Competition between Airbus and Boeing

The competition between Airbus and Boeing has been characterised as a duopoly in the large jet airliner market since the 1990s.[1] This resulted from a series of mergers within the global aerospace industry, with Airbus beginning as a European consortium while the American Boeing absorbed its former arch-rival, McDonnell Douglas, in 1997. Other manufacturers, such as Lockheed Martin and Convair in the United States, and British Aerospace (now BAE Systems) and Fokker in Europe, were no longer able to compete and effectively withdrew from this market.

In the 10 years from 2007 to 2016, Airbus has received 9,985 orders while delivering 5,644, and Boeing has received 8,978 orders while delivering 5,718. In the midst of their intense competition, each company regularly accuses the other of receiving unfair state aid from their respective governments.

Competing products

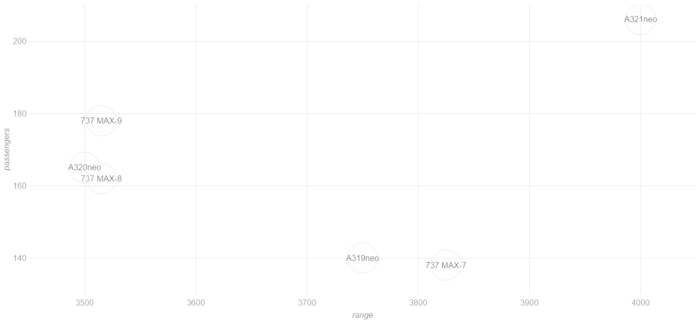

Passenger capacity and range comparison

Airbus and Boeing have wide product ranges including single-aisle and wide-body aircraft covering a variety of combinations of capacity and range.

| Type | length | span | MTOW | pax | range | list price[4][5][6] |

|---|---|---|---|---|---|---|

| A220-100 | 35 m | 35.1 m | 60.8 t | 116 | 2950 nm | US$79.5M |

| A220-300 | 38.7 m | 35.1 m | 67.6 t | 141 | 3200 nm | US$89.5M |

| 737 MAX-7 | 35.6 m | 35.9 m | 80.3 t | 138 | 3850 nm | US$96.0M |

| A319neo | 33.84 m | 35.8 m | 75.5 t | 140 | 3700 nm | US$101.5M |

| 737 MAX-8 | 39.5 m | 35.9 m | 82.19 t | 162 | 3550 nm | US$117.1M |

| A320neo | 37.57 m | 35.8 m | 79 t | 165 | 3400 nm | US$110.6M |

| 737 MAX-9 | 42.11 m | 35.9 m | 88.31 t | 178 | 3550 nm | US$120.2M |

| 737 MAX-10 | 43.8 m | 35.9 m | TBA | 188 | 3300 nm | US$129.9M |

| A321neo | 44.51 m | 35.8 m | 97 t | 206 | 4000 nm | US$129.5M |

Flight Global fleet forecasts 26,860 single aisle deliveries for a $1,360 Bn value at a compound annual growth rate of 5% for the 2016-2035 period, with a 45% market share for Airbus (12090), 43% for Boeing (11550), 5% for Bombardier Aerospace (1340), 4% for COMAC (1070) and 3% for Irkut Corporation (810) ; Airbus predicts 23,531 and Boeing 28,140.[7] Single aisles generates a vast majority of profits for both, followed by legacy twin aisles like the A330 and B777: Kevin Michaels of AeroDynamic Advisory estimates the 737 have a 30% profit margin and the 777 classic 20%.[8]

| Type | length | span | MTOW | pax | range | list price[4][5] |

|---|---|---|---|---|---|---|

| 787-8 | 56.69 m | 60.17 m | 227.95 t | 242 | 7355 nm | US$239.0M |

| A330neo-800 | 58.82 m | 64 m | 251 t | 257 | 8150 nm | US$259.9M |

| A330neo-900 | 63.66 m | 64 m | 251 t | 287 | 7200 nm | US$296.4M |

| 787-9 | 63 m | 60.17 m | 254 t | 290 | 7635 nm | US$281.6M |

| A350-900 | 66.80 m | 64.75 m | 280 t | 325 | 8100 nm | US$317.4M |

| 787-10 | 68.27 m | 60.17 m | 254 t | 330 | 6430 nm | US$325.8M |

| 777X-8 | 69.8 m | 71.8 m | 351.5 t | 365 | 8690 nm | US$394.9M |

| A350-1000 | 73.79 m | 64.75 m | 316 t | 366 | 8400 nm | US$366.5M |

| 777X-9 | 76.7 m | 71.8 m | 351.5 t | 414 | 7525 nm | US$425.8M |

| 747-8 | 76.3 m | 68.4 m | 447.7 t | 410 | 8000 nm | US$402.9M |

| A380 | 72.72 m | 79.75 m | 575 t | 575 | 8000 nm | US$445.6M |

Flight Global fleet forecasts 7,960 twin aisle deliveries for a $1,284 Bn value for the 2016-2035 period.[12] They predict the B787 taking 31% of the market share, followed by the A350 with 27% and the 777 with 21%, then the A330 and A380 each taking 7%.[13] In June 2017, The orderbook was for 1038 Airbus (41%) and 1,514 Boeings (59%).[14]

| Market | North Atlantic[15] | Trans-pacific[16] | ||

|---|---|---|---|---|

| type | 1H2006 | 1H2016 | 2005 | 2015 |

| A310/DC10/MD11 | 3% | 1% | 3% | - |

| A320/B737 | 1% | 1% | - | - |

| A330 | 16% | 26% | 3% | 10% |

| A340 | 10% | 6% | 11% | 1% |

| A380 | - | 3% | - | 4% |

| B747 | 15% | 9% | 49% | 10% |

| B757 | 6% | 9% | - | - |

| B767 | 28% | 19% | 7% | 7% |

| B777 | 21% | 20% | 27% | 55% |

| B787 | - | 6% | - | 13% |

Cargo capacity and range comparison

| Type | length | span | MTOW | capacity | range | list price (USD) |

|---|---|---|---|---|---|---|

| A320P2F[17] | 37.57 m | 35.8 m | 78.0 t | 21.0 t | 2100 nm | converted |

| 737-800BCF[18] | 39.5 m | 35.8 m | 79.0 t | 22.7 t | 2000 nm | converted |

| A321P2F[17] | 44.51 m | 35.8 m | 93.5 t | 27.0 t | 1900 nm | converted |

| 767-300BCF[18] | 54.94 m | 50.9 m | 186.9 t | 51.7 t | 3300 nm | converted |

| 767-300F[18] | 54.94 m | 47.57 m | 186.9 t | 52.5 t | 3260 nm | $203.7M |

| A330-200P2F[19] | 58.82 m | 60.3 m | 233.0 t | 59.0 t | 4000 nm | converted |

| A330-200F[2] | 58.82 m | 60.3 m | 233.0 t | 70.0 t | 4000 nm | $237.0M |

| A330-300P2F[19] | 63.67 m | 60.3 m | 233.0 t | 61.0 t | 3600 nm | converted |

| 777F[18] | 63.73 m | 64.80 m | 347.8 t | 102.0 t | 4970 nm | $325.7M |

| 747-8F[18] | 76.3 m | 68.4 m | 447.7 t | 137.7 t | 4120 nm | $387.5M |

Airbus A320 vs Boeing 737

In terms of sales, while the Boeing 737 Next Generation outsold the Airbus A320 family since its introduction in 1988, it is still lagging overall with 7,033 orders against 7,940 in January 2016. Airbus received 4,471 orders since the A320neo family launch in December 2010, while the 737 MAX got 3,072 from August 2011 till January 2016. In the same timeframe, the neo had 3,355 orders.[20] Through August, Airbus have a 59.4% market share of the re-engined single aisle market, while Boeing had 40.6%; Boeing has doubts on over-ordered A320 neos by new operators and expects to narrow the gap with replacements not already ordered.[21] In July 2017, Airbus still had sold 1,350 more A320neos than Boeing had sold 737 MAXs.[22]

In terms of deliveries, Boeing has shipped 9,522 aircraft of the 737 family since late 1967, with 8,016 of those deliveries since March 1, 1988,[23] and has a further 4,430 on firm order as of May 2017. In comparison, Airbus has delivered 7,610 A320 series aircraft since their certification/first delivery in early 1988, with another 5,501 on firm order (as of May 2017).[24]

While Boeing ramp-up 737 monthly production from 47 in 2017 to 57 in 2019 and Airbus from 46 to 60, both consider accelerating further despite supplier strain.[27]

By September 2018, there were 7,251 A320 family ceo aircraft in service versus 6,757 737NGs, while Airbus should deliver 3,174 A320neos compared with 2,999 Boeing 737 MAX through 2022. Airbus sold well the A320 to low-cost startups and offering a choice of engines could make them more attractive to airlines and lessors than the single sourced 737, but CFM engines are extremely reliable. The six month head-start of the A320neo allowed Airbus to rack up 1,000 orders before Boeing announced the MAX. The A321 has outsold the 737-900 three to one, as the A321neo is again dominating the 737-9 MAX, to be joined by the 737-10 MAX.[28]

Twin Aisles

In November 2017, for its chief Willie Walsh, International Airlines Group budget carrier Level benefits more from its two A330-200 lower cost of ownership than its 6t higher fuel burn ($3,500) on a Barcelona-Los Angeles flight: it will introduce three more as there aren't enough B787 pilots.[29] In early 2018, of the 2673 twin-aisle orders excluding the Airbus A330CEO and quad engine planes (the A380 and B747-8), Boeing had 1603 (60%) and Airbus 1070 (40%).[30]

The ultra-long-range variants of new types enable new routes between far away city pairs: the 9,700 nmi Airbus A350-900 ULR should start in 2018 and the 8,700 to 9,100 nmi Boeing 777-8 in 2022. Singapore Airlines plans to introduce the world’s longest flight between Singapore and New York (8,285 nmi) in 2018 with an A350-900 ULR, Qantas hopes to fly from Sydney to New York (8,650 nmi) or London (9,200 nmi) within four years for the Project Sunrise and Air New Zealand wish to operate to the U.S. East Coast: Auckland and New York are 7,670 nmi apart.[31] The Singapore-New York A350-900ULR will have a low density premium-focused configuration with only 161 seats: 94 premium economy and 67 business.[32]

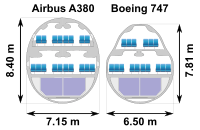

Airbus A380 vs Boeing 747

During the 1990s both companies researched the feasibility of a passenger aircraft larger than the Boeing 747, which was then the largest airliner in operation. Airbus subsequently launched a full-length double-deck aircraft, the A380, a decade later while Boeing decided the project would not be commercially viable and developed the third generation 747, Boeing 747-8, instead.[33] The Airbus A380 and the Boeing 747-8 are therefore placed in direct competition on long-haul routes.

Rival performance claims by Airbus and Boeing appear to be contradictory, their methodologies unclear and neither are validated by a third party source. Boeing claims the 747-8I to be over 10% lighter per seat and have 11% less fuel consumption per passenger, with a trip-cost reduction of 21% and a seat-mile cost reduction of more than 6%, compared to the A380. The 747-8F's empty weight is expected to be 80 tonnes (88 tons) lighter and 24% lower fuel burnt per ton with 21% lower trip costs and 23% lower ton-mile costs than the A380F.[34] On the other hand, Airbus claims the A380 to have 8% less fuel consumption per passenger than the 747-8I and in 2007 Singapore Airlines CEO Chew Choong Seng stated the A380 was performing better than both the airline and Airbus had anticipated, burning 20% less fuel per passenger than the airline's 747-400 fleet.[35] Emirates' Tim Clark also claims that the A380 is more fuel economic at Mach 0.86 than at 0.83.[36] One independent, industry analysis shows fuel consumption in litres per seat per 100 kilometres flown (L/seat/100 km) as 3.27 for the A380 and 3.35 for the B747-8I, or a fuel cost per seat mile of $0.055 and $0.057 respectively. A possible, as yet uncommitted, re-engined A380neo is expected to achieve 2.82 or 2.65 L/seat/100 km depending on the options taken.[37]

Airbus emphasises the longer range of the A380 while using up to 17% shorter runways.[38] The A380-800 has 478 square metres (5,145.1 sq ft) of cabin floor space, 49% more than the 747-8, while commentators noted the "downright eerie" lack of engine noise, with the A380 being 50% quieter than a 747-400 on takeoff.[39] Airbus delivered the 100th A380 on 14 March 2013.[40] From 2012, Airbus will offer, as an option, a variant with improved maximum take-off weight allowing for better payload/range performance. The precise increase in maximum take-off weight is still unknown. British Airways and Emirates will be the first customers to take this offer.[41]

As of December 2015, Airbus has 319 orders[42] for the passenger version of the A380 and is not currently offering the A380-800 freighter. Production of the A380F has been suspended until the A380 production lines have settled with no firm availability date.[43] A number of original A380F orders were cancelled following delays to the A380 program in October 2006, notably FedEx and the United Parcel Service. Some A380 launch customers converted their A380F orders to the passenger version or switched to the 747-8F or 777F aircraft.[44][45]

At Farnborough in July 2016, Airbus announced that in a "prudent, proactive step," starting in 2018 it expects to deliver 12 A380 aircraft per year, down from 27 deliveries in 2015. The firm also warned production might slip back into red ink on each aircraft produced at that time, though it anticipates production will remain in the black for 2016 and 2017. The firm expects that healthy demand for its other aircraft would allow it to avoid job losses from the cuts.[46][47]

As of June 2014, Boeing has 51 orders for the 747-8I passenger version and 69 for the 747-8F freighter.[48]

EADS/Northrop Grumman KC-45A vs Boeing KC-767

The announcement in March 2008 that Boeing had lost a US$40 billion refuelling aircraft contract to Northrop Grumman and Airbus for the EADS/Northrop Grumman KC-45 with the United States Air Force drew angry protests in the United States Congress.[49] Upon review of Boeing's protest, the Government Accountability Office ruled in favour of Boeing and ordered the USAF to recompete the contract. Later, the entire call for aircraft was rescheduled, then cancelled, with a new call decided upon in March 2010 as a fixed-price contract.

Boeing later won the contest against Airbus (Northrop having withdrawn) and US Aerospace/Antonov (disqualified), with a lower price, on February 24, 2011.[50] The price was so low some in the media believe Boeing would take a loss on the deal; they also speculated that the company could perhaps break even with maintenance and spare parts contracts.[51] In July 2011, it was revealed that projected development costs rose $1.4bn and will exceed the $4.9bn contract cap by $300m. For the first $1bn increase (from the award price to the cap), the U.S. government would be responsible for $600m under a 60/40 government/Boeing split. With Boeing being wholly responsible for the additional $300m ceiling breach, Boeing would be responsible for a total of $700m of the additional cost.[52][53][54]

Small narrowbodies

In October 2017, Airbus took a 50.01% stake in the Bombardier CSeries programme[55] In December 2017, Boeing confirmed that it was holding discussions with Embraer for its airliner business.[56] Airbus took control of the CSeries on 1 July 2018 and renamed it Airbus A220.[57] On July 5, 2018, a Boeing-Embraer joint venture was announced for Embraer's airliners, valued at $4.75 billion, for which Boeing will invest $3.8 billion for 80%, approval is expected by the end of 2019.[58] The Embraer E-Jet E2 family competes with the Cseries.

Modes of competition

Outsourcing

Because many of the world's airlines are wholly or partially government owned, aircraft procurement decisions are often taken according to political criteria in addition to commercial ones. Boeing and Airbus seek to exploit this by subcontracting production of aircraft components or assemblies to manufacturers in countries of strategic importance in order to gain a competitive advantage overall.

For example, Boeing has maintained longstanding relationships since 1974 with Japanese suppliers including Mitsubishi Heavy Industries and Kawasaki Heavy Industries by which these companies have had increasing involvement on successive Boeing jet programs, a process which has helped Boeing achieve almost total dominance of the Japanese market for commercial jets. Outsourcing was extended on the 787 to the extent that Boeing's own involvement was reduced to little more than project management, design, assembly and test operation, outsourcing most of the actual manufacturing all around the world. Boeing has since stated that it "outsourced too much" and that future airplane projects will depend far more on its own engineering and production personnel.[59]

Partly because of its origins as a consortium of European companies, Airbus has had fewer opportunities to outsource significant parts of its production beyond its own European plants. However, in 2009 Airbus opened an assembly plant in Tianjin, China for production of its A320 series airliners.[60]

Technology

Airbus sought to compete with the well-established Boeing in the 1970s through its introduction of advanced technology. For example, the A300 made the most extensive use of composite materials yet seen in an aircraft of that era, and by automating the flight engineer's functions, was the first widebody jet to have a two-person flight crew. In the 1980s Airbus was the first to introduce digital fly-by-wire controls into an airliner (the A320).

With Airbus now an established competitor to Boeing, both companies use advanced technology to seek performance advantages in their products. Many of these improvements are about weight reduction and fuel efficiency. For example, the Boeing 787 Dreamliner is the first large airliner to use 50% composites for its construction. The Airbus A350 XWB features 53% composites.[61]

Provision of engine choices

The competitive strength in the market of any airliner is considerably influenced by the choice of engine available. In general, airlines prefer to have a choice of at least two engines from the major manufacturers General Electric, Rolls-Royce and Pratt & Whitney. However, engine manufacturers prefer to be single source, and often succeed in striking commercial deals with Boeing and Airbus to achieve this.

Several notable aircraft have only provided a single engine offering: the Boeing 737-300 series onwards (CFM56), the Airbus A340-500 & 600 (Rolls-Royce Trent 500), the Airbus A350 XWB (Rolls-Royce Trent XWB), the Boeing 747-8 (GEnx-2B67), and the Boeing 777-300ER/200LR/F (General Electric GE90).[62] However, the Airbus A380 has a choice of either the Engine Alliance GP7000 or the Rolls-Royce Trent 900, while the Boeing 787 Dreamliner can be fitted with the General Electric GEnx or the Rolls-Royce Trent 1000.

As of the late 2000s, there appears to be a polarizing of both the engine suppliers as well as the airline manufacturers, such as Boeing and General Electric partnering for the upcoming Boeing 777X, and Airbus working closely with Rolls Royce for the Airbus A350-1000.[63][64]

Currency and exchange rates

Boeing's production costs are mostly in United States dollars, whereas Airbus's production costs are mostly in Euro. When the dollar appreciates against the euro the cost of producing a Boeing aircraft rises relatively to the cost of producing an Airbus aircraft, and conversely when the dollar falls relative to the euro it is an advantage for Boeing. There are also possible currency risks and benefits involved in the way aircraft are sold. Boeing typically prices its aircraft only in dollars, while Airbus, although pricing most aircraft sales in dollars, has been known to be more flexible and has priced some aircraft sales in Asia and the Middle East in multiple currencies. Depending on currency fluctuations between the acceptance of the order and the delivery of the aircraft this can result in an extra profit or extra expense—or, if Airbus has purchased insurance against such fluctuations, an additional cost regardless.[65]

Safety and quality

Both aircraft manufacturers have good safety records on recently manufactured aircraft and generally, both firms have a positive reputation of delivering well-engineered and high-quality products.[66][67] By convention, both companies tend to avoid safety comparisons when selling their aircraft to airlines or comparisons on product quality. Most aircraft dominating the companies' current sales, the Boeing 737-NG and Airbus A320 families and both companies' wide-body offerings, have good safety records. Older model aircraft such as the Boeing 707, Boeing 727, Boeing 737-100/-200, Boeing 747-100/SP/200/300, Airbus A300, and Airbus A310, which were respectively first flown during the 1960s, 1970s, and 1980s, have had higher rates of fatal accidents.[68] According to Airbus's John Leahy, the Boeing 787 Dreamliner battery problems will not cause customers to switch airplane suppliers.[69]

Aircraft prices

Airbus and Boeing publish list prices for their aircraft but the actual prices charged to airlines vary; they can be difficult to determine and tend to be much lower than the list prices. Both manufacturers are engaged in a price competition to defend their market share.[70]

The actual transaction prices may be as much as 63% less than the list prices, as reported in 2012 in the Wall Street Journal, giving some examples from the Flight International subsidiary Ascend:[71]

| Model | List price 2012, US$M | Market price | % Discount |

|---|---|---|---|

| Boeing 737-800 | 84 | 41 | 51% |

| Boeing 737-900ER | 90 | 45 | 50% |

| Boeing 777-300ER | 298 | 149 | 50% |

| Airbus A319 | 81 | 30 | 63% |

| Airbus A320 | 88 | 40 | 55% |

| Airbus A330-200 | 209 | 84 | 60% |

In May 2013, Forbes magazine reported that the Boeing 787 offered at $225 million was selling at an average of $116m, a 48% discount.[72]

For Ascend's Les Weal, Launch customers obtain good prices on heavier aircraft, Lessors are large buyers and benefit too, like airlines as Singapore Airlines or Cathay Pacific since their name gives credibility to a program. In its annual report, Air France cites a €149 million ($195 million) A380, a 52% cut, while in an October 2011 financial release Doric Nimrod Air notes a $234 million for its A380 leased to Emirates. Teal group's Richard Aboulafia notes that Boeing's pricing power for the 777-300ER was better when it was alone in its long-haul, large capacity twinjet market but this advantage dissipates with the A350-1000 coming.[73]

For Leeham's Scott Hamilton, small orders are content with 35-40% discount but large airlines sometimes attain 60% and customers with old ties with Boeing like American, Delta or Southwest get a Most-Favoured-Customer Clause guaranteeing them no other customer gets a lower price. Wells Fargo indicates Southwest, the largest 737 customer with 577, got a unit price of $34.7 million for its 737 MAX order of 150 in December 2011, a 64 % discount. Ryanair got 53 % in September 2001 and claims to obtain at least the same on its last 175 orders. The Airbus-Boeing WTO proceedings indicates EasyJet got a $19,4 million unit price on its A319 order for 120 in 2002, a 56% discount at the time, the same kind of rebate Lion Air got for its A320 order of 234 on 18 March 2013.[73]

Each sale includes an escalation rate covering the workforce and raw material costs increases and as acquisition cost represents 15% of the 20 year total cost of ownership, discussions also include the delivery date, fuel consumption guarantees, financial incentives, maintenance and training. At Airbus, final price in large campaigns is validated by a committee comprising sales head John Leahy, program director Tom Williams, financial principal Harald Wilhelm and CEO Fabrice Brégier who has the final cut.[73]

Those discounts were presented again in Le Nouvel Observateur's Challenges.fr again with Ascend valuations in 2013:[73]

| Model | List price 2013 | Market price | Discount |

|---|---|---|---|

| Boeing 747-8 | 351.4 | 145.0 | 59% |

| Airbus A320-200 | 91.5 | 38.75 | 58% |

| Airbus A330-200 | 239.4 | 99.5 | 58% |

| Boeing 737-800 | 89.1 | 41.8 | 53% |

| Boeing 777-300ER | 315.0 | 152.5 | 52% |

| Airbus A380 | 403.9 | 193.0 | 52% |

| Airbus A320neo | 100.2 | 49.2 | 51% |

| Boeing 737 MAX-8 | 100.5 | 51.4 | 49% |

| Boeing 787-8 | 206.8 | 107.0 | 48% |

| Airbus A350-900 | 287.7 | 152.0 | 47% |

In 2014, Airways news indicated discounted list prices for long haul liners :[74]

| Model | List price 2014 | Market price | Discount |

|---|---|---|---|

| Airbus A330-900neo | 275.6 | 124.0 | 55% |

| Airbus A350-900 | 295.2 | 159.4 | 46% |

| Boeing 777-200LR | 296.0 | 118.4 | 60% |

| Boeing 787-9 | 249.5 | 134.7 | 46% |

On 24 December 2014, Transasia Airways announced a commitment to four A330-800neos, list price $241.7m, for $480m or $120m each.[75] At the end of 2015, the sale and leaseback of new Airbus A350-900 from GECAS to Finnair value them at €132.5M ($144M)[76]

In order to close the production gap between the B777 classic and the new 777X, Boeing is challenged by a $120m market price for the -300ERs. Competitive pressure from the Bombardier CSeries and E-Jet E2 lead Boeing to pursue the development of the 737 MAX-7 despite low sales,[77] and to sell the Boeing 737-700 at $22m to United Airlines, 27% of the 2015 list price and well below what Embraer or Bombardier could offer for their aircraft.[78]

Moody’s Investors Service estimates Delta Air Lines paid $40 million each for its 37 A321ceo order on 29 April 2016, an "end-of-the-line model pricing" of 35% of the $114.9 million list price.[79] Likewise, Air Caraïbes subsidiary French Blue received its A330-300 for $100 million in September 2016.[80]

| Aircraft | List ($m) | Mkt Value ($m) | Discount | Seats | Mkt/Seat |

|---|---|---|---|---|---|

| A380 | 432.6 | 236.5 | 45% | 544 | 434743 |

| B777-300ER | 339.6 | 154.8 | 54% | 368 | 420652 |

| A350-900 | 308.1 | 150.0 | 51% | 325 | 461538 |

| B787-9 | 264.6 | 142.8 | 46% | 290 | 492414 |

| B787-8 | 224.6 | 117.1 | 48% | 242 | 483884 |

| A330-300 | 256.4 | 109.5 | 57% | 277 | 395307 |

| A330-200 | 231.5 | 86.6 | 63% | 247 | 350607 |

| A321 | 114.9 | 52.5 | 54% | 185 | 283784 |

| A320neo | 107.3 | 48.5 | 55% | 165 | 293939 |

| B737-900ER | 101.9 | 48.1 | 53% | 174 | 276437 |

| B737-800 | 96.0 | 46.5 | 52% | 160 | 290625 |

| A320 | 98.0 | 44.4 | 55% | 150 | 296000 |

| A319 | 89.6 | 37.3 | 58% | 124 | 300806 |

| B737-700 | 80.6 | 35.3 | 56% | 128 | 275781 |

This appears in the manufacturer's accounting: in their annual reports, Boeing values its 5,700 airliners order book at $416 billion using the contractual prices while Airbus has a backlog of 6,900 worth €1,010 ($1,200) billion at catalog prices, but when updating to more stringent IFRS-15 rules, Credit Suisse estimates it will be revised to €500 billion from 945.[82] Airbus will disclose its backlog value in its 2018 annual report at the latest.[83]

In January 2018, Airbus and Boeing raised their list prices by 2% and 4%, further obscuring pricing transparency as discount levels will rise and with the growing importance of aftermarket services, following the Power by the Hour engine maker model.[84]

In February 2018, Hawaiian Airlines cancelled its order for six Airbus A330-800s to replace them with Boeing 787-9s priced less than $100-115m, close to their production cost of $80-90m, while their normal sales price is around $125m.[85]

Effect of competition on product plans

The A320 has been selected by 222 operators (Dec. 2008), among these several low-cost operators, gaining ground against the previously well established 737 in this sector; it has also been selected as a replacement for 727s and aging 737s by many full-service airlines such as Star Alliance members United Airlines, Air Canada and Lufthansa. After dominating the very large aircraft market for four decades, the Boeing 747 now faces a challenge from the A380. In response, Boeing now offer the stretched and updated 747-8, with greater capacity, fuel efficiency, and longer range. Frequent delays to the Airbus A380 program caused several customers to consider cancelling their orders in favour of the refreshed 747-8.[86] However, all orders for the A380F freight variant have been cancelled. To date, Boeing has secured orders for 78 747-8F and 51 747-8I aircraft with first deliveries originally scheduled for 2011 and 2012 as the 747-8I is only in service with Lufthansa, while Airbus has orders for 318 A380s, the first of which entered service in 2007 and has delivered a total of 152 to customers (as of December 31, 2014).

Several Boeing projects were pursued and then cancelled, for example the Sonic Cruiser. Boeing's current platform for fleet rejuvenation is the Boeing 787 Dreamliner, which uses technology from the Sonic Cruiser concept.

Boeing initially ruled out producing a re-engined version of its 737 to compete with the Airbus A320neo family launch planned for 2015, believing airlines would be looking towards the Boeing Y1 and a 30% fuel saving, instead of paying 10% more for fuel efficiency gains of only a few percent. Industry sources believe that the 737's design makes re-engining considerably more expensive for Boeing than it was for the Airbus A320. However, there did prove to be considerable demand. Southwest Airlines, who use the 737 for their entire fleet (680 in service or on order), said they were not prepared to wait 20 years or more for a new 737 model and threatened to convert to Airbus.[87] Boeing eventually bowed to airline pressure and in 2011 approved the 737 MAX project, scheduled for first delivery in 2017.

Orders and deliveries

It took Boeing 42 years and 1 month to deliver its 10,000 7series aircraft (October 1958-November 2000) and, 42 years and 5 months for Airbus to achieve the same milestone (May 1974-October 2016).[88] Boeing deliveries considerably exceeded that of Airbus throughout the 1980s. In the 1990s, this lead narrowed significantly but Boeing remained ahead of Airbus. In the 2000s, Airbus assumed the lead in narrow-body aircraft. By 2010, little difference remained between Airbus and Boeing in both the wide-body or narrow-body categories or the range on offer.

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| Airbus | 256 | 1109 | 731 | 1080 | 1456 | 1503 | 833 | 1419 | 574 | 281 | 777 | 1341 | 790 | 1055 | 370 | 284 | 300 | 375 | 520 | 476 | 556 | 460 | 326 | 106 | 125 | 138 | 136 | 101 | 404 | 421 |

| Boeing | 581 | 912 | 668 | 768 | 1432 | 1355 | 1203 | 805 | 530 | 142 | 662 | 1413 | 1044 | 1002 | 272 | 239 | 251 | 314 | 588 | 355 | 606 | 532 | 664 | 379 | 112 | 220 | 230 | 240 | 456 | 563 |

| Sources: Airbus Orders & Deliveries to 30 September, 2018 Boeing orders to 31 August, 2018 | ||||||||||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | |

| Airbus | 503 | 718 | 688 | 635 | 629 | 626 | 588 | 534 | 510 | 498 | 483 | 453 | 434 | 378 | 320 | 305 | 303 | 325 | 311 | 294 | 229 | 182 | 126 | 124 | 123 | 138 | 157 | 163 | 95 | 105 |

| Boeing | 481 | 763 | 748 | 762 | 723 | 648 | 601 | 477 | 462 | 481 | 375 | 441 | 398 | 290 | 285 | 281 | 381 | 527 | 491 | 620 | 563 | 346 | 219 | 207 | 272 | 330 | 446 | 435 | 385 | 491 |

| Sources: Airbus Orders & Deliveries to 30 September, 2018 Boeing deliveries to 31 August, 2018 The former McDonnell Douglas MD-80, the MD-90 and the MD-11 are included in Boeing deliveries since MD's August 1997 merger with Boeing. | ||||||||||||||||||||||||||||||

Airbus orders |

Airbus deliveries |

Boeing orders |

Boeing deliveries |

| Manufacturer | Class | Product | 2017 | Historical Deliveries * | ||

|---|---|---|---|---|---|---|

| Orders | Deliveries | Backlog | ||||

| Airbus [91] | Narrow-body | A320 | 1054 | 558 | 6141 | 7979 |

| Wide-body | A300 | 561 | ||||

| A310 | 255 | |||||

| A330 | 16 | 62 | 312 | 1385 | ||

| A340 | 377 | |||||

| A350 | 36 | 78 | 712 | 142 | ||

| A380 | -2 | 15 | 95 | 222 | ||

| Total | 1104 | 713 | 7260 | 10921 | ||

| Boeing [92] | Narrow-body | 707 | 1010 | |||

| 717 | 155 | |||||

| 727 | 1831 | |||||

| 737 | 724 | 529 | 4664 | 9847 | ||

| 757 | 1049 | |||||

| Wide-body | 747 | -2 | 12 | 14 | 1540 | |

| 767 | 0 | 10 | 83 | 1106 | ||

| 777 | 60 | 74 | 428 | 1534 | ||

| 787 | 94 | 136 | 658 | 636 | ||

| Total | 887 | 763 | 5856 | 18710 | ||

| * Historical deliveries are all jet airliners from Boeing since 1958 and Airbus since 1974 until 31 December 2017 | ||||||

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | Boeing[93] | A220 | A300 | A310 | A320 | A330 | A340 | A350 | A380 | Airbus | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1974 | 21 | 91 | 55 | 22 | 189 | 4 | 4 | ||||||||||||

| 1975 | 7 | 91 | 51 | 21 | 170 | 8 | 8 | ||||||||||||

| 1976 | 9 | 61 | 41 | 27 | 138 | 13 | 13 | ||||||||||||

| 1977 | 8 | 67 | 25 | 20 | 120 | 15 | 15 | ||||||||||||

| 1978 | 13 | 118 | 40 | 32 | 203 | 15 | 15 | ||||||||||||

| 1979 | 6 | 136 | 77 | 67 | 286 | 26 | 26 | ||||||||||||

| 1980 | 3 | 131 | 92 | 73 | 299 | 39 | 39 | ||||||||||||

| 1981 | 2 | 94 | 108 | 53 | 257 | 38 | 38 | ||||||||||||

| 1982 | 8 | 26 | 95 | 26 | 2 | 20 | 177 | 46 | 46 | ||||||||||

| 1983 | 8 | 11 | 82 | 22 | 25 | 55 | 203 | 19 | 17 | 36 | |||||||||

| 1984 | 8 | 8 | 67 | 16 | 18 | 29 | 146 | 19 | 29 | 48 | |||||||||

| 1985 | 3 | 115 | 24 | 36 | 25 | 203 | 16 | 26 | 42 | ||||||||||

| 1986 | 4 | 141 | 35 | 35 | 27 | 242 | 10 | 19 | 29 | ||||||||||

| 1987 | 9 | 161 | 23 | 40 | 37 | 270 | 11 | 21 | 32 | ||||||||||

| 1988 | 165 | 24 | 48 | 53 | 290 | 17 | 28 | 16 | 61 | ||||||||||

| 1989 | 5 | 146 | 45 | 51 | 37 | 284 | 24 | 23 | 58 | 105 | |||||||||

| 1990 | 4 | 174 | 70 | 77 | 60 | 385 | 19 | 18 | 58 | 95 | |||||||||

| 1991 | 14 | 215 | 64 | 80 | 62 | 435 | 25 | 19 | 119 | 163 | |||||||||

| 1992 | 5 | 218 | 61 | 99 | 63 | 446 | 22 | 24 | 111 | 157 | |||||||||

| 1993 | 152 | 56 | 71 | 51 | 330 | 22 | 22 | 71 | 1 | 22 | 138 | ||||||||

| 1994 | 1 | 121 | 40 | 69 | 41 | 272 | 23 | 2 | 64 | 9 | 25 | 123 | |||||||

| 1995 | 89 | 25 | 43 | 37 | 13 | 207 | 17 | 2 | 56 | 30 | 19 | 124 | |||||||

| 1996 | 76 | 26 | 42 | 43 | 32 | 219 | 14 | 2 | 72 | 10 | 28 | 126 | |||||||

| 1997 | 135 | 39 | 46 | 42 | 59 | 321 | 6 | 2 | 127 | 14 | 33 | 182 | |||||||

| 1998 | 282 | 53 | 54 | 47 | 74 | 510 | 13 | 1 | 168 | 23 | 24 | 229 | |||||||

| 1999 | 12 | 320 | 47 | 67 | 44 | 83 | 573 | 8 | 222 | 44 | 20 | 294 | |||||||

| 2000 | 32 | 282 | 25 | 45 | 44 | 55 | 483 | 8 | 241 | 43 | 19 | 311 | |||||||

| 2001 | 49 | 299 | 31 | 45 | 40 | 61 | 525 | 11 | 257 | 35 | 22 | 325 | |||||||

| 2002 | 20 | 223 | 27 | 29 | 35 | 47 | 381 | 9 | 236 | 42 | 16 | 303 | |||||||

| 2003 | 12 | 173 | 19 | 14 | 24 | 39 | 281 | 8 | 233 | 31 | 33 | 305 | |||||||

| 2004 | 12 | 202 | 15 | 11 | 9 | 36 | 285 | 12 | 233 | 47 | 28 | 320 | |||||||

| 2005 | 13 | 212 | 13 | 2 | 10 | 40 | 290 | 9 | 289 | 56 | 24 | 378 | |||||||

| 2006 | 5 | 302 | 14 | 12 | 65 | 398 | 9 | 339 | 62 | 24 | 434 | ||||||||

| 2007 | 330 | 16 | 12 | 83 | 441 | 6 | 367 | 68 | 11 | 1 | 453 | ||||||||

| 2008 | 290 | 14 | 10 | 61 | 375 | 386 | 72 | 13 | 12 | 483 | |||||||||

| 2009 | 372 | 8 | 13 | 88 | 481 | 402 | 76 | 10 | 10 | 498 | |||||||||

| 2010 | 376 | 12 | 74 | 462 | 401 | 87 | 4 | 18 | 510 | ||||||||||

| 2011 | 372 | 9 | 20 | 73 | 3 | 477 | 421 | 87 | 26 | 534 | |||||||||

| 2012 | 415 | 31 | 26 | 83 | 46 | 601 | 455 | 101 | 2 | 30 | 588 | ||||||||

| 2013 | 440 | 24 | 21 | 98 | 65 | 648 | 493 | 108 | 25 | 626 | |||||||||

| 2014 | 485 | 19 | 6 | 99 | 114 | 723 | 490 | 108 | 1 | 30 | 629 | ||||||||

| 2015 | 495 | 18 | 16 | 98 | 135 | 762 | 491 | 103 | 14 | 27 | 635 | ||||||||

| 2016 | 490 | 9 | 13 | 99 | 137 | 748 | 545 | 66 | 49 | 28 | 688 | ||||||||

| 2017 | 529 | 14 | 10 | 74 | 136 | 763 | 558 | 67 | 78 | 15 | 718 | ||||||||

| 2018 | 269 | 3 | 9 | 25 | 72 | 378 | 239 | 18 | 40 | 6 | 303 | ||||||||

| Total (All-time) |

1010 | 155 | 1831 | 10133 | 1545 | 1049 | 1115 | 1559 | 708 | 19105 | 561 | 255 | 8218 | 1408 | 377 | 182 | 228 | 11229 | |

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | A300 | A310 | A320 | A330 | A340 | A350 | A380 |

| Airliner | Europe | North America | Latin America & Caribbean | Asia Pacific | Middle East | Africa | Leasing Companies | VIP-Gov-Others | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | Narrow-body | Wide-body | ||

| 707 | 139 | 582 | 21 | 73 | 37 | 31 | 127 | 1010 | |||||||||

| 717 | 9 | 125 | 10 | 11 | 155 | ||||||||||||

| 727 | 210 | 1301 | 89 | 106 | 36 | 54 | 25 | 10 | 1831 | ||||||||

| 737 Original | 284 | 455 | 60 | 138 | 44 | 94 | 34 | 35 | 1144 | ||||||||

| 737 Classic | 457 | 691 | 18 | 276 | 27 | 513 | 6 | 1988 | |||||||||

| 737NG | 1163 | 1609 | 213 | 1404 | 88 | 143 | 1301 | 282 | 6203 | ||||||||

| 737 MAX | |||||||||||||||||

| A320ceo | 1639 | 1029 | 521 | 1734 | 207 | 103 | 2004 | 116 | 7353 | ||||||||

| A320neo | 18 | 4 | 4 | 24 | 18 | 68 | |||||||||||

| 757 | 172 | 634 | 83 | 10 | 7 | 137 | 6 | 1049 | |||||||||

| 767 | 115 | 447 | 60 | 264 | 28 | 19 | 149 | 14 | 1096 | ||||||||

| A300 | 101 | 179 | 9 | 187 | 32 | 28 | 22 | 3 | 561 | ||||||||

| A310 | 114 | 39 | 4 | 48 | 27 | 13 | 7 | 3 | 255 | ||||||||

| 777 | 194 | 211 | 12 | 538 | 246 | 30 | 207 | 22 | 1460 | ||||||||

| 777X | |||||||||||||||||

| A330ceo | 203 | 90 | 41 | 458 | 114 | 38 | 339 | 40 | 1323 | ||||||||

| A330neo | |||||||||||||||||

| A340 | 179 | 10 | 4 | 80 | 35 | 22 | 33 | 14 | 377 | ||||||||

| 787 | 67 | 72 | 31 | 198 | 48 | 29 | 50 | 5 | 500 | ||||||||

| A350 | 8 | 7 | 24 | 13 | 12 | 64 | |||||||||||

| 747 | 366 | 280 | 13 | 637 | 63 | 31 | 14 | 14 | 1418 | ||||||||

| 747-8 | 43 | 10 | 47 | 10 | 110 | ||||||||||||

| A380 | 36 | 64 | 107 | 207 | |||||||||||||

| Total | 4091 | 1426 | 6430 | 1338 | 926 | 181 | 3848 | 2545 | 422 | 713 | 459 | 210 | 4043 | 833 | 582 | 125 | 28172 |

| Narrow-body | Wide-body | Boeing[93] | Narrow-body | Wide-body | Airbus | Ratio B:A | |

|---|---|---|---|---|---|---|---|

| 1980s | 1747 | 624 | 2371 | 74 | 402 | 476 | 4.98:1 |

| 1990s | 2466 | 1232 | 3698 | 1068 | 563 | 1631 | 2.27:1 |

| 2000s | 2974 | 966 | 3940 | 2983 | 827 | 3810 | 1.03:1 |

| 2010s | 3585 | 1580 | 5165 | 3854 | 1069 | 4923 | 1.05:1 |

| Total | 13892 | 4816 | 18708 | 7979 | 2942 | 10921 |

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | Boeing[93] | A300 | A310 | A320 | A330 | A340 | A350 | A380 | Airbus | Ratio B:A | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 68 | 155 | 620 | 4328 | 989 | 996 | 862 | 575 | 8593 | 408 | 199 | 2761 | 418 | 306 | 4092 | 2.09:1 | ||||||||

| 2007 | 63 | 155 | 561 | 4583 | 985 | 1000 | 880 | 640 | 8867 | 392 | 193 | 3095 | 481 | 330 | 4491 | 1.97:1 | ||||||||

| 2008 | 61 | 154 | 500 | 4761 | 955 | 980 | 873 | 714 | 8998 | 387 | 194 | 3395 | 533 | 330 | 4 | 4843 | 1.86:1 | |||||||

| 2009 | 58 | 142 | 442 | 4928 | 947 | 970 | 864 | 780 | 9131 | 376 | 188 | 3737 | 607 | 345 | 16 | 5269 | 1.73:1 | |||||||

| 2010 | 39 | 147 | 398 | 5153 | 915 | 945 | 863 | 858 | 9318 | 348 | 160 | 4092 | 675 | 342 | 30 | 5647 | 1.65:1 | |||||||

| 2011 | 10 | 130 | 250 | 5177 | 736 | 898 | 837 | 924 | 8962 | 296 | 121 | 4392 | 766 | 332 | 50 | 5957 | 1.50:1 | |||||||

| 2012 | 2 | 143 | 169 | 5357 | 690 | 860 | 838 | 1017 | 15 | 9091 | 262 | 102 | 4803 | 848 | 312 | 76 | 6403 | 1.42:1 | ||||||

| 2013 | 148 | 109 | 5458 | 627 | 855 | 821 | 1094 | 68 | 9180 | 234 | 84 | 5170 | 927 | 298 | 106 | 6819 | 1.35:1 | |||||||

| 2014 | 154 | 87 | 5782 | 585 | 812 | 795 | 1188 | 163 | 9564 | 216 | 71 | 5632 | 1020 | 266 | 136 | 7341 | 1.30:1 | |||||||

| 2015 | 136 | 69 | 6135 | 571 | 738 | 765 | 1265 | 286 | 9965 | 207 | 62 | 6050 | 1095 | 227 | 5 | 167 | 7813 | 1.28:1 | ||||||

| 2016 | 154 | 64 | 6512 | 515 | 688 | 742 | 1324 | 423 | 10422 | 210 | 47 | 6510 | 1154 | 196 | 29 | 193 | 8339 | 1.25:1 | ||||||

| 2017 | 154 | 57 | 6864 | 489 | 689 | 744 | 1387 | 554 | 10938 | 211 | 37 | 6965 | 1214 | 176 | 92 | 212 | 8907 | 1.23:1 | ||||||

| 707 | 717 | 727 | 737 | 747 | 757 | 767 | 777 | 787 | A300 | A310 | A320 | A330 | A340 | A350 | A380 | |||||||||

| World Airliner Census 2006 [96] 2007 [97] 2008 [98] 2009 [99] 2010 [100][101] 2011 [102] 2012 [103] 2013 [104] 2014 [105][106] 2015 [107] 2016[108][109]2017[110][111] | ||||||||||||||||||||||||

In 2017, there were 6858 Boeing 737s in service, and almost as many of the Airbus A320 family with 6,838.[112]

For 2018, Forecast International expects 750-770 deliveries for Airbus, 800-820 for Boeing and 600-800 net new orders for each manufacturer.[113]

Controversies

.jpg)

Subsidies

Boeing has continually protested over launch aid in the form of credits to Airbus, while Airbus has argued that Boeing receives illegal subsidies through military and research contracts and tax breaks.[114]

In July 2004, Harry Stonecipher (then CEO of Boeing) accused Airbus of abusing a 1992 bilateral EU-US agreement regarding large civil aircraft support from governments. Airbus is given reimbursable launch investment (RLI, called "launch aid" by the US) from European governments with the money being paid back with interest, plus indefinite royalties if the aircraft is a commercial success.[115] Airbus contends that this system is fully compliant with the 1992 agreement and WTO rules. The agreement allows up to 33 per cent of the program cost to be met through government loans which are to be fully repaid within 17 years with interest and royalties. These loans are held at a minimum interest rate equal to the cost of government borrowing plus 0.25%, which would be below market rates available to Airbus without government support.[116] Airbus claims that since the signing of the EU-U.S. agreement in 1992, it has repaid European governments more than U.S.$6.7 billion and that this is 40% more than it has received.

Airbus argues that pork barrel military contracts awarded to Boeing (the second largest U.S. defence contractor) are in effect a form of subsidy (see the Boeing KC-767 vs EADS (Airbus) KC-45 military contracting controversy). The U.S. government support of technology development via NASA also provides support to Boeing. In its recent products such as the 787, Boeing has also received support from local and state governments.[117] Airbus's parent, EADS, itself is a military contractor, and is paid to develop and build projects such as the Airbus A400M transport and various other military aircraft.[118]

In January 2005, European Union and United States trade representatives Peter Mandelson and Robert Zoellick agreed to talks aimed at resolving the increasing tensions. These talks were not successful, with the dispute becoming more acrimonious rather than approaching a settlement.

World Trade Organization litigation

Joint EU-US statement[119]

On 31 May 2005 the United States filed a case against the European Union for providing allegedly illegal subsidies to Airbus. Twenty-four hours later the European Union filed a complaint against the United States protesting support for Boeing.[120]

Increased tensions, due to the support for the Airbus A380, escalated toward a potential trade war as the launch of the Airbus A350 neared. Airbus preferred the A350 program to be launched with the help of state loans covering a third of the development costs, although it stated it will launch without these loans if required. The A350 will compete with Boeing's most successful project in recent years, the 787 Dreamliner. EU trade officials questioned the nature of the funding provided by NASA, the Department of Defense, and in particular the form of R&D contracts that benefit Boeing; as well as funding from US states such as Washington, Kansas, and Illinois, for the development and launch of Boeing aircraft, in particular the 787.[121] An interim report of the WTO investigation into the claims made by both sides was made in September 2009.[122]

In March 2010, the WTO ruled that European governments unfairly financed Airbus.[123] In September 2010, a preliminary report of the WTO found unfair Boeing payments broke WTO rules and should be withdrawn.[124] In two separate findings issued in May 2011, the WTO found, firstly, that the US defence budget and NASA research grants could not be used as vehicles to subsidise the civilian aerospace industry and that Boeing must repay $5.3 billion of illegal subsidies.[125] Secondly, the WTO Appellate Body partly overturned an earlier ruling that European Government launch aid constituted unfair subsidy, agreeing with the point of principle that the support was not aimed at boosting exports and some forms of public-private partnership could continue. Part of the $18bn in low interest loans received would have to be repaid eventually; however, there was no immediate need for it to be repaid and the exact value to be repaid would be set at a future date.[126] Both parties claimed victory in what was the world's largest trade dispute.[127][128][129]

On 1 December 2011 Airbus reported that it had fulfilled its obligations under the WTO findings and called upon Boeing to do likewise in the coming year.[130] The United States did not agree and had already begun complaint procedures prior to December, stating the EU had failed to comply with the DSB's recommendations and rulings, and requesting authorisation by the DSB to take countermeasures under Article 22 of the DSU and Article 7.9 of the SCM Agreement. The European Union requested the matter be referred to arbitration under Article 22.6 of the DSU. The DSB agreed that the matter raised by the European Union in its statement at that meeting be referred to arbitration as required by Article 22.6 of the DSU however on 19 January 2012 the US and EU jointly agreed to withdraw their request for arbitration.[131]

On 12 March 2012 the appellate body of the WTO released its findings confirming the illegality of subsidies to Boeing whilst confirming the legality of repayable loans made to Airbus. The WTO stated that Boeing had received at least $5.3 billion in illegal cash subsidies at an estimated cost to Airbus of $45 billion. A further $2 billion in state and local subsidies that Boeing is set to receive have also been declared illegal. Boeing and the US government were given six months to change the way government support for Boeing is handled.[132] At the DSB meeting on 13 April 2012, the United States informed the DSB that it intended to implement the DSB recommendations and rulings in a manner that respects its WTO obligations and within the time-frame established in Article 7.9 of the SCM Agreement. The European Union welcomed the US intention and noted that the 6-month period stipulated in Article 7.9 of the SCM Agreement would expire on 23 September 2012. On 24 April 2012, the European Union and the United States informed the DSB of Agreed Procedures under Articles 21 and 22 of the DSU and Article 7 of the SCM Agreement.[133]

On 25 September 2012 the EU requested discussions with the USA, because of the alleged non compliance of the US and Boeing with the WTO ruling of 12 March 2012. On 27 September 2012 the EU requested the WTO to approve EU countermeasures against USA's subsidy of Boeing. The WTO approved creating a panel to rule on the disputed compliance this was initially to rule in 2014 but is not now expected to complete its work before 2016 due to the complexity of the case. The EU wants permission to place trade sanctions of up to 12 billion US$ annually against the USA. The EU believes this amount represents the damage the illegal subsidies of Boeing cause to the EU.[134][135]

On 19 December 2014 the EU requested WTO mediated consultations with the US over the tax incentives given by the state of Washington to large civil aircraft manufacturers which they believed violated the earlier WTO ruling, on 22 April 2015 at the request of the EU a WTO panel was set up to rule on the complaint.[136] The tax incentives given by the state of Washington and believed to be the largest in US history[137] surpassing the previous record of $5.6bn over 30 years awarded by the state of New York to the aluminum producer Alcoa in 2007. The $8.7bn over 40 years incentive to Boeing to manufacture the 777X in the state includes $4.2bn from a 40% reduction in business taxes, £3.5bn in tax credits for the firm, a $562m tax credit on property and buildings belonging to Boeing, a $242m sales tax exemption for buying computers and $8m to train 1000 workers,[138] Airbus alleges this is larger than the budgeted cost of Boeing's 777X development program and the EU argues amounts to an entire publicly funded free aircraft program for Boeing, the legislation was an extension of the duration of a tax break program given to Boeing for Dreamliner development that had already been ruled illegal by the WTO in 2012.[139] Boeing defends the allegation by arguing the subsidies are available to anyone however for an aircraft to qualify for the tax breaks a company must manufacture aircraft wings and perform all final assembly for an aircraft model or variant exclusively in the state.[140]

In September 2016, the WTO found that Airbus did not remedy the harm to Boeing from illegal subsidies, and the EU immediately appealed for a final decision in late spring 2018. Boeing expect the 2016 decision will be largely maintained with sanctions between $10 to $15 billion, which could be levied by punitive tariffs by the U.S. government, but the EU would retaliate strongly. The EU case against Boeing filed as a countersuit lags the U.S. case and the decision on Boeing’s appeal won’t come out until late in 2018 or even in 2019.[141] Both are exposed with a backlog of 644 Boeing orders in the EU and 1,340 Airbus orders in the US, but this is mitigated as many are from lessors, to be delivered elsewhere, and as Airbus has an assembly line in Alabama.[142]

On 15 May 2018, in its EU appeal ruling, the WTO concluded that the A380 and A350 received improper subsidies through repayable launch aids or low interest rates, like previous airliners, which could have been avoided. Boeing claimed victory but Airbus countered it is thin with 94% of the complaints rejected, as launch aids are legal but at market interest rates, not lower: violations will be corrected. US tariffs, probably on other industries, may take up to 18 months to get WTO approval, but EU could retaliate over Washington State 787 subsidies and tax breaks for the 777X.[143] The U.S. will pursue penalties if an agreement can’t be reached but is willing to reach a settlement with the European Union.[144]

See also

Notes

References

- ↑ Airlines Industry Profile: United States, Datamonitor, November 2008, pp. 13–14

- 1 2 3 "Family figures" (PDF). Airbus. July 2018.

- ↑ "737 MAX". Boeing.

- 1 2 "Airbus 2018 Price List" (Press release). Airbus. 15 January 2018.

- 1 2 "About Boeing Commercial Airplanes: Prices". Boeing.

- ↑ "List Prices - Commercial Aircraft". Bombardier Aerospace. January 2017.

- ↑ "Flight Fleet Forecast's single-aisle outlook 2016-2035". Flight Global. 16 August 2016.

- ↑ "Pontifications: Boeing's long-term message doesn't resonate". Leeham Co. February 20, 2017. Retrieved 14 January 2018.

- ↑ "787 by design". Boeing.

- ↑ "777X by design". Boeing.

- ↑ "747-8". Boeing.

- ↑ "Flight Fleet Forecast Summary". Flight Global. 2016.

- ↑ "Ascend widebody fleet forecast". Flight Global. 13 October 2016.

- ↑ "wide boys". Flight Global. June 2017.

- ↑ "747-400 fleet profile: Air France, Cathay Pacific and Saudia retire passenger 747 fleets in 2016". CAPA - Centre for Aviation. 18 January 2016.

- ↑ "Singapore Airlines to resume non-stop US services with A350-900ULR: a strategic imperative". CAPA - Centre for Aviation. 15 October 2015.

- 1 2 "EFW, ST Aerospace and Airbus to launch A320/A321P2F freighter conversion programme". Airbus. 17 June 2015. Retrieved 16 May 2017.

- 1 2 3 4 5 "Freighters". Boeing. Retrieved 13 May 2017.

- 1 2 "A330P2F Passenger to Freighter". Airbus. Retrieved 16 May 2017.

- ↑ "ANALYSIS: A320neo vs. 737 MAX: Airbus is Leading (Slightly) – Part I". Airways News. January 27, 2016.

- ↑ "Boeing positioned to narrow market share gap". Leeham Co. Sep 22, 2016.

- ↑ Addison Schonland (July 10, 2017). "The Big Duopoly Race". Airinsight.

- ↑ "Orders and Deliveries search page". Boeing. May 31, 2017. Retrieved June 14, 2017.

- 1 2 "Orders & deliveries viewer". Airbus. Archived from the original on December 30, 2012. Retrieved May 6, 2017.

- ↑ "Historical Orders and Deliveries 1974–2009". Airbus S.A.S. January 2010. Archived from the original (Microsoft Excel) on December 23, 2010. Retrieved 10 December 2012.

- ↑ "Historical Deliveries". Boeing. December 2015. Retrieved February 5, 2016.

- ↑ Jens Flottau (Feb 9, 2018). "Airbus And Boeing Consider Higher Narrowbody Production". Aviation Week & Space Technology.

- ↑ Alex Derber (Aug 29, 2018). "How The A320 Overtook The 737, And MRO Implications". Aviation Week Network.

- ↑ David Kaminski Morrow (6 Nov 2017). "IAG lauds ownership-cost benefit of Level A330s". Flightglobal.

- ↑ "Airbus and Boeing are head-to-head in the widebody sector". Flightglobal. 6 Feb 2018.

- ↑ Adrian Schofield (May 17, 2018). "Airbus, Boeing Size Asia-Pacific Carrier Opportunities". Aviation Week & Space Technology.

- ↑ "A350-900ULR: Singapore Airlines could be the sole customer". CAPA - Centre for Aviation. 11 August 2018. Retrieved 12 September 2018.

- ↑ "Boeing, partners expected to scrap Super-Jet study". Los Angeles Times. 10 July 1995. Retrieved 30 December 2011.

- ↑ "Boeing 747-8 Family background". boeing.com. 2005-11-14. Retrieved 2011-05-21.

- ↑ "SIA's Chew: A380 pleases, Virgin Atlantic disappoints". ATW Online. 13 December 2007. Archived from the original on 15 December 2007. Retrieved 13 December 2007.

- ↑ Flottau, Jens (21 November 2012). "Emirates A350-1000 Order 'In Limbo'". Aviation Week. Retrieved 22 November 2012.

Clark points out that "the faster you fly [the A380], the more fuel-efficient she gets; when you fly at [Mach] 0.86 she is better than at 0.83."

- ↑ "Updating the A380: the prospect of a neo version and what's involved". 2014-02-03. Retrieved 2014-06-29.

- ↑ "A380 family presskit". 2012-01-01. Retrieved 2012-02-08.

- ↑ Saporito, Bill (23 November 2009). "Can the A380 Bring the Party Back to the Skies?". TIME magazine. Archived from the original on 19 September 2010. Retrieved 21 September 2010.

- ↑ "The A380 global fleet spreads its wings as deliveries hit the 'century mark'" Archived 2016-03-03 at the Wayback Machine.. Airbus, 14 March 2013.

- ↑ "British Airways and Emirates will be first for new longer-range A380". flightglobal.com. Retrieved 2011-05-21.

- ↑ "Orders & Deliveries". Airbus.com. Retrieved 22 November 2015.

- ↑ Quentin Wilber, Dell (8 November 2006). "Airbus bust, Boeing boost". The Washington Post. Retrieved 30 December 2011.

- ↑ Robertson, David. "Airbus will lose €4.8bn because of A380 delays", Time, 3 October 2006.

- ↑ Schwartz, Nelson D. "Big plane, big problems", CNN, 1 March 2007.

- ↑ Clark, Nicola (12 July 2016). "Airbus to Sharply Cut Production of A380 Jumbo Jets". Nytimes.com. Retrieved 13 January 2018.

- ↑ Wall, Robert; Ostrower, Jon (12 July 2016). "Airbus Cuts A380 Production Plans". Wsj.com. Retrieved 13 January 2018.

- ↑ "747 model summary". Boeing.com. Retrieved 3 August 2014.

- ↑ "Air tanker deal provokes US row, BBC, 1 March 2008". BBC News. 2008-03-01. Retrieved 2011-05-21.

- ↑ "The USAF's KC-X Aerial Tanker RFP: Canceled". Defense Industry Daily. 13 March 2011. Retrieved 13 January 2018.

- ↑ Leeham News and Comment: How will Boeing profit from tanker contract? Archived 2011-07-17 at the Wayback Machine., 12-7-2011, visited: 3-2-2012

- ↑ Broken link:

- ↑ "John McCain blasts Boeing overruns on Air Force tanker contract". Blog.al.com. Retrieved 14 January 2018.

- ↑ Defensenews.com: Boeing Lowers KC-46 Cost Estimate, 27-7-2011, visited: 3-2-2012

- ↑ Airbus, Bombardier (16 October 2017). "Airbus and Bombardier Announce C Series Partnership" (Press release).

- ↑ Boeing and Embraer (December 21, 2017). "Boeing and Embraer Confirm Discussions on Potential Combination" (Press release).

- ↑ "Airbus introduces the A220-100 and A220-300" (Press release). Airbus. 10 July 2018.

- ↑ Boeing, Embraer (July 5, 2018). "Boeing and Embraer to Establish Strategic Aerospace Partnership to Accelerate Global Aerospace Growth" (Press release).

- ↑ Gates, Dominic (March 1, 2010). "Albaugh: Boeing's 'first preference' is to build planes in Puget Sound region". The Seattle Times. Retrieved 2010-06-16.

- ↑ "Airbus' China gamble". Flight International. October 28, 2008. Retrieved 2008-11-15.

- ↑ "Qatar Airways A350 XWB factsheet". Airbus.com. Retrieved 28 September 2016.

- ↑ Thomas, Geoffrey (April 4, 2008). "Engines the thrust of the Boeing-Airbus battle". The Australian. Retrieved 2008-11-08.

- ↑ "ANALYSIS: Rolls and Airbus – how the latecomer excelled". Flightglobal.com. Retrieved 14 January 2018.

- ↑ "GE In, Rolls Out As Boeing Seeks 777X Approval". Aviationweek.com. Retrieved 14 January 2018.

- ↑ "Strong Euro Weighs on Airbus, Suppliers". Wall Street Journal: B3. October 30, 2009.

- ↑ Muellerleile, Christopher M (2009). "Financialization takes off at Boeing". Journal of Economic Geography. doi:10.1093/jeg/lbp025.

Boeing’s engineers [...] tended to be first and foremost concerned with safety and quality. This contributed to Boeing’s solid reputation

- ↑ Gray, Edmund R.; Balmer, John MT (1998). "Managing corporate image and corporate reputation". Long Range Planning. 31.5. doi:10.1016/S0024-6301(98)00074-0.

Airbus [...] enjoys a high-profile image and positive reputation

- ↑ "Statistical Summary of Commercial Jet Airplane Accidents - Worldwide Operations - 1959–2015" (PDF). Boeing. July 2016.

- ↑ Robert Wall & Andrea Rothman (17 January 2013). "Airbus Says A350 Design Is 'Lower Risk' Than Troubled 787". Bloomberg. Retrieved 17 January 2013.

I don't believe that anyone's going to switch from one airplane type to another because there's a maintenance issue," Leahy said. "Boeing will get this sorted out.

- ↑ TIM HEPHER (9 July 2012). "How plane giants descended into global 'price war'". Reuters.

- ↑ DANIEL MICHAELS (9 July 2012). "The Secret Price of a Jet Airliner". Wall Street Journal.

- ↑ Agustino Fontevecchia (21 May 2013). "Boeing Bleeding Cash As 787 Dreamliners Cost $200M But Sell For $116m, But Productivity Is Improving". Forbes.

- 1 2 3 4 Vincent Lamigeon (13 June 2013). "Le vrai prix des avions d'Airbus et de Boeing" (in French). Challenges.fr.

- ↑ Vinay Bhaskara (November 25, 2014). "UPDATED ANALYSIS: Delta Order for A350; A330neo Hinged on Pricing, Availability". Airways News. Archived from the original on November 17, 2015.

- ↑ DAVID KAMINSKI-MORROW (24 December 2014). "TransAsia to take four A330-800neo jets". Flight Global.

- ↑ "Finnair has entered into a memorandum of understanding on the sale and leaseback of two A350 aircraft" (Press release). Finnair. 2015-12-23.

- ↑ "In strategy shift, Boeing backs 7 MAX: sources". Leeham news and comment. 22 February 2016.

- ↑ "Boeing Gives United A Smoking Deal On 737s To Block Bombardier From Gaining Traction". Forbes. 8 March 2016.

- ↑ "ANALYSIS: Delta sees long upgauge runway ahead with A321s". Flightglobal. 2 May 2016.

- ↑ "Premier vol français (et vendéen) low-cost long courrier" (in French). Ouest France. 13 September 2016.

- ↑ "Aircraft Pricing - List vs. market". Airinsight. May 16, 2016.

- ↑ Chris Bryant (Nov 13, 2017). "Airbus Loses Its $1 Trillion Order Book". Bloomberg.

- ↑ Tim Hepher (April 27, 2018). "Airbus keeps plane pricing secrets just a little longer". Reuters.

- ↑ Ernest S. Arvai (January 19, 2018). "The Meaningless Game of List Prices". AirInsight.

- ↑ "Boeing displaces Airbus at Hawaiian, wins 787-9 deal; airline cancels A330-800 order". Leeham. Feb 20, 2018.

- ↑ Robertson, David (October 4, 2006). "Airbus will lose €4.8bn because of A380 delays". London: The Times Business News.

- ↑ Associated, The (2011-01-20). "Southwest waiting to hear Boeing's plan for 737". BusinessWeek. Retrieved 2013-02-16.

- ↑ "How Airbus went from zero to 10,000". Flight Global. 14 October 2016.

- ↑ airbus.com

- ↑ boeing.com

- ↑ "Orders & deliveries". Airbus.com. 2018-01-15. Retrieved 2018-01-15.

- ↑ "The Boeing Company". Active.boeing.com. Retrieved 2014-02-06.

- 1 2 3 Time Period Reports. boeing.com

- ↑ "Boeing". boeing.com.

- ↑ "Orders & deliveries". airbus.

- ↑ "Western-built jet and turboprop airliners". Flightglobal.com. Retrieved 14 January 2018.

- ↑ "WESTERN-BUILT JET AND TURBOPROP AIRLINERS". Flightglobal.com. Retrieved 14 January 2018.

- ↑ "WESTERN-BUILT JET AND TURBOPROP AIRLINE". Flightglobal.com. Retrieved 14 January 2018.

- ↑

- ↑ "WESTERN-BUILT JET AND TURBOPROP AIRLINE". Flightglobal.com. Retrieved 14 January 2018.

- ↑ "Airliner Census 2010 – fleet growth marginal and idle jets at record high". Flight Global. 2010-08-23. Retrieved 2014-02-06.

- ↑

- ↑

- ↑

- ↑ "ANALYSIS: The changing size and shape of the world airliner fleet". Flightglobal.com. Retrieved 14 January 2018.

- ↑ "World Airliner Census 2014" (PDF). D1fmezig7cekam.cloudfront.net. Retrieved 14 January 2018.

- ↑ "World Airliner Census 2015" (PDF). D1fmezig7cekam.cloudfront.net. Retrieved 14 January 2018.

- ↑ "12798". Flightglobal.com. Retrieved 13 January 2018.

- ↑ "ANALYSIS: FlightGlobal airliner census reveals fleet developments". Flightglobal.com. 8 August 2016. Retrieved 13 January 2018.

- ↑ "WorldCensus2017.pdf". Flightglobal.com. Retrieved 13 January 2018.

- ↑ "ANALYSIS: 787 stars in annual airliner census". Flightglobal.com. 14 August 2017. Retrieved 13 January 2018.

- ↑ "787 stars in annual airliner census". FlightGlobal. 14 August 2017.

- ↑ J. Kasper Oestergaard (January 26, 2018). "Boeing Wins by Deliveries as Airbus Takes Orders Crown in Wild Year-End Finish". Forecast International.

- ↑ "Don't Let Boeing Close The Door On Competition" (PDF). Retrieved 2011-01-09.

- ↑ O'Connell, Dominic; Porter, Andrew (29 May 2005). "Trade war threatened over £379m subsidy for Airbus". The Times. London. Archived from the original on 14 January 2006. Retrieved 22 October 2014.

- ↑ "Q&A: Boeing and Airbus". BBC News. 7 October 2004. Retrieved 22 October 2014.

- ↑ "See you in court". The Economist. 23 March 2005.

- ↑ "EADS Military Air Systems Website, retrieved September 3, 2009". eads.net. 2011-05-13. Retrieved 2011-05-21.

- ↑ "EU, US face off at WTO in aircraft spat". Defense Aerospace. 31 May 2005.

- ↑ "Flare-up in EU-US air trade row". BBC News. 31 May 2005. Retrieved 2010-01-02.

- ↑ Milmo, Dan (14 August 2009). "US accuse Britain of stoking trade row with £340m Airbus loan". London: The Guardian.

- ↑ "US refuses to disclose WTO ruling on Boeing-Airbus row". EU Business. 5 September 2009.

- ↑ "WTO says Europe subsidises Airbus, Boeing's rival, unfairly". USA Today. 3 March 2010. Retrieved 2010-06-16.

- ↑ "EU claims victory in WTO case versus Boeing". Paris: Reuters. 15 September 2010.

- ↑ Freedman, Jennifer M. "WTO Says U.S. Gave at Least $5.3 Billion Illegal Aid to Boeing". Bloomberg. Retrieved 2011-05-21.

- ↑ "BBC News: WTO Airbus ruling leaves both sides claiming victory". bbc.co.uk. 2011-04-19. Retrieved 2011-05-21.

- ↑ Lewis, Barbara (2011-05-19). "WTO gives mixed verdict on Airbus appeal". Reuters. Retrieved 2011-05-21.

- ↑ "WTO final ruling: Decisive victory for Europe". LogisticsWeek. 2011-03-25. Retrieved 2011-05-21.

- ↑ Khimm, Suzy (2011-05-17). "U.S. claims victory in Airbus-Boeing case". The Washington Post. Retrieved 2011-05-21.

- ↑ "Airbus satisfy WTO obligations".

- ↑ "European Communities — Measures Affecting Trade in Large Civil Aircraft".

- ↑ "Sweeping Loss for Boeing in WTO Appeal". Airbus.com. 2014-01-16. Retrieved 2014-02-06.

- ↑ "United States — Measures Affecting Trade in Large Civil Aircraft — Second Complaint".

- ↑ "WTO Boeing case: EU requests to impose countermeasures against the US". European Commission. 2012-09-27. Retrieved 2012-09-28.

- ↑ "Next chapter in eight year old WTO conflict: Boeing's WTO Default Prompts $ 12 Bn in Annual Sanctions". Airbus. 2012-09-27. Retrieved 2012-09-28.

- ↑ "WTO - dispute settlement - the disputes - DS487". Wto.org. Retrieved 13 January 2018.

- ↑ Reid Wilson (12 November 2013). "Washington just awarded the largest state tax subsidy in U.S. history". Washington Post.

- ↑ Jon Ostrower (10 December 2013). "Boeing Holds Bake-Off for Biggest Tax Breaks". WSJ.

- ↑ "Exclusive: EU may challenge $8.7 billion U.S. tax breaks in Boeing-Airbus trade dispute - sources". Reuters UK.

- ↑ "Washington state's Boeing tax breaks are illegal, Europe charges". mcclatchydc.

- ↑ Dominic Gates (February 10, 2018). "Boeing's biggest trade fight could spark a U.S. confrontation with Europe". The Seattle Times.

- ↑ "Next round in Airbus-Boeing WTO battle nears". Leeham. Feb 14, 2018.

- ↑ "WTO issues ruling on EU appeal in Airbus-Boeing complaint". Leeham News. May 15, 2018.

- ↑ Bryce Baschuk and Benjamin D Katz (28 May 2018). "U.S. Is Said to Open Door to Talks With EU on Airbus Settlement". Bloomberg.

- Bibliography

- Newhouse, John (2007), Boeing versus Airbus, USA: Vintage Books, ISBN 978-1-4000-7872-1

.jpg)