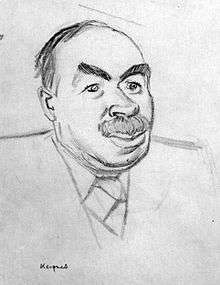

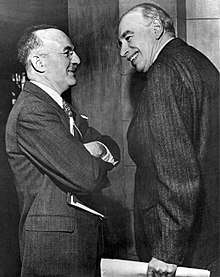

John Maynard Keynes, 1st Baron Keynes of Tilton (5 June 1883 – 21 April 1946) was a British economist whose ideas, known as Keynesian economics, had a major impact on modern economic and political theory and on many governments' fiscal policies.

Quotes

I work for a Government I despise for ends I think criminal.

- I work for a Government I despise for ends I think criminal.

- Letter to Duncan Grant (15 December 1917)

- That she [France] has anything to fear from Germany in the future which we can foresee, except what she may herself provoke, is a delusion. When Germany has recovered her strength and pride, as in due time she will, many years must pass before she again casts her eyes Westwards. Germany's future now lies to the East, and it is in that direction her hopes and ambitions, when they revive, will certainly turn.

- A Revision of the Treaty (London: Macmillan, 1922), p. 186

- The real struggle today, just as in the second quarter of the nineteenth century, is between a view of the world termed liberalism or radicalism, for which the primary object of government and of foreign policy is peace, freedom of trade and intercourse, and economic wealth and that other view, militarist or rather diplomatic, which thinks in terms of power, prestige, national or personal glory, the imposition of a culture and hereditary or racial prejudice. To the good English radical, the latter is so unreal, so crazy in its combination of futility and evil, that he is often in danger of forgetting or disbelieving its actual existence.

- published in Manchester Guardian (1922); in Collected Writings, Volume 17, p. 370

- When, therefore, we enter the realm of State action, everything is to be considered and weighed on its merits. Changes in death duties, income tax, land tenure, licensing, game laws, church establishment, feudal rights, slavery, and so on through all ages, have received the same denunciations from the absolutists of contract, who are the real parents of revolution.

- A Tract on Monetary Reform (1923), Ch. 2 : Public Finance and Changes in the Value of Money

But this long run is a misleading guide to current affairs. In the long run we are all dead.

- But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again.

- A Tract on Monetary Reform (1923), Ch. 3, p. 80

- Those who advocate the return to a gold standard do not always appreciate along what different lines our actual practice has been drifting. If we restore the gold standard, are we to return also to the pre-war conceptions of bank-rate, allowing the tides of gold to play what tricks they like with the internal price-level, and abandoning the attempt to moderate the disastrous influence of the credit-cycle on the stability of prices and employment? Or are we to continue and develop the experimental innovations of our present policy, ignoring the "bank ration" and, if necessary, allowing unmoved a piling up of gold reserves far beyond our requirements or their depletion far below them?

- In truth, the gold standard is already a barbarous relic.

- A Tract on Monetary Reform (1923), p. 172

- He was the nicest, and the only talented person I saw in all Berlin, except perhaps old Fuerstenberg … and Kurt Singer. And he was a Jew; and so was Fuerstenberg. And my dear Melchior is a Jew too. Yet if I lived there, I felt I might turn anti-Semite. For the poor Prussian is too slow and heavy on his legs for the other kind of Jews, the ones who are not imps but serving devils, with small horns, pitch forks, and oily tails. It is not agreeable to see civilization so under the ugly thumbs of its impure Jews who have all the money and the power and brains. I vote rather for the plump hausfraus and thick fingered Wandering Birds. But I am not sure that I wouldn’t even rather be mixed up with Lloyd George than with the German political Jews.

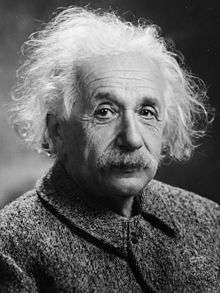

- Notes after a meeting with Albert Einstein in 1926, The Collected Writings of John Maynard Keynes, Vol. 10, p. 383

- The ignorance of even the best-informed investor about the more remote future is much greater than his knowledge, and he cannot but be influenced to a degree which would seem wildly disproportionate to anyone who really knew the future, and be forced to seek a clue mainly here to trends further ahead. But if this is true of the best-informed, the vast majority of those who are concerned with the buying and selling of securities know almost nothing whatever about what they are doing. They do not possess even the rudiments of what is required for a valid judgement, and are the prey of hopes and fears easily aroused by transient events and as easily dispelled.

- A Treatise on Money, Volume II (1930), pp. 360–61

- Words ought to be a little wild, for they are the assault of thoughts on the unthinking.

- National self-sufficiency, New Statesman and Nation (15 July 1933)

- The decadent international but individualistic capitalism in the hands of which we found ourselves after the war is not a success. It is not intelligent. It is not beautiful. It is not just. It is not virtuous. And it doesn't deliver the goods. In short we dislike it, and we are beginning to despise it. But when we wonder what to put in its place, we are extremely perplexed.

- National self-sufficiency (1933) Section 3, republished in Collected Writings Vol. 11 (1982).

- Nothing mattered except states of mind, chiefly our own.

- On the Cambridge Apostles of Cambridge University, in Essays in Biography (1933) Ch. 39; also later used in My Early Beliefs, a memoir he read to the Bloomsbury Group's Memoir Club in 1943.

- Shaw and Stalin are still satisfied with Marx’s picture of the capitalist world… They look backwards to what capitalism was, not forward to what it is becoming.

- “Stalin-Wells Talk: The Verbatim Report and A Discussion”, G.B. Shaw, J.M. Keynes et al., London, The New Statesman and Nation, (1934) p. 34

- Communism draws its strength from deeper, more serious sources. Offered to us as a means of improving the economic situation, it is an insult to our intelligence. But offered as a means of making the economic situation worse, that is its subtle, its almost irresistible, attraction. Communism is not a reaction against the failure of the nineteenth century to organize optimal economic output. It is a reaction against its comparative success.

- “Stalin-Wells Talk: The Verbatim Report and A Discussion”, G.B. Shaw, J.M. Keynes et al., London, The New Statesman and Nation, (1934) p. 35

- The boys, who cannot grow up to adult human nature, are beating the prophets of the ancient race — Marx, Freud, Einstein — who have been tearing at our social, personal and intellectual roots, tearing with an objectivity which to the healthy animal seems morbid, depriving everything, as it seems, of the warmth of natural feeling. What traditional retort have the schoolboys but a kick in the pants? ...

To our generation Einstein has been made to become a double symbol — a symbol of the mind travelling in the cold regions of space, and a symbol of the brave and generous outcast, pure in heart and cheerful of spirit. Himself a schoolboy, too, but the other kind — with ruffled hair, soft hands and a violin. See him as he squats on Cromer beach doing sums, Charlie Chaplin with the brow of Shakespeare...

So it is not an accident that the Nazi lads vent a particular fury against him. He does truly stand for what they most dislike, the opposite of the blond beast — intellectualist, individualist, supernationalist, pacifist, inky, plump... How should they know the glory of the free-ranging intellect and soft objective sympathy to whom money and violence, drink and blood and pomp, mean absolutely nothing? Yet Albert and the blond beast make up the world between them. If either cast the other out, life is diminished in its force. When the barbarians destroy the ancient race as witches, when they refuse to scale heaven on broomsticks, they may be dooming themselves to sink back into the clods which bore them.- Collected Writings volume xxviii pages 21-22

- Economics is a science of thinking in terms of models joined to the art of choosing models which are relevant to the contemporary world. It is compelled to be this, because, unlike the typical natural science, the material to which it is applied is, in too many respects, not homogeneous through time. The object of a model is to segregate the semi-permanent or relatively constant factors from those which are transitory or fluctuating so as to develop a logical way of thinking about the latter, and of understanding the time sequences to which they give rise in particular cases.

Good economists are scarce because the gift for using "vigilant observation" to choose good models, although it does not require a highly specialised intellectual technique, appears to be a very rare one.- Letter to Roy Harrod (4 July 1938), in The Collected Writings of John Maynard Keynes, Vol. XIV (1971), p. 297

- It is a grand book worthy of one’s hopes of you. A most powerful piece of well organized analysis with high aesthetic qualities, though written more perhaps than you see yourself for the cognoscenti in the temple and not for those at the gate. Anyhow I prefer it for intellectual enjoyment to any recent attempts in this vein.

- Letter to Abba Lerner, 1942, On The Economics of Control

- The old saying holds. Owe your banker £1000 and you are at his mercy; owe him £1 million and the position is reversed.

- "Overseas Financial Policy in Stage III" (unpublished memo distributed to the British Cabinet on 15 May 1945, in Collected Writings volume 24, p. 258).

- If you owe your bank manager a thousand pounds, you are at his mercy. If you owe him a million pounds, he is at your mercy.

- Variant reported in Time magazine, Monday, Feb. 17, 1947

- If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.

- As quoted in The Economist (13 February 1982), p. 11

The day is not far off when the economic problem will take the back seat where it belongs...

- The day is not far off when the economic problem will take the back seat where it belongs, and the arena of the heart and the head will be occupied or reoccupied, by our real problems — the problems of life and of human relations, of creation and behaviour and religion.

- First Annual Report of the Arts Council (1945-1946)

- They offer me neither food nor drink — intellectual nor spiritual consolation... [Conservatism] leads nowhere; it satisfies no ideal; it conforms to no intellectual standard, it is not safe, or calculated to preserve from the spoilers that degree of civilisation which we have already attained.

- On the Conservative Party; Skidelsky (1992:231) quoting Collected Writings Volume IX page 296-297

- There was an attraction at first that Mr Baldwin should not be clever. But when he forever sentimentalises about his own stupidity, the charm is broken.

- Skidelsky (1992:232) quoting Keynes Papers PS/6

- The book, as it stands, seems to me to be one of the most frightful muddles I have ever read, with scarcely a sound proposition in it beginning with page 45 [Hayek provided historical background up to page 45; after that came his theoretical model], and yet it remains a book of some interest, which is likely to leave its mark on the mind of the reader. It is an extraordinary example of how, starting with a mistake, a remorseless logician can end up in bedlam.

- On Friedrich Hayek's Prices and Production, in Collected Writings, vol. XII, p. 252

- His peculiar gift was the power of holding continuously in his mind a purely mental problem until he had seen it through.

- "Newton, the Man"; address to the Royal Society Club (1942), read by Geoffrey Keynes at the Newton Tercentenary Celebrations (1946)

- Newton was not the first of the age of reason. He was the last of the magicians, the last of the Babylonians and Sumerians, the last great mind that looked out on the visible and intellectual world with the same eyes as those who began to build our intellectual inheritance rather less than 10 000 years ago.

- "Newton, the Man"; address to the Royal Society Club (1942), read by Geoffrey Keynes at the Newton Tercentenary Celebrations (1946)

The Economic Consequences of the Peace (1919)

Perhaps a day might come when there would be at last be enough to go round, and when posterity could enter into the enjoyment of our labors.

Men will not always die quietly.

- The power to become habituated to his surroundings is a marked characteristic of mankind.

- Chapter I, p. 3

- The great events of history are often due to secular changes in the growth of population and other fundamental economic causes, which, escaping by their gradual character the notice of contemporary observers, are attributed to the follies of statesmen or the fanaticism of atheists.

- Chapter II, Section I, pp. 14-15

- The disruptive powers of excessive national fecundity may have played a greater part in bursting the bonds of convention than either the power of ideas or the errors of autocracy.

- Chapter II, Section I, p. 15

- The immense accumulations of fixed capital which, to the great benefit of mankind, were built up during the half century before the war, could never have come about in a Society where wealth was divided equitably.

- Chapter II, Section III, p. 19

- The duty of "saving" became nine-tenths of virtue and the growth of the cake the object of true religion.

- Chapter II, Section III, p. 20

- Perhaps a day might come when there would be at last be enough to go round, and when posterity could enter into the enjoyment of our labors.

- Chapter II, Section III, p. 21

- He had one illusion — France; and one disillusion — mankind, including Frenchmen, and his colleagues not least.

- On Georges Clemenceau, in Chapter III, p. 32

- The glory of the nation you love is a desirable end, — but generally to be obtained at your neighbor's expense.

- Chapter III, p. 33

- To see the British Prime Minister watching the company, with six or seven senses not available to ordinary men, judging character, motive, and subconscious impulse, perceiving what each was thinking and even what each was going to say next, and compounding with telepathic instinct the argument or appeal best suited to the vanity, weakness, or self-interest of his immediate auditor, was to realize that the poor President would be playing blind man's bluff in that party.

- On David Lloyd George and Woodrow Wilson, in Chapter III, p. 41

- The future life of Europe was not their concern; its means of livelihood was not their anxiety. Their preoccupations, good and bad alike, related to frontiers and nationalities, to the balance of power, to imperial aggrandizements, to the future enfeeblement of a strong and dangerous enemy, to revenge, and to the shifting by the victors of their unbearable financial burdens on to the shoulders of the defeated.

- Chapter IV, p. 56

- The division of the spoils between the victors will also provide employment for a powerful office, whose doorsteps the greedy adventurers and jealous concession hunters of twenty or thirty nations will crowd and defile.

- Chapter IV, Section I, p. 77

- But the dreams of designing diplomats do not always prosper, and we must trust the future.

- Chapter IV, Section III, p. 105

- Men will not always die quietly.

- Chapter VI, p. 228

- Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become 'profiteers,' who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.- Chapter VI, pp. 235-236

- Perhaps it is historically true that no order of society ever perishes save by its own hand.

- Chapter VI, p. 238

- Economic privation proceeds by easy stages, and so long as men suffer it patiently the outside world cares little.

- Chapter VI, p. 250

- The forces of the nineteenth century have run their course and are exhausted.

- Chapter VII, p. 254

- If we aim deliberately at the impoverishment of Central Europe, vengeance, I dare predict, will not limp.

- Chapter VII, Section 1, p. 268

Essays in Persuasion (1931)

- Money is only important for what it will procure. Thus a change in the monetary unit, which is uniform in its operation and affects all transactions equally, has no consequences. If, by a change in the established standard of value, a man received and owned twice as much money as he did before in payment for all rights and for all efforts, and if he also paid out twice as much money for all acquisitions and for all satisfactions, he would be wholly unaffected.

- "Social Consequences of Changes in The Value of Money" (1923)

- During the lengthy process of production the business world is incurring outgoings in terms of money-paying out in money for wages and other expenses of production-in the expectation of recouping this outlay by disposing of the product for money at a later date. That is to say, the business world as a whole must always be in a position where it stands to gain by a rise of price and to lose by a fall of price. Whether it likes it or not, the technique of production under a regime of money-contract forces the business world always to carry a big speculative position; and if it is reluctant to carry this position, the productive process must be slackened.

- "Social Consequences of Changes in The Value of Money" (1923)

- The best way to cure this mortal disease of individualism must be to provide that there shall never exist any confident expectation either that prices generally are going to fall or that they are going to rise; and also that there shall be no serious risk that a movement, if it does occur, will be a big one. If, unexpectedly and accidentally, a moderate movement were to occur, wealth, though it might be redistributed, would not be diminished thereby.

- "Social Consequences of Changes in The Value of Money" (1923)

- Inflation is unjust and Deflation is inexpedient. Of the two perhaps Deflation is, if we rule out exaggerated inflations such as that of Germany, the worse; because it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier. But it is not necessary that we should weigh one evil against the other. It is easier to agree that both are evils to be shunned.

- "Social Consequences of Changes in The Value of Money" (1923)

- This is a nightmare, which will pass away with the morning. For the resources of nature and men's devices are just as fertile and productive as they were. The rate of our progress towards solving the material problems of life is not less rapid. We are as capable as before of affording for everyone a high standard of life … and will soon learn to afford a standard higher still. We were not previously deceived. But to-day we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time — perhaps for a long time.

- "The Great Slump of 1930" (1930); appeared in the Nation and Athenaeum (1930) ; Referring to economics and the Great Depression

- This state of affairs is not an inevitable consequence of a decreased capacity to produce wealth. I see no reason why, with good management, real wages need be reduced on the average. It is the consequence of a misguided monetary policy.

- "The Economic Consequences of Mr. Churchill" (1925)

- By what modus operandi does credit restriction attain this result? In no other way than by the deliberate intensification of unemployment.

- "The Economic Consequences of Mr. Churchill" (1925)

- Why should coal miners suffer a lower standard of life than other classes of labour? They may be lazy, good-for-nothing fellows who do not work so hard or so long as they should. But is there any evidence that they are more lazy or more good-for-nothing than other people?

On grounds of social justice, no case can be made out for reducing. the wages of the miners. They are the victims of the economic Juggernaut. They represent in the flesh the "fundamental adjustments" engineered by the Treasury and the Bank of England to satisfy the impatience of the City fathers to bridge the "moderate gap" between $4.40 and $4.86. They (and others to follow) are the "moderate sacrifice" still necessary to ensure the stability of the gold standard. The plight of the coal miners is the first, but not—unless we are very lucky—the last, of the Economic Consequences of Mr. Churchill.- "The Economic Consequences of Mr. Churchill" (1925)

- Are the solutions offered us always to be too late? Shall we in Great Britain invite three-quarters of the world, including the whole of our Empire, to join with us in evolving a new currency system which shall be stable in terms of commodities? Or would the gold standard countries be interested to learn the terms, which must needs be strict, on which we should be prepared to re-enter the system of a drastically reformed gold standard?

- "The End of Gold Standard" (1931)

- Leninism is a combination of two things which Europeans have kept for some centuries in different compartments of the soul — religion and business. We are shocked because the religion is new, and contemptuous because the business, being subordinated to the religion instead of the other way round, is highly inefficient.

- "A Short View of Russia" (1925); Originally three essays for the Nation and Athenaeum, later published separately as A Short View of Russia (1925), then edited down for publication in Essays in Persuasion (1931)

- Comfort and habits let us be ready to forgo, but I am not ready for a creed which does not care how much it destroys the liberty and security of daily life, which uses deliberately the weapons of persecution, destruction and international strife. How can I admire a policy which finds a characteristic expression in spending millions to suborn spies in every family and group at home, and to stir up trouble abroad?

- "A Short View of Russia" (1925); Originally three essays for the Nation and Athenaeum, later published separately as A Short View of Russia (1925), then edited down for publication in Essays in Persuasion (1931)

- How can I accept a doctrine which sets up as its bible, above and beyond criticism, an obsolete economic textbook which I know to be not only scientifically erroneous but without interest or application for the modern world? How can I adopt a creed which, preferring the mud to the fish, exalts the boorish proletariat above the bourgeois and the intelligentsia who, with whatever faults, are the quality in life and surely carry the seeds of all human advancement?

- "A Short View of Russia" (1925); Originally three essays for the Nation and Athenaeum, later published separately as A Short View of Russia (1925), then edited down for publication in Essays in Persuasion (1931)

- I can be influenced by what seems to me to be justice and good sense; but the class war will find me on the side of the educated bourgeoisie.

- "Am I a Liberal?" (1925)

- A study of the history of opinion is a necessary preliminary to the emancipation of the mind.

- "The End of Laissez-faire" (1926); Full text online; Ch. 1

- I do not know which makes a man more conservative — to know nothing but the present, or nothing but the past.

- "The End of Laissez-faire" (1926); Full text online; Ch. 1

- The phrase laissez-faire is not to be found in the works of Adam Smith, of Ricardo, or of Malthus. Even the idea is not present in a dogmatic form in any of these authors. Adam Smith, of course, was a Free Trader and an opponent of many eighteenth-century restrictions on trade. But his attitude towards the Navigation Acts and the usury laws shows that he was not dogmatic. Even his famous passage about 'the invisible hand' reflects the philosophy which we associate with Paley rather than the economic dogma of laissez-faire.

- "The End of Laissez-faire" (1926); Full text online; Ch. 2

- Marxian Socialism must always remain a portent to the historians of Opinion — how a doctrine so illogical and so dull can have exercised so powerful and enduring an influence over the minds of men, and, through them, the events of history.

- "The End of Laissez-faire" (1926); Full text online; Ch. 3

- For my part I think that capitalism, wisely managed, can probably be made more efficient for attaining economic ends than any alternative system yet in sight, but that in itself it is in many ways extremely objectionable.

- "The End of Laissez-faire" (1926); Full text online; Ch. 5

- Most men love money and security more, and creation and construction less, as they get older.

- "Clissold" (1927); appeared in the Nation and Athenaeum (1927)

- When the accumulation of wealth is no longer of high social importance, there will be great changes in the code of morals. We shall be able to rid ourselves of many of the pseudo-moral principles which have hag-ridden us for two hundred years, by which we have exalted some of the most distasteful of human qualities into the position of the highest virtues. We shall be able to afford to dare to assess the money-motive at its true value. The love of money as a possession — as distinguished from the love of money as a means to the enjoyments and realities of life — will be recognised for what it is, a somewhat disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease … But beware! The time for all this is not yet. For at least another hundred years we must pretend to ourselves and to everyone that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still. For only they can lead us out of the tunnel of economic necessity into daylight.

- "Economic Possibilities for our Grandchildren" (1930); appeared in the Nation and Athenaeum (1930); as quoted in "Keynes and the Ethics of Capitalism" by Robert Skidelsy

- If economists could manage to get themselves thought of as humble, competent people on a level with dentists, that would be splendid.

- "Economic Possibilities for our Grandchildren" (1930); appeared in the Nation and Athenaeum (1930)

- For many ages to come the old Adam will be so strong in us that everybody will need to do some work if he is to be contented. We shall do more things for ourselves than is usual with the rich to-day, only too glad to have small duties and tasks and routines. But beyond this, we shall endeavour to spread the bread thin on the butter-to make what work there is still to be done to be as widely shared as possible. Three-hour shifts or a fifteen-hour week may put off the problem for a great while. For three hours a day is quite enough to satisfy the old Adam in most of us!

- "Economic Possibilities for our Grandchildren" (1930); appeared in the Nation and Athenaeum (1930)

Essays In Biography (1933)

- I have sought with some touches of detail to bring out the solidarity and historical continuity of the High Intelligentsia of England, who have built up the foundations of our thought in the two and a half centuries, since Locke, in his Essay Concerning Human Understanding, wrote the first modern English book. I relate below the amazing progeny of Sir George Villiers. But the lineage of the High Intelligentsia is hardly less interbred and spiritually inter-mixed. Let the Villiers Connection fascinate the monarch or the mob and rule, or seem to rule, passing events. There is also a pride of sentiment to claim spiritual kinship with the Locke Connection and that long English line, intellectually and humanly linked with one another, to which the names in my second section belong. If not the wisest, yet the most truthful of men. If not the most personable, yet the queerest and sweetest. If not the most practical, yet of the purest public conscience. If not of high artistic genius, yet the most solid and sincere accomplishment within many of the fields which are ranged by the human mind.

- Preface, p. viii

- If Mr. Lloyd George had no good qualities, no charms, no fascinations, he would not be dangerous. If he were not a syren, we need not fear the whirlpools.

- "Mr. Lloyd George: A Fragment", p. 35; Originally published in The Nation and the Athenaeum, May 26, 1923.

- All the political parties alike have their origins in past ideas and not in new ideas — and none more conspicuously so than the Marxists.

- "Trotsky On England", p. 91; Originally published in The Nation and the Athenaeum, March 27, 1926.

- The next move is with the head, and fists must wait.

- "Trotsky On England", p. 91;

- Economics is a very dangerous science.

- "Robert Malthus: The First of the Cambridge Economists", p. 128

- Adam Smith and Malthus and Ricardo! There is something about these three figures to evoke more than ordinary sentiments from us their children in the spirit.

- "Robert Malthus: The First of the Cambridge Economists", p. 148

- The study of economics does not seem to require any specialized gifts of an unusually high order. Is it not, intellectually regarded, a very easy subject compared with the higher branches of philosophy and pure science? Yet good, or even competent, economists are the rarest of birds. An easy subject, at which very few excel! The paradox finds its explanation, perhaps, in that the master-economist must possess a rare combination of gifts. He must reach a high standard in several different directions and must combine talents not often found together. He must be mathematician, historian, statesman, philosopher – in some degree. He must understand symbols and speak in words. He must contemplate the particular in terms of the general, and touch abstract and concrete in the same flight of thought. He must study the present in the light of the past for the purposes of the future. No part of man's nature or his institutions must lie entirely outside his regard. He must be purposeful and disinterested in a simultaneous mood; as aloof and incorruptible as an artist, yet sometimes as near the earth as a politician. Much, but not all, of this many-sidedness Marshall possessed. But chiefly his mixed training and divided nature furnished him with the most essential and fundamental of the economist's necessary gifts – he was conspicuously historian and mathematician, a dealer in the particular and the general, the temporal and the eternal, at the same time.

- "Alfred Marshall", p. 170; as cited in: Donald Moggridge (2002), Maynard Keynes: An Economist's Biography, p. 424; Originally published in The Economic Journal, September 1924

- There is no harm in being sometimes wrong — especially if one is promptly found out.

- "Alfred Marshall", p. 175

- Jevons saw the kettle boil and cried out with the delighted voice of a child; Marshall too had seen the kettle boil and sat down silently to build an engine.

- "Alfred Marshall", p. 188

- Economists must leave to Adam Smith alone the glory of the Quarto, must pluck the day, fling pamphlets into the wind, write always sub specie temporis, and achieve immortality by accident, if at all.

- "Alfred Marshall", p. 212

- The general theory of economic equilibrium was strengthened and made effective as an organon of thought by two powerful subsidiary conceptions — the Margin and Substitution. The notion of the Margin was extended beyond utility to describe the equilibrium point in given conditions of any economic factor which can be regarded as capable of small variations about a given value,or in its functional relation to a given value.

- "Alfred Marshall", p. 223

- There were endless possibilities, not out of reach.

- "Alfred Marshall", p. 253

- The atomic hypothesis which had worked so splendidly in Physics breaks down in Psychics.

- "Francis Ysidro Edgeworth", p. 286; Originally published in The Economic Journal, March 1926

- Logic, like lyrical poetry, is no employment for the middle-aged,

- "F. P. Ramsey", p. 296; Originally published in The Economic Journal, March 1930. and The New Statesman and Nation, October 3, 1931

- I don't feel the least humble before the vastness of the heavens.

- "F. P. Ramsey", p. 310; Originally published in The Economic Journal, March 1930. and The New Statesman and Nation, October 3, 1931

The General Theory of Employment, Interest and Money (1936)

- The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back. I am sure that the power of vested interests is vastly exaggerated compared with the gradual encroachment of ideas. Not, indeed, immediately, but after a certain interval; for in the field of economic and political philosophy there are not many who are influenced by new theories after they are twenty-five or thirty years of age, so that the ideas which civil servants and politicians and even agitators apply to current events are not likely to be the newest. But, soon or late, it is ideas, not vested interests, which are dangerous for good or evil.

- Ch. 24 "Concluding Notes" p. 383-384

How to Pay for the War (1940)

- It is not easy for a free community to organise for war. We are not accustomed to listen to experts or prophets. Our strength lies in an ability to improvise. Yet an open mind to untried ideas is also necessary. No-one can say when the end will come. In the war services it is recognised that the best security for an early conclusion is a plan for long endurance.

- Ch. 1 : The Character of the Problem

- Courage will be forthcoming if tile leaders of opinion in all parties will summon out of tile fatigue and confusion of war enough lucidity of mind to understand for themselves and to explain to tile public what is required; and then propose a plan conceived in a spirit of social justice, a plan which uses a time of general sacrifice, not as an excuse for postponing desirable reforms, but as an opportunity for moving further than we have moved hitherto towards reducing in equalities.

- Ch. 1 : The Character of the Problem

- Nothing can be settled in isolation. Every use of our resources is at the expense of an alternative use.

- Ch. 1 : The Character of the Problem

- It is extraordinarily difficult to secure the right outcome for this resultant of many separate policies. It depends on weighing one advantage against another. There is hardly a conceivable decision within the range of the supply services which does not affect it.

- Ch. 1 : The Character of the Problem

- In peace time, that is to say, the size of the cake depends on the amount of work done. But in war time the size of the cake is fixed. If we work harder, we can fight better. But we must not consume more.

- Ch. 1 : The Character of the Problem

- The general character of our solution must be, therefore, that it withdraws from expenditure a proportion of the increased earnings. This is the only way, apart from shortages of goods or higher prices, by which we can secure a balance between money to be spent and goods to be bought.

- Ch. 2 : The Character of the Solution

- In order to calculate the size of the cake which will be left for civilian consumption, we have to estimate (1) the maximum current output that we are capable of organising from our resources of men and plant and materials, (2) how fast we can safely draw on our foreign reserves by importing more than we export, (3) how much of all this will be used up by our war effort.

- Ch. 3 : Our Output Capacity and the National Income

- The nature of unemployment today is totally different from what it was a year ago. It is no longer caused by a deficiency of demand. There is no longer a potential surplus supply of the things we want. The transition to full employment is hindered by two obstacles. The first is due to the difficulty of shifting labour to the points where it is wanted. The second— and, for the time being, the chief—-obstacle is caused by the difficulties, other than the shortage of labour, in the way of existing demand becoming effective.

- Ch. 3 : Our Output Capacity and the National Income

- I have now reached a stage in the argument where I have to choose between being too definite or being too vague. If I set forth a concrete proposal in all its particulars, I expose myself to a hundred criticisms on points not essential to the principle of the plan. If I go further in the use of figures for illustration, I am involved more and more in guess-work; and I run the risk of getting the reader bogged in details which may be inaccurate and could certainly be amended without injury to the main fabric. Yet if I restrict myself to generalities, I do not give the reader enough to bite on; and am in fact shirking the issue, since the size, the order of magnitude, of the factors involved is not an irrelevant detail.

- Ch. 5 : A Plan for Deferred Pay, Family, Allowances and a Cheap Ration

- For each individual it is a great advantage to retain the rights over the fruits of his labour even though he must put off the enjoyment of them. His personal wealth is thus increased. For that is what wealth is,—command of the right to postponed consumption.

- Ch. 5 : A Plan for Deferred Pay, Family, Allowances and a Cheap Ration

- For the Trade Unions such a scheme as this offers great and evident advantages compared with progressive inflation or with a wages tax. In spite of the demands of war, the workers would have secured the enjoyment, sooner or later, of a consumption fully commensurate with their increased effort; whilst family allowances and the cheap ration would actually improve, even during the war, the economic position of the poorer families. We should have succeeded in making the war an opportunity for a positive social improvement. How great a benefit in comparison with a futile attempt to evade a reasonable share of the burden of a just war, ending in a progressive inflation!

- Ch. 5 : A Plan for Deferred Pay, Family, Allowances and a Cheap Ration

- The appropriate time for the ultimate release of the deposits will have arrived at the onset of the first post-war slump.

- Ch. 7 : The Release of Deferred Pay and a Capital Levy

- The mechanism of reaching equilibrium by means of a rising cost of living, which is vainly pursued by a rising level of wages, will be described in the next chapter. But it is admitted on all hands that this is the worst possible solution.

- Ch. 8 : Rationing Price Control and Wage Control

Attributed

- Capitalism is “the astonishing belief that the nastiest motives of the nastiest men somehow or other work for the best results in the best of all possible worlds.”

- Attributed by Sir George Schuster, Christianity and human relations in industry (1951), p. 109

- Recent variant: Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.

- As quoted in Moving Forward: Programme for a Participatory Economy (2000) by Michael Albert, p. 128

When my information changes, I alter my conclusions. What do you do, sir?

- Ideas shape the course of history.

- As quoted in The Peter Plan: A Proposal for Survival (1976) by Laurence J. Peter, p. 97

- The avoidance of taxes is the only intellectual pursuit that still carries any reward.

- As quoted in A Dictionary of Scientific Quotations (1977) by Alan L. MacKay, p. 140

- Education is the inculcation of the incomprehensible into the ignorant by the incompetent.

- From hearer's memory in Jewish Frontier, vol. 29 (1962).

- Alternate version: Education: the inculcation of the incomprehensible into the indifferent by the incompetent.

- As quoted in Infinite Riches: Gems from a Lifetime of Reading (1979) by Leo Calvin Rosten, p. 165

- I don't really start until I get my proofs back from the printers. Then I can begin my serious writing.

- As quoted in The Guardian (8 June 1983). p. 82

- When my information changes, I alter my conclusions. What do you do, sir?

- Reply to a criticism during the Great Depression of having changed his position on monetary policy, as quoted in "The Keynes Centenary" by Paul Samuelson, in The Economist Vol. 287 (June 1983), p. 19; later in The Collected Scientific Papers of Paul Samuelson, Volume 5 (1986), p. 275; also in Understanding Political Development: an Analytic Study (1987) by Myron Weiner, Samuel P. Huntington and Gabriel Abraham Almond, p. xxiv; this has also been paraphrased as "When the facts change, I change my mind. What do you do, sir?"

My only regret is that I have not drunk more champagne in my life.

- You can't push on a string.

- Attributed by Varian, Hal R. (June 5, 2003). "Dealing with Deflation". The New York Times. Retrieved on 2007-01-11.

- Successful investing is anticipating the anticipations of others.

- As quoted in Isms (2006) by Gregory Bergman, p. 105

- Markets can remain irrational longer than you can remain solvent.

- As quoted in When Genius Failed (2000) by Roger Lowenstein, p. 123; actually "Markets can remain irrational a lot longer than you and I can remain solvent." from A. Gary Shilling, Forbes (1993) v. 151, iss. 4, p. 236; and again A. Gary Shilling in Semi information services seminar transcript, January 23 - 26, 1983: Newport Beach Marriott Hotel, Newport Beach, California p. 384 "... and the markets usually do anticipate recoveries. They've anticipated twelve of the last eight, I think. Of course, you need to keep in mind that the stock market can remain irrational a lot longer than you can remain solvent."

- My only regret is that I have not drunk more champagne in my life.

- At a King's College college feast, as quoted in 1949, John Maynard Keynes, 1883-1946, Fellow and Bursar, (A memoir prepared by direction of the Council of King’s College, Cambridge University, England), Cambridge University Press, 1949, page 37. This in turn quoted in Quote Investigator, "My Only Regret Is That I Have Not Drunk More Champagne In My Life", 2013-07-11

- If farming were to be organised like the stock market, a farmer would sell his farm in the morning when it was raining, only to buy it back in the afternoon when the sun came out.

- Attributed by Hutton, Will (November 2, 2008). "Will the real Keynes stand up, not this sad caricature?". Guardian. Retrieved on 2009-02-05.

- Actual quote: "the Stock Exchange revalues many investments every day and the revaluations give a frequent opportunity to the individual (though not to the community as a whole) to revise his commitments. It is as though a farmer, having tapped his barometer after breakfast, could decide to remove his capital from the farming business between 10 and 11 in the morning and reconsider whether he should return to it later in the week."

- We will not have any more crashes in our time.

- Conversation with Felix Somary in 1927, reported in Felix Somary, The Raven of Zurich, London: C. Hurst, 1986 (1960), 146-7

Misattributed

- It is better to be roughly right than precisely wrong.

- Not attributed to Keynes until after his death. The original quote comes from Carveth Read and is:

- It is better to be vaguely right than exactly wrong.

Quotes about Keynes

No one embodied the Cambridge spirit of culture, fun, and public duty so much as Maynard Keynes. No one was more brilliant or charming. No economist in this century influenced politicians or the course of economics more. ~ Todd G. Buchholz

No one in our age was cleverer than Keynes nor made less attempt to conceal it. ~ R. F. Harrod

- Sorted alphabetically by author or source

He was an economist, of course — a Cambridge don with all the dignity and erudition that go with such an appointment; but when it came to choosing a wife he eschewed the ladies of learning and picked the leading ballerina from Diaghilev’s famous company. ~ Robert L. Heilbroner

Keynes's intellect was the sharpest and clearest that I have ever known. When I argued with him, I felt that I took my life in my hands, and I seldom emerged without feeling something of a fool. ~ Bertrand Russell

- His [Keynes's] own leisure was admirably as it was variously employed: in inspecting his pigs; in attending a sale of pictures; in perusing (unlike some bibliophiles) a minor Elizabethan poet, his latest acquisition; in listening to a piano recital, recumbent in a box of the theatre he had built; in gossip and good talk and a glass of wine. ‘My only regret’, he said at the close of a College feast, ‘is that I have not drunk more champagne in my life.’ And so it was that he knew what leisure could give and desired that all should share the gift.

- King's College (University of Cambridge). John Maynard Keynes, 1883-1946: Fellow and Bursar. King's College at the University Press, 1949.

- Following the financial crisis of September 2008 when the American investment bank Lehman Brothers collapsed, threatening to engulf the entire banking system, the British economist John Maynard Keynes returned to center stage. In the popular press and in the writings of many economists, Keynes featured prominently as governments around the world urgently sought ways to avoid economic collapse.

- Roger E. Backhouse and Bradley W. Bateman, Ch. 1 : "Keynes Returns, but Which Keynes?" Capitalist revolutionary : John Maynard Keynes (2011)

- Keynes was a man of prodigious intellectual gifts, who straddled the worlds of banking, politics, the City, journalism and the arts, playing a significant role in all of them. But that doesn't express the nub of his attitude to the world and to human behaviour. What I admire is his belief in the moral responsibility of society towards its members, an attitude he brought to bear on his economic theories.

- Joan Bakewell, "My hero John Maynard Keynes, by Joan Bakewell" (19 June 2010)

- After careful research along these lines, I came to the annoying conclusion that Keynes had been 100 percent right in the 1930s. Previously, I had thought the opposite. But facts were facts and there was no denying my conclusion. It didn’t affect the argument in my book, which was only about the rise and fall of ideas. The fact that Keynesian ideas were correct as well as popular simply made my thesis stronger.

- Bruce Bartlett, "Revenge of the Reality-Based Community" (2012)

- I think it is pretty hard to explain most governments’ responses to the crisis and recession without a healthy dose of Keynes.

- Alan S. Blinder, "Teaching Macro Principlesafterthe Financial Crisis", The Journal of Economic Education (2010)

- Keynes was no revolutionary, but his ideas revolutionized 20th-century economics.

- Samuel Bowles, Richard Edwards, and Frank Roosevelt. Understanding Capitalism: Competition, Command, and Change (3rd ed., 2005), p.82

- With all his beguiling power of expression and great, but disorderly force of intellect, Keynes will be best remembered as the man who made inflation respectable.

- Brendan Bracken, in 1953, quoted in William Sydney Robinson, If I Remember Rightly: The Memoirs of W. S. Robinson, 1876-1963 (1967)

- Without Keynes, government budgets would have become unbalanced, as they did before Keynes, during periods of depression and war. Without Keynes, governments would have varied the rate of money creation over time and place, with bad and good consequences. Without Keynes, World War II would have happened, and the economies of Western democracies would have been pulled out of the lingering stagnation of the 1930s. Without Keynes, substantially full employment and an accompanying inflationary threat would have described the postwar years. But these events of history would have been conceived and described differently, then and now, without the towering Keynesian presence. Without Keynes, the proclivities of ordinary politicians would have been held in check more adequately in the 1960s and 1970s. Without Keynes, modern budgets would not be quite so bloated, with the threat of more to come, and inflation would not be the clear and present danger to the free society that it has surely now become. The legacy or heritage of Lord Keynes is the putative intellectual legitimacy provided to the natural and predictable political biases toward deficit spending, inflation, and the growth of government.

- James M. Buchanan and Richard E. Wagner, Democracy in Deficit (1977) , Ch. 3 : First, the Academic Scribblers

- Why does Camelot lie in ruins? Intellectual error of monumental proportion has been made, and not exclusively by the politicians. Error also lies squarely with the economists. The "academic scribbler" who must bear substantial responsibility is Lord Keynes...

- James M. Buchanan, in The Consequences of Keynes written with Richard E. Wagner and John Burton (1978)

- Keynes is largely responsible for elevating employment (and/or output) to a position as an explicit objective for policy. As I have emphasized, Keynes sought to change the basic perception of the economic process; he sought to bring employment, as such, onto center stage as a variable subject to direct manipulation. He sought to overthrow the classical model of market equilibrium in which employment is determined only as an emergent result or consequence of the interaction among the demand and supply choices made by market participants.

Once again in this respect, Keynes was too persuasive. By elevating full employment to explicit consideration as a policy target, and thereby generating neglect of both monetary and market institutions, the Keynesian emphasis ensured the eventual stagflation that we experienced in the 1970s. The scenario might have been quite different if the Keynesian effort had been recognized for what it was rather than for what it was not.- James M. Buchanan, "Keynesian Follies", in The Legacy of Keynes, edited by David A. Reese (1987)

- No one embodied the Cambridge spirit of culture, fun, and public duty so much as Maynard Keynes. No one was more brilliant or charming. No economist in this century influenced politicians or the course of economics more.

- Todd G. Buchholz, "Keynes: Bon Vivant as Savior" in New Ideas from Dead Economists

- I can tell you — I was helping when Britain was trying to get a loan from the United States immediately after the war, and I was talking to one of Keynes's assistants. And Keynes came in the room and walked over to us and the man I was talking to us said, "This is Coase, who is helping us with the statistics. I don't think you know him." And Keynes said, "No, I don't." And walked off. And that's my life with Keynes.

- The belief that monetary instability--inflation and deflation--is the principal, or at least a principal, cause of other economic evils; the hope that sound monetary principles can be identified and, when identified, would greatly diminish uncertainty and risk; the focus on the job of the public sector being to provide the private economy with a stable measuring-rod and a stable environment--all these are core ideas of whatever we choose to call monetarism. Keynes believed these ideas very, very strongly in the mid-1920s. And his Tract on Monetary Reform is a review of economic theory and a look at the economic problems of post-WWI Europe through this set of monetarist spectacles.

- J. Bradford DeLong, "Monetary Reform" (1996)

- Keynes’s central concerns for his own time ring true today. He was worried about the fragility of our collective prosperity, and the grave tensions between nationalism and the rootless cosmopolitan attitudes underpinning a peaceful and flourishing global society. He focused on how to organize our activities and use our prosperity to create a world fit for the good life. He sought to expose the bankruptcy of ascendant ideological nostrums: laissez-faire, spontaneous order, collective cooperation, central planning. And he thought deeply about the technocratic problems of economic management – and about the social, moral, and political disasters that would follow from failing to address them.

- J. Bradford DeLong, "Which Thinkers Will Define Our Future?", Project Syndicate (June 28, 2016)

- I was lucky to hear the economist John Maynard Keynes, a few years before his death, give a lecture about the physicist Isaac Newton. Keynes was at that time himself a legendary figure, gravely ill and carrying a heavy responsibility as economic adviser to Winston Churchill. He had snatched a few hours from his official duties to pursue his hobby of studying Newton's unpublished manuscripts. Newton had kept his early writings hidden away until the end of his life in a big box, where they remained until quite recently. Keynes was speaking in the same old building where Newton had lived and worked 270 years earlier. In an ancient, dark, cold room, draped with wartime blackout curtains, a small audience crowded around the patch of light under which the exhausted figure of Keynes was huddled. He spoke with passionate intensity, made even more impressive by the pallor of his face and the gloom of the surroundings.

- Freeman Dyson, Disturbing The Universe (1979), p. 8

- Keynes was chief economic adviser to the British government and largely responsible for keeping the British economy afloat at a time when more than half of our gross national product, and all of our foreign exchange, was being spent on the war. ...I was lucky to be present at one of his rare appearances in Cambridge, when he gave a lecture with the title "Newton, the Man." …Four years later he died of heart failure, precipitated by overwork and the hardships of crossing the Atlantic repeatedly in slow propeller-driven airplanes under wartime conditions.

- Freeman Dyson, The Scientist As Rebel (2006)

- For Keynes unemployment could never be a "natural" disaster, like an earthquake or a flood. He knew that it is a failure of social and economic organization, a failure by society and social institutions to achieve a desirable goal. Quite simply, when millions of people are out of work, we have failed to organize our society so that full employment is secured. And being a problem of social organization, there must be a solution if only society is willing to take the steps necessary. This doesn't mean that either finding or implementing a solution will be easy. Our society and our economy are complicated institutions, linking a multitude of firms and people at home and abroad, each with their own goals and their ways of doing things. Moreover, achieving full employment may conflict with other goals we consider to be important. But it is irrational simply to accept unemployment, as if it were a fact of nature. Unemployment is our failure. At the very least, we must spell out clearly the choices that must be made if we are to attain full employment.

- John Eatwell, "Citizen Keynes", The American Prospect (1994)

- John Maynard Keynes first raised the question of what can be done to stabilize the economy when it has fallen into a liquidity trap-when interest rates have fallen to a level below which they cannot be driven by further monetary expansion-and whether monetary policy can be effective at all under such circumstances. Long treated as a mere theoretical curiosity, Keynes's question now appears to be one of urgent practical importance, but one with which theorists have become unfamiliar.

- Gauti B. Eggertsson and Michael Woodford, "The Zero Bound on Interest Rates and Optimal Monetary Policy" (2003)

- We can say that around Keynes, around the economic interventionist policy perfected between 1930 and 1960, immediately before and after the war, all these interventions have brought about what we can call a crisis of liberalism, and this crisis manifests itself in a number of re-evaluations, re-appraisals, and new projects in the art of government which were formulated immediately before and after the war in Germany, and which are presently being formulated in America.

- Michel Foucault, The Birth of Biopolitics

- We're all Keynesians now.

- Milton Friedman, in the cover story of TIME (31 December 1965)

- Time published a letter from Friedman (4 February 1966) saying: Sir: You quote me as saying: “We are all Keynesians now.” The quotation is correct, but taken out of context. As best I can recall it, the context was: “In one sense, we are all Keynesians now; in another, nobody is any longer a Keynesian.” The second half is at least as important as the first.

- Often misattributed to President Richard Nixon

- There was nothing in these views to repel a student; or to make Keynes attractive. Keynes had nothing to offer those of us who had sat at the feet of Simons, Mints, Knight, and Viner.

- Milton Friedman, "Comments on the Critics", Journal of Political Economy, Vol. 80, No. 5 (Sep. - Oct., 1972)

- Keynes’s heritage was twofold—to technical economics and to politics. I have no doubt that Keynes’s bequest to technical economics was extremely beneficial, and that historians of economic thought will continue to regard him as one of the great economists of all time, in the direct line of succession to his famous British predecessors, Adam Smith, David Ricardo, J. S. Mill, Alfred Marshall, and W. Stanley Jevons.(...) The situation is very different with respect to Keynes’s bequest to politics, which has had far more influence on the shape of today’s world than his bequest to technical economics. In particular, it has contributed substantially to the proliferation of overgrown governments, increasingly concerned with every aspect of the daily lives of their citizens.

- Milton Friedman, "Keynes's Political Legacy" (1986)

- John Maynard Keynes (1883–1946) is the latest in a line of great British economists who had a profound influence on the discipline of economics. (...) In listing “the” classic of each of these great economists, historians will cite the General Theory as Keynes’s pathbreaking contribution. Yet, in my opinion, Keynes would belong in this line even if the General Theory had never been published. Indeed, I am one of a small minority of professional economists who regard his Tract on Monetary Reform (1923), not the General Theory, as his best book in economics. Even after sixty-five years, it is not only well worth reading but continues to have a major influence on economic policy.

- Milton Friedman, "John Maynard Keynes." in Economic Quarterly (1997)

- I conclude that Keynes’s political bequest has done far more harm than his economic bequest and this for two reasons. First, whatever the economic analysis, benevolent dictatorship is likely sooner or later to lead to a totalitarian society. Second, Keynes’s economic theories appealed to a group far broader than economists primarily because of their link to his political approach.

- Milton Friedman, "John Maynard Keynes." in Economic Quarterly (1997)

- Keynes's views shocked orthodox sensibilities, then and now. The ideas that consumption is the goal of economic life, that savings could be pathological, that public-sector deficits are necessary and virtuous in a slump, that interest rates should be kept low have always conflicted with respectable banker and business views. Yet the Depression and World War II appeared to prove him right, and at the end of his life in 1946 his ideas were enshrined in national income accounts, at the root of the Bretton Woods monetary system, and ascendant in the academy. One group of followers – technically advocates of a “neoclassical synthesis” – rose to power, with ultimately unhappy consequences for the reputation of Keynesian theory. In the 1970s a counter-revolution got underway: monetarism, supply-side economics, rational expectations, deregulation. By the 2000s it was complete – just in time for the Great Crisis of 2007 to demonstrate, once again, the enduring relevance of his views.

- James K. Galbraith, "Keynes, John Maynard (1883–1946)", in Coole, Diana H.; Gibbons, Michael; Ellis, Elisabeth et al., The encyclopedia of political thought (2014)

- By the autumn of 1936 Keynes had reached Harvard with tidal force, There had been no such excitement among the younger economists before; there has been none such since. Here was a solution to depression and unemployment, the most urgent problem of the time. It was also a conservative one. Keynes showed that the government, by offsetting the excess of savings -- the short fall in purchasing power -- could prop up the economy so that it functioned at or near full employment instead of at some painful and socially demoralizing level down below.

- John Kenneth Galbraith in A Life in Our Times (1981), Ch. 5 : Revelation

- Keynes was quite frequently in Washington during the war on some negotiating mission. Anybody who's had experience with diplomatic negotiating matters knows that it's an exercise in idleness. You're waiting for instructions from your government, you're waiting for the others to be instructed; you're waiting for a meeting. Keynes filled in those times by moving into the American meeting. By this time there was a sizable group of younger people, of whom I was one, who were devoted to his ideas ― a much larger group, as he has said, in Washington than he had in London. His vanity was not above being touched by this effect, so he brought around him a group of younger Washington people for discussion of wartime policy, and I was naturally in that group.

- John Kenneth Galbraith, in interview (in August 1986), David C. Colander and Christian A. Johnson, The Coming of Keynesianism to America: Conversations with the Founders of Keynesian Economics (1996)

- Did Keynes create a sense of hope? Oh, unquestionably. There was this breath of hope and optimism, and I came back from Cambridge to find a whole group of people here who had also read The General Theory.

- John Kenneth Galbraith in PBS interview (28 September 2000)

- Keynes never sought to change the world out of any sense of personal dissatisfaction or discontent. Marx swore that the bourgeoisie would suffer for his poverty and his carbuncles. Keynes experienced neither poverty or boils. For him the world was excellent.

- John Kenneth Galbraith, The Age of Uncertainty, Chapter 7, p. 198

- Keynes himself had in his day been known to make some fairly radical noises, for instance, calling for the complete elimination of that class of people who lived off other people's debts—"the euthanasia of the rentier," as he put it—though all he really meant by this was their elimination through a gradual reduction of interest rates. As in much of Keynesianism, this was much less radical than it first appeared. Actually, it was thoroughly in the great tradition of political economy, hearkening back to Adam Smith's ideal of a debtless utopia but especially David Ricardo's condemnation of landlords as parasites, their very existence inimical to economic growth.

- David Graeber, Debt: the First 5000 Years, Chapter 12, "1971–The Beginning…", p. 374

- Keynes could be gross, crude, coarse, he had a Rabelaisian wit, an obsessive curiosity about sexual matters, and he often lacked refinement. He could be a show-off and a know-all. This emanated from his remarkably quick and piercing mind, his ability to ‘gut’ books in a few hours (not that this did not show now and then) and an insatiable curiosity about all manner of things. Keynes had the class and racial prejudices of his time, expressed in distasteful, often disgraceful terms to modern eyes and ears, yet rarely acted upon in his actual relationships. For at his core he was a deeply serious person, still a Victorian as well as an Edwardian, seeking for a philosophy by which to live in both private and public life.

- G. C. Harcourt and Sean Turnell, "On Skidelsky’s Keynes", Economic and Political Weekly, vol. 40, 19 November 2005

- In the field of policy Keynes had a keen sense of the realities of the situation. He was practical and a man of the world. He was a tremendous fighter, prepared to take on great odds, but he was not inclined to be a crusader for a merely Utopian aim.

- R. F. Harrod, "John Maynard Keynes", The Review of Economic Statistics (1946)

- Whatever the final verdict on the General Theory, Keynes' greatness as an economist will not be questioned. His mental capacities had a far wider range than those usually found in professional economists. He was a logician, a great prose writer, a deep psychologist, a bibliophile, an esteemed connoisseur of painting; he had practical gifts of persuasion, political finesse, businesslike efficiency; he had personal gifts which made him have profound influence on those who came into direct contact with him.

- R. F. Harrod, "John Maynard Keynes", The Review of Economic Statistics (1946)

- No one in our age was cleverer than Keynes nor made less attempt to conceal it.

- R. F. Harrod, in The Life of John Maynard Keynes (1951)

- In order to understand the situation into which we have been led, it will be necessary to take a brief look at the intellectual sources of the full-employment policy of the "Keynesian" type. The development of Lord Keynes's theories started from the correct insight that the regular cause of extensive unemployment is real wages that are too high. The next step consisted in the proposition that a direct lowering of money wages could be brought about only by a struggle so painful and prolonged that it could not be contemplated. Hence he concluded that real wages must be lowered by the process of lowering the value of money. This is really the reasoning underlying the whole "full employment" policy, now so widely accepted. If labor insists on a level of money wages too high to allow of full employment, the supply of money must be so increased as to raise prices to a level where the real value of the prevailing money wages is no longer greater than the productivity of the workers seeking employment. In practice, this necessarily means that each separate union, in its attempt to overtake the value of money, will never cease to insist on further increases in money wages and that the aggregate effort of the unions will thus bring about progressive inflation.

- Friedrich Hayek, The Constitution of Liberty (1960), Chapter 18. Labor Union and Empolyment

- see also: John Maynard Keynes and Friedrich Hayek

- The same challenge—how to understand what had happened between the wars and prevent its recurrence—was confronted by John Maynard Keynes. The great English economist, born in 1883 (the same year as Schumpeter), grew up in a stable, confident, prosperous, and powerful Britain. And then, from his privileged perch at the Treasury and as a participant in the Versailles peace negotiations, he watched his world collapse, taking with it all the reassuring certainties of his culture and class. Keynes, too, would ask himself the question that Hayek and his Austrian colleagues had posed. But he offered a very different answer.

Yes, Keynes acknowledged, the disintegration of late Victorian Europe was the defining experience of his lifetime. Indeed, the essence of his contributions to economic theory was his insistence upon uncertainty: in contrast to the confident nostrums of classical and neoclassical economics, Keynes would insist upon the essential unpredictability of human affairs. If there was a lesson to be drawn from depression, fascism, and war, it was this: uncertainty—elevated to the level of insecurity and collective fear—was the corrosive force that had threatened and might again threaten the liberal world.

- Keynes was unmistakably a man formed by the previous century. In the first place, and like so many of the best economists of the earlier generations, from Adam Smith to John Stuart Mill, Keynes was primarily a philosopher who happened to deal in economic data. He might just as well have been a philosopher had the circumstances positioned him differently; indeed, in his Cambridge years, he wrote some properly philosophical papers, albeit with a mathematical bent.

As an economist, Keynes always saw himself responding to the nineteenth-century tradition in economic reasoning. Alfred Marshall and the economists who followed J. S. Mill had assumed that the default condition of markets, and therefore of the capitalist economy at large, was stability. Thus instabilities—whether economic depression, or distorted markets, or government interference—were to be expected as part of the natural order of economic and political life; but they did not need to be theorized as part of the necessary nature of economic activity itself.

Even before the First World War, Keynes was beginning to write against this assumption; after the war, he did little else. Over time he came to the position that the default condition of a capitalist economy could not be understood in the absence of instability and the inevitably accompanying inefficiencies. The classical economic assumption, that equilibrium and rational outcomes were the norm, instability and unpredictability the exception, were now reversed.

Moreover, in Keynes’s emerging theory, whatever it was that caused instability could not be addressed from within a theory which was unable to take that instability into account. The basic innovation here is comparable to the Gödelian paradox: as we might put it today, you cannot expect systems to resolve themselves without intervention. Thus, not only do markets not self-regulate according to a hypothetically invisible hand, they actually accumulate self-destructive distortions over time.

Keynes’s point is an elegantly symmetrical bookend to Adam Smith's claim in The Theory of Moral Sentiments. Smith argued that capitalism does not in itself generate the values that make its success possible; it inherits them from the pre-capitalist or non-capitalist world, or else borrows them (so to speak) from the language of religion or ethics. Values such as trust, faith, belief in the reliability of contracts, assumptions that the future will keep faith with past commitments and so on have nothing to do with the logic of markets per se, but they are necessary for their functioning. To this Keynes added the argument that capitalism does not generate the social conditions necessary for its own sustenance.- Tony Judt, in Tony Judt and Timothy Snyder, Thinking the twentieth century (2012), Ch. 9. The Banality of Good: Social Democrat

- Whatever the number of hours that Maynard, no time was wasted. His mind worked quickly and he possessed to a high degree the power of concentration. He also worked steadily at home and was allowed to share his father’s study, a tribute to the son’s habitual quiet attention to the subject in hand, for the father was extremely sensitive to any kind of disturbance.

- Geoffrey Keynes, in "The Early Years" in Essays on John Maynard Keynes (1979) edited by Milo Keynes

- Keynes himself was very much interested in monetary policy. He was a specialist all his life in the theory of money and interest rates. But this approach fell out of fashion and people concentrated on fiscal policy. Then, when monetary policy came back into fashion, people concentrated on the money supply and other monetary aggregates, such as M1 and M2, rather than interest rates, but that was not the way to go about it. Fortunately, I think interest rate policy is more effective now.

- Lawrence Klein, "Keynsianism Again: Interview with Lawrence Klein", Challenge (May-June 2001)

- Now I’m not saying that Keynes was right about everything, that we should treat The General Theory as a sort of secular bible - the way that Marxists treat Das Kapital. But the essential truth of Keynes’s big idea - that even the most productive economy can fail if consumers and investors spend too little, that the pursuit of sound money and balanced budgets is sometimes (not always!) folly rather than wisdom - is as evident in today’s world as it was in the 1930s. And in these dangerous days, we ignore or reject that idea at the world economy’s peril.

- Paul Krugman, "Why aren't we all Keynesians yet?", Fortune (Aug. 3, 1998)

- Keynes was no socialist – he came to save capitalism, not to bury it. And there’s a sense in which The General Theory was, given the time it was written, a conservative book.

- Paul Krugman, Introduction to The General Theory of Employment, Interest, and Money (2006)

- He was declaring that the trouble with the engine was not fundamental, that it was amenable to a technical fix. At a time when many of the world's intellectuals were convinced that capitalism was a failed system, that only by moving to a centrally planned economy could the West emerge from the Great Depression, Keynes was saying that capitalism was not doomed, that a very limited sort of intervention — intervention that would leave private property and private decision making intact — was all that was needed to make the system work. Confounding the skeptics, capitalism did survive; but although today's free-market enthusiasts may find this proposition hard to accept, that survival was basically on the terms Keynes suggested. World War II provided the jump start Keynes had been urging for years; but what restored faith in free markets was not just the recovery from the Depression but the assurance that macroeconomic intervention — cutting interest rates or increasing budget deficits to fight recessions — could keep a free-market economy more or less stable at more or less full employment. In effect, capitalism and its economists made a deal with the public: it will be okay to have free markets from now on, because we know enough to prevent any more Great Depressions.

- Paul Krugman, in The Return of Depression Economics and the Crisis of 2008 (2009), Ch. 5 : Policy Perversity

- I shall quote another economic source, one of particular significance—Keynes, the British diplomat and author of The Economic Consequenices of the Peace, who, on instructions from his government, took part in the Versailles peace negotiations, observed them on the spot from thc purely bourgeois point of view, studied the subject in detail, step by step, and took part in the conferences as an economist. He has arrived at conclusions which are more weighty, more striking and more instructive than any a Communist revolutionary could draw, because they are the conclusions of a well-known bourgeois and implacable enemy of Bolshevism, [...]

- Vladimir Lenin, The Second Congress Of The Communist International (1920)

- The historical balance sheet of Keynesian policy is clear. The most extensive experiment, Roosevelt’s New Deal in the United States during the 1930s, ended in failure.

- Ernest Mandel, "Why Keynes Isn’t the Answer" (1992)

- If you were going to turn to only one economist to understand the problems facing the economy, there is little doubt that the economist would be John Maynard Keynes. Although Keynes died more than a half-century ago, his diagnosis of recessions and depressions remains the foundation of modern macroeconomics. His insights go a long way toward explaining the challenges we now confront.

- N. Gregory Mankiw, "What Would Keynes Have Done?" in New York Times (28 November 2008)

- Which brings us to a third group of macroeconomists: those who fall into neither the pro- nor the anti-Keynes camp. I count myself among the ambivalent. We credit both sides with making legitimate points, yet we watch with incredulity as the combatants take their enthusiasm or detestation too far. Keynes was a creative thinker and keen observer of economic events, but he left us with more hard questions than compelling answers.

- N. Gregory Mankiw, "Back In Demand" Wall Street Journal (21 September 2009)

- Although Keynes’s General Theory provides the foundation for much of our current understanding of economic fluctuations, it is important to remember that classical economics provides the right answers to many fundamental questions.

- N. Gregory Mankiw, preface in Macroeconomics

- I think that if you went in for the Tripos, merely re-reading Economics in the ten days before it, you would probably get a first class: & that if you did not, you wd not injure your position, since it wd.. be known that you had had very little time free for economics.

- Alfred Marshall, letter to John Maynard Keynes (2 May 1906)