Income tax in India

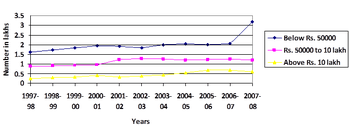

Central Revenue collections in 2007-08 (Source: Compiled from reports of Comptroller and Auditor General of India for relevant years)

The Constitution of India → Schedule VII → Union List → Entry 82 has given the power to the Central Government to levy a tax on any income other than agricultural income, which is defined in Section 10(1) of the Income Tax Act, 1961.[1] The Income Tax Law consists of Income Tax Act 1961, Income Tax Rules 1962, Notifications and Circulars issued by Central Board of Direct Taxes (CBDT), Annual Finance Acts and judicial pronouncements by the Supreme Court and High Courts.

The government imposes a tax on taxable income of all persons who are individuals, Hindu Undivided Families (HUF's), companies, firms, LLP, association of persons, body of individuals, local authority and any other artificial juridical person. Levy of tax on a person depends upon his residential status. The CBDT administers the Income Tax Department, which is a part of the Department of Revenue under the Ministry of Finance, Govt. of India. Income tax is a key source of funds that the government uses to fund its activities and serve the public.

The Income Tax Department is the biggest revenue mobilizer for the Government. The total tax revenues of the Central Government increased from ₹1,392.26 billion (US$19 billion) in 1997-98 to ₹5,889.09 billion (US$82 billion) in 2007-08.[2][3]

History

The "Direct Taxes Code Bill" was tabled in the Parliament on 30 August 2010 by the then Finance Minister to replace the Income Tax Act, 1961 and Wealth Tax Act.[4] The bill, however, could not go through and eventually lapsed after revocation of the Wealth Tax Act in 2015.

Amnesty scheme

Government of India allowed the people to declare their undisclosed incomes in Income Declaration Scheme, 2016 and pay a total of 45% tax for one time settlement. 64,275 disclosures were made amounting to ₹652.5 billion (US$9.1 billion).[5]

Charge to income tax

For the assessment year 2016-17, Individuals earning an income up to ₹2.5 lakh (US$3,500) were exempt from income tax.[6]

About 1% of the national population, called the upper class, fall under the 30% slab. It grew 22% annually on average during 2000-10 to 0.58 million income taxpayers. The middle class, who fall under the 10% and 20% slabs, grew 7% annually on average to 2.78 million income taxpayers.[7]

Agricultural income

Agricultural income is exempt from tax as per section 10(1) of the Act. Section 2(1A) defines agricultural income as:

- Any rent or revenue derived from land, which is situated in India and is used for agricultural purposes.

- Any income derived from such land by agricultural operations including processing of agricultural produce, raised or received as rent-in-kind so as to render it fit for the market or sale of such produce.

- Income attributable to a farm house (subject to some conditions).

- Income derived from saplings or seedlings grown in a nursery.

Income partly agricultural and partly business activities

Income in respect of the below mentioned activities is initially computed as if it is business income and after considering permissible deductions. Thereafter, 40,35 or 25 percent of the income as the case may be, is treated as business income, and the rest is treated as agricultural income.

| Incomea | Business income | Agricultural income |

|---|---|---|

| Growing & manufacturing tea in India | 40% | 60% |

| Sale of latex or cenex or latex based crepes or brown crepes manufactured from field latex or coalgum obtained from rubber plants grown by a seller in India | 35% | 65% |

| Sale of coffee grown & cured by seller in India | 25% | 75% |

| Sale of coffee grown, cured, roasted & grounded by seller in India | 40% | 60% |

^a For apportionment of a composite business-cum-agricultural income, other than the above-mentioned, the market value of any agricultural produce, raised by the assessee or received by him as rent-in-kind and utilized as raw material in his business, should be deducted. No further deduction is permissible in respect of any expenditure incurred by the assessee as a cultivator or receiver of rent-in-kind.

Permissible deductions from gross total income

Ministry of Finance has notified certain deductions from gross total income of an assessee. Below are deductions as updated by Finance Act, 2015.

| Section | Nature of deduction | Remarks |

| 80C | This section has been introduced by the Finance Act, 2005. Broadly speaking, this section provides deduction from total income in respect of various investments/ expenditures/payments in respect of which tax rebate u/s 88 was earlier available. The total deduction under this section is limited to Rs. 1.50 lakh only.

Deductions can be claimed for: Provident Fund (PF) & Voluntary Provident Fund (VPF) : PF is automatically deducted from your salary. Both you and your employer contribute to it. While employer’s contribution is exempt from tax, your contribution (i.e., employee’s contribution) is counted towards section 80C investments. You also have the option to contribute additional amounts through voluntary contributions (VPF). Current rate of interest is 8.5% per annum (p.a.) and is tax-free. Public Provident Fund (PPF): Among all the assured returns small saving schemes, Public Provident Fund (PPF) is one of the best. Current rate of interest is 8.70% tax-free (Compounded Yearly) and the normal maturity period is 15 years. Minimum amount of contribution is Rs 500 and maximum is Rs 1,50,000. A point worth noting is that interest rate is assured but not fixed. Life Insurance Premiums: Any amount that you pay towards life insurance premium for yourself, your spouse or your children can also be included in. Please note that life insurance premium paid by you for your parents (father / mother / both) or your in-laws is not eligible for deduction under section 80C. If you are paying premium for more than one insurance policy, all the premiums can be included. It is not necessary to have the insurance policy from Life Insurance Corporation (LIC) – even insurance bought from private players can be considered here. Equity Linked Savings Scheme (ELSS): There are some mutual fund (MF) schemes specially created for offering you tax savings, and these are called Equity Linked Savings Scheme, or ELSS. The investments that you make in ELSS are eligible for deduction under Sec 80C. Home Loan Principal Repayment: The Equated Monthly Installment (EMI) that you pay every month to repay your home loan consists of two components – Principal and Interest. The principal component of the EMI qualifies for deduction under Sec 80C. Even the interest component can save you significant income tax – but that would be under Section 24 of the Income Tax Act. Please read “Income Tax (IT) Benefits of a Home Loan / Housing Loan / Mortgage”, which presents a full analysis of how you can save income tax through a home loan. Stamp Duty and Registration Charges for a home: The amount you pay as stamp duty when you buy a house, and the amount you pay for the registration of the documents of the house can be claimed as deduction under section 80C in the year of purchase of the house. Sukanya Samriddhi Account : Sukanya Samriddhi Account meaning Girl Child Prosperity Scheme is a special deposit scheme launched by Prime Minister Narendra Modi on 22 January 2015 for girl child. The scheme of Sukanya Samriddhi Account came into effect via notification of Ministry of Finance. The notification details are Notification No. G.S.R.863(E) Dated 02.12.2014. Scheme will be governed by ‘Sukanya Samriddhi Account Rules, 2014’.

National Savings Certificate (NSC) (VIII Issue): NSC is a time-tested tax saving instrument with a maturity period of Five and Ten Years. Presently, the interest is paid @ 8.50% p.a. on 5 year NSC and 8.80% Per Annum on 10 year NSC. Interest is Compounded Half Yearly. While the minimum investment amount is Rs 100, there is no maximum amount. Premature withdrawals are permitted only in specific circumstances such as death of the holder. Investments in NSC are eligible for a deduction of up to Rs 150,000 p.a. under Section 80C. Furthermore, the accrued interest which is deemed to be reinvested qualifies for deduction under Section 80C. However, the interest income is chargeable to tax in the year in which it accrues. Infrastructure Bonds: These are also popularly called Infra Bonds. These are issued by infrastructure companies, and not the government. The amount that you invest in these bonds can also be included in Sec 80C deductions. Pension Funds – Section 80CCC: This section – Sec 80CCC – stipulates that an investment in pension funds is eligible for deduction from your income. Section 80CCC investment limit is clubbed with the limit of Section 80C – it means that the total deduction available for 80CCC and 80C is Rs. 1.50 Lakh.This also means that your investment in pension funds up to Rs. 1.50 Lakh can be claimed as deduction u/s 80CCC. However, as mentioned earlier, the total deduction u/s 80C and 80CCC can not exceed Rs. 1.50 Lakh. 5-Yr bank fixed deposits (FDs): Tax-saving fixed deposits (FDs) of scheduled banks with tenure of 5 years are also entitled for section 80C deduction. Senior Citizen Savings Scheme 2004 (SCSS): A recent addition to section 80C list, Senior Citizen Savings Scheme (SCSS) is the most lucrative scheme among all the small savings schemes but is meant only for senior citizens. Current rate of interest is 9.20% per annum payable quarterly. Please note that the interest is payable quarterly instead of compounded quarterly. Thus, unclaimed interest on these deposits won’t earn any further interest. Interest income is chargeable to tax. |

|

| 80CCC | Payment of premium for annuity plan of LIC or any other insurer Deduction is available up to a maximum of Rs. 1,00,000/- | The premium must be deposited to keep in force a contract for an annuity plan of the LIC or any other insurer for receiving pension from the fund. The Finance Act 2015 has enhanced the ceiling of deduction under Section 80CCC from Rs.100,000 to Rs. 1,50,000 with effect from A.Y. 2016-17 |

| 80CCD | Deposit made by an employee in his pension account to the extent of 10% of his salary. | Where the Central Government makes any contribution to the pension account, deduction of such contribution to the extent of 10% of salary shall be allowed. Further, in any year where any amount is received from the pension account such amount shall be charged to tax as income of that previous year. The Finance Act, 2009 has extended benefit to any individual assesse, not being a Central Government employee. |

| 80CCF | Subscription to long term infrastructure bonds | Subscription made by individual or HUF to the extent of Rs. 20,000 to notified long term infrastructure bonds is exempt from A.Y. 2011-12 onwards. This deduction is discontinued w.e.f. A.Y. 2013-14. |

| 80CCG | Investment under Rajiv Gandhi Equity Savings Scheme, 2013 | The deduction was 50% of amount invested in such equity shares or ₹ 25,000, whichever is lower. The maximum Investment permissible for claiming deduction under RGESS is Rs. 50,000. The benefit is in addition to deduction available u/s Sec 80C. |

| 80D | Payment of medical insurance premium. Deduction is available up to Rs.25,000/ for self/ family and also up to Rs. 25,000/- for insurance in respect of parent/parents of the assessee. In case of senior citizens, a deduction up to Rs.50,000/- shall be available under this Section. Insurance premiumum of senior citizen parent/ parents of the assessee also eligible for enhanced deduction of Rs. 50000/- | The premium is to be paid by any mode of payment other than cash and the insurance scheme should be framed by the General Insurance Corporation of India & approved by the Central Govt. or Scheme framed by any other insurer and approved by the Insurance Regulatory & Development Authority. The premium should be paid in respect of health insurance of the assessee or his family members. The Finance Act 2008 has also provided deduction up to Rs. 15,000/- in respect of health insurance premium paid by the assessee towards his parent/parents. w.e.f. 01.04.2011, contributions made to the Central Government Health Scheme is also covered under this section. |

| 80DD | Deduction of Rs.40,000/ — In respect of (a) expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative. (b) Payment or deposit to specified scheme for maintenance of dependent handicapped relative. W.e.f. 01 .04.2004 the deduction under this section has been enhanced to Rs.50,000/- Further, if the dependent is a person with severe disability a deduction of Rs.1,00,000/– shall be available under this sectionBudget 2015 has Further Proposed to hike the limit from A.Y. 2016-17 to Rs. 75000 from existing Rs. 50,000/- and for person with severe disability to Rs. 1.25 lakh from existing Rs. 1 Lakh. | The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist.Note: A person with severe disability means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the “Persons with Disabilities (Equal opportunities, Protection of Rights and Full Participation) Act.,” |

| 80DDB | Deduction of Rs.40,000/- in respect of medical expenditure incurred. W.e.f. 01.04.2004, deduction under this section shall be available to the extent of Rs.40,000/- or the amount actually paid, whichever is less. Earlier, the deduction for a senior citizen and a super senior citizen were Rs 60,000 and Rs 80,000 or the amount actually paid, whichever is less respectively.Now, as per Finance Act 2018, the deduction has been raised to Rs 1,00,000 for both senior citizens as well as very senior citizen. | Expenditure must be actually incurred by resident assessee on himself or dependent relative for medical treatment of specified disease or ailment. The diseases have been specified in Rule 11DD. A certificate in form 10I is to be furnished by the assessee from a specialist working in a Government hospital.Budget 2015 has proposed for the purpose of claiming deduction under the section assessee will be required to obtain a prescription from a specialist doctor instead of Certificate. |

| 80E | Deduction in respect of payment in the previous year of interest on loan taken from a financial institution or approved charitable institution for higher studies. | This provision has been introduced to provide relief to students taking loans for higher studies. The payment of the interest thereon will be allowed as deduction over a period of up to 8 years. Further, by Finance Act, 2007 deduction under this section shall be available not only in respect of loan for pursuing higher education by self but also by spouse or children of the assessee. W.e.f. 01.04.2010 higher education means any course of study pursued after passing the senior secondary examination or its equivalent from any recognized school, board or university. |

| 80EE | Deduction in respect of interest on loan taken for residential house property | Vide Finance Act 2013, an individual is allowed a deduction up to a limit of Rs 1,00,000 being paid as interest on a loan taken from a financial institution, sanctioned during the period 01-04- 2013 to 31-03-2014 (loan not to exceed Rs 25 lakhs) for acquisition of a residential house whose value does not exceed Rs 40 lakhs. However the deduction is available if the assessee does not own any residential house property on the date of sanction of the loan. |

| 80G | Donation to certain funds, charitable institutions etc. | The various donations specified in Sec. 80G are eligible for deduction up to either 100% or 50% with or without restriction as provided in Sec. 80G . |

| 80GG | Deduction available is the least of (i) Rent paid less 10% of total income. (ii) Rs.5000 per month.[8] (iii) 25% of total income. | (1) Assessee or his spouse or minor child should not own residential accommodation at the place of employment. (2) He should not be in receipt of house rent allowance. (3) He should not have a self-occupied residential premises in any other place . |

| 80TTA | Deduction in respect of interest on deposits in savings account | Section 80TTA is introduced wef A.Y. 2013-14 to provide deduction to an individual or a Hindu undivided family in respect of interest received on deposits (not being time deposits) in a savings account held with banks, cooperative banks and post office. The deduction is restricted to Rs 10,000 or actual interest whichever is lower. |

| 80TTB | Deduction on interest of time deposits for Senior Citizen | Section 80TTB is introduced w.e.f F.Y 2018-19 to provide deduction specifically to senior citizen (60 years or more) of Rs 50,000 or the amount of interest on deposits whichever is lower. This section includes the post office deposits, bank deposits (FD or savings both) or deposits in cooperative society engaged in banking.

Consequential amendment have been made in section 194A in respect of TDS of senior citizens. Now, no TDS shall be deducted on the interest from FD up to Rs. 50,000 in case of senior citizens. Further,it is to be noted that as section Section 80TTB has been introduced exclusively for senior citizens, so no deduction under Section 80TTA shall be available to senior citizens. |

| 80U | Deduction in case of a disabled person | If an assessee furnishes the certificate issued in a prescribed format from a notified ‘medical authority’, then shall become eligible to avail this deduction. The quantum of deduction shall be Rs. 75,000 in case of a person with disability. However, in case of severe disability the deduction shall be raised to Rs. 1,25,000. In this deduction, a person can claim deduction when he himself is disabled. |

| 87A | Rebate of Rs 2500 for individuals having total income up to Rs 3.5 lakh | Finance Act 2017 has provided relief in the form of rebate to individual taxpayers, resident in India, who are in lower income bracket, i. e. having total income not exceeding Rs 3,50,000/-. The amount of rebate is Rs 2500/- or the amount of tax payable, whichever is lower. WEF A.Y. 18-19 (F.Y 17-18). |

| 80RRB | Deduction in respect of any income by way of royalty in respect of a patent registered on or after 01.04.2003 under the Patents Act 1970 shall be available as :-Rs. 3 lacs or the income received, whichever is less. | The assessee who is a patentee must be an individual resident in India. The assessee must furnish a certificate in the prescribed form duly signed by the prescribed authority along with the return of income. |

| 80QQB | Deduction in respect of royalty or copyright income received in consideration for authoring any book of literary, artistic or scientific nature other than text book shall be available to the extent of Rs. 3 lacs or income received, whichever is less. | The assessee must be an individual resident in India who receives such income in exercise of his profession. To avail of this deduction, the assessee must furnish a certificate in the prescribed form along with the return of income. |

Due date of submission of return

The due date of submission of return shall be ascertained according to section 139(1) of the Act as under:-

| 30 September of the Assessment Year (AY) | -If the assessee is a company (not having any inter-nation transaction), or -If the assessee is any person other than a company whose books of accounts are required to be audited under any law, or -If the assessee is a working partner in a firm whose books of accounts are required to be audited under any law. |

| 30 November of the AY | If the assessee is a company and it is required to furnish report under section 92E pertaining to international transactions. |

| 31 July of the AY | In any other case. |

If the Income of a Salaried Individual is less than ₹ 500,000 and he has earned income through salary or Interest or both, such Individuals are exempted from filing their Income Tax return provided that such payment has been received after the deduction of TDS and this person has not earned interest more than ₹ 10,000 from all source combined. Such a person should not have changed jobs in the financial year.[9]

CBDT has announced that all individual/HUF taxpayers with income more than ₹ 500,000 are required to file their income tax returns online. However, digital signatures won't be mandatory for such class of taxpayers.[9]

Advance tax

Under this schemes, every assessee is required to pay tax in a particular financial year, preceding the assessment year, on an estimated basis. However, if such estimated tax liability for an individual who is not above 60 years of age at any point of time during the previous year and does not conduct any business in the previous year, and the estimated tax liability is below ₹ 10,000, advance tax will not be payable.

Until FY 2015-16, the due dates and amount of advance tax were different for corporate taxpayers and individual taxpayers.However, from FY 2016-17, both categories of taxpayers were brought at par. Further, individuals opting presumptive scheme of taxation u/s 44AD, 44ADA are liable to pay advance tax in single instalment.

The due dates of payment of advance tax for F.Y 17-18 are:-

| In case of corporate assessee as well as Individuals | For Persons opting sec 44AD & 44ADA | |

|---|---|---|

| On or before 15 June of the previous year | Up to 15% of advance tax payable | - |

| On or before 15 September of the previous year | Up to 45% of balance of advance tax payable | - |

| On or before 15 December of the previous year | Up to 75% of balance of advance tax payable | - |

| On or before 15 March of the previous year | Up to 100% of balance of advance tax payable | Up to 100 % of the advance tax payable |

Any default in payment of advance tax attracts interest under section 234B and any deferment of advance tax attracts interest under section 234C.

Tax deducted at source (TDS)

The general rule is that the total income of an assessee for the previous year is taxable in the relevant assessment year. However, income tax is recovered from the assessee in the previous year itself by way of TDS. The relevant provisions therein are listed below. (To be used for reference only. The detailed provisions therein are not listed below.1)

| Section | Nature of payment | Threshold limit (up to which no tax is deductible) | TDS to be deducted |

|---|---|---|---|

| 192 | Salary to any person | Exemption limit | As specified for individual in Part III of I Schedule |

| 193 2 | Interest on securities to any resident | Subject to detailed provisions of given section | 10% |

| 194A 2 | Interest (other than interest on securities) to any resident | In case of Bank/cooperative bank - ₹ 10000 (for persons below 60 years) & 50000 (for persons 60 years or more) and in any other case - ₹ 5000 | 10% |

| 194B | Winning from lotteries etc. to any person | ₹ 10000 | 30% |

| 194BB | Winning from horse races to any person | ₹ 10000 | 30% |

| 194C 2 | Payment to resident contractors | ₹ 30000 (for single contract) & ₹ 100000 (for aggregate consideration in a financial year) | 2% (for companies/firms) & 1% otherwise |

| 194D | Insurance commission to resident | ₹ 15000 | 5% (for resident person) & 10% (for domestic companies) |

| 194DA | Payment in respect of life insurance policy | ₹ 100000 | 1% |

| 194E | Payment to non-resident sportsmen or sports association | Not applicable | 20% |

| 194EE | Payment of deposit under National Savings Scheme to any person | ₹ 2500 | 10% |

| 194F | Payment on account of repurchase of unit by Mutual Fund or Unit Trust of India | NIL | 20% |

| 194G | Commission on sale of lottery tickets to any person | ₹ 15000 | 5% |

| 194H 2 | Commission/brokerage to a resident | ₹ 15000 | 5% |

| 194-I 2 | Rents paid to any resident | ₹ 180000 | 2% (for plant,machinery,equipment) & 10% (for land, building, furniture) |

| 194IA | Payment for Purchase of Immovable Property | ₹ 5000000 | 1% |

| 194IB | Payment of rent by individual or HUF not liable to tax audit | ₹ 50000 | 5% |

| 194J 2 | Fees for professional/technical services; Royalty | ₹ 30000 | 10% |

| 194LA | Payment of compensation on acquisition of certain immovable property | ₹ 250000 | 10% |

| 194LB | Interest paid by Infrastructure Development Fund under section 10(47) to non-resident or foreign company | - | 5% |

| 194LC | Payment of interest by an Indian Company or a business trust in respect of money borrowed in foreign currency under a loan agreement or by way of issue of long-term bonds | - | 5% |

| 195 | Interest or other sums (not being salary,which is covered under section 192) paid to non-residents or foreign company except under section 115O | Amount as computed by the Assessing Officer on application made under section 195(2) or 195(3) | As per double taxation avoidance treaty or regular provisions of Income Tax Act, which is beneficial to the recipient |

^1 At what time tax has to be deducted at source and some other specifications are subject to the above sections.

^2 In most cases, these payments shall not to deducted by an individual or an HUF if books of accounts are not required to be audited under the provisions of the Income Tax Act,1961 in the immediately preceding financial year.

In most cases, the tax deducted should be deposited within 7 days from the end of the month in which tax was deducted.

Corporate income tax

For Domestic Companies, the tax rate shall be flat 30%. However, as per Finance Act, 2018, the tax rate for MSME has been reduced from 29% to 25% for companies having turnover or gross receipts less than Rs.250 Crores in the last year i.e. in Financial Year 2016-17. Surcharge and Cess shall be levied over and above the flat rate of tax. Therefore, for large corporates, the tax rate is still 30% but for MSME (Micro, Small and Medium Enterprise) it has been reduced to 25%.

For Foreign companies, the tax rate shall be 40% in India for normal income. However, specifically in case of Royalty income or fees for rendering technical services the tax rate shall be 50%. Surcharge and Cess shall be levied over and above the flat rate of tax.[10]

Note - For both companies, an EC and SHEC of 3% (on both the tax and the surcharge) will be payable till F.Y 17-18.But, from F.Y 18-19, the EC and SHEC has been replaced by Health and Education Cess @ 4%.From 2005-06, electronic filing of company returns is mandatory till date.[11]

Surcharge1

Non-corporate assessee: Surcharge of 10 % shall be levied if income is more than 50 lakhs but less than Rs. 1 crore. Further, Surcharge of 15% shall be levied in case the income is more than 1 crore of an individual. Corporate assessee:

| Particulars | Taxable income > 1 crore | Taxable income > 10 crore |

| Domestic company | 7% of income tax payable | 12% of income tax payable |

| Foreign company | 2% of income tax payable | 5% of income tax payable |

^1 Applicable from assessment year 2015-16 onwards.

Tax returns

Categories

There are five categories of income tax returns.

- Normal return u/s 139(1)

Any assessee (Company or firm or a person) who's income exceeds the maximum amount which is not chargeable to tax is required to file return u/s 139(1) within the due date. Currently, the maximum amount not chargeable to tax (basic exemption limit) for individuals is Rs. 2,50,000 for below 60 years, 3,00,000 for 60 years to 79 years and 5,00,000 for 80 years and above. The due date is different for various assessees.

- Belated return u/s 139(4)

In case of failure to file the return on or before the due date, belated return can be filed.As per Budget 2016, it can be filed before the expiry of relevant assessment year.

- Revised return u/s 139(5)

In case of any omission or any wrong statement mentioned in the normal return can be revised.As per Budget 2017, the return can be revised at any time before the expiry of relevant assessment year.Further, from F.Y 16-17, the belated return can also be revised.

- Defective return u/s 139(9)

If the assessing officer considers the return as defective, he may intimate the defect. One has to rectify the defect within a period of fifteen days from the date of such intimation.

- Apart from the above-mentioned categories, the return is also required to filed in response to notices under the various sections like section 142(1)(i), 143(1)(a), 139(9), 154 etc. of the income tax act, 1961.

Statistics

As of January 2016, a total of more than 3.27 crore returns were e-filed for the financial year 2014-15.[12]

Annual information return and statements

Annual information return

Those who are responsible for registering, or, maintaining books of account or other documents containing a record of any specified financial transaction,[13] shall furnish an annual information return in Form No.61A.

Statements by producers

Producers of a cinematographic film during the financial year shall, prepare and deliver to the Assessing Officer a statement in the Form No.52A,

- within 30 days from the end of such financial year or

- within 30 days from the date of the completion of the production of the film,

whichever is earlier.

Statements by non-resident having a liaison office in India

With effect from 01,June 2011, Non-Resident having a liaison office in India shall prepare and deliver a statement in Form No. 49C to the Assessing Officer within sixty days from the end of such financial year.

Income tax rates for individuals

Income Tax Rates for Financial Year 2017-2018 & Assessment Year 2018-2019

Income Tax Rates Slab for FY 2017-18 (AY 2018-19) - The Finance Bill, 2017

RATES FOR CHARGING INCOME-TAX IN CERTAIN CASES, DEDUCTING INCOME-TAX FROM INCOME CHARGEABLE UNDER THE HEAD “SALARIES” AND COMPUTING “ADVANCE TAX”

In cases in which income-tax has to be charged under sub-section (4) of section 172 of the Income-tax Act or sub-section (2) of section 174 or section 174A or section 175 or sub-section (2) of section 176 of the said Act or deducted from, or paid on, from income chargeable under the head “Salaries” under section 192 of the said Act or in which the “advance tax” payable under Chapter XVII-C of the said Act has to be computed at the rate or rates in force, such income-tax or, as the case may be, “advance tax” [not being “advance tax” in respect of any income chargeable to tax under Chapter XII or Chapter XII-A or income chargeable to tax under section 115JB or section 115JC or Chapter XII-FA or Chapter XII-FB or sub-section (1A) of section 161 or section 164 or section 164A or section 167B of the Income-tax Act at the rates as specified in that Chapter or section or surcharge, wherever applicable, on such “advance tax” in respect of any income chargeable to tax under section 115A or section 115AB or section 115AC or section 115ACA or section 115AD or section 115B or section 115BA or section 115BB or section 115BBA or section 115BBC or section 115BBD or section 115BBDA or section 115BBE or section 115BBF or section 115BBG or section 115E or section 115JB or section 115JC] shall be charged, deducted or computed at the following rate or rates:—

(I) In the case of every individual other than the individual referred to in items (II) and (III) of this Paragraph or Hindu undivided family or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Income-tax Act, not being a case to which any other Paragraph of this Part applies,—

| Part I: Income tax slab for individual tax payers & HUF (less than 60 years old) (both men & women) | ||

| Rates of income-tax | ||

| (1) | where the total income does not exceed Rs. 2,50,000 | No Tax |

| (2) | where the total income exceeds Rs. 2,50,000 but does not exceed Rs. 5,00,000 | 5 % |

| (3) | where the total income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000 | 20 % |

| (4) | where the total income exceeds Rs. 10,00,000 | 30 % |

| Surcharge:

** 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. ** 15% of income tax, where total income exceeds Rs. 1 crore. | ||

| Cess: 3% on total of income tax + surcharge. | ||

| * *Income up to Rs. 2,50,000 is exempt from tax if you are less than 60 years old. | ||

(II) In the case of every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the previous year, -

| Part II: Income tax slab for individual tax payers & HUF (60 years old or more but less than 80 years old) (both men & women) | ||

| Rates of income-tax | ||

| (1) | where the total income does not exceed Rs. 3,00,000 | No Tax |

| (2) | where the total income exceeds Rs. 3,00,000 but does not exceed Rs. 5,00,000 | 5 % |

| (3) | where the total income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000 | 20 % |

| (4) | where the total income exceeds Rs. 10,00,000 | 30 % |

| Surcharge:

** 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. ** 15% of income tax, where total income exceeds Rs. 1 crore. | ||

| Cess: 3% on total of income tax + surcharge. | ||

| * *Income up to Rs. 3,00,000 is exempt from tax if you are more than 60 years but less than 80 years of age. | ||

(III) In the case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the previous year, -

| Part III: Income tax slab for super senior citizens (80 years old or more) (both men & women) | ||

| Rates of income-tax | ||

| (1) | where the total income up to Rs. Rs. 2,50,000 | No Tax |

| (2) | where the total income up to Rs. 5,00,000 | No Tax |

| (3) | where the total income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000 | 20 % |

| (4) | where the total income exceeds Rs. 10,00,000 | 30 % |

| Surcharge:

** 10% of income tax, where total income is between Rs. 50 lakhs and Rs.1 crore. ** 15% of income tax, where total income exceeds Rs. 1 crore. | ||

| Cess: 3% on total of income tax + surcharge. | ||

| * *Income up to Rs. 3,00,000 is exempt from tax if you are more than 60 years but less than 80 years of age. | ||

| In the case of every co-operative society,— | ||

| Rates of income-tax | ||

| (1) | where the total income does not exceed Rs. 10,000 | 10 per cent. of the total income; |

| (2) | where the total income exceeds Rs. 10,000 but does not

exceed Rs. 20,000 |

Rs. 1,000 plus 20 per cent. of the amount by which the total income exceeds Rs. 10,000 |

| (3) | where the total income exceeds Rs. 20,000 | Rs. 3,000 plus 30 per cent. of the amount by which the total income exceeds Rs. 20,000 |

| Surcharge on income-tax

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, in the case of every co-operative society, having a total income exceeding one crore rupees, be increased by a surcharge for the purposes of the Union calculated at the rate of twelve per cent. of such incometax | ||

| Provided that in the case of every co-operative society mentioned above having total income exceeding one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees. | ||

| In the case of every firm,— | |

| Rates of income-tax | |

| On the whole of the total income | 30 per cent. of the total income; |

| Surcharge on income-tax

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, in the case of every firm, having a total income exceeding one crore rupees, be increased by a surcharge for the purposes of the Union calculated at the rate of twelve per cent. of such income-tax. | |

| Provided that in the case of every firm mentioned above having total income exceeding one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees. | |

| In the case of every local authority,— | |

| Rates of income-tax | |

| On the whole of the total income | 30 per cent. of the total income; |

| Surcharge on income-tax

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, in the case of every local authority, having a total income exceeding one crore rupees, be increased by a surcharge for the purposes of the Union calculated at the rate of twelve per cent.of such income-tax. | |

| Provided that in the case of every local authority mentioned above having total income exceeding one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees. | |

| In the case of a domestic company | |

| Rates of income-tax | |

| (i) where its total turnover or the gross receipt in the previous year 2015-16 does not exceed fifty crore rupees; | 25 per cent. of the total income; |

| (ii) other than that referred to in item (i) | 30 per cent. of the total income; |

| Surcharge on income-tax

(a) having a total income exceeding one crore rupees but not exceeding ten crore rupees, at the rate of seven per cent. of such income-tax; and (b) having a total income exceeding ten crore rupees, at the rate of twelve per cent. of such income-tax; | |

| In the case of a company other than a domestic company - | |

| Rates of income-tax | |

| (i) on so much of the total income as consists of,—

(a) royalties received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976; or (b) fees for rendering technical services received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement has, in either case, been approved by the Central Government |

50 per cent. of the total income; |

| (ii) on the balance, if any, of the total income | 40 per cent. of the total income |

| Surcharge on income-tax

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, be increased by a surcharge for the purposes of the Union, calculated,- (a) having a total income exceeding one crore rupees but not exceeding ten crore rupees, at the rate of two per cent. of such income-tax; and (b) having a total income exceeding ten crore rupees, at the rate of five per cent. of such income-tax: | |

| Provided that in the case of every company having a total income exceeding one crore rupees but not exceeding ten crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees:

Provided further that in the case of every company having a total income exceeding ten crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax and surcharge on a total income of ten crore rupees by more than the amount of income that exceeds ten crore rupees. | |

Assessments

Self-assessment is done by the assessee himself in his Return of Income. The department assess the tax of an assessee under section 143(3) (scrutiny), 144 (best judgement), 147 and 153A (search and seizure). The notices for such assessments are issued under section 143(2), 148 and 153A respectively. The time limits are prescribed under section 153.[15]

Tax penalties

There are various penalties & fees which can be levied as per the Income Tax Act, 1961. Some of the important penalties and fees are discussed as under :

1. Penalty under section 271(1)(c)[16] for either concealment of income or for furnishing inaccurate particulars of income:-

If the Assessing Officer or the Commissioner (Appeals) or the Commissioner in the course of any proceedings under this Act, is satisfied that any person-

(b) has failed to comply with a notice under sub-section (1) of section 142 or sub-section (2) of section 143 or fails to comply with a direction issued under sub-section (2A) of section 142, or (c) has concealed the particulars of his income or furnished inaccurate particulars of such income,

he may direct that such person shall pay by way of penalty,-

(ii) in the cases referred to in clause (b), in addition to any tax payable by him, a sum of ten thousand rupees for each such failure; (iii) in the cases referred to in clause (c), in addition to any tax payable by him, a sum which shall not be less than, but which shall not exceed three times, the amount of tax sought to be evaded by reason of the concealment of particulars of his income or the furnishing of inaccurate particulars of such income.

In other words, u/s 271(1)(c), the penalty may range from 100 % to 300% of the amount of tax sought to be evaded.

2. Penalty u/s 270A for under reporting or misreporting of income :-

The Assessing Officer or the Commissioner (Appeals) or the Principal Commissioner or Commissioner may direct any person to pay a penalty in addition to tax, if he has under-reported or misreported his income while filing his return.

In case of under reported income, the penalty shall be 50% of the amount of tax payable on under reported income. Further, in case of misreporting income, the penalty shall be 200% of the amount of tax payable on misreported income.

3. Fee u/s 234F for late filing of ITR :-

As per the budget 2017, a new section 234F has been introduced to ensure timely filing of returns of income. According to Section 234F, if a person is required to file income tax return (ITR) as per income tax law (section 139(1)) but does not file it within the due date then late fees shall be levied upon him. The amount of fees shall depend upon the time of filing the return and total income.

The quantum of fees u/s 234F has been enumerated as below : (i) If the return is filed after 31st July but on or before the 31st day of December of the assessment year - Rs. 5000 (ii) If the return is filed after 31st December of the assessment year - Rs. 10,000 However, if the Total income is less than or equal to five lakh rupees, then in that case, the fee amount shall not exceed Rs. 1000.

The provisions of this section shall be applicable from in respect of Income Tax returns to be filed for FY 2017-18 (or AY 2018-19).This section shall be applicable on all persons including Individual, HUF, Company, Firm, AOP etc., if the return is filed after their respective due dates.Financial year 17-18 would be the first year when any such fees would be leviable without the intervention of Assessing Officer.

Appeals

When taxpayers dispute the income tax demands raised on them, a structured appeal process has to be followed. The first level of appeals lies with the CIT (A). The next level of appeal lies with the Income Tax Appellate Tribunal - an independent body, which is the final fact finding authority. Courts can subsequently be approached by the aggrieved party only if a question of law is involved.[17]

See also

References

- ↑ Institute of Chartered Accountants of India (2011). Taxation. ISBN 978-81-8441-290-1.

- ↑ "Growth of Income Tax revenue in India" (PDF). Retrieved 16 November 2012.

- ↑ "Home - Central Board of Direct Taxes, Government of India". Incometaxindia.gov.in. Retrieved 2018-04-18.

- ↑ "Impact of DTC on India Inc", The Hindu Business Line, 6 September 2010

- ↑ "Black money haul: Rs 65,250 crore collected through Income Declaration Scheme", The Economic Times, 1 October 2016

- ↑ "All you need to know about Income Tax Returns for AY 2016-17", Daily News and Analysis, 16 April 2016

- ↑ Santosh Tiwari. "Evasion of personal tax dips to 59% of mop-up". The Financial Express.

- ↑ https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx

- 1 2 "E-Filing is mandatory Income is more than 5 lacs". CA club india.

- ↑ "Income Tax rates for Companies". businesssetup.in.

- ↑ Corporate taxpayers must file electronically, point 4 of I T circular.

- ↑ "e-Filing Statistics", incometaxindiaefiling.gov.in

- ↑ "Annual Information return".

- ↑ Kumar, Pawan. "Income Tax Rates Slab for FY 2017-18 (AY 2018-19) - Param News: Latest India News, Breaking News, Sports, Bollywood, Politics, Jobs". www.paramnews.com. Retrieved 2017-04-20.

- ↑ "Readers' Corner: Taxation", Business Standard, 27 March 2016

- ↑ Section 271 of India IT Act

- ↑ "CIT (Appeals) to pass orders within a fortnight", The Times of India, 23 June 2015