Asian Infrastructure Investment Bank

The Asian Infrastructure Investment Bank (AIIB) is a multilateral development bank that aims to support the building of infrastructure in the Asia-Pacific region. The bank currently has 82 members as well as 20 prospective members from around the world.[1] The bank started operation after the agreement entered into force on 25 December 2015, after ratifications were received from 10 member states holding a total number of 50% of the initial subscriptions of the Authorized Capital Stock.[4]

| |

| Abbreviation | AIIB |

|---|---|

| Formation | 16 January 2016 (Open for business) 25 December 2015 (Entry into force Articles of Agreement) |

| Type | Regional Investment Bank |

| Legal status | Treaty |

| Purpose | Crediting |

| Headquarters | Beijing, China |

Region served | Asia and Oceania |

Membership | 102 Members[1] |

Official language | English[2] |

Key people | Jin Liqun[3] (President) |

Main organ |

|

| Website | www |

| Asian Infrastructure Investment Bank | |||||||

|---|---|---|---|---|---|---|---|

| Simplified Chinese | 亚洲基础设施投资银行 | ||||||

| Traditional Chinese | 亞洲基礎設施投資銀行 | ||||||

| |||||||

| Alternative Chinese name | |||||||

| Simplified Chinese | 亚投行 | ||||||

| Traditional Chinese | 亞投行 | ||||||

| |||||||

The United Nations has addressed the launch of AIIB as having potential for "scaling up financing for sustainable development"[5] and to improve the global economic governance.[6] The starting capital of the bank was $100 billion, equivalent to 2⁄3 of the capital of the Asian Development Bank and about half that of the World Bank.[7]

The bank was proposed by China in 2013[8] and the initiative was launched at a ceremony in Beijing in October 2014.[9] It received the highest credit ratings from the three biggest rating agencies in the world, and is seen as a potential rival to the World Bank and IMF.[10][11]

History

The proposal for the creation of an "Asian Infrastructure Investment Bank" was first made by the Vice Chairman of the China Center for International Economic Exchanges, a Chinese thinktank, at the Bo'ao Forum in April 2009. The initial context was to make better use of Chinese foreign currency reserves in the wake of the global financial crisis.[12]

The initiative was officially launched by China's Paramount leader Xi Jinping on a state visit to Indonesia in October 2013.[13] The Chinese government has been frustrated with what it regards as the slow pace of reforms and governance, and wants greater input in global established institutions like the IMF, World Bank and Asian Development Bank which it claims are heavily dominated by American, European and Japanese interests.[14]

In April 2014, Chinese Premier Li Keqiang delivered a keynote speech at the opening of the Boao Forum for Asia and said that China was ready to intensify consultations with relevant parties in and outside Asia on the preparations for the Asian Infrastructure Investment Bank.[15][16]

The Asian Development Bank Institute published a report in 2010 which said that the region requires $8 trillion to be invested from 2010 to 2020 in infrastructure for the region to continue economic development.[14][17] In a 2014 editorial, The Guardian newspaper wrote that the new bank could allow Chinese capital to finance these projects and allow it a greater role to play in the economic development of the region commensurate with its growing economic and political clout.[18] But until March 2015, China in the ADB has only 5.47 percent voting right, while Japan and US have a combined 26 percent voting right (13 percent each) with a share in subscribed capital of 15.7 percent and 15.6 percent, respectively. Dominance by both countries and slow reforms underlie China's wish to establish the AIIB, while both countries worry about China's increasing influence.[19]

In June 2014 China proposed doubling the registered capital of the bank from $50 billion to $100 billion and invited India to participate in the founding of the bank.[20][21] On 24 October 2014, twenty-one countries signed a Memorandum of Understanding (MOU) regarding the AIIB in Beijing, China: Bangladesh, Brunei, Cambodia, India, Kazakhstan, Kuwait, Laos, Malaysia, Myanmar, Mongolia, Nepal, Oman, Pakistan, Philippines, Qatar, Singapore, Sri Lanka, Thailand, Uzbekistan and Vietnam.[22] Indonesia's joining was slightly delayed due to their new presidential administration not being able to review the membership in time. Indonesia signed the MOU on 25 November 2014.[23]

The U.S. allegedly tried to keep Australia and South Korea from becoming prospective founding members, after they expressed an interest in it.[24] However, both Australia and South Korea applied to join the bank in March 2015.[25][26][27]

Hong Kong's Financial Secretary John Tsang announced in his budget speech in February 2015 that the territory would join the AIIB.[28] It did however not become one of the prospective founding members and negotiated as part of the Chinese delegation.

In early March 2015, the United Kingdom's Chancellor of the Exchequer, George Osborne, announced that the UK had decided to apply to join the Bank, becoming the third Western country to do so after Luxembourg and New Zealand.[29] The announcement was criticised by the U.S. Obama Administration. A US government official told Financial Times, "We are wary about a trend toward constant accommodation of China, which is not the best way to engage a rising power." The official further stated that the British decision was taken after "no consultation with the US."[30] In response, the UK indicated that the subject had been discussed between Chancellor Osborne and US Treasury Secretary Jack Lew for several months preceding the decision. It was further stated that joining the bank as a founding member would allow the UK to influence the development of the institution. By encouraging Chinese investments in the next generations of nuclear power plants, Osborne announced that "the City of London would become the base for the first clearing house for the yuan outside Asia."[31]

Following the criticism, the White House National Security Council, in a statement to The Guardian, declared,

Our position on the AIIB remains clear and consistent. The United States and many major global economies all agree there is a pressing need to enhance infrastructure investment around the world. We believe any new multilateral institution should incorporate the high standards of the World Bank and the regional development banks. Based on many discussions, we have concerns about whether the AIIB will meet these high standards, particularly related to governance, and environmental and social safeguards […] The international community has a stake in seeing the AIIB complement the existing architecture, and to work effectively alongside the World Bank and Asian Development Bank.[32]

Several other European states – including Germany, France and Italy – followed the UK's decision to join the AIIB in March.[33] German Finance Minister Wolfgang Schäuble stated, "We want to contribute our long-standing experience with international financial institutions to the creation of the new bank by setting high standards and helping the bank to get a high international reputation."[34] In March 2015, the South Korean Ministry of Strategy and Finance announced that it, too, is planning to join the AIIB, citing its potential in helping South Korean companies win deals in infrastructural projects as well expanding South Korea's influence in international banking as a founding member.[35] States could indicate their interest in becoming a Prospective Founding Member until 31 March 2015.

Negotiations took place in the framework of five Chief Negotiators Meetings (CNMs) which took place between November 2014 and May 2015. The Articles of Agreement, the legal framework of the bank, were concluded in the fifth CNM. It was signed on 29 June 2015 by 50 of the named 57 prospective founding members in Beijing, while the other seven signed later.

On 25 December 2015, the Articles of Agreement entered into force. On 16 January 2016, the board of governors of the bank convened its inaugural meeting in Beijing and declared the bank open for business. Jin Liqun was elected as the bank's president for a five-year term. 17 states (Australia, Austria, Brunei, China, Georgia, Germany, Jordan, Luxembourg, Mongolia, Myanmar, the Netherlands, New Zealand, Norway, Pakistan, Singapore, South Korea and the United Kingdom) together holding 50.1% of the initial subscriptions of Authorized Capital Stock, had deposited the instrument of ratification for the agreement, triggering entry into force, and making them all founding members[36] and bringing the Articles of Agreement, the bank's charter, into force. 35 other states followed later, taking the amount of Authorized Capital Stock held by the 29 members of the bank to 74%.

AIIB within PRC policy thinking

Fostering long-term economic development

The Asian Infrastructure Investment Bank can be construed as a natural inter-national extension of the infrastructure-driven economic development framework that has sustained the rapid economic growth of China since the adoption of the Chinese economic reform under chairman Deng Xiaoping. It stems from the notion that long-term economic growth can only be achieved through systematic, and broad-based investments in infrastructure assets – in contrast with the more short-term "export-driven" and "domestic consumption" development models favored by mainstream Western Neoclassical economists and pursued by many developing countries in the 1990s and the first decade of the 21st century with generally disappointing results.[37][38]

Infrastructure as regional integration and foreign policy tool

In his 29 March 2015 speech at the Boao Forum for Asia (BFA) annual conference, Chinese leader Xi Jinping said:

[T]he Chinese economy is deeply integrated with the global economy and forms an important driving force of the economy of Asia and even the world at large. […] China's investment opportunities are expanding. Investment opportunities in infrastructure connectivity as well as in new technologies, new products, new business patterns, and new business models are constantly springing up. […] China's foreign cooperation opportunities are expanding. We support the multilateral trading system, devote ourselves to the Doha Round negotiations, advocate the Asia-Pacific free trade zone, promote negotiations on regional comprehensive economic partnership, advocate the construction of the Asian Infrastructure Investment Bank (AIIB), boost economic and financial cooperation in an all-round manner, and work as an active promoter of economic globalization and regional integration[15]

Xi insisted also that the Silk Road Fund and the Asian Infrastructure Investment Bank would foster "economic connectivity and a new-type of industrialization [in the Asia Pacific area], and [thus] promote the common development of all countries as well as the peoples' joint enjoyment of development fruits."[15][39]

Legal basis and membership

Long name:

| |

|---|---|

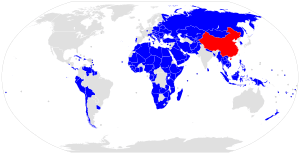

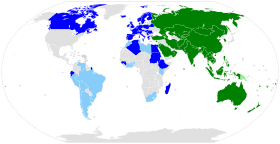

Prospective members (regional)

Members (regional)

Prospective members (non-regional)

Members (non-regional) | |

| Signed | 29 June 2015 |

| Location | Beijing, China |

| Effective | 25 December 2015 |

| Condition | Ratification by 10 states, comprising 50% of initial subscriptions of capital stock[2] |

| Signatories | 57 |

| Parties | 72 (96% of initial subscriptions of capital stock)[40] |

| Depositary | Government of the People’s Republic of China[2] |

| Languages | Chinese, English (used in disputes) and French[2] |

The Articles of Agreement form the legal basis for the Bank. 57 Prospective Founding Members (PFM) named in annex A of the agreement are eligible to sign and ratify the Articles, thus becoming a member of the Bank. Other states, which are parties to the International Bank for Reconstruction and Development or the Asian Development Bank may become members after approval of their accession by the bank.[4]

The Articles were negotiated by the Prospective Founding Members, with Hong Kong joining the negotiations via China.[41][42]

Members

The 57 Prospective Founding Members can become Founding Members through:

- Signing the Articles of Agreement in 2015

- Ratifying the Articles of Agreement in 2015 or 2016

All Prospective Founding Members have signed the Articles, 52 of which have ratified them, comprising 92% of the shares of all PFM. The formal actions towards becoming a Founding Member are shown below, as well as the percentage of the votes and of the shares, in the event all prospective founding states become parties, and no other members are accepted.

In March 2017, 13 other states were granted prospective membership: 5 regional (Afghanistan, Armenia, Fiji, Timor Leste and Hong Kong, China) and 8 non-regional: Belgium, Canada, Ethiopia, Hungary, Ireland, Peru, Sudan and Venezuela. In May 2017, 7 states were granted prospective membership: 3 regional (Bahrain, Cyprus, Samoa) and 4 non-regional (Bolivia, Chile, Greece, Romania). In June 2017, 3 other states were granted prospective membership: 1 regional (Tonga) and 2 non-regional (Argentina, Madagascar).[43] In 2018, 7 other states were granted prospective membership: 1 regional (Lebanon) and 6 non-regional (Algeria, Ghana, Libya, Morocco, Serbia, Togo).[44][45] In 2019, 7 other states were granted prospective membership: 7 non-regional (Djibouti, Rwanda, Benin, Côte d'Ivoire, Guinea, Tunisia, Uruguay).[46] They become members after finishing their domestic procedures. As of 16 May 2020, the total number of countries approved for membership of AIIB is 102 (Regional Members: 44, Non-Regional Members: 36, Prospective Members: 22).[47]

| Country / Region | Prospective Founding Member status |

Signature (Articles)[40] |

Ratification or Acceptance (Articles)[40] |

Total Subscriptions (Amount of Shares in millions USD)[2] |

Voting Power (Number of Votes)[2] |

|---|---|---|---|---|---|

| 13 October 2017 | 86.6 | 2,624 | |||

| 27 December 2019 | 5.0 | 1,698 | |||

| 5.0 | 1,700 | ||||

| 3 April 2015[48] | 29 June 2015 | 10 November 2015 | 3,691.2 | 39,323 | |

| 11 April 2015[49] | 29 June 2015 | 3 December 2015 | 500.8 | 7,539 | |

| 15 April 2015[50] | 29 June 2015 | 24 June 2016 | 254.1 | 5,072 | |

| 24 August 2018 | 103.6 | 2,967 | |||

| 24 October 2014 | 29 June 2015 | 22 March 2016 | 660.5 | 9,136 | |

| 17 January 2019 | 64.1 | 2,474 | |||

| 10 July 2019 | 284.6 | 4,679 | |||

| 27 May 2020 | 5.0 | 1,698 | |||

| 26.1 | 1,911 | ||||

| 12 April 2015[51] | 29 June 2015 | 5.0 | [52] 2,300 | ||

| 24 October 2014 | 29 June 2015 | 12 October 2015 | 52.4 | 3,055 | |

| 24 October 2014 | 29 June 2015 | 17 May 2016 | 62.3 | 3,154 | |

| 19 March 2018 | 995.4 | 11,765 | |||

| 10.0 | 1,750 | ||||

| 24 October 2014 | 29 June 2015 | 26 November 2015 | 29,780.4 | 300,215 | |

| 1 June 2020} | 0.5 | 1,653 | |||

| 26 February 2020 | 5.0 | 1,698 | |||

| 27 June 2018 | 20.0 | 2,131 | |||

| 12 April 2015[51] | 27 October 2015 | 14 January 2016 | 369.5 | 6,226 | |

| 1 November 2019 | 5.0 | 1,698 | |||

| 14 April 2015[53] | 29 June 2015 | 12 August 2016 | 650.5 | 9,036 | |

| 13 May 2017 | 45.8 | 2,389 | |||

| 11 December 2017 | 12.5 | 2,056 | |||

| 12 April 2015[51] | 29 June 2015 | 7 January 2016 | 310.3 | 5,634 | |

| 2 April 2015[54] | 29 June 2015 | 16 June 2016 | 3,375.6 | 36,167 | |

| 12 April 2015[51] | 29 June 2015 | 14 December 2015 | 53.9 | 3,070 | |

| 1 April 2015[55] | 29 June 2015 | 21 December 2015 | 4,484.2 | 47,253 | |

| 21 February 2020 | 5.0 | 1,698 | |||

| 20 August 2019 | 10.0 | 1,933 | |||

| 12 July 2019 | 5.0 | 1,698 | |||

| 7 June 2017 | 765.1 | 9,462 | |||

| 16 June 2017 | 100.0 | 2,931 | |||

| 15 April 2015[50] | 29 June 2015 | 4 March 2016 | 17.6 | 2,707 | |

| 24 October 2014 | 29 June 2015 | 11 January 2016 | 8,367.3 | 86,084 | |

| 25 November 2014[23] | 29 June 2015 | 14 January 2016 | 3,360.7 | 36,018 | |

| 7 April 2015[56] | 29 June 2015 | 6 January 2017 | 1,580.8 | 15,057 | |

| 23 October 2017 | 131.3 | 3,244 | |||

| 15 April 2015[50] | 29 June 2015 | 15 January 2016 | 749.9 | 9,910 | |

| 2 April 2015[54] | 29 June 2015 | 13 July 2016 | 2,571.8 | 28,129 | |

| 7 February 2015 | 29 June 2015 | 25 December 2015 | 119.2 | 3,723 | |

| 24 October 2014 | 29 June 2015 | 18 April 2016 | 729.3 | 9,704 | |

| 11 April 2015[49] | 29 June 2015 | 11 December 2015 | 3,738.7 | 39,798 | |

| 24 October 2014 | 4 December 2015 | 536.0 | |||

| 9 April 2015[57] | 29 June 2015 | 11 April 2016 | 26.8 | 2,799 | |

| 24 October 2014 | 29 June 2015 | 15 January 2016 | 43.0 | 2,961 | |

| 27 March 2015[58] | 29 June 2015 | 9 December 2015 | 69.7 | 3,228 | |

| 27 June 2018 | 5.0 | 1,698 | |||

| 24 October 2014 | 21 August 2015[59] | 27 March 2017 | 109.5 | 3,626 | |

| 31 December 2014[60] | 29 June 2015 | 4 January 2016 | 7.2 | 2,603 | |

| 9 April 2015[57] | 29 June 2015 | 7 January 2016 | 13.6 | 2,667 | |

| 24 October 2014 | 29 June 2015 | 27 November 2015 | 41.1 | 2,942 | |

| 24 October 2014 | 29 June 2015 | 1 July 2015 | 264.5 | 5,179 | |

| 24 October 2014 | 29 June 2015 | 13 January 2016 | 80.9 | 3,340 | |

| 12 April 2015[51] | 29 June 2015 | 16 December 2015 | 1,031.3 | 12,724 | |

| 5 January 2015[61] | 29 June 2015 | 9 December 2015[62] | 461.5 | 7,146 | |

| 14 April 2015[53] | 29 June 2015 | 22 December 2015 | 550.6 | 8,037 | |

| 24 October 2014 | 29 June 2015 | 21 June 2016 | 259.2 | 5,123 | |

| 24 October 2014 | 29 June 2015 | 22 December 2015 | 1,034.1 | 12,753 | |

| 154.6 | 3,196 | ||||

| 24 October 2014 | 31 December 2015 | 6 December 2016 | 979.1 | 12,202 | |

| 15 April 2015[50] | 9 October 2015 | 20 April 2016[63] | 831.8 | 10,729 | |

| 15 April 2015[50] | 29 June 2015 | 8 February 2017 | 65.0 | 3,181 | |

| 24 October 2014 | 29 June 2015 | 24 June 2016 | 604.4 | 8,575 | |

| 28 December 2018 | 153.0 | 3,461 | |||

| 14 April 2015[64] | 29 June 2015 | 28 December 2015 | 6,536.2 | 67,773 | |

| 16 April 2020 | 5.0 | 1,698 | |||

| 6 March 2018 | 2.1 | 1,948 | |||

| 13 January 2015[65] | 29 June 2015 | 19 February 2016 | 2,544.6 | 27,857 | |

| 15 August 2018 | 5.0 | 1,698 | |||

| 24 October 2014[66] | 29 June 2015 | 10 September 2015 | 250.0 | 5,031 | |

| 15 April 2015[50] | 3 December 2015 | 590.5 | |||

| 11 April 2015[49] | 29 June 2015 | 19 December 2017 | 1,761.5 | 20,026 | |

| 24 October 2014 | 29 June 2015 | 22 June 2016 | 269.0 | 5,221 | |

| 18 September 2018 | 59.0 | 2,521 | |||

| 15 April 2015[50] | 29 June 2015 | 23 June 2016 | 630.0 | 8,831 | |

| 28 March 2015[67] | 29 June 2015 | 25 April 2016 | 706.4 | 9,475 | |

| 13 January 2015[65] | 29 June 2015 | 16 January 2016 | 30.9 | 2,840 | |

| 24 October 2014[66] | 1 October 2015 | 20 June 2016 | 1,427.5 | 16,686 | |

| 22 November 2017 | 16.0 | 2,091 | |||

| 10 April 2015[68] | 29 June 2015 | 15 January 2016 | 2,609.9 | 28,510 | |

| 5 April 2015[69] | 29 June 2015 | 15 January 2016 | 1,185.7 | 14,268 | |

| 28 March 2015[67] | 29 June 2015 | 3 December 2015 | 3,054.7 | 32,958 | |

| 28 April 2020 | 5.0 | 1,698 | |||

| 24 October 2014 | 29 June 2015 | 30 November 2016 | 219.8 | 4,729 | |

| 6 March 2018 | 0.5 | 1,653 | |||

| 209.0 | 3,740 | ||||

| 24 October 2014 | 29 June 2015 | 11 April 2016 | 663.3 | 9,164 | |

| Unallocated Shares | 1,844.7 | ||||

| Grand Total | 100 44 Regional 30 non-Regional 26 prospective | 100 100.00% of shares | 100 100.00% of shares | 100,000 | 1,148,383 |

Dependent territories

The Articles of Agreement provide for non-sovereign entities to become members of the bank. In addition to the requirements for sovereign states, the membership of dependent territories must be supported by the state responsible for its external relations.

Non-members

The Czech Republic,[70] Nigeria, Iraq,[71] Colombia,[72] Ukraine are considering joining the AIIB as members. Mexico, Japan and the United States have no immediate intention to participate. Taiwan's request to become a Prospective Founding Member was rejected by China as it does not consider the former to be a sovereign state.[73]

- Taiwan applied for PFM to join the AIIB via Taiwan Affairs Office on 31 March, possibly under the name "Chinese Taipei",[74][75] but was rejected by the Multilateral Interim Secretariat of the AIIB on 13 April, without any reason stated. However, China claims that there is the possibility for Taiwan to obtain membership at a later date.[73] China's Foreign Ministry spokeswoman Hua Chunying said that Taiwan should avoid creating a "two Chinas" or "one China, one Taiwan" situation.[76] ROC Finance Minister Chang Sheng-ford announced in April 2016 that Taiwan was not being treated with "dignity" or "respect" during the registration process and Taiwan eventually chose to leave the decision to join to the new president.[77]

- The United States' officials have expressed concerns about whether the AIIB would have high standards of governance, and whether it would have environmental and social safeguards.[78] The United States is reported to have used diplomatic pressure to try and prevent key allies, such as Australia, from joining the bank,[79] and expressed disappointment when others, such as Britain, joined.[66][78] The US' opposition to the AIIB, as well as its attempt to dissuade allies from joining was seen as a manifestation of a multifaceted containment strategy. The failure of that approach in this case was widely acknowledged as a strategic blunder.[80]

![]()

- Masato Kitera, Tokyo's envoy in Beijing, stated previously that Japan might join the AIIB.[81] Japanese Finance Minister Tarō Asō previously indicated interest in joining the AIIB, but later switched his stance. Yoshihide Suga, Japan's Cabinet Secretary, told the public that Japan was still seeking China's full explanation of the AIIB as he stated, "As of today, Japan will not join AIIB and a clear explanation has not been received from China" and "Japan is dubious about whether (the AIIB) would be properly governed or whether it would damage other creditors". He also stated that Japan is no longer considering whether or not to join the bank. The Japanese Government Spokesman also announced that Japan would not join the AIIB. Japanese prime minister Shinzō Abe also added that Japan does not need to join the bank.[82] But two years later, in May 2017, Shinzō Abe said join the AIIB, created in part to fund the initiative, could be an option if governance questions were resolved.[83] Toshihiro Nikai, secretary-general of the ruling party Liberal Democratic Party, suggested join the AIIB.[84]

Shareholding structure

The Authorized Capital Stock of the bank is 100 billion US Dollars, divided into 1 million shares of 100 000 dollars each. Twenty percent are paid-in shares (and thus have to be transferred to the bank), and 80% are callable shares.[2] The allocated shares are based on the size of each member country's economy (calculated using GDP Nominal (60%) and GDP PPP (40%)), whether they are an Asian or Non-Asian Member, and the number of shares determines the fraction of authorized capital in the bank.[4][85][86][87] Of the prospective founding members, three states decided not to subscribe to all allocated shares: Malaysia, Portugal and Singapore,[88] resulting in 98% of available shares to be subscribed.[2]

Three categories of votes exist: basic votes, share votes and Founding Member votes. The basic votes are equal for all members and constitute 12% of the total votes, while the share votes are equal to the number of shares. Each Founding Member furthermore gets 600 votes. An overview of the shares, assuming when all 57 Prospective Founding Members have become Founding Members is shown below (values in bold do not depend on the number of members):[89]

| Vote Type | % of Total Votes | Total Votes | Vote per Member | China (Largest PFM) | Maldives (Smallest PFM) |

|---|---|---|---|---|---|

| Basic votes | 12 | 138,510 | 2,430 | 2,430 | 2,430 |

| Share votes | 85 | 981,514 | Varies | 297,804 | 72 |

| Founding Member votes | 3 | 34,200 | 600 | 600 | 600 |

| Total | 100 | 1,154,224 | varies | 300,834 (26.1%) | 3,102 (0.3%) |

Governance

The bank's governance structure is composed of the Board of Governors[90] as the top-level and highest decision-making body.[91] It is composed of 1 governor for each member state of the bank and in principle meets once a year.[91] The board of directors, composed of 12 governors, each representing one or more member is responsible for daily operations and tasks delegated to it by the board of governors. Nine of those members are from within the Asia-Pacific region and three representing members outside the region.[91]

Of the non-regional directors, 1 constituency is made up of EU member states having the Euro as their currency, and 1 from other European countries.[92]

New members are considered for admission only once a year. An overview of the constituencies is shown below:[93]

| Country of Director | Countries of Alternates | Other Constituencies |

|---|---|---|

| Unallocated: | ||

| Senior Management of AIIB | |||

| Country | Name | Position in AIIB | |

|---|---|---|---|

| China | Jin Liqun | President | |

| United Kingdom | Danny Alexander | Vice President and Corporate Secretary | |

| Russia | Konstantin Limitovskiy | Vice President, Investment Operations (Region 2) | |

| India | D. J. Pandian | Vice President, Investment Operations (Region 1) | |

| Germany | Joachim von Amsberg | Vice President - Policy and Strategy | |

| Indonesia | Luky Eko Wuryanto | Vice President and Chief Administration Officer | |

| New Zealand | Gerard Sanders | General Counsel | |

| Germany | Martin Kimmig | Chief Risk Officer | |

| New Zealand United Kingdom |

Andrew Cross | Chief Financial Officer | |

Reception

The former President of the World Bank, Jim Yong Kim, has said that the need for infrastructure in developing countries is great so that the activities of new organizations would be welcome.[94]

Geopolitical implication in Asia and beyond

There is no consensus in the United States about the role of the AIIB. G. John Ikenberry (Princeton University) sees the AIIB as part of "China's emerging institutional statecraft,"[95] but argues that it is not clear whether the institution will tie China more deeply into the existing order or become a vehicle to challenge the order. Phillip Lipscy (Stanford University) argues that the United States and Japan should support the AIIB to encourage China's peaceful global leadership and discourage China from pursuing coercive or military options.[96] On the other hand, Paola Subacchi (Chatham House) argues that the AIIB represents a threat to US-dominated global governance.[97]

Think-tanks such as Chatham House, the China Studies Centre at the University of Sydney and the World Pensions Council (WPC) have argued that the successful establishment of a new supranational financial powerhouse headquartered in PRC would be facilitated by the large number of participating developed economies.[98][99] These experts observe that the establishment of the Beijing-based AIIB does not necessitate rivalry, when economic cooperation is possible,[98] and that the decision by the UK to participate advances its own interests even if some of its allies are opposed.[99]

Environmental record

As the bank is still in its early years, it has no environmental record. Several organisations have however expressed their concerns over environmental policy of the proposed bank because of the high stake of China in the bank's business. Although the proposed bank declared "AIIB will learn from the best practice in the world and adopt international standards of environmental protection," Oxford scholar of economics and energy policy Yuge Ma has argued that this may be complicated in developing Asian countries.[100]

Comparison with ADB and IBRD

| AIIB | ADB[101] | IBRD[102] | |||

|---|---|---|---|---|---|

| Established | 2016 | 1966 | 1944 | ||

| Date as of | 31 December 2016[103] | 31 December 2017[104] | 31 December 2017 | 30 June 2018 | |

| Member.[47] | Total | 57 | 84 | 67 | 189 |

| (Regional, Non-regional, Prospective) | 34, 16, 7 | 40, 20, 24 | 48, 19, 0 | – | |

| Credit rating | Unrated | AAA | AAA | AAA | |

| Capital | Subscribed | 90,327 | 95,001 | 151,169 | 274,730 |

| Paid-in | 18,065 | 19,000 | 7,563 | 16,456 | |

| Total assets | 17,795 | 18,973 | 182,381 | 403,056 | |

| Lending | 1,730 | 4,220 | 101,126 | 183,588 | |

Lending results

2016

During 2016, AIIB committed a total of $1.73 billion to nine projects, among which six projects are joint initiatives with other international lenders such as the World Bank and the Asian Development Bank. It had achieved its loan target of $1.2 billion for the first year.[105][106]

| Approval date | Country | Purpose | Amount M$ | Co-lenders |

|---|---|---|---|---|

| 24 June 2016 | Tajikistan | Road improvement | 27.5 | European Bank for Reconstruction and Development |

| 24 June 2016 | Bangladesh | Power distribution lines | 165.0 | none |

| 24 June 2016 | Pakistan | Motorway construction | 100.0 | Asian Development Bank and United Kingdom's Department for International Development |

| 24 June 2016 | Indonesia | Redevelopment of poor districts | 216.5 | World Bank |

| 27 September 2016 | Pakistan | Hydropower plant | 300.0 | World Bank |

| 27 September 2016 | Myanmar | Combined Cycle Gas Turbine power plant | 20.0 | International Finance Corporation, the Asian Development Bank and certain commercial lenders |

| 8 December 2016 | Oman | Railways | 36.0 | none |

| 8 December 2016 | Oman | Port facilities | 265.0 | none |

| 21 December 2016 | Azerbaijan | Gas pipeline | 600.0 | A number of other multilateral development banks including the World Bank and other commercial entities |

| Total | 1,730.0 | |||

2017

| Approval date | Country | Purpose | Amount M$ | Co-lenders |

|---|---|---|---|---|

| 22 March 2017 | Indonesia | Regional Infrastructure Development Fund Project | 100.0 | World Bank |

| 22 March 2017 | Indonesia | Dam Operational Improvement and Safety Project Phase II | 125.0 | World Bank |

| 22 March 2017 | Bangladesh | Natural Gas Infrastructure and Efficiency Improvement Project | 60.0 | Asian Development Bank |

| 2 May 2017 | India | Andhra Pradesh 24x7 – Power For All | 160.0 | World bank and Government of Andhra Pradesh |

| 5 June 2017 | Georgia | Batumi Bypass Road Project | 114.2 | Asian Development Bank |

| 15 June 2017 | India | India Infrastructure Fund | 150.0 | Other investors |

| 15 June 2017 | Tajikistan | Nurek Hydropower Rehabilitation Project, Phase I | 60.0 | World Bank and Eurasian Development Bank |

| 4 July 2017 | India | Gujarat Rural Roads Project | 329.0 | Government of Gujarat |

| 4 September 2017 | Egypt | Egypt Round II Solar PV Feed-in Tariffs Program | 17.5 | International Finance Corporation and other lenders |

| 27 September 2017 | India | Transmission System Strengthening Project | 100.0 | Asian Development Bank and Power Grid Corporation of India |

| 27 September 2017 | Philippines | Metro Manila Flood Management Project | 207.60 | World Bank |

| 8 December 2017 | India | Bangalore Metro Rail Project – Line R6 | 335.0 | European Investment Bank and other lenders |

| 8 December 2017 | Oman | Broadband Infrastructure Project | 239.0 | none |

| 8 December 2017 | China | Beijing Air Quality Improvement and Coal Replacement Project | 250.0 | Beijing Municipality, China CDM Fund and Beijing Gas |

| Total | ||||

2018

| Approval date | Country | Purpose | Amount M$ | Co-lenders |

|---|---|---|---|---|

| 9 February 2018 | Bangladesh | Bhola IPP | 60.0 | none |

| 11 April 2018 | India | Madhya Pradesh Rural Connectivity Project | 140.0 | World Bank |

| 24 June 2018 | India | National Investment and Infrastructure Fund | 100.0 | Government of India |

| 24 June 2018 | Turkey | Tuz Golu Gas Storage Expansion Project | 600.0 | World Bank, Islamic Development Bank, BOTAS and commercial loans |

| 24 June 2018 | Indonesia | Strategic Irrigation Modernization and Urgent Rehabilitation Project | 250.0 | World Bank |

| 28 September 2018 | India | Andhra Pradesh Rural Roads Project | 455.0 | Government of Andra Pradesh |

| 28 September 2018 | Egypt | Sustainable Rural Sanitation Services Program | 300.0 | World Bank |

| 28 September 2018 | Turkey | TSKB Sustainable Energy and Infrastructure On-lending Facility | 200.0 | none |

| 7 December 2018 | Indonesia | Mandalika Urban and Tourism Infrastructure Project | 248.39 | Government of Indonesia |

| 7 December 2018 | India | Andhra Pradesh Urban Water Supply and Septage Management Improvement Project | 400.0 | Government of Andhra Pradesh |

2019

| Approval date | Country | Purpose | Amount M$ | Co-lenders |

|---|---|---|---|---|

| 26 March 2019 | Bangladesh | Power System Upgrade and Expansion Project | 120.0 | Government of Bangladesh and Power Grid Corporation of Bangladesh |

| 26 March 2019 | Laos | National Road 13 Improvement and Maintenance Project | 40.0 | Government of Laos, NDF and IDA |

| 4 April 2019 | Sri Lanka | Reduction of Landslide Vulnerability by Mitigation Measures Project | 80.0 | Government of Sri Lanka |

| 4 April 2019 | Sri Lanka | Colombo Urban Regeneration Project | 200.0 | Government of Sri Lanka and private partner |

| 21 May 2019 | Nepal | Upper Trisuli I Hydropower Project | 90.0 | ADB, IFC, Korean Consortium |

See also

- New Development Bank (BRICS)/NDB BRICS

- Asian Development Bank

- African Development Bank

- Caribbean Development Bank

- CAF - Development Bank of Latin America

- European Investment Bank

- Islamic Development Bank

Notes

- Signatories of the Memorandum of Understanding

References

- "Members and Prospective Members of the Bank". AIIB. Retrieved 6 August 2019.

- "Articles of Agreement – AIIB" (PDF). Asian Infrastructure Investment Bank. Archived from the original (PDF) on 27 December 2015. Retrieved 21 July 2015.

- "Jin Liqun Selected President-designate of the Asian Infrastructure Investment Bank". Multilateral Interim Secretariat of AIIB. 24 August 2015. Archived from the original on 3 August 2016. Retrieved 28 August 2015.

- "Asian Infrastructure Investment Bank – Articles of Agreement" (PDF). Asian Infrastructure Investment Bank. Archived from the original (PDF) on 14 July 2015. Retrieved 21 July 2015.

- "World Economic Situation and Prospects 2015" (PDF). United Nations. Retrieved 21 July 2015.

- United Nations Financing for Development Office. "Global Economic Governance". Retrieved 29 March 2015.

- "The Economist explains". The Economist. 11 November 2014.

- "China says new bank to complement existing institutions". The Washington Post. 21 March 2015.

- "Three major nations absent as China launches World Bank rival in Asia". Reuters. 5 November 2014.

- "AIIB looks to attract private financing for projects". GBTIMES.

- Dahir, Abdi Latif. "The growing membership of a China-led development bank challenges the IMF-World Bank orthodoxy". Quartz.

- Callaghan, Mike; Hubbard, Paul (4 April 2016). "The Asian Infrastructure Investment Bank: Multilateralism on the Silk Road". China Economic Journal. 9 (2): 116–139. doi:10.1080/17538963.2016.1162970. S2CID 155902703.

- "An Asian infrastructure bank: Only connect". The Economist. 4 October 2013. Retrieved 2 April 2015.

- Brant, Philippa (25 September 2014). "Why Australia should join the Asian Infrastructure Investment Bank". The Interpreter. Lowy Institute for International Policy. Retrieved 27 October 2014.

- Firzli, M. Nicolas J. (2015). "China's AIIB, America's Pivot to Asia & the Geopolitics of Infrastructure Investments". Revue Analyse Financière. Paris. Retrieved 1 October 2015.

- "ChinaBoao Forum China eyes closer Asia's economic integration through Asian infrastructure bank". GBTIMES BEIJING. 11 April 2014.

- Bhattacharyay, Biswa N. (9 September 2010). "Estimating Demand for Infrastructure in Energy, Transport, Telecommunications, Water and Sanitation in Asia and the Pacific: 2010–2020". Asian Development Bank Institute. Retrieved 27 October 2010.

- "The Guardian view on the Asian Infrastructure Bank: the US should work with it, not oppose it: It's no surprise that China is promoting a solution to the shortage of infrastructure capital in Asia". The Guardian. 27 October 2014. Retrieved 2 April 2015.

- Isabel Reynolds and Enda Curran (18 March 2015). "In Development Bank Battle, Surge to China Rattles Japan". Retrieved 5 April 2015.

- Anderlini, Jamil (24 June 2014). "China expands plans for World Bank rival". Financial Times.

- Aneja, Atul (30 June 2014). "China invites India to join Asian Infrastructure Investment Bank". The Hindu. Retrieved 2 April 2015.

- "China, 20 other countries initiate new Asian bank". 24 October 2014.

- "Indonesia becomes 22nd founding member of AIIB". Xinhua News Agency. 27 November 2014. Retrieved 28 November 2014.

- "China launches AIIB in Asia to counter World bank". Affairscloud. 24 October 2014.

- "Australia decides to join China-proposed AIIB". Retrieved 30 June 2015.

- "Asian Infrastructure Investment Bank: Australia to sign Memorandum of Understanding to join China development fund". ABC News. 28 March 2015. Retrieved 30 June 2015.

- "S. Korea decides to join China-proposed AIIB". Retrieved 30 June 2015.

- "The 2015–16 Budget – Budget Speech". Retrieved 29 March 2015.

- "UK announces plans to join Asian Infrastructure Investment Bank". HM Treasury. 12 March 2015. Retrieved 19 October 2015.

- "Europeans defy US to join China-led developme". Financial Times. 16 March 2015. Retrieved 31 December 2015.

- "US Anger at Britain Joining Chinese-led Investment Bank AIIB". The Guardian. 26 March 2015. Retrieved 31 December 2015.

- "Washington rebukes Britain's decision to join China-backed Asian infrastructure bank". The Standard. 13 March 2015. Archived from the original on 16 March 2015. Retrieved 17 March 2015.

- "UK move to join China-led bank a surprise even to Beijing". Financial Times. 26 March 2015. Retrieved 30 December 2015.

- "Germany, France, Italy to Join China-Backed Development Bank". Wallstreet Journal. 17 March 2015.

- Choe Sang-Hun (27 March 2015). "South Korea Plans to Join Regional Development Bank Led by China". The New York Times.

- "Articles of Agreement of the Asian Infrastructure Investment Bank". Government of the Netherlands. Retrieved 30 September 2015.

- M. Nicolas J. Firzli World Pensions Council (WPC) Director of Research quoted by Andrew Mortimer (14 May 2012). "Country Risk: Asia Trading Places with the West". Euromoney Country Risk. . Retrieved 5 November 2012.

- M. Nicolas J. Firzli (8 March 2011). "Forecasting the Future: The BRICs and the China Model". International Strategic Organization (USAK) Journal of Turkish Weekly. . Retrieved 9 May 2015.

- Wang Huning; et al. (29 April 2015). "Xi Jinping Holds Talks with Representatives of Chinese and Foreign Entrepreneurs Attending BFA Annual Conference". PRC Ministry of Foreign Affairs. . Retrieved 9 May 2015.

- "Signing and Ratification status of the AOA of the AIIB". AIIB. Archived from the original on 17 May 2016. Retrieved 5 December 2015.

- "Financial Secretary – My Blog – 亞投行". Government of Hong Kong. Retrieved 29 March 2015.

- "The Status of AIIB, About AIIB". Asian Infrastructure Investment Bank. Archived from the original on 11 August 2015. Retrieved 21 July 2015.

- "AIIB Approves Membership of Argentina, Madagascar and Tonga // The Bank's approved membership rises to 80". AIIB. Beijing, China: AIIB. 16 June 2017. Retrieved 30 June 2017.

- "AIIB Approves Membership of Algeria, Ghana, Libya, Morocco, Serbia, Togo". AIIB. Beijing, China: AIIB. 19 December 2018. Retrieved 20 December 2018.

- "AIIB Approves Lebanon Membership". AIIB. Beijing, China: AIIB. 26 June 2018. Retrieved 20 December 2018.

- "AIIB Approves Membership of Côte d'Ivoire, Guinea, Tunisia, and Uruguay". AIIB. Beijing, China: AIIB. 22 April 2019. Retrieved 13 July 2019.

- "Members and Prospective Members of the Bank". AIIB.

- "Australia approved as AIIB founder". Xinhua News Agency. 13 April 2015. Retrieved 25 April 2015.

- "Spain, ROK, Austria join AIIB as founding members". China Daily. 11 April 2015. Retrieved 25 April 2015.

- "AIIB membership means opportunity for Iceland: official". Xinhua News Agency. 18 April 2015. Retrieved 25 April 2015.

- "Georgia, Denmark, Brazil, Netherlands, Finland Join China's AIIB Bank". Sputnik. 12 April 2015.

- Voting Power of Latin American members

- "Egypt, Norway, Russia approved as AIIB founders". China Daily. 15 April 2015. Retrieved 25 April 2015.

- "Italy, France approved as AIIB founding members". People's Daily. 2 April 2015. Retrieved 25 April 2015.

- "Germany becomes AIIB prospective founding member". Xinhuanet. Retrieved 30 June 2015.

- "Iran Joins China-Led Asian Bank". Fars News Agency. 7 April 2015. Archived from the original on 20 July 2015. Retrieved 25 April 2015.

- "Malta, Kyrgyzstan join AIIB as founding members". Retrieved 30 June 2015.

- "Luxembourg becomes AIIB's prospective founding member". Xinhua News Agency. 27 March 2015. Retrieved 25 April 2015.

- "Malaysia's Ambassador to China signed the Articles of Agreement of the Asian Infrastructure Investment Bank". Archived from the original on 4 March 2016. Retrieved 27 August 2015.

- "Asian Infrastructure Development Bank to be operational by year-end". The Economic Times. 2 January 2015. Retrieved 22 January 2015.

- "New Zealand becomes 24th founding member of AIIB". China Daily. 5 January 2015. Archived from the original on 2 April 2015. Retrieved 25 April 2015.

- "NZ formally joins Asian Infrastructure Investment Bank". Scoop.co.nz. Retrieved 10 December 2015.

- "President [Andrzej Duda] signs the act of ratification concerning joining AIIB". tvn24. Missing or empty

|url=(help) - "Russia officially joins $50bn China-led infrastructure bank". RT. 14 April 2015. Retrieved 14 April 2015.

- "Saudi Arabia, Tajikistan to join Beijing-backed development bank". Reuters. 13 January 2015. Retrieved 25 April 2015.

- "The infrastructure gap". The Economist. 19 March 2015. Retrieved 21 March 2015.

- "U.K. and Switzerland follow Brazil to China-backed Asia investment bank". Reuters. 28 March 2015. Retrieved 25 April 2015.

- "Turkey joins AIIB as founding member". Xinhua News Agency. 11 April 2015. Retrieved 25 April 2015.

- "UAE joins AIIB as prospective founding member". Gulf News. 5 April 2015. Retrieved 25 April 2015.

- "Číňané do Asijské rozvojové banky přibrali 57 zemí. Česko se vstupem váhá". Hospodářské noviny (in Czech). 15 April 2015.

- "InfraAsia – AIIB approves 13 new members". LinkedIn. 29 March 2017. Retrieved 10 July 2017.

- "AIIB approves 13 new members". ChinaGoAbroad. Retrieved 10 July 2017.

- Taiwan unable to become AIIB prospective founding member: China. Retrieved 13 April 2014.

- "Taiwan to apply to join China-backed AIIB investment bank". Reuters. 31 March 2015. Retrieved 31 March 2015.

- "Legislature not against AIIB bid". Taipei Times. 2 April 2015. Retrieved 2 April 2015.

- "Foreign Ministry Spokesperson Hua Chunying's Regular Press Conference on March 31, 2015". .FMPRC. 31 March 2015. Retrieved 1 April 2015.

- Chiu, Bernie; Wu, Lilian (12 April 2016). "Taiwan's bid to join AIIB a non-starter: finance minister". Central News Agency. Archived from the original on 13 April 2016. Retrieved 12 April 2016 – via Taipei Times.

- Watt, Nicholas; Lewis, Paul; Branigan, Tania (15 March 2015). "US anger at Britain joining Chinese-led investment bank AIIB". The Guardian. Retrieved 2 April 2015.

- "Europeans defy US to join China-led development bank". Financial Times. 16 March 2015.

Australia, a key US ally in the Asia-Pacific region which had come under pressure from Washington to stay out of the new bank, has also said that it will now rethink that position.

- Etzioni, Amitai (2016). "The Asian Infrastructure Investment Bank: A Case Study of Multifaceted Containment". Asian Perspective. 40 (2): 173–196. doi:10.1353/apr.2016.0008. SSRN 2788704.

- "Japan denies plan to join China-led development bank". Yahoo!. Agence France-Presse. Retrieved 31 March 2015.

- "Taiwan to join China-led regional bank, Japan says not now". Yahoo!. Elaine Kurtenbach. Retrieved 31 March 2015.

- "Abe, Nikai say Japan could consider joining AIIB". Japan Today. Retrieved 18 May 2017.

- "Japan's ruling party heavyweight signals readiness to join AIIB-Nikkei". Reuters. 15 May 2017. Retrieved 18 May 2017.

- "China to have 30 per cent stake, veto power under AIIB deal". South China Morning Post. 29 June 2015.

- China to have 30 per cent stake, veto power under AIIB deal

- "China to have 30 per cent stake, veto power under AIIB deal".

- "33625 Nr. 179, verslag van een schriftelijk overleg". OfficieleBekendmakingen.nl (in Dutch). 14 September 2015.

- "Botschaft über den Beitritt der Schweiz zur Asiatischen Infrastruktur-Investitionsbank" (PDF). The Federal Council of Switzerland (in German). 11 September 2015. Retrieved 26 December 2015.

- "China's legislature ratifies AIIB agreement". Xinhuanet. 4 November 2015. Retrieved 26 December 2015.

- "purpose, functions and membership". AIIB. Archived from the original on 16 October 2015. Retrieved 26 December 2015.

- "Verdrag betreffende de Aziatische Infrastructuurinvesteringsbank; Beijing, 29 juni 2015; Nr. 8; BRIEF VAN DE MINISTER VAN FINANCIËN". Officiele Bekenmakingen.nl (in Dutch). 11 January 2016.

- "AIIB Governance Board of Directors". AIIB. Archived from the original on 12 June 2018. Retrieved 15 July 2018.

- "World Bank welcomes China-led infrastructure bank". Reuters. 8 July 2014.

- Ikenberry, G. John (April 2017). "China's emerging institutional statecraft: The Asian Infrastructure Investment Bank and the prospects for counter-hegemony". Brookings. Retrieved 10 November 2017.

- Phillip Lipscy (7 May 2015). "Who's Afraid of the AIIB: Why the United States Should Support China's Asian Infrastructure Investment Bank". Foreign Affairs.

- Paola Subacchi (31 March 2015). "The AIIB Is a Threat to Global Economic Governance". Foreign Policy.

- Firzli, M. Nicolas J. (October 2015). "China's Asian Infrastructure Bank and the 'New Great Game'". Analyse Financière. Retrieved 20 January 2016.

- Kerry Brown (20 March 2015). "The UK Shows Leadership, and Strategic Clarity, in Joining AIIB". Chatham House Asia Programme.

- Yuge Ma (5 December 2014). "The Environmental Implications of China's New Bank". The Diplomat. Retrieved 27 July 2015.

- "ASIAN DEVELOPMENT BANK – FINANCIALREPORT – Management's Discussion and Analysis and Annual Financial Statements 31 December 2017" (PDF). Asian Development Bank. 2018.

- "Management's Discussion & Analysis and Financial Statements June 30, 2018" (PDF). International Bank for Reconstruction and Development. 2018.

- "Annual Report and Accounts 2016" (PDF). Asian Infrastructure Investment Bank. 2017.

- "FINANCING ASIA'S FUTURE – 2017 AIIB Annual Report and Financials" (PDF). AIIB. 2018.

- "Approved Projects". AIIB.

- "AIIB hits its first-year lending target". Nikkei Asian Review. 26 January 2017.

External links

| Wikimedia Commons has media related to Asian Infrastructure Investment Bank. |

.svg.png)