Capital One

| |

| Public company | |

| Traded as | |

| Industry | Financial services |

| Founded |

1988 Richmond, Virginia, U.S. |

| Founder | Richard Fairbank, Nigel Morris |

| Headquarters | McLean, Virginia |

Key people |

Richard Fairbank (Chairman, President and CEO) Stephen S. Crawford (Head of Finance and Corporate Development) R. Scott Blackley (CFO) |

| Products | Retail banking, credit cards, loans, savings |

| Revenue |

|

|

| |

| Total assets |

|

| Total equity |

|

Number of employees | 49,300 (2017) |

| Capital ratio | 10.3% (2017) |

| Website |

www |

|

Footnotes / references [1] | |

Capital One Financial Corporation is a bank holding company specializing in credit cards, auto loans, banking and savings products headquartered in McLean, Virginia.[1]

Capital One is ranked 11th on the list of largest banks in the United States by assets. The bank has 755 branches including 30 café style locations[2] and 2,000 ATMs. It is ranked 101st on the Fortune 500,[3] 17th on Fortune's 100 Best Companies to work for list,[4] and conducts business in the United States, Canada, and the United Kingdom.[1] The company helped pioneer the mass marketing of credit cards in the 1990s, and it is one of the largest customers of the United States Postal Service due to its direct mail credit card solicitations.[5] In 2016, it was the 5th largest credit card issuer by purchase volume, after American Express, JP Morgan Chase, Bank of America, and Citigroup.[6]

Capital One is also the 4th largest bank auto lender, with a market share of 4.2% in 2016.[7]

In 2016, 62% of the company's revenues were from credit cards, 26% was from consumer banking, 11% was from commercial banking, and 1% was from other.[1]

Divisions

Capital One operates 3 divisions as follows:[1]

- Credit Cards – Capital One issues credit cards in the United States, Canada, and the United Kingdom and is the 3rd largest credit card issuer, after JP Morgan Chase and Citigroup. As of December 31, 2017, Capital One had $105.293 billion in credit card loans outstanding in the United States and $9.469 billion of credit card loans outstanding in Canada and the United Kingdom. Credit card loans represented 45.1% of total loans outstanding as of December 31, 2017.[1]

- Consumer Banking – offers banking services, including checking accounts, saving accounts, and money market accounts via its branches and direct bank.

- Auto loans – Along with Wells Fargo, Bank of America, Ally Financial, and JP Morgan Chase, Capital One is one of the top bank auto lenders in the U.S. by volume.[8] As of December 31, 2017, Capital One had $53.991 billion in auto loans outstanding. Auto loans represented 21.2% of total loans outstanding as of December 31, 2017.[1]

- Home mortgage – Capital One had $17.633 billion in home loans outstanding as of December 31, 2017. However, it exited the business and does not originate new home mortgage loans. Home mortgage loans represented 6.9% of total loans outstanding as of December 31, 2017.[1]

- Commercial banking – As of December 31, 2017, Capital One had $64.575 billion in loans outstanding secured by commercial, multifamily, and industrial properties. Commercial loans represented 25.4% of total loans outstanding as of December 31, 2017.[1]

History

Monoline credit card company (1994–2004)

On July 27, 1994, Richmond, Virginia-based Signet Financial Corp (now part of Wells Fargo) announced the corporate spin-off of its credit card division, OakStone Financial, naming Richard Fairbank as CEO.[9] Signet renamed the subsidiary Capital One in October 1994.[10] The spinoff was concluded February 28, 1995, making Capital One fully independent.[11]

At that time, Capital One was a monoline bank, meaning that all of its revenue came from a single product, in this case, credit cards.[12] This strategy is risky in that it can lead to losses during bad times.[12] Capital One attributed its relative success as a monoline to its use of data collection to build demographic profiles, allowing it to target personalized offers of credit direct to consumers.[13]

Capital One commenced operations in Canada in 1996.

Expansion into auto loans (1998-present)

In July 1998, Capital One acquired auto financing company Summit Acceptance Corporation.[14]

In 1999, Capital One was looking to expand beyond credit cards. CEO Richard Fairbank announced moves to use Capital One's experience with collecting consumer data to offer loans, insurance, and phone service.[15] [16]

In October 2001, PeopleFirst Finance LLC was acquired by Capital One.[17]

The companies were combined and rebranded as Capital One Auto Finance Corporation in 2003.[18]

In late 2002, Capital One and the United States Postal Service proposed a negotiated services agreement for bulk discount in mailing services.[19] The resulting three-year agreement[20] was extended in 2006.[21] In June 2008, however, Capital One had filed a complaint[22] with the USPS regarding the terms of the next agreement,[23] citing the terms of the NSA of Capital One's competitor, Bank of America. Capital One subsequently withdrew its complaint to the Postal Regulatory Commission following a settlement with the USPS.[24]

Onyx Acceptance Corporation was acquired by Capital One in January 2005.[25]

Expansion into retail banking (2005-present)

While many other monolines were acquired by larger, diverse banks, Capital One expanded into retail banking with a focus on subprime customers.

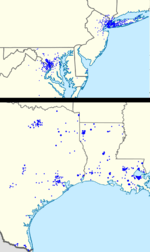

Capital One acquired New Orleans, Louisiana-based Hibernia National Bank for $4.9 billion in cash and stock in 2005[26] and acquired Melville, New York-based North Fork Bank for $13.2 billion in cash and stock in 2006,[27] which reduced its dependency on credit cards from 90% to 55%.[28]

In 2007, Capital One acquired NetSpend, a marketer of prepaid debit cards, for $700 million.[29]

During the 2007 subprime mortgage financial crisis, Capital One closed its mortgage platform, GreenPoint Mortgage, due in part to investor pressures.[30][31][32]

In 2008, Capital One received an investment of US$3.56 billion from the United States Treasury as a result of the Troubled Asset Relief Program.[33][34] On June 17, 2009, Capital One completed the repurchase of the stock the company issued to the U.S. Treasury paying a total of US$3.67 billion, resulting in a profit of over $100 million to the U.S. Treasury.[35]

The U.S. Securities and Exchange Commission criticized Capital One's conduct during the crisis, claiming that they understated auto loan losses during the financial crisis of 2007–2008. In 2013, Capital One paid $3.5 million to settle the case, but was not required to directly address the allegations of wrongdoing.[36]

In February 2009, Capital One acquired Chevy Chase Bank for $520 million in cash and stock.[37][38][39][40]

In June 2011, ING Group announced the sale of its ING Direct division to Capital One for US$9 billion in cash and stock.[41] On August 26, 2011, the Federal Reserve Board of Governors announced it would hold public hearings on the Capital One acquisition of ING Direct, and extend to October 12, 2011, the public comment period that had been scheduled to end August 22.[42] The move came amidst rising scrutiny of the deal on systemic risk, or "Too-Big-to-Fail," performance under the Community Reinvestment Act, and pending legal challenges. A coalition of national civil rights and consumer groups, led by the National Community Reinvestment Coalition, were joined by Rep. Barney Frank to challenge immediate approval of the deal. The groups argued that the acquisition is a test of the Dodd-Frank Wall Street Reform and Consumer Protection Act, under which systemically risky firms must demonstrate a public benefit that outweighs new risk before they are allowed to grow. Kansas City Federal Reserve Bank head Thomas M. Hoenig was also skeptical of the deal.[43][44] In February 2012, the acquisition was approved by regulators and Capital One completed its acquisition of ING Direct.[45] Capital One received permission to merge ING into its business in October 2012,[46] and rebranded ING Direct as Capital One 360 in November 2012.[47]

In August 2011, Capital One reached a deal with HSBC to acquire its U.S. credit card operations.[48] Capital One paid US$31.3 billion in exchange for US$28.2 billion in loans and $600 million in other assets. The acquisition was completed by May 2012.[49]

On February 26, 2012, along with several other banks, Capital One announced support for the Isis Mobile Wallet payment system.[50] However, in September 2013, Capital One dropped support for the venture.[51]

In 2012, Capital One closed 41 branch locations.[52]

In 2015, Capital One closed several branch locations to leave 174 operating branches in the D.C. metro area.[53]

On February 19, 2014, Capital One became a 25% owner in ClearXchange, a Peer-to-peer transaction money transfer service designed to make electronic funds transfers to customers within the same bank and other financial institutions via mobile phone number or email address.[54] ClearXchange was sold to Early Warning in 2016.[55]

In January 2015, Capital One acquired Level Money, a budgeting app for consumers.[56]

On July 8, 2015, the company acquired Monsoon, a design studio, development shop, marketing house and strategic consultancy.[57]

In 2015, Capital One acquired General Electric's Healthcare Financial Services unit, which included $8.5 billion in loans made to businesses in the healthcare industry, for $9-billion.[58]

In October 2016, Capital One acquired Paribus, a price tracking service, for an undisclosed amount.[59][60]

Exit from mortgage banking (2006–2007 and 2011–2017)

In November 2017, Sanjiv Yajnik announced that the mortgage market is too competitive in the low rate environment to make money in the business.[61] The company exited the mortgage origination business on November 7, 2017, laying off 1,100 employees.[62] This was the second closure; the first occurred on August 20, 2007, when GreenPoint Mortgage unit was closed.[63] GreenPoint had been acquired December 2006 when Capital One paid $13.2 billion to North Fork Bancorp Inc. The re-emergence into the mortgage industry came in 2011 with the purchase of online bank ING Direct USA.[64]

Other acquisitions

In May 2018, the company acquired Confyrm, a digital identity and fraud alert service.[65][66][67]

Sports marketing

Since 2001, Capital One has been the principal sponsor of the college football Florida Citrus Bowl, which has been called the Capital One Bowl since 2003. It sponsors a mascot challenge every year, announcing the winner on the day of the Capital One Bowl. Capital One is one of the top three sponsors of the NCAA, paying an estimated $35 million annually in exchange for advertising and access to consumer data.[68][69] Capital One also sponsored the EFL Cup, an English Soccer Competition, from 2012 to 2016. The company sponsored Sheffield United F.C. from 2006 to 2008. In 2017, the company became the sponsor of the Capital One Arena in Washington D.C..[70][71]

In 2018, to celebrate the Washington Capitals' second-ever Stanley Cup Finals appearance, the firm temporarily changed its logo by replacing the word "Capital" with the Capitals' titular logo, without the "s" plural.[72][73]

Corporate citizenship

Capital One operates some charitable programs, such as the "No Hassle Giving" web portal, in which Capital One covers the transaction fees on customer and non-customer donations made through the site.[74] The accountability organization National Committee for Responsive Philanthropy has been highly critical of Capital One's relatively low rate of giving, stating that "Capital One's philanthropic track record is dismal".[75] The organization pointed out that Capital One's donations of 0.024% of revenue were much less than the industry median of 0.11% of revenue.[75] Capital One has disputed the groups figures, saying that "... In 2011 alone, our giving totals are more than 6 times greater ($30 million) than the number given by the NCRP".[76]

Criticism and legal actions

Fines for misleading customers to pay extra for services

In July 2012, Capital One was fined by the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau for misleading millions of its customers, such as paying extra for payment protection or credit monitoring when they took out a card.[77] The company agreed to pay $210 million to settle the legal action and to refund two million customers.[78] This was the CFPB's first public enforcement action.[79]

Automated dialing to customers' phones

In August 2014, Capital One and three collection agencies entered into an agreement to pay $75.5 million to end a consolidated class action lawsuit pending in the United States District Court for the Northern District of Illinois alleging that the companies used an automated dialer to call customers’ cellphones without consent, which is a violation of the Telephone Consumer Protection Act of 1991.[80] It is notable that this legal action involved informational telephone calls, which are not subject to the "prior express written consent" requirements which have been in place for telemarketing calls since October 2013.[81]

2014 amendment to terms of use to allow personal visits

In 2014, Capital One amended its terms of use to allow it to "contact you in any manner we choose", including a "personal visit . . . at your home and at your place of employment." It also asserted its right to "modify or suppress caller ID and similar services and identify ourselves on these services in any manner we choose."[82] Los Angeles Times writer David Lazarus commented that "Cap One has made deliberate decisions that seem intended to overreach and intimidate, confirming in the eyes of many the company's thoughtlessness and occasional ruthlessness".[83] Emily Rusch, the executive director of the California Public Interest Research Group, found the company's assertion of a right to "spoof" Caller ID particularly disturbing, saying "Now more than ever, consumers need to be able to trust companies".[82]

Capital One spokeswoman Pam Girardo responded that the company would not actually make personal visits to customers except "As a last resort, . . . if it becomes necessary to repossess [a] sports vehicle".[82] Capital One also attributed its assertion of a right to "spoof" as necessary because "sometimes the number is 'displayed differently' by 'some local phone exchanges,' something that is 'beyond our control'".[84]

Girardo told The New York Times that the company was "reviewing" the language involved. David Lazarus noted that "now that a little sunlight has been applied, the company is not as comfortable as it previously was with behaving like a total maniac. In the meantime, cardholders can make up their own minds. Do they want to believe the non-binding explanations of a company representative or the legally enforceable language that's currently in their written contracts?"[82]

Notable office buildings

Capital One West Creek Campus: 15000 Capital One Drive, Richmond, VA 23238

Capital One McLean Building 1: 1680 Capital One Drive, McLean, VA 22102

References

- 1 2 3 4 5 6 7 8 9 "Capital One Financial 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- ↑ "Capital One 360 Café Locations". Capital One.

- ↑ "Fortune 500". Fortune.

- ↑ "Capital One: #17 on 100 Best Companies to Work For in 2017". Fortune.

- ↑ MYERBERG, PAUL (January 1, 2010). "Capital One Bowl: No. 13 Penn State (10-2) vs. No. 12 L.S.U. (9-3)". The New York Times.

- ↑ Comoreanu, Alina (February 10, 2017). "Market Share by Credit Card Issuer". WalletHub.

- ↑ "Which U.S. Banks Hold The Largest Share In The Country's Auto Lending Industry?". Nasdaq. November 11, 2016.

- ↑ Hoffman, William (March 3, 2017). "Chase Ties Ally as Top Bank Auto Lender". Auto Finance News.

- ↑ "COMPANY NEWS; SIGNET BANKING TO SPIN OFF CREDIT CARD BUSINESS". The New York Times. July 28, 1994.

- ↑ Conn, David (October 12, 1994). "Signet renames credit card subsidiary Capital One". Baltimore Sun.

- ↑ "CAPITAL ONE REPORTS FIRST QUARTER EARNINGS" (Press release). PR Newswire. April 19, 1995.

- 1 2 Perez, Saul (March 5, 2015). "Capital One's history: From credit cards to a diversified bank". Market Realist.

- ↑ Wheatley, Malcolm (November 1, 2001). "Capital One Builds Entire Business on Savvy Use of IT". CIO magazine.

- ↑ "CAPITAL ONE PLANS PURCHASE OF AUTO FINANCING COMPANY". The New York Times. Bloomberg L.P. July 17, 1998.

- ↑ Mcnamee, Mike (November 21, 1999). "Capital One: Isn't There More To Life Than Plastic?". Bloomberg L.P.

- ↑ Pedchenko, Alex (March 10, 2017). "TOP 6 companies using NodeJS in production". Medium.

- ↑ "Capital One Financial Agrees to Acquire PeopleFirst Inc.; Expands Auto Financing Business" (Press release). PR Newswire. September 21, 2001.

- ↑ "PeopleFirst Changes Brand to Capital One Auto Finance" (Press release). PR Newswire. June 27, 2003.

- ↑ "Postal Service Files Capital One Negotiated Service Agreement". September 20, 2002.

- ↑ "Experimental Rate and Service Changes to Implement Negotiated Service Agreement with Capital One: OPINION AND RECOMMENDED DECISION" (PDF). May 15, 2003.

- ↑ Campanelli, Melissa (August 25, 2006). "PRC Says OK To Capital One NSA Extension". Direct Marketing News.

- ↑ "COMPLAINT OF CAPITAL ONE SERVICES, INC. REGARDING DISCRIMINATION AND OTHER VIOLATIONS OF LAW BY THE UNITED STATES POSTAL SERVICE" (PDF). Postal Regulatory Commission. June 19, 2008.

- ↑ Yurcan, Bryan (January 8, 2009). "USPS, Capital One dispute remains in discovery". Direct Marketing News.

- ↑ "Postal Regulatory Commission Proceedings". United States Postal Service.

- ↑ Clabaugh, Jeff (January 12, 2005). "Capital One completes Onyx acquisition". American City Business Journals.

- ↑ "Capital One Completes Acquisition of Hibernia Corporation" (Press release). U.S. Securities and Exchange Commission. November 16, 2005.

- ↑ "Capital One Completes Acquisition of North Fork Bancorporation" (Press release). U.S. Securities and Exchange Commission. December 1, 2006.

- ↑ Moyer, Liz (March 4, 2006). "A Hot Time In Banking". Forbes.

- ↑ "Capital One Acquires Nation's Prepaid Card Leader NetSpend" (Press release). PR Newswire. August 7, 2007.

- ↑ "Capital One Closes Wholesale Mortgage Unit" (Press release). PR Newswire. August 20, 2007.

- ↑ Bauerlein, Valerie (August 21, 2007). "Capital One to Close Its GreenPoint Unit". The Wall Street Journal. (subscription required)

- ↑ "Capital One Financial Closes Wholesale Mortgage Unit". CNBC. Associated Press. August 20, 2007.

- ↑ "Capital One, Form 8-K, Current Report, Filing Date Nov 18, 2008" (PDF). secdatabase.com. November 18, 2008.

- ↑ "CAPITAL PURCHASE PROGRAM Transaction Report" (PDF). Tarp Transactions. United States Treasury. November 17, 2008.

11/14/2008 Capital One Financial Corporation / McLean VA / Purchase Preferred Stock w/Warrants / $3,555,199,000 / Par

- ↑ "Capital One, Form 8-K, Current Report, Filing Date Jun 17, 2009". secdatabase.com. June 17, 2009.

- ↑ Protess, Ben (April 25, 2013). "DEALBOOK; Capital One Settles Charges It Understated Loan Losses". The New York Times.

- ↑ "Capital One to Buy Chevy Chase Bank". The New York Times. December 4, 2008.

- ↑ Fitzpatrick, Dan (December 4, 2008). "Capital One to Acquire Chevy Chase Bank". The Wall Street Journal. (subscription required)

- ↑ Goldfarb, Zachary A.; Appelbaum, Binyamin (December 4, 2008). "Capital One Awoke To Its Dream Deal". The Washington Post.

- ↑ "Capital One Completes Acquisition of Chevy Chase Bank" (Press release). PR Newswire. February 27, 2009.

- ↑ "ING To Sell ING Direct USA to Capital One" (Press release). ING Group. June 16, 2011.

- ↑ "Federal Reserve Board announces public meetings on the notice by Capital One Financial Corporation to acquire ING Bank". Federal Reserve System. August 26, 2011.

- ↑ Felsenthal, Mark (August 25, 2011). "Fed's Hoenig Says Doesn't See Recession Looming". Reuters.

- ↑ Pearlstein, Steven (August 28, 2011). "Steven Pearlstein: Time to say no to bank consolidation". The Washington Post.

- ↑ "Capital One Completes Acquisition of ING Direct" (Press release). PR Newswire. February 17, 2012.

- ↑ "Conditional Merger Approval" (PDF). Office of the Comptroller of Currency. October 17, 2012.

- ↑ Ruiz Switzky, Bryant (November 8, 2012). "ING Direct rebranded as Capital One 360". American City Business Journals.

- ↑ Wilchins, Dan; Thomas, Denny (August 10, 2011). "Capital One bulks up U.S. cards with HSBC deal". Reuters.

- ↑ Zhen, Simon (May 2, 2012). "Capital One Completes Purchase of HSBC US Credit Cards". MyBankTracker.

- ↑ Yurcan, Bryan (February 27, 2012). "Isis Adds Three Banks to its Mobile Wallet". InformationWeek.

- ↑ Mlot, Stephanie (September 20, 2013). "Capital One Drops Support for Isis Mobile Wallet". PC Magazine.

- ↑ Ellis, Blake (January 25, 2013). "Say goodbye to more bank branches". CNNMoney.

- ↑ Medici, Andy (May 4, 2016). "Here's how much Capital One is spending this year to close, renovate its branches". American City Business Journals.

- ↑ "CAPITAL ONE JOINS CLEARXCHANGE NETWORK" (PDF) (Press release). pymnts.com. February 19, 2014.

- ↑ "Early Warning Completes Acquisition of clearXchange" (Press release). Early Warning. January 12, 2016.

- ↑ Perez, Sarah (January 12, 2015). "Capital One Acquires Budgeting App Level Money". TechCrunch.

- ↑ Perez, Sarah (July 8, 2015). "Capital One Acquires Oakland-Based Design And Development Firm Monsoon". TechCrunch.

- ↑ "Capital One Completes Acquisition of GE Capital's Healthcare Financial Services Lending Business" (Press release). PR Newswire. December 1, 2015.

- ↑ Perez, Sarah (October 6, 2016). "Capital One acquires online price tracker Paribus". TechCrunch.

- ↑ Yurcan, Bryan (October 12, 2016). "Capital One Adds to Its Growing List of Fintech Deals". American Banker.

- ↑ Ramirez, Kelsey (November 16, 2017). "Capital One suddenly exits mortgage and home equity business". HousingWire.com.

- ↑ Surane, Jennifer (November 7, 2017). "Capital One Exits Mortgage Origination Business, Cuts 1,100 Jobs". Bloomberg L.P.

- ↑ Wilchins, Dan (August 20, 2007). "Capital One slashes jobs, mortgage industry swoons". Reuters.

- ↑ Merle, Renae (June 16, 2011). "Capital One Bank to acquire ING Direct USA". The Washington Post.

- ↑ Perez, Sarah (May 11, 2018). "Capital One acquires digital identity and fraud alert startup Confyrm". TechCrunch.

- ↑ Nash, Andrew (May 11, 2018). "Confyrm Joins Capital One to Fuel Consumer Identity Services at Scale". Medium.

- ↑ DiCamillo, Nathan (May 30, 2018). "How Capital One sees digital identity as a business opportunity". American Banker.

- ↑ Dosh, Kristi (November 3, 2013). "Capital One maximizing March's madness". ESPN.

- ↑ Hornblass, JJ (April 11, 2013). "Cap One Uses March Madness to Mine Customer Data, Even After Tournament". Bank Innovation.

- ↑ Steinberg, Dan (August 9, 2017). "Verizon Center to become Capital One Arena, starting now". The Washington Post.

- ↑ Medici, Andy (August 9, 2017). "Verizon Center to become Capital One Arena, starting now". American City Business Journals.

- ↑ Pimpo Jr., Stephen (May 27, 2018). "Capital One changes website logo to support Caps ahead of Stanley Cup finals". WJLA-TV.

- ↑ Brandt, Caroline (May 27, 2018). "Capital One Bank just made a Caps-themed update to its logo and we're here for it". NBC Sports.

- ↑ "Individual Donations Add Up With Capital One's No Hassle Giving Program" (Press release). Business Wire. November 25, 2009.

- 1 2 "Doubt Over Capital One's Commitment to Philanthropy" (Press release). National Committee for Responsive Philanthropy. October 4, 2011.

- ↑ "Charity group wary of Capital One-ING merger". NBC News. Associated Press. October 5, 2011.

- ↑ "Capital One fined for misleading millions of customers". BBC News. July 18, 2012.

- ↑ "Capital One, Form 8-K, Current Report, Filing Date Jul 18, 2012" (PDF). secdatabase.com. July 18, 2012.

- ↑ "Capital One to pay $210 million in fines, consumer refunds". CNN Money. July 18, 2012.

- ↑ Dale, Margaret A. (August 19, 2014). "Capital One to Pay Largest TCPA Settlement on Record". The National Law Review. Proskauer Rose. ISSN 2161-3362.

- ↑ Slawe, Meredith C.; Madway, Brynne S. (August 11, 2014). "Capital One Agrees to $75 Million Telephone Consumer Protection Act (TCPA) Settlement". The National Law Review.

- 1 2 3 4 Lazarus, David (February 17, 2014). "Capital One says it can show up at cardholders' homes, workplaces". Los Angeles Times.

- ↑ David Lazarus, "Another complaint about Capital One bafflegab", Los Angeles Times, February 17, 2014. Lazarus's comment involved both the terms of service changes and other customer complaints.

- ↑ Amanda Alix, "Capital One to Customers: You Can't Hide From Us", February 19, 2014

External links

| Wikimedia Commons has media related to Capital One. |

- Official website (United States)

- Official website (Canada)

- Official website (United Kingdom)

- Business data for Capital One: Google Finance

- Yahoo! Finance

- Bloomberg

- Reuters

- SEC filings