Lightning Network

The Lightning Network is a "layer 2" payment protocol that operates on top of a blockchain-based cryptocurrency (like bitcoin). It is supposed to enable fast transactions among participating nodes and has been proposed as a solution to the bitcoin scalability problem.[1][2] It features a peer-to-peer system for making micropayments of cryptocurrency through a network of bidirectional payment channels without delegating custody of funds.[3] Lightning Network implementation also simplifies atomic swaps.

Normal use of the Lightning Network consists of opening a payment channel by committing a funding transaction to the relevant base blockchain (layer 1), followed by making any number of Lightning Network transactions that update the tentative distribution of the channel's funds without broadcasting those to the blockchain, optionally followed by closing the payment channel by broadcasting the final version of the settlement transaction to distribute the channel's funds.[4]

To perform as intended, Lightning Network required a transaction malleability fix in the layer 1 blockchain, such as Segregated Witness (SegWit) in bitcoin.[5][3]

History

Joseph Poon and Thaddeus Dryja published a draft of the Lightning Network white paper in February 2015.[6][7]

In 2017 the bitcoin community activated SegWit which enabled second layer solutions such as the Lightning Network.[7]

On March 15, 2018, Lightning Labs CEO Elizabeth Stark announced the initial release of lnd 0.4-beta for developers, with the intent on making it available for testing purposes on the main Bitcoin network with Litecoin support. The network was endorsed by mobile payment entrepreneur Jack Dorsey.[8]

2019 bitcoin lightning torch

On January 19, 2019, pseudonymous Twitter user hodlonaut began a game-like promotional test of the Lightning Network by sending 100,000 satoshis (0.001 bitcoin) to a trusted recipient where each recipient added 10,000 satoshis ($0.34 at the time) to send to the next trusted recipient. The "lightning torch" payment reached notable personalities including Twitter CEO Jack Dorsey, Lightning Labs CEO Elizabeth Stark, and Binance CEO "CZ" Changpeng Zhao, among others.[9][10] The lightning torch was passed 292 times before reaching the formerly hard-coded limit of 4,390,000 satoshis. The final payment of the lightning torch was sent on April 13, 2019 as a donation of 4,290,000 satoshis ($217.78 at the time) to Bitcoin Venezuela, a non-profit that promotes bitcoin in Venezuela.

Design

Andreas Antonopoulos has referred to the Lightning Network as a second layer routing network.[11] The payment channels allow participants to transfer money to each other without having to make all their transactions public on the blockchain.[12][13] This is done by penalizing uncooperative participants. When opening a channel, participants must commit an amount (in a funding transaction, which is on the blockchain).[14] Time-based script extensions like CheckSequenceVerify and CheckLockTimeVerify make the penalties possible.

"If we presume a large network of channels on the Bitcoin blockchain, and all Bitcoin users are participating on this graph by having at least one channel open on the Bitcoin blockchain, it is possible to create a near-infinite amount of transactions inside this network. The only transactions that are broadcast on the Bitcoin blockchain prematurely are with uncooperative channel counterparties."[15]

The CheckSequenceVerify (CSV) Bitcoin Improvement Proposal details how Hash Time-Locked Contracts are implemented with CSV and used in Lightning: BIP 0112.

Benefits

There are several claimed future benefits to using the Lightning Network compared to on-chain transactions:

- Granularity: According to Andreas Antonopoulos, some implementations of the Lightning Network allow for payments that are smaller than a satoshi, the smallest unit on the base layer of bitcoin.[11] Routing fees paid to intermediary nodes on the Lightning Network are frequently denominated in millisatoshis or msat.

- Privacy: The details of individual lightning network payments are not publicly recorded on the blockchain.[16] Lightning network payments may be routed through many sequential channels where each node operator will be able to see payments across their channels, but they will not be able to see the source nor destination of those funds if they are non-adjacent.[11]

- Speed: Settlement time for lightning network transactions is under a minute and can occur in milliseconds.[11] Confirmation time on the bitcoin blockchain, for comparison, occurs every ten minutes, on average.

- Transaction throughput: There are no fundamental limits to the amount of payments per second that can occur under the protocol. The amount of transactions are only limited by the capacity and speed of each node.[11]

Limitations

The Lightning Network is made up of bidirectional payment channels between two nodes which combined create smart contracts. If at any time either party drops the channel, the channel will close and be settled on the blockchain.

Due to the nature of the Lightning Network's dispute mechanism, which requires all users to watch the blockchain constantly for fraud, the concept of a "watchtower" has been developed, where trust can be outsourced to watchtower nodes to monitor for fraud.

Another limitation the Lightning Network faces is payment routing, a concept discussed below.

Routing

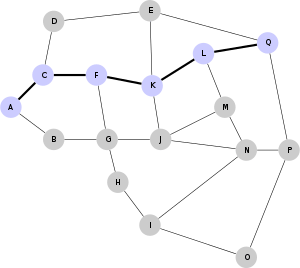

In the event that a bi-directional payment channel is not open between the transacting parties, the payment must be routed through the network. This is done using an onion routing technique similar to Tor, and it requires that the sender and receiver of the payment have enough established peers in common to find a path for the payment. In effect, a simple route would look like this:

- Bob wants to pay Alice 1 BTC but Bob and Alice don't have a channel open with each other.

- Bob does have a channel open with Carol, and Alice also has a channel open with Carol

- To route the payment, Bob sends 1 BTC to Carol, and Carol then sends 1 BTC to Alice

The original whitepaper in reference to routing suggests that "eventually, with optimizations, the network will look a lot like the correspondent banking network, or Tier-1 ISPs".

Implementations

BOLT (Basis of Lightning Technology) specifications were drafted in late 2016.[17] Several implementations were made:

- Lightning Labs' lnd implementation in Go

- Blockstream's c-lightning implementation in C

- ACINQ's eclair implementation in Scala

- A non-commercial implementation by MIT Digital Currency Initiative

Use cases

Cryptocurrency exchanges such as Bitfinex use it to enable deposits and withdrawals.[18] Laszlo Hanyecz, who gained fame in the cryptocurrency community for paying 10,000 BTC for two pizzas in 2010, bought two more pizzas in 2018 using Lightning Network and paid 0.00649 BTC.[19]

References

- Russo, Camila (March 15, 2018). "Technology Meant to Make Bitcoin Money Again Is Now Live". www.bloomberg.com. Retrieved 2019-12-12.

- "MIT and Stanford Professors Are Designing a Cryptocurrency to Top Bitcoin: Unit-e". fortune.com. January 17, 2019. Retrieved 2019-12-12.

- Popper, Nathaniel (August 15, 2017). "Bitcoin price surges after deal on software updates". The Boston Globe. Retrieved December 12, 2019.

- Lee, Timothy B. (2018-02-04). "Bitcoin has a huge scaling problem—Lightning could be the solution". Ars Technica. Retrieved 2019-12-12.

- "lightning-rfc: Lightning Network Specifications". 25 September 2017 – via GitHub.

- "Lightning Network whitepaper 0.5 by Joseph Poon and Thaddeus Dryja". 28 February 2015. Archived from the original on 2015-02-28.

- "SegWit and the bitcoin transaction fee conspiracy theory". FT Alphaville. FT. 2018-03-21.

- "Bitcoin price: What is Bitcoin lightning network - how could it cause CHAOS with BTC price". Express. 2018-07-06.

- Browne, Ryan (6 February 2019). "Jack Dorsey says the 'only' cryptocurrency he owns is bitcoin". CNBC. Retrieved 17 December 2019.

- Hackett, Robert; Roberts, Jeff John; Wieczner, Jen. "The Ledger: Cryptocurrency Custody, QuadrigaCX Quagmire, CEOs Pass Bitcoin 'Torch'". Fortune. Fortune Magazine. Retrieved 17 December 2019.

- Antonopoulos, Andreas (2017-07-21). Mastering Bitcoin (2nd ed.). O'Reilly. pp. 297–304. ISBN 978-1491954386.

- "The Lightning Network Could Make Bitcoin Faster—and Cheaper". Wired. ISSN 1059-1028. Retrieved 2019-12-12.

- "MIT, Stanford Academics Design Cryptocurrency to Better Bitcoin". Bloomberg. Retrieved 2019-12-12.

- Burchert, Conrad; Decker, Christian; Wattenhofer, Roger (August 29, 2018). "Scalable Funding of Bitcoin Micropayment Channel Networks" (PDF). Royal Society Open Science. 5 (8): 180089. Bibcode:2018RSOS....580089B. doi:10.1098/rsos.180089. PMC 6124062. PMID 30225004. Retrieved 17 December 2019.

- "The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments" (PDF). lightning.network. January 14, 2016.

- Ajiboye, Timi; Buenaventura, Luis; Gladstein, Alex; Liu, Lily; Lloyd, Alexander; Machado, Alejandro; Song, Jimmy; Vranova, Alena (2019-08-14). The little bitcoin book : why bitcoin matters for your freedom, finances, and future. Redwood City, CA: 21 Million Books. ISBN 978-1-64199-050-9.

- GitHub - lightningnetwork/lightning-rfc: Lightning Network Specifications., lightningnetwork, 2019-08-11, retrieved 2019-08-11

- Kaminska, Izabella (December 5, 2019). "By Jove! Crypto has discovered netting". FT Alpha. Retrieved 2019-12-12.

- Russo, Camila (February 27, 2018). "Crypto Legend Who Bought Pizza With 10,000 Bitcoin Is Back At It". Bloomberg. Retrieved 2019-12-12.

External links

| Wikimedia Commons has media related to Lightning Network. |