Call option

A call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option.[1] The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price). The seller (or "writer") is obligated to sell the commodity or financial instrument to the buyer if the buyer so decides. The buyer pays a fee (called a premium) for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

Price of options

Option values vary with the value of the underlying instrument over time. The price of the call contract must reflect the "likelihood" or chance of the call finishing in-the-money. The call contract price generally will be higher when the contract has more time to expire (except in cases when a significant dividend is present) and when the underlying financial instrument shows more volatility. Determining this value is one of the central functions of financial mathematics. The most common method used is the Black–Scholes formula. Importantly, the Black-Scholes formula provides an estimate of the price of European-style options.[2]

Whatever the formula used, the buyer and seller must agree on the initial value (the premium or price of the call contract), otherwise the exchange (buy/sell) of the call will not take place.

Adjustment to Call Option: When a call option is in-the-money i.e. when the buyer is making profit, he has many options. Some of them are as follows:

- He can sell the call and book his profit

- If he still feels that there is scope of making more money he can continue to hold the position.

- If he is interested in holding the position but at the same time would like to have some protection,he can buy a protective "put" of the strike that suits him.

- He can sell a call of higher strike price and convert the position into "call spread" and thus limiting his loss if the market reverses.

Similarly if the buyer is making loss on his position i.e. the call is out-of-the-money, he can make several adjustments to limit his loss or even make some profit.

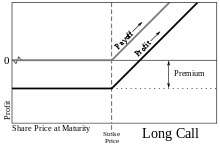

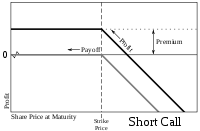

Call option profit / loss chart

Trading options involves a constant monitoring of the option value, which is affected by the following factors:

- Changes in the base asset price (the higher the price, the more expensive the call option is)

- Changes in the volatility of the base asset (the higher the volatility, the more expensive the call option is)

- Time decay – as time goes by, options become cheaper and cheaper.

Moreover, the dependence of the option value to price, volatility and time is not linear – which makes the analysis even more complex.

One very useful way to analyze and track the value of an option position is by drawing a Profit / Loss chart that shows how the option value changes with changes in the base asset price and other factors. For example, this Profit / Loss chart shows the profit / loss of a call option position (with $100 strike and maturity of 30 days) purchased at a price of $3,5 (blue graph – the day of the purchase of the option; orange graph – at expiry):

Options

See also

References

- ↑ O'Sullivan, Arthur; Sheffrin, Steven M. (2003). Economics: Principles in Action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 288. ISBN 0-13-063085-3.

- ↑ Fernandes, Nuno (2014). Finance for Executives: A Practical Guide for Managers. NPV Publishing. p. 313. ISBN 978-9899885400.