Australian government debt

- Throughout this article, the unqualified term "dollar" and the $ symbol refers to the Australian dollar.

| Date (30 June) | Gross debt (A$ billion) | Debt ceiling (A$ billion) |

|---|---|---|

| 2004 | 59.628 | n/a |

| 2005 | 60.103 | n/a |

| 2006 | 59.078 | n/a |

| 2007 | 58.273 | 75 |

| 2008 | 60.451 | 75 |

| 2009 | 101.136 | 200 |

| 2010 | 147.122 | 200 |

| 2011 | 191.282 | 250 |

| 2012 | 233.968 | 300 |

| 2013 | 257.370 | 300 |

| 2014 | 319.479 | n/a |

| 2015 | 368.730 | n/a |

| 2016 | 420.405 | n/a |

| 2017 (11 Apr) | 551.750 | n/a |

| Source: Commonwealth of Australia[1] | ||

| Source: Australian Debt Clock[2] | ||

The Australian government debt is the amount owed by the Australian federal government. The Australian Office of Financial Management, which is part of the Treasury Portfolio, is the agency which manages the government debt and does all the borrowing on behalf of the Australian government.[3] Australian government borrowings are subject to limits and regulation by the Loan Council, unless the borrowing is for defence purposes or is a 'temporary' borrowing. Government debt and borrowings (and repayments) have national macroeconomic implications, and are also used as one of the tools available to the national government in the macroeconomic management of the national economy, enabling the government to create or dampen liquidity in financial markets, with flow on effects on the wider economy.

As of 11 April 2017, the gross Australian government debt was $551.75 billion.[1] The government debt fluctuates from week to week depending on government receipts, general outlays and large-sum outlays. Australian government debt does not take into account government funds held in reserve within statutory authorities such as the Australian Government Future Fund, which at 30 September 2016 was valued at $122.8 billion,[4] and the Reserve Bank of Australia. Nor is the net income of these statutory authorities taken into account. For example, the Future Fund net income in 2014–15 was $15.61 billion, which went directly into the fund's reserves. Also, guarantees offered by the government do not figure in the government debt level. For example, on 12 October 2008, in response to the Economic crisis of 2008, the government offered to guarantee 100% of all bank deposits. This was subsequently reduced to a maximum of $1 million per customer per institution. From 1 February 2012, the guarantee was reduced to $250,000,[5] and is ongoing.

Australia's net international investment liability position (government debt and private debt) was $1,028.5 billion at 31 December 2016, an increase of $5.4 billion (0.5%) on the liability position at 31 December 2016, according to the Australian Bureau of Statistics.[6]

Australia's bond credit rating was rated AAA by all three major credit rating agencies as at May 2017.[7] Around two-thirds of Australian government debt is held by non-resident investors – a share that has risen since 2009 and remains historically high.[8]

Net government debt

Net government debt is defined by the International Monetary Fund as "gross debt minus financial assets corresponding to debt instruments".[9] Financial assets corresponding to debt instruments include currency and deposits, debt securities and loans. In the context of the budget, general government sector net debt is equal to the sum of deposits held, government securities (at market value), loans and other borrowing, minus the sum of cash and deposits, advances paid and investments, loans and placements.[10][11] The net debt to GDP ratio over time is influenced by a government surplus/deficit or due to growth of GDP and inflation, as well as movements in the market value of government securities which may in turn be influenced by movements in general interest rates and currency values.

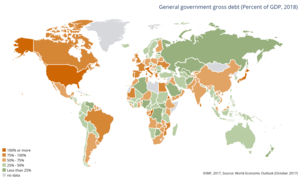

Australia's net government debt as percentage of GDP in the 2016–17 budget was estimated at 18.9% ($326.0 billion); much lower than most developed countries.[12] The budget forecasted that net government debt would increase to $346.8 and $356.4 billion in 2017–18 and 2018–19 respectively. However, despite continuing to rise in aggregate terms, growth in the economy means the government expects the proportion of debt to GDP to peak at 19.2% in 2017–18 before starting to fall thereafter.

The net government debt was negative (i.e. The Australian government had net positive bond holdings) in the 2006–07-year for the first time in three decades, from an original peak of 18.5% of GDP ($96 billion) in 1995–96.[13] The reduction in net debt is attributable to the consistent budget surpluses in the mid-2000s as well as the privatisation of government assets in the preceding decade.

Latest budget forecasts

The federal budget is the main mechanism that determines the government's net debt position from one period to the next. A surplus (revenue is greater than expenses) allows the government to pay down its debt while a deficit (expenses are greater than revenue) requires the government to issue more debt to cover the shortfall. The 2017 federal budget forecast a deficit of $29.3 billion, or 1.6% of GDP.[14] The 2018 budget forecast a deficit of $18.2 billion. This would be Australia's eleventh consecutive budget deficit.[15]

The 2017 budget forecast government spending to be in surplus in the 2020/21 fiscal year, while the 2018 budget forecast a surplus of $2.2 billion in 2019/20. The government's debt level is forecast to be $629 billion in 2019/20.[16]

Debt ceiling

A debt ceiling on how much the Australian government could borrow existed between 2007 and 2013.

The statutory limit was created in 2007 by the Rudd Government and set at $75 billion. It was increased in 2009 to $200 billion,[17] $250 billion in 2011 and $300 billion in May 2012. In November 2013, Treasurer Joe Hockey requested Parliament's approval for an increase in the debt limit from $300 billion to $500 billion, saying that the limit will be exhausted by mid-December 2013.[18] With the support of the Australian Greens, the Abbott Government repealed the debt ceiling over the opposition of the Australian Labor Party.

The debt ceiling was contained in section 5 of the Commonwealth Inscribed Stock Act 1911[19] until its repeal in December 2013.

See also

References

- 1 2 "Australian Government Securities on Issue 2015–16". Commonwealth of Australia. Retrieved 8 August 2017.

- ↑ "Government Sector Debts, National Government Debt". Retrieved 11 April 2017.

- ↑ "Role and Function". Commonwealth of Australia. Retrieved 2 February 2013.

- ↑ "2015/16 Future Fund Annual Report" (PDF). Future Fund – Australia's Sovereign Wealth Fund. 27 September 2016.

- ↑ "Questions & Answers about the Guarantee on Deposits". guaranteescheme.gov.au.

- ↑ "5302.0 – Balance of Payments and International Investment Position, Australia, March 2017". abs.gov.au.

- ↑ "Federal budget 2017: Standard & Poor's reaffirms Australia's AAA credit rating". Australian Broadcasting Corporation. 17 May 2017. Retrieved 8 August 2017.

- ↑ The Age, 29 January 2016, Treasury secretary John Fraser: Australia has a spending and a revenue problem.

- ↑ International Monetary Fund, Government Finance Statistics Manual 2014

- ↑ Parliament of Australia, The Australian Government’s current debt position – April 2015 update

- ↑ MYEFO 2014–15, p.94.

- ↑ "Budget Paper No.1 2016–17". budget.gov.au. Retrieved 8 August 2017.

- ↑ Budget 2006–07, Australian Government is now debt free

- ↑ "Budget Overview 2017–18" (PDF). budget.gov.au. 9 May 2017. Retrieved 8 August 2017.

- ↑ Australian Federal Budget analysis 2018/19

- ↑ Australian Federal Budget analysis 2018/19

- ↑ The Age, 24 October 2013 – Debt ceiling – all because of West Wing?

- ↑ The Age, 14 November 2013.

- ↑ Commonwealth Inscribed Stock Act 1911, s.5

External links

| Wikimedia Commons has media related to Statistics about bonds in Australia. |

- Australian Office of Financial Management

- Katrina Di Marco, Mitchell Pirie and Wilson Au-Yeung: A history of public debt in Australia, Treasury, Commonwealth of Australia. (ca. 2011).

- Debt Statistics for Australia

- Australian government debt clock