Absa Group Limited

Absa Group Limited (ABGL), formerly Barclays Africa Group Limited, and originally Amalgamated Banks of South Africa, is an African based financial services group, offering personal and business banking, credit cards, corporate and investment banking, wealth and investment management as well as bancassurance.[6]

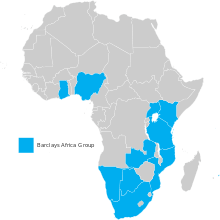

ABGL is the majority shareholder of 11 banks spanning Botswana, Ghana, Kenya, Mauritius, Mozambique, Seychelles, South Africa, Tanzania (two entities), Uganda and Zambia. The group maintains representative offices in Namibia and Nigeria.[6]

It also has an international office in London, which opened in September 2018.[7] In 2019, Absa Group opened another international office in New York City.[8]

History

Absa was founded in 1991 through the merger of financial service providers United Bank (South Africa), the Allied Bank (South Africa), the Volkskas Bank Group and certain interests of the Sage Group.[9] The following year, Absa acquired the entire shareholding of the Bankorp Group which included Trustbank, Senbank and Bankfin. In the early years of this union, each bank operated under its own name. In 1998, they were fused into one single brand. A year later, Absa adopted a new corporate identity and the name was changed into Absa Group Limited.[10]

In May 2005, Barclays Bank of the United Kingdom purchased 56.4% stake in Absa.[11]

In early 2007, the Barclays Bank acquisition of Absa was criticised by governor of the South African Reserve Bank, Tito Mboweni who said he "had yet to see the benefits of Barclays' management of Absa".[12]

In 2013, the group acquired the entire issued share capital of Barclays Africa Limited and issued 129,540,636 Consideration Shares to Barclays Africa Group Holdings Limited (a wholly owned subsidiary of Barclays) thus increasing the shareholding of Barclays plc to 62,3%. The Consideration Shares were listed on the JSE from the commencement of trading on 31 July 2013. The name change from “ABSA Group Limited” to “Barclays Africa Group Limited” was announced on 22 July 2013, and became effective 2 August 2013.

In 2017, the South African Public Protector, Busisiwe Mkhwebane, found that the bailout of R1.125 billion that Absa's predecessor Bankorp Group had received between 1985 and 1992 from the Reserve Bank was illegal, and recommended that Absa be forced to pay back R2.25 billion, the current equivalent of the amount.[13][14] The report was set aside by the Pretoria High Court,[15] finding that "The public protector did not conduct herself in a manner which would be expected from a person occupying the office of the public protector."[16] The court assessed some costs of the case personally against Mkhwebane due to her conduct,[17][18] an order upheld by the Constitutional Court of South Africa in July 2019.[19][20][21]

In March 2018, Barclays Africa announced the group's name would revert to Absa Group Limited, effective 30 May 2018.[22] The company underwent rebranding in 2018, inclusive of a new logo and slogans.[23]

Overview and structure

As of October 2019, according to Club of Mozambique, Absa Group Limited had total assets in excess of US$91 billion.[5] Barclays Bank Plc owns 14.9 percent of Absa Group Limited, whose shares are listed on the JSE Limited. Absa Bank Kenya Plc and Absa Bank Botswana Limited continue to be listed on their respective stock exchanges.[24][25]

Major shareholders

Below is the Absa Group’s 10 largest shareholders as at 15 January 2019:[26]

| Current Majority shareholders | 15 January 2019 (%) |

|---|---|

| Barclays plc (UK) | 14.88 |

| Public Investment Corporation (SA) | 6.53 |

| Deutsche Securities | 4.28 |

| Old Mutual Asset Managers (SA) | 3.56 |

| BlackRock, Inc. (USA, UK) | 3.48 |

| FIL Limited (UK) | 3.18 |

| Prudential Investment (SA) | 3.18 |

| Citigroup Global Markets | 3.01 |

| The Vanguard Group (US, AU) | 3.00 |

| Schroders Plc | 2.92 |

| Others | 51.98 |

| Geographical holding (by owner) | 31 Dec 2018 (%) |

|---|---|

| United Kingdom | 27.27 |

| South Africa | 40.47 |

| United States and Canada | 17.64 |

| Other countries | 14.62 |

Controversies

Bank charges

Finweek Bank Charges Reports from 2008 through 2010[27] found Absa Group Limited to be the most expensive bank in South Africa.[28][29][30] Pay-as-you-transact (PAYT) fees increased 82% from 2005 to 2010.[29]

The 2012, Finweek Bank Charges Report ranked Absa's Gold Value Bundle as the cheapest package option amongst the four banks that were compared. The report has also shown Absa's PAYT pricing structure to have reduced by 25%, leaving it third cheapest in the overall ranking.[31]

.jpg)

Mortgage loans misconduct

In 2014, South African courts made a number of rulings against Absa's mortgage loan division in a number of summary judgements against clients who had taken out loans with the bank and who the bank had accused of defaulting on their loans. In August 2014, Absa brought a case against James Grobbelaar and Kevin Jenzen for allegedly defaulting on their home loans. However, Absa was unable to provide proof of the loan agreements, claiming that they had been destroyed in a fire in 2009 and instead presented an unsigned blank loan agreement.[32] In November 2014, Absa withdrew a case it brought in the North Gauteng High Court against Emmarentia and Monica Liebenberg for allegedly defaulting on loans taken out in 2007, with the bank being unable to provide an electronic copy of the documents.[33]

The Liebenberg's accused the bank of trying to bully them "into submission, by threatening legal costs and expenses and by pursuing a wrongful summary judgement application knowing full well the massive disputes involved." The Liebenbergs also stated in their affidavit that the bank inflated the interest rate of the loan and charged additional fees that were never agreed to.[33]

In South Africa, banks have to secure consent from the borrower if the bank wishes to securitise the loan. This allows the bank to bundle in the loan with other loans and sell it to new owners.[32][33][34]

See also

- List of banks

- List of banks in South Africa

References

- Absa Group (25 July 2018). "Absa Group". Absa Group. Retrieved 25 July 2018.

- "Contact Us: Head Office, Johannesburg". ABSA Group Limited. Retrieved 11 July 2018.

- "Absa appoints Daniel Mminele as new CEO". Fin24 (Press release). 6 January 2020.

- "Financial results for the reporting period ended 31 December 2019" (PDF). Absa.Africa. Absa Group Limited. pp. 125–127. Archived from the original (PDF) on 12 April 2020. Retrieved 12 April 2020.

- Adrian Frey (23 October 2019). "Barclays in Mozambique rebranding as Absa Bank". Maputo: Club of Mozambique. Retrieved 14 November 2019.

- "Absa Group Limited: About Us". Absa Group Limited. 2020. Retrieved 27 March 2020.

- https://www.fin24.com/Companies/Financial-Services/absa-opens-uk-office-to-entice-post-brexit-trade-in-africa-20180913

- Emma Rumney and Alex Richardson (11 November 2019). "South Africa's Absa to open New York office by end of the year". Reuters.com. Retrieved 16 February 2020.

- "Barclays Group Archives: ABSA". Barclays Group Archives. Barclays PLC. Retrieved 28 December 2015.

- "Better late than never for Barclays-Absa merger". Euromoney. Retrieved 31 August 2017.

- "ABSA Group 2005 Annual Report" (PDF). 31 March 2005. ABSA Group. Retrieved 7 January 2016.

- "Mboweni fires confounding salvo at Barclays". Business Report. 30 March 2007. Archived from the original on 4 November 2012. Retrieved 30 December 2017.

- Wet, Athandiwe Saba, Phillip de. "Absa may have to pay back apartheid-era bailout billions". The M&G Online. Retrieved 18 January 2017.

- "Don't Let The Politics Get In the Way Of Understanding This Explosive Detail In Mkhwebane's Absa Report". Huffington Post South Africa. Archived from the original on 18 January 2017. Retrieved 18 January 2017.

- Groenewald, Yolandi (16 February 2018). "Public Protector's ABSA bailout report set aside". Mail & Guardian. Johannesburg, South Africa. Archived from the original on 13 June 2018.

- Feltham, Luke; Kekana, Mashadi (13 June 2018). "The case against Mkhwebane". Mail & Guardian. Johannesburg, South Africa.

- Bateman, Barry (28 March 2018). "Mkhwebane loses appeal on costs order in Absa-Bankorp matter". Eye Witness News (EWN). Archived from the original on 28 March 2018.

- Maughan, Karyn (9 July 2018). "Busisiwe Mkhwebane still fighting R900‚000 legal bill". Times Live. Johannesburg, South Africa: Tiso Blackstar Group. Archived from the original on 9 July 2018.

- Niselow, Tehillah (22 July 2019). "ConCourt upholds cost order against Mkhwebane, rules she was 'not honest' in Absa investigation". News24.

- "Public protector Busisiwe Mkhwebane must pay up in Reserve Bank/Absa matter". TimesLIVE. Retrieved 29 July 2019.

- Wyk, Pauli Van. "MKHWEBANE JUDGMENT: Bad faith, dishonest, biased, reprehensible behaviour, not up to standard, falsehoods — the storm that broke over Mkhwebane". Daily Maverick. Retrieved 29 July 2019.

- "Proposed Change of Mame" (PDF). Barclays Africa Group Ltd. 1 March 2018. Archived from the original (PDF) on 8 May 2018. Retrieved 7 May 2018.

- "Here is Absa's brand new look". BusinessTech. 11 July 2018. Retrieved 11 July 2018.

- Nancy Mwape (17 July 2018). "Absa Assures Barclays Customers of Smooth Transition". Zambia Daily Mail. Lusaka. Retrieved 9 November 2019.

- Kenneth Mosekiemang (18 February 2020). "Absa Resumes Trading on BSE". Weekend Post Botswana. Gaborone. Retrieved 27 March 2020.

- "Shareholders". Absa. 15 January 2019. Retrieved 15 January 2019.

- David McKay. "SA's most expensive bank: Absa". Fin24.com. Archived from the original on 19 August 2008. Retrieved 19 August 2008.

- Fin24.com reporter. "SA outraged by bank 'fleecing'". Fin24.com. Archived from the original on 10 September 2009. Retrieved 2009-11-11.

- Fin24.com reporter (27 September 2010). "SA's most expensive bank". Fin24.com. Retrieved 9 February 2011.

- "Afriforum: Standard Bank and Absa is South Africa's most expensive banks". Afriforum. 3 November 2010. Archived from the original on 6 November 2010. Retrieved 9 February 2011.

- http://finweek.com/wp-content/uploads/2013/01/Finweek-report-on-bank-charges_2012.pdf

- "Smack down for Absa in Joburg High Court". ACTS. 4 August 2014. Retrieved 2 December 2014.

- "Absa gets snot-klapped in Pretoria High Court by women's army". ACTS. 30 November 2014. Retrieved 2 December 2014.

- "Securitisation: a conspiracy of silence" (PDF). New Economic Rights Alliance. Archived from the original (PDF) on 21 September 2014. Retrieved 2 December 2014.