Gold holdings

Gold holdings are the quantities of gold held by individuals, private corporations, or public entities as a store of value, an investment vehicle, or perceived as protection against hyperinflation and against financial and/or political upheavals.

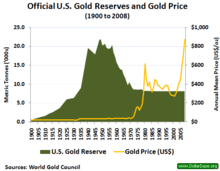

During the 19th and early 20th Century eras of the gold standard, national governments undertook an obligation to redeem the national currency for a certain amount of gold.[1] In such times, the nation's central bank used its reserves to meet that obligation, backing some or all of the currency in issue with the metal it held.[2]

The World Gold Council estimates that all the gold ever mined totals 187,200 tonnes, as of 2017[3] but other independent estimates vary by as much as 20%.[4] At a price of US$1,250 per troy ounce, marked on 16 August 2017, one tonne of gold has a value of approximately US$40.2 million. The total value of all gold ever mined would exceed US$7.5 trillion at that valuation, using WGC's 2017 estimates.[note 1]

IMF holdings

Since early 2011, the gold holdings of the IMF have been constant at 90.5 million troy ounces (2,814.1 metric tons).[5]

National holdings

The IMF regularly maintains statistics of national assets as reported by various countries.[6] This data is used by the World Gold Council to periodically rank and report the gold holdings of countries and official organizations.

On 17 July 2015, China disclosed its official gold holdings for the first time in six years and announced that they increased by about 57 percent, from 1,054 to 1,658 metric tons.[7][8]

The gold listed for each of the countries in the table may not be physically stored in the country listed, as central banks generally do not allow independent audits of their reserves.

| Rank | Country/Organization | Gold holdings (in tonnes) |

Gold as % of forex reserves |

|---|---|---|---|

| 1 | 8,133.5 | 74.6% | |

| 2 | 3,374.1 | 69.1% | |

| — | International Monetary Fund | 2,814.0 | N/A |

| 3 | 2,451.8 | 67.2% | |

| 4 | 2,435.9 | 65.0% | |

| 5 | 1,842.6 | 2.4% | |

| 6 | 1,729.4 | 16.8% | |

| 7 | 1,040.0 | 5.5% | |

| 8 | 765.2 | 2.5% | |

| 9 | 612.5 | 66.0% | |

| 10 | 557.8 | 5.8% | |

| 11 | 504.8 | 24.0% | |

| 12 | 482.9 | 18.3% | |

| 13 | 423.6 | 3.7% | |

| 14 | 382.5 | 58.6% | |

| 15 | 322.9 | 2.6% | |

| 16 | 310.3 | 7.2% | |

| 17 | 286.8 | 21.6% | |

| 18 | 281.6 | 17.5% | |

| 19 | 280.9 | 34.8% | |

| 20 | 280.0 | 53.7% | |

| 21 | 227.4 | 36.5% | |

| 22 | 196.4 | 9.8% | |

| 23 | 188.1 | 71.3% | |

| 24 | 173.6 | 6.2% | |

| 25 | 152.4 | 3.3% | |

| 26 | 127.4 | 1.9% | |

| 27 | 125.7 | 8.0% | |

| 28 | 125.3 | 10.8% | |

| 29 | 120.1 | 2.8% | |

| 30 | 116.6 | 6.6% | |

| 31 | 112.9 | 65.6% | |

| 32 | 104.4 | 1.1% | |

| 33 | 103.7 | 9.4% | |

| 34 | Bank for International Settlements | 103.0 | N/A |

| 35 | 103.0 | 3.8% | |

| 36 | 89.8 | 8.0% | |

| 37 | 79.9 | 5.5% | |

| 38 | 79.3 | 2.6% | |

| 39 | 79.0 | 8.8% | |

| - | Total for the Top 40 | 31,721.1 |

Private holdings

| Rank | Name | Type | Gold holdings (in tonnes) |

|---|---|---|---|

| 1 | SPDR Gold Shares | ETF | 672.7[14] |

| 2 | ETF Securities Gold Funds | ETF | 215.2[13] |

| 3 | COMEX Gold Trust | ETF | 164.7[13] |

| 4 | ZKB Physical Gold | ETF | 138.7[13] |

| 5 | Central Fund of Canada | CEF | 52.7[15] |

| 6 | Julius Baer Physical Gold Fund | ETF | 49.1[13] |

| 7 | Sprott Physical Gold Trust | CEF | 38.6[16] |

| 8 | BullionVault | Bailment | 34.2[17] |

| 9 | GoldMoney | Bailment | 34.1[18] |

| 10 | ABSA NewGold Exchange Traded Fund | ETF | 26.6[19] |

| 11 | ETFS Physical Swiss Gold Shares | ETF | 23.4[20] |

| 12 | Central GoldTrust | CEF | 21.9[21] |

| 13 | Bullion Management Group | OEF | 4.629 |

| - | Total for the above 13 | 1,461.829 |

World holdings

| Location | Gold holdings (in tonnes) |

Share of total world gold holdings |

|---|---|---|

| Total | 171,300 | 100% |

| Jewellery | 84,300 | 49.2% |

| Investment (bars, coins) | 33,000 | 19.26% |

| Central banks | 29,500 | 17.2% |

| Industrial | 20,800 | 12.14% |

| Unaccounted | 3,700 | 2.2% |

See also

Notes

- Gold, silver, and other precious metals and gems are weighed by the troy ounce, whereby 12 troy ounces = 1 pound and the typicsl 16-to-1 ratio in most other normal weights. There would be 24,000 troy ounces to 1 ton of weight. One tonne is equal to approximately 32,150.75 troy ounces.

References

- Schenk, Catherine (2013). The global gold market and the international monetary system (PDF). Palgrave Macmillan. ISBN 9781137306708. Retrieved 17 January 2018.

- "Central Bank Gold Reserves, an historical perspective since 1845", Timothy Green, World Gold Council Study No.23, November 1999

- "How much gold has been mined?", World Gold Council

- "How much gold is there in the world?", BBC News, 1 April 2013

- "Gold in the IMF". International Monetary Fund. Archived from the original on April 22, 2011.

- "Data Template on International Reserves and Foreign Currency Liquidity -- Reporting Countries".

- "Gold & Foreign Exchange Reserves".

- "Major Factors Affecting Gold Prices Fluctuation". FXdailyReport.Com. 2016-07-22. Retrieved 2016-10-28.

- "Research - World Gold Council".

- "Latest World Official Gold Reserves - World Gold Council".

- "Gold Demand Trends - World Gold Council".

- "Top 40 reported official gold holdings (as at September 2017)"

- "Holdings of SPDR Gold, iShares Silver". Reuters. 2 July 2015. Archived from the original on August 1, 2015. Retrieved 1 August 2015.

- "Total Gold in Trust". SPDR Gold Shares. 31 July 2015. Retrieved 1 August 2015.

- "Central Fund's Net Asset Value". Central Fund of Canada. 31 July 2015. Archived from the original on August 1, 2015. Retrieved 1 August 2015.

- "Net Asset Value - Sprott Physical Gold Trust - Sprott Physical Bullion Trusts". Sprott Asset Management. 31 July 2015. Archived from the original on August 1, 2015. Retrieved 1 August 2015.

- "Daily audit - Allocated gold bar lists and bank statements". BullionVault. 31 July 2015. Retrieved 1 August 2015.

- "Real-Time Audit". GoldMoney. 31 July 2017. Retrieved 31 July 2017.

- "NewGold Exchange Traded Fund". Absa Group. 31 July 2015. Archived from the original on August 1, 2015. Retrieved 1 August 2015.

- "ETFS Physical Swiss Gold Shares". ETF Securities. 31 July 2015. Retrieved 1 August 2015.

- "GoldTrust's Net Asset Value". Central GoldTrust. 31 July 2015. Archived from the original on August 1, 2015. Retrieved 1 August 2015.

- on page 2 of the pdf file; last paragraph just before the "Production" section on that page

- "Two Methods for Estimating the Price of Gold by Mike Hewitt". DollarDaze Economic Commentary Blog - Gold, Oil, Stocks, Investments, Currencies, and the Federal Reserve. Archived from the original on 2012-01-09. Retrieved 2012-01-08.