Tax inversion

.png)

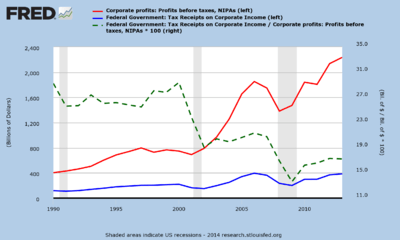

Brad Setser & Cole Frank

(Council on Foreign Relations)[1]

Tax inversion, or corporate inversion, is the practice of relocating a corporation's legal domicile to a lower-tax country, while retaining its material operations (including management, functional headquarters and majority shareholders) in its higher-tax country of origin.[2][3] In practice, it means replacing the existing U.S.-based parent company with a foreign-based parent company, thus making the original U.S. company a subsidiary of the new foreign-based parent.[4]

Overview

The first US inversion took place in 1982 (McDermott International), but the practice only became common in the late 1990s. It was stopped in 2002 as legislators promised rules to curb inversions, however, after passing the American Jobs Creation Act of 2004 (sec. 7874), a new wave of inversions took advantage of exclusions in Act.[5][6] Of 85 US inversions since 1982, the most popular destination is Ireland (with 22) followed by Bermuda (with 19) and the UK (with 11).[7]

Quasi-inversions, as executed by U.S. technology firms in Ireland are accepted. Example being Apple's 2015 restructuring of circa $300 billion in intellectual property (or IP) to Ireland (the leprechaun economics affair), to avail of Ireland's 0-3% effective tax rates.[1] However full corporate inversions, like the 2016 $160 billion Irish Pfizer-Allergan merger, have been rejected. Commentators point to the ability of the fully inverted US corporation to use IP-based BEPS tools (or Debt-based BEPS tools), to reduce taxes on U.S.-sourced profits as a key reason (the U.S. technology firms don't seem to try this from Ireland).[8][9]

To make a tax inversion work, the corporation must also be able to relocate profit streams to the new location.[10] This either requires intellectual property (or "IP") (can be relocated via IP-based BEPS tools), and/or existing debt financing (relocation via "earnings stripping"). This limits inversions to either the IP-heavy industries of life sciences, financials, technology and businesses with patents and licenses, or industries with leveraged assets like oil & gas.[6][3]

Stronger "substance" rules (the "SBA test") in the 2004 Act (the foreign target had to be 25% of US corporation) made inversions harder for large US technology corporations (Google, Facebook, Apple, Microsoft etc. use Irish "multinational tax schemes" which act like a quasi-inversions), and life sciences came to dominate post-2004 inversions.[4] Pfizer's attempted 2016 merger with Irish-based Allergan (after failed 2014 takeover of UK-based Astra Zeneca[11][12]), the largest inversion in history,[13][14] was blocked by the Obama administration[15] with further rule tightening,[16] and upheld by the Trump administration.[17][18]

A smaller group of non-U.S. corporations have executed inversions, most notably UK corporations to Ireland. Shire plc's 2008 Irish inversion,[19] led to changes in UK tax law, including a full "territorial tax" system, that turned the UK into an inversion destination.[20] The driver has usually been the high US 35% corporation tax rate on worldwide income (one of the highest rates in the world).[6][3][21] At the same time low-tax locations like Ireland, the most popular destination for US inversions,[7] have advanced IP-based BEPS tools and Debt-based BEPS tools,[22] that give Irish effective tax rates of 0-3%.[23][24][25]

Mechanics

Although inverting companies are colloquially said to "change" their domicile to a foreign country, technically inversion usually involves creating a new parent company that sits "on top" of the corporate structure and is incorporated in the desired foreign jurisdiction. The legacy U.S. corporation retains its domicile and becomes a mere subsidiary. Since the profits of subsidiaries of U.S. corporations are typically subject to tax, a U.S. company that establishes a new foreign parent typically seeks to shift as much of its profits as possible out from under the legacy U.S. corporation, so that profits can be delivered directly to the ultimate foreign parent company without passing through a U.S. entity.

Importantly, corporate inversions do not by themselves require a change in the location of the actual corporate headquarters. In about 70 percent of inversions out of the U.S., the chief executive officer remained in the U.S. Confusingly, many inverted companies claim "headquarters" in the new foreign jurisdiction even though all their most senior officers remain in the U.S. To complicate things further, companies seeking to establish tax residency in certain jurisdictions, such as Ireland and the UK, may have reason to claim their "principal executive offices" are in those locations. This can typically be achieved by holding a majority of board meetings in these jurisdictions, and does not require the senior executives to actually work at these locations.

Earnings stripping

Earnings stripping is a commonly used technique in United States domestic tax avoidance in which a U.S. corporation uses loans between different divisions of the same company to shift profits out of high-tax jurisdictions and into lower-tax ones. According to the New York Times, a multinational could reduce its "American tax bill by having its American subsidiary borrow money from a foreign parent company and then deduct the interest on that loan against its earnings."[26] Earnings stripping is one of the most common tax avoidance techniques facilitated by tax inversions. In addition to allowing U.S. companies to avoid tax on non-U.S. profits, inversion also allows them to avoid taxes on some domestic profits because it facilitates several techniques for re-allocating U.S. profits to lower-tax foreign jurisdictions. One study of four inverted companies in 2004 found that most tax saving was generated by earnings stripping, not by avoiding tax on genuinely foreign profits.[27]

In April 2016, new Treasury Department rules were introduced by the Obama administration to narrow the loopholes used for corporate tax avoidance that "will fight earnings stripping by treating the loan in the transaction as equity, which removes the debt-based tax benefit."[26]

Rationale

In the United States taxation can be imposed as a statutory corporate income tax as well as a taxation on the profits that domestic corporations collect from their subsidiaries abroad.[28][29] This policy of taxing foreign profits is called a "worldwide" system of taxation, and it contrasts with the "territorial" system employed by most developed countries including the United Kingdom and Canada, which generally tax only profits from domestic activities. The result is that U.S. corporations with subsidiaries in lower-tax jurisdictions face higher taxes on those foreign operations than they would if they were incorporated elsewhere. As Bloomberg View columnist Matt Levine wrote in 2014:[30]

If we're incorporated in the U.S., we'll pay 35 percent taxes on our income in the U.S. and Canada and Mexico and Ireland and Bermuda and the Cayman Islands, but if we're incorporated in Canada, we'll pay 35 percent on our income in the U.S. but 15 percent in Canada and 30 percent in Mexico and 12.5 percent in Ireland and zero percent in Bermuda and zero percent in the Cayman Islands.

The Economist explains:[31]

The incentive is simple. America taxes profits no matter where they are earned, at a rate of 39% — higher than in any other rich country. When a company becomes foreign through a merger, or "inverts", it no longer owes American tax on its foreign profit. It still owes American tax on its American profit.

By changing its domicile to another country with a territorial tax regime, the corporation typically pays taxes on its earnings in each of those countries at the specific rates of each country. Further, the corporation executing the tax inversion may find additional tax avoidance strategies allowed to corporations domiciled in foreign countries not available in the U.S. For example, the corporation may find ways of defining its revenue or costs such that they are taxed in lower-tax countries, although the customers may be in higher-tax countries.[30]

The Congressional Budget Office also described how tax inversions work in a January 2013 report.[32]

History

1980s–90s: McDermott Inc. and Helen of Troy

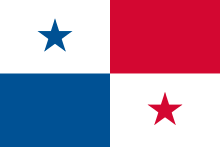

The first inversion took place in 1982, when McDermott Inc., a New Orleans-based construction company, became Panamanian. McDermott had accumulated a large amount of profit in a Panama-registered subsidiary that served as the holding company for the company's non-U.S. operations. Rather than pay corporate income tax on those profits, the company took the unprecedented step of flipping its corporate structure, so that the Panamanian subsidiary, McDermott International, became the parent. This would allow the company to pass the Panamanian profits to shareholders in the form of dividends without facing a U.S. corporate income tax. The transaction was conceived by McDermott's lawyers at Davis Polk & Wardwell, especially John P. Carroll, and by the company's tax director, Charles Kraus.[33]

After the transaction was completed, the IRS challenged it by arguing that shareholders of McDermott were liable for a hefty tax bill on the deal. The company defended the shareholders in U.S. Tax Court, and in 1987, in Bhada v. Commissioner, the company prevailed. It also prevailed on appeal to a federal circuit court. Congress attacked the McDermott transaction in 1984 by adding Section 1248(i) to the Internal Revenue Code. The measure narrowly prevented future deals along the lines of McDermott and left open the possibility of other inversion structures.

The second inversion took place in 1994 and also provoked a sharp response from the government. Rather than raise up an existing foreign subsidiary to become a parent, Helen of Troy, of El Paso, Texas, created a new subsidiary in Bermuda and then flipped it to become the parent. The so-called "Helen of Troy rules" followed. The Treasury Department, under the authority of Section 367 of the tax code, wrote regulations that imposed a shareholder-level tax on inversions.[34]

1990s–2000s: Turn-of-century wave and crackdown

The end of the decade and the beginning of the next saw several large and well-known companies invert, mostly to the island tax havens of Bermuda and the Cayman Islands, neither of which impose corporate income tax. The departed included Ingersoll-Rand, Tyco International, and Fruit of the Loom. In 2002, Stanley Works' proposal to invert to Bermuda provoked a storm of media reports and Congressional discussions. The top Democrat and Republican on the Senate Finance Committee jointly pledged to enact legislation to prevent inversions and to make it retroactive to 2002. Since no company wanted to risk having a transaction unwound by subsequent legislation, the pledge became a de facto moratorium on inversions. The anti-inversion bill finally became law in 2004, and it was made retroactive to 2003.

At the same time some lawmakers were weighing tax-code revisions to attack inversions, others were using the federal government's contracting heft to discourage the deals. A 2002 law creating the Department of Homeland Security forbid the new agency from signing contracts with inverted companies; the same language was later added to temporary spending bills across the federal government.

The 2004 law effectively banned inversions, but its definition contained some notable exceptions. It allowed companies to adopt the foreign address of a merger partner as long as the partner was at least one-fourth the size of the U.S. firm. Eventually, a new wave of inversion deals arose, many of them involving pharmaceutical companies, in which they assumed the foreign address of an acquisition target.[35]

2010s: Executive action

In early 2014, Pfizer (inverting to the UK by taking over AstraZeneca),[11][36] Walgreen, and Medtronic had each proposed high-profile inversions. Concerns about an accelerating exodus prompted a round of public policy proposals in Congress. One group of Congressional Democrats proposed a measure to disallow inversions involving a smaller merger partner; another group proposed tightening rules on government contracts with inverted companies; both groups were blocked by Republicans. The two parties also split over whether to enact short-term measures to discourage inversions. President Barack Obama called the maneuvers "unpatriotic" during a speech in July 2014. The Economist responded to the calls in America to restrict companies from relocating abroad by way of merger "misguided" and called for wider tax reform to address what it describes as more fundamental flaws in the American corporate tax system instead.[5]

Democratic lawmakers attempted again in September 2014 to propose a tax reform that would focus on slowing the number and rate of corporate inversions via taxing any earnings outside the U.S. as income, until the inversion occurs. Republicans and Democrats had several proposals that could possibly address the issue.[37] An additional consideration surrounding any proposed inversion regulations is whether the regulations would apply retroactively, and further, whether such a retroactive application would be constitutional.[38]

Expecting the likelihood of the proposals passing through Congress to be low, the Obama administration acted administratively to discourage inversions. On September 22, 2014, the Treasury Department issued a notice that reduced some of the tax benefits of inversions completed after that date, and barred companies from manipulating their capital structure to take advantage of inversion rules.[39] The September 22, 2014, Notice describes future regulations that can be separated into two categories: (i) special rules regarding ownership threshold requirements (ii) rules targeting certain tax planning after an inversion, primarily to access foreign earnings of the U.S. acquired corporation.[40]

In early 2015, the Financial Times reported that the new regulations to prevent tax inversions had the "perverse effect" of a "sharp increase" in tax inversion deals.[41]

In November 2015, the U.S. Treasury Department announced new rules that would "restrain U.S. companies from putting their addresses in foreign countries to reduce tax through a tax inversion."[42] The Wall Street Journal reported subsequently that "Allergan PLC and Pfizer Inc. are considering structuring a merger of the drug companies so that it is an acquisition of Pfizer by Allergan."[43] The article described how,[43]

However the deal is technically structured, the much larger Pfizer will effectively be buying the Dublin-based Allergan and assuming a lower offshore tax jurisdiction. Allergan shareholders would receive a premium and end up with 40% to 45% of the combined company, some of the people said. The deal is expected to be mainly in stock, but it could contain a small cash component.

— Wall Street Journal

In early April 2016, the Obama administration introduced new rules that would "limit the ability of American companies to shift their home overseas simply to lower their tax bills." In response Pfizer and Allergan ended their $152 billion merger.[44]

Diana Furcht-Roth of the Manhattan Institute for Policy Research—who is critical of the U.S. Treasury Department's new rules— explained that "Under the old rules, Pfizer shareholders would have owned 56 percent of the combined company, enough to substantially lower its United States taxes. Under the new rules, Pfizer would own between 60 and 80 percent, subjecting it to much higher United States taxes."[45] She argues that companies need lower taxes so they can "grow their businesses."[45]

Paul Krugman coined the term "leprechaun economics" in 2016 for Ireland's illusory economic boom after multinational corporations made use of Ireland's tax regime for tax inversion purposes.[46]

2010s: U.S. Tax Reform

It is asserted that the Tax Cuts and Jobs Act of 2017 will stop US inversions[47] and in particular the move to a territorial tax system[48] and an attractive low-tax IP taxation regime.[5][49] There is a belief that the TCJA could even attract inversions (and IP) back to the US (as similar rules did in the UK in 2009-2012[20]). However, the Irish (and the UK) ultra-low-tax schemes could still attract US corporate inversions.[50] For example, the TCJA's new GILTI regime enforces a minimum 10.5% tax rate on IP-heavy US corporates, whereas Apple, Google and Facebook pay Irish effective tax rates of <1%.[23][24][25]

Since the block of the Pfizer Allergan merger, and 2017 TCJA, there have been no material new US corporate inversions nor reversals of previous US inversions.

U.S. multinationals like Pfizer announced in Q1 2018, a post-TCJA global tax rate for 2019 of circa 17%, which is very similar to the circa 16% expected by past U.S. multinational Irish tax inversions, Eaton, Allergan, and Medtronic. This is the effect of Pfizer being able to use the new U.S. 13.125% FDII regime, as well as the new U.S. BEAT regime penalising non-U.S. multinationals (and past tax inversions) by taxing income leaving the U.S. to go to low-tax corporate tax havens like Ireland.[51]

Now that corporate tax reform has passed, the advantages of being an inverted company are less obvious

Destinations

Where do US inversions go?

The following destinations have attracted the 85 US corporate inversions since 1982[7]

Ireland - most advanced platform

Ireland received its first US corporate inversion with Tyco International in 1997 (re-inverted by Johnson Controls in 2016).

In the 2009 Finance Act, Ireland materially enhanced its "Capital Allowances for Intangible Assets" scheme which enables IP-heavy US corporates to write off 80-100% of the full cost of their inversion (structured as an IP acquisition), against future Irish corporate tax giving "effective" tax rates of 0-3%.[52][53]

Ireland's Revenue Commissioners quote an "effective" 2015 Irish corporation tax rate of 9.8%, however, this is a definition omits income that would be considered taxable under the US Bureau of Economic Analysis ("BEA") method of assessing "effective" taxation. Under the BEA definition, Ireland's "effective" 2015 corporation tax rate is 2.5%.[54][55][56][57]

Ireland further upgraded its holding company regime (to minimize pass-through taxes), and introduced the first OECD compliant "Knowledge Development Box" ("KDB") with a 6.5% rate.[58][22][59][60]

Ireland then experienced a boom in much larger US corporate inversions, and particularly from the Pharmaceutical industry (see last 5 years):[7]

- 2016

.svg.png)

- 2016

.svg.png)

- 2015

.svg.png)

- 2014

.svg.png)

- 2014

.svg.png)

- 2013

.svg.png)

- 2013

.svg.png)

United Kingdom - from donor to recipient

As well as the 3rd largest recipient of US corporate inversions, the UK is the most interesting case for the US post the TCJA.[48]

After a succession of UK corporate inversions to Ireland, the UK made the changes to its tax code that are envisaged under the TCJA:[20][61]

- Moved to a full "territorial tax" system in 2009;

- Reduced its headline corporation tax rate (from 28% to 19%) in 2010-12;

- Developed the more advanced IP regimes available in Ireland (including a KDB 10% rate and "capital allowances for intangibles" regimes) 2009-2012.

The UK went from being a donor of UK corporate inversions, and mainly to Ireland (the last one being Shire plc in 2008[19]), to a major recipient of US corporate inversions (see last 5 years):[7]

- 2016

.svg.png)

- 2016

.svg.png)

- 2016

.svg.png)

- 2015

.svg.png)

- 2015

.svg.png)

- 2013

.svg.png)

- 2013

.svg.png)

Notable inversions

- McDermott International to Panama, 1982

- Helen of Troy to Bermuda, 1994

- Tyco International to Bermuda, 1997

- Fruit of the Loom to the Cayman Islands, 1998

- Transocean to the Cayman Islands, 1999

- Ingersoll Rand to Bermuda, 2001

- Ensco plc to the United Kingdom, 2009

- Eaton Corporation to Ireland, 2012

- Actavis to Ireland, 2013

- Liberty Global to the United Kingdom, 2013

- Burger King to Canada, 2014

- Medtronic to Ireland, 2015

- Mylan to the Netherlands, 2015

- Arris Group to the UK[62][63](2016)

- Johnson Controls to Ireland, (2016)[64]

See also

References

- 1 2 "Tax Avoidance and the Irish Balance of Payments". Council on Foreign Relations. 25 April 2018.

- ↑ "Here's How American CEOs Flee Taxes While Staying in U.S." Bloomberg. 5 May 2014.

- 1 2 3 "An Analysis of Corporate Inversions 2017" (PDF). US Congressional Budget Office. September 2017.

- 1 2 "A Look at Corporate Inversions, Inside and Out". Federal Reserve of St. Louis. March 2017.

- 1 2 3 "How to stop the inversion perversion". The Economist. 26 July 2014. ,

- 1 2 3 "Bloomberg Special TAX INVERSION". Bloomberg. 2 May 2017.

- 1 2 3 4 5 "Tracking Tax Runaways". Bloomberg News. 1 March 2017.

- ↑ "The New Corporate Migration TAX DIVERSION THROUGH INVERSION" (PDF). Stanford University. September 2015.

- ↑ "Inconvenient Truth About Corporate Inversions". Houston Law. June 2012.

- ↑ "Tax Structuring: A Primer on Inversions". DLA Piper. June 2014.

- 1 2 "Pfizer Ends AstraZeneca Bid But The Tax Issues It Raised Live On". Forbes. 26 May 2014.

- ↑ Sander Levin (22 July 2014). "Inversions Highlight Unfairness of the Tax Code". New York Times.

- ↑ "The world's largest drug company will soon be based in Ireland". thejournal.ie. 23 November 2015.

- ↑ "Pfizer pulls out of €140bn Irish Allergan merger". Irish Independent. 6 April 2016.

- ↑ "Big Pharma Murdered Tax Inversions". Bloomberg News. 6 August 2016.

- ↑ "US issues new rules to clamp down on tax 'inversions'". Irish Times. 16 October 2016.

- ↑ "Trump to keep Obama rule curbing corporate tax inversion deals". Reuters. 4 October 2017.

- ↑ "Global Tax Aleart Corporate Inversions" (PDF). Ernst & Young. 20 January 2017.

- 1 2 "Drugs company moves to cut tax bill". The Guardian. 15 April 2008.

- 1 2 3 "How Tax Reform solved UK inversions". Tax Foundation. 14 October 2014.

- ↑ "Global Corporate Tax Rates". Tax Foundation. 12 February 2018.

- 1 2 "Corporate Taxation in Ireland 2016" (PDF). Industrial Development Authority (IDA). 2018.

- 1 2 "Pinning Down Apple's Alleged 0.005% Tax Rate Is Nearly Impossible". Bloomberg News. 1 September 2016.

- 1 2 "Google pays €47m in tax in Ireland on €22bn sales revenue". The Guardian. 4 November 2016.

- 1 2 "Facebook paid just €30m tax in Ireland despite earning €12bn". Irish Indepdenent. 29 November 2017.

- 1 2 "A Corporate Tax Dodge Gets Harder". The New York Times. 6 April 2016. Retrieved 7 April 2016.

- ↑ "Despite managements' claims that inversion–related tax savings will be due to the avoidance of U.S. tax on foreign earnings, we conclude... that most of the tax savings is attributable to the avoidance of U.S. tax on U.S. earnings." "Effective tax rate changes" (PDF). National Tax Journal. December 2004.

- ↑ https://www.usnews.com/opinion/economic-intelligence/2015/11/13/reality-check-on-corporate-income-tax-rates

- ↑ https://www.irs.gov/businesses/corporations

- 1 2 Levine, Matt (25 August 2014). "Burger King May Move to Canada for the Donuts". Bloomberg View.

- ↑ "Inverse logic". The Economist. Washington, D.C. 20 September 2014.

- ↑ "Options for Taxing U.S. Multinational Corporations" (PDF). Congressional Budget Office. January 2013.

- ↑ "The Greatest Tax Story Ever Told". Bloomberg.com. 2014-12-18. Retrieved 2018-04-18.

- ↑ "US anti-inversion provisions | International Tax Review". www.internationaltaxreview.com. Retrieved 2018-04-18.

- ↑ Drawbaugh, Kevin. "INSIGHT-When companies flee US tax system, investors often don't..." U.S. Retrieved 2018-04-18.

- ↑ Levin, Sander (22 July 2014). "Inversions Highlight Unfairness of the Tax Code". New York Times. Retrieved 20 November 2015.

- ↑ Stephenson, Emily (19 September 2014). "U.S. Senate Democrats propose exit tax for inverting companies". Reuters. Retrieved 19 September 2014.

- ↑ Halper, Jason. "Assessing Retroactive Inversion Legislation and Its Risks". Transaction Advisors. ISSN 2329-9134.

- ↑ Drawbaugh, Kevin (23 September 2014). "U.S. Treasury moves against tax-avoidance 'inversion' deals". Reuters. Retrieved 22 September 2014.

- ↑ DeNovio, Nicholas; Stein, Laurence; Doyle, Diana; Murphey, Lauren. "Treasury Announces Inversion Regulations; Reach Extends to Other Cross-Border M&A". Transaction Advisors. ISSN 2329-9134.

- ↑ "Tax inversion curb turns tables on US". Financial Times. 15 March 2015.

A crackdown by the Obama administration on 'tax inversion' deals, which allowed U.S. companies to slash their tax bills, has had the perverse effect of prompting a sharp increase in foreign takeovers of American groups.

- ↑ Rubin, Richard (19 November 2015). "U.S. Unveils Rules to Make Corporate Inversions More Difficult Move intended to stop American companies from putting their addresses in foreign countries to reduce tax bills". Wall Street Journal. Retrieved 20 November 2015.

- 1 2 Rockoff, Jonathan; Cimilluca, Dana; Mattioli, Dana (19 November 2015). "Allergan-Pfizer Talks Include Allergan as Possible Buyer". Wall Street Journal. Retrieved 20 November 2015.

- ↑ Bray, Chad (6 April 2016). "Pfizer and Allergan Call Off Merger After Tax-Rule Changes". New York Times. Retrieved 6 April 2016.

- 1 2 Furchtgoot-Roth, Diana (7 April 2016). "Free Pfizer! Why Inversions Are Good for the U.S." The New York Times. Retrieved 8 April 2016.

- ↑ https://www.bloomberg.com/news/articles/2016-07-13/-leprechaun-economics-earn-ireland-ridicule-443-million-bill

- ↑ "KPMG Report on TCJA" (PDF). KPMG. February 2018.

- 1 2 "The United Kingdom's Experience with Inversions". Tax Foundation. 5 April 2016.

- ↑ "Vantiv decides against Inversion". Bloomberg News. 10 August 2017.

- ↑ "Inversions under the new TCJA tax law". Tax Foundation. 18 March 2018.

- 1 2 "U.S. Tax Cuts and Jobs Act: Winners and Losers". Taxnotes. 19 March 2018. p. 1235.

- ↑ "Intangible Assets Scheme under Section 291A Taxes Consolidation Act 1997" (PDF). Irish Revenue. 2010.

- ↑ "Capital Allowances for Intangible Assets under section 291A of the Taxes Consolidation Act 1997 (Part 9 / Chapter2)" (PDF). Irish Revenue. February 2018.

- ↑ "An Analysis of 2015 Corporation Tax Returns and 2016 Payments" (PDF). Revenue Commissioners. April 2017. p. 4.

- ↑ "Auditor General Report on Corporate Tax Chapter 20" (PDF). Auditor General. April 2017. p. 294.

- ↑ "Report on Ireland's Relationship with Global Corporate Taxation Architecture" (PDF). Department of Finance. 2014. p. 13.

- ↑ "US firms 'paid effective tax rate of 2.2% in 2011'". Irish Times. 11 February 2014. p. 13.

- ↑ "Corporate Tax regime in Ireland". Industrial Development Authority (IDA). 2018.

- ↑ "Holding Companies in Ireland" (PDF). Dillon Eustace Law Partners (Dublin). 2016.

- ↑ "Irish Corporation Tax Portal". Revenue Commissioners of Ireland. 2018.

- ↑ "Tax Reform in the UK Reversed the Tide of Corporate Tax Inversions" (PDF). Tax Foundation. 14 October 2014.

- ↑ Daurat, Cecile (22 April 2015). "Pace Soars as Arris Agrees to $2.1 Billion Inversion Deal". Bloomberg.

- ↑ "The overseas tax tactic is back". Yahoo Finance. 23 April 2015.

- ↑ Gilbert, Craig (27 January 2016). "Hillary Clinton slams Johnson Controls-Tyco deal". Milwaukee Journal Sentinel.

Further reading

- "Tax Inversion". Bloomberg.com. Retrieved 2018-04-18. contains a list of references for further reading

- "Corporate Inversions, Inside and Out". St. Louis Fed. Retrieved 2018-04-18.

- "Corporate Inversions: History and Impact". U.S. Chamber of Commerce. Retrieved 2018-04-18.

- "The New Corporate Migration" (PDF). Standford University. Retrieved 2018-04-18.

- Tax Inversion Remains (Huge), by Maarten van 't Riet, Researcher, CPB Netherlands Bureau for Economic Policy Analysis and Arjan Lejour, Programme leader, CPB. Naked Capitalism

- How potential changes in Tax Inversion laws affected markets

- Tax Inversions Quick Take, Bloomberg View

- CBO-An Analysis of Corporate Inversions-September 18,2017