Pyramid scheme

A pyramid scheme (commonly known as pyramid scams) is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products or services. As recruiting multiplies, recruiting becomes quickly impossible, and most members are unable to profit; as such, pyramid schemes are unsustainable and often illegal.

Pyramid schemes have existed for at least a century in different guises. The difference between a pyramid scheme and multi-level marketing is that multi-level marketing provides an actual product or service whereas pyramid schemes don’t and only funnel the money up from recruitment costs.

Concept and basic models

In a pyramid scheme, an organization compels individuals who wish to join to make a payment. In exchange, the organization promises its new members a share of the money taken from every additional member that they recruit. The directors of the organization (those at the top of the pyramid) also receive a share of these payments. For the directors, the scheme is potentially lucrative—whether or not they do any work, the organization's membership has a strong incentive to continue recruiting and funneling money to the top of the pyramid.

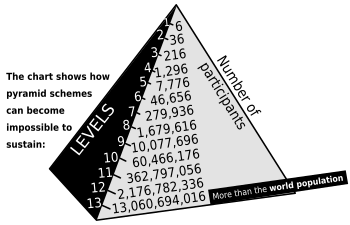

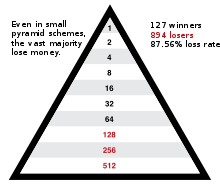

Such organizations seldom involve sales of products or services with value. Without creating any goods or services, the only revenue streams for the scheme are recruiting more members or soliciting more money from current members. The behavior of pyramid schemes follows the mathematics concerning exponential growth quite closely. Each level of the pyramid is much larger than the one before it. For a pyramid scheme to make money for everyone who enrolls in it, it would have to expand indefinitely. This is not possible because the population of Earth is finite. When the scheme inevitably runs out of new recruits, lacking other sources of revenue, it collapses. Because in a geometric series, the biggest terms are at the end, most people will be in the lower levels of the pyramid (and indeed the bottom level is always the biggest single layer).

In a pyramid scheme, people in the upper layers typically profit while people in the lower layers typically lose money. Since at any given time, most of the members in the scheme are at the bottom, most participants in a pyramid scheme will not make any money. In particular, when the scheme collapses, most members will be in the bottom layers and thus will not have any opportunity to profit from the scheme, yet they will have paid to join the scheme. Therefore, a pyramid scheme is characterized by a few people (including the creators of the scheme) making large amounts of money, while most who join the scheme lose money. For this reason, they are considered scams.[1]

The "eight ball" model

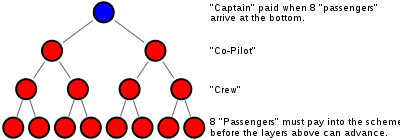

Many pyramids are more sophisticated than the simple model. These recognize that recruiting a large number of others into a scheme can be difficult, so a seemingly simpler model is used. In this model each person must recruit two others, but the ease of achieving this is offset because the depth required to recoup any money also increases. The scheme requires a person to recruit two others, who must each recruit two others, and so on.

Prior instances of this scheme have been called the "Airplane Game" and the four tiers labelled as "captain", "co-pilot", "crew", and "passenger" to denote a person's level. Another instance was called the "Original Dinner Party" which labeled the tiers as "dessert", "main course", "side salad", and "appetizer". A person on the "dessert" course is the one at the top of the tree. Another variant, "Treasure Traders", variously used gemology terms such as "polishers", "stone cutters", etc.

Such schemes may try to downplay their pyramid nature by referring to themselves as "gifting circles" with money being "gifted". Popular schemes such as "Women Empowering Women"[2] do exactly this.

Whichever euphemism is used, there are 15 total people in four tiers (1 + 2 + 4 + 8) in the scheme—with the Airplane Game as the example, the person at the top of this tree is the "captain", the two below are "co-pilots", the four below are "crew", and the bottom eight joiners are the "passengers".

The eight passengers must each pay (or "gift") a sum (e.g., $5,000) to join the scheme. This sum (e.g., $40,000) goes to the captain, who leaves, with everyone remaining moving up one tier. There are now two new captains so the group splits in two with each group requiring eight new passengers. A person who joins the scheme as a passenger will not see a return until they advance through the crew and co-pilot tiers and exit the scheme as a captain. Therefore, the participants in the bottom three tiers of the pyramid lose their money if the scheme collapses.

If a person is using this model as a scam, the confidence trickster would take the majority of the money. They would do this by filling in the first three tiers (with one, two, and four people) with phony names, ensuring they get the first seven payouts, at eight times the buy-in sum, without paying a single penny themselves. So if the buy-in were $5,000, they would receive $40,000, paid for by the first eight investors. They would continue to buy in underneath the real investors, and promote and prolong the scheme for as long as possible to allow them to skim even more from it before it collapses.

Although the "captain" is the person at the top of the tree, having received the payment from the eight paying passengers, once they leave the scheme they are able to re-enter the pyramid as a "passenger" and hopefully recruit enough to reach captain again, thereby earning a second payout.

Matrix schemes

Matrix schemes use the same fraudulent, unsustainable system as a pyramid; here, the participants pay to join a waiting list for a desirable product, which only a fraction of them can ever receive. Since matrix schemes follow the same laws of geometric progression as pyramids, they are subsequently as doomed to collapse. Such schemes operate as a queue, where the person at head of the queue receives an item such as a television, games console, digital camcorder, etc. when a certain number of new people join the end of the queue. For example, ten joiners may be required for the person at the front to receive their item and leave the queue. Each joiner is required to buy an expensive but potentially worthless item, such as an e-book, for their position in the queue. The scheme organizer profits because the income from joiners far exceeds the cost of sending out the item to the person at the front. Organizers can further profit by starting a scheme with a queue with shill names that must be cleared out before genuine people get to the front. The scheme collapses when no more people are willing to join the queue. Schemes may not reveal, or may attempt to exaggerate, a prospective joiner's queue position, a condition that essentially means the scheme is a lottery. Some countries have ruled that matrix schemes are illegal on that basis.

Relation to Ponzi schemes

While often confused for each other, pyramid schemes and Ponzi schemes are different from each other. They are related in the sense that both pyramid and Ponzi schemes are forms of financial fraud.[3] However, pyramid schemes are based on network marketing, where each part of the pyramid takes a piece of the pie / benefits, forwarding the money to the top of the pyramid. They fail simply because there aren't sufficient people. Ponzi schemes, on the other hand, are based on the principle of "Robbing Peter to pay Paul"—early investors are paid their returns through the proceeds of investments by later investors. In other words, one central person (or entity) in the middle taking money from one person, keeping part of it and giving the rest to others who had invested in the scheme earlier. Thus, schemes such as the Anubhav teak plantation scheme (teak plantation scam of 1998) in India can be called Ponzi schemes. Some Ponzi schemes can depend on multi-level marketing for popularizing them, thus forming a combination of the two.[4]

Connection to multi-level marketing

Some multi-level marketing (MLM) companies operate as pyramid schemes and consumers often confuse legitimate multi-level marketing with pyramid schemes.[5][6][7][8]

According to the U.S. Federal Trade Commission legitimate MLM, unlike pyramid schemes:

- "have a real product to sell."[9] "Not all multilevel marketing plans are legitimate. If the money you make is based on your sales to the public, it may be a legitimate multilevel marketing plan. If the money you make is based on the number of people you recruit and your sales to them, it’s probably not. It could be a pyramid scheme."[10]

Pyramid schemes however "may purport to sell a product, but they often simply use the product to hide their pyramid structure".[7] While some people call MLMs in general "pyramid selling",[11][12][13][14] others use the term to denote an illegal pyramid scheme masquerading as an MLM.[15]

The Federal Trade Commission warns, "It’s best not to get involved in plans where the money you make is based primarily on the number of distributors you recruit and your sales to them, rather than on your sales to people outside the plan who intend to use the products."[16] It states that research is your best tool and gives eight steps to follow:

- Find—and study—the company's track record.

- Learn about the product.

- Ask questions.

- Understand any restrictions.

- Talk to other distributors. Beware of shills.

- Consider using a friend or adviser as a neutral sounding board, or for a gut check.

- Take your time.

- Think about whether this plan suits your talents and goals.[16]

Some commentators contend that MLMs in general are nothing more than legalized pyramid schemes.[17][18][19]

Legality

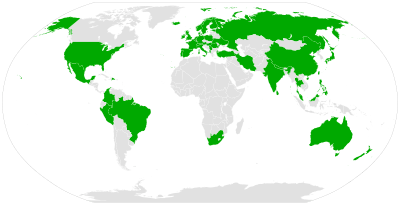

Pyramid schemes are illegal in many countries or regions including Albania, Australia,[20][21] Austria,[22] Belgium,[23] Bahrain, Brazil, China,[24] Colombia,[25] Denmark, the Dominican Republic,[26] Estonia,[27] Finland,[28] France, Germany, Hong Kong,[29] Hungary, Iceland, India, Iran,[30] the Republic of Ireland,[31] Italy,[32] Japan,[33] Malaysia, Maldives, Mexico, Nepal, the Netherlands,[34] New Zealand,[35] Norway,[36] Peru, Philippines,[37] Poland, Portugal, Romania,[38] Russian Federation, Serbia,[39] South Africa,[40], Singapore,[41] Spain, Sri Lanka,[42] Sweden,[43] Switzerland, Taiwan, Thailand,[44] Turkey,[45] Ukraine,[46] the United Kingdom,[47] and the United States.[7]

Franchise fraud is defined by the United States Federal Bureau of Investigation as a pyramid scheme. The FBI website states:

Pyramid schemes—also referred to as franchise fraud or chain referral schemes—are marketing and investment frauds in which an individual is offered a distributorship or franchise to market a particular product. The real profit is earned, not by the sale of the product, but by the sale of new distributorships. Emphasis on selling franchises rather than the product eventually leads to a point where the supply of potential investors is exhausted and the pyramid collapses.[48]

Notable recent cases

The 1997 rebellion in Albania was partially motivated by the collapse of Ponzi schemes; however, they were widely referred to as pyramid schemes due to their prevalence in Albanian society.[49]

In 2003, the United States Federal Trade Commission (FTC) disclosed what it called an Internet-based "pyramid scam." Its complaint states that customers would pay a registration fee to join a program that called itself an "internet mall" and purchase a package of goods and services such as internet mail, and that the company offered "significant commissions" to consumers who purchased and resold the package. The FTC alleged that the company's program was instead and in reality a pyramid scheme that did not disclose that most consumers' money would be kept, and that it gave affiliates material that allowed them to scam others.[50]

WinCapita was a scheme run by Finnish criminals that involved about €100 million. The scheme started in 2005.[51]

In early 2006, Ireland was hit by a wave of schemes with major activity in Cork and Galway. Participants were asked to contribute €20,000 each to a "Liberty" scheme which followed the classic eight-ball model. Payments were made in Munich, Germany to skirt Irish tax laws concerning gifts. Spin-off schemes called "Speedball" and "People in Profit" prompted a number of violent incidents and calls were made by politicians to tighten existing legislation.[52] Ireland has launched a website to better educate consumers to pyramid schemes and other scams.[53]

On 12 November 2008, riots broke out in the municipalities of Pasto, Tumaco, Popayan and Santander de Quilichao, Colombia after the collapse of several pyramid schemes. Thousands of victims had invested their money in pyramids that promised them extraordinary interest rates. The lack of regulation laws allowed those pyramids to grow excessively during several years. Finally, after the riots, the Colombian government was forced to declare the country in a state of economic emergency to seize and stop those schemes. Several of the pyramid's managers were arrested, and are being prosecuted for the crime of "illegal massive money reception."[54]

The Kyiv Post reported on 26 November 2008 that American citizen Robert Fletcher (Robert T. Fletcher III; aka "Rob") was arrested by the SBU (Ukraine State Police) after being accused by Ukrainian investors of running a Ponzi scheme and associated pyramid scam netting US$20 million. (The Kiev Post also reports that some estimates are as high as US$150 million.)[55]

In the United Kingdom in 2008 and 2009, a £21 million pyramid scheme named 'Give and Take' involved at least 10,000 victims in the south-west of England and South Wales. Leaders of the scheme were prosecuted and served time in jail before being ordered to pay £500,000 in compensation and costs in 2015. The cost of bringing the prosecution was in excess of £1.4 million.[56]

Throughout 2010 and 2011 a number of authorities around the world including the Australian Competition and Consumer Commission, the Bank of Namibia and the Central Bank of Lesotho have declared TVI Express to be a pyramid scheme. TVI Express, operated by Tarun Trikha from India has apparently recruited hundreds of thousands of "investors", very few of whom, it is reported, have recouped any of their investment.[57][58][59][60][61] In 2013, Tarun Trikha was arrested at the IGI Airport in New Delhi.[62]

BurnLounge, Inc. was a multi-level marketing online music store founded in 2004 and based in New York City. By 2006 the company reported 30,000 members using the site to sell music through its network. In 2007 the company was sued by the Federal Trade Commission for being an illegal pyramid scheme. The company lost the suit in 2012, and lost appeal in June 2014. In June 2015, the FTC began returning $1.9 million to people who had lost money in the scheme.[63]

In August 2015, the FTC filed a lawsuit against Vemma Nutrition Company, an Arizona-based dietary supplement MLM accused of operating an illegal pyramid scheme. In December 2016, Vemma agreed to a $238 million settlement with the FTC, which banned the company from "pyramid scheme practices" including recruitment-focused business ventures, deceptive income claims, and unsubstantiated health claims.[64][65]

In March 2017, Ufun Store registered as an online business for its members as a direct-sales company was declared operating a pyramid scheme in Thailand. The Criminal Court handed down prison terms totaling 12,265 to 12,267 years to 22 people convicted over the scheme, which conned about 120,000 people out of more than 20 billion baht[66].

See also

References

- ↑ "Pyramid schemes".

- ↑ Tracy McVeigh (2001-08-05). "Pyramid selling scam that preys on women to be banned". Guardian. Retrieved 2013-04-02.

- ↑ Zuckoff, Mitchell (10 January 2006). Ponzi's scheme - the true story of a financial legend. New York: Random House Trade Paperbacks. ISBN 0812968360.

- ↑ "Book reading by Mitchell Zuckoff at olsson's Books and Records, Washington D.C.". www.youtube.com. The Film Archives. Missing or empty

|url=(help);|access-date=requires|url=(help) - ↑ Smith, Rodney K. (1984). Multilevel Marketing. Baker Publishing Group. p. 45. ISBN 0-8010-8243-9.

- ↑ Keep, William W; Vander Nat, Peter J. (2014). "Multilevel marketing and pyramid schemes in the United States: An historical analysis" (PDF). Journal of Historical Research in Marketing. 6 (2): 188–210. doi:10.1108/JHRM-01-2014-0002. Retrieved 26 March 2016.

- 1 2 3 Valentine, Debra (May 13, 1998). "Pyramid Schemes". Federal Trade Commission. Retrieved 25 March 2016.

- ↑ Edwards, Paul (1997). Franchising & licensing: two powerful ways to grow your business in any economy. Tarcher. p. 356. ISBN 0-87477-898-0.

- ↑ "Pyramid Schemes". 18 July 2013.

- ↑ "Multilevel Marketing". 14 July 2016.

- ↑ Clegg, Brian (2000). The invisible customer: strategies for successive customer service down the wire. Kogan Page. p. 112. ISBN 0-7494-3144-X.

- ↑ Higgs, Philip; Smith, Jane (2007). Rethinking Our World. Juta Academic. p. 30. ISBN 0-7021-7255-3.

- ↑ Kitching, Trevor (2001). Purchasing scams and how to avoid them. Gower Publishing Company. p. 4. ISBN 0-566-08281-0.

- ↑ Mendelsohn, Martin (2004). The guide to franchising. Cengage Learning Business Press. p. 36. ISBN 1-84480-162-4.

- ↑ Blythe, Jim (2004). Sales & Key Account Management. Cengage Learning Business Press. p. 278. ISBN 1-84480-023-7.

- 1 2 "Multilevel Marketing". Federal Trade Commission. Retrieved 20 June 2018.

There are multi-level marketing plans – and then there are pyramid schemes. Before signing on the dotted line, study the company’s track record, ask lots of questions, and seek out independent opinions about the business.

- ↑ Carroll, Robert Todd (2003). The Skeptic's Dictionary: A Collection of Strange Beliefs, Amusing Deceptions, and Dangerous Delusions. Wiley. p. 235. ISBN 0-471-27242-6.

- ↑ Coenen, Tracy (2009). Expert Fraud Investigation: A Step-by-Step Guide. Wiley. p. 168. ISBN 0-470-38796-3.

- ↑ Salinger (Editor), Lawrence M. (2005). Encyclopedia of White-Collar & Corporate Crime. 2. Sage Publishing. p. 880. ISBN 0-7619-3004-3.

- ↑ "Pyramid schemes". Australian Competition and Consumer Commission. Retrieved 2012-04-08.

- ↑ "Competition and Consumer Act 2010 - Schedule 2, Division 3 - Pyramid schemes". Austlii.edu.au. Retrieved 2013-04-02.

- ↑ Trade Practices Amendment Act (No. 1) 2002 Trade Practices Act 1974 (Cth) ss 65AAA - 65AAE, 75AZO

- ↑ http://economie.fgov.be/nl/geschillen/klachten/welke_klachten_terecht_ADCB/Verkopen/Piramideverkoop/

- ↑ "Regulations for the Prohibition of Pyramid Sales". Tradeinservices.mofcom.gov.cn. Retrieved 2013-04-02.

- ↑ "Colombia scam: 'I lost my money'". BBC News. November 18, 2008. Retrieved April 12, 2010.

- ↑ "Proyecto De Ley Que Prohíbe La Venta Bajo El Esquema Piramidal" (PDF) (in Spanish).

- ↑ "Tarbijakaitseseadus" [The Consumer Protection Law of Estonia] (in Estonian). §12³(8) #14. Retrieved October 11, 2010.

- ↑ "Rahankeräyslaki 255/2006 - Ajantasainen lainsäädäntö - FINLEX ®".

- ↑ "Pyramid Schemes Prohibition Ordinance". Retrieved 24 February 2015.

- ↑ "Key GoldQuest members arrested in Iran Airport". Presstv.ir. Retrieved 2013-04-02.

- ↑ "Pyramid Schemes". Competition and Consumer Protection Commission. Retrieved 12 June 2015.

- ↑ Legge 17 agosto 2005, n. 173 (in Italian)

- ↑ 無限連鎖講の防止に関する法律 (in Japanese)

- ↑ "Sentence by the High Council of the Netherlands regarding a pyramid scheme". Zoeken.rechtspraak.nl. Retrieved 2013-04-02.

- ↑ Laws and Regulations Covering Multi-Level Marketing Programs and Pyramid Schemes Consumer Fraud Reporting.com

- ↑ "Lovdata.no". Lovdata.no. Retrieved 2013-04-02.

- ↑ NYtimes.com, "Investors in Philippine Pyramid Scheme Lose over $2 Billion"

- ↑ Explozia piramidelor Ziarul Ziua, 12.07.2006

- ↑ , "Trading law"

- ↑ Whitecollarcrime.co.za, Pyramid Schemes

- ↑ http://www.asianlii.org/sg/legis/consol_act/mmapsac190538/mmapsac190538.html MULTI-LEVEL MARKETING AND PYRAMID SELLING (PROHIBITION) ACT

- ↑ Pyramid Schemes Illegal Under Section 83c of the Banking Act of Sri Lanka Department of Government Printing, Sri Lanka

- ↑ lagen.nu - Tillkännagivande (2008:487) med anledning av marknadsföringslagen (2008:486)

- ↑ TDSA.gov Archived 2009-02-20 at the Wayback Machine., ข้อมูลเพิ่มเติมในระบบธุรกิจขายตรงและธุรกิจพีระมิด by Thai Direct Selling Association (in Thai)

- ↑ "Saadet zinciri operasyonu: 60 gözaltı". Cnnturk.com. 2010-05-14. Retrieved 2013-04-02.

- ↑ Rada at first reading passes bill on banning financial pyramid schemes in Ukraine, Interfax-Ukraine (20 November 2013)

- ↑ "Pyramid scheme fraud". Action Fraud. City of London Police. Retrieved 5 July 2016.

- ↑ "FBI — Common Fraud Schemes". Fbi.gov. Retrieved 2013-04-02.

- ↑ "Finance and Development". Finance and Development | F&D. Retrieved 2018-07-04.

- ↑ FTC Charges Internet Mall Is a Pyramid Scam Federal Trade Commission

- ↑ "SS: Some WinCapita Ponzi scheme victims to soon receive compensation". Yle Uutiset. Retrieved 2018-07-04.

- ↑ Gardaí hold firearm after pyramid scheme incident Archived 2008-03-23 at the Wayback Machine. Irish Examiner

- ↑ "National Consumer Agency Ireland". Consumerconnect.ie. Retrieved 2013-04-02.

- ↑ Colombians riot over pyramid scam. Colombia: BBC news. Nov 13, 2008.

- ↑ "Caught! American arrested in Kyiv on suspicion of fraud - Nov. 26, 2008". KyivPost. 2008-11-26. Retrieved 2018-07-04.

- ↑ "Prosecuting members of a £21m pyramid scheme cost taxpayers £1.4m". 14 September 2015 – via www.bbc.co.uk.

- ↑ ACCC obtains restraining orders against operators of alleged pyramid selling scheme TVI Express Archived 2011-06-02 at the Wayback Machine. Australian Competition and Consumer Commission

- ↑ BoN warns public about TVI Express Bank of Namibia

- ↑ BoL warns public about TVI Express Archived 2011-10-03 at the Wayback Machine. Bank of Lesotho

- ↑ South African Sunday Times on TVI Express South African Sunday Times

- ↑ Consumer Watchdog Botswana on TVI Express Consumer Watchdog Botswana

- ↑ "Trikha family to be investigated in online TVI Express scam". MailOnline India. 2013-04-20. Retrieved 2013-07-24.

- ↑ Hull, Tim (2 June 2014). "9th Circuit Affirms BurnLounge Judgment". Courthouse News. Retrieved 19 June 2014.

- ↑ "Vemma Agrees to Ban on Pyramid Scheme Practices to Settle FTC Charges". FTC.gov. Retrieved 22 December 2016.

- ↑ "Vemma reaches $238 million settlement with FTC". TruthInAdvertising.org. Retrieved 22 December 2016.

- ↑ Limited, Bangkok Post Public Company. "Ufun fraudsters sentenced to thousands of years". https://www.bangkokpost.com. Retrieved 2018-05-20. External link in

|work=(help)

- The Fraudsters: How Con Artists Steal Your Money, Chapter 9, "Pyramids of Sand" ( ISBN 978-1-903582-82-4) by Eamon Dillon, published September 2008 by Merlin Publishing, Ireland.

External links