History of banking in China

The history of banking in China includes the business of dealing with money and credit transactions in China.

Imperial China

Early Chinese banks

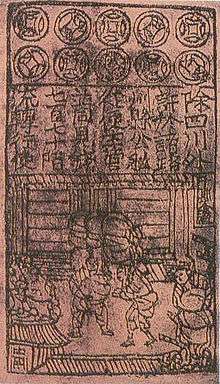

Chinese financial institutions were conducting all major banking functions, including the acceptance of deposits, the making of loans, issuing notes, money exchange, and long-distance remittance of money by the Song Dynasty (960-1279). In 1024, the first paper currency was issued by the state in Sichuan.[1]

Under the Ming dynasty in the 1440s, the confidence in fiat money was so undermined that China abandoned the Da-Ming Baochao paper money around 1445. The latter Ming and Qing dynasties both regressed to commodity money in response. The single whip tax reform by Grand Secretary Zhang Juzheng's in 1581 had mandated the payment of taxes to be made in bulk silver only, this reform had re-energised the exchange shop business.[2]

Two major types of early Chinese banking institutions are piaohao and qianzhuang. The first nationwide private financial system, so-called "draft banks" or piaohao (simplified Chinese: 票号; traditional Chinese: 票號) was created by the Shanxi merchants during the Qing dynasty. [3] Smaller scale local banking institutions called qianzhuang (simplified Chinese: 钱庄; traditional Chinese: 錢莊), more often cooperated than competed with Piaohao in China's financial market.

Due to structural weaknesses of traditional Chinese law, Chinese financial institutions focused primarily on commercial banking based on close familial and personal relationships, and their working capital was primarily based on the float from short-term money transfers rather than long-term demand deposits. The modern concepts of consumer banking and fractional reserve banking never developed among traditional Chinese banks and were introduced to China by European bankers in the 19th century.

A major difference between the piaohao and the qianzhuang was the fact that the qianzhuang banking companies grew out of the money-changing businesses known as the qianpu and would engage in business typical of banks such as providing loans, savings accounts with interest, and so forth, while the piaohao would primarily facilitate the sending of remittances, that is, the sending of money, across the Chinese realm.[4]

Furthermore qianzhuang tended to be very locally run operations and were typically run only by a single family, or a close set of associates,[4] in contrast the piaohao maintained branch offices across China, this allowed money to be paid into one branch office and withdrawn from another branch office - essentially "sent" - without there to be any actual physical silver sycees or strings of copper-alloy cash coins having to be arduously transported, under heavy guard, across great distances bringing many risks with them.[4]

Piaohao

An early Chinese banking institution was called the draft bank or piaohao (票号) in Chinese, also known as Shanxi banks because they were owned primarily by Shanxi merchants. The first "piaohao" Rishengchang originated from Xiyuecheng Dye Company Pingyao in central Shanxi.[5] To deal with the transfer of large amounts of cash from one branch to another, the company introduced drafts, cashable in the company's many branches around China. Although this new method was originally designed for business transactions within the Xiyuecheng Company, it became so popular that in 1823 the owner gave up the dye business altogether and reorganised the company as a special remittance firm, Rishengchang Piaohao. In the next thirty years, eleven piaohao were established in Shanxi province, including Pingyao and neighboring counties of Qi County, Taigu, and Yuci. By the end of the nineteenth century, thirty-two piaohao with 475 branches were in business covering most of China, and the central Shanxi region became the de facto financial centres of Qing China.[6]

All piaohao were organised as single proprietaries or partnerships, where the owners carried unlimited liability. They concentrated on interprovincial remittances, and later on conducting government services. From the time of the Taiping Rebellion, when transportation routes between the capital and the provinces were cut off, piaohao began involvement with the delivery of government tax revenue. Piaohao grew by taking on a role in advancing funds and arranging foreign loans for provincial governments, issuing notes, and running regional treasuries.[7]

Qianzhuang

Independent of the nationwide network of piaohao there were a large number of small native banks, generally called qianzhuang. These institutions first appeared in the Yangzi Delta region, in Shanghai, Ningbo, and Shaoxing. The first qianzhuang can be traced to at least the mid-eighteenth century. In 1776, several of these banks in Shanghai organised themselves into a guild under the name of qianye gongsuo.[8] In contrast to piaohao, most qianzhuang were local and functioned as commercial banks by conducting local money exchange, issuing cash notes, exchanging bills and notes, and discounting for the local business community.[9][10]

Qianzhuang maintained close relationships with Chinese merchants, and grew with the expansion of China's foreign trade. When Western banks first entered China, they issued "chop loans" (caipiao) to the qianzhuang, who would then lend this money to Chinese merchants who used it to purchase goods from foreign firms. It is estimated that there were around 10,000 qianzhuang in China in the early 1890s.[11]

There were several financial crashes which occurred in China during which a large number of qianzhuang closed, the largest of these occurred in the years 1883, 1910, and 1911. By and by the traditional qianzhuang banks were being replaced by modern credit banks in China, particularly those residing in Shanghai. This would continue to happen well into the Republican period. The last qianzhuang banks were nationalised in 1952 by the government of the People's Republic of China.[12]

During the 1990s qianzhuang made a come back in Mainland China, these new qianzhuang are informal financial companies which are often operating just within the edges of what is legal. The government attitude towards these new qianzhuang isn't that much different from their attitude in the 1950s.[10]

Entry of foreign banks

British and other European banks entered China around the middle of the nineteenth century to service the growing number of Western trade firms. The Chinese coined the term yinhang (銀行), meaning "silver institution", for the English word "bank". The first foreign bank in China was the Bombay-based British Oriental Bank Corporation (東藩匯理銀行), which opened branches in Hong Kong, Guangzhou and Shanghai in the 1840s. Other British banks followed suit and set up their branches in China one after another. The British enjoyed a virtual monopoly on modern banking for forty years. The Hong Kong and Shanghai Banking Corporation (香港上海匯豐銀行), now HSBC, established in 1865 in Hong Kong, later became the largest foreign bank in China.[13][14][15][16]

In the early 1890s, Germany's Deutsch-Asiatische Bank (德華銀行), Japan's Yokohama Specie Bank (橫濱正金銀行), France's Banque de l'Indochine (東方匯理銀行), and Russia's Russo-Asiatic Bank (華俄道勝銀行) opened branches in China and challenged British ascendancy in China's financial market. By the end of the nineteenth century there were nine foreign banks with forty-five branches in China's treaty ports.[17]

At the time due to unfair treaties, foreign banks enjoyed extraterritorial rights. They also enjoyed complete control over China's international remittance and foreign trade financing. Being unregulated by the Chinese government, they were free to issue banknotes for circulation. They also accepted deposits from Chinese government institutions and Chinese private customers and provided and received loans from qianzhuang.[18]

Government banks

.png)

After the launch of the Self-strengthening movement, the Qing government began initiating large industrial projects which required large amounts of capital. Though the existing domestic financial institutions provided sufficient credit and transfer facilities to support domestic trade and worked well with small-scale enterprises, they could not meet China's new financial demands. China turned to foreign banks for large scale and long term finance. Following a series of military defeats, the Qing government was forced to borrow from foreign banks and syndicates to finance its indemnity payments to foreign powers.

A number of proposals were made by a modern Chinese banking institution from the 1860s onwards. Li Hongzhang, one of the leaders of the self-strengthening movement, made serious efforts to create a foreign-Chinese joint bank in 1885 and again in 1887.

The Imperial Bank of China (中國通商銀行), China's first modern bank, opened for business in 1897. The bank was organised as a joint-stock firm. It adopted the internal regulations of HSBC, and its senior managers were foreign professionals. After the proclamation of the Republic of China, the bank changed its English name to the Commercial Bank of China in 1912. The name more accurately translated its Chinese name and removed any link to the Qing Dynasty.

In 1905, China's first central bank was established as the Bank of the Board of Revenue (大清户部銀行). Three years later, its name was changed to the Great Qing Government Bank (大清銀行). Intended as a replacement for all existing banknotes, the Da Qing Bank's note was granted exclusive privilege to be used in all public and private fund transfers, including tax payments and debt settlements. Da Qing Bank was also given exclusive privilege to run the state treasury. The Board of Revenue that controlled most of the central government's revenue transferred most of its tax remittance through the bank and its branches. The government entrusted the bank with the transfer of the Salt Surplus Tax, diplomatic expenditures, the management of foreign loans, the payment of foreign indemnities, and the deposit and transfer of the customs tax in many treaty ports.

Following the Xinhai Revolution of 1911, Daqing Bank was renamed the Bank of China. This bank continues to exist today.

Another government bank, the Bank of Communications (交通銀行), was organised in 1908 by the Ministry of Posts and Communications to raise money for the redemption of the Beijing-Hankou Railway from Belgian contractors. The bank's aim was to unify funding for steamship lines, railways, as well as telegraph and postal facilities.

Private banks

The first private bank dates to 1897, courtesy of the entrepreneurship of Shen Xuanhui.[19] Three private banks appeared in the late Qing period, all created by private entrepreneurs without state funding. The Xincheng Bank was established in Shanghai in 1906, followed by the National Commercial Bank in Hangzhou the following year, and the Ningbo Commercial and Savings Bank (四明銀行) in 1908. In that year, the Regulations of Banking Registration was issued by the Ministry of Revenue, which continued to have effect well after the fall of the Qing dynasty.

A lion's share of the profitable official remittance business was taken by the Daqing Bank from the piaohao. The piaohao all but disappeared following the Xinhai Revolution in 1911.

The same period saw the increasing power of private interests in modern Chinese banking and the concentration of banking capital. In Shanghai, the so-called "southern three banks" (南三行) were established. They were the Shanghai Commercial and Savings Bank (上海商業儲蓄銀行), the National Commercial Bank (浙江興業銀行), and the Zhejiang Industrial Bank (浙江實業銀行). Four other banks, known as the "northern four banks" (北四行) emerged later. They were the Yien Yieh Commercial Bank (鹽業銀行), the Kincheng Banking Corporation (金城銀行), the Continental Bank (大陸銀行), and the China & South Sea Bank (中南銀行). The first three were initiated by current and retired officials of the Beijing government, whilst the last was created by an overseas Chinese.

Republic of China

_-_General_Bank_of_Communications%2C_Beijing_Branch_(%E5%8C%97%E4%BA%AC%E4%BA%A4%E9%80%9A%E9%8A%80%E8%A1%8C%E9%80%9A%E7%94%A8%E9%8A%80%E5%9C%93%E5%A3%B9%E5%85%83%E7%B4%99%E5%B9%A3)_issue_(%E6%B0%91%E5%9C%8B%E5%85%83%E5%B9%B4_-_1912)_-_KKNews_-_Obverse_%26_Reverse_02.png)

Note suspension incident

In 1916 the Republican government in Beijing ordered the suspension of paper note conversion to silver. With the backing of the Mixed Court, the Shanghai Branch of the Bank of China successfully resisted the order.

The Bank of China's bylaws were revised in 1917 to restrict government intervention.[20]

Golden Age of Chinese banking

The decade from the Northern Expedition to the Second Sino-Japanese War in 1937 has been described as a "golden decade" for China's modernisation as well as for its banking industry.[21] Modern Chinese banks extended their business in scope, making syndicated industrial loans and offering loans to rural areas.

Takeover of the banking industry by the Kuomintang

Prior to the year 1935 the Republic of China had a limited free banking system. Throughout China there were privately owned banks, although in reality the largest Chinese-owned banking companies and basically all the foreign-owned banks that were operating in China were based in the city of Shanghai.[22] Some Chinese provincial governments had established their own provincial banks, which had existed since the late Qing dynasty period, but these local government banks had to maintain the same standards as privately owned banks in order to compete on the financial market.[22]

Despite various attempts, both the imperial Chinese and Republican Chinese governments did not have a central bank that regulated the Chinese monetary systems at the time, instead large networks of privately owned banks spread across China had more influence over the Chinese currency system. During this era copper was very commonly used for coinage, but silver was the primary medium of exchange and the whole economy of China was based on a de facto silver standard.[23]

The Chinese free banking system allowed the interaction of private banks operating in various regions of China. Privately held banks during this period still operated like any other Chinese business and competed with one another to obtain customers. Most Chinese private banks still issued their own banknotes which were usually redeemable in silver. The banknotes from each bank until these reforms circulated freely with the banknotes from other banks throughout China.[24]

In the year 1927 the Kuomintang (KMT) took over the Chinese government and slowly started taking steps to replace the Chinese free banking system with a more centralised banking system. Instead of immediately seizing all private banks they took slow steps aimed at gaining complete control over the Chinese currency by getting both the financial and political support of the largest banks in China by making these dependent on the Nationalist Chinese government. The final step in this process was to completely bring every bank in China under the control or influence of the Chinese government.[22]

The slow process of getting complete control over the Chinese banking system by the government started in 1927 when the leaders of Communist labour unions instigated violent labour strikes in the city of Shanghai, these strikes completely crippled the industry of Shanghai. Shanghainese bankers appealed to the Kuomintang to stop the strikes.[22] Chiang Kai-Shek saw these strikes as an opportunity to improve the financial standing of the new Chinese Nationalist government and he created a deal where he would take down the strikes in exchange for the bankers giving out loans for the newly established government. The banks of China calculated that a Communist Party victory would be less beneficial for them than a Kuomintang victory so they were eager to support the Kuomintang through issuing loans.[22] However, the Chinese government appeared to be a financial black hole and the heads of China's largest banks began to suspect that the Chinese Nationalist government wasn't able to pay back their debts, this was as the Chinese government continued to increase its debt without having any way of servicing it to those it owed.[22] This led to some bankers to stop giving out more loans to the Chinese Nationalist government, but as a response Chiang started treating these bankers the same as he had done his political adversaries and would imprison them or confiscate their property on the grounds that these bankers were being politically subversive.[22]

The Chinese Nationalist government had become extremely dependent on deficit financing as the Kuomintang saw introducing widespread taxation as being politically unattractive as well as an administrative nightmare to implement all over China, meaning that they were extremely dependent on receiving loans from private banks.[22] Chiang Kai-Shek saw that deficit spending as the most expedient method for financing the Nationalist government. In the year 1927, which was the first year of the new Nationalist government's rule over China, loans the government had taken from private Chinese banks had accounted for as much as 49% of total government revenue.[22]

In spring of the year 1928, Chinese minister of finance T. V. Soong had created a plan for the Chinese government to issue large quantities of government securities.[22] In order to promote the purchasing of government securities Soong added high interest rates and the government sold these securities with large discounts. In the year 1931 the Chinese Nationalist government sold securities at around 50% of their face value.[25][22] By issuing these government bonds the Chinese government was able to delay financial problems, at least until these government bonds would come due.[22] In order to make sure that these securities were accepted by skeptics the government guaranteed them. Every issue of government bonds were backed by some form of government revenue, these forms included Chinese customs taxes or salt taxes.[22] The bonds were so designed that bankers would be able to make more money from investing in government bonds than they ever could make in investing in private businesses.[22]

The Nationalist government created the Central Bank of China in 1928, with T. V. Soong as its first president. The Bank of China was reorganised as a bank specialising in the management of foreign exchange while the Bank of Communications focused on developing industry. The Central Bank of China when it was established had its headquarters in the economically most influential city of Shanghai, and the entire country was formally put on a Chinese silver-dollar (yuan) standard.[23]

The Bureau of Financial Supervision was set up under the Ministry of Finance, to supervise financial affairs.

At first the Central Bank of the Republic of China was mostly just an extension of the treasury of the Republic of China, but during this period it already started issuing its own banknotes. The revenues of the Central Bank of the Republic of China were used to buy government securities.[22] In order to create a deeper relationship with the private banking industry T.V. Soong established a board for the Central Bank of the Republic of China which included members and directors of the private banks of China, but in reality the board had little to no actual decision making powers.[22] By the year 1932, private Chinese banks which were located in the major city of Shanghai held between 50% and 80% of outstanding government bonds meaning that the bankers had become very much tied to the Chinese Nationalist government.[22]

The banks had become so reliant on the government through this scheme that any activities by the government had a substantial effect on the worth of the assets held by the private banks.[22]

It was common for the Kuomintang officials who were in charge of the issuance of government bonds to also sit on the boards of private Chinese banks.[22] This would give these government officials inside information and many of them had become extremely wealthy by trading in government bonds and securities.[22]

The Great Depression, the United States Silver Purchase Act of 1934, and deflation

During the global economic downturn that occurred during the Great Depression, starting in 1929, China had not only averted its negative effects, it thrived and experienced a boom in exports, during this time China enjoyed inflation while most of the world was suffering from severe deflation.[23]

In September of the year 1931 the United Kingdom officially went off of the gold standard and more countries around the world started to depreciate their currencies, this had as a side-effect that the value of the silver Chinese yuan was negatively by this trend.[23] In the years 1933 and 1934 the fatal blow to the Chinese currency, American president Franklin Roosevelt had remonetised silver as a part of his New Deal. The United States government then went on a silver-buying spree at a price which was above the world price in an attempt to push up prices in the United States.[23]

The final blow to the autonomy of private banking in China was dealt largely by external factors, developments in the United States lead to the Chinese Nationalist government to enact reforms that ended autonomous Chinese private banking altogether.[22] In 1933 the government of the United States had begun purchasing substantial amounts of silver, and the following year in June 1934 it passed the Silver Purchase Act, which stipulated that the United States Treasury should purchase silver from all over the world until the global price was higher than $1.29 per ounce, or until the total monetary value of the American silver stock would reach ⅓ of the monetary value of its gold stock.[22] The original intent of the United States Silver Purchase Act was to be a commodity support programme for American silver producers, but it would have to prove many unintended consequences for the Chinese banking sector.[22] This legislation by the United States federal government would cause the global price of silver to rise by 75% in 1933 alone and two years later this price would triple. As almost all banknotes that circulated in China were on the silver standard, China's many private currencies were experiencing a lot of deflation.[22] The Republic of China was soon experiencing a rise in imports and a decline in exports, this also meant that silver started flowing out of the country.[22]

The export price of silver would severely rose in the financial centre of China, Shanghai, this caused large amounts of silver to flow from the Chinese countryside to the main port cities on the Chinese coast, this was followed by a massive export of Chinese silver to the United States. The deflation of the silver prices in China most severely affected the Chinese agriculture and industry sectors.[23]

As a result, private Chinese banks would sell their silver reserves outside of China while slowing down the production and issuance of new banknotes as they were withdrawing more of their older banknotes from circulation. This caused the supply of circulating banknotes to decline and those still left in circulation saw their purchasing power rise.[22] This was disastrous for many private businesses across China as they would suffer from accounting losses as a result, the prices would continue to decline and the price of a sale was often lower than what the product had cost the business. Many business were forced to fire a large chunk of their work forces to stay afloat and cut production costs.[22] The debts which many businesses had previously made remained in the prices of the pre-deflated currencies meaning that the value of their debts were rising as it had become harder to make more money for them. As nobody foresaw what the United States government would do, many businesses had made a large number of now unpayable debts.[22]

In November of the year 1935 the Central Bank of China officially took the country off the silver standard, this happened following foreign-exchange controls imposed on silver exports in October of the previous year. This move also made the banknotes of the Central Bank of China legal tender and made the Chinese currency a fiat currency, which gave the Chinese Nationalist government in full control of the quantity of money circulating in China.[23]

As there were now no restraints on the power of the Chinese government to turn the handle of the printing press to produce more banknotes, the Chinese Central Bank policy soon led to monetary disaster, this disastrous outcome was only made worse with the coming of China's war with Japan.[23]

The rampant deflation also severely affected the Chinese Nationalist government as their deficit financing scheme had become an even bigger burden for them. The Chinese Nationalist government quickly began to enact policies to halt the server deflation by creating controls on the export of silver out of China.[22] But these new controls were proven to be largely ineffective as the Chinese government had no say over the operation of foreign banks in China which exported silver out of China and illegal smuggling of silver out of China had become a profession in of itself.[22]

Desperate to keep its finances in check the Chinese Nationalist government was forced to seek new revenue streams. The Chinese Nationalist government gave special privileges to the Central Bank of the Republic of China such as exempting it from the current regulations on the export of silver, this allowed for the Central Bank of the Republic of China to thrive while almost all private banks in China were facing severe losses.[22]

Because the Central Bank of China enjoyed government patronage it soon grew to become the most profitable financial institution in all of China. In the year 1934 the Central Bank of China owned only 11% of the assets of all Chinese-owned banks, but it earned as much as 37% of all Chinese banking profits. The majority of the income the central bank made were used for the Chinese government.[22]

In spite of the export controls placed by the Chinese Nationalist government on silver and the revenues of the Central Bank of China, all throughout the year 1934 the financial situation of the Chinese Nationalist government had become exponentially unfavourable.[22]

The Chinese Nationalist government them quickly attempted to sell more government securities to finance its endeavours, the Kuomintang issued the Savings Bank Law to help accomplish this goal.[22] This piece of legislation mandated that each Chinese savings bank had to purchase government bonds until its holdings of these bonds would represent ¼ of all of its total deposits. But even the drastic Savings Bank Law had failed to have any substantial effect on the financial position of the Chinese Nationalist government.[22]

Impact of the Second Sino-Japanese War on banks

Following the Japanese invasion in January 1932 the banks were so closely linked to the Chinese Nationalist government that the arrival of the Japanese instigated a financial panic and many people rushed to the government bonds market to sell their bonds, only 5 days after the initial Japanese invasion the price of Chinese government bonds had dropped to become less than 60% of their face value.[22] This meant that private banks which held a large amount of government bonds would see their value drop significantly as well.[22]

During the Second Sino-Japanese War (World War II) many people started to fear that the banknotes issued by some banks would become irredeemable in a short amount of time, this caused a major panic to spread and bank runs severely affected some Chinese banks in process; at least two private Chinese banks had failed due to this crisis.[22]

The Second Sino-Japanese war lasted for eight years, from July 1937 to September 1945. The imperial Japanese army occupied more than a third of all of China, this included virtually all of the leading Chinese port cities and industrial centres that were vital for the Chinese economy. Over 10,000,000 Chinese civilians had lost their lives during the conflict.[23] During World War II the Chinese Nationalist government resorted to printing out a large amount of money to finance the majority of its spending, covering 65% to 80% of its annual expenditures through the creation of more money.[23]

When the Second Sino-Japanese war broke out in 1937, the total quantity of Chinese yuan in circulation (this figure includes both currency and demand deposits) was 3.6 billion yuan. By December of the year 1941, when the [[Entry of the United States to World War II|United States entered the war]{, the total supply of Chinese yuan in circulation had increased to 22.8 billion yuan. For the remainder of the Second Sino-Japanese war the numbers were: 1942, 50.8 billion yuan; 1943, 100.2 billion yuan; 1944, 275 billion yuan; and 1945, 1,506.6 billion yuan.[23]

The end of the Second Sino-Japanese war only re-opened the longstanding civil war between the Chinese Nationalist government and the large communist forces in China. These circumstances all proved to be disastrous for China's banking sector and overall economy.[23] The civil war brought a worse inflation. During the Chinese civil war the Chinese Nationalist government financed its expenditures through a monetary expansion of 50% – 65% annually.[23] Both during and after the war, the Chinese Nationalist government had imposed unworkable price and wage controls that would only succeed in creating even more distortions and imbalances throughout the Chinese economy at the time severely affecting the Chinese financial sector.[23]

Confronted with imminent war with Japan, the Chinese government took control of over 70 percent of the assets of modern Chinese banks through the notorious banking coup.

The banking coup

In response to the dire financial situation of the Chinese Nationalist government, the biggest privately owned bank in China, the Bank of China, tried to loosen their ties with the Kuomintang government. The Bank of China soon would try to liquidate all of their holdings that were denominated in Chinese government bonds, even at a short-term loss.[22]

Generally speaking smaller private banks would follow the Bank of China in its decisions, so this move had become a worrying development for the Kuomintang, it had become very likely that a large-scale liquidation of Chinese government bonds by private banks would occur unless the government would act soon.[22] If this would occur the Chinese Nationalist government would no longer be able to rely on deficit financing for their income, and the government was forced to act in desperation.[22]

The new minister of finance, H.H. Kung decided to consult Chiang Kai-Shek to devise a scheme that would attempt to take the resources of the biggest private banks in China and make them underwrite the Kuomintang government.[22] Rather than making the Chinese government bonds more attractive for bankers and investors, minister Kung wanted to nationalise the two biggest privately operated Chinese banks, the Bank of China and the Bank of Communications.[22]

The Chinese Nationalist government instigated a propaganda campaign designed to place private bankers in a negative light, the campaign placed the blame of all of China's economic problems on greedy bankers.[22] H.H. Kung had asserted that business failures, which were caused by the monetary deflation tied to the international price of silver, were in reality a result of the private banks of China placing their own gains and profits above the public interest of the Chinese people.[22] The campaign had worked to illicit hatred towards the private bankers. Angry Chinese civilians would voice their opposition to the private banks, and it became common for Chinese newspapers to run editorials that supported Kung's charges against the bankers.[22]

The shift in public opinion and the defamation campaigns by Kung had convinced the banks to create a fund which was designed to make "emergency loans" to businesses that were having trouble due to the widespread deflation.[22] Unbeknownst to the banks, H.H. Kung's was not designed for the financial well-being of private business owners, but for the finances of the Chinese government. The main reason of the large propaganda push was to get the Chinese people to support the nationalisation of the two largest Chinese banks. On 23 March, 1935, the Kuomintang officially unveiled their plans and Kung stated that the Chinese government would nationalise the Bank of China and the Bank of Communications.[22] The takeover was veiled as being legal by arbitrarily creating enough shares in each of the two banks for the Chinese Nationalist government to become the majority stockholder in both of them. Money from the emergency find set up by the banks was being used to buy shares for the Chinese government. The rest of the government takeover was financed with a nominally equivalent value of Chinese government bonds. Kung then started to remove the old bank directors and had them replaced with government appointed people who would be more beneficial for the Chinese Nationalist government.[22]

In June of the year 1935, the Chinese Nationalist government used the assets of the Bank of China and the Bank of Communications to take control over a number of smaller privately owned Chinese banks. Kung then instigated a plan where the Central Bank of China, the Bank of China, and the Bank of Communications would start hoarding banknotes that were issued by smaller privately owned Chinese banks and then present these banknotes for redemption at their offices all at the same time, knowing that the smaller banks would be unable to reimburse the government banks, Kung could then declare all of these banks to be insolvent and swiftly nationalise them. Kung insisted to the Chinese public that the Nationalist government would manage these banks in the public interest. Like with the Bank of China and the Bank of Communications the directors of the smaller banks were removed and replaced with people appointed by the Chinese Nationalist government in order to keep these banks in check.[22]

The end of the autonomy of private banks

By July of the year 1935, the Kuomintang had completely ended private banking in China. All assets and resources of privately owned Chinese banks and the (now nationalised) major banks of China were at the disposal of the Chinese government, as they had become the majority shareholder of each bank in China.[22] The Chinese Nationalist government didn't waste a second and immediately started using all resources of the Chinese financial sector to finance the government and its expenditures.[22] The banks were all ordered to buy more government bonds and to lend more money to the Chinese government. Despite having all the resources of the largest banks of China, the Chinese Nationalist government only had just enough revenue to remain solvent.[22]

The banking coup proved to have no effect, good or bad, on the deflation plaguing China at the time and many private businesses would continue to go bankrupt as smugglers would take more silver off the Chinese shores to sell at a profit.[22] In order to prevent the illegal export of silver out of China, the Kuomintang made the crime of smuggling of silver out of China punishable by either the death penalty or life imprisonment.[26] The new legislation proved ineffective and the deflation would continue to lower the prices.[22]

As private banking had come to an end in China, minister Kung laid for a proposal to create a new national fiat currency which would only be backed by government promises. The new currency would only consist of paper money and was intended to give multiple benefits exclusively to the Chinese Nationalist government, one of these benefits was making all silver in China government-owned property and the other was by expanding the Kuomintang's control over China's economy.[22] As the Chinese government was now officially in possession of all silver in China and with the aid of the "Currency Stabilisation Fund", which was created by the United Kingdom and the United States to help the Chinese currency, it was generally believed that China's deflation problem could be solved. The Chinese Nationalist government would gain a complete monopoly over the Chinese money supply, this would make it possible for the government to monetise its debts.[22] The destruction of the Chinese monetary system during this era had helped the Chinese communist movement triumph on the Chinese mainland in 1949.[23]

Introduction of the Chinese national yuan

.jpg)

Following the 1935 currency reform the government of the Republic of China introduced the fabi (法幣, "legal tender"), from November of the year 1935 to December 1936, the 3 officially sanctioned note-issuing banks issued the new paper currency, the fabi was completely detached from the silver standard. The Central Government of the Republic of China had enacted these currency reforms to limit currency issuance to three major government controlled banks: the Bank of China (中國銀行), Central Bank of China (中央銀行), Bank of Communications (交通銀行), and later the Farmers Bank of China (中國農民銀行). Chinese people were required by government mandate to hand in all of their current silver reserves in return for the newly introduced fabi, this was primarily done by the government in order to supply the silver that the Chinese government owed to the United States. The Chinese government and the central bank were careful to do a controlled release of about 2,000,000,000 yuan worth of new fabi banknotes, this was done in order to prevent inflation, and the government had taken many precautions to distribute these banknotes both gradually and fairly. In the first few months following the release of the fabi banknotes, the Chinese government did this to wait to see whether the Chinese public would place their trust in the new, unified Chinese currency.[27][28]

The banknotes issued by Chinese private banks (such as the zhuangpiao) were allowed to still circulate in amounts fixed by the government, but these privately produced banknotes were to be gradually phased out in favour of the new currency.[22] All private individuals and intuitions that were in the possession of any silver were decreed to exchange it for the new national currency within a period of 6 months.[22]

The new currency decree also contained language that was intended to preserve the confidence that the general populace held in the newly established currency.[22] It contained a decree that promised the establishment of a new "Currency Stabilisation Fund" that would purchase and sell foreign exchange in an attempt to keep the exchange rate between the new Chinese yuan and foreign currencies quite constant.[22]

The Currency Decree also contained several provisions that were intended to alter the function of the Central Bank of China itself. Instead of the central bank merely being a division of the Chinese government treasury, the Central Bank of China was decreed to become a "banker's bank" that would become completely distinct from the Chinese government treasury.[22] The Currency Decree also maintained in its text that "plans of financial readjustment have been made whereby the National Budget will be balanced."[22] And, Minister of Finance H.H. Kung also reaffirmed that the Chinese government was determined to make sure that the new currency would not suffer from inflation.[22]

While the new Currency Decree was formulated in a way that the Chinese people would not fear that it would lead to uncontrollable inflation, the reality painted a very different picture. During this time Chinese newspapers would run editorials that were intended to assure the Chinese public that the Kuomintang had nothing but the absolute best intentions for the economy of China, and the move to a paper fiat currency was heralded by contemporary economists around the globe as a major step towards a more modern banking system.[22] The currency reform and the newly introduced Chinese national yuan had, in reality, completely destroyed the private banking system in China, which had served the Chinese economy well, and placed control of the Chinese currency in the hands of an ill intended corrupt and inept government.[22]

Despite the wording of the new Currency Decree, the Central Bank of China would continue to operate as a part of the Chinese Treasury and the Chinese Nationalist government made no attempt at balancing their national budget.[22] In fact, the Chinese Nationalist government doubled down on their deficit financing scheme in the coming years. Inflation began almost immediately after the introduction of the new currency.[22]

The new yuan replaced the old yuan at a conversion rate of 1:3,000,000 in 1948. In August of the same year the total amount of the new currency in circulation was 296.82 billion yuan.[23]

The new yuan proved to be equally affected by the government overprinting, the printing presses produced enough money to cause hyperinflation in the new currency as well. By December of the year 1948, the supply of this new yuan in circulation had reached 8,186.33 billion yuan. Only gour months later, in April of the year 1949, the amount in circulation had increased to 5,161,240.0 billion yuan.[23]

A combination of war-related scarcities and destruction, and the uneven impact of the monetary expansion led to the dramatic increase of prices to varying degrees across the many regions of China.[23] The wholesale price index of Shanghai during this period increased dramatically during this period.[23]

The Shanghai wholesale price index between May 1937 and April 1949:[23]

| Shanghai wholesale price index (1937–1949) | |

|---|---|

| Date | Shanghai wholesale price index |

| May 1937 | 1 |

| End of 1941 | 15.98 |

| December 1945 | 177,088 |

| End of 1947 | 16,759,000 |

| December 1948 | 36,788,000,000 |

| April 1949 | 151,733,000,000,000 |

During this era the value of China's paper money on the foreign-exchange market also reflected this huge depreciation of the Chinese currency through the years.[23] The market exchange rates on the black market rose drastically during this short period.[23]

| Black market exchange rates between the Chinese yuan and the United States dollar (1937–1949) | |

|---|---|

| Date | Exchange rate for 1 USD |

| June 1937 | 3.41 yuan |

| December 1941 | 18.93 yuan |

| End of 1945 | 1,222 yuan |

| May 1949 | 23,280,000 yuan |

Jay Habegger of the Foundation for Economic Education (FEE) stated that the promises made by H.H. Kung seemed to be a cruel joke at the expense of the Chinese people.[22] The severe hyperinflation had completely destroyed the wealth of the Chinese middle class and drove some segments of the rural and agricultural population of China into severe poverty.[23]

Eventually, the inflation had become so severe that it helped bring about the collapse of the Chinese Nationalist government on Mainland China during the Chinese Civil War.[22] But it would be an exaggeration to say that China's Great Inflation during this period was in fact the primary cause for the defeat of the Chinese Nationalist government at the hand of the Chinese Communist Party.[23]

Taiwan

Following the Chinese civil war between the Kuomintang and the Communist Party, the General Management Office and the Bank of Communications accompanied the government of the Republic of China during their move to Taiwan. The branches of Chinese banks that had remained in mainland China were nationalised by the government of the People's Republic of China and branches of the Bank of China and Bank of Communications continued to be called "Bank of China" and "Bank of Communications". The branches of Chinese banks abroad would continue to serve overseas Chinese. These branches would also accept remittances and assisted the government of the Republic of China in handling foreign procurement matters.[29]

In the year 1960, the General Management Office of the Bank of China was reopened in Taiwan, during this era the Taiwanese version of the Bank of China was a professional bank for international trade and exchange, and operated as a general commercial banking corporation. [29]

On 25 October, 1971, the Communist Party-run People's Republic of China replaced the Republic of China at the United Nations following the passing of Resolution 2758.[30] In order to prevent all of its assets from being forcibly transferred to the government of the People's Republic of China as it was seen as a "successor state" that was "inheriting China" from the still existing Republic of China. For this reason the Bank of China in Taiwan was renamed to the "International Commercial Bank of China" (中國國際商業銀行), also referred to as the ICBC, it was later privatised by the government of the Republic of China.[29]

People's Republic of China

After 1949

The history of the Chinese banking system has been somewhat checkered. Nationalization and consolidation of the country's banks received the highest priority in the earliest years of the People's Republic, and banking was the first sector to be completely socialized. In the period of recovery after the Chinese civil war (1949–52), the People's Bank of China moved very effectively to halt raging inflation and bring the nation's finances under central control. Over the course of time, the banking organization was modified repeatedly to suit changing conditions and new policies.

The banking system was centralized early on under the Ministry of Finance, which exercised firm control over all financial services, credit, and the money supply. During the 1980s the banking system was expanded and diversified to meet the needs of the reform program, and the scale of banking activity rose sharply. New budgetary procedures required state enterprises to remit to the state only a tax on income and to seek investment funds in the form of bank loans. Between 1979 and 1985, the volume of deposits nearly tripled and the value of bank loans rose by 260 percent. By 1987 the banking system included the People's Bank of China, Agricultural Bank of China, Bank of China (which handled foreign exchange matters), China Investment Bank, China Industrial and Commercial Bank, People's Construction Bank, Communications Bank, People's Insurance Company of China, rural credit cooperatives, and urban credit cooperatives.

The People's Bank of China was the central bank and the foundation of the banking system. Although the bank overlapped in function with the Ministry of Finance and lost many of its responsibilities during the Cultural Revolution, in the 1970s it was restored to its leading position. As the central bank, the People's Bank of China had sole responsibility for issuing currency and controlling the money supply. It also served as the government treasury, the main source of credit for economic units, the clearing center for financial transactions, the holder of enterprise deposits, the national savings bank, and a ubiquitous monitor of economic activities.

Another financial institution, the Bank of China, handled all dealings in foreign exchange. It was responsible for allocating the country's foreign exchange reserves, arranging foreign loans, setting exchange rates for China's currency, issuing letters of credit, and generally carrying out all financial transactions with foreign firms and individuals. The Bank of China had offices in Beijing and other cities engaged in foreign trade and maintained overseas offices in major international financial centers, including Hong Kong, London, New York City, Singapore, and Luxembourg.

The Agricultural Bank was created in the 1950s to facilitate financial operations in the rural areas. The Agricultural Bank provided financial support to agricultural units. It issued loans, handled state appropriations for agriculture, directed the operations of the rural credit cooperatives, and carried out overall supervision of rural financial affairs. The Agricultural Bank was headquartered in Beijing and had a network of branches throughout the country. It flourished in the late 1950s and mid-1960s but languished thereafter until the late 1970s, when the functions and autonomy of the Agricultural Bank were increased substantially to help promote higher agricultural production. In the 1980s it was restructured again and given greater authority in order to support the growth and diversification of agriculture under the responsibility system.

The People's Construction Bank managed state appropriations and loans for capital construction. It checked the activities of loan recipients to ensure that the funds were used for their designated construction purpose. Money was disbursed in stages as a project progressed. The reform policy shifted the main source of investment funding from the government budget to bank loans and increased the responsibility and activities of the People's Construction Bank.

Rural credit cooperatives were small, collectively owned savings and lending organizations that were the main source of small-scale financial services at the local level in the countryside. They handled deposits and short-term loans for individual farm families, villages, and cooperative organizations. Subject to the direction of the Agricultural Bank, they followed uniform state banking policies but acted as independent units for accounting purposes. In 1985 rural credit cooperatives held total deposits of ¥72.5 billion.

Urban credit cooperatives were a relatively new addition to the banking system in the mid-1980s, when they first began widespread operations. As commercial opportunities grew in the reform period, the thousands of individual and collective enterprises that sprang up in urban areas created a need for small-scale financial services that the formal banks were not prepared to meet. Bank officials therefore encouraged the expansion of urban credit cooperatives as a valuable addition to the banking system. In 1986 there were more than 1,100 urban credit cooperatives, which held a total of ¥3.7 billion in deposits and made loans worth ¥1.9 billion.

In the mid-1980s the banking system still lacked some of the services and characteristics that were considered basic in most countries. Interbank relations were very limited, and interbank borrowing and lending was virtually unknown. Checking accounts were used by very few individuals, and bank credit cards did not exist. In 1986 initial steps were taken in some of these areas. Interbank borrowing and lending networks were created among twenty-seven cities along the Yangtze River and among fourteen cities in north China. Interregional financial networks were created to link banks in eleven leading cities all over China, including Shenyang, Guangzhou, Wuhan, Chongqing, and Xi'an and also to link the branches of the Agricultural Bank. The first Chinese credit card, the Great Wall Card, was introduced in June 1986 to be used for foreign exchange transactions. Another financial innovation in 1986 was the opening of China's first stock exchanges since 1949. Small stock exchanges began operations somewhat tentatively in Shenyang, Liaoning Province, in August 1986 and in Shanghai in September 1986.

Throughout the history of the People's Republic, the banking system has exerted close control over financial transactions and the money supply. All government departments, publicly and collectively owned economic units, and social, political, military, and educational organizations were required to hold their financial balances as bank deposits. They were also instructed to keep on hand only enough cash to meet daily expenses; all major financial transactions were to be conducted through banks. Payment for goods and services exchanged by economic units was accomplished by debiting the account of the purchasing unit and crediting that of the selling unit by the appropriate amount. This practice effectively helped to minimize the need for currency.

Since 1949 China's leaders have urged the Chinese people to build up personal savings accounts to reduce the demand for consumer goods and increase the amount of capital available for investment. Small branch offices of savings banks were conveniently located throughout the urban areas. In the countryside savings were deposited with the rural credit cooperatives, which could be found in most towns and villages. In 1986 savings deposits for the entire country totaled over ¥223.7 billion.

See also

- History of banking

- History of economics

- Economy of the Song Dynasty

- Economy of China

- Economic history of China (Pre-1911)

- Economic history of China (1912–1949)

References

- Morton, W. Scott, China: Its History and Culture (New York: Lippincott, 1980), p. 95.

- Randall Morck (University of Alberta - Department of Finance and Statistical Analysis; National Bureau of Economic Research (NBER); European Corporate Governence Institute; Asian Bureau of Finance and Economic Research) & Fan Yang (University of Saskatchewan) (12 April 2010). "The Shanxi Banks". Academia.edu. Retrieved 31 October 2019.CS1 maint: multiple names: authors list (link)

- Shanxi Provincial Academy of Social Sciences, ed., Shanxi piaohao shiliao (山西票号史料) (Taiyuan: Shanxi jingji chubanshe, 1992), pp. 36-39.

- Lloyd Eastman, Family, Fields, and Ancestors: Constancy and Change in China's Social and Economic History, 1550-1949, Oxford University Press (1988), pages 112-114.

- Huang Jianhui, Shanxi piaohao shi (Taiyuan: Shanxi jingji chubanshe, 1992), pp. 36-39.

- Shanxi Provincial Academy of Social Sciences, ed., Shanxi piaohao shiliao (山西票号史料) (Taiyuan: Shanxi jingji chubanshe, 1992), pp. 36-39.

- R. O. Hall, Chapters and Documents on Chinese National Banking (Shanghai: Shangwu yinshuguan, 1917), p. 3.

- Zhongguo Renmin Yinhang, Shanghai fenghang, Jinrong Yanjiu Suo (Institute of Financial Studies, Shanghai Branch, People’s Bank of China), ed., Shanghai qianzhuang shi liao (上海钱庄史料: "Historical Materials of Shanghai qianzhuang"), 1961, Shanghai (reprint, Shanghai, 1978), p.11.

- Ulrich Theobald (24 November 2015). "qianzhuang 錢莊, private banks". Chinaknowledge.de. Retrieved 9 August 2019.

- Yum Liu (August 2013). "A City of Commerce and its Native Banks: Hankou Qianzhuang (1800s-1952)". ResearchGate. Retrieved 17 August 2019.

- Tang Chuanshi and Huang Hanmin, "Shilun 1927 nian yiqian de Zhongguo yinhangye", Zhongguo jindai jingjishi yanjiu ziliao 4 (1986): 59.

- Ji Zhaojin (2002) A history of modern Shanghai banking. M.E. Sharpe, Armonk. Chapter 9. Socialist Transformation, 1949-1952.

- Ulrich Theobald (10 May 2016). "Paper Money in Premodern China". Chinaknowledge. Retrieved 27 March 2019.

- Ulrich Theobald (13 April 2016). "Qing Period Paper Money". Chinaknowledge.de. Retrieved 27 March 2019.

- John E. Sandrock (1997). "THE FOREIGN BANKS IN CHINA, PART I - EARLY IMPERIAL ISSUES (1850-1900) by John E. Sandrock - The Opening of China to the Outside World" (PDF). The Currency Collector. Retrieved 1 April 2019.

- John E. Sandrock (1997). "FOREIGN BANKS IN CHINA, Part II - IMPERIAL CHINESE ISSUES (1900-1911) by John E. Sandrock" (PDF). The Currency Collector. Retrieved 10 April 2019.

- Wang Jingyu, Shijiu shiji xifang ziben zhuyi dui Zhongguo de jingji qinlue (Beijing: Renmin chubanshe, 1983) at 146-148.

- Moazzin, Ghassan. "Sino-Foreign Business Networks: Foreign and Chinese banks in the Chinese banking sector, 1890–1911". Modern Asian Studies: 1–35. doi:10.1017/S0026749X18000318. ISSN 0026-749X.

- Hubert Bonin (28 July 2015). "Banking, Money and International Finance". Asian Imperial Banking History. Routledge. ISBN 1317316932.

- Bank of China, "Xiuzheng Zhongguo yinhang zeli" 修正中國銀行則例 (Revised regulations of the Bank of China), November 22, 1917, Bank of China file, no. 397/2-798.

- Zhongguo wenhua fuxingshe, ed., Kangzhan qian shinian zhi Zhongguo (抗戰前十年之中國) (1937: Longmen shudian, 1965)

- Mr. Habegger is a student at the University of Colorado in Boulder. He was a summer intern at FEE in 1986. (1 September 1988). "Origins of the Chinese Hyperinflation". Foundation for Economic Education (FEE). Retrieved 19 September 2019.

- Richard M. Ebeling (5 July 2010). "The Great Chinese Inflation - Inflation Undermined Popular Support Against Communism". Foundation for Economic Education (FEE). Retrieved 8 October 2019.

- http://www.marketoracle.co.uk/UserInfo-Mike_Hewitt.html Mike Hewitt] (22 May). "Hyperinflation in China, 1937 - 1949". The Market Oracle. Retrieved 8 October 2019. Check date values in:

|date=(help) - Eduard A. Kann, The History of China’s Internal Loan Issues (New York: Garland Publishing, Inc, 1980), p. 82.

- W. Y. Lin, The New Monetary System of China (Shanghai: Kelly and Walsh Publishers, 1936 [reprinted by the University of Chicago Press]), p. 73.

- Noah Elbot (2019). "China's 1935 Currency Reform: A Nascent Success Cut Short By Noah Elbot". Duke East Asia Nexus (Duke University). Retrieved 15 September 2019.

- Chang, H.: The Silver Dollars and Taels of China. Hong Kong, 1981 (158 pp. illus.). Including Subsidiary Notes on “The Silver Dollars and Taels of China” Hong Kong, 1982 (40 pp. illus.). OCLC 863439444.

- Xue Huayuan (薛化元):"The History of Taiwan after the War",(《戰後臺灣歷史閱覽》),Taipei (台北):Wunan Book Publishing (五南圖書出版),Published: 2010年,ISBN 9789571159102. Page: 245. (in Mandarin Chinese using traditional Chinese characters).

- United Nations General Assembly Session 26 Resolution 2758. Restoration of the lawful rights of the People's Republic of China in the United Nations A/RES/2758(XXVI) page 1. 25 October 1971. Retrieved 2008-10-07.

![]()

Further reading

- Linsun Cheng, Banking in Modern China: Entrepreneurs, Professional Managers, and the Development of Chinese Banks, 1897-1937 (Cambridge University Press, 2007). ISBN 0-521-03276-8

- Zhaojin Ji, A History of Modern Shanghai Banking: The Rise and Decline of China's Finance Capitalism (M. E. Sharpe, 2003). ISBN 0-7656-1003-5