National Iranian Oil Refining and Distribution Company

National Iranian Oil Refining and Distribution Company (NIORDC) is part of the Ministry of Petroleum of Iran. NIORDC was established on 8 March 1991 and undertook to perform all operations relating to refining and distribution of oil products.

Although NIORDC was formed in the 1990s, the company has actually inherited 90 years of Iran’s oil industries' experiences in the fields of refining, transfer and distribution of oil products, as well as, engineering and construction of installations of oil industries.

Responsibilities and duties (as of 2009)

- Refining crude oil and producing a variety of oil products.

- Transferring crude oil from production bases and “Khazar Terminal” to the refineries and also transferring oil products from refineries and import bases to distribution procurement depots and distribution centres.

- Performing all refining projects and schemes, transfer and storing.

- Production, transfer and distribution of 250 million litres (66,000,000 US gallons; 55,000,000 imperial gallons) of oil products per day.

- Daily export of around 60 million litres (16,000,000 US gallons; 13,000,000 imperial gallons) of oil products abroad via oil terminals.

- Providing different sectors – industry, agriculture and power plants – with fuel and feed regularly e.g. petrochemical complexes.

- Providing consuming fuel to residential sector, business sector in urban and the peasantry communities all over the country.

- Providing more than 7 million vehicles – heavy and light – in the transportation sector with their required daily fuel.

Installations and capabilities

As of 2010, NIORDC had 19 subsidiaries and affiliated companies, including 9 oil existing refineries.[1] Between 2007 and 2012, oil refining capacity for crude oil and gas condensate would increase from 1,600,000 barrels per day (250,000 m3/d) to 3,300,000 barrels per day (520,000 m3/d).[2] By 2009, Iran had a total refining capacity of 1,860,000 barrels per day (296,000 m3/d).[3]

| Refinery | Installed Capacity (bbl/d) |

|---|---|

| Abadan | 350,000 |

| Isfahan | 280,000 |

| Bandar Abbas | 230,000 |

| Tehran (Shahid Tondgouyan) | 220,000 (Euro 5 compliant by 2012)[6] |

| Arak (Shazand) | 170,000 |

| Arvand Oil Refinery | 120,000 |

| Tabriz | 100 |

| Kermanshah | 40 |

| Shiraz | 30 |

| Lavan Island | 63000 (Since 2012) |

| Total: | 1.45 Mbbl/d (231,000 m3/d). |

| Oil Products | KBPD (thousand barrel per day) | Percent |

|---|---|---|

| Gasoline | 283 | 17% |

| Gas oil | 511 | 32% |

| Kerosene (Jet fuel) | 136 | 8% |

| Fuel oil | 457 | 29% |

| LPG | 50 | 3% |

| Others | 184 | 11% |

Other facilities:

- Fourteen thousand kilometers of crude oil and oil product transfer pipelines.

- 150 pumping stations.

- Oil industry telecommunication network.

- Operational zones for pipelines and telecommunication.

- 35 operational zones for NIOPDC.

- 220 operational areas for NIOPDC.

- Storage tank installations with 10 billion litres (2.6×109 US gallons; 2.2×109 imperial gallons) capacity (2009).[7] As of 2010, the storage capacity of oil products in the country was around 11.5 billion litres (3.0×109 US gallons; 2.5×109 imperial gallons), but it would reach 16.7 billion litres (4.4×109 US gallons; 3.7×109 imperial gallons) by the end of the Fifth Five Year Development Plan (2010-2015).[8]

Fuel imports

Major gasoline suppliers to Iran historically have been India, Turkmenistan, Azerbaijan, the Netherlands, France, Singapore, and the United Arab Emirates.[9][10] The Financial Times reported that Vitol, Glencore, Trafigura and other (western) companies had since stopped supplying petrol to Iran because of international sanctions.[11] In 2006, Vitol, a MNC based in Switzerland, supplied Iran with 60% of its total gasoline cargo imports.[9]

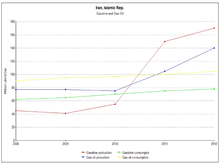

- Average daily gasoline consumption stood at 73 million litres (19,000,000 US gallons; 16,000,000 imperial gallons) in 2006 but fell to 64 million litres (17,000,000 US gallons; 14,000,000 imperial gallons) per day in 2007 concurrent with gasoline rationing plan and to 61 million litres (16,000,000 US gallons; 13,000,000 imperial gallons) after the full implementation of the first phase of the subsidy reforms plan.[12] Gasoline production would reach 70 million litres (18,000,000 US gallons; 15,000,000 imperial gallons) per day in 2013.[12]

- In 2008 Iran has imported nearly 40% of its market needs because of lack of refining capacity and contraband.[13]

- In 2009, Iran spent paid $11 billion on imported fuel.[13] In 2010, gasoline import declined to 30% of its market needs at 25 million litres (6,600,000 US gallons; 5,500,000 imperial gallons) of gasoline and 11 million litres (2,900,000 US gallons; 2,400,000 imperial gallons) of diesel fuel per day.[14][15]

- In September 2010, Iran claimed that it has stopped importing gasoline according to the domestic capacity expansion plans.[16] This statement was later denied by the government of Hassan Rouhani.[17]

- As of July 2010, Iran produces between 280,000 barrels (45,000 m3) and 285,000 barrels (45,300 m3) of gasoline a day and until recently had acquired the remaining 30 percent, which is about 115,000 barrels per day (18,300 m3/d) to 120,000 barrels per day (19,000 m3/d), through big oil companies.[18]

- In 2014 Iran will import 10–11 million litres (2,600,000–2,900,000 US gallons; 2,200,000–2,400,000 imperial gallons) of gasoline per day overall,[19] including 8–10 million litres (2,100,000–2,600,000 US gallons; 1,800,000–2,200,000 imperial gallons) of premium gasoline from India per day because some of the gasoline produced domestically does not meet the Euro-5 quality standards[20] (and also because of the fuel smuggling/price differential with neighboring countries.)

- In 2016, fuel imports decreased 50% to about 4 million litres (1,100,000 US gallons; 880,000 imperial gallons) per day on average thanks to falling oil prices (i.e. falling price differential with neighboring countries and consequent fall in the smuggling activity).[21]

| 2008 | 2009 |

|---|---|

| BP (UK) | CNPC (China) |

| ENOC (UAE) | Glencore (Switzerland) |

| Glencore (Switzerland) | IPG (Kuwait) |

| IPG (Kuwait) | Litasco (Russia) |

| MEP (UAE) | Petronas (Malaysia) |

| Reliance Industries (India) | Reliance Industries (India) |

| Shell (Netherlands) | Shell (Netherlands) |

| SPC (Singapore) | Total (France) |

| Total (France) | Trafigura (Switzerland) |

| Trafigura (Switzerland) | Vitol (Switzerland) |

| Vitol (Switzerland) | Zhenhua Oil (China) |

New facilities

After completion of 7 new refineries and improvement to the existing refineries at a cost of $26 billion; along with the implementation of the subsidy reform plan to cut demand, it is possible that Iran would cease being a gasoline importer by 2010-2011 and will become a net exporter by 2013-2015.[18][22][23][24]

While the country remains dependent on small gasoline and diesel imports, net gasoline imports in 2013 averaged only 33 000 bpd. This compares to refined product imports of 182 000 bpd in 2009, of which two thirds was gasoline (approximately 132 000 bpd).[25]

As of 2015, except for the Persian Gulf Star Refinery in Assalouyeh, all plans for the building of 13 new oil refineries have been abandoned "due to technical and financial issues" according to Iranian media.[26]

| Refinery | Location | Refining capacity[27] | Estimated costs [28] | Estimated completion date[28] |

|---|---|---|---|---|

| Khuzestan refinery (privately owned) | Arvand Free Zone, near Abadan | 180,000 barrels per day (29,000 m3/d). The refinery will refine the heavy crude oil produced in Azadegan and Yadavaran oil fields. It will also produce 10 million litres (2,600,000 US gallons; 2,200,000 imperial gallons) of super gasoline complying with Euro IV standard, 12.6 million litres (3,300,000 US gal; 2,800,000 imp gal) of diesel oil, 3 million litres (790,000 US gal; 660,000 imp gal) of jet fuel, 5 million litres (1,300,000 US gal; 1,100,000 imp gal) of liquefied gas, and 440 tonnes (430 long tons; 490 short tons) of sulfur. | 2.9 billion euros | 2012 |

| The Persian Gulf Star refinery | Assalouyeh | 360,000 of gas condensates per day and to produce gasoline, jet fuel, and other valuable products. | 2.5 billion euros | 2010 |

| Shahriar refinery | Tabriz | 150,000 barrels per day (24,000 m3/d); gasoline production: 70,000 barrels per day (11,000 m3/d) | 1.2 billion euros | 2012 |

| Anahita refinery | Kermanshah Province | 150,000 barrels per day (24,000 m3/d) | 1.3 billion euros | 2012 |

| Hormoz refinery | Bandar Abbas | 300,000 barrels (48,000 m3) of heavy and extra heavy crude oil | $4.3 billion | 2012 |

| Caspian refinery | Gorgan, Golestan Province | 300,000 barrels (48,000 m3) of crude oil; 20 million litres (5,300,000 US gal; 4,400,000 imp gal) of gasoline, 11 million litres (2,900,000 US gal; 2,400,000 imp gal) of gas oil from Caspian Sea countries with exports to Turkey, Afghanistan and Pakistan | $4 billion | 2013 |

| Pars refinery | Shiraz | 120,000 barrels per day (19,000 m3/d) | 800 million euros | 2012 |

| Refinery | Location | Refining capacity | Estimated costs | Completion date |

|---|---|---|---|---|

| Yasouj refinery | Yasouj | 150,000 barrels per day (24,000 m3/d). The refinery will produce petrol, gasoil, kerosene, furnace oil, liquefied gas, asphalt, and sulfur.[30] | $2.2 billion | 2014 |

Planned in 2011, Qeshm refinery (capable of processing heavy crude oil) will have an output capacity of 30,000 barrels a day of light oil products and will become operational by 2014.[31]

Policy

- Providing desirable fuel supplying services and supplying feed of industries and factories all over the country in due time.

- Reducing consumption rate through employing energy consumption management and raising export rate to make foreign currency.

- Reducing waste materials through improving efficiency in refining and distribution system.

- Reducing environment pollution to reach stable development.

- Raising human force productivity and promoting level of training.

- Increasing output of refinery facilities and transfer are distribution of oil products.

- Reducing cost of production, transfer and distribution of oil products.

Subsidiary companies

The NIORDC subsidiaries are as follows:

- National Iranian Oil Products Distribution Co.

- Management of Construction & Development of "CNG" Stations Co.

- National Iranian Oil Engineering and Construction Co. (NIOEC)

- Oil Pipeline and Telecommunication Co.

- Oil Refining Co.

See also

References

- ↑ "NIORDC - National Iranian Oil Refining and Distribution Company". NIORDC. Retrieved 6 February 2012.

- 1 2 "NIORDC - National Iranian Oil Refining and Distribution Company". NIORDC. Retrieved 6 February 2012.

- ↑ Statistical review of world energy full report 2010 BP.

- 1 2 "Iran". U.S. Energy Information Administration. Archived from the original on 31 March 2008. Retrieved 6 February 2012.

- ↑ "Iran's Gasoline Production to Rise by 23 ml/d Next Year". Shana. Retrieved 6 February 2012.

- ↑ "'Tehran Refinery to get Euro-5 standard'". PressTV. 2 May 2011. Retrieved 6 February 2012.

- ↑ "US and Europe left out as Iran's gas output soars". PressTV. 9 October 2009. Retrieved 6 February 2012.

- ↑ "$1bn invested to improve Iran's gasoline". PressTV. 20 December 2010. Retrieved 6 February 2012.

- 1 2 https://fpc.state.gov/documents/organization/107234.pdf

- ↑ Kittrie, Orde F. (13 November 2008). "How to Put the Squeeze on Iran". The Wall Street Journal. Retrieved 6 February 2012.

- ↑ "World's biggest oil trader ends supplies to Iran: company". AFP. 8 March 2010. Retrieved 6 February 2012.

- 1 2 http://english.farsnews.com/newstext.php?nn=9104254519

- 1 2 "'17 percent of daily fuel production smuggled abroad'". PressTV. 26 September 2009. Archived from the original on 15 May 2012. Retrieved 6 February 2012.

- ↑ Erdbrink, Thomas; Lynch, Colum (23 June 2010). "Iran is ready for planned U.S. sanctions targeting fuel imports, analysts say". The Washington Post. Retrieved 6 February 2012.

- ↑ "Sanctions And Iran's Achilles Heel". Payvand. Retrieved 6 February 2012.

- ↑ "Iran Claims It Has Started Exporting Gasoline". Payvand. Retrieved 6 February 2012.

- ↑ https://www.youtube.com/watch?v=M_md49UCw1U&feature=c4-overview&list=UUyM62OUafVbdcyqxpyMAiAA

- 1 2 "Iran gasoline exporter by 2015: Report". PressTV. 26 July 2010. Retrieved 6 February 2012.

- ↑ http://www.payvand.com/news/14/apr/1023.html

- ↑ http://www.tehrantimes.com/economy-and-business/110844-iran-plans-to-import-10-million-liters-of-indian-premium-gasoline-per-day

- ↑ http://en.mehrnews.com/news/120510/Iran-halves-gasoline-imports

- ↑ "Iran to Become Gasoline Exporter by 2013". Zawya. 3 January 2009. Retrieved 6 February 2012.

- ↑ New Refineries Planned Iran Daily.

- ↑ "Iran to export gasoline in four years". PressTV. 28 July 2010. Retrieved 6 February 2012.

- ↑ http://tehrantimes.com/economy-and-business/119119-iran-on-verge-of-fuel-self-sufficiency-business-monitor-international-

- ↑ http://presstv.com/Detail/2015/07/06/419012/iran-gasoline-refineries-nioc-import

- ↑ "Iran: Construction of 7 refineries moving ahead". Payvand. Retrieved 6 February 2012.

- 1 2 "NIORDC - National Iranian Oil Refining & Distribution Company". NIORDC. Retrieved 6 February 2012.

- ↑ "Country Overview" (PDF). Iran Investment. 4 (50). November 2010. Retrieved 26 January 2014.

- ↑ "Iran's first private refinery". Tehran Times. Retrieved 6 February 2012.

- ↑ "Market Overview". Iran Investment. 6 (61). October 2011.