Usury

Usury (/ˈjuːʒəri/)[1][2] is, as defined today, the practice of making unethical or immoral monetary loans that unfairly enrich the lender. Originally, usury meant interest of any kind. A loan may be considered usurious because of excessive or abusive interest rates or other factors. Historically, in some Christian societies, and in many Islamic societies even today, charging any interest at all would be considered usury. Someone who practices usury can be called a usurer, but a more common term in contemporary English is loan shark.

The term may be used in a moral sense—condemning, taking advantage of others' misfortunes—or in a legal sense where interest rates may be regulated by law. Historically, some cultures (e.g., Christianity in much of Medieval Europe, and Islam in many parts of the world today) have regarded charging any interest for loans as sinful.

Some of the earliest known condemnations of usury come from the Vedic texts of India.[3] Similar condemnations are found in religious texts from Buddhism, Judaism, Christianity, and Islam (the term is riba in Arabic and ribbit in Hebrew).[4] At times, many nations from ancient Greece to ancient Rome have outlawed loans with any interest. Though the Roman Empire eventually allowed loans with carefully restricted interest rates, the Catholic Church in medieval Europe banned the charging of interest at any rate (as well as charging a fee for the use of money, such as at a bureau de change).

Historical meaning

Banking during the Roman Empire was different from modern banking. During the Principate, most banking activities were conducted by private individuals who operated as large banking firms do today. Anybody that had any available liquid assets and wished to lend it out could easily do so.[5]

The annual rates of interest on loans varied in the range of 4–12 percent, but when the interest rate was higher, it typically was not 15–16 percent but either 24 percent or 48 percent. The apparent absence of intermediate rates suggests that the Romans may have had difficulty calculating the interest on anything other than mathematically convenient rates. They quoted them on a monthly basis, and the most common rates were multiples of twelve. Monthly rates tended to range from simple fractions to 3–4 percent, perhaps because lenders used Roman numerals.[6]

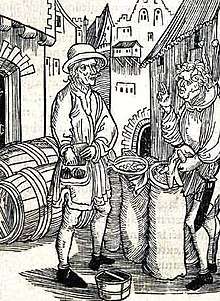

Moneylending during this period was largely a matter of private loans advanced to persons persistently in debt or temporarily so until harvest time. Mostly, it was undertaken by exceedingly rich men prepared to take on a high risk if the profit looked good; interest rates were fixed privately and were almost entirely unrestricted by law. Investment was always regarded as a matter of seeking personal profit, often on a large scale. Banking was of the small, back-street variety, run by the urban lower-middle class of petty shopkeepers. By the 3rd century, acute currency problems in the Empire drove such banking into decline.[7] The rich who were in a position to take advantage of the situation became the moneylenders when the increasing tax demands in the last declining days of the Empire crippled and eventually destroyed the peasant class by reducing tenant-farmers to serfs. It was evident that usury meant exploitation of the poor.[8]

The First Council of Nicaea, in 325, forbade clergy from engaging in usury[9] (canon 17). At the time, usury was interest of any kind, and the canon forbade the clergy to lend money at interest rates even as low as 1 percent per year. Later ecumenical councils applied this regulation to the laity.[9][10]

Lateran III decreed that persons who accepted interest on loans could receive neither the sacraments nor Christian burial.[11] Pope Clement V made the belief in the right to usury a heresy in 1311, and abolished all secular legislation which allowed it.[12] Pope Sixtus V condemned the practice of charging interest as "detestable to God and man, damned by the sacred canons, and contrary to Christian charity."[12]

Theological historian John Noonan argues that "the doctrine [of usury] was enunciated by popes, expressed by three ecumenical councils, proclaimed by bishops, and taught unanimously by theologians."[10]

Certain negative historical renditions of usury carry with them social connotations of perceived "unjust" or "discriminatory" lending practices. The historian Paul Johnson, comments:

Most early religious systems in the ancient Near East, and the secular codes arising from them, did not forbid usury. These societies regarded inanimate matter as alive, like plants, animals and people, and capable of reproducing itself. Hence if you lent 'food money', or monetary tokens of any kind, it was legitimate to charge interest.[13] Food money in the shape of olives, dates, seeds or animals was lent out as early as c. 5000 BC, if not earlier. ...Among the Mesopotamians, Hittites, Phoenicians and Egyptians, interest was legal and often fixed by the state. But the Hebrew took a different view of the matter.[14]

The Hebrew Bible regulates interest taking. Interest can be charged to strangers but not between Hebrews.

Deuteronomy 23:19 Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest.

Deuteronomy 23:20 Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.[15]

Israelites were forbidden to charge interest on loans made to other Israelites, but allowed to charge interest on transactions with non-Israelites, as the latter were often amongst the Israelites for the purpose of business anyway; but in general, it was seen as advantageous to avoid getting into debt at all, to avoid being bound to someone else. Debt was to be avoided and not used to finance consumption, but only taken on when in need; however, the laws against usury were among many laws which the prophets condemn the people for breaking.[16]

Johnson contends that the Torah treats lending as philanthropy in a poor community whose aim was collective survival, but which is not obliged to be charitable towards outsiders.

A great deal of Jewish legal scholarship in the Dark and the Middle Ages was devoted to making business dealings fair, honest and efficient.[17]

Usury (in the original sense of any interest) was at times denounced by a number of religious leaders and philosophers in the ancient world, including Moses,[18] Plato, Aristotle, Cato, Cicero, Seneca,[19] Aquinas,[20] Muhammad,[21] Jesus,[22] Philo and Gautama Buddha.[23] For example, Cato said:

"And what do you think of usury?"—"What do you think of murder?"

Interest of any kind is forbidden in Islam. As such, specialized codes of banking have developed to cater to investors wishing to obey Qur'anic law. (See Islamic banking)

As the Jews were ostracized from most professions by local rulers, the Western churches and the guilds [24], they were pushed into marginal occupations considered socially inferior, such as tax and rent collecting and moneylending. Natural tensions between creditors and debtors were added to social, political, religious, and economic strains.[25]

...financial oppression of Jews tended to occur in areas where they were most disliked, and if Jews reacted by concentrating on moneylending to non-Jews, the unpopularity—and so, of course, the pressure—would increase. Thus the Jews became an element in a vicious circle. The Christians, on the basis of the Biblical rulings, condemned interest-taking absolutely, and from 1179 those who practiced it were excommunicated. Catholic autocrats frequently imposed the harshest financial burdens on the Jews. The Jews reacted by engaging in the one business where Christian laws actually discriminated in their favor, and became identified with the hated trade of moneylending.[26]

In England, the departing Crusaders were joined by crowds of debtors in the massacres of Jews at London and York in 1189–1190. In 1275, Edward I of England passed the Statute of the Jewry which made usury illegal and linked it to blasphemy, in order to seize the assets of the violators. Scores of English Jews were arrested, 300 were hanged and their property went to the Crown. In 1290, all Jews were to be expelled from England, allowed to take only what they could carry; the rest of their property became the Crown's. Usury was cited as the official reason for the Edict of Expulsion; however, not all Jews were expelled: it was easy to avoid expulsion by converting to Christianity. Many other crowned heads of Europe expelled the Jews, although again converts to Christianity were no longer considered Jewish (see the articles on marranos or crypto-Judaism).

The growth of the Lombard bankers and pawnbrokers, who moved from city to city, was along the pilgrim routes.

In the 16th century, short-term interest rates dropped dramatically (from around 20–30% p.a. to around 9–10% p.a.). This was caused by refined commercial techniques, increased capital availability, the Reformation, and other reasons. The lower rates weakened religious scruples about lending at interest, although the debate did not cease altogether.

The papal prohibition on usury meant that it was a sin to charge interest on a money loan. As set forth by Thomas Aquinas, the natural essence of money was as a measure of value or intermediary in exchange. The increase of money through usury violated this essence and according to the same Thomistic analysis, a just transaction was one characterized by an equality of exchange, one where each side received exactly his due. Interest on a loan, in excess of the principal, would violate the balance of an exchange between debtor and creditor and was therefore unjust.

Charles Eisenstein has argued that pivotal change in the English-speaking world came with lawful rights to charge interest on lent money,[28] particularly the 1545 Act, "An Act Against Usurie" (37 H. viii 9) of King Henry VIII of England.

Religious context

Judaism

Jews are forbidden from usury in dealing with fellow Jews, and this lending is to be considered tzedakah, or charity. However, there are permissions to charge interest on loans to non-Jews.[29] This is outlined in the Jewish scriptures of the Torah, which Christians hold as part of the Old Testament, and other books of the Tanakh. From the Jewish Publication Society's 1917 Tanakh,[30] with Christian verse numbers, where different, in parentheses:

Exodus 22:24 (25)—If thou lend money to any of My people, even to the poor with thee, thou shalt not be to him as a creditor; neither shall ye lay upon him interest.

Leviticus 25:36— Take thou no interest of him or increase; but fear thy God; that thy brother may live with thee.

Leviticus 25:37— Thou shalt not give him thy money upon interest, nor give him thy victuals for increase.

Deuteronomy 23:20 (19)—Thou shalt not lend upon interest to thy brother: interest of money, interest of victuals, interest of any thing that is lent upon interest.

Deuteronomy 23:21 (20)—Unto a foreigner thou mayest lend upon interest; but unto thy brother thou shalt not lend upon interest; that the LORD thy God may bless thee in all that thou puttest thy hand unto, in the land whither thou goest in to possess it.

Ezekiel 18:17—that hath withdrawn his hand from the poor, that hath not received interest nor increase, hath executed Mine ordinances, hath walked in My statutes; he shall not die for the iniquity of his father, he shall surely live.

Psalm 15:5—He that putteth not out his money on interest, nor taketh a bribe against the innocent. He that doeth these things shall never be moved.

Several historical rulings in Jewish law have mitigated the allowances for usury toward non-Jews. For instance, the 15th-century commentator Rabbi Isaac Abrabanel specified that the rubric for allowing interest does not apply to Christians or Muslims, because their faith systems have a common ethical basis originating from Judaism. The medieval commentator Rabbi David Kimchi extended this principle to non-Jews who show consideration for Jews, saying they should be treated with the same consideration when they borrow.[31]

Islam

The following quotations are English translations from the Qur'an:

Those who charge usury are in the same position as those controlled by the devil's influence. This is because they claim that usury is the same as commerce. However, God permits commerce, and prohibits usury. Thus, whoever heeds this commandment from his Lord, and refrains from usury, he may keep his past earnings, and his judgment rests with God. As for those who persist in usury, they incur Hell, wherein they abide forever (Al-Baqarah 2:275)

God condemns usury, and blesses charities. God dislikes every sinning disbeliever. Those who believe and do good works and establish worship and pay the poor-due, their reward is with their Lord and there shall no fear come upon them neither shall they grieve. O you who believe, you shall observe God and refrain from all kinds of usury, if you are believers. If you do not, then expect a war from God and His messenger. But if you repent, you may keep your capitals, without inflicting injustice, or incurring injustice. If the debtor is unable to pay, wait for a better time. If you give up the loan as a charity, it would be better for you, if you only knew. (Al-Baqarah 2:276-280)

O you who believe, you shall not take usury, compounded over and over. Observe God, that you may succeed. (Al-'Imran 3:130)

And for practicing usury, which was forbidden, and for consuming the people's money illicitly. We have prepared for the disbelievers among them painful retribution. (Al-Nisa 4:161)

The usury that is practiced to increase some people's wealth, does not gain anything at God. But if people give to charity, seeking God's pleasure, these are the ones who receive their reward many fold. (Ar-Rum 30:39)

The attitude of Muhammad to usury is articulated in his Last Sermon

O People, just as you regard this month, this day, this city as Sacred, so regard the life and property of every Muslim as a sacred trust. Return the goods entrusted to you to their rightful owners. Hurt no one so that no one may hurt you. Remember that you will indeed meet your LORD, and that HE will indeed reckon your deeds. ALLAH has forbidden you to take usury (interest), therefore all interest obligation shall henceforth be waived. Your capital, however, is yours to keep. You will neither inflict nor suffer any inequity. Allah has Judged that there shall be no interest and that all the interest due to Abbas ibn 'Abd'al Muttalib (Prophet's uncle) shall henceforth be waived...

Christianity

The first of the scholastic Christian theologians, Saint Anselm of Canterbury, led the shift in thought that labeled charging interest the same as theft. Previously usury had been seen as a lack of charity.

St. Thomas Aquinas, the leading scholastic theologian of the Roman Catholic Church, argued charging of interest is wrong because it amounts to "double charging", charging for both the thing and the use of the thing. Aquinas said this would be morally wrong in the same way as if one sold a bottle of wine, charged for the bottle of wine, and then charged for the person using the wine to actually drink it.[34] Similarly, one cannot charge for a piece of cake and for the eating of the piece of cake. Yet this, said Aquinas, is what usury does. Money is a medium of exchange, and is used up when it is spent. To charge for the money and for its use (by spending) is therefore to charge for the money twice. It is also to sell time since the usurer charges, in effect, for the time that the money is in the hands of the borrower. Time, however, is not a commodity that anyone can charge. In condemning usury Aquinas was much influenced by the recently rediscovered philosophical writings of Aristotle and his desire to assimilate Greek philosophy with Christian theology. Aquinas argued that in the case of usury, as in other aspects of Christian revelation, Christian doctrine is reinforced by Aristotelian natural law rationalism. Aristotle's argument is that interest is unnatural, since money, as a sterile element, cannot naturally reproduce itself. Thus, usury conflicts with natural law just as it offends Christian revelation: see Thought of Thomas Aquinas.

Outlawing usury did not prevent investment, but stipulated that in order for the investor to share in the profit he must share the risk. In short he must be a joint-venturer. Simply to invest the money and expect it to be returned regardless of the success of the venture was to make money simply by having money and not by taking any risk or by doing any work or by any effort or sacrifice at all, which is usury. St Thomas quotes Aristotle as saying that "to live by usury is exceedingly unnatural". Islam likewise condemns usury but allowed commerce (Al-Baqarah 2:275) - an alternative that suggests investment and sharing of profit and loss instead of sharing only profit through interests. Judaism condemns usury towards Jews, but allows it towards non-Jews. (Deut 23:19-20) St Thomas allows, however, charges for actual services provided. Thus a banker or credit-lender could charge for such actual work or effort as he did carry out e.g. any fair administrative charges. The Catholic Church, in a decree of the Fifth Council of the Lateran, expressly allowed such charges in respect of credit-unions run for the benefit of the poor known as "montes pietatis".[35]

In the 13th century Cardinal Hostiensis enumerated thirteen situations in which charging interest was not immoral.[36] The most important of these was lucrum cessans (profits given up) which allowed for the lender to charge interest "to compensate him for profit foregone in investing the money himself." (Rothbard 1995, p. 46) This idea is very similar to opportunity cost. Many scholastic thinkers who argued for a ban on interest charges also argued for the legitimacy of lucrum cessans profits (e.g. Pierre Jean Olivi and St. Bernardino of Siena). However, Hostiensis' exceptions, including for lucrum cessans, were never accepted as official by the Roman Catholic Church.

The Roman Catholic Church has always condemned usury, but in modern times, with the rise of capitalism and the disestablishment of the Catholic Church in majority Catholic countries, this prohibition on usury has not been enforced.

Pope Benedict XIV's encyclical Vix Pervenit gives the reasons why usury is sinful:[37]

The nature of the sin called usury has its proper place and origin in a loan contract… [which] demands, by its very nature, that one return to another only as much as he has received. The sin rests on the fact that sometimes the creditor desires more than he has given…, but any gain which exceeds the amount he gave is illicit and usurious.

One cannot condone the sin of usury by arguing that the gain is not great or excessive, but rather moderate or small; neither can it be condoned by arguing that the borrower is rich; nor even by arguing that the money borrowed is not left idle, but is spent usefully…[38]

Other contexts

Usury in literature

In The Divine Comedy Dante places the usurers in the inner ring of the seventh circle of hell.

Interest on loans, and the contrasting views on the morality of that practice held by Jews and Christians, is central to the plot of Shakespeare's play "The Merchant of Venice". Antonio is the merchant of the title, a Christian, who is forced by circumstance to borrow money from Shylock, a Jew. Shylock customarily charges interest on loans, seeing it as good business, while Antonio does not, viewing it as morally wrong. When Antonio defaults on his loan, Shylock famously demands the agreed upon penalty-a measured quantity of muscle from Antonio's chest. This is the source of the phrase "a pound of flesh" often used to describe the dear price of a loan or business transaction. Shakespeare's play is a vivid portrait of the competing views of loans and use of interest, as well as the cultural strife between Jews and Christians that overlaps it.

By the 18th century, usury was more often treated as a metaphor than a crime in itself, so Jeremy Bentham's Defense of Usury was not as shocking as it would have appeared two centuries earlier.

In Honoré de Balzac's 1830 novel Gobseck, the title character, who is a usurer, is described as both "petty and great—a miser and a philosopher..."[39] The character Daniel Quilp in The Old Curiosity Shop by Charles Dickens is a usurer.

In the early 20th century Ezra Pound's anti-usury poetry was not primarily based on the moral injustice of interest payments but on the fact that excess capital was no longer devoted to artistic patronage, as it could now be used for capitalist business investment.[40]

Usury law

Usury and the law

.jpg)

"When money is lent on a contract to receive not only the principal sum again, but also an increase by way of compensation for the use, the increase is called interest by those who think it lawful, and usury by those who do not." (William Blackstone's Commentaries on the Laws of England).

United States

Usury laws are state laws that specify the maximum legal interest rate at which loans can be made.[42] In the United States, the primary legal power to regulate usury rests primarily with the states. Each U.S. state has its own statute that dictates how much interest can be charged before it is considered usurious or unlawful.[43]

If a lender charges above the lawful interest rate, a court will not allow the lender to sue to recover the unlawfully high interest, and some states will apply all payments made on the debt to the principal balance.[42] In some states, such as New York), usurious loans are voided ab initio.[44]

The making of usurious loans is often called loan sharking. That term is sometimes also applied to the practice of making consumer loans without a license in jurisdictions that requires lenders to be licensed.

Federal regulation

On a federal level, Congress has never attempted to federally regulate interest rates on purely private transactions, but on the basis of past U.S. Supreme Court decisions, arguably the U.S. Congress might have the power to do so under the interstate commerce clause of Article I of the Constitution.

Congress imposed a federal criminal penalty for unlawful interest rates through the Racketeer Influenced and Corrupt Organizations Act (RICO Statute), and its definition of "unlawful debt", which makes it a potential federal felony to lend money at an interest rate more than twice the local state usury rate and then try to collect that debt.[45]

It is a federal offense to use violence or threats to collect usurious interest (or any other sort).[46]

Separate federal rules apply to most banks. The U.S. Supreme Court held unanimously in the 1978 case, Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp., that the National Banking Act of 1863 allowed nationally chartered banks to charge the legal rate of interest in their state regardless of the borrower's state of residence.[47]

In 1980, Congress passed the Depository Institutions Deregulation and Monetary Control Act. Among the Act's provisions, it exempted federally chartered savings banks, installment plan sellers and chartered loan companies from state usury limits. Combined with the Marquette decision that applied to National Banks, this effectively overrode all state and local usury laws.[43][48] The 1968 Truth in Lending Act does not regulate rates, except for some mortgages, but requires uniform or standardized disclosure of costs and charges.[49]

In the 1996 Smiley v. Citibank case, the Supreme Court further limited states' power to regulate credit card fees and extended the reach of the Marquette decision. The court held that the word "interest" used in the 1863 banking law included fees and, therefore, states could not regulate fees.[50]

Some members of Congress have tried to create a federal usury statute that would limit the maximum allowable interest rate, but the measures have not progressed. In July 2010, the Dodd–Frank Wall Street Reform and Consumer Protection Act, was signed into law by President Obama. The act provides for a Consumer Financial Protection Bureau to regulate some credit practices but has no interest rate limit.[50]

Texas

State law in Texas also includes a provision for contracting for, charging, or receiving charges exceeding twice the amount authorized (A/K/A "double usury"). A person who violates this provision is liable to the obligor as an additional penalty for all principal or principal balance, as well as interest or time price differential. A person who is liable is also liable for reasonable attorney's fees incurred by the obligor. [51]

Canada

Canada's Criminal Code limits the interest rate to 60% per year.[52] The law is broadly written and Canada's courts have often intervened to remove ambiguity.[53]

Japan

Japan has various laws restricting interest rates. Under civil law, the maximum interest rate is between 15% and 20% per year depending upon the principal amount (larger amounts having a lower maximum rate). Interest in excess of 20% is subject to criminal penalties (the criminal law maximum was 29.2% until it was lowered by legislation in 2010).[54] Default interest on late payments may be charged at up to 1.46 times the ordinary maximum (i.e., 21.9% to 29.2%), while pawn shops may charge interest of up to 9% per month (i.e., 108% per year, however, if the loan extends more than the normal short-term pawn shop loan, the 9% per month rate compounded can make the annual rate in excess of 180%, before then most of these transaction would result in any goods pawned being forfeited).

Avoidance mechanisms and interest-free lending

Islamic banking

In a partnership or joint venture where money is lent, the creditor only provides the capital yet is guaranteed a fixed amount of profit. The debtor, however, puts in time and effort, but is made to bear the risk of loss. Muslim scholars argue that such practice is unjust.[55] As an alternative to usury, Islam strongly encourages charity and direct investment in which the creditor shares whatever profit or loss the business may incur (in modern terms, this amounts to an equity stake in the business).

Non-recourse mortgages

A non-recourse loan is secured by the value of property (usually real estate) owned by the debtor. However, unlike other loans, which oblige the debtor to repay the amount borrowed, a non-recourse loan is fully satisfied merely by the transfer of the property to the creditor, even if the property has declined in value and is worth less than the amount borrowed. When such a loan is created, the creditor bears the risk that the property will decline sharply in value (in which case the creditor is repaid with property worth less than the amount borrowed), and the debtor does not bear the risk of decrease in property value (because the debtor is guaranteed the right to use the property, regardless of value, to satisfy the debt.)

Interest-free banks

The JAK members bank is a usury-free saving and loaning system.

Interest-free micro-lending

Growth of the Internet internationally has enabled both business micro-lending through sites such as Kickstarter as well as through global micro-lending charities where lenders make small sums of money available on zero-interest terms. Persons lending money to on-line micro-lending charity Kiva for example do not get paid any interest,[56] although the end users to whom the loans are made may be charged interest by Kiva's partners in the country where the loan is used.[57]

See also

References

- ↑ "Usury". Oxford English Dictionary. Oxford University Press. 2012. Retrieved 26 October 2012.

- ↑ The word is derived from Medieval Latin usuria, "interest", or from Latin usura, "interest"

- ↑ Jain, L. C. (1929). Indigenous Banking In India. London: Macmillan and Co.

- ↑ Karim, Shafiel A. (2010). The Islamic Moral Economy: A Study of Islamic Money and Financial Instruments. Boca Raton, FL: Brown Walker Press. ISBN 978-1-59942-539-9.

- ↑ Zgur, Andrej: The economy of the Roman Empire in the first two centuries A.D., An examination of market capitalism in the Roman economy Archived 2012-06-11 at the Wayback Machine., Aarhus School of Business, December 2007, pp. 252–261.

- ↑ Temin, Peter: Financial Intermediation in the Early Roman Empire Archived 2011-07-17 at the Wayback Machine., The Journal of Economic History, Cambridge University Press, 2004, vol. 64, issue 03, p. 15.

- ↑ Young, Frances: Christian Attitudes to Finance in the First Four Centuries, Epworth Review 4.3, Peterborough, September 1977, p. 80.

- ↑ Young, Frances: Christian Attitudes to Finance in the First Four Centuries, Epworth Review 4.3, Peterborough, September 1977, pp. 81–82.

- 1 2 Moehlman, Conrad H. 1934. "The Christianization of Interest." Church History. Issue 3, p. 6.

- 1 2 Noonan, John T., Jr. 1993. "Development of Moral Doctrine." 54 Theological Stud. 662.

- ↑ Moehlman, 1934, p. 6-7.

- 1 2 Moehlman, 1934, p. 7.

- ↑ Johnson cites Fritz E. Heichelcheim: An Ancient Economic History, 2 vols. (trans. Leiden 1965), i.104-566

- ↑ Johnson, Paul: A History of the Jews (New York: HarperCollins Publishers, 1987) ISBN 0-06-091533-1, pp. 172–73.

- ↑ "Deuteronomy 23 / Hebrew Bible in English / Mechon-Mamre". www.mechon-mamre.org.

- ↑ Examples of debt: 1 Samuel 22:2, 2 Kings 4:1, Isaiah 50:1. Prophetic condemnation of usury: Ezekiel 22:12, Nehemiah 5:7 and 12:13. Cautions regarding debt: Prov 22:7, passim.

- ↑ Johnson, p. 272.

- ↑ Exodus 22:25

- ↑ "Usury - The Root of All Evil". The Spirit of Now. Peter Russell.

- ↑ "Thomas Aquinas: On Usury, c. 1269-71". Fordham University.

- ↑ "The Prophet Muhammad's Last Sermon". Fordham University.

- ↑ Matthew 21:12-13, Matthew 5:17-18

- ↑ Bodhi, Bhikku. "Right Speech, Right Action, Right Livelihood (Samma Vaca, Samma Kammanta, Samma Ajiva)". Buddhist Publication Society. Retrieved 29 June 2012.

- ↑ "Petition of the Jews of Paris, Alsase, and Lorraine to the National Assembly, January 28, 1790." Ed. Hunt, Lynn. The French Revolution and Human Rights: A Brief Documentary History. Bedford Books of St. Martin's Press, 1996, p. 96.

- ↑ Cooper, Zaki (31 July 2015). "Christian approach to usury forced Jews into money lending". Financial Times. Retrieved 21 March 2018.

- ↑ Johnson, p. 174.

- ↑ Archived February 25, 2009, at the Wayback Machine.

- ↑ Eisenstein, Charles: Sacred Economics: Money, Gift, and Society in the Age of Transition

- ↑ Robinson, George. "Interest-Free Loans in Judaism". Retrieved 12 March 2015.

- ↑ "A Hebrew - English Bible According to the Masoretic Text and the JPS 1917 Edition". Retrieved 4 January 2013.

- ↑ "Encyclopedia Judaica: Moneylending". Jewish Virtual Library. 2008. Retrieved October 16, 2017.

- ↑ "IslamiCity.com - Mosque - The Prophet Muhammad's (PBUH) Last Sermon". www.islamicity.com.

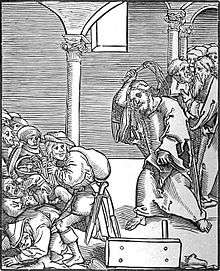

- ↑ The references cited in the Passionary for this woodcut: 1 John 2:14-16, Matthew 10:8, and The Apology of the Augsburg Confession, Article 8, Of the Church

- ↑ Thomas Aquinas. Summa Theologica, "Of Cheating, Which Is Committed in Buying and Selling." Translated by The Fathers of the English Dominican Province. pp. 1-10 Retrieved June 19, 2012

- ↑ Session Ten: On the reform of credit organisations (Montes pietatis). Fifth Lateran Council. Rome, Italy: Catholic Church. 4 May 1515. Retrieved 2008-04-05.

- ↑ Roover, Raymond (Autumn 1967). "The Scholastics, Usury, and Foreign Exchang". Business History Review. The Business History Review, Vol. 41, No. 3. 41 (3): 257–271. doi:10.2307/3112192. JSTOR 3112192.

- ↑ See also: Church and the Usurers: Unprofitable Lending for the Modern Economy Archived 2015-10-17 at the Wayback Machine. by Dr. Brian McCall or Interest and Usury by Fr. Bernard W. Dempsey, S.J. (1903-1960).)

- ↑ "Vix Pervenit - Papal Encyclicals". 1 November 1745.

- ↑ Honoré de Balzac (1830).

- ↑ Archived January 5, 2006, at the Wayback Machine.

- ↑ Archived October 17, 2007, at the Wayback Machine.

- 1 2 Larson, Aaron (17 August 2016). "Legal Limits on Interest Rates for Loans and Credit". ExpertLaw.com. Retrieved 6 April 2018.

- 1 2 "Maximum Interest Rate Matrix" (PDF). docutech. Docutech Corporation. May 2013. Retrieved 6 April 2018.

- ↑ NY Gen Oblig 5-501 et seq. and NY 1503.

- ↑ 18 U.S.C. § 1961 (6)(B). See generally, Racketeer Influenced and Corrupt Organizations Act

- ↑ "18 USC Chapter 42: Extortionate Credit Transactions". Legal Information Institute. Cornell Law School. Retrieved 6 April 2018.

- ↑ Marquette Nat. Bank of Minneapolis v. First of Omaha Service Corp., 439 U.S. 299 (1978).

- ↑ The Effect of Consumer Interest Rate Deregulation on Credit Card Volumes, Charge-Offs, and the Personal Bankruptcy Rate Archived 2008-09-24 at the Wayback Machine., Federal Deposit Insurance Corporation "Bank Trends" Newsletter, March, 1998.

- ↑ "15 U.S. Code Part A". Legal Information Institute. Cornell Law School. Retrieved 6 April 2018.

- 1 2 ABA Journal, March 2010, p. 59

- ↑ "FINANCE CODE CHAPTER 349. PENALTIES AND LIABILITIES". www.statutes.legis.state.tx.us.

- ↑ Criminal Interest Rate, R.S.C. 1985, c. C-46, s. 347, as amended by 1992, c. 1, s. 60(F) and 2007, c. 9, s. 1

- ↑ Waldron, Mary Anne (2011). "Section 347 of the Criminal Code "A Deeply Problematic Law"". Uniform Law Conference of Canada. Retrieved 2012-01-01.

- ↑ "上限金利の引き下げ". Japan Financial Services Association. Retrieved 16 January 2014.

- ↑ Maududi(1967), vol. i, pg. 199

- ↑ Kiva Faq: Will I get interest on my loan?: "Loans made through Kiva's website do not earn any interest. Kiva's loans are not an investment and are not recommended as an investment."

- ↑ Kiva FAQ: Do Kiva.org's Field Partners charge interest to the entrepreneurs?: "Our Field Partners are free to charge interest, but Kiva.org will not partner with an organization that charges exorbitant interest rates."

Further reading

- 'In Restraint of Usury: the Lending of Money at Interest', Sir Harry Page, The Chartered Institute of Public Finance and Accounts, London, 1985,

- The Bibliography therein - particularly:

- 'The Idea of Usury: from Tribal Brotherhood to Universal Otherhood', Benjamin Nelson, 2nd Edition, University of Chicago Press, Chicago and London, 1949, enlarged 2nd edition, 1969.

- 'Interest and Inflation Free Money: Creating an Exchange Medium That Works for Everybody and Protects the Earth', Margrit Kennedy, with Declan Kennedy: Illustrations by Helmut Creutz; New and Expanded Edition, New Society Publishers, Philadelphia, PA, USA and Gabriola Island, BC, Canada, 1995.

External links

| Wikiquote has quotations related to: Usury |

| Look up usury in Wiktionary, the free dictionary. |

| Wikimedia Commons has media related to Usury. |

- The History of Usury from Americans for Fairness in Lending

- Usury and the Church of England

- Usury is Riba in Islam, this is an exclusive site on the subject of Riba (ar-Riba, usury, interest), answering the logic and reasoning for the prohibition of usury

- USURY, A Scriptural, Ethical and Economic View, by Calvin Elliott, 1902. (a searchable facsimile at the University of Georgia Libraries; DjVu & layered PDF format)

- Catholic Encyclopedia article on Usury, 1912

- Question 78. The sin of usury (St Thomas Aquinas' Summa Theologiæ)

- Luther's Sermon on Trading and Usury

- Concordia Cyclopedia: Usury

- What Love Is This? A Renunciation of the Economics of Calvinism

- Dr. Ian Hodge on Usury

- S.C. Mooney's Response to Dr. Gary North's critique of Usury: Destroyer of Nations

- Norman Jones's article on usury from EH.NET's Encyclopedia

- Islamic definition of Usury

- Usury laws by state.

- History of Religious Injunctions Against Usury

- Origin of Modern Banking and Usury in Britain

- Buddha on Right Livelihood and Usury

- Usury (Jewish Encyclopedia, 1906 ed.)

- Usury (Beyond the Pale exposition, friends-partners.org)

- Defence of Usury by Jeremy Bentham. 1787

- Of Usury by Francis Bacon

- Thomas Geoghegan on "Infinite Debt: How Unlimited Interest Rates Destroyed the Economy"