Scotiabank

|

| |

| Scotiabank | |

| Public | |

| Traded as |

TSX: BNS NYSE: BNS TTSE: SBTT S&P/TSX 60 component |

| Industry | Banking, Financial services |

| Founded |

1832 Halifax, Nova Scotia, Canada |

| Headquarters | Toronto, Ontario, Canada[1] |

Key people |

Brian J. Porter (President and CEO) Sean McGuckin (CFO) |

| Revenue |

|

|

| |

| AUM |

|

| Total assets |

|

| Total equity |

|

Number of employees | 88,645 (2017)[2] |

| Subsidiaries | |

| Website | scotiabank.com |

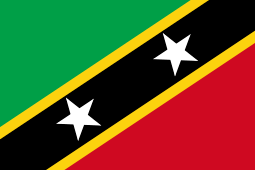

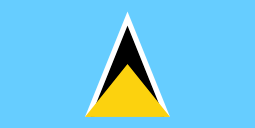

The Bank of Nova Scotia (French: La Banque de Nouvelle-Écosse), operating as Scotiabank (French: Banque Scotia), is a Canadian multinational bank. It is the third largest bank in Canada by deposits and market capitalization. It serves more than 24 million customers in over 50 countries around the world and offers a range of products and services including personal and commercial banking, wealth management, corporate and investment banking. With a team of more than 88,000 employees and assets of $915 billion (as at October 31, 2017), Scotiabank trades on the Toronto (TSX: BNS) and New York Exchanges (NYSE: BNS).

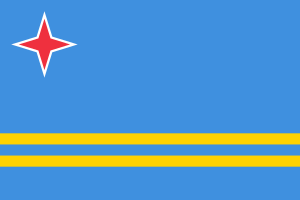

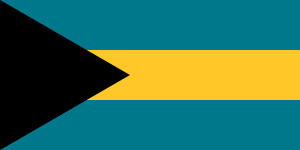

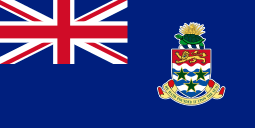

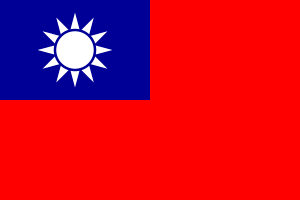

Founded in Halifax, Nova Scotia in 1832, Scotiabank moved its executive offices to Toronto, Ontario, in 1900.[3] Scotiabank has billed itself as "Canada's most international bank" due to its acquisitions primarily in Latin America and the Caribbean, and also in Europe and parts of Asia. Through its subsidiary ScotiaMocatta, it is a member of the London Bullion Market Association and one of five banks that participates in the London gold fixing.[4]

Scotiabank's Institution Number (or bank number) is 002. The company ranked at number 41 on the SNL Financial World's 100 biggest banks listing, September 2013 and is led by President and CEO Brian J. Porter.[5]

History and expansion

The 19th century

The bank was incorporated by the Legislative Assembly of Nova Scotia on March 30, 1832, in Halifax, Nova Scotia, with William Lawson (1772–1848) serving as the first president.[6] Scotiabank was founded in Halifax, Nova Scotia, in 1832 under the name of The Bank of Nova Scotia. The bank intended to facilitate the trans-Atlantic trade of the time.[3] Later, in 1883, The Bank of Nova Scotia acquired the Union Bank of Prince Edward Island, although most of the bank's expansion efforts in the century took the form of branch openings.[7]

The bank launched its branch banking system by opening in Windsor, Nova Scotia. The expansion was limited to the Maritimes until 1882, when the bank moved west by opening a branch in Winnipeg, Manitoba. The Manitoba branch later closed, but the bank continued to expand into the American Midwest. This included opening a branch in Minneapolis in 1885, which later transferred to Chicago in 1892. Following the collapse of the Commercial Bank of Newfoundland and Union Bank of Newfoundland on December 10, 1894, The Bank of Nova Scotia established on December 15, 1894, in Newfoundland.[6]

In 1899, Scotiabank opened a branch in Boston, Massachusetts.

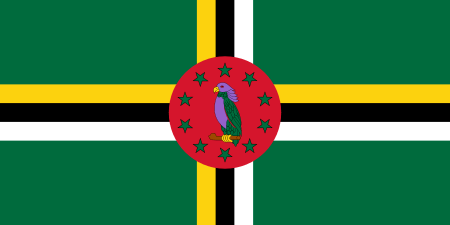

The bank opened a branch in Kingston, Jamaica in 1889 to facilitate the trading of sugar, rum, and fish. This was Scotiabank's first move into the Caribbean and historically the first branch of a Canadian bank to open outside of the United States or the United Kingdom.[3][7] By the end of the 19th century, the bank was represented in all of the Maritimes, Quebec, Ontario, and Manitoba.

In 1900, the bank moved its headquarters to Toronto, Ontario.[8][7]

The 20th and 21st century

The bank continued to expand in the 20th century, although its growth now took the form of acquisitions rather than branch openings.

- 1906 – The bank opened a branch in Havana, Cuba. By 1931, it had five branches in Havana, and one branch each in Camagüey, Cienfuegos, Manzanillo, and Santiago de Cuba. In 1960, the Government of Cuba nationalized all banks in Cuba, and the Scotiabank withdrew services from all eight branches.

- 1907 – The bank opened a branch in New York City.

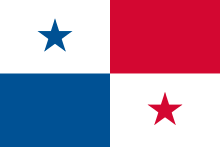

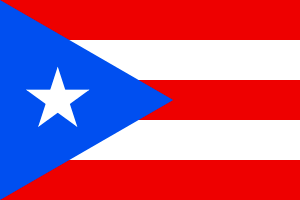

- 1910 – The bank opened a branch in San Juan, Puerto Rico.

- 1913 – The Bank of Nova Scotia merged with the Bank of New Brunswick.[7]

- 1914 – Toronto-based Metropolitan Bank was acquired, making Scotiabank the fourth largest financial institution in Canada.[7]

- 1919 – The bank opened a branch in Fajardo, Puerto Rico, located in Puerto Rico's northeast.

- 1919 – Bank of Ottawa was amalgamated.[7]

- 1920 – The bank opened a branch in London, and another in Santo Domingo, Dominican Republic.

- 1961 – The bank became the first Canadian bank to appoint women bank managers on September 11, 1961.[6]

- 1962 – The bank expanded into Asia with the opening of a Representative Office in Japan.[7]

- 1975 – The bank adopted "Scotiabank" as its worldwide brand name.

- 1978 – The bank and Canadian Union of Public Employees signed the first collective agreement between a Canadian bank and a union on September 28, 1978, in Toronto.[6]

- 1997 – The bank acquired Banco Quilmes in Argentina.

- 2000 – Scotiabank's stake in Mexican bank Grupo Financiero Inverlat was increased to 55 percent. The Mexican bank was subsequently renamed to Grupo Financiero Scotiabank Inverlat.[7]

- 2002 – The bank shut its branches (formerly Banco Quilmes) in Argentina during the currency crisis and massive sovereign default.

- 2003 -The bank's Guangzhou Branch was awarded the first licence to a Canadian bank by the Chinese government to deal in Chinese currency.[6]

- 2003–2004 – The bank acquired Inverlat banking house in Mexico, taking over all of its branches and establishing a strong presence in the country.

- 2010 – The bank arrived in Bogotá, Colombia.

- 2012 - Scotiabank entered into an agreement to acquire ING Direct Bank of Canada from ING Groep N.V.

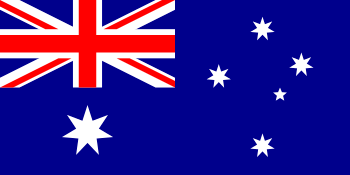

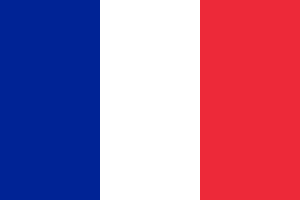

In its early expansion, the bank clearly followed trade and its customers' businesses rather than pursuing a strategy of expansion into international financial centres. Scotiabank is a member of the Global ATM Alliance, a joint venture of several major international banks that allows customers of the banks to use their ATM cards or check cards at certain other banks within the Global ATM Alliance without fees when traveling internationally. Other participating banks are Barclays (United Kingdom), Bank of America (United States), BNP Paribas (France and Ukraine through UkrSibbank), Deutsche Bank (Germany), and Westpac (Australia and New Zealand).[9]

The 21st century

Scotiabank has also spent almost $100 million implementing a controversial system to report to the United States the account holdings of close to one million Canadians of American origin and their Canadian-born spouses. Scotiabank has been forced to implement this system in order to comply with FATCA. According to Financial Post, FATCA requires Canadian banks to provide information to the United States including total assets, account balances, account numbers, transactions, account numbers, and other personal identifying information, as well as assets held jointly with Canadian-born spouses and other family members.[10][11]

Portfolio evolution

Throughout the 20th century, the bank grew not only in size but also in breadth of products and services. Progress was conditioned by changing consumer needs, legal changes, or acquisitions of external service providers. Major changes include:[7]

- 1954 – Passage of the National Housing Act lead Scotiabank to create a mortgage department.

- 1958 – Changes to Bank Act of 1954 enabled Scotiabank to introduce a consumer credit program.

- 1986 – The bank created Scotia Securities to provide discount brokerage and security underwriting services.

- 1988 – Scotiabank added the brokerage firm of McLeod Young Weir Ltd.

- 1994 – Montreal Trustco Inc. became part of Scotiabank.

- 1997 – Scotiabank purchased National Trustco Inc. for C$1.25 billion.

- 2012 - The bank acquired ING Direct for C$3.13 billion and renamed it Tangerine in April 2014.

- 2018 - Scotiabank acquires Montreal investment firm Jarislowsky Fraser.

Mergers and acquisitions

The bank has amalgamated with several other Canadian financial institutions through the years, and purchased several other banks overseas:[3][12]

| Bank | Year established | Year of amalgamation |

|---|---|---|

Many former branches of Montreal Trust and National Trust were rebranded "Scotiabank & Trust", and continue to operate as such.

Controversies

Wrongful dismissal lawsuit

In June 2005, David Berry, a very successful Canadian Scotiabank trader who had built a $75M/year business in trading preferred shares was fired on the grounds that he had committed securities regulatory violations.[13]

At the time, as part of a 20% direct drive deal, he was making more than double the CEO's salary and Scotiabank management had already taken steps to limit his compensation.[14]

The regulatory violation allegations from his former employer, left him unemployable to Scotiabank's competitors despite the appeal of potentially adding more than $75M/year to their equity trading profits.[14]

Documents delivered to the media showing that Scotiabank management had sought advice on terminating Berry prior to the Investment Industry Regulatory Organization of Canada (IIROC) violation accusation, and the results of questioning during the IIROC inquiries strongly suggest that the securities charges were part of a plan by Scotiabank senior management to remove Berry from his position and simultaneously prevent him from becoming their competitor.[15]

In a ruling on January 15, 2013, more than seven years after the initial accusation, a hearing panel of the IIROC dismissed all charges against Berry.[16][17]

David Berry filed a $100M wrongful dismissal lawsuit against Scotiabank. As of January 2015, and nine years after Berry was terminated, Scotiabank settled with Berry for an undisclosed amount. Barry Critchley, who followed the story since its beginning, wrote an article on November 6, 2014, in which he believes Scotiabank's $55 million reported legal charges would likely be connected to the $100 million lawsuit; but it is unlikely to ever be known.[18]

Unpaid overtime lawsuit

In 2014, the bank reached a settlement in a class-action lawsuit that covered thousands of workers owed more than a decade of unpaid overtime. The lawsuit included 16,000 Scotiabank employees across Canada who worked as personal banking officers, senior personal banking officers, financial advisors, and small business account managers from January 1, 2000, to December 1, 2013. The 2007 lawsuit was similar to a class-action filed by Canadian Imperial Bank of Commerce (CIBC) bank teller Dara Fresco of Toronto.

Under terms of the settlement, employees received 1.5 times their standard wage at the time, but no interest. Scotiabank also paid legal fees of $10.45 million. Plaintiffs' counsels were David O'Connor of Roy O'Connor and Louis Sokolov of Sotos LLP.[19][20]

Fraud in Mexico

A 2001 investigation into the murder of Maru Oropesa, a Scotiabank branch manager in Mexico City revealed US$14 million missing from the branch. Initially, investigators found that Oropesa and Jaime Ross, her former boss, had illegally transferred US$5 million from client investment accounts. The money was eventually transferred to the United States where it was used to purchase three aircraft. As the investigation continued, officials found an additional $9 million missing and involvement of 16 other bank employees in the fraud.[21][22] Ross was convicted of fraud and money laundering for his role and sentenced to 15 years.[23] Scotiabank terminated the other 16 employees, but did not prosecute them.[21]

Operating units

Scotiabank has four business lines:[24]

- Canadian Banking provides a full suite of financial advice and banking solutions, supported by an excellent customer experience, to personal and business customers across Canada. Scotiabank also provides an alternative self-directed banking solution through Tangerine Bank.

- International Banking provides a full range of financial products, solutions and advice to retail and commercial customers in select regions outside of Canada, supplemented by additional products and services offered by Global Banking & Markets and Global Wealth & Insurance to meet customers' needs.

- Global Wealth & Insurance (GWI) combines the Bank's wealth management and insurance operations in Canada and internationally, and Global Transaction Banking. GWI is diversified across geographies and product lines.

- Global Banking & Markets, Scotiabank's wholesale banking and capital markets arm, offers a wide variety of products and services to corporate, government and institutional investor clients globally.

| Year | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues, bln $ | 10.365 | 10.727 | 10.261 | 10.295 | 10.726 | 11.208 | 12.49 | 11.876 | 14.457 | 15.505 | 17.31 | 19.646 | 21.299 | 23.604 | 24.049 | 26.350 |

| Net income, bln $ | 2.077 | 1.708 | 2.422 | 2.908 | 3.209 | 3.579 | 4.045 | 3.14 | 3.547 | 4.239 | 5.33 | 6.39 | 6.61 | 7.298 | 7.213 | 7.368 |

| Assets, bln $ | 284.4 | 296.4 | 285.9 | 279.2 | 314 | 379 | 411.5 | 507.6 | 496.5 | 526.7 | 594.4 | 668.2 | 743.6 | 805.7 | 856.5 | 896.3 |

| Employees | 46,804 | 44,633 | 43,986 | 43,928 | 46,631 | 54,199 | 58,113 | 69,049 | 67,802 | 70,772 | 75,362 | 81,497 | 86,690 | 86,932 | 89,214 | 88,901 |

| Branches | 2005 | 1847 | 1850 | 1871 | 1959 | 2191 | 2331 | 2672 | 2686 | 2784 | 2926 | 3123 | 3330 | 3288 | 3177 | 3113 |

Corporate sponsorship and branding

Sports

- Scotiabank is the title sponsor of Guadalajara's Scotiabank Aquatics Center.

- Scotiabank is the title sponsor for the Jewish National Fund's "Pitch for Israel" event.

- Scotiabank has been the title sponsor of Calgary's Scotiabank Saddledome since October 8, 2010.

- Scotiabank is the title sponsor for running events that are part of the Canada Running Series: Banque Scotia 21k de Montreal + 10k & 5k (April), Scotiabank Vancouver Half-Marathon & 5k Run/Walk (June) & Scotiabank Toronto Waterfront Marathon, Half-Marathon & 5k (October) and the Scotiabank Bluenose Marathon.[28] As well, it is the title sponsor for the Scotiabank Calgary Marathon.

- In October 2007, Scotiabank became a sponsor of Hockey Night in Canada and the title sponsor of its Gemini award-winning pregame show, Scotiabank Hockey Tonight.

- Scotiabank is the Official Bank of the National Hockey League and National Hockey League Players' Association.[29] And the official bank of the NHLPA, the NHL Alumni, the Canadian Women's Hockey League. Scotiabank also sponsors the Little NHL (native hockey league) and several girls' hockey festivals across Canada.

- From 2006 through 2013, Scotiabank held the naming rights to the arena of the Ottawa Senators, branding it Scotiabank Place. Canadian Tire took over the naming rights as of June 2013.[30]

- Scotiabank was a primary sponsor for Champion Boxer Miguel Cotto during his 2009 bout with Manny Pacquiao.

- In 2006, Scotiabank was awarded the title as the official bank for the International Cricket Council's 2007 Cricket World Cup. During the event, several stadia and venues across the Caribbean (and Guyana in South America) are to become outfited with Scotiabank automated banking machines.[31]

- Since 2005, Scotiabank has been the title sponsor of the CFL playoffs semi-final and conference final games, with games titled as the Scotiabank East Semi-finals and Scotiabank West Semi-finals. This is in addition to being the official financial services provider to the Canadian Football League.

- Since 2008, Scotiabank has been the official team sponsor of Canadian Cricket Team and the title sponsor of National T20 Championship in Canada.

- In 2010, Scotiabank was a sponsor of the World Rally Championship's Corona Rally Mexico.

- In 2013, Scotiabank became the sponsor for Club Deportivo Guadalajara (Chivas).

- Scotiabank has an industry partnership with the University of Waterloo Stratford Campus.[32]

- Since 2013, Scotiabank has been a sponsor of the CTV Television Network's and TSN's coverage of Premier League Soccer and the FA Cup Final.

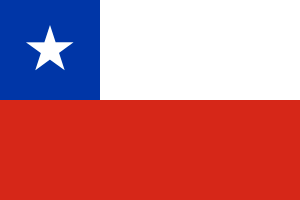

- In 2014, Scotiabank became the official sponsor for the Chilean Primera División, in a five-year period contract, replacing the previous sponsor, Petrobras.

- On June 25, 2014, Halifax Regional Municipality announced that Scotiabank had won the naming rights to Halifax Metro Centre for ten years. In return for annual fees of $650,000, the facility would be renamed the Scotiabank Centre.[33] The facility official opened its doors as the rebranded Scotiabank Centre on September 19, 2014.[34]

- Since 2015, Scotiabank is the title sponsor for the CONCACAF Champions League tournament.

- On August 29, 2017, the bank and Maple Leaf Sports & Entertainment, owner of the Toronto Maple Leafs and Toronto Raptors, announced that Scotiabank purchased the naming rights to the Air Canada Centre for $800 million. The Multi-Sport complex was renamed July 1, 2018 as Scotiabank Arena.[35]

Culture

- In 2007, Scotiabank and Cineplex Entertainment partnered up to create a loyalty rewards program called Scene. The program allows patrons to sign-up for a special card that grants them points which can be redeemed for free movies or concession discounts. Scotiabank customers can also request a Scene debit card which gives them points when used. The bank launched a Scene Visa credit card in early May. Five Cineplex Entertainment locations were rebranded as "Scotiabank Theatres." In 2015, the two companies announced they extended the partnership through October 31, 2025 and would expand naming rights to ten theatres.[36]

- From 2006 through 2015, Scotiabank was the title sponsor of the Nuit Blanche event in Toronto.[37]

- Scotiabank became title sponsor of the Giller Prize in 2005.[38]

- Scotiabank Hall of Brock University in St. Catharines, Ontario.[39]

- Scotiabank Hall in the Marion McCain Arts and Social Sciences Building at Dalhousie University in Halifax, Nova Scotia.[40]

- In 2008, Scotiabank announced a two-year sponsorship of Toronto's Caribana which would become the Scotiabank Caribbean Carnival Toronto after a series of extensions, it ended the partnership in 2015.[37]

- In 2016 Scotiabank held its first hackathon with the goal of solving Canadian debt.

Recent events

- On October 20, 2011, Scotiabank acquired a 51% stake in Colpatria, Colombia's fifth largest bank and second largest issuer of credit cards, for $1 billion Canadian in cash and stock (10 million shares). It is the second largest foreign transaction ever by a Canadian financial company overseas, behind Royal Bank of Canada's purchase in Royal Bank of Trinidad and Tobago.[41]

- On August 29, 2012, Scotiabank announced that it would acquire ING Direct Canada for $3.13 billion.[42] The sale completed on November 15, 2012.[43]

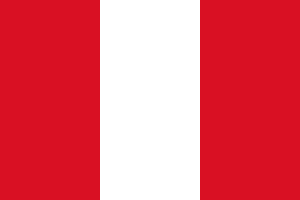

- On July 14, 2015, Scotiabank announced that it would buy Citigroup's retail and commercial banking operations in Panama and Costa Rica. Terms of the transaction were not disclosed. The purchase would increase Scotiabank's client base in both countries from 137,000 to 387,000, and would add 27 branches to the existing 51 branches in both Central American nations.[44]

Scotiabank has a strong presence in Thailand through its 48.99% owned affiliate, Thanachart Bank. With the recent acquisition of Siam City Bank, Thanachart Bank is now the 6th largest bank (by assets) in Thailand with over 16,000 staff serving more than four million customers through 680 branches and 2,100 ATMs across the country.[45]

Scotiabank's former President, CEO and Chairman Cedric Ritchie died on March 20, 2016. He was a President of Scotiabank from 1972, and CEO and Chairman from 1974 to 1995. He was made an Officer of the Order of Canada for his extensive knowledge of banking and commerce in 1981. Under his leadership, Scotiabank expanded into more than 40 countries and grew to 33,000 employees.[46]

Awards

- 2005 – "Bank of the Year" – For Mexico, the Caribbean and in Jamaica by LatinFinance.[47]

- 2007 – "Bank of the Year" The Banker – London England, Scotiabank Trinidad and Tobago, Scotiabank Belize, Scotiabank Turks and Caicos

- 2008 – "Bank of the Year" The Banker - London England, Scotiabank Barbados, Scotiabank Trinidad and Tobago, Scotiabank Guyana, Scotiabank Turks and Caicos

- 2009 – "Bank of the Year" The Banker – London England, Scotiabank Canada, Scotiabank Barbados, Scotiabank Dominican Republic, Scotiabank Trinidad and Tobago, Scotiabank Turks and Caicos

- 2010 – "Bank of the Year" The Banker – London England, Scotiabank Barbados, Scotiabank Trinidad and Tobago, Scotiabank Turks and Caicos

- 2011 – "Best Emerging Market Bank" Global Finance Magazine – New York, Scotiabank Jamaica, Scotiabank Barbados, Scotiabank Costa Rica, Scotiabank Turks and Caicos.[48]

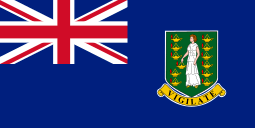

- 2012 - "Global Bank of the Year" The Banker "Bank of the Year" for the Americas, Antigua, Barbados, Belize, British Virgin Islands, Canada and Turks and Caicos.[49]

- 2013 - "Bank of the Year" in British Virgin Islands, Canada, Guyana, Jamaica and Trinidad and Tobago by The Banker.[50]

- 2014 – "Best Emerging Market Bank in Latin America" Global Finance Magazine in Jamaica, Barbados, Trinidad & Tobago, Turks and Caicos and U.S. Virgin Islands.[51]

Unionization

Scotiabank has unionized relationships with employees in a number of locations around the world.[52] In Canada, the sole unionized workplace is the domestic banking branch in Deep River, Ontario.

Credit agency ratings

| Agency | Rating | |

|---|---|---|

| DBRS | AA | Stable |

| Fitch | AA- | Stable |

| Moody's | Aa2 | Stable |

| Standard & Poor's | A+ | Stable |

Membership

BNS is a member of the Canadian Bankers Association (CBA) and registered member with the Canada Deposit Insurance Corporation (CDIC), a federal agency insuring deposits at all of Canada's chartered banks. It is also a member of:

- Amex in Canadian markets

- CarIFS ATM Network

- Global ATM Alliance

- Interac

- MAGNA Rewards as part of the Scotiabank MAGNA MasterCard.

- MasterCard in the Caribbean markets

- MultiLink Network ATM network[53]

- NYCE ATM Network

- Plus Network for VISA card users

- VISA International

Gallery

A Scotiabank branch on Queen Street, Toronto.

A Scotiabank branch on Queen Street, Toronto.- Scotiabank branch in Belize City, Belize.

A Scotiabank in Thunder Bay, Ontario

A Scotiabank in Thunder Bay, Ontario Scotiabank branch in Christ Church, Barbados.

Scotiabank branch in Christ Church, Barbados. Scotiabank in Richmond Hill, Ontario

Scotiabank in Richmond Hill, Ontario Scotiabank Place in Ottawa; renamed Canadian Tire Centre in 2013

Scotiabank Place in Ottawa; renamed Canadian Tire Centre in 2013 Scotiabank ATMs at PATH Toronto.

Scotiabank ATMs at PATH Toronto.

Branch and office locations

Canada

- All provinces and territories except Nunavut

International

.svg.png)

.svg.png)

Sources

- Bank of Nova Scotia. 1932. The Bank of Nova Scotia, 1832–1932. Halifax: Bank of Nova Scotia.

- The Scotiabank Story: A History of the Bank of Nova Scotia, 1832–1982. by Joseph Schull

See also

References

- ↑ "Mail Us". Scotiabank. Retrieved December 4, 2010.

- 1 2 3 4 5 6 "2017 Annual Report" (PDF).

- 1 2 3 4 "The Scotiabank Story". Scotiabank. 2010. Retrieved 2013-10-13.

- ↑ "The London Gold Fix". Bullionvault Ltd. 2016. Retrieved 2016-02-15.

- ↑ Touryalai, Halah (12 February 2014). "Largest 100 banks in the world". Forbes. Retrieved 2017-08-18.

- 1 2 3 4 5 Pound, Richard W. (2005). Fitzhenry and Whiteside Book of Canadian Facts and Dates. Fitzhenry and Whiteside. ISBN 978-1554550098.

- 1 2 3 4 5 6 7 8 9 "The Bank of Nova Scotia History". Funding Universe. Retrieved 2017-08-18.

- ↑ "Scotiabank". Toronto Star. 3 May 1904. p. 12. Retrieved 2017-08-18. (Subscription required (help)).

- ↑ "Automated Banking Machine (ABM)". Scotiabank. Retrieved 2017-08-18.

- ↑ Greenwood, John (23 October 2013). "Electronic spying 'a big issue' for banks, Scotia CEO Waugh says". Financial Post.

- ↑ Swanson, Lynne. "Dual Canadian-American citizens: We are not tax cheats". Financial Post. Retrieved 2017-08-18.

- ↑ Sawyer, Deborah C. (16 November 2016). "Bank of Nova Scotia". The Canadian Encyclopedia. Historica Canada. Retrieved 2017-08-18.

- ↑ Critchley, Barry (13 July 2005). "In defence of David Berry". National Post. Retrieved 2017-08-18.

- 1 2 Finkle, Derek (1 June 2008). "The Trader's Revenge". Toronto Life.

- ↑ Critchley, Barry (19 October 2012). "Scotiabank explored fallout of cutting star trader's $15M pay months before he was fired, documents suggest". Financial Post.

- ↑ "In the matter of David Berry – Discipline Decision" (PDF) (Press release). IIROC. 17 January 2013.

- ↑ Critchley, Barry (16 January 2013). "Former top Scotiabank trader cleared of allegations that led to his $100M wrongful dismissal lawsuit". Financial Post. Retrieved 2017-08-18.

- ↑ Critchley, Barry (6 November 2013). "Could Scotiabank's $55-million legal charge be linked to dismissed trader Dave Berry's lawsuit?". Financial Post. Retrieved 2017-08-18.

- ↑ Acharya-Tom Yew, Madhavi (12 August 2014). "Ontario court approves settlement deal for unpaid overtime at Scotiabank". Toronto Star. Retrieved 2017-08-18.

- ↑ Maurino, Romina (24 July 2014). "Scotiabank agrees to settle in overtime lawsuit". CTV News. The Canadian Press.

- 1 2 Culbert, Andrew (18 October 2013). "The Murder and the Money Trail". The Fifth Estate. CBC. Retrieved 2017-08-18.

- ↑ Sisler, Julia (October 19, 2013). "Scotiabank manager's death probe reveals multimillion-dollar fraud". CBC News. Retrieved 2017-08-18.

- ↑ Stewart, Art (11 November 2013). "Murder of Bank Manager Tied to Fraud". Internal Auditor. Retrieved 2017-08-18.

- ↑ "Corporate Profile". Scotiabank. Retrieved 1 October 2013.

- ↑ "Annual Report 2016". Scotiabank.

- ↑ "Scotiabank 2010 Annual Report". Retrieved 2016-02-18.

- ↑ "Scotiabank 2005 Annual Report". Retrieved 2016-02-18.

- ↑ "Races". Canada Running Series. Retrieved 2017-08-18.

- ↑ "Scotiabank and NHL announce partnership renewal" (Press release). NHL. 28 January 2012. Retrieved 2017-08-18.

- ↑ Wallace, Lisa (18 June 2013). "Scotiabank Place becomes Canadian Tire Centre". Global News. The Canadian Press. Retrieved 2017-08-18.

- ↑ "Article 46(2) of the Collective Labour Agreement acknowledges that there will be strikes". Stabroek News. Guyana. 6 January 2010. Retrieved 2017-08-18.

- ↑ "Scotiabank funds environment-related scholarships and international development work" (Press release). University of Waterloo. 25 May 2011. Retrieved 2017-08-18.

- ↑ Bundale, Brett (25 June 2014). "Scotiabank wins naming rights for Halifax Metro Centre". The Chronicle Herald. Halifax. Retrieved 2017-08-18.

- ↑ "Rebranded Scotiabank Centre Opens" (Press release). Halifax Regional Municipality. 19 May 2014.

- ↑ Hornby, Lance (29 August 2017). "Air Canada Centre to be renamed Scotiabank Arena". Toronto Sun. Retrieved 2018-05-19.

- ↑ "Cineplex and Scotiabank Announce 10-Year Extension of SCENE Loyalty Program" (Press release). Scotiabank and Cineplex. 6 November 2015. Retrieved 2017-08-18.

- 1 2 Krashinsky, Susan (14 October 2015). "Scotiabank drops support for three more Toronto events". The Globe and Mail. Retrieved 2017-08-18.

- ↑ "Prize History". Scotiabank Giller Prize. Retrieved 2017-08-18.

- ↑ "Scotiabank Hall". Brock University. Retrieved 2017-08-18.

- ↑ "2003 Public Accountability Statement". Retrieved 2017-08-18.

- ↑ Pasternak, Sean (October 20, 2011). "Scotiabank Buys Colpatria in Biggest International Purchase". Bloomberg Markets. Retrieved October 22, 2011.

- ↑ "Scotiabank to buy ING Bank of Canada for $3.13 billion in cash". CTV News Channel. The Canadian Press. August 29, 2012.

- ↑ "ING completes sale of ING Direct Canada". Reuters. November 15, 2012. Archived from the original on September 24, 2015.

- ↑ "Scotiabank expands in Central America" (Press release). Scotiabank. 14 July 2015.

- ↑ "Bank's Profile". Thanachart Bank. Retrieved 1 January 2016.

- ↑ Kiladze, Tim (21 March 2016). "Former Bank of Nova Scotia head Cedric Ritchie dies at 88". The Globe and Mail. Retrieved 2017-08-18.

- ↑ "International Banking". Scotiabank. Archived from the original on February 15, 2017. Retrieved August 18, 2017.

- ↑ Giarraputo, Joseph. "World's Best Emerging Market Banks 2011 in Latin America". Global Finance. Retrieved 2017-08-18.

- ↑ "The Banker Awards 2012 - Global and regional winners". TheBanker. 29 November 2012. Retrieved 2017-08-18. (Subscription required (help)).

- ↑ "Scotiabank Trinidad and Tobago Named Bank of the Year 2013" (Press release). Scotiabank. 29 November 2013. Retrieved 2017-08-18.

- ↑ "World's Best Emerging Markets Banks in Latin America 2014". Global Finance. 18 March 2014. Retrieved 2017-08-18.

- ↑ "2005 Corporate Social Responsibility Report" (PDF). Scotiabank. Retrieved 2017-08-18.

- ↑ "MultiLink Debit Nrtwork". J.E.T.S Ltd. 25 July 2004. Archived from the original on June 20, 2013.

External links

| Wikimedia Commons has media related to Scotiabank. |