Student debt

Student debt is a form of debt that is owed by an attending, withdrawn, or graduated student to a lending institution. The lending is often of a student loan, but debts may be owed to the school if the student has dropped classes and withdrawn from the school. Withdrawing from a school, especially if a low- or no-income student has withdrawn with a failing grade, could deprive the student of the ability of further attendance by disqualifying the student of necessary financial aid. Student loans also differ in many countries in the strict laws regulating renegotiating and bankruptcy. Due payments may be a retroactive penalty for services rendered by the school to the individual, including room and board.

As with most other types of debt, student debt may be considered defaulted after a given period of non-response to requests by the school or the lender for information, payment or negotiation. At that point, the debt is turned over to a Student Loan Guarantor or a collection agency.

In the United States, the “Congress created a rule called the ‘Cohort Default rate’. Annually the Department of Education evaluates the proportions of students who have received student loans and have withdrawn from a college, and have a defaulted on their federal government backed loans.” If that nonpayment (default) rate is too high, the college will be refused the privilege of having government financial aid available to their students. Also you can not get federal financial aid if you dont have a passing grade or if you are not showing them you are committed.[1] According to Adam Looney, and Constantine Yannelis with the Brookings Papers on Economic Activity, in 2011, “borrowers at for-profit and 2-year institutions represented almost half of student-loan borrowers leaving school and starting to repay loans, and accounted for 70 percent of student loan defaults." [2] This rule was an instantaneous achievement, ‘there were more than fifteen hundred for profit colleges were pushed out of the system’. Colleges have to change their funding habits to get in line with the government guidelines. Many colleges are continuously forced to lower their nonpayment rates, down.” The number of defaulters has not changed, it is just the way the government tracks them.[3]

History

Many factors are accountable for student debt. The growing problem of student debt has become more prominent, inspiring numerous documentaries that examine the causes and effects. One factor is amount of interest on the loans. Another factor is the new guidelines developed by the federal government. There are now new rules deciding who can borrow, as well as how much debt they can take on.[4] Colleges and universities have been increasing the costs for students to attend their schools subsequently increasing the amount of debt these students take on as student loans. Reports have shown that borrowers who finished college in the early 1990s were able to manage their student loans without an enormous burden.[4] The average debt increased 58% since in the seven years from 2005 to 2012. The debt for students in the United States rose from $17,233 in 2005 to $27,253 in 2012.[5] Some blame the economy for the debt increases, but in the same 7-year period credit card debt and auto debt have decreased.[5] According to the American Center for Progress' report on the Student Debt Crisis, within the past three decades the cost of attaining a college degree has drastically increased by more than 1,000 percent.[6] If student debt had stayed constant with inflation since 1992, graduates would not be facing this level of student debt.[4] Newer data, as of 2018, reflects an even larger crisis and cumulative level of student debt. As of 2018, a total of 44.2 Million borrowers now owe a total of over $1.5 Trillion in student debt. In addition to more borrowers, and the total amount owed having more than doubled (up 250%) from $600 Billion to $1.5 Trillion in 10 years, according to Forbes Magazine [7], the rate of delinquency greater than 90 days, or default, has doubled to over 11% nationwide, according to the Federal Reserve.[8]

Statistics

United States

There are two types of loans students borrow in the US: Federal loans and Private loans. Federal loans have a fixed interest rate, usually lower than private loans' interest, set annually by the congress. The direct subsidized loan with the maximum amount of $5,500 has an interest rate of 4.45%, while the direct plus loan with the maximum amount of $20,500 has an interest rate of 7%.[9] As for private loans, there are more options like fixed interest rate, variable interest rate, and income based monthly plans whose interest rates vary depending on the lender, credit history and cosigners. The average interest rate for a private loan in 2017 was 9.66%.[10] The Economist reported in June 2014 that U.S. student loan debt exceeded $1.2 trillion with over 7 million debtors in default. In 2014, there was approximately $1.3 trillion of outstanding student loan debt in the U.S. that affected 44 million borrowers who had an average outstanding loan balance of $37,172.[10] As of 2018, outstanding student loan debt totals 1.5 trillion.[11]

The interest rates are a major factor in the alarming debt numbers, however, the booming of prices of college is another major factor for US tremendous student debt. The Public universities increased their fees by a total of 27% over the five years ending in 2012, or 20% adjusted for inflation. Public university students paid an average of almost $8,400 annually for in-state tuition, with out-of-state students paying more than $19,000. For two decades ending in 2012, college costs rose 1.6% more than inflation each year. Government funding per student fell 27% between 2007 and 2012. Student enrollments rose from 15.2 million in 1999 to 20.4 million in 2011, but fell 2% in 2012.[12][13] Bloomberg reported in July 2014 that: "The biggest growth in the program came in the past decade, as student debt rose an average of 14 percent a year, to $966 billion in 2012 from $364 billion in 2004, according to New York Fed data."[14]

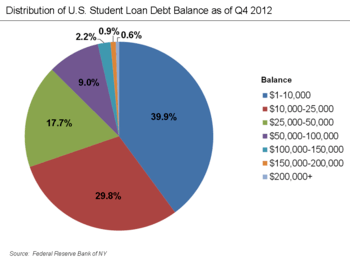

There were around 37 million student loan borrowers with outstanding student loans in 2013. According to the Federal Reserve Bank of New York, outstanding student loan debt in the United States lies between $902 Billion and $1 Trillion with around $864 Billion in Federal student loan debt.[15] As of Quarter 1 in 2012, the average student loan balance for all age groups is $24,301.[15] About one-quarter of borrowers owe more than $28,000; 10% of borrowers owe more than $54,000; 3% owe more than $100,000; and less than 1%, or 167,000 people, owe more than $200,000.[15] Of the 37 million borrowers who have outstanding student loan balances, 14%, or about 5.4 million borrowers, have at least one past due student loan account.[15] For every student loan borrower who defaults, at least two more borrowers become delinquent without default.[15] In 2010 for the first time ever, student loan debt exceeded credit card debt and in 2011 student debt surpassed auto loans (both of which were decreasing).[16] According to Mark Kantrowitz, publisher of FinAid.org, student loan debt is growing by $3,000 per second.[16] According to a report by The Institute for College Access and Success the average debt from those who graduated in 2013 topped $30,000 in six states and was only below $20,000 in one state.[17] Data released by the Federal Reserve Bank of New York showed that in the fourth quarter of 2014 delinquency rates for students dipped to the point where approximately one in nine student loans is past due.[18] As of 2015 over half of outstanding student loans are in deferral, delinquency or default.[19] Rising student loan debt is exacerbating wealth inequality.[20]

Student loan borrowers that attended a for profit, and two year community colleges, in comparison, earn low annual salaries; an average of $22,000 for people withdrawing from schools as of 2010. This means that these people have troubles paying back their loans. The new evidence is reliable with the previous data. For example, the statistics presenting that default rates are essentially lower within the demographic of borrowers with large loans than within borrowers with small loans. However, the new evidence which goes back twenty years, shows how much the scenery of borrowing has changed. Currently, most borrowers are older and attended a for profit or two year community college. About ten years ago, the standard borrower was an established student at a four-year university.[21]

In recent years, tuition has been rising due to the cuts of government funding in education. As an example, more specifically, the University of Pittsburgh has had an increase in tuition of 3.9 percent for the academic school year of 2014-15. In 2014, the U.S. Department of Education ranked Pitt as the most expensive public university for tuition and fees at $16,240, just ahead of Penn State University.[22]

In 2005, the difference in median annual income between those with a bachelor's degree vs. those with a high school diploma was $16,638, though this varies considerably by field of study.[23]

Canada

Canada ranks second in the world behind Korea for the percentage of people in the age group of 25-34 with a bachelor's degree.[24] But Canadians are not prone to the rapid accumulation of student loans. As of September 2012, the average debt for a Canadian leaving University was 28,000 Canadian dollars, and that accumulated debt takes an average of 14 years to fully repay based on an average starting salary of $39,523.[25] To temporarily help their low income struggling citizens with student debt, Canada has a program called interest relief. It grants 6 months free of mandatory payments, for a maximum of 30 months. The Canadian government pays for the interest on those loans during the grace period, so the loan amount is the same at the end of the grace period.[26] Also, students are relieved of their debt after 15 years.[27] As a nation, Canadians have accumulated more than $15 billion of student loan debt as they continue to fight tuition rates from further skyrocketing.[28]

United Kingdom

There is concern about the level of student debt in the United Kingdom. There is also concern about possible changes in government policy forcing graduates to pay back more.[29] Andrew Adonis claims most student loans will never be repaid, Adonis also maintains university leaders have failed to improve teaching standards but rewarded themselves handsomely with high salaries. The Institute for Fiscal Studies maintains three quarters of graduates will never repay all their debts. Andrew McGettigan, loans system expert said, “Until the government removes their right to retrospectively change terms, then you as a borrower appear to be on the hook to future policy changes.[30] Sebastian Burnside NatWest economist, said student debt was rising faster than all other types of debt, he said, “These latest figures show student debt is becoming of greater priority with every passing year. Student debt is the fastest growing type of borrowing and is rapidly becoming economically significant.”[31]

Germany

With student debt being one of the most prominent issues in the world, it seems Germany has found a solution to avoid tremendous student debt that many first world countries face. Germany has both private and public universities with the majority being public universities. For undergraduate studies, public universities are free but have an enrollment fee of no more than €250 per year which is roughly 305 USD. [32]Their private universities cost an average of €10,000 a semester which is about 12,000 USD.[32] Private universities account for 7.1% enrollment with the rest attending the public universities.[33] The private universities have a smaller teacher to student ratio and tend to offer more specialized programs which is why Germany is experiencing a boom in private universities enrollment in recent years for majors like law and medicine. [33]However, most students still prefer public universities due to the drastic difference in tuition cost. The only expense students take out loans for in public universities is the living cost which ranges from €3600 to €8,200 a year depending on the university location.[34] However, the repayment of this loan is interest free and no borrower pays more than €10,000 regardless of the borrowed amount. [34]The average debt at graduation is €5,600 which is 6,680 USD.[35] The chance to gain a bachelor's through well respected universities at a reasonable price without interest packed loans attracts many foreign students as seen through increased enrollment of students from all around the world.

France

France is another country known for its reasonable price for college. The average tuition for a bachelor’s degree is around 190 euros a year, around 620 euros a year for engineering degrees, around 260 euros a year for a master's degree and around 400 euros a year for a PhD.[36] These prices are similar to its neighboring country, Germany. And, the only expense that’s difficult to pay for is the cost of living which is an average of 500 to 1250 euros a month depending on the city.[37] Students can borrow money to pay for these expenses. Only less than 2% students take out loans as there is financial assistance to pay for the full tuition or half of the tuition for low income families depending on their needs.[38]

Pakistan

Student loans are an unknown concept in Pakistan, like most third world countries. Students attend college through the help of their parents who spend majority of their income on their children’s education and some students work to help out with the tuition. The top universities in Pakistan are mostly located in the provinces of Sindh and Punjab. There are 177 universities in the country. [39]To better understand this number, let’s consider the US which is twelve times the size of Pakistan and has 5900 colleges. That means the US has about 477 universities in an area as big as Pakistan.

Pakistan has universities ranking in the top 250 and top 700 in the world.[40] The average tuition cost for these universities is around 402,000 Pakistani Rupees ($3500). But this is not the only expense citizens have to pay for; most people pay for books, food, bus or van to get to their university and a tuition center for help with the tough curriculum which adds up to about 130,000 Rupees ($1147).[40] Even though this seems like a small total to someone from the first world, this is very expensive for Pakistanis as the average salary is about $7,800 a year.[41] The majority of parents cannot afford college education for their children which is why only 12% of all 18-24 years olds are attending college.[42]

Even though students in Pakistan do not carry the burden of student loans, Pakistan has their own problem of making college education more accessible and affordable for their citizens.

Social and political reactions

The growing problem of student debt has caused many reactions from young people throughout the United States. As a result, the Occupy Colleges and Occupy Student Debt movements merged in 2012 in an effort to gain support from students around the country.[43] There have been significant efforts made via social media for the Occupy Student Debt campaign. In particular, students all over the United States have posted their personal student debt testimonies.[44] While some success stories of students eliminating debt have been reported on,[45] they are met with heavy skepticism. Since last October, Occupy Student Debt has provided a platform for over 800 students to share their horror stories.[43] Because of this, other organizations such as, Rebuild the Dream, Education Trust, and the Young Invincibles, have joined in the effort and started similar platforms. The Occupy College movement itself has staged over 10 direct actions.[43][46] They have also gathered over 31,000 signatures on the White House’s petition site, “We the People”. As a result, President Obama announced the Pay as you Earn initiative. Another petition, titled 'Support the Student Loan Forgiveness Act of 2012' on MoveOn.org, which seeks similar relief for student borrowers, has gotten over one million signatures.[47][48][49] HR 4170: “The Student Loan Forgiveness Act of 2012” would give relief to borrowers with both federal and private student loans.[50] HR 4170 also includes the “10-10” programs, which allows borrowers to pay 10% of their discretionary income for ten years with the remaining balance forgiven afterwards.[50]

In April 2012, student loan debt reached US$1 trillion.[51] Severity of the student debt burden represents such a threat to the middle class that some have demanded a general bailout.[52][53] Anthropologist David Graeber, author of Debt: The First 5000 Years, argues that student debt is "destroying the imagination of youth":

If there’s a way of a society committing mass suicide, what better way than to take all the youngest, most energetic, creative, joyous people in your society and saddle them with, like $50,000 of debt so they have to be slaves? There goes your music. There goes your culture. There goes everything new that would pop out. And in a way, this is what’s happened to our society. We’re a society that has lost any ability to incorporate the interesting, creative and eccentric people.[54]

In 2014, a Chilean activist, artist Francisco Tapia, known as "Papas Fritas" (French Fries) "burned $500 million worth of debt papers" from Viña del Mar University, and displayed the ashes in a van as an art project. "The University was being shut down due to financial irregularities. 'It is a concrete fact that the papers were burned. They are gone, burned completely, and there’s no debt,' said Papas Fritas in his first U.S. broadcast interview. 'Since these papers don’t exist anymore, there’s no way to charge the students.'[55]

On November 12, 2015, students organized rallies at more than 100 college campuses across the United States to protest crippling student loan debt and to advocate for tuition-free higher education at public colleges and universities. The demonstrations took place just days after fast food workers went on strike for a minimum wage of $15 an hour and union rights.[56]

In 2015, Central Saint Martins student Brooke Purvis announced that he would burn his student loan as a form of protest art, raising awareness about student debt. It is argued the art work addresses the subject matter of the materialism of money and brings to light the political issues of the U.K student loan system.[57][58][59][60][61][62][63][64]

Leon Botstein, president of Bard College in Annandale-on-Hudson, N.Y., contends that the next president elected in 2016 should push for all outstanding student loan debt to be forgiven.[65]

A February 2018 research paper from the Levy Economics Institute of Bard College argues that government cancellation student debt in the United States would result in rising consumer demand, along with economic growth and increased employment. Over the following decade, the GDP would increase by between $86 billion and $108 billion annually, which would result in an increase of between 1.2 and 1.5 million jobs and a decreased unemployment rate of 0.22 to 0.36 percent.[66]

See also

- College admissions in the United States

- College tuition in the United States

- EdFund

- Free education

- Higher education bubble in the United States

- Higher Education Price Index

- Post-secondary education

- Private university

- Student benefit

- Student loan

- Student loans in the United States

- Tuition

- Tuition agency

- Tuition center

- Tuition fees

- Tuition freeze

References

- ↑ "Am I eligible to receive financial aid?". fafsa.ed.gov. Retrieved 2018-09-17.

- ↑ "A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults". The Brookings Institution. Retrieved 2015-12-11.

- ↑ Carey, Kevin (2015-10-07). "Student Debt Is Worse Than You Think". The New York Times. ISSN 0362-4331. Retrieved 2015-12-11.

- 1 2 3 "Inside Higher Ed's News". www.insidehighered.com.

- 1 2 Touryalai, Halah. "Student Loan Increase". Forbes. Forbes. Retrieved 19 February 2013.

- ↑ "The Student Debt Crisis - Center for American Progress".

- ↑ https://www.forbes.com/sites/zackfriedman/2018/06/13/student-loan-debt-statistics-2018/#50a5ed8d7310

- ↑ https://www.minneapolisfed.org/publications/fedgazette/a-rising-mountain-of-student-debt

- ↑ "Federal Student Aid at a Glance" (PDF).

- 1 2 "Student loan interest rates edge higher and higher".

- ↑ vanden Heuvel, Katrina (June 19, 2018). "Americans Are Drowning in Student-Loan Debt. The US Should Forgive All of It". The Nation. Retrieved August 13, 2018.

- ↑ "Creative destruction".

- ↑ "The digital degree".

- ↑ "Bloomberg-Student Debt-July 2014".

- 1 2 3 4 5 "Student Loan Debt Statistics". American Student Assistance. Retrieved 18 February 2013.

- 1 2 "Student Loans: Debt for Life". Bloomberg Businessweek. Retrieved 18 February 2013.

- ↑ The Institute for College Access and Success http://ticas.org/content/pub/average-debt-2013-grads-tops-30k-6-states-only-1-below-20k-0

- ↑ Federal Reserve Bank of New York http://www.newyorkfed.org/newsevents/news/research/2015/rp150217.html

- ↑ Chuck Collins (March 13, 2015). The Student Debt Time Bomb. Moyers & Company. Retrieved March 23, 2015.

- ↑ Carolyn Thompson (March 27, 2014). $1 trillion student loan debt widens US wealth gap. Associated Press. Retrieved July 7, 2014.

- ↑ Dynarski, Susan (2015-09-10). "New Data Gives Clearer Picture of Student Debt". The New York Times. ISSN 0362-4331. Retrieved 2015-12-11.

- ↑ "University of Pittsburgh approves 3.9 percent tuition increase".

- ↑ Source: US Census Bureau. See charts at Income in the United States.

- ↑ "Education attainment - Population with tertiary education - OECD Data". theOECD. Retrieved 2018-05-11.

- ↑ "Student debt: Average payback takes 14 years". Financial Post. Retrieved 21 February 2013.

- ↑ "Interest Relief for Canada Student Loans". 2007-06-17. Archived from the original on 2007-06-17. Retrieved 2018-05-11.

- ↑ Canada, Employment and Social Development. "Repayment Assistance Plan - Canada.ca". www.canada.ca. Retrieved 2018-05-14.

- ↑ "Canadian Federation of Students". Retrieved 21 February 2013.

- ↑ Could tuition fees really cost £54,000? BBC

- ↑ Tuition fees should be scrapped, says 'architect' of fees Andrew Adonis The Guardian

- ↑ UK student loan debt soars to more than £100bn The Guardian

- 1 2 Playdon, Jane (2018-04-24). "How Much Does it Cost to Study in Germany". Top Universities.

- 1 2 Trines, Stefan. "Education in Germany".

- 1 2 "Around 850 a Month for Living Expenses".

- ↑ Usher, Alex. Global Debt Patterns.

- ↑ "Low university tuition fees in France". www.campusfrance.org. Retrieved 2018-05-17.

- ↑ "Costs of Attending College in France - Study in France". Study in France. 2013-07-24. Retrieved 2018-05-11.

- ↑ "Les bourses de l'enseignement supérieur" (in French). Retrieved 2018-05-11.

- ↑ "Analysis: The rising cost of higher education in Pakistan - The Express Tribune". The Express Tribune. 2016-05-27. Retrieved 2018-05-11.

- 1 2 "Study in Pakistan". Top Universities. 2016-04-05. Retrieved 2018-05-11.

- ↑ "Pakistan Annual Household Income per Capita | Economic Indicators". www.ceicdata.com. Retrieved 2018-05-11.

- ↑ "Safety in numbers: higher education in Pakistan". Times Higher Education (THE). 2016-04-21. Retrieved 2018-05-11.

- 1 2 3 Abrams, Natalia. "Occupy Colleges and Occupy Student Debt Join Forces". Retrieved 20 February 2013.

- ↑ "Occupy Student Debt".

- ↑ Martin, Emmie (8 March 2017). "How one 31-year-old paid off $220,000 in student loans in 3 years". Business Insider. Retrieved 12 March 2018.

- ↑ Goodman, Amy (2011-11-29). "Occupy Student Debt: Students Urged to Refuse to Pay Off Loans as Schools Hike Tuition". Democracy Now!. Retrieved 2014-05-26.

- ↑ Kristof, Gregory (15 June 2012). "Hansen Clarke's Student Loan Forgiveness Act Finds Big Support Online". Huffington Post. Retrieved 25 June 2013.

- ↑ Hopkins, Katy. "1 Million People Show Support for Student Loan Forgiveness Act". Retrieved 25 June 2013.

- ↑ Park, Minjae. "Fix the Economy, Forgive Student Debt". Retrieved 25 June 2013.

- 1 2 Applebaum, Robert. "HR 4170 : The Student Loan Forgiveness Act of 2012". Retrieved 20 February 2013.

- ↑ Goodman, Amy (2012-04-25). "1T Day: As U.S. Student Debt Hits $1 Trillion, Occupy Protests Planned for Campuses Nationwide". Democracy Now!. Retrieved 2014-05-26.

- ↑ Hickman, John. "Writing off a Generation". Retrieved 21 April 2014.

- ↑ Goodman, Amy (2013-07-03). "Failure to Stop Doubling of Student Loan Rates Sparks Call to Tackle "Systemic" Debt Crisis". Democracy Now!. Retrieved 2014-05-26.

- ↑ David Graeber: ‘There Has Been a War on the Human Imagination’. Truthdig. Retrieved November 16, 2014.

- ↑ Goodman, Amy (2014-05-23). "Exclusive: Chilean Robin Hood? Artist Known as "Papas Fritas" on Burning $500M Worth of Student Debt". Democracy Now!. Retrieved 2014-05-26.

- ↑ Students across US march over debt, free public college. Al Jazeera America. November 12, 2015.

- ↑ "Meet Student Brooke Purvis, Who's Burning His Student Loan In Protest Against Capitalism".

- ↑ Aftab Ali (30 October 2015). "Central Saint Martins artist, Brooke Purvis, to set fire to his student loan in protest against capitalism". The Independent.

- ↑ "This British art student is burning his student loan to make a valuable point about money".

- ↑ "Artist Brooke Purvis is burning his student loan in a protest against money - Metro News". Metro.

- ↑ Kirstie McCrum (3 November 2015). "Man to burn his entire student loan as a protest in the name of art". Mirror.

- ↑ Cait Munro (28 October 2015). "Art Student Burns Student Loan - artnet News". artnet News.

- ↑ "Meeting the Man Who Plans to Set His Entire Student Loan On Fire". VICE.

- ↑ "The guy burning his entire student loan doesn't deserve your attention".

- ↑ Why the Next President Should Forgive All Student Loans. Time. Aug. 12, 2016.

- ↑ Levitz, Eric (February 9, 2018). "We Must Cancel Everyone's Student Debt, for the Economy's Sake". New York. Retrieved February 10, 2018.