Marshall & Ilsley

.png) | |

| |

| Public | |

| Traded as | NYSE: MI |

| Industry | Banking |

| Fate | Absorbed by BMO Harris Bank |

| Successor | BMO Harris Bank |

| Founded | 1847 in Milwaukee, Wisconsin as Samuel Marshall & Co. |

| Defunct | July 5, 2011 |

| Headquarters | Milwaukee, Wisconsin, United States |

Key people |

|

| Products | retail and commercial banking, trusts and investment management |

| Revenue | $4.025 Billion USD (2008) |

|

| |

| Website | Archived official website |

Marshall & Ilsley Corporation (also known as M&I Bank) was a U.S. bank and diversified financial services corporation headquartered in Milwaukee, Wisconsin, that was purchased by Bank of Montreal in 2010.

The bank was founded in 1847 and by 2008 the bank had assets of $63.5 billion and over 250 branches.[1] After the acquisition, Bank of Montreal combined the Marshall & Ilsley Corporation operations into its existing U.S. subsidiary Harris Bank.

History

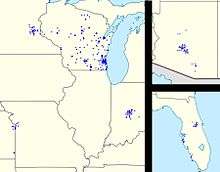

When founded in 1847, Marshall & Ilsley Bank, aka M&I, was the largest Wisconsin-based bank. Branch offices included:

- 194 offices throughout the state of Wisconsin

- 45 locations throughout Arizona

- 17 offices in Kansas City and nearby communities

- 17 offices on Florida's west coast

- 26 offices in metropolitan Minneapolis/St. Paul (Twin Cities), and one in Duluth, Minnesota

- 1 office in Las Vegas, Nevada

- 16 offices in the greater St. Louis area

- 32 offices in the greater Indianapolis area

In 1987, Marshall & Ilsley attempted a hostile takeover of the Milwaukee-based Marine Corporation, the parent of Marine Bank.[2][3] Marine turned down M&I overtures and chose Banc One Corporation's offer instead.[4]

On September 20, 1993, M&I announced a merger with Wisconsin-based Valley Bancorporation, converting Valley stock to M&I in a stock transaction valued at $875 million. The merger converted 155 Valley Bank locations to M&I. 154 of these were in Wisconsin, and one in Illinois. At the time of the merger, Valley Bancorporation had more bank locations than M&I did.[5]

In December 2006, M&I signed a definitive agreement to acquire United Heritage Bankshares of Florida with 13 locations in the Orlando area.

In 2007, Metavante Corporation, formerly a wholly owned subsidiary known as Marshall and Ilsley Data Services, was spun off into a separate publicly traded company and began trading on the New York Stock Exchange.

On January 2, 2008, M&I announced it had completed the acquisition of First Indiana (NASDAQ: FINB), which had 32 locations in central Indiana, for about $529 million.[6][7]

In late summer of 2010, M&I Bank additionally completed the acquisition of Southwest Bank, St Louis.

In mid-August 2009 the bank was named as one of the largest of more than 150 U.S. lenders that owned nonperforming loans, which made up more than 5 percent—a threshold beyond which a bank's equity can be wiped, according to regulators.[8]

Acquisition and BMO Harris Bank

On December 17, 2010, Bank of Montreal (BMO) agreed to purchase Marshall & Ilsley in an all-stock transaction valued at about $4.1 billion. Marshall & Ilsley was combined with BMO's Harris Bank subsidiary based in Chicago, Illinois, on October 9, 2012, to form BMO Harris Bank.[9][10]

On April 5, 2011, bank officers from M&I Bank, Harris Bank, and the Bank of Montreal announced the name of the bank after the merger will be "BMO Harris Bank". Both M&I Bank and Harris bank will be affected by the name change. The new logo will be similar to BMO's logo. The difference is the words "Bank of Montreal" will be replaced with "Harris Bank". The name change to "BMO Harris Bank" took place over a span of 18 months, completing on October 9, 2012.[11]

On July 5, 2011, BMO Financial Group acquired Marshall & Ilsley Corporation through its subsidiary BMO Financial Corp. (formerly Harris Financial Corp). At the time of the acquisition, certain bank mergers also occurred. M&I Marshall & Ilsley Bank, M&I Bank N.A. (successor to M&I Bank FSB), and The Harris Bank N.A. merged into Harris N.A. At the time of these mergers, Harris National Association changed its name to BMO Harris Bank National Association.

References

- ↑ "M&I participates in FDIC program". Milwaukee Business Journal. December 5, 2008.

- ↑ Richards, Bill (June 30, 1987). "Marshall & Ilsley Proposes to Buy Marine Corp". Wall Street Journal. p. 1. (Subscription required (help)).

Marshall & Ilsley Corp. said it proposed to acquire Marine Corp. for $62.50 a share, or $537.5 million on a fully diluted basis.

Alternate Link via ProQuest. - ↑ "M&I Reaffirms Offer For Marine Corp". Associated Press. July 31, 1987.

- ↑ "Banc One, Marine Agree to Merge in $543-Million Deal". Los Angeles Times. July 27, 1987.

- ↑ "M&I, Valley plan merger". Racine Journal Times. September 21, 1993. Retrieved 2016-05-20.

- ↑ "First Indiana to be Acquired by Wisconsin Bank". Inside INdiana Business. July 9, 2007. Archived from the original on 2011-07-19. Retrieved 2008-02-16.

- ↑ "M&I completes First Indiana deal". The Business Journal of Milwaukee. January 2, 2008. Retrieved 2008-02-16.

- ↑ Levy, Ari (August 24, 2009). "Toxic Loans Topping 5% May Push 150 Banks to Point of No Return". Bloomberg News. New York City, NY.

- ↑ Perkins, Tara & Kiladze, Tim (December 17, 2010). "BMO to buy U.S. bank for $4.1-billion". The Globe and Mail. Retrieved 2010-12-17.

- ↑ White, Michael (December 20, 2010). "Marshall & Ilsley's Shotgun Marriage". Wall Street Journal. (Subscription required (help)).

- ↑ Gores, Paul (2011-07-06). "It's official: M&I is absorbed by Canada's BMO". Milwaukee Journal Sentinel. Retrieved 2011-07-06.