Cipla Quality Chemical Industries Limited

Cipla Quality Chemical Industries Limited (CiplaQCIL) is a pharmaceutical manufacturing company in Uganda. According to a 2007 published report, it was the only company in Africa that manufactured triple-combination antiretroviral (ARV) drugs.[2] CiplaQCIL also manufactures the antimalarial drug Lumartem, containing artemisinin and lumefantrine,[3] and the Hepatitis B generic medicines Texavir and Zentair.[4][5]

| Public USE: CQCIL | |

| Industry | Pharmaceutical Industry |

| Founded | July 10, 2005 |

| Headquarters | Luzira, Kampala, Uganda |

Key people | Emmanuel Katongole Executive Chairman Nevin Bradford Executive Director & CEO |

| Services | Pharmaceuticals |

| Revenue | |

| Total assets | USh287.561 billion (US$78.516 million) (March 2019) |

Number of employees | 350 (2012)[1] |

| Website | ciplaqcil |

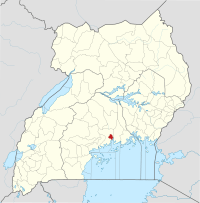

Location

CiplaQCIL's pharmaceutical manufacturing plant is located in Luzira, a neighborhood in Nakawa Division in south-eastern Kampala. The plant is approximately 9 kilometres (6 mi), by road, south-east of Kampala's central business district.[6] The coordinates of the plant are 0°18'17.0"N, 32°38'22.0"E (Latitude:0.304723; Longitude:32.639436).[7]

Overview

As of March 2019, the company's total assets were valued at USh287.561 billion (US$78.516 million), with shareholders' equity of USh168.310 billion (US$46 million).[8]

History

In 2004, Quality Chemicals Limited (QCL) convinced Indian drug maker Cipla to go into a joint venture with QCL and the government of Uganda to establish a pharmaceutical plant in Uganda. Ground was broken in 2005 and the factory was commissioned in 2007,[9] with capacity of 6 million pills daily.[10]

In 2009, TLG Capital, a London-based private equity company,[11] invested an undisclosed amount of money in the plant.[12] Later, CapitalWorks Investment Partners, a private equity firm based in South Africa, also became a shareholder in the plant.[13] In February 2010, the government of Uganda divested from the plant by selling its shares "at cost" to CiplaQCIL. The transaction was valued at US$5 million.[14]

In February 2011, the owners of the plant announced a US$40 million expansion of the production line to include increased production of antiretroviral and antimalarial medication. In April 2012, British media reported that CiplaQCIL was in the process of expanding its manufacturing capacity fourfold. The plant had received approval of its processes and products from the World Health Organization. The products were expected to be initially marketed in Burundi, the Democratic Republic of the Congo, Kenya, Rwanda, South Sudan, Tanzania, and Uganda.[14]

According to a 2012 published report, a second plant is being planned to be built next to the first plant, which would raise CiplaQCIL's manufacturing capacity to 18 million pills daily.[15]

As of April 2016, the company's products were marketed in Cameroon, Comoros, Kenya, Namibia, Tanzania, Uganda, and Zambia.[16]

In February 2020, the factory passed the first of three stages, in qualification to supply medication to South Africa. At that time, the following countries were accepting shipments from the factory: (1) Tanzania (2) Namibia (3) Sierra Leone (4) Angola (5) Mozambique (6) Zambia (7) Rwanda and (8) Myanmar.[17] In March 2020 the company shipped 300,000 ARV does to South Africa. This was followed by another 150,000 doses in April 2020, to be followed by 150,000 doses every month thereafter. Rwanda, Ghana, Zimbabwe and Zambia are receiving regular shipments from CQCIL.[18]

Ownership of pharmaceutical plant

As of April 2017, the shareholding in the pharmaceutical plant was as depicted in the table below:[19] In 2017, the company began to implement plans to list some of its shares on the Uganda Securities Exchange.[20] After the listing it is expected that the shareholding in the company stock will be as reflected in the table below.[19][21][22][23]

| Rank | Name of Owner | % Ownership Pre-IPO | % Ownership Post-IPO |

|---|---|---|---|

| 1 | Meditab Holdings Limited[24] | 51.05[22] | 51.05[22] |

| 2 | Cipla European Union[22] | 11.25[22] | 0.00[22] |

| 3 | CapitalWorks Investment Partners | 14.40[25] | 11.11[22] |

| 4 | TLG Capital (Amistad) | 12.50[26] | 11.50[22] |

| 5 | Emmanuel Katongole | 3.60[19] | 2.78[22] |

| 5 | Frederick Mutebi Kitaka | 3.60[19] | 2.78[22] |

| 6 | George Baguma | 3.60[19] | 2.78[22] |

| 7 | Other investors via USE | 0.00[19] | 18.00[22] |

| Total | 100.00 | 100.00 | |

- Cipla also owns 51 percent of Quality Chemicals Limited.[27]

- Up until May 2015 Quality Chemicals Limited owned 22.05 percent of CiplaQCIL.[27] Sometime after that, Quality Chemicals sold their entire shareholding; 10.8 percent to three of the individual founders and the remaining 11.25 percent to Cipla European Union, thus raising Cipla's shareholding to the pre-IPO level of 62.3 percent.[28]

Governance

The executive chairman of the board of directors of CiplaQCIL is Emmanuel Katongole, who was formerly the managing director of QCIL. He replaced Francis Kitaka, the first person in East Africa to train as a biochemist,[29][30] The managing director of CiplaQCIL is Nevin Bradford.[31]

Valuation

In September 2018, CQCIL offloaded 18 percent shareholding to institutional and individual investors. The IPO raised US$43.8 million. This puts the valuation of shareholders equity in the company at US$243.3 million.[32]

See also

References

- BBC (9 April 2012). "Making drugs into profit in Uganda". London: British Broadcasting Company (BBC). Retrieved 10 November 2018.

- Wendo, Charles (6 October 2007). "ARVs Production Starts Monday". New Vision. Kampala. Retrieved 23 June 2014.

- Key, Data (2011). "Quality Chemical Industries, Uganda". Pharmaceutical Technology. Retrieved 23 June 2014.

- CiplaQCi (2015). "Timeline & Milestones". Ciplaqcil.co.ug. Retrieved 10 April 2016.

- CiplaQCi (December 2015). "Komboa Newsletter" (PDF). Ciplaqcil.co.ug. p. 4. Retrieved 10 April 2016.

- Globefeed.com (11 June 2016). "Distance between Post Office Building, Kampala Road, Kampala, Central Region, Uganda and Cipla Quality Chemicals Industries Limited, Port Bell Road, Kampala, Central Region, Uganda". Globefeed.com. Retrieved 11 July 2016.

- Google (11 July 2016). "Location of Cipla Quality Chemical Industries Limited Pharmaceutical Factory, Luzira, Nakawa Division, Kampala, Uganda" (Map). Google Maps. Google. Retrieved 11 July 2016.

- Cipla Quality Chemical Industries Limited (21 May 2019). "Cipla Quality Chemical Industries Limited: Audited Financial Statements For The Twelve Months Ended 31 March 2019" (PDF). Kampala: Uganda Securities Exchange. Retrieved 29 June 2019.

- Elvis Basudde, and Robert Kasozi (31 October 2007). "Kitaka, The Brain Behind Africa's First ARVs Factory". New Vision. Kampala. Retrieved 11 July 2016.

- Anderson, Tatum (22 November 2007). "Trip into the unknown". Nature. 450 (7169): 471–471. doi:10.1038/450471a.

- TLG Capital (25 June 2018). "About TLG Capital". London: TLG Capital. Retrieved 25 June 2018.

- Investment International (9 September 2009). "Ugandan Project Attracts Investors". InvestmentInternational.com. Retrieved 23 June 2014.

- CIPLAQCIL. "Investment Partners in Cipla Quality Chemical Industries Limited". Kampala: Cipla Quality Chemical Industries Limited (CIPLAQCIL).

- BBC (9 April 2012). "Making Drugs Into Profit In Uganda". London: BBC News. Retrieved 11 July 2016.

- Baguma, Raymond (18 May 2012). "Quality Chemicals Giving Ugandans Fighting Chance". New Vision. Retrieved 23 June 2014.

- Ainebyoona, Emmanuel (9 April 2016). "Uganda exports 70 tonnes of ARVs". Daily Monitor. Kampala. Retrieved 11 July 2016.

- Dorothy Nakaweesi (14 February 2020). "Cipla starts move to export drugs to South Africa". Daily Monitor. Kampala. Retrieved 15 February 2020.

- Dorothy Nakaweesi (4 May 2020). "Cipla Starts ARV Export To South Africa". Daily Monitor. Kampala. Retrieved 4 May 2020.

- Uganda Business News (7 April 2017). "Cipla Quality Chemical Industries to list 31.1% stake in IPO". Kampala: Uganda Business News. Retrieved 25 June 2018.

- Wakabi, Michael (23 June 2018). "Drug maker CIPLA and telco MTN to list on Uganda bourse". The EastAfrican. Nairobi. Retrieved 24 June 2018.

- P K Malinz (2 August 2018). "Uganda's CiplaQCi set for IPO with a valuation of US $12.5 Million". Kampala: Digest Africa Technologies. Retrieved 2 August 2018.

- CQCIL (July 2018). "Cipla Quality Chemical Industries Limited: Investment Prospectus for Initial Public Offering, July 2018". Luzira, Kampala: Cipla Quality Chemical Industries Limited (CQCIL). Retrieved 4 August 2018.

- Mpagi, Charles (18 August 2018). "Cipla Listing On Uganda Bourse A Key Milestone". The EastAfrican. Nairobi. Retrieved 21 August 2018.

- Musisi, Frederic (22 November 2013). "Indian firm buys more shares in Quality Chemicals Limited". Daily Monitor. Kampala. Retrieved 28 October 2016.

- Press Release (16 July 2014). "Quality Chemical Industries Limited rebrands following Cipla's increased shareholding" (PDF). Kampala: Cipla Quality Chemical Industries Limited (QCIL). Archived from the original (PDF) on 28 October 2016. Retrieved 10 November 2018.

- VCCircle.com (11 July 2011). "TLG Capital ups stake in Cipla's Africa JV". Reuters India. Retrieved 28 October 2016.

- Verma, Anuradha (22 May 2015). "Cipla To Acquire 51% Stake In Ugandan Firm Quality Chemicals for $30 Million". Dehli: VCCirle.com. Retrieved 4 August 2018.

- Busuulwa, Bernard (7 April 2017). "Drug Firm CiplaQCIL Plans To Sell 31 Percent Stake In IPO On Uganda Bourse". The EastAfrican. Nairobi. Retrieved 4 August 2018.

- Senyonyi, Taddewo (4 January 2014). "Francis X. Kitaka: The Unsung Hero of Uganda's Health And Agricultural Sectors". Kampala: The CEO Magazine. Retrieved 9 April 2016.

- Monitor Reporter (18 October 2013). "Emmanuel Katongole: The Founder of Quality Chemicals". Daily Monitor. Kampala. Retrieved 17 March 2015.

- CiplaQCIL (30 November 2013). "Board of Directors of CiplaQCIL". Ciplaqcil.co.ug. Retrieved 17 March 2015.

- Reuters (17 September 2018). "Ugandan unit of Indian drugs firm Cipla raises $43.8 million in IPO - Renaissance Capital". New York City: Nasdaq Quoting Reuters. Retrieved 10 November 2018.