Centrica

| |

| Public limited company | |

| Traded as |

LSE: CNA FTSE 100 Component |

| Industry | Utilities |

| Founded | February 17, 1997 |

| Headquarters | Windsor, England, UK |

Key people |

Richard Haythornthwaite (Chairman) Iain Conn (Group Chief Executive) |

| Revenue |

|

|

| |

|

| |

| Subsidiaries | See below |

| Website |

www |

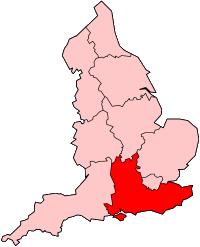

Centrica plc is a British multinational energy and services company with its headquarters in Windsor, Berkshire. Its principal activity is the supply of electricity and gas to businesses and consumers in the United Kingdom, Ireland and North America.

It is the largest supplier of gas to domestic customers in the United Kingdom, and one of the largest suppliers of electricity, operating under the trading names Scottish Gas in Scotland and British Gas in England and Wales. It owns Bord Gáis Energy in Ireland. It is also active in the provision of household services including plumbing.

Centrica is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

History

Historical origins

The company has its historical origin in the Gas Light and Coke Company which incorporated in 1812. Over the next 137 years, it grew by acquisition of other gas companies to become the primary supplier of gas to Greater London. In 1949, under the Gas Act 1948 the ownership of the company transferred to a government agency, North Thames Gas Board.[2] The various area gas boards were merged into the national British Gas Corporation in 1973. The Gas Act 1986 sold the company to private investors as British Gas plc.[3]

Origin

Centrica became a separate, distinct corporation on 17 February 1997, when British Gas plc split (demerged) to form three separate companies: Centrica plc, BG plc and Transco plc. Centrica took over gas sales and gas trading, services and retail businesses, together with the gas production operations in the North and South Morecambe gas fields (Rampside Gas Terminal).[4]

In 1998, Centrica's supplier monopoly for gas came to an end. Centrica maintained the British Gas retail brand but is only allowed to use this brand name in the United Kingdom. The electricity market also opened up to competition and, through the British Gas brand, the company started supplying its first domestic electricity customers.[5]

1998 to 2010

In the end of 1998, under CEO Sir Roy Gardner and Finance Director Mark Clare, Centrica attempted to diversify – firstly by developing the Goldfish credit card,[6] then in July 1999, by acquiring the AA for £1.1 billion.[7] In July 2001, Centrica further diversified with the opportunistic purchase of OneTel in the United Kingdom, a residential telecoms operator.[8]

Soon afterwards, Centrica acquired the Dyno franchise group (best known for its Dyno-Rod drains unblocking service).[9] Centrica also moved into the North American energy supply market, through the acquisition of the Canada-based company Direct Energy in July 2000, for £406 million.[10] Direct Energy's operations were subsequently considerably expanded through a number of further acquisitions, including of Enbridge Services for £437 million in January 2002.[11]

This strategy of diversification changed in the middle of 2003, possibly under pressure from major city shareholders to deliver better returns and/or possibly anticipating pressure on the core energy supply business. The change of strategy started with the sale of the Goldfish business to Lloyds TSB Bank[12] (who subsequently sold it to Morgan Stanley Bank International Limited).[13]

Then, in July 2004, Centrica sold the AA to two private equity firms; Luxembourgish CVC and British Permira for £1.75 billion.[14] Centrica then acquired Dyno-Rod in October 2004.[15] Then, in December 2005, Centrica sold their OneTel business to Carphone Warehouse.[16]

Since 2005, Centrica has declared a strategy of consolidating within the energy sector, upstream and downstream, including expanding operations overseas. New chairman Roger Carr replaced retiring chairman Sir Michael Perry in 2005, whilst new CEO Sam Laidlaw picked up the reins from retiring CEO Sir Roy Gardner in March 2006.[17]

In January 2006, it was rumoured that the Russian state owned utility company Gazprom was seeking a takeover of Centrica. This created controversy in the media, while the Department for Trade and Industry stated any deal would be subject to "intense scrutiny". Tony Blair announced in April that he would not block any potential deal.[18]

In September 2008, the company acquired the Caythorpe gas-producing field near Bridlington to use for storage purposes.[19] It also agreed to buy 20% of British Energy from EDF, financing this with a £2.2 billion, 3 for 8 rights issue.[20][21] The rights issue offered shares at 160 pence per share and closed on 12 December 2008.[22] In August 2009, Centrica took over Venture Production, a North Sea gas producer.[23]

2010 to present

On 13 June 2010 Centrica, through Direct Energy, acquired Clockwork Home Services. Combining with the existing energy offer made Centrica the largest provider of heating and cooling, plumbing and electrical services in North America.[24]

On 17 November 2010, Centrica acquired the assets of heat pump installation company Cool Planet Technologies Ltd. for £0.5 million in cash. This aimed to boost the company's strategy of developing a broad range of low carbon technologies and advice.[24]

In February 2011, Centrica signed a £2 billion three-year contract with Qatargas for the purchase of 2.4 million tonnes a year of liquefied natural gas.[25] In March 2011, Centrica agreed the sale of the electricity and gas supply business of its Netherlands-based subsidiary Oxxio to Eneco BV for €72 million (£63 million) in cash.[26] The sale completed Centrica's exit from the supply of electricity and gas in Continental Europe, following the earlier disposal of its supply businesses in Belgium and Spain.[26]

In November 2011, Centrica agreed to buy $1.6 billion stakes of 8 fields on the Norwegian continental shelf from Statoil ASA. In a second deal, Centrica agreed to buy 5 billion cubic meters a year gas from the same company from 2015 to 2025 as equal to 5% of gas consumption in the United Kingdom.[27] Centrica's Germany based trading division Centrica Energie GmbH was closed in April 2012.[28]

In July 2013, it was announced that Centrica would acquire the energy marketing unit of Hess Corporation for $1.03 billion.[29] In March 2014, Centrica acquired the retail arm and other assets belonging to Ireland's state owned Bord Gáis for a fee of around €1.1 billion.[30]

In 2010, Centrica entered into joint venture arrangements with Tullow Oil to explore for oil in the South Lokichar Basin in Kenya. In August 2014, Tullow, the operator, revealed significant oil discoveries had been made in the Etom 1 exploration well and testing block 10BB, which expanded the already proven South Lokichar Basin "significantly northwards," taking in an additional 247sq km.[31]

In 2013 Centrica established Hive as part of its Connected Home offering, building on its Remote Heating Control service provided through its British Gas subsidiary. Hive is one of the largest connected home providers in the UK and provides smart home technologies including a smart thermostat that allows customers to control heating and hot water in their homes via the company's website or app.

In February 2015, in light of significantly changed circumstances, a fundamental strategic review was launched. This focused on outlook and sources of growth; portfolio mix and capital intensity; operating capability and efficiency; and Group financial framework. The review was a thorough and rigorous analysis of the Group's prospects, led by Centrica's senior management. It concluded that Centrica's strength lay in being a customer-facing business and that all activities and priorities would focus on meeting customers' changing needs. The shape of the Group would be reworked to reflect this, including a Group-wide efficiency programme that would reduce employee numbers by around 6,000.[32]

Also in 2015, under its British Gas brand, Centrica completed the acquisition of AlertMe,[33] a UK-based connected home company that provided innovative energy management products and services. The net cost to British Gas was £44 million, taking into account an existing 21% holding in AlertMe. AlertMe provided the technical platform that underpinned British Gas' existing connected homes activity, including its remote heating control product, Hive Active Heating. The acquisition gave British Gas ownership and control over a scalable technology platform, software development capability, data analytics and a patent portfolio. The acquisition also enabled further development of connected homes products and services in other parts of the Centrica Group, through Direct Energy in North America, and Bord Gáis in the Republic of Ireland.

In November 2015, Direct Energy also acquired Panoramic Power,[34] a leading provider of device-level energy management technology, for $60 million (£39 million). The acquisition built upon an existing exclusive partnership in the US and provided Centrica with leading capabilities in energy management technology and data science expertise, in addition to full control over research and development activity.

In 2016, Centrica launched Local Heroes as part of a shift into more customer facing businesses.[32] Local Heroes is an online home services company working with local tradespeople in a variety of trades including plumbing, electricians and heating engineers.[33]

In 2016 Centrica acquired Neas Energy A/S (Neas), one of Europe's leading providers of energy management and revenue optimisation services for decentralised third-party owned assets. It also acquired ENER-G Cogen International Limited ("ENER-G Cogen"), an established supplier and operator of combined heat and power (CHP) systems and REstore NV, Europe's leading demand response aggregator. The acquisitions were part of Centrica's strategy to expand its route to market services in Europe, and to continue to utilise and build its knowledge of European energy markets to benefit from trading and optimisation activity.

In 2017 Centrica launched British Gas Lite, its first online-only energy offering to small businesses in the UK. [35]

In June 2017, it was announced that the CQ Energy Canada Partnership, the Canadian E&P joint venture in which Centrica plc owned a 60% interest, was to be sold to a consortium comprising MIE Holdings Corporation, The Can-China Global Resource Fund and Mercuria for a purchase price of C$722 million (£413 million) in cash.[36] In line with its strategy announced in July 2015, the divestment meant Centrica's E&P activity was now solely focused on European assets, with the Group having completed the sale of its gas assets in Trinidad and Tobago in May 2017.

On 21 June 2017, the company agreed to sell its operational Langage and South Humber Bank combined cycle gas turbine power stations, with a combined capacity of 2.3GW, to EP UK Investments Ltd for £318million in cash.[37] The transaction was consistent with Centrica's strategy to shift investment towards its customer facing businesses and to seek opportunities in flexible peaking units, energy storage and distributed generation whilst reducing focus on large scale central power generation.

On 11 December 2017 Centrica launched a new company as a joint venture with German energy and infrastructure firm Stadtwerke München (SWM)[38]. Spirit Energy, an exploration and production (E&P) company, is the result of a combination of Centrica's E&P business and Bayerngas Norge AS, which was formerly majority-owned by SWM. Centrica plc owns 69% of Spirit Energy, with Bayerngas Norge's former shareholders, led by SWM and Bayerngas GmbH, owning 31%.

The creation of Spirit Energy completed the first phase of Centrica's planned portfolio transformation, enabling the company to pursue delivery of longer-term returns and growth with a greater focus on its customer-facing businesses.

In December 2017, the Competition & Markets Authority agreed to grant Centrica plc and Centrica Storage Limited's (CSL's) request to be released from the Rough Undertakings. CSL decided that it could no longer operate Rough as a storage facility as the facility was no longer capable of safe injection operations due to the age and condition of the asset, and that due to the economics of seasonal storage and the cost of refurbishing or rebuilding the facility, neither pathway would be economic.[39]

Operations

Centrica's operations are principally focused on the supply of electricity and gas to businesses and consumers in the United Kingdom and North America. Centrica has some back-office functions located in India and South Africa.

Principal divisions and subsidiaries

North America

- Direct Energy – one of North America's largest energy and energy-related services providers with more than 4 million residential and commercial customers

- Bounce Energy

- First Choice Power

- WTU Retail Energy

- CPL Retail Energy

- Home Warranty America (HWA)

- One Hour Heating & Air Conditioning

- Mister Sparky

- Benjamin Franklin

- AWHR

United Kingdom

- British Gas – supplies gas and electricity and services to residential and business customers in the United Kingdom.

- Local Heroes - an online home services company working with local tradespeople in a variety of trades including plumbing, electricians and heating engineers.

- Hive - provides smart home technologies including a smart thermostat that allows customers to control heating and hot water in their homes via the company's website or app.[40]

- Dyno – A provider of plumbing and drains and formerly of lock, fire and burglar alarm, and glazing services before this was sold off.

- British Gas Insurance Limited[35]

- Centrica Storage – previously the United Kingdom's largest gas storage company, it operated the Rough facility for gas storage until last year. The Rough facility is now a production asset, the storage function having been discontinued in 2017 on safety grounds.[39]

Shareholdings

In May 2009, Centrica purchased a 20% stake in nuclear power generator British Energy from EDF Energy. The company now produces 14.3% of its electricity from nuclear (the second highest rate in the United Kingdom), helping it to achieve the lowest carbon emissions of the major providers.[41] Centrica has also acquired an option to purchase a 20% stake in EDF's subsidiary, NNB Generation Company (NNB GenCo).[42]

In December 2017 Centrica launched a new company as a joint venture with German energy and infrastructure firm Stadtwerke München (SWM). Spirit Energy, an exploration and production (E&P) company, is the result of a combination of Centrica's E&P business and Bayerngas Norge AS, which was formerly majority-owned by SWM. Centrica plc owns 69% of Spirit Energy, with Bayerngas Norge's former shareholders, led by SWM and Bayerngas GmbH, owning 31%.[43]

Senior management

Sam Laidlaw was the chief executive of Centrica between 1 July 2006 and 31 December 2014. In the financial year of 2010, Laidlaw received a total compensation of £1,841,000 from Centrica, comprising a salary of £941,000 and a bonus of £900,000.[44]

Iain Conn was appointed Group Chief Executive of Centrica on 1 January 2015. Iain was previously BP's chief executive, downstream (BP's refining and marketing division), a position he held for seven years.[45]

Controversies

Greenwash

British Gas was accused of greenwashing in the advertising of its Zero Carbon tariff in January 2008, after the Advertising Standards Association upheld a complaint about the 'greenest domestic tariff' claim.[46]

Customer complaint response

In July 2011, British Gas was fined £2.5 million by the energy regulator Ofgem for failing to deal properly with customer complaints.[40] After a year long investigation into the British Gas, Ofgem found it had breached regulations on how energy companies should handle disputes. Ofgem found that British Gas failed to re-open complaints from customers who indicated they felt the matter was not resolved adequately, failed to provide sufficient information to complainants about the energy ombudsman service, and failed to deal properly with complaints from micro businesses because it had not implemented the necessary processes and practices.[40]

A spokesperson for British Gas said the company felt that finding it in breach of rules for failing to provide adequate information to consumers about the energy ombudsman was "disproportionate to the mistake".[47]

British Gas Business was fined £1 million in July after Ofgem's investigation found the company had misreported the amount of electricity supplied under the British government's renewables obligation.[47] British Gas claims it spotted the problem – it said an over-reporting of the amount of renewable energy it was supplying caused by human error – and notified the regulator.[47]

Political activity

Centrica has entered the political arena by threatening an investment strike in response to the Labour Party's proposal for a price freeze. Caroline Flint, the shadow energy secretary, said: "It is not acceptable for companies to threaten that the lights will go out because they don't want greater transparency, competition and accountability".[48]

See also

References

- 1 2 3 "Preliminary Results 2017" (PDF). Retrieved 2 March 2018.

- ↑ "Gas, Light and Coke Company". Archives in the M25 area. AIM25.

- ↑ "30 SECOND GUIDE: Tell Sid". 2012-07-17. Retrieved 2012-12-29.

- ↑ "Green light for split British Gas divides with aim of conquering market". Herald Scotland. 13 February 1997. Retrieved 20 March 2016.

- ↑ "An alternative history of energy deregulation and energy price comparison in the UK". The energy shop. Retrieved 20 March 2016.

- ↑ "Centrica pays £85m for Goldfish data". BBC News. 6 August 2001. Retrieved 18 April 2011.

- ↑ "Power firm buys AA". BBC News. 5 July 1999. Retrieved 18 April 2011.

- ↑ Wray, Richard (4 July 2001). "Centrica purchase builds up telecoms business". The Guardian. UK. Retrieved 18 April 2011.

- ↑ This is Money (16 August 2004). "Dyno-Rod in Centrica's sights?". Daily Mail. Retrieved 18 April 2011.

- ↑ "Centrica plans £289m refinancing move at Enbridge". The Scotsman. 10 December 2002. Retrieved 11 February 2012.

- ↑ "Centrica picks up an extra 1.3m Canadian customers". The Scotsman. 29 January 2002. Retrieved 11 February 2012.

- ↑ "Rough ruling and Goldfish sale boost Centrica]" (PDF). Lloyds PLC. Retrieved 2015-01-15.

- ↑ "Lloyds TSB sells Goldfish brand". BBC News. 20 December 2005. Retrieved 18 April 2011.

- ↑ "Centrica gets bumper price for AA". BBC News. 1 July 2004. Retrieved 18 April 2011.

- ↑ "Centrica acquires Dyno-Rod". Archived from the original on 19 January 2013.

- ↑ "Carphone buys One-tel for £132m". BBC News. 19 December 2005. Retrieved 18 April 2011.

- ↑ "Centrica's new Chief Executive is outsider Sam Laidlaw". Businesswriter.wordpress.com. 14 March 2006. Retrieved 18 April 2011.

- ↑ Gazprom free to bid for Centrica The Daily Telegraph, 26 April 2006

- ↑ "Centrica buys old gas field". Yorkshire Post. 25 September 2008. Retrieved 18 April 2011.

- ↑ "Centrica looks to raise £2.2bn". BBC. 31 October 2008.

- ↑ "Approval from the OFT of Centrica's acquisition of 20% of British Energy from EDF". Centrica. 7 August 2008. Archived from the original on 15 August 2009.

- ↑ Centrica (November 2008). "Provisional Allotment Letter".

- ↑ "Venture offer – Centrica achieves 58.7 per cent. level". Centrica Plc. 24 August 2009. Archived from the original on 28 August 2009.

- ↑ "Direct Energy to acquire Clockwork Home Services". Centrica.com. 10 June 2010.

- ↑ "Centrica in £2bn Qatar gas deal". The Independent. 23 February 2011. Retrieved 11 February 2012.

- 1 2 "Centrica disposes of Dutch retail business". Centrica plc. Retrieved 11 February 2012.

- ↑ Gismatullin, Eduard; Lundgren, Kari (22 November 2011). "Centrica Agrees to Buy Norwegian Gas Fields From Statoil for $1.6 Billion". Bloomberg.

- ↑ "Centrica Energie GmbH". Centrica-energie.de. Archived from the original on 25 February 2007. Retrieved 21 February 2014.

- ↑ Gopinath, Swetha; Young, Sarah (30 July 2013). "Hess to sell Energy Marketing unit to UK's Centrica for $1.03 billion". Reuters.

- ↑ "Centrica buys Irish energy supplier as profits sink at home". Reuters. 25 March 2014. Retrieved 25 March 2014.

- ↑ "More oil discovery announced by Tullow in Kenya". Kenya Star. 28 August 2014. Retrieved 28 August 2014.

- ↑ "Interim Results 2015 and outcome of Strategic Review". www.centrica.com. Retrieved 2018-04-20.

- ↑ "British Gas to acquire connected homes company AlertMe". www.centrica.com. Retrieved 2018-04-20.

- ↑ "Direct Energy to acquire energy management solutions provider Panoramic Power". www.centrica.com. Retrieved 2018-04-20.

- ↑ "British Gas Lite - a new, online, cost effective product". www.centrica.com. Retrieved 2018-10-12.

- ↑ "Centrica agrees the sale of its Canadian E&P business". www.centrica.com. Retrieved 2018-04-20.

- ↑ "Centrica to sell Langage and South Humber Bank gas-fired power stations". www.centrica.com. Retrieved 2018-04-20.

- ↑ "Spirit Energy launched following completion of Centrica and Bayerngas Norge E&P joint venture". www.centrica.com. Retrieved 2018-04-20.

- 1 2 "Centrica and CSL welcome CMA's decision to terminate the Rough Undertakings". www.centrica.com. Retrieved 2018-04-20.

- ↑ Gilbert, David (2015-07-15). "#Hive gets a big update as @BritishGas make big move into connect home market". International Business Times UK. Retrieved 2018-04-20.

- ↑ "Fuel Mix Information". Electricity-guide.org.uk. Retrieved 21 February 2014.

- ↑ "Centrica to invest in EDF nuclear business in the UK". Centrica.com. 31 December 2013. Archived from the original on 25 November 2011. Retrieved 21 February 2014.

- ↑ Key, Alys (2017-12-11). "British Gas owner Centrica has launched a new company". Retrieved 2018-04-20.

- ↑ "Sam Laidlaw: Executive Profile & Biography". Bloomberg BusinessWeek. McGraw-Hill. Retrieved 2 September 2009.

- ↑ "Iain Conn | Centrica plc". www.centrica.com. Retrieved 2018-04-20.

- ↑ "ASA Adjudication on British Gas Trading Ltd". ASA. 30 January 2008. Archived from the original on 4 December 2008.

- 1 2 3 Insley, Jill (27 July 2011). "British Gas hits out at £2.5m Ofgem fine". The Guardian. London.

- ↑ Neate, Rupert (20 February 2014). "Energy chief: political wrangling raises UK blackout risk | Business". The Guardian. Retrieved 21 February 2014.