OTP Bank

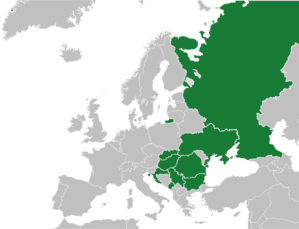

OTP Bank Group is one of the largest independent financial services providers in Central and Eastern Europe with full range of banking services for private individuals and corporate clients. OTP Group comprise large subsidiaries, granting services in the field of insurance, real estate, factoring, leasing and asset management, investment and pension funds. The bank is serving clients in 10 countries, namely Hungary, Slovakia, Bulgaria, Serbia, Romania, Croatia, Ukraine, Montenegro, Albania and Russia. In 2019, OTP Bank entered into an agreement to purchase MobiasBanca of Moldova. The agreement was finalized on 25 July, 2019.[2]

| |

| Public | |

| Traded as | BPSE: OTP Euronext: OTP BUX Component CETOP20 Component |

| ISIN | HU0000061726 |

| Industry | Banking, Financial services |

| Founded | 1949 |

| Headquarters | , |

Area served | Central and Eastern Europe |

Key people | Sándor Csányi (Chairman & CEO) |

| Products | Consumer banking, corporate banking, credit cards, finance and insurance, foreign currency exchange, investment banking, mortgage loans, private banking, private equity, wealth management |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 41,128 (2018)[1] |

| Subsidiaries | Vojvođanska banka, DSK Bank, Crnogorska Komercijalna banka, see full list in OTP Group section |

| Website | otpbank.com |

Nowadays OTP Groups' more than 36,000 employees are serving 13 million clients in over 1,500 branches and through electronic channels on all the markets of the bank.[3] OTP is still the largest commercial bank in Hungary with over 25% market share.[4]

OTP Group started its activity in 1949 when OTP Bank was founded as a state savings and commercial bank. OTP stands for Országos Takarék Pénztár (National Savings Bank) which indicates the origin purpose of establishment of the bank. The bank went public in 1995, and the share of the state in the bank capital decreased to one preferential gold share, which also eliminated shortly thereafter. Currently most of the banks' shares are owned by private and institutional investors, which ensures stable ownership structure of the company. OTP has a high free float shareholder structure, with a free float ratio of 68.61%. The rest are held by the Forbes billionaire Megdet Rahimkulov at 8.88%, Hungarian MOL Group at 8.57%, French Groupama at 8.3% and American Lazard at 5.64%.[5]

History

The predecessor of OTP Bank, called the National Savings Bank (OTP Bank) was established in 1949 as a nationwide, state-owned, banking entity providing retail deposits and loans. In the ensuing years, its activities and the scope of its authority gradually widened. First, it was authorised to enter into real estate transactions. Later, its role was extended to provide domestic foreign currency accounts and foreign exchange services; there was a subsequent diversification into providing banking services for Hungarian municipalities.

Since 1989, the bank has operated as a multi-functional commercial bank. In addition to continuing its previous retail and municipal activities, the bank has been authorised to solicit corporate loan accounts and deposits, and to provide commercial loans and banking services for correspondent banking and export-import transactions.

In 1990, the National Savings Bank became a public company with a share capital of HUF 23 billion. Its name was changed to the National Savings and Commercial Bank. Subsequently, non-banking activities were separated from the bank, along with their supporting organisational units. The state lottery was reorganised into a separate state-owned company and OTP Real Estate was established as a subsidiary of the bank.

OTP Bank's privatisation began in 1995. As a result of 3 public offers along with the introduction of the bank's shares into the Budapest Stock Exchange the state's ownership in the bank decreased to a single voting preference (golden) share. Currently the bank is characterized by dispersed ownership of mostly private and institutional (financial) investors.

After the realisation of its own privatisation process, OTP Bank started its international expansion targeting countries in Central and Eastern Europe. OTP Bank has completed several acquisitions in the past years. Besides Hungary, OTP Group currently operates in 8 countries of the region via its subsidiaries: in Bulgaria (DSK Bank), in Croatia (OTP banka Hrvatska), in Romania (OTP Bank Romania), in Serbia (Vojvođanska banka), in Slovakia (OTP Banka Slovensko), in Ukraine (OTP Bank JSC), in Montenegro (Crnogorska komercijalna banka) and in Russia (OAO OTP Bank).

2008 was milestone in OTP Bank history since it was the first time to sell one of its subsidiaries. The French Groupama S.A. acquired its insurance business line, and part of the transaction they resolved to collaborate in strategic points and crossell their financial and insurance products. Groupama S.A. has acquired 8% of shares of OTP Group.

In April 2014, it was announced that OTP Bank was close to a deal to acquire the Hungarian MKB Bank from German firm BayernLB.[6] French Axa Bank Europe announced in February 2016 it has entered into an agreement with OTP Bank to sell its Hungarian banking operations, which is considered as medium-sized bank in Hungary.[7]

OTP Group

.jpg)

The Bank hosts an international organisation called the OTP group. The several parts of the group work in different areas of business.

| OTP Bank Nyrt. | Universal Bank |

| Merkantil Bank Ltd. | Personal Loans |

| Merkantil Car Ltd. | Auto Leasing |

| Merkantil Lease Ltd. | Leasing |

| OTP Building Society Ltd. | Savings Bank |

| OTP Mortgage Bank Ltd. | Mortgage Bank |

| DSK Bank (Банка ДСК) | Universal Bank (Bulgaria) |

| Expressbank (will be merged into DSK Bank) | Universal Bank (Bulgaria) |

| OTP Banka Slovensko, a.s. | Universal Bank (Slovakia) |

| OTP Bank Romania SA | Commercial Bank (Romania) |

| OTP Banka Hrvatska d.d. Split | Commercial Bank (Croatia) |

| Splitska banka d.d. (merged with OTP Hrvatska d.d. Split) | Commercial Bank (Croatia) |

| OTP banka Srbija | Commercial Bank (Serbia) |

| Vojvođanska banka | Commercial Bank (Serbia) |

| Crnogorska komercijalna banka a.d. | Commercial Bank (Montenegro) |

| OTP Capital | Asset Management Company (Ukraine) |

| OTP Fund Management Ltd. | Investment Fund |

| OTP Real Estate Fund Management Ltd. | Investment Fund |

| Hungarian International Finance Ltd. | International Financing |

| OTP Real Estate Ltd. | Construction and sale of properties |

| OTP Lakáslízing | Mortgage |

| OTP Factoring Ltd. | Factoring, forfeiting |

| OTP Factoring Trustee Ltd. | Evaluation and sale of properties |

| OTP Pension | Non-government Pension Fund (Ukraine) |

| OTP Health Fund | Health Fund |

| OTP Travel Ltd. | Travel Agency |

| OTP Életjáradék Zrt. | Pension Fund |

Buildings

.jpg)

- OTP Bank in Hajdúszoboszló, Hungary

- OTP Bank in Bratislava, Slovakia

OTP Splitska banka in Split, Croatia

OTP Splitska banka in Split, Croatia

See also

- OTP Banka Slovensko

- European Banking Authority

- List of banks

- List of banks in Europe

References

- "Financial Statements" (PDF). OTP Bank. Retrieved 8 November 2019.

- "Closing the financial transaction of the acquisition in Moldova". Mobiasbanca – OTP Group S.A.| Prima bancă cu capital străin din Moldova. Cele mai accesibile credite, carduri.

- "OTP Bank - Magánszemélyek". www.otpbank.hu. Archived from the original on 10 August 2014. Retrieved 26 April 2018.

- "OTP Bank - Magánszemélyek". www.otpbank.hu. Archived from the original on 3 December 2013. Retrieved 26 April 2018.

- "Archived copy". Archived from the original on 2013-01-30. Retrieved 2013-06-01.CS1 maint: archived copy as title (link)

- "Hungary's biggest bank OTP nearing deal to buy MKB". Reuters. 8 April 2014. Archived from the original on 24 September 2015.

- "OTP agrees to buy Axa's Hungarian banking unit". IntelliNews. 2016. Archived from the original on 2016-04-04.