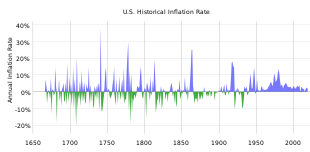

Annual inflation rates in the United States since 1666.

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services.

Quotes

- Quotes are arranged alphabetically by author

A - F

- The [pay] policy is principally designed to hold down wages rather than to check inflation. Inflation is being used as an excuse to destroy free trade union bargaining.

- Tony Benn Speech in the House of Commons (Hansard, 7 November 1973, Col. 1015).

- The big, looming, monetary issue is "quantitative easing": that is, printing money. What happens is that the government borrows from the Bank of England, not from the markets. It expands the money supply to keep the economy going and also to counter deflation without simultaneously increasing government debt. The attractions are obvious, as are the dangers. The Robert Mugabe school of economics provides a salutary warning about uncontrolled monetary expansion in generating hyper-inflation. The road to Harare is not as long as we might hope. Monetary easing may prove to be necessary but will have to be managed with great skill and care: Too little easing and the crisis drags on – as in Japan. If there is too much, the authorities face the messy task of mopping-up liquidity by issuing bonds which add to the burden of borrowing or else we lurch back from deflation to inflation. So interest rates may soon become yesterday's story.

- Vince Cable "Confiscating savings from the poor is stupid and cruel". The Independent. 8 January 2009.

- Low inflation and government prudence may be harmful for economic development.

- Ha-Joon Chang Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism (2008) Prologue, p. xxv.

- Inflation is bad for growth—this has become one of the most widely accepted economic nostrums of our age. But see how you feel about it after digesting the following piece of information.

During the 1960s and the 1970s, Brazil’s average inflation rate was 42% a year. Despite this, Brazil was one of the fastest growing economies in the world for those two decades—its per capita income grew at 4.5% a year during this period. In contrast, between 1996 and 2005, during which time Brazil embraced the neo-liberal orthodoxy, especially in relation to macroeconomic policy, its inflation rate averaged a much lower 7.1% a year. But during this period, per capita income in Brazil grew at only 1.3% a year.

If you are not entirely persuaded by the Brazilian case—understandable, given that hyperinflation went side by side with low growth in the 1980s and the early 1990s—how about this? During its ‘miracle’ years, when its economy was growing at 7% a year in per capita terms, Korea had inflation rates close to 20%-17.4% in the 1960s and 19.8% in the 1970s. These were rates higher than those found in several Latin American countries … Are you still convinced that inflation is incompatible with economic success?- Ha-Joon Chang Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism (2008) Ch. 7: Mission impossible?; Can financial prudence go too far?, There is inflation and there is inflation, p. 139-140.

- Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. … A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

- Milton Friedman The Counter-Revolution in Monetary Theory (1970).

G - L

- Tax reduction has an almost irresitible appeal to the politician, and it is no doubt also gratifying to the citizen. It means more dollars in his pocket, dollars that he can spend if inflation doesn't consume them first. But dollars in his pocket won't buy him clean streets or an adequate police force or good schools or clear air and water. Handing money back to the private sector in tax cuts and starving the public sector is a formula for producing richer and richer consumers in filthier and filthier communities. If we stick to that formula we shall end up in affluent misery.

- John W. Gardner The Recovery of Confidence (1970), p. 152.

- Hyperinflation is not going to happen in this country, will never happen... The Fed putting so much money into the system is not going to create the risk of hyperinflation in the future. We have a strong independent Federal Reserve with a very strong mandate from the Congress, and they will do what's necessary to keep inflation low and stable over time.

- Timothy Geithner This Week with George Stephanopoulos, March 29, 2009

- We are obviously all hurt by inflation. Everybody is hurt by inflation. If you really wanted to examine who percentage-wise is hurt the most in their incomes, it is the Wall Street brokers. I mean their incomes have gone down the most.

- Alan Greenspan, at a conference on inflation, Washington, D.C. (September 19, 1974). In Report of the Health, Education, and Welfare, Income Security, Social Services Conference on Inflation (1974), pp. 804–5.

- Globalization was exerting a dis-inflationary impact.

- Alan Greenspan The Age of Turbulence (2008) Chapter Eleven, "The Nation Challenged", p. 228.

- As soon as interest is abolished, inflation becomes unnecessary...

- Margrit Kennedy (1995) Interest and Inflation Free Money Chapter Two, Creating an Interest and Inflation Free Money, p. 41.

- In the new money system we abolish interest and inflation, thereby reducing the prices of all goods and services as well as taxes by about 40%.

- Margrit Kennedy (1995) Interest and Inflation Free Money Chapter Three, Who Would Profit From a New Monetary System?, p. 66.

- Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become 'profiteers,' who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.- John Maynard Keynes The Economic Consequences of the Peace (1919) Chapter VI, pg.235-236.

- The acid test of monetary policy is its record in reducing inflation. Those who wish to join the debate about the intricacies of different measures of money and the implications they may have for the future are welcome to do so. But at the end of the day the position is clear and unambiguous. The inflation rate is judge and jury.

- Nigel Lawson Mansion House Speech (17 October, 1985).

M - R

- Indeed, let us be frank about it. Most of our people have never had it so good.

- Harold Macmillan quoted in "More production 'the only answer' to inflation", The Times, 22 July 1957, p. 4; About speech at Bedford, 20 July 1957.

- Inflation is an increase in the quantity of money without a corresponding increase in the demand for money, i.e., for cash holdings.

- Ludwig von Mises The Free Market and Its Enemies, speech to the Foundation for Economic Education (1951).

- In most Western economies, the general relationship is not in fact between the rate of inflation and the level of unemployment, but between the rate of change of inflation and the rate of change of unemployment.

- Paul Ormerod The Death of Economics (1994) Part II, Chapter 6, Unemployment and Inflation, p. 130.

- Once the true relationship between inflation and unemployment is understood, with luck and skill, a free lunch is possible.

- Paul Ormerod The Death of Economics Part II, Chapter 6, Unemployment and Inflation, p. 13.

- The well-being of the British people and the health of our economy are far more important than any government's commitment to a particular strategy, but to change course now would be fatal to the whole counter-inflation strategy.

- Geoffrey Howe In: "Chancellor determined not to change course in the fight against inflation", The Times, 11 March 1981, p. 6.

- 1981 budget speech.

- A merchant trading with capital has been injured by the depreciation of money, as his capital has not been equal to the same extent of business as before the depreciation; but there are few merchants in this situation:—their capitals, as well as that of tradesmen, are invested in goods, ships, &c. they are rather debtors than creditors to the rest of the community... the prices of their commodities will undergo the same variations as the prices of all others, their comparative value will... be the same... The depreciation of the circulating medium has been more injurious to monied men... It may be laid down as a principle of universal application, that every man is injured or benefited by the variation of the value of the circulating medium in proportion as his property consists of money, or as the fixed demands on him in money exceed those fixed demands which he may have on others. Thus the farmer is injured by any increase in the value of money... whilst he has a fixed money rent, and fixed money taxes to pay. His produce... will sell for less, whilst his taxes and rent continue the same. ...He, more than any other class of the community, is benefited by the depreciation of money, and injured by the increase of its value.

- David Ricardo, Letter to the Editor, Morning Chronicle (Sep 6, 1810) as quoted in "Report of the Bullion Committee, The Works and Correspondence of David Ricardo (1962) Cambridge at the University Press for the Royal Economic Society, Vol. III, Pamphlets and Papers 1809-1811, p. 136.

- The natural tendency of the state is inflation.

S - Z

- Let's turn inflation over to the post office. That'll slow it down.

- Morris Udall Quoted in Richard Severo, "Morris K. Udall, Fiercely Liberal Congressman, Dies at 76," The New York Times (December 14, 1998).

External links

This article is issued from

Wikiquote.

The text is licensed under Creative

Commons - Attribution - Sharealike.

Additional terms may apply for the media files.