Privatisation in Pakistan

The Privatization process in Pakistan[1] (sometimes referred to as Denationalization programme[2] or simply the Privatization in Pakistan)[3] was a policy measure programme in the economic period of Pakistan. It was first conceived and implemented by the then-people-elected Prime Minister Nawaz Sharif and the Pakistan Muslim League, in an attempt to enable the nationalized industries towards market economy, immediately after the economic collapse of the Soviet Union in 1989–90.[4] The program was envisaged and visioned to improve the GDP growth of the national economy of Pakistan, and reversal of the nationalization programme in 1970s— an inverse of the privatization programme.[4]

In the period of the 1970s, all major private industries and utilities were put under the government ownership in an intensified programme, called the nationalization programme that led the economic disaster in Pakistan. Since then, the demand for denationalization gained currency towards the ending of the government of Pakistan Peoples Party in 1977, although a commission was set up by General Zia-ul-Haq government but no denationalization programme began until 1990.

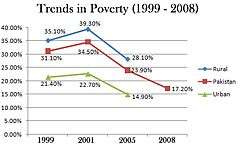

The privatization programme was launched on 22 January 1991[5] by Prime minister Nawaz Sharif in a vision to promote free-market economic principles, private-ownership and the mainstream goal to attract foreign investment in the country.[6] But, as a result a good deal of the national wealth fell into the hands of a relatively small group of so-called business oligarchs (tycoons), and the wealth gap increased dramatically in the 1990s that halted the programme by Benazir Bhutto.[6] Revisions were made in 1999, and finally launched the much more intensified privatization programme under the watchful presiding leadership of Prime minister Shaukat Aziz in 2004.[7] Finally, the programme was ended effectively at the end of 2007 when ~80%–90% of the industries were put under the management of private ownership of enterprises by Prime minister Shaukat Aziz.[7]

Privatization (Spontaneous phase: 1989–1993)

The momentum and demands for denationalization gained currency towards the end of the government of Prime minister Zulfikar Ali Bhutto and Pakistan Peoples Party who under intensified their nationalization programme had effectively the government-ownership management in the private industries of Pakistan; it had built a strong public-sector with priority on cement, steel and fertilizers.[8] After the end of government of peoples party, a white paper was issued by General Zia-ul-Haq's government, followed by setting up the commission under Pakistan Industrial Credit and Investment Corporation (PICIC) chairman N.M. Ukailie.[4] However, only three industries were returned to its rightful owners, namely Eittefaq Group of Industries to Mian Mohammed Sharif whilst others remains under government controlled.[4]

| “ | Nawaz Sharif lacked Bhutto's chrisma but he countered Bhutto's ideology, by imitating him. In many ways.... he imitated Bhutto better than Bhutto's own daughter Benazir. | ” |

| — Tripod Publications, Cited source[4] | ||

As an aftermath of 1988 general elections, Benazir Bhutto and the peoples party returned to power, promising to denationalized and replace with the industrialization programme by means other than the state intervention.[9] But controversially Benazir Bhutto did not carried out the denationalization programme or liberalization of the economy.[9] No nationalized units were privatized, few economic regulations were reviewed.[9] The partial privatization began to kick off by Chief Minister of Punjab Province Nawaz Sharif who presided the liquidation of many industrial units put under provisional government to private sector.[4] All industries based on Punjab government ownership were returned to its rightful owners on a mutual understanding; the prices on units returned to industrialists are still kept as "top secret" by the provisional government.[4]

A large-scale privatization programme was launched on 22 January 1991 as the primary economic policy by Prime Minister Navaz Sharif who came to national power after securing a flight-winning victory in the 1990 general elections.[10] The privatization programme was inspired and influenced in its nature after witnessing the success of the privatization in Great-Britain by British Prime minister Margaret Thatcher. The first phase of the privatization program covered the half of the public sector industries in terms of total employment,[11] and the programme was in a direct response to Pakistan Peoples Party and Zulfikar Ali Bhutto, and for instance Sharif's privatization programme was swift as nationalization programme.[11] During the course of first phase, Sharif presided the denationalization of banking sector and industries to private sector, starting first with MCB limited.[11] Sharif termed his privatization programme as "turning Pakistan into a (South) Korea by encouraging greater private saving and investment to accelerate economic growth.".[12]

The second phase was promulgated by Sartaj Aziz with the goal to transform the enterprises into profit-seeking businesses, not depended to the government subsidies for their survival. The mega-energy corporations such as Water and Power Development Authority (WAPDA) and Karachi Electric Supply Corporations, and the Pakistan Telecommunication Corporation were set off to private sector. From 1990–93, around 115 industrial units were hastily privatized, including the privatization two major banks, 68 industrial units and 10% Shares of Sui Northern Gas Pipelines Limited.[12]

The privatization programme came with great surrounding controversies with lacked competition as the programme was largely controlled by favored insider.[13] The recklessness and favoritism shown in privatization of the industrial and banking units by Prime minister Nawaz Sharif was to become the hallmark and the rise of strong business oligarch who have concentrated enormous assets, further increasing the wealth gap in Pakistan and contributing to the political instability.[14]

Privatization phase (1993–1999)

Introduction In today’s world if we look to the competition everybody wants and wish to get an edge over the others. Each and everyone want to become the best and perfect among all the other. This competition and antagonism world come into existence when the company becomes liberalized, in developing countries. In Pakistan, the concept of the privatization was introduced in the late 1990. And after introducing this concept privatization was suddenly implemented in different forms in Pakistan, which includes the direct sale and auction of public assets, outsourcing, commercialization, and public private partnerships. At that time it was expected that the concept of the privatization would generate more wealth and will lead the efficiency of each company or organization at a peek level, also assume that after privatization the productivity level of organization become higher and thus the organization deliver their best services. Basically the word privatization means to shift the production of a goods or the provision of a services from government to private sector, usually by selling the government assets.

Most of the privatization program starts with a period of partial or limited privatization in which the management of the organization sold only the non controlling shares of the firm in a stock market. As a result management control is not shifted or transferred to the private owners. It is broadly contended that partial or limited privatization has little impact. This viewpoint ignores the function that the stock market can play a managerial and in monitoring performance even though when the governments remain the controlling owner.In British English the word privatization has several meanings. Privatization run very wide range, sometimes leaving extremely small government involvement, and sometimes creates such kind of partnerships between the government and private services provider where the government was a dominant player. The word privatization is regard as one of the most famous and a prominent trend in finance over the last two decades. Beginning in August 1990, pakistan initiated a drastic process of stabilization and structural reform that included a vast privatization program. The objective of this study is to analyze empirically the impact of this program on the performance of privatized state enterprises. The transfer from the public to the private sector Vickers and Yarrow, (1998) implies a change in the relationships between those responsible for the company's decisions and the beneficiaries of the profit flows (the social perspective and the agent's perspective). In general, the transfer of property rights leads to a different structure of administrative incentives, which causes changes in the managerial behavior and performance of the company, as well as in the quality of the service in terms of availability and use. However, as Jean-Jacques Laffont and Jean Tirole (1993) mention, "it is unlikely that the single theory is conclusive about it" and, therefore, empirical work is of crucial importance. In this study, the impact of Peruvian privatization is analyzed following a methodology similar to that of La Porta and Lopez de Silanes (1999). The impact of privatization on profitability indexes, operating efficiency indices, labor indicators and capital deepening is evaluated. Although the impact of these changes on the incentives depends on the competitive and regulatory environment in which a company operates, it is stated that the degree of competition of the products in the market and the effectiveness of the regulatory criteria will also have very important effects on the performance of the company rather more than the property itself (Vickers and Yarrow, 1998). In this analysis, the necessary variables are taken into account to identify the role assumed by the regulatory agencies and the forces of competition in the performance of the companies (the existence of a regulatory framework, the independence of the regulatory body, etc.). In Pakistan the banking system has transformed through liberalization, the entrance of new private banks, similarly the privatization of public sectors bank, and also the tightening of prudential rule and regulations. These changes bring a small effect on bank efficiency and productivity.

The dominance of the public sectors banks at the beginning time of 1990s was appeared with a share of 92.2% in the total assets of a banking sector. The remaining banks belonged to a foreign bank, as at that time domestic private banks did not exist. In a time period of 1991 to 1993 smaller private’s banks are allowed to establish their position in banking sectors. And it was seems that a dozen of banks in a private sector were opened and start their operations in different areas. From the period 1991-2004 round about seven state owned banks was privatized which includes Muslim commercial Bank (1991), Allied Bank Limited, United Bank Limited (2000), and Habib Bank Limited (2003). The Allied Bank Limited was sold in (2004) to a local leasing company. After that a lot of changes were seems as they reduce the staff members working in the banks. But they also increased the staff member salary working in the banks as compared to before privatization of the banks.

In 1991 the two publicly owned banks, i.e. “MCB” Muslim Commercial Bank and “ABL” Allied Bank limited was privatized. At the equivalent time period permission was granted by the government and state for setting and running up new banks in the private sectors. So a license of 10 new banks was issued by the state to commence their operations in 1991. As a result, towards the end of the 2004, the formation/structure of banking sector in Pakistan has considerable changed and it is due to a result of the liberalization/privatization rules and policies pursue in the broader canvas of financial sector reforms. Similarly the shares of the public sector bank in the assets of the banking system was seemed to reduced up to 32.2 % in 2004 compare to over 92 % in 1990, while the private banks were reached over 50 % starting from 1990. In the same way, the share price of public sectors bank in deposit base banking system was reduced to 43.5 % starting from 93 % in 1990.

The main purpose of the privatization system in Pakistan was that to implement the instruction of international level of financial institutions’ likes the “IMF” International Monetary Fund, Asian Development Bank and the World Bank. Also argued that almost all private enterprises work more professionally and has also fulfilled the requirements and necessity of the free market economy, as in the United State of America. The concept emerges that the state could confine its role as a facilitator and regulator only. The ownership and operation of industrial, financial, utilities and services enterprises should left to the private sectors only. Similar to other developing countries in the world Pakistan must follow the global rules, regulation and policies to achieve the goals of the industrialization.

Similarly other purpose of the privatization was that to earn more money from the sale of the units produce and that amount was to be use to retire the domestic and foreign debts, besides, eliminate the losses of public sector units as they was financed from the budget.In accord with the government privatization policies and beneath its overall direction and guidance the privatization commission strive to privatize the state assets in a transparent and an open manner. The major objectives are to attract the new capital and management in order to improve the value, the quality and quantity of all Pakistan’s goods and services. One more objective is that to strengthen the public finances by dropping and reducing the fiscal hemorrhaging from loss making public enterprise increase taxes revenues from that of higher economics and profits activity and reduce or lowering the debt service payments by using the bulk of privatizations proceeds to retire the expansive debt. The scope of the current research is that to determine the main and major effect of the privatizations on Habib Bank Limited, United Bank Limit and also on Allied Bank Limit in Pakistan. Similarly Government of Pakistan determined to nationalize the banks. For this purpose the nationalization act was introduce in the year 1974. Major Banks were privatized during this short time period. For logical and analytical purpose the effect of the privatization of the privatized banks were categorized: Effects on the losses and profits of this privatized bank. For the reason to understand the subject matter, the analysis and the recommendations have generalized to the whole country and on all the banks in a country, as the environment and the culture prevailing consider to be same throughout the whole country. The key objectives of the above research are: To examine the impact of the privatization on bank profitability. To measure the performance of the Banks previous to Privatization and after the privatization. The (PC) “privatization commission” was entrust to sell out the Federal Government owned property such as its own shares in the banks, in the industrial units, in oil and gas companies etc in an open and in a transparent manner. Privatization commission has also a right to sell the state owned banks in the country. Here a question raised and that needs to be addressed as follow: Has privatization of the national banks achieve its goals/objectives or not? Compares the efficiency and performance of the banks before the privatization period and after the privatization period.

What is the impact of the privatization on the bank profitability? Does the overall performance of the banks improve after privatization?

In 1992, the Leader of the Opposition in the Parliament, Benazir Bhutto, vehemently criticized the whole policy measure program at the public circles.[15] While Commerce minister Faisal Hyatt and Finance minister Sartaj Aziz enthusiastically projected the privatization as a "success phase",[15] Benazir Bhutto had, with a touch of drama in the state parliament, maintained that "while one brother was selling, other was buying."[16]

After 1993 general elections, the second phase of the privatization programme began in 1993 under the "disciplined macroeconomics policy"[17] of Prime minister Benazir Bhutto.[17] Her programme aimed to capitalize on the rising business oligarch class but the programme suffered with great difficulties and problems even inside the peoples party.[13] The second phase involves the privatization of financial institutions, several telecommunications corporations, thermal power plants, oil and gas sectors.[11] Benazir's government did not privatize all state corporations, especially those who were collecting large revenues abroad; only certain industries were privatized which were at the brink of financial collapse.[15]

The first attempt was made to privatize the United Bank Limited but the proposal met with great hostility by the workers union and opposition.[18] Proposals were also made to put the private-ownership to Pakistan Railway but it was rebuffed by Prime minister Benazir Bhutto who quoted: "Railways privatization will be the "black-hole" of this government. Please never mention the railways to me again."[15] The economic growth declined when the US embargo began to bite the government of Benazir Bhutto.[18] By the end of 1996, ~20 industrial units, one financial institution, one electric power plant and 12% shares of Pakistan Telecommunications Ltd. were privatized by Benazir Bhutto.[11]

The second phase remained continued until 1998 when it was abruptly ended by Prime Minister Nawaz Sharif after imposing economic emergency after ordering to perform capability of nuclear deterrence in response to Indian nuclear aggression.[19][20] All stock exchange, stock markets and the second phase of the privatization programme were immediately halted by Prime minister Nawaz Sharif until his government was ended in 1999.[19]

Privatization (intensified phase: 1999–2008)

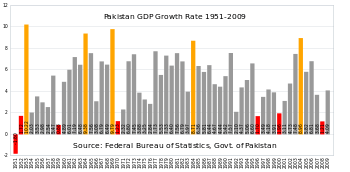

After the end of government of Prime minister Nawaz Sharif, Pervez Musharraf invited Shaukat Aziz to take the control of declining economy of Pakistan.[21] The GDP rate had declined from 10.0% in the 1980s to 3.6% in 1999, with foreign debt increased to 44% up as compared to 1986.[21] Major economic reforms were introduced by Shaukat Aziz who first consolidated the industries under one platform and restructured them before setting them to privatization market.[21] Numbers of controversial sales tex were enforced by Shaukat Aziz, mostly on import duties; and based on these reforms, patronage-based industries remained under serious threat and privatization discussion began to take place on usual based.[21] Aziz consistently worked on to restructured the industries and provided a vital leadership and economic relief after 2001 also played an important role in strengthening the patronage-based industries financially and physically.[21]

In 2004, Aziz became Prime minister and initiated an intensified privatization programme in order to grow the GDP rate annually.[22]

Aziz forcefully and aggressively pushed 100% privatization of state-owned corporations while virtually planned to privatized 85% of banking sector.[23] Starting from 2003 until 2007, Aziz successfully privatized 80%[23] of the banking industry into private-ownership enterprises, while privatizing the numbers of shares of Pakistan International Airlines and other mega-corporations into the public circles.[23]

Nothing is sacred... We are packaging up our companies. (....).... These state-owned corporations (SOEs) have been well-run for the past few years.... and now we are offering them to investors from all over the world....!

— Shaukat Aziz, 2006, source[23]

Intensified privatization policies had major impact on public sector organization which diminished with the privatization of the state-owned corporations. Prime minister Aziz defended his privatization programme as he maintained that "these institutions viable while they were on the verge of collapse.". Aziz's privatization programme subsequently improved the country’s growth rate by 6.4%—8.6% a year. Inflation rate dropped to 3.5% in last 3 years as against 11–12% in 1990. However, in the end of 2007, Aziz's privatization programme suffered a major set back which initially halted the privatization programme in the country.[24] The Supreme Court halted the privatization of Pakistan Steel Mills after transferring the inquiry from FIA to NAB, while issued standing orders to keep the Steel Mills under the nationalization programme.[25] The proceedings and Supreme Court's decision initially halted Aziz's intensified and aggressive privatization programme at the end days of his tenure.[25]

Public perception

The privatization programme still marks the question of "big" controversies.[26] In public circles, it has generated much more heated debates where it is perceived to have more negative impact on civil society.[26] The general perception remains highly contentious and polarizing issue in the civil society, gearing up the negative sentiments among the population, including the continued injection of public money in many privatized entities and less than expected improvement in the services.[27] Although, the programme produced a relatively faster and efficient way of promoting competition and enhancing growth, on the other hand, the programme experienced the exponential increase in unemployment, reducing the access of workers' class to the basic needs of life and contributed in declining the social status of workers' class in to poor get poorer.[26]

But on the other hand, a significant support for the privatization programme has been raised in the media. In an editorial written in Dawn, it argues that the privatisation programme has been a key "constituent of structural reform" programmes in both, the developed and developing economies, in order to achieve greater microeconomic efficiency as opposed to macroeconomics.[28] Overall, the GDP rate grows smoothly with privatization programme remains in effect as opposed to nationalization programme that it had dropped the GDP growth rate of Pakistan, Dawn maintained.[28] Major proposals were made to privatise the major and most-profitable industries of Pakistan, namely the Pakistan Railways (PR) where The Express Tribune argued that the national railways' condition has gone from bad to worse under government ownership, and only privatisation programme can save the railways with the creation of sense of competition that would drive improvement.[29]

Adversary opposition

Despite its success, the public sector organizations, labor and workers unions remained extremely hostile towards the privatization programmes.[30] In 2005, major demonstrations and worker's revolt took place in Islamabad by the PTCL Workers Unions Action Committee, in an attempt to privatized the Pakistan Telecommunication Company Ltd (PTCL).[30] Despite the demonstrations the state-corporation was privatized by Shaukat Aziz which resulted in workers’ losing their jobs.[30]

In 2012, an unsuccessful attempt was carried out by current government of Pakistan Peoples Party when the government sought to privatize the mega-state corporations, particularly the power sector; major nationalized industries such as WAPDA, IESCo, TESCo, PEPCo were proposed by the finance ministry to privatize the power distribution companies.[31] Major worker's strike were initiated by the central labour unions, and after receiving much criticism, his government halted the privatization programme of energy sector, and nationalized the remaining power sector industries due to public pressure.[32][33]

The Pakistan Peoples Party's intellectuals remains skeptical about the privatization programme and targeted the controversial implementation on numerous occasions.[34] The peoples party maintained that "an elitist or top-notch educational system" which exceedingly comprises private sector’s foreign affiliated schools and universities, has built the "sole source" of producing some proficient minds. While on the other hand, the privatized Madrassah system of education has been patronize different sects of religion, patronize different sects of religion, and further exploited as source of religious extremism and associated with terrorist outfits and their offshoot.[34] The private sector education system negative effects of private sector education and it hashas created a disparity between the rich and the poor.[35]

Dr. Professor Athar Maqsood of School of Business of the National University of Sciences and Technology (NUST), set forward his argumentative thesis that there are two reasons behind why the privatization has not been successful as was originally perceived are economic reasons and socio-psychological and political reasons.[36] In the 1990s, the privatized enterprises have laid off employees by introducing schemes like golden hand shake.[36]

See also

References

- ↑ E-Govt. "Privatization Commission". Ministry of Informationa and mass-media broadcasting. The Electronic Government of Pakistan. Retrieved 2 June 2012.

- ↑ Khan, PhD, Mubbsher Munawar; Mohammad Zafar Yaqub; Farida Faisal; Muhammad Asim Khan (4 April 2011). "Privatization in Emerging Markets: Pakistan's perspective". Punjab University Department of Business and Commerce. Punjab University Press. Retrieved 1 June 2012.

- ↑ Akbar, Bilal. "Privatization in Pakistan". Bilal Akbar. Retrieved 2 June 2012.

- 1 2 3 4 5 6 7 Press Release. "Nawaz Sharif's privatization". Nawaz Sharif's privatization.and Report. Retrieved 1 June 2012.

- ↑ E-Govt. of Pakistan. "History". Privatization Commission of Pakistan. The Electronic Government of Pakistan. Retrieved 1 June 2012.

- 1 2 Press. "Business Oligarch of Pakistan". Tripod nuclues. Retrieved 1 June 2012.

- 1 2 Malcolm Borthwick (1 June 2006). "Pakistan steels itself for sell-offs". BBC Pakistan, Malcolm Borthwick. Retrieved 30 May 2012.

Pakistan has had the most broad-based structural reform of any country in Asia. Last year, we were the second fastest growing economy in the world after China. We grew at 8.4%

- ↑ See Nationalization in Pakistan

- 1 2 3 Farazmand, Ali (1996). Public Enterprise management. United States: Greewood publishing Group, Inc. pp. 182–250. ISBN 0-313-28025-8. Retrieved 10 April 2014.

- ↑ Bokhari, Syed Anwar-ul-Hassan (18 September 1998). "History and Evaluation of Privatization in Pakistan" (google docs). Pakistan Federation of Trade Unions. National Seminar on Privatization. pp. 5–8, 10. Retrieved 1 June 2012.

- 1 2 3 4 5 Aziz, Sartaj (1990). Privatisation in Pakistan (google books). Paris, France: Organization for Economic Cooperation and Development. ISBN 92-64-15310-1. Retrieved 1 June 2012.

- 1 2 Abdus Samad. "The Economic Policies of the first Nawaz Sharif Government 1990–93:Privatization". Dr. Abdus Samad, Author of "Governance, Economic Policy and Reform in Pakistan". Author of "Governance, Economic Policy and Reform in Pakistan". Retrieved 1 June 2012.

- 1 2 Press unknown. "Big Cover up in Corruption in Privatization". Tripod Publishings. Retrieved 1 June 2012.

- ↑ US Govt, United States Government (April 1994). "The Government of Nawaz Sharif". United States Government. US Department of State :Case Study. Retrieved 1 June 2012.

Benazir and the PPP, criticized Nawaz Sharif's efforts at privatization, calling them the "loot and plunder" of Pakistan and saying his plan favored large investors and ran roughshod over labor

- 1 2 3 4 Dutt, Sanjay (2000). Inside Pakistan : 52 years outlook. New Delhi: APH Pub. Corp. p. 250. ISBN 8176481572.

- ↑ Akbar, M.K. (1998). Pakistan today (1st ed.). New Delhi: Mittal Publications. p. 208. ISBN 8170997003.

- 1 2 Muhammad Ali Siddiqi (13 April 1995). "MOU worth $6bn signed". DawnWireService (April13th 1995; from the United States). Retrieved 20 November 2011.

- 1 2 Staff Reporter. "Concern over UBL sale move". October 11, 1995. UBL Dawn Wire Services Management. Retrieved 20 November 2011.

- 1 2 Lieven, Anatol (2011). Pakistan: A Hard Country. PublicAffairs. p. 244. ISBN 978-1-61039-021-7.

- ↑ "DAWN Profiles". Dawn (newspaper). Retrieved 19 October 2011.

- 1 2 3 4 5 Cohen, Stephen P. (2004). "General Musharraf, the Economist". The Idea of Pakistan (googlebooks). Brookings Institution Press (September 2004). pp. 255–290. ISBN 978-0815715023. Retrieved 1 June 2012.

- ↑ Weber, Tim (29 January 2005). "Pakistan pushes India on pipeline". BBC Pakistan Business Editor, BBC News website, in Davos. BBC. Retrieved 1 June 2012.

Better economic relations between India and Pakistan depend on both countries joining forces to build a gas pipeline to Iran, Pakistan's prime minister has said.

- 1 2 3 4 Borthwick, Malcolm (1 June 2006). "Pakistan steels itself for sell-offs". BBC Pakistan Asia Business Report editor, BBC World, Port Mohammad Bin Qasim. BBC Pakistan Directorate. Retrieved 1 June 2012.

Pakistan's only steel company, created more than 20 years ago with Soviet technical expertise and financial help, has come full circle after being sold last month to a Russian-led consortium.

- ↑ Ahmed, Naveed (27 March 2007). "Privatisation of Pakistan Steel Mills". Political deception. Retrieved 30 May 2012.

- 1 2 Mudasser Aziz (16 May 2012). "Steel Mills corruption case: SC transfers inquiry from FIA to NAB". The News Tribe. Retrieved 30 May 2012.

- 1 2 3 Zafar, Shaukat Masood (6 March 2012). "Globalization Pushing Towards Diseased Pakistan". The Pakistani Spectator. p. 1. Retrieved 2 June 2012.

- ↑ Kiani, Khaleeq (12 March 2012). "Privatisation questioned". Dawn Newspapers, 12 March 2012. Retrieved 2 June 2012.

Pakistan has sold a total of 166 state-owned enterprises for Rs476.5 billion since 1990 to finance budget deficit, cut losses and improve efficiencies of the mismanaged entities through privatisation aimed at spurring economic growth and job creation.

- 1 2 Khan, Nasr Ullah (16 March 2011). "Privatisation needs to happen now". Dawn Newspapers, 16 March 2011. Islamabad, Pakistan. Dawn Group of Media. p. 1. Retrieved 2 June 2012.

y Pakistan’s economy is in dire need of privatisation which must also include large and inefficient public sector organisations that are depriving the national exchequer of huge sums of money year after year.

- ↑ Ansari, Adeel (12 January 2012). "Privatisation can save Pakistan Railways". The Express Tribune, 12 January 2012. Retrieved 2 June 2012.

It seems that the damage done to the railways system by our lack of leadership and management has not crippled the institution just yet – the prime minister has just announced a business class service to be offered from February 3, 2012. This is not a novel idea, but a good one nonetheless

- 1 2 3 Vilani Peiris & Keith Jones (4 June 2005). "Pakistani workers revolt against PTCL privatization". World Socialist Organization. Retrieved 1 June 2012.

- ↑ Staff Reports (24 January 2012). "Wapda staff goes on strike". Dawn News, 24 January 2012. Retrieved 13 May 2012.

- ↑ Our Correspondent (6 May 2012). "Wapda workers' protest enters 6th day". Dawn News 6 May 2012. Retrieved 13 May 2012.

- ↑ Press (13 May 2012). "WAPDA strikes ended". Jang News Group (Urdyu). Retrieved 13 May 2012.

- 1 2 Akhtar, Suleman (2 November 2010). "Bhutto's nationalization policy: A response to PM Gilani's statement". The Directorate for Press and Public Relations of the Pakistan Peoples Party. The Directorate for Press and Public Relations of the Pakistan Peoples Party (Akhtar). p. 1. Retrieved 1 June 2012.

- ↑ Nishapuri, Abdul (1 November 2010). "Was nationalisation policy measure programme a mistake?". Abdul Nishapuri, Directorate Press for Public Relations of Pakistan Peoples Party. Directorate for the Press and Public Relations of Pakistan Peoples Party. p. 1. Retrieved 1 June 2012.

Under Nationalization programme, Zulfiqar Ali Bhutto gave hope and honour to Pakistan's poor and downtrodden people.

- 1 2 Staff reporter (2 March 2012). "If Rs300b spending on PSEs stops Govt can control budget deficit". The Nation (Pakistan). Retrieved 2 June 2012.

External links

- E-Govt. "Privatization Commission". Ministry of Informationa and mass-media broadcasting. The Electronic Government of Pakistan. Retrieved 2 June 2012.

Sources

- Akbar, Bilal. "Privatization in Pakistan". Bilal Akbar. Retrieved 2 June 2012.

- Kemal, PhD, Dr. A.R. "Privatization in Pakistan" (google docs). Retrieved 2 June 2012.

- Hussain, Ishrat (17 August 2005). "Why Privatization is necessary for economical growth in Pakistan" (googledocs). Governor of State Bank of Pakistan. Dr. Ishrat Hussain, State Bank of Pakistan. p. 10. Retrieved 2 June 2012.

- Aziz, Sartaj (1990). Privatisation in Pakistan (google books). Paris, France: Organization for Economic Cooperation and Development. ISBN 92-64-15310-1. Retrieved 1 June 2012.