Oliver E. Williamson

Oliver Eaton Williamson (September 27, 1932 – May 21, 2020) was an American economist, a professor at the University of California, Berkeley, and recipient of the 2009 Nobel Memorial Prize in Economic Sciences, which he shared with Elinor Ostrom.[1] His transaction costs theories are influential in the social sciences.

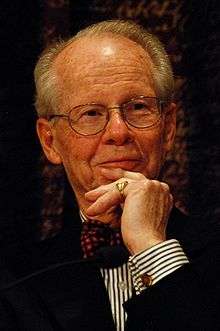

Oliver E. Williamson | |

|---|---|

Williamson in 2009 | |

| Born | Oliver Eaton Williamson September 27, 1932 Superior, Wisconsin, U.S. |

| Died | May 21, 2020 (aged 87) Berkeley, California, U.S. |

| Nationality | United States |

| Institution | University of California, Berkeley Yale University University of Pennsylvania |

| Field | Microeconomics |

| School or tradition | New Institutional Economics |

| Alma mater | Carnegie Mellon, (Ph.D. 1963) Stanford, (MBA 1960) MIT, (B.Sc 1955) |

| Influences | Chester Barnard Ronald Coase Richard Cyert Ian Roderick Macneil Herbert A. Simon John R. Commons |

| Awards | John von Neumann Award (1999) Nobel Memorial Prize in Economic Sciences (2009) |

| Information at IDEAS / RePEc | |

Life and career

Williamson was born in Superior, Wisconsin, the son of Sara Lucille (Dunn) and Scott Williamson.[2] A student of Ronald Coase, Herbert A. Simon and Richard Cyert, he specialized in transaction cost economics. Williamson attended Central High School in Superior.[3] He received his B.S. in management from the MIT Sloan School of Management in 1955, MBA from Stanford University in 1960, and his Ph.D. from Carnegie Mellon University in 1963. From 1965 to 1983 he was a professor at the University of Pennsylvania and from 1983 to 1988, Gordon B. Tweedy Professor of Economics of Law and Organization at Yale University. He held professorships in business administration, economics, and law at the University of California, Berkeley since 1988 and was the Edgar F. Kaiser Professor Emeritus at the Haas School of Business.[4] As a Fulbright Distinguished Chair, in 1999 he taught Economics at the University of Siena.

Found to be one of the most cited authors in the social sciences,[5] in 2009, he was awarded the Nobel Memorial Prize in Economics for "his analysis of economic governance, especially the boundaries of the firm",[6] sharing it with Elinor Ostrom. Williamson died on May 21, 2020 in Berkeley, California.[7][8]

Theory

By drawing attention at a high theoretical level to equivalences and differences between market and non-market decision-making, management and service provision, Williamson was influential in the 1980s and 1990s debates on the boundaries between the public and private sectors.

His focus on the costs of transactions led Williamson to distinguish between repeated case-by-case bargaining on the one hand and relationship-specific contracts on the other. For example, the repeated purchasing of coal from a spot market to meet the daily or weekly needs of an electric utility would represent case-by-case bargaining. But over time, the utility is likely to form ongoing relationships with a specific supplier, and the economics of the relationship-specific dealings will be importantly different, he argued.

Other economists have tested Williamson's transaction-cost theories in empirical contexts. One important example is a paper by Paul L. Joskow, "Contract Duration and Relationship-Specific Investments: Empirical Evidence from Coal Markets", in American Economic Review, March 1987. The incomplete contracts approach to the theory of the firm and corporate finance is partly based on the work of Williamson and Coase.[9]

Williamson was credited with the development of the term "information impactedness", which applies in situations in which it is difficult to ascertain the costs to information. As he explained in Markets and Hierarchies, it exists "mainly because of uncertainty and opportunism, though bounded rationality is involved as well. It exists when true underlying circumstances relevant to the transaction, or related set of transactions, are known to one or more parties but cannot be costlessly discerned by or displayed for others".

Nobel Memorial Prize in Economic Sciences

.jpg)

In 2009, the Royal Swedish Academy of Sciences cited Williamson and Elinor Ostrom to share the 10-million Swedish kronor (£910,000; $1.44 million) prize "for his analysis of economic governance, especially the boundaries of the firm".[10] Williamson, in the BBC's paraphrase of the academy's reasoning, "developed a theory where business firms served as structures for conflict resolution".[11]

Awards and fellowships

- The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, 2009.

- Distinguished Fellow, American Economic Association, 2007.

- Horst Claus Recktenwald Prize in Economics, 2004.

- Fellow, American Academy of Political and Social Science, 1997.

- Member, National Academy of Sciences, 1994.

- Fellow, American Academy of Arts and Sciences, 1983.

- Fellow, Econometric Society, 1977.

- Alexander Henderson Award, 1962.

- Doctoris Honoris Causa in Economics, Université Paris-Dauphine, 2012.

- Doctoris Honoris Causa in Economics, Nice University, 2005.

- Doctoris Honoris Causa in Economics, University of Valencia, 2004.

- Doctoris Honoris Causa in Economics, University of Chile, 2000.

- Honorary Doctorate in Economics and Business Administration, Copenhagen Business School, 2000.

- Doctoris Honoris Causa, HEC Paris, 1997.

- Doctoris Honoris Causa in Business Administration, St. Petersburg University, 1997.

- Doctoris Honoris Causa in Economics, Turku School of Economics and Business Administration, 1995.

- Doctoris Honoris Causa in Economic Science, Groningen University, 1989.

- Doctoris Honoris Causa in Economic Science, University of St. Gallen, 1987.

- Oeconomiae Doctorem Honoris Causa, Ph.D., Norwegian School of Economics and Business Administration, Jubilee Celebration,1986.

Selected papers

- Oliver E. Williamson (1981). "The Economics of Organization: The Transaction Cost Approach" (PDF). The American Journal of Sociology. 87 (3): 548–577. doi:10.1086/227496. Archived from the original (PDF) on 2009-05-30. Retrieved 2012-01-11.

- Oliver E. Williamson (2002). "The Theory of the Firm as Governance Structure: From Choice to Contract". Journal of Economic Perspectives. 16 (3): 171–195. doi:10.1257/089533002760278776. JSTOR 3216956.

Books

- Williamson, Oliver E. (1975). Markets and Hierarchies: Analysis and Antitrust Implications. New York: Macmillan Publishers. ISBN 978-0029353608.

- Williamson, Oliver E. (1985). The Economic Institutions of Capitalism. New York: Macmillan. ISBN 9780029348208.

- Williamson, Oliver E. (1989). Antitrust Economics. Basil Blackwell. ISBN 9780631171829.

- Williamson, Oliver E. (1990). Economic Organization. New York: New York University Press. ISBN 9780814792407.

- Williamson, Oliver E. (1991). The Nature of the Firm. New York: Oxford University Press. ISBN 9780195065909.

- Williamson, Oliver E. (1995). Organization Theory: From Chester Barnard to the Present and Beyond. New York: Oxford University Press. ISBN 9780195098303.

- Williamson, Oliver E. (1996). The Mechanisms of Governance. New York: Oxford University Press. ISBN 978-0195078244.

- Williamson, Oliver E. (1996). Industrial Organization. USA: Elgar Pub. ISBN 9781858984889.

References

- "Nobel Prizes 2009". www.nobelprize.org. Retrieved 2018-02-28.

- "Five Individuals, 1952 Cathedral Football Team Among 2010 HOF Inductees". Superior Telegram. February 11, 2010.

- "Curriculum Vitae of Oliver E. Williamson" (PDF). University of California, Berkeley. Archived from the original (PDF) on 2015-06-11. Retrieved 2009-10-17.

- Pessali, Huascar F. (2006). "The rhetoric of Oliver Williamson's transaction cost economics". Journal of Institutional Economics. 2 (1): 45–65. doi:10.1017/S1744137405000238. ISSN 1744-1382.

- Sveriges Riksbank's Prize in Economic Sciences in Memory of Alfred Nobel 2009. Sveriges Riksbank. 12 October 2009. Archived from the original on 17 October 2009. Retrieved 2009-10-12..

- https://newsroom.haas.berkeley.edu/nobel-laureate-oliver-williamson-dies-at-87/

- "The Passing of Oliver Williamson | SIOE". www.sioe.org. Retrieved 2020-05-23.

- Hart, Oliver, (1995), Firms, Contracts, and Financial Structure. Oxford University Press, ISBN 0-19-828881-6.

- https://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2009/williamson-facts.html Retrieved May-05-21

- Special Issue of Journal of Retailing in Honor of The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2009 to Oliver E. Williamson, Volume 86, Issue 3, pp. 209–290 (September 2010). Edited by Arne Nygaard and Robert Dahlstrom

External links

| Wikimedia Commons has media related to Oliver E. Williamson. |

| Wikiquote has quotations related to: Oliver E. Williamson |

- Oliver E. Williamson at University of California, Berkeley

- Transaction Cost Economics: The Natural Progression, 2009 lecture at NobelPrize.org

- Profile and Papers at Research Papers in Economics/RePEc

- Works by or about Oliver E. Williamson in libraries (WorldCat catalog)

From the Haas School of Business, University of California, Berkeley:

From the University of California, Berkeley:

In The News:

- San Francisco Chronicle

- Wall Street Journal (October 12, 2009)

- Wall Street Journal (October 12, 2009)

- Wall Street Journal (October 12, 2009)

- Wall Street Journal (October 13, 2009)

- New York Times

- Washington Post

- ABC7 News, San Francisco

- KTVU, San Francisco

| Awards | ||

|---|---|---|

| Preceded by Paul Krugman |

Laureate of the Nobel Memorial Prize in Economics 2009 Served alongside: Elinor Ostrom |

Succeeded by Peter A. Diamond Dale T. Mortensen Christopher A. Pissarides |