Magnetic ink character recognition

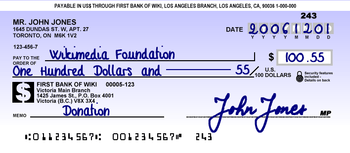

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the MICR line, is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount (usually added after a cheque is presented for payment), and a control indicator. The format for the bank code and bank account number is country-specific.

The technology allows MICR readers to scan and read the information directly into a data-collection device. Unlike barcode and similar technologies, MICR characters can be read easily by humans. MICR encoded documents can be processed much faster and more accurately than conventional OCR encoded documents.

International spread

There are two major MICR fonts in use: E-13B and CMC-7. There is no particular international agreement on which countries use which font.[1] In practice, this does not create particular problems as cheques and other vouchers do not usually flow out of a particular jurisdiction.

The MICR E-13B font has been adopted as the international standard in ISO 1004:1995, and is the standard in Australia, Canada, the United Kingdom, the United States, as well as Central America and much of Asia, besides other countries.[1]

The CMC-7 font is widely used in Europe, including France and Italy, and South America, including Argentina, Brazil, Mexico, besides other countries.

Israel is the only country that can use both fonts simultaneously, though the practice makes the system significantly less efficient. This situation is the product of the Israelis adopting CMC7, while the Palestinians opted for E13B.[1]

Fonts

E-13B

E-13B has a 14 character set, comprising the 10 decimal digits, and the following symbols:

- ⑆ (transit: used to delimit a bank code),

- ⑈ (on-us: used to delimit a customer account number),

- ⑇ (amount: used to delimit a transaction amount),

- ⑉ (dash: used to delimit parts of numbers—e.g., routing numbers or account numbers).

In the check printing and banking industries the E13B MICR line is also commonly referred to as the TOAD line. This reference comes from the 4 characters: Transit, Onus, Amount, and Dash.

The E-13B repertoire can be represented in Unicode (see below). Prior to Unicode, it could be encoded according to ISO 2033:1983.

CMC-7

CMC-7 has a 15 character set, comprising the 10 numeric digits and 5 control characters, internal, terminator, amount, routing, and an unused character. CMC-7 has a barcode format, with every character having two distinct large gaps in different places, as well as distinct patterns in between, to minimize any chance for character confusion while reading.[1]

MICR reader

MICR characters are printed on documents in one of the two MICR fonts, using magnetizable (commonly known as magnetic) ink or toner, usually containing iron oxide. In scanning, the document is passed through a MICR reader, which performs two functions, the magnetization of the ink and the detection of the characters. The characters are read by a MICR reader head, a device similar to the playback head of a tape recorder. As each character passes over the head, it produces a unique waveform that can be easily identified by the system.

The use of MICR allows the characters to be read reliably even if they have been overprinted or obscured by other marks, such as cancellation stamps and the signature. The error rate for the magnetic scanning of a typical cheque is smaller than with optical character recognition systems. For well printed MICR documents, the "can't read" rate is usually less than 1%,[1] while the substitution rate (misread rate) is in the order of 1 per 100,000 characters. Rejected items are hand processed.

MICR readers are the primary tool for cheque sorting and are utilised across the cheque distribution network at multiple stages. For example, a merchant will use a MICR reader to sort cheques by bank and send the sorted cheques to a clearing house for redistribution to those banks. Upon receipt, the banks perform another MICR sort to determine which customer's account is charged and to which branch the cheque should be sent on its way back to the customer. However, many banks no longer offer this last step of returning the cheque to the customer. Instead, cheques are scanned and stored digitally. Sorting of cheques is done as per the geographical coverage of banks in a nation. [2]

Unicode

MICR characters were added to the Unicode Standard in June 1993 with the release of version 1.1.

The Unicode block that includes MICR characters is called Optical Character Recognition and covers U+2440–U+245F:

| Optical Character Recognition[1][2] Official Unicode Consortium code chart (PDF) | ||||||||||||||||

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | A | B | C | D | E | F | |

| U+244x | ⑀ | ⑁ | ⑂ | ⑃ | ⑄ | ⑅ | ⑆ | ⑇ | ⑈ | ⑉ | ⑊ | |||||

| U+245x | ||||||||||||||||

| Notes | ||||||||||||||||

History

Before the mid-1940s, cheques were processed manually using the Sort-A-Matic or Top Tab Key method. The processing and clearance of cheques was very time consuming and was a significant cost in cheque clearance and bank operations. As the number of cheques increased, ways were sought for automating the process. Standards were developed to ensure uniformity in financial institutions. By the mid-1950s, the Stanford Research Institute and General Electric[3] Computer Laboratory had developed the first automated system to process cheques using MICR. The same team also developed the E13B MICR font. "E" refers to the font being the fifth considered, and "B" to the fact that it was the second version. The "13" refers to the 0.013 inch character grid.

The trial of MICR E13B font was shown to the American Bankers Association (ABA) in July 1956, which adopted it in 1958 as the MICR standard for negotiable documents in the United States. ABA adopted MICR as its standard because machines could read MICR accurately, and MICR could be printed using existing technology. In addition, MICR remained machine readable, even through overstamping, marking, mutilation and more. The first cheques using MICR were printed by the end of 1959. Although compliance with MICR standards was voluntary in the United States, it had been almost universally adopted in the United States by 1963.[4] In 1963, ANSI adopted the ABA's E13B font as the American standard for MICR printing,[5] and E13B was also standardized as ISO 1004:1995.

Other countries set their own standards, though the MICR readers and most other equipment were US manufactured. MICR technology has been adopted in many countries, with some variations. The E13B font was adopted as the standard in the United States, Canada, United Kingdom, Australia and many other countries. In Australia, the system is managed by the Australian Payments Network.

The CMC-7 font was developed in France by Groupe Bull in 1957. It was adopted as the MICR standard in Argentina, France, Italy, and some other European countries.

In the 1960s, the MICR fonts became a symbol of modernity or futurism, leading to the creation of lookalike "computer" typefaces that imitated the appearance of the MICR fonts, which unlike real MICR fonts, had a full character set.

MICR E-13B is also used to encode information in other applications, such as sales promotions, coupons, credit cards, airline tickets, insurance premium receipts, deposit tickets, and more. E13b is the version specifically developed for offset litho printing. There was a subtly different version for letterpress, called E13a. Also, there was a rival system named 'Fred' (Figure Reading Electronic Device) which used figures that looked more conventional.

See also

- Cheque truncation system

- Electronic Recording Machine, Accounting

- OCR-A font

- OCR-B

- Westminster (typeface)

References

- Battle of the MICR Fonts: Which Is Better, E13B or CMC7?

- "Reserve Bank of India - Publications". rbi.org.in.

- . 195610.pdf. "ARTICLES: Magnetic Ink Character Recognition". Computers and Automation. 5 (10): 10–16, 44 (12 - Other Sessions). Oct 1956. Archived from the original on 2018-08-01. Retrieved 2018-06-12.CS1 maint: others (link)

- Mandell, Lewis, "Diffusion of EFTS among National Banks: Notes", "Journal of Money, Credit and Banking" 'Vol. 9, No. 2. (May, 1977)

- ANSI standard X9.27-1995 and ANSI standard ANS X9.7-1990.

External links

- MICR Basics Handbook, Troy Group, Inc.

- Which Is Better, E13B or CMC7?

- Easy experiment to detect magnetic ink in bank notes, (in French)