Taxation in India

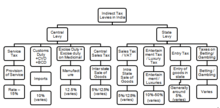

Taxes in India are levied by the Central Government and the state governments.[1] Some minor taxes are also levied by the local authorities such as the Municipality.[2]

The authority to levy a tax is derived from the Constitution of India which allocates the power to levy various taxes between the Central and the State. An important restriction on this power is Article 265 of the Constitution which states that "No tax shall be levied or collected except by the authority of law".[3] Therefore, each tax levied or collected has to be backed by an accompanying law, passed either by the Parliament or the State Legislature. In 2015-2016, the gross tax collection of the Centre amounted to ₹14.60 trillion (US$200 billion).[4]

History

India has abolished multiple taxes with passage of time and imposed new ones. Few of such taxes include inheritance tax,[5] interest tax, gift tax, wealth tax, etc. Wealth Tax Act, 1957 was repealed in the year 2015.[6]

Direct Taxes in India were governed by two major legislations, Income Tax Act, 1961 and Wealth Tax Act, 1957. A new legislation, Direct Taxes Code (DTC), was proposed to replace the two acts.[7] However, the Wealth Tax Act was repealed in 2015 and the idea of DTC was dropped.

Service tax

It is a tax levied on services provided in India, except the State of Jammu and Kashmir. The responsibility of collecting the tax lies with the Central Board of Excise and Customs(CBEC). From 2012, service tax is imposed on all services, except those which are specifically exempted under law(e.g. Exempt under Negative List, Exempt as exclusion from Service definition as per Service Tax, Exempt under MEN(Mega exemption notification)). In budget presented for 2008-2009, it was announced that all small service providers whose turnover does not exceed ₹10 lakh (US$14,000) need not pay service tax. Service tax at a rate of 14 percent(Inclusive of EC & SHEC) will be imposed on all applicable services from 1 June 2015.[8] From 15 November 2015, Swacch Bharat cess of 0.5% has been added to all taxable service leading the new Service Tax rate to be 14.5 percent (Inclusive of EC, SHEC & Swacch Bharat cess).[9] On 29 February 2016, Current Finance Minister Mr. Arun Jaitley announces a new Cess, Krishi Kalyan Cess that would be levied from 1 June 2016 at the rate of 0.5% on all taxable services. The purpose of introducing Krishi Kalyan Cess is to improve agriculture activities and welfare of Indian farmers. Thus, the new Service Tax rate would be 15% incorporating EC, SHEC, Swachh Bharat Cess and Krishi Kalyan Cess.[10]

From 2015 to currently, the gross tax collection of the Centre from service tax has amounted in excess of ₹2.10 trillion (US$29 billion).[11]

Central Excise

In 2015-2016, the gross tax collection of the Centre from excise amounted to ₹2.80 trillion (US$39 billion).[11]

- Central Excise Act, 1944, which imposes a duty of excise on goods manufactured or produced in India;

- Central Sales Tax, 1956, which imposes sales tax on goods sold in inter-state trade or commerce in Indisale of property situated within the state[12]

In the 2016 Union budget of India, an excise of duty of 1% without |date=4 March 2016 }}</ref> The government had earlier proposed an excise duty in the Budget 2011-12, which had to be rolled back after massive protests by jewellers.[13]

Constitutionally established scheme of taxation

Article 246[3] of the Indian Constitution, distributes legislative powers including taxation, between the Parliament of India and the State Legislature. Schedule VII enumerates these subject matters with the use of three lists:[3]

- List - I entailing the areas on which only the parliament is competent to make laws,

- List - II entailing the areas on which only the state legislature can make laws, and

- List - III listing the areas on which both the Parliament and the State Legislature can make laws upon concurrently.

Separate heads of taxation are no head of taxation in the Concurrent List (Union and the States have no concurrent power of taxation).[16] The list of thirteen Union heads of taxation and the list of nineteen State heads are given below:[16]

Central government of India

| SL. No. | Taxes as per Union List |

|---|---|

| 82 | Income tax:Taxes on income other than agricultural income. |

| 83 | Custom Duty: Duties of customs including export duties |

| 84 | Excise Duty: Duties of excise on the following goods manufactured or produced in India namely (a)Petroleum crude (b)high speed diesel (c)motor spirit (commonly known as petrol) (d)natural gas (e) aviation turbine fuel and (f)Tobacco and tobacco products |

| 85 | Corporation Tax |

| 86 | Taxes on capital value of assets, exclusive of agricultural land, of individuals and companies, taxes on capital of companies |

| 87 | Estate duty in respect of property other than agricultural land |

| 88 | Duties in respect of succession to property other than agricultural land |

| 89 | Terminal taxes on goods or passengers, carried by railway, sea or air; taxes on railway fares and freight. |

| 90 | Taxes other than stamp duties on transactions in stock exchanges and futures markets |

| 92A | Taxes on sale or purchase of goods other than newspapers, where such sale or purchase takes place in the course of inter-State trade or commerce |

| 92B | Taxes on the consignment of goods in the course of inter-State trade or commerce |

| 97 | All residuary types of taxes not listed in any of the three lists of Seventh Schedule of Indian Constitution |

State governments

| SL. No. | Taxes as per State List |

|---|---|

| 45 | Land revenue, including the assessment and collection of revenue, the maintenance of land records, survey for revenue purposes and records of rights, and alienation of revenues. |

| 46 | Taxes on agricultural income |

| 47 | Duties in respect of succession to agricultural land. |

| 48 | Estate Duty in respect of agricultural land |

| 49 | Taxes on lands and buildings. |

| 50 | Taxes on mineral rights. |

| 51 | Duties of excise for following goods manufactured or produced within the State (i) alcoholic liquors for human consumption, and (ii) opium, Indian hemp and other narcotic drugs and narcotics. |

| 53 | Electricity Duty:Taxes on the consumption or sale of electricity[18] |

| 54 | Taxes on sale of petroleum crude, high speed diesel, motor spirit (commonly known as petrol),Natural gas aviation turbine fuel and alcohol liquor for human consumption but not including sale in the course of inter state or commerce or sale in the source of international trade or commerce such goods. |

| 56 | Taxes on goods and passengers carried by roads or on inland waterways. |

| 57 | Taxes on vehicles suitable for use on roads. |

| 58 | Taxes on animals and boats. |

| 59 | Tolls. |

| 60 | Taxes on profession, trades, callings and employments. |

| 61 | Capitation taxes. |

| 62 | Taxes on entertainment and amusements to be extent levied and collected by a panchayat or Municipality or a regional council or a district council. |

| 63 | Stamp duty |

Income Tax

Income Tax is a tax imposed on individuals or entities (taxpayers) that varies with respective income or profits (taxable income). Income tax generally is computed as the product of a tax rate times taxable income. The tax collected by Income Tax Department for central government.

Goods and Services Tax

Goods and Services Tax is a indirect tax collected on supply of goods or service.

- Central Tax: Portion of Tax to central government on intra state sales.

- State Tax: Portion of Tax to state on intra state sales.

- Integrate Tax: tax for inter state sales.

Custom Duty

Custom Duty is a indirect tax for goods when import or export[19]. When import goods import from outside in the tax known as import custom duty. we goods export to outside India is known as export custom duty. The tax collected by Central Board of Indirect Taxes and Customs.

Local Body Taxes

"Local Body Tax", popularly known by its abbreviation as "LBT", is the tax imposed by the local civic bodies of India on the entry of goods into a local area for consumption, use or sale therein.[20] The tax is imposed based on the Entry 52 of the State List from the Schedule VII of the Constitution of India which reads; "Taxes on the entry of goods into a local area for consumption, use or sale therein."[21] The tax is to be paid by the trader to the civic bodies and the rules and regulations of these vary amongst different States in India. The LBT is now partially abolished as of 1 August 2015.[22]

Property Tax

Property tax, or 'house tax,' is a local tax on buildings, along with appurtenant land, and imposed on Possessor (certainly, not true custodian of property as per 1978, 44th amendment of constitution). It resembles the US-type wealth tax and differs from the excise-type UK rate. The tax power is vested in the states and it is delegated by law to the local bodies, specifying the valuation method, rate band, and collection procedures. The tax base is the annual rental value (ARV) or area-based rating. Owner-occupied and other properties not producing rent are assessed on cost and then converted into ARV by applying a percentage of cost, usually six percent. Vacant land is generally exempt. Central government properties are exempt. Instead a 'service charge' is permissible under executive order. Properties of foreign missions also enjoy tax exemption without an insistence for reciprocity. The tax is usually accompanied by a number of service taxes, e.g., water tax, drainage tax, conservancy (sanitation) tax, lighting tax, all using the same tax base. The rate structure is flat on rural (panchayat) properties, but in the urban (municipal) areas it is mildly progressive with about 80% of assessments falling in the first two slabs.[23]

See also

References

- ↑ "Welcome to India in Business : Investment". indiainbusiness.nic.in. Retrieved 2016-11-14.

- ↑ "Directorate of Town Panchayats".

- 1 2 3 "THE CONSTITUTION OF INDIA". Act of 26 November 1949.

- ↑ "Tax Collection in 2015-16", The Times of India, 3 August 2016

- ↑ "Inheritance tax on HNIs likely to be reintroduced", The Economic Times, 5 October 2017

- ↑ "View: Government should reinstate wealth tax in Budget 2017", The Economic Times, 6 December 2016

- ↑ "Direct Taxes Code Bill: Government keen on early enactment". The Times Of India. 16 March 2012.

- ↑ "New service tax rate of 14% to come into effect from June 1". Times of India. 19 May 2015. Retrieved 21 May 2015.

- ↑ "Swachh Bharat Cess will not be levied on services exempted from tax: CBEC". The Economic Times. The Economic Times. Retrieved 2016-01-14.

- ↑ "Krishi Kalyan Cess at 0.5% Levy on all Taxable Services". 2016-04-09.

- 1 2 "GST will change the way India does business: Who will win, who will lose", The Economic Times, 3 August 2016

- ↑ Taxation System in India, India in Business, Ministry of External Affairs, Government of India, Investment and Technology Promotion Division

- ↑ "Jewellers' strike: Govt seeks alternatives to excise duty", The Financial Express, 10 March 2016

- ↑ "Simplified Central Excise norms for Jewellery Sector notified", Business Standard, 29 June 2016

- ↑ "Sale of goods below cost will be accepted in certain circumstances for excise duty levy: CBEC", The Times of India, 17 January 2014

- 1 2 Distribution of Powers between Centre, States and Local Governments, archived from the original on 11 June 2007, retrieved 2009-04-18

- ↑ "Ministry of Statistics and Program Implementation - Government Of India". mospi.nic.in. Retrieved 1 July 2017.

- ↑ "THE KERALA ELECTRICITY DUTY ACT, 1963". ACT 23 of 1963 (PDF).

- ↑ "Customs Duties In India - International Law - India". www.mondaq.com. Retrieved 21 September 2018.

- ↑ Mhatre, Shridhar (29 July 2011). "What is Local Body Tax?". Amazing Maharashtra.

- ↑ Rao, Ananthram (13 May 2013). "The draconian LBT: Local Body Tax explained". Money Life. Retrieved 14 May 2013.

- ↑ Express News Service (1 August 2015). "LBT all but abolished, state's kitty poorer". Indian Express. Retrieved 2015-08-01.

- ↑ Datta, Abhijit. (1992). Local Government Finances: Trends, Issues and Reforms, in Bagchi, Amaresh. et al. (Eds.), State Finances in India, New Delhi: Vikas Publishing House for the NIPFP...

External links

| Wikimedia Commons has media related to Taxation in India. |