Nord Pool

Nord Pool AS is a European power exchange owned by Euronext and the continental Nordic and Baltic countries' Transmission system operators (TSOs). Nord Pool delivers power trading across Europe. Nord Pool offers day-ahead and intraday trading, clearing and settlement, data and compliance, as well as consultancy services. More than 360 customers trade on Nord Pool today.

Logotype since 2016 | |

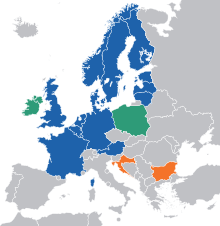

Current markets (blue), expansion markets (green) and serviced markets (orange) | |

| Type | Physical commodity exchange (energy exchange) |

|---|---|

| Location | Lysaker, Norway |

| Founded | 2002 |

| Owner | Euronext (66%), Nordic and Baltic countries' transmission system operators (34%)[1] |

| Key people | Kari Ekelund Thørud (CEO) Torger Lien (Chairman) |

| Currency | NOK, SEK, DKK, EUR |

| Commodities | Electric power |

| Website | www.nordpoolgroup.com |

Nord Pool operates power trading markets in Norway, Denmark, Sweden, Finland, Estonia, Latvia, Lithuania, Germany, the Netherlands, Belgium, Austria, Luxembourg, France and the United Kingdom. Nord Pool is a Nominated Electricity Market Operator (NEMO) in 15 European countries, while also providing serviced power markets in Croatia and Bulgaria.

In 2019 Nord Pool had a total turnover of 494 TWh traded power, this includes more than 90% of total power consumption in the Nordic and Baltic market. The company has offices in Oslo, Stockholm, Helsinki, Tallinn, London and Berlin.

History

1932-1991: Norwegian origins

Nord Pool traces its origin to Foreningen Samkjøringen (lit. the Coordination Association), a power exchange formed by eastern Norwegian electricity companies in 1932 on the initiative of Augustin Paus, and which soon encompassed all the electricity companies in eastern Norway. In 1971 the exchange merged with the regional exchanges in other parts of Norway, and became Samkjøringen av kraftverkene i Norge (literally the Coordination of Power Stations in Norway), with 118 power companies as members as of 1988.

1991-2000: Nordic deregulation and integration

In 1991 the Norwegian parliament decided to deregulate the market for power trading. In 1993 Statnett Marked AS was established as an independent company.

_logo.svg.png)

In 1996, the Swedish electricity market was also deregulated. Statnett Marked AS was subsequently replaced by Nord Pool ASA, owned in equal parts by the Swedish and Norwegian Transmission System Operators (TSOs), Svenska Kraftnät and Statnett. This contributed to the unification of the two countries' electricity markets.

Finland as well as western and eastern Denmark joined Nord Pool ASA in 1998, 1999 and 2000, respectively.

2000-present: Expansion in Europe

In 2000, Nord Pool ASA participated in establishing the Leipzig Power Exchange (now part of the European Energy Exchange). Nord Pool also supplied its technology to France's Powernext exchange.

On 27 December 2001, Nord Pool ASA's spot market (derivatives and physical energy markets) activities were spun off into a new company, Nord Pool Spot AS. The remaining parts of Nord Pool ASA were later acquired by Nasdaq, and are presently known as Nasdaq Commodities.[lower-alpha 1]

In 2005, Nord Pool Spot AS started trading and clearing of European Union (EU) emission allowances, becoming the first exchange to expand its activities into this area. The company expanded its activities to Germany by opening the KONTEK bidding area.

On 12 January 2010, Nord Pool Spot AS in cooperation with Nasdaq Commodities launched the N2EX power market in the United Kingdom.[7]

On 2 February 2010, Nord Pool Spot signed an agreement with the Estonian national grid company Elering to create the Nord Pool Spot Estlink bidding area starting from 1 April 2010.[8] Nord Pool Spot also delivered the technical solution for the Lithuanian market place Baltpool.[9] On 9 June 2010, APX-ENDEX, Belpex and Nord Pool Spot agreed to create a cross-border intraday electricity market based on Nord Pool Spot's Elbas technology. Today, the common intraday market includes the Nordic countries, the Baltic countries, Germany, the Netherlands, and Belgium.[10]

Prior to Euronext's acquisition, Nord Pool was owned by the Nordic countries' TSOs:

In 2012, Nord Pool Spot opened a bidding area in Lithuania, and in 2013 the Latvian market was opened.[11]

On 20 January 2016, Nord Pool Spot AS was rebranded to Nord Pool AS.[12]

In 2017, a new clearing and settlement system was launched and a new GB half hourly auction was introduced. In addition, Nord Pool was nominated as a NEMO in the island of Ireland and joined forces with Agder Energi to develop NODES, a new marketplace capable of exploiting decentralised flexibility.

On 27 August 2019 Nord Pool started trading in France, Germany, Luxembourg, Belgium, Austria and the Netherlands, the result of a European Union decision to allow several power exchanges to operate in the same markets, increasing competition.[13]

On 5 December 2019 Euronext announced that it would acquire 66% of Nord Pool.[14][1] The acquisition was completed on 15 January 2020.[15]

Organisation

Nord Pool has its main office in Lysaker (Oslo) and further offices in Stockholm, Helsinki, Tallinn, Berlin and London.[16]

It is owned by Euronext and the national grid companies Fingrid, Energinet, Statnett, Svenska Kraftnät, and Litgrid, and have wholly owned subsidiaries Nord Pool AB and Nord Pool Finland Oy.

Nord Pool AS has 360 trading customers in about 20 countries. These include public and private energy producers, energy intensive industries, large consumers, distributors, funds, investment companies, banks, brokers, utility companies and financial institutions.[17]

See also

Other pan-European exchanges

Related technology companies

Notes

- Nord Pool ASA's remaining subsidies Nord Pool Clearing, which dealt with clearing transactions, and Nord Pool Consulting - were acquired by Nasdaq OMX on 21 December 2007.[2] On 17 March 2010, NASDAQ OMX announced it would acquire all shares of Nord Pool ASA. This did not include Nord Pool Spot AS, which continued physical electricity market trading operations independently.[3][4] The deal was approved by market regulators on 31 May 2010.[5] On 1 November 2010, Nord Pool ASA changed its name to NASDAQ OMX Oslo ASA and introduced a trade name NASDAQ OMX Commodities Europe. It is presently known as Nasdaq Commodities[6]

References

- https://www.nordpoolgroup.com/message-center-container/newsroom/exchange-message-list/2019/q4/nord-pool-welcomes-new-owner/

- "OMX buys Nord Pool's clearing, consulting operation". Reuters. 2007-12-21. Retrieved 2008-06-15.

- Fouche, Gwladys (2010-03-17). "Nasdaq OMX buys Nordic power bourse Nord Pool". Reuters. Retrieved 2010-06-13.

- "Norway's Nasdaq OMX to acquire Nord Pool ASA". Bloomberg Businessweek. Associated Press. 2010-03-17. Retrieved 2010-06-13.

- "NASDAQ OMX Completes Nord Pool ASA Acquisition" (Press release). NASDAQ OMX. 2010-03-17. Retrieved 2010-06-13.

- "Nord Pool ASA changes its name" (Press release). NASDAQ OMX. 2010-11-01. Retrieved 2010-12-25.

- Kwok W. Wan (2010-01-12). "Nasdaq, Nord Pool launch new UK power market". Reuters. Retrieved 2010-02-06.

- Juhan Tere (2010-02-02). "Elering and Nord Pool Spot conclude a cooperation agreement". The Baltic Course. Retrieved 2010-02-06.

- "Nord Pool Spot will deliver the technical solution for new Lithuanian market place" (Press release). Nord Pool Spot. 2009-08-28. Retrieved 2010-02-06.

- "APX-ENDEX, Belpex and Nord Pool Spot to establish cross-border intraday electricity market from Helsinki to Brussels" (Press release). Nord Pool Spot. 2010-06-10. Archived from the original on 2010-10-23. Retrieved 2010-06-13.

- "See outline of our power market history". www.nordpoolgroup.com.

- "Nord Pool History". Archived from the original on 2017-04-15. Retrieved 2016-11-16.

- https://www.reuters.com/article/europe-power-trade/new-nord-pool-power-markets-trade-14-gw-hours-in-first-week-idUSL5N25T20V

- https://www.euronext.com/en/investor-relations/financial-information/regulated-information-and-investor-news/euronext-acquire-0

- https://www.nordpoolgroup.com/message-center-container/newsroom/exchange-message-list/2020/q1/euronext-completes-the-acquisition-of-nord-pool/

- "Membership". Nord Pool Spot. Retrieved 13 March 2015.