full year 2018 was 2.8% with a range of 2.5% to 3.0% as of June 2018.[155] For historical comparison, real GDP grew 2.9% in 2015 and 3.5% in 2005, the last time growth exceeded 3.0% for a full year.[156]

CBO estimates real potential GDP, a measure of what the U.S. economy can sustainably produce at full employment. CBO forecast in April 2018 that from 2018-2027, real potential GDP growth would average 1.8%.[157] Amounts above this threshold for short periods may be driven by economic stimulus (debt additions) such as the Tax Cuts and Jobs Act or unusual events such as activity to avoid tariffs.[158]

Quarterly

Real GDP growth was 4.1% in Q2 2018 (later revised to 4.2%[160]) and 2.2% in Q1 2018.[161] The 4.1% level was the highest since the 4.9% level in Q3 2014. There were four quarters with 4.1% or higher growth during the Obama administration (Q4 2009, Q4 2011, Q2 2014 and Q3 2014).[162]

The 4.1% figure was boosted by net exports, which contributed 1.1 percentage points to the total due to higher exports to avoid retaliatory tariffs. Critics doubted the sustainability of this export boost.[163] This addition from net exports was much higher than the average 0.5 percentage point reduction in real GDP growth from net exports for the Q1 2014 to Q1 2018 periods.[164] Hypothetically, if the 0.5 average reduction due to net exports from recent periods were applied to Q2 2018 rather than the unusual 1.1 positive contribution, real GDP would have grown about 2.6%. The Committee for a Responsible Federal Budget estimated that of the 4.1% growth, legislation (tax cuts and additional spending) contributed 0.8% and Chinese pre-purchases of soybeans in anticipation of tariffs contributed 0.6%, meaning the "base" growth rate was 2.7%.[165]

CBO also estimated that GDP cumulatively would be 0.3% higher by the end of 2018 due to the Tax Cuts and Jobs Act.[6] A quarterly growth rate to generate a 0.3% higher cumulative total is about 0.07% per quarter, indicating the tax cuts contributed less than 0.1 percentage points to the real GDP growth rate in Q1 and Q2 2018.[166]

From 2009 through 2016, GDP growth exceeded 3% in eight quarters—including 4.6% and 5.2% in consecutive quarters of 2014[167]—yet it did not sustain 3% or more for any full calendar year.[168] Although GDP exceeded 3% in two consecutive quarters of 2017, the average growth was 2.4% through Trump's first five quarters in office.[169]

Commentary

National Economic Council director Larry Kudlow asserted on June 29, 2018, "they've been saying that all along, OK? We could never get to 3% growth ... It couldn't be done, they say. It's being done."[170] Trump made a similar remark the previous day.[171] However, analysts have actually said that 3% sustained growth was unlikely,[171][172][173][174] rather than periodic quarters of growth of 3% or more. The final figure for first quarter 2018 GDP growth was released the day before Kudlow spoke—coming in at 2.0%[175] (before later revision to 2.2%).

Trump falsely claimed on July 13, 2018 that "GDP since I've taken over has doubled and tripled."[176] Real GDP had grown a cumulative total of 3.1% from Q4 2016 through Q1 2018.[177]

Inflation

Trends in inflation rates over the 2016-2018 period vary depending on whether volatile food and energy prices are included in the measure:

- Inflation measured by the consumer price index for all items rose from 1.3% in 2016 to 2.1% in 2017 and 2.5% year-to-date (YTD) June 2018. This was mainly driven by higher energy prices.

- Core inflation, which excludes volatile food and energy prices, was relatively flat, at 2.2% in 2016, 1.8% in 2017, and 2.1% YTD June 2018.[178]

Energy

In May 2018 Trump ordered the Department of Energy to conduct unprecedented intervention in energy markets to protect the coal and nuclear industries from competitive market pressures.[179][180] Robert Powelson, whom Trump appointed to the Federal Energy Regulatory Commission, testified to the Senate Energy and Natural Resources Committee on June 12, 2018 that "unprecedented steps by the federal government – through the President's recent directive to the Department of Energy to subsidize certain resources – threaten to collapse the wholesale competitive markets that have long been a cornerstone of FERC policy. This intervention could potentially "blow up" the markets and result in significant rate increases without any corresponding reliability, resilience, or cybersecurity benefits."[181][182]

Infrastructure

On January 24, 2017, President Trump signed presidential memoranda to revive both the Keystone XL and Dakota Access pipelines. The memorandum is designed to expedite the environmental review process.[183]

On February 12, 2018, President Trump released his $1.5 trillion federal infrastructure plan during a meeting with several governors and mayors at The White House.[184] Congress showed little enthusiasm for the plan, with The Hill reporting, "President Trump's infrastructure plan appears to have crashed and burned in Congress."[185][186]

Trade

Trans-Pacific partnership

In a November 10, 2015 Republican debate, Trump stated the bi-partisan, 12-nation Trans-Pacific Partnership (TPP) was "a deal that was designed for China to come in, as they always do, through the back door and totally take advantage of everyone." Politifact rated this assertion "Pants On Fire,"[188] while the conservative Wall Street Journal editorial board wrote, "It wasn't obvious that [Trump] has any idea what's in [TPP]".[189] Trump stated similar rhetoric about TPP on June 26, 2016, which the Washington Post factchecker found to be incorrect.[190]

President Trump abandoned TPP during his first week in office through an executive order. This decision was a component of his "America First" strategy and signaled a change from long-term Republican orthodoxy, that expanding global trade was good for America and the world. The TPP was to create complex trade rules between 12 countries, to create an economic competitor to a rising China. The move was criticized as an opportunity for China to expand its influence in Asia.[191]

On April 13, 2018 US President Donald Trump said the United States may rejoin TPP.[192][193][194][195]

Transatlantic Trade and Investment Partnership

Upon taking office, Trump halted negotiations on the Transatlantic Trade and Investment Partnership (TTIP), which had been under way since 2013 during the Obama administration.[196][197] In May 2018, Trump initiated a trade conflict with the EU by imposing tariffs on steel and aluminum,[198] for which the EU retaliated in June with tariffs of their own,[199] with Trump threatening to escalate the conflict with additional tariffs.[200] In July 2018, Trump and the EU declared a truce of sorts, announcing they would enter into negotiations for an agreement similar to the TTIP.[197] In a Rose Garden appearance with European Commission president Jean-Claude Juncker, Trump touted the negotiations as "a new phase in the relationship between the United States and the European Union."[201]

Value of the dollar

In January 2018, Treasury Secretary Steven Mnuchin stated he welcomed a weaker dollar to encourage American exports.[202] The following day, Trump stated "The dollar is going to get stronger and stronger and ultimately I want to see a strong dollar."[203] After a three-month dollar rally,[204] on July 20, 2018 Trump tweeted "... the dollars gets stronger and stronger with each passing day - taking away our big competitive edge."[205]

The trade weighted dollar index measures the value of the dollar vs. several major foreign currencies. After trending generally upward since 2011 and reaching a near-record high in December 2016, the value of the dollar has since generally trended downward through April 2018, down 6.6% since Trump took office.[206][207]

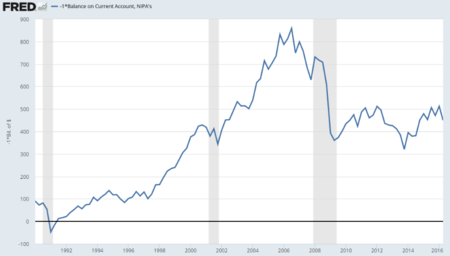

Trade deficit

According to the U.S. Census Bureau, the trade deficit during 2016 was $505 billion, with a $753 billion deficit in goods partially offset by a $248 billion surplus in services. The 2017 trade deficit was $566 billion, an increase of $61 billion or 11%, with a $810 billion deficit in goods partially offset by a $244 billion surplus in services.[208][209] The trade deficit continued to widen during the first half of 2018.[210][211]

The U.S. goods trade deficit with China rose from $347.0 billion in 2016 to $375.2 billion in 2017, an increase of $28.2 billion or 8%.[212]

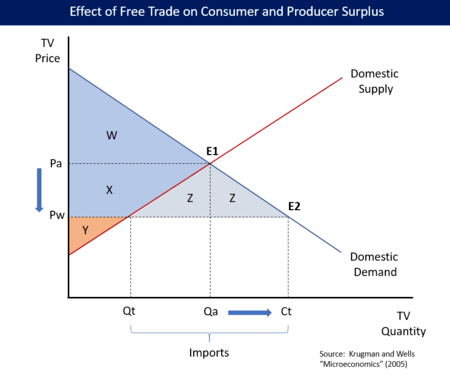

Trump's tax plan was criticized as likely increasing the trade deficit (i.e., imports greater than exports). In one sense, a trade deficit is a subtraction from GDP, so in theory a larger trade deficit offsets economic growth and reduces the number of jobs. However, increasing the budget deficit (as the tax bill does per CBO and JCT estimates) means increasing the trade deficit, other things equal, under the sectoral balance framework. One inconsistent argument made by the Administration for the tax cuts is that they would bring in a sizable amount of foreign capital (increasing the capital surplus and its mathematical offset, the trade deficit), which would be invested by corporations and drive increases in GDP. However, this inflow of capital would drive up the price of the dollar, hurting exports and thus raising the trade deficit and thus reducing GDP.[213]

Economists at the Federal Reserve Bank of St. Louis explained that a trade deficit is not necessarily bad for an economy. On the positive side, a trade deficit can mean: 1) Foreigners are net investors in your country's economy and production capacity; and 2) The economy is doing sufficiently well such that your citizens are importing more from abroad than they are exporting because local demand cannot meet supply.[214] On the negative side, if the inflow of foreign capital is used instead to bid up housing and financial asset prices (as was the case during the United States housing bubble that contributed to the Great Recession) then a trade deficit can be detrimental. In other words, it depends on how the inflow of foreign capital is used.[215]

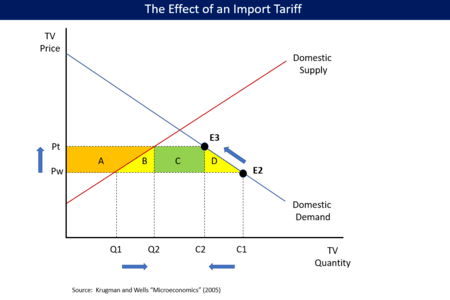

Tariffs

Steel and aluminum

On March 1, 2018, Trump announced plans to impose import tariffs of 25% on steel and 10% on aluminum during March 2018, although implementation dates and details were yet to be announced. His authority to impose these tariffs derived from a Commerce Department investigation that found imported metal threatened national security by "degrading the American industrial base." These tariffs would impact China, but would fall most heavily upon steel producing allies such as Brazil, Canada, Germany, Mexico and South Korea, and aluminum producers Canada, Russia and the United Arab Emirates. In response, Canada, the European Union and other exporters indicated they might be forced to retaliate in response. Peter Navarro, Trump's director of the National Trade Council, stated on March 2, "I don't believe any country is going to retaliate for the simple reason that we are the most lucrative and biggest market in the world."[218] Trump explained via Twitter than when the U.S. has a trade deficit with another country, "trade wars are good, and easy to win". Stocks of American automakers, which use these metals to construct its cars, went down, as theoretically the price of these inputs post-tariff would rise.[219] The Dow Jones Industrial Average dropped 500 points, about 2%, in response to the announcement.

Large steel consumers, such as U.S. car manufacturers, Ford, Chrysler and General Motors saw even larger drops in share prices.[220] On April 30, 2018, Trump announced that the steel and aluminum tariffs on American allies would be deferred.[221] One month later, the Administration implemented the tariffs on the European Union, Canada and Mexico. The EU, Canada and Mexico immediately announced they would retaliate.[222][223] Mexico retaliated on June 5, 2018 with tariffs ranging between 15% and 25% on $3 billion in American goods.[224] Canada also retaliated on June 29, 2018 by imposing tariffs ranging from 10% to 25% on $12.6 billion in American goods, effective July 1.[225] Through May 2018, American steel prices increased about 40% since the Trump administration announced its tariff plans the preceding March, while prices in Europe and China remained relatively stable.[226][227] By June 2018, the price for hot-rolled band, one of the most common types of steel, was 52% higher in America than in Western Europe and 73% higher than in China.[228]

The New York Times reported on August 5, 2018 that two major American steel companies with close ties to senior Trump administration officials had succeeded in blocking requests from 1,600 American manufacturing companies for waivers of the steel tariffs, compelling them to purchase more expensive American steel. Nucor had financed a documentary made by Peter Navarro, Trump's Director of the White House National Trade Council, and US Steel had previously been represented in legal matters by Trump's trade representative Robert Lighthizer and his deputy Jeffrey Gerrish. American steel prices at the time were about 60% higher than in the rest of the world, according to Whirlpool Corporation CEO Marc Bitzer.[229][230]

China

On March 22, 2018 Trump announced trade actions regarding China, including tariffs in the $50 billion range, initiation of a WTO dispute and investment restrictions.[231] The Dow Jones Industrial Average fell more than 700 points that day, nearly 3%, on concerns of a trade war.[232] Reuters reported days later that the tariffs might not be actually imposed until June 2018.[233] In response to these pending tariffs, China announced its intent to impose 25% tariffs against certain American products, notably on the $14 billion in soybeans it buys from America each year. Media reports indicated that China had already begun to cancel soybean orders from America[234] and buying them from other countries.[235] Chinese orders for pork and corn had also been canceled.[236] Soybean exporters, located primarily in states Trump won in 2016, expressed concerns about the situation as soybean prices fell to the lowest level since the Great Recession in 2009.[237][238][239] The Trump administration reportedly planned to provide a federal relief package to farmers totaling billions of dollars.[240] On May 29, 2018 the Trump administration announced it would proceed to implement the proposed tariffs within a month, although Commerce Secretary Wilbur Ross was scheduled to begin another round of negotiations in Beijing within days.[241] The Trump administration announced on June 15, 2018 that the tariffs would begin July 6, and China immediately announced it would retaliate and withdraw any proposals it had made in previous negotiations, which had included importing an additional $200 billion in American exports by 2020—including $70 billion in agricultural and energy products.[242][243]

The Washington Post reported on June 15 that China's threatened retaliatory tariffs were "targeted with laserlike precision at farmers, ranchers and certain manufacturing workers, as well as at the local economies of rural and small-town America," while The Wall Street Journal published similar findings on July 6.[244][245]

The New York Times reported on June 16, 2018 that fear of an impending trade war was disrupting global commerce, noting that "shipments are slowing at ports and airfreight terminals around the world. Prices for crucial raw materials are rising. At factories from Germany to Mexico, orders are being cut and investments delayed. American farmers are losing sales as trading partners hit back with duties of their own."[246] On June 18, 2018 Trump instructed his trade representative to identify an additional $200 billion in Chinese goods that would be hit with 10% tariffs if China did not back down from their retaliation threat, and threatened another $200 billion in tariffs if China retaliated to the new tariffs Trump announced that day.[247] Trump's proposed tariffs, if fully implemented, would cover nearly all of the $505 billion in products the United States imports from China.[248] Unlike previously-announced tariffs which were targeted almost entirely at intermediate goods purchased by businesses (which might absorb the new costs rather than pass them on to consumers) the newly-announced tariffs would directly target consumer goods.[249] The Trump administration implemented $34 billion in tariffs against China on July 6, which China immediately matched.[250] On July 10, 2018 the Trump administration announced a list[251] of $200 billion in Chinese products upon which tariffs would be imposed, subject to a two-month period for public comment and hearings.[252] Those tariffs were implemented on September 17, with China responding the next day with $60 billion in tariffs on 5.207 American goods, including farm goods, machinery and chemicals.[253][254]

The European Union announced on June 21, 2018 that it would retaliate with tariffs[255] targeted at Trump's political base, effective midnight that night.[256] India and Turkey also announced retaliatory tariffs that day.[257][258]

Trump responded to the EU's retaliation on June 22, 2018, threatening a 20% tariff on European cars.[259] American automakers and unions were nearly unanimous in their opposition to the proposal.[260] with General Motors stating the tariffs could lead to "less investment, fewer jobs and lower wages" for its employees and vehicle price increases of thousands of dollars.[261] The EU warned on June 29, 2018 that it would respond to Trump's tariffs on cars with tariffs on as much as $294 billion in American exports—19% of the total exports to the EU in 2017.[262][263]

During talks on June 25, 2018, trade representatives of China and the EU agreed they are united in opposition to Trump's tariffs, with China's Vice Premier Liu He saying "both sides believe that we must resolutely oppose unilateralism and trade protectionism and prevent such behavior from causing volatility and recession in the global economy." [264]

China announced on June 28, 2018 that effective July 1 it was reducing or eliminating tariffs on 8,549 products imported from five Asian nations, including chemicals, agricultural products, medical products, soybeans, clothing and steel & aluminum products. China's move would help to reduce the costs of such imports should a trade dispute with the United States escalate.[265][266] Edward Alden, a trade scholar at the Council on Foreign Relations, remarked "There's no question that China is preparing for a trade war," adding "These tariff cuts will also help to strengthen China's relations with its Asian neighbors, even as the United States has turned its back on the region economically, by walking away from the TPP."[267]

On July 1, 2018, as Trump continued threatening to impose tariffs on European cars, China cut its tariffs on imported cars from 25% to 15%. Although most foreign cars sold in China are assembled there, the tariff cut would primarily benefit German automakers that still export many cars to China, while Chinese imports of General Motors and Ford vehicles are relatively insignificant. However, China was also preparing to impose a 25% tariff on cars imported from America on July 6. Because many of the sport-utility vehicles BMW and Mercedes export to China are made in American plants, the new tariff might induce those automakers to shift some production to non-American facilities, costing American jobs.[268][269] The United States Chamber of Commerce estimated that South Carolina—where BMW operates its largest plant in the world—exports $1.9 billion worth of cars to China annually, as well as another $1.1 billion in other exports to China that might be subject to tariffs. The BMW plant employs approximately 10,000 workers and has 235 American suppliers.[270] The Chamber also found that Tennessee exports totaling $1.4 billion could be at risk, including $202 million in auto exports. Trump handily won both states in the 2016 election.[271]

Other products

- On April 25, 2017, the Trump administration announced plans to impose duties of up to 24% on most Canadian lumber, charging that lumber companies are subsidized by the government. The duties are on the five firms: West Fraser Mills, Tolko Marketing and Sales, J. D. Irving, Canfor Corporation, and Resolute FP Canada. West Fraser Mills will pay the highest duty of 24%. The preliminary determination directs U.S. Customs and Border Protection to require cash deposits for the duties on all new imports as well as softwood products imported over the past 90 days. To remain in effect, however, the duties need to be finalized by Commerce and then confirmed by the U.S. International Trade Commission after an investigation that includes testimony from both sides. In response, the Canadian federal government indicated that it was exploring the possibility of banning United States coal from being exported through Canadian ports and imposing a retaliatory tariff on lumber exports from Oregon. Canada did not retaliate.

- In January 2018, news outlets announced that Trump had imposed tariffs on solar panels produced outside the United States.[272][273] China is currently the world leader in solar panel manufacture, and China has decried the tariffs.[274] Environmentalists and animal rights advocates have expressed concern that the new tariffs will hurt the growth of sustainable energy and the species which are on the endangered list due to climate change.[275]

- Trump also announced tariffs on imported washing machines in January 2018.[276] This benefited domestic producers such as Whirlpool Corporation, whose CEO Marc Bitzer remarked, "This is, without any doubt, a positive catalyst for Whirlpool." Six months later, Whirlpool slashed its 2018 earnings outlook due to a "very challenging cost environment," with Bitzer telling analysts "The global steel costs have risen substantially, and in particular, in the US, they have reached unexplainable levels" — 60% higher than the rest of the world, due to the steel tariffs imposed by the Trump administration. That same morning, Trump tweeted "Tariffs are the greatest!"[277]

- In January 2018, the Trump administration imposed a tariff specifically on one Canadian producer of newsprint, Catalyst Paper.[278] The tariff was imposed solely on the basis of a complaint by one American newsprint producer, North Pacific Paper Company, which is owned by a New York private equity firm, One Rock Capital Partners. The tariff had an immediate negative cost impact on American newspapers, many of which cut staff, reduced frequency of publication, or shut down entirely.[279] The United States International Trade Commission unanimously overturned the tariff on August 29, 2018.[280]

Commentary

The New York Times reported on June 7, 2018 that Trump's Council of Economic Advisors had concluded the president's tariffs strategy would hurt American economic growth.[281] On June 29, 2018, CEA chairman Kevin Hassett declined to confirm or deny the existence of such analysis, asserting executive privilege.[282] By June 22, both The Wall Street Journal and The New York Times were reporting that negative effects of the Trump tariffs policy had begun to ripple through the American economy.[283][284] Anecdotally, on June 22 a steel nail manufacturer in Butler County, Missouri reported losing about 50% of its sales in the two weeks after steel tariffs had been imposed, had begun layoffs and feared being out of business by Labor Day. The company—the remaining major nail producer in the country—is one of the largest employers in Butler County, where Trump won 79.2% of the 2016 vote.[285][286]

The Wall Street Journal reported on July 2, 2018:

The U.S. Farm Belt helped deliver Donald Trump to the White House, drawn to his promises to revive rural America and deregulate industry. Now, the president's global trade offensive is threatening the livelihoods of many farmers.

Mounting trade disputes, spurred by U.S. threats to withdraw from the North American Free Trade Agreement and tariffs on billions of dollars' worth of goods from key trading partners, have cut U.S. agricultural exports and sent commodity prices tumbling. Many farmers, who depend on shipments overseas for one-fifth of the goods they produce, say they are anxious, especially because they are already expecting bumper harvests or grappling with a dairy glut.

Farmers for Free Trade, an advocacy group, recently rolled out its third advertisement warning about the harmful consequences of trade fights for farmers. U.S. farm and agribusiness groups in June joined manufacturing, retail and technology organizations imploring Congress to step up oversight of the president's actions.[287]

On July 2, 2018, the United States Chamber of Commerce—which has historically supported conservative and Republican economic policies—announced a campaign to oppose Trump's trade tariff policies by publicizing the negative economic impacts on each state.[271]

On September 1, 2018, the National Taxpayers Union Foundation, the research arm of the conservative tax advocacy group National Taxpayers Union, published analysis showing that the Trump "trade taxes" implemented to date would exceed all the taxes in Obama's Affordable Care Act in 2019. The analysis also found that if proposed additional tariffs were implemented, the total tariffs would offset nearly half the 2019 benefits of Trump's 2017 tax cut.[288]

Congressional action

On July 11, 2018, the United States Senate approved by an 88-11 vote a non-binding resolution calling for Trump to seek congressional approval before invoking national security to impose tariffs, as he had done with steel and aluminum tariffs against Mexico, Canada and the EU.[289]

Economic impact

The Trump administration announced on July 24, 2018 that it would provide $12 billion in assistance to farmers hurt by Trump's tariffs.[290]

A running tally prepared by Bloomberg News indicated on August 6, 2018 that far more large, global companies were being harmed rather than helped by Trump's tariffs.[291]

The Wall Street Journal reported on August 7, 2018 that small businesses and start-ups were being especially hurt by the Trump tariffs because they lack the flexibility to absorb materials cost increases, raise prices for customers or shift production to other locations that larger businesses enjoy. The Journal's monthly survey of small businesses in July found the lowest confidence level since the 2016 election.[292]

Responses by specific companies

In response to the increased EU tariffs on American motorcycles, Harley-Davidson announced on June 25, 2018 that it was moving some production to foreign markets to avoid the higher tariffs.[293] Chad Bown, a senior fellow at the Peterson Institute for International Economics, noted that the reciprocal tariffs' "double whammy" effect of higher costs for raw materials and higher prices for their products in foreign markets might compel other American manufacturers to follow Harley-Davidson's lead and move production to less expensive markets.[294]

Foreign investment in United States

Shortly after being elected, Trump cited a handful of anecdotes to assert that foreign investment had begun pouring into America because of his election.[295][296] However, aggregate statistical data showed that foreign direct investment—the total flow of investment capital into the United States from the rest of the world—declined sharply during Trump's first six quarters in office, down 45% compared to the six quarters immediately preceding his presidency.[297]