New York Community Bank

| |

| Public company | |

| Traded as |

NYSE: NYCB S&P 400 component |

| Industry | Commercial bank |

| Founded | 1859 |

| Headquarters | Westbury, New York |

Number of locations | 225 branches |

Key people |

Joseph R. Ficalora, CEO Thomas R. Cangemi, CFO Dominick Ciampa, Chairman |

| Products |

Multi-family loans Commercial real estate loans |

| Total assets |

|

| Total equity |

|

Number of employees | 3,096 (2017) |

| Capital ratio | 11.36% Common equity tier 1 capital (2017) |

| Website |

www |

|

Footnotes / references [1] | |

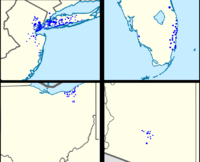

New York Community Bancorp, Inc. (NYCB) is a bank headquartered in Westbury, New York, with 225 branches in New York, New Jersey, Ohio, Florida, and Arizona.[1] NYCB is on the list of largest banks in the United States.

Almost all of the loans originated by the bank are either multi-family or commercial loans, many of which are in New York City and are subject laws regarding rent control in New York.

Divisions

New York Community Bank operates branches under the following names:[1]

- Community Bank (New York)

- Queens County Savings Bank (New York)

- Roslyn Savings Bank (New York)

- Richmond County Savings Bank (New York)

- Roosevelt Savings Bank (New York)

- Garden State Community Bank (New Jersey)

- AmTrust Bank (Florida and Arizona)

- Ohio Savings Bank (Ohio)

History

NYCB was founded on April 14, 1859, in Flushing, Queens, as Queens County Savings Bank,[1] and changed its name on December 15, 2000, to New York Community Bank to better reflect its market area beyond Queens.

In 1993, the company became a public company via an initial public offering.[1]

In 2000, the bank acquired Haven Bancorp for $196 million.[2]

In 2001, NYCB acquired Richmond County Financial in an $802 million transaction.[3]

In 2002, NYCB acquired asset manager Peter B. Cannell & Co.[4]

In 2003, NYCB acquired Roslyn Bancorp in a $1.6 billion transaction.[5]

In 2005, NYCB acquired Long Island Financial in a $70 million transaction.[6]

In 2006, NYCB acquired Atlantic Bank of New York from the National Bank of Greece for $400 million.[7]

In March 2007, NYCB acquired 11 branches in New York City from Doral Financial Corporation.[8]

In April 2007, NYCB acquired Penn Federal Savings Bank for $262 million, adding branches in East Central and North East New Jersey.[9]

In October 2007, NYCB acquired Synergy Bank of Cranford, New Jersey for $168 million in stock. In September 2009, NYCB re-branded the Synergy branches to Garden State Community Bank.[10]

In December 2009, the Federal Deposit Insurance Corporation seized AmTrust, a bank headquartered in Cleveland, OH with 66 branches and $13 billion in assets in Ohio, Florida and Arizona.[11] NYCB acquired Amtrust, which expanded NYCB's branch footprint outside of the New York metropolitan area for the first time.[12] In 2017, the bank sold the mortgage business acquired from the purchase of AmTrust at a $90 million profit.[13]

In March 2010, Desert Hills Bank of Phoenix, Arizona, with $496 million in assets, was seized by the FDIC and acquired by NYCB.[14][15]

In June 2012, NYCB acquired the assets of Aurora Bank from Lehman Brothers.[16]

On October 29, 2015, the bank announced an agreement to merge with Astoria Bank, but the proposed merger was terminated in December 2016 after failing to win regulatory approval.[17][18]

References

- 1 2 3 4 5 "New York Community Bancorp, Inc. 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- ↑ "Metro Business: Haven Bancorp Acquired". The New York Times. Bloomberg L.P. June 29, 2000.

- ↑ "NEW YORK COMMUNITY BANCORP, INC. AND RICHMOND COUNTY FINANCIAL CORP. ANNOUNCE MERGER-OF-EQUALS IN AN $802 MILLION TRANSACTION EXPECTED TO GENERATE 2002 CASH EARNINGS ACCRETION OF 16%" (Press release). U.S. Securities and Exchange Commission. March 27, 2001.

- ↑ Solnik, Claude (December 28, 2001). "NYCB acquires balance of Peter B. Cannell & Co". Long Island Business News.

- ↑ "New York Community Bancorp, Inc. Completes Strategic Merger with Roslyn Bancorp, Inc" (Press release). Business Wire. November 3, 2003.

- ↑ "NEW YORK COMMUNITY BANCORP, INC. TO ACQUIRE LONG ISLAND FINANCIAL CORP" (Press release). U.S. Securities and Exchange Commission. August 1, 2005.

- ↑ Diamataris, Antonis (October 14, 2005). "Ntl. Bank of Greece Sells Atlantic Bank to New York Bank for $400M in Cash". The National Herald.

- ↑ "New York Community Bancorp, Inc. Announces the Acquisition of 11 New York City Branches of Doral Bank, FSB by New York Commercial Bank" (Press release). Business Wire. March 15, 2007.

- ↑ "New York Community Bancorp, Inc. Completes the Acquisition of PennFed Financial Services, Inc" (Press release). Business Wire. April 2, 2007.

- ↑ "New York Community bank buys Synergy for $168 mln". Reuters. May 14, 2007.

- ↑ "FDIC Failed Bank Information: Information for AmTrust Bank, Cleveland, OH". Federal Deposit Insurance Corporation.

- ↑ Murray, Teresa Dixon (December 4, 2009). "AmTrust Bank fails, bought by New York bank". Cleveland Plain Dealer.

- ↑ "New York Community Bancorp, Inc. Announces Strategic Sale of Mortgage Banking Business and Residential Assets Covered under FDIC Loss Share Agreement" (Press release). Business Wire. June 27, 2017.

- ↑ "FDIC Failed Bank Information: Information for Desert Hills Bank, Phoenix, AZ". Federal Deposit Insurance Corporation.

- ↑ Casacchia, Chris (March 27, 2010). "Desert Hills Bank latest to be shut down by FDIC". American City Business Journals.

- ↑ "Lehman Brothers Holdings Announces Completion of the Sale of Substantially All Aurora Bank Assets and Insured Deposits" (Press release). Business Wire. June 29, 2012.

- ↑ Orol, Ronald (December 20, 2016). "N.Y. Community Bank Scraps $2 Billion Astoria Deal as Fed Review Lingers". TheStreet.com.

- ↑ "New York Community Bancorp, Inc. and Astoria Financial Corporation Announce the Termination of Their Definitive Merger Agreement Effective January 1, 2017" (Press release). Business Wire. December 20, 2016.

External links

- Business data for New York Community Bancorp, Inc.: Google Finance

- Yahoo! Finance

- Bloomberg

- Reuters

- SEC filings