Nicholas Barbon

Nicholas Barbon (c. 1640 – c. 1698) was an English economist, physician, and financial speculator. Critics of mercantilism consider him to be one of the first proponents of the free market. In the aftermath of the Great Fire of London, he also helped to pioneer fire insurance and was a leading player in the reconstruction work—although his buildings were planned and erected primarily for his own financial gain. His purported baptismal name–"If-Jesus-Christ-had-not-died-for-thee-thou-hadst-been-damned"–was given to him by his Fifth Monarchist father and is an example of a hortatory name: religious "slogan names" were sometimes given in Dissenting families in 17th-century England.[1] "He was unique in the unscrupulousness and brazenness of his business tactics" and his contemporary Roger North, who studied his dealings and interviewed him on the subject, called him "an exquisite mob master" in recognition of his ability to manipulate people to carry out his schemes.[2]

Nicholas Barbon | |

|---|---|

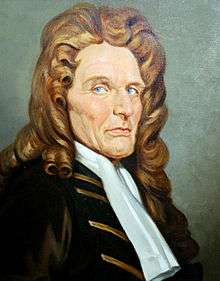

Portrait of Nicholas Barbon. | |

| Born | c. 1640 London |

| Died | c. 1698 |

| Other names | Nicholas Barebon, Nicholas Barebone |

| Occupation | Physician, economist and builder |

| Known for | Fire insurance; economic theory; speculation; middle name |

| Part of a series on |

| Economics |

|---|

|

|

|

By application |

|

Notable economists |

|

Lists |

|

Glossary |

|

Life

Nicholas Barbon was the eldest son of Praise-God Barebone (or Barbon), after whom the Barebone's Parliament of 1653—the predecessor of Oliver Cromwell's Protectorate—was named.[1][3] Conflicting sources claim the name "Unless-Jesus-Christ-Had-Died-For-Thee-Thou-Hadst-Been-Damned" was given to Nicholas' father[3] or to his uncle[4], and Nicholas' hortatory name was supposedly a variant on this name. He became a religious separatist with Millenarianist beliefs, with fervent views in favour of infant baptism in particular.[5][6]

Nicholas was born in London in either 1637[5] or 1640.[1][7] He studied medicine at the Universities of Leiden and Utrecht in the Netherlands, and received his Doctor of Medicine qualification from the latter in 1661. Three years later, he became an honorary fellow of the Royal College of Physicians in London.[5][7]

He soon turned from the medical profession to the building trade, which suddenly became important in 1666 when the Great Fire of London devastated the City of London—the commercial district of London which at the time was still separate from Westminster, the seat of Britain's government. Within a few years he was "the most prominent London builder of his age".[5] He worked on a large scale—building swathes of housing and commercial developments to the west of the City of London, where land was plentiful—and was ultimately responsible for connecting the City and Westminster for the first time as a result of his work in the districts which became The Strand and Bloomsbury.[7][8] Barbon did this despite long-established restrictions on new buildings associated with various Acts of Parliament and royal declarations in the late 16th century: he often simply disregarded legal and local objections, demolished existing buildings without permission and rebuilt speculatively in search of a quick profit.[7][8]

On 11 June 1684, Barbon's continued aggressive expansionary speculation brought him and his workers into conflict with lawyers based at Gray's Inn. Barbon started his largest project yet,[9] the redevelopment of Red Lion Square, without being authorised to do so. The Gray's Inn lawyers, whose Inns of Court were adjacent, started and won a physical battle with Barbon and his colleagues, and arranged for warrants to be issued against him to stop the scheme proceeding.[7] Another setback came when cheaply built houses at Mincing Lane collapsed because their foundations were inadequate.[5][7] Nevertheless, by the time of his death, Barbon had built or financed developments to the value of £200,000 (£26.3 million as of 2020)[10] according to Sir John Lowther, 1st Viscount Lonsdale.[9]

At the same time, Barbon took an interest in the development of insurance and the banking industry, and helped to pioneer both.[9] In 1680–81, with 11 associates, he founded an "Insurance Office for Houses" which offered fire insurance for up to 5,000 households in London.[7][11] Fires were a major danger in London at the time: the Great Fire destroyed more than 13,000 houses and displaced about 100,000 people,[12] and another conflagration in 1678 damaged the Middle Temple, one of the Inns of Court.[5] In 1690, together with John Asgill, he founded the National Land Bank.[7] This was Britain's first land bank—a financial institution which issued loans in the form of mortgages against real estate. These were popular with landowners because they could now raise money against the value of their main asset.[13] The bank was moderately successful, and even threatened to usurp the Bank of England in 1696. The government budget deficit had grown to an unsustainable level; Barbon merged the National Land Bank with another institution (founded by John Briscoe) to form Land Bank United, and offered the government a £2 million loan (£280 million as of 2020).[10] The scheme foundered when Barbon and Briscoe could not raise enough money, and Land Bank United was demerged.[7][13]

Barbon was also active in other fields during the 1690s. Largely in order to take advantage of Parliamentary privilege and thus gain immunity from prosecution by his creditors[7] he bought a number of burgages[14] in the rotten borough of Bramber in Sussex, which enabled him to be elected one of its Members of Parliament in 1690 and 1695. Another project involved trying to pump drinking water from the River Thames, to be piped to his new building developments. He patented a design in 1694, and tried to sell pumping rights alongside fire insurance contracts.[13] He built a house for himself and his business interests in Fleet Street, but later moved to Osterley House, a 16th-century manor house west of London. He died there in 1698 or 1699: his will was written in May 1698 and his executors received probate on 6 February 1699.[7][15]

Economics

During the later part of his life, Nicholas Barbon wrote extensively on economic theory. His pamphlets and books on political economy are considered important because of their innovative views on money, trade (especially free trade) and supply and demand.[7][16] His works, especially A Discourse of Trade (written in 1690), influenced and drew praise from 20th-century economists such as John Maynard Keynes (in The General Theory of Employment, Interest and Money)[17] and Joseph Schumpeter.[16] He was one of several late 17th-century economic, social and political theorists with a medical education background; contemporaries included Benjamin Worsley, Hugh Chamberlen, William Petty and John Locke.[18]

His early writings sought to explain and advertise his insurance and mortgage schemes and his building developments; for example, in his Apology for the Builder: or a Discourse showing the Cause and Effects of the Increase of Building of 1685—written in the aftermath of his fight with the lawyers of Gray's Inn—Barbon justified (anonymously) his expansionary building policy by describing the benefits it would bring to London and Britain as a whole.[19] His A Discourse of Trade, written five years later, was much more significant, however. As a broad explanation of his economic and political views, it brought together all of his ideas and became the basis for his reputation as an economic theorist.[20]

Barbon observed the power of fashion and luxury goods to enhance trade. Fashion demanded the replacement of goods before they had worn out; he believed this directed people towards the continuous purchasing of goods, which therefore created constant demand. These views were contrary to standard moral values of the time, influenced by the government and the church. He was one of the earliest writers to draw this distinction between the moral and economic aspects of purchasing.[7][21]

His views on interest were praised by Joseph Schumpeter. Barbon described as a "mistake" the standard view that interest is a monetary value, arguing that because money is typically borrowed to buy assets (goods and stock), the interest that is charged on the loan is a type of rent—"a payment for the use of goods".[16] From this, Schumpeter extrapolated the argument that just as rent is the price paid for the use of what he called "unwrought stock, or the natural agents of [economic] production", interest is the price paid for "wrought stock—the produced means of production".[22]

One of the main arguments in A Discourse of Trade[7] was that money did not have enough intrinsic value to justify a government's hoarding of it; policies intended to help accumulate supposedly "valuable" commodities such as silver and gold were not appropriate, because the laws of supply and demand were the main determiner of their value.[21] Such criticism of mercantilism—the view that a country's prosperity can be measured by its stock of bullion—helped to lay the foundation for classical economics, and was unusual at the time. Along with John Locke, with whom he debated his theories, Barbon was one of the first theorists to argue that money's value was principally symbolic and that its main function was to assist trade. These views were expanded upon in his 1696 pamphlet, A Discourse Concerning Coining the New Money Lighter.[7][23]

Barbon was influenced by populationism; he identified a country's wealth with its population. He also advocated the use of paper and credit money, and postulated the reduction of interest rates, which he thought impeded the growth in manufacturing and trade.[21][24] He discussed these issues in his 1696 pamphlet, which also considered the effects of the Recoinage of that year, in which the Royal Mint recalled large quantities of silver coins, melted them down and reminted them, resulting in a temporary fall in the supply of money.[7]

Despite the importance of some of his theories, Barbon's work (especially A Discourse of Trade) has been criticised for an excess of "definition and classification" instead of analysis and a disjointed style which lacked rigour.[3][25] This has been attributed to the early period in which he wrote, when economic thought was not yet fully developed.[17]

Works

- A Discourse Shewing the Great Advantages that New-buildings and the Enlarging of Towns and Cities do Bring to a Nation (1678)

- A Letter to a Gentleman in the Country, Giving an Account of the Two Insurance - Offices; the Fire-Office & Friendly-Society (1684)

- Apology for the Builder; or a Discourse showing the Cause and Effects of the Increase of Building (1685)

- A Discourse of Trade (1690)

- An Answer to Paper Entituled, Reasons against Reducing Interest to Four per Cent (1694)

- A Discourse Concerning Coining the New Money Lighter (1696)

Memorial

Barbon Close, opposite Great Ormond Street Children's Hospital, is named after him.

Notes

- Ash 2008, p. 254.

- The Birth of Modern London: The Development and Design of the City 1660-1720 By Elizabeth McKellar, pp.43,45

- Letwin 2003, p. 48.

- Sherwood, Gilbert, and Piper,The Monthly Repository of Theology and General Literature, 1816. Vol. 11, Article IV 'The History and Antiquity of Dissenting Churches, etc'

- Letwin 2003, p. 49.

- Wright, Stephen (September 2004). "Oxford DNB article: Barbon (Barebone), Praisegod". Oxford Dictionary of National Biography (online ed.). Oxford University Press. doi:10.1093/ref:odnb/1335. Retrieved 16 February 2010. (Subscription or UK public library membership required.)

- Sheldon, R.D. (September 2004). "Oxford DNB article: Barbon, Nicholas". Oxford Dictionary of National Biography. 1 (online ed.). Oxford University Press. doi:10.1093/ref:odnb/1334. Retrieved 16 February 2010. (Subscription or UK public library membership required.)

- Letwin 2003, pp. 50–51.

- Letwin 2003, p. 51.

- UK Retail Price Index inflation figures are based on data from Clark, Gregory (2017). "The Annual RPI and Average Earnings for Britain, 1209 to Present (New Series)". MeasuringWorth. Retrieved 2 February 2020.

- Dickson 1960, p. 7.

- Porter 1994, pp. 87–88.

- Letwin 2003, p. 54.

- History of Parliament biography

- "Will of Nicholas Barbon of Osterley, Middlesex" (fee usually required to view pdf of probate copy of will). DocumentsOnline. The National Archives. Retrieved 17 February 2010.

- Letwin 2003, p. 61.

- Ullmer, James H. (March 2007). "The Macroeconomic thought of Nicholas Barbon". Journal of the History of Economic Thought. 29 (1): 101–116. doi:10.1080/10427710601178336.

- Letwin 2003, pp. 48–49.

- Letwin 2003, p. 55.

- Letwin 2003, p. 56.

- Letwin 2003, p. 63.

- Letwin 2003, pp. 62–63.

- Letwin 2003, pp. 63–64.

- Letwin 2003, p. 60.

- Letwin 2003, p. 57.

References

- Ash, Russell (2008). Potty, Fartwell and Knob: Extraordinary but True Names of British People. London: Headline Publishing Group. ISBN 978-0-7553-1655-7.CS1 maint: ref=harv (link)

- Dickson, P.G.M. (1960). The Sun Insurance Office 1710–1960: The History of Two and a half Centuries of British Insurance. Oxford: Oxford University Press.CS1 maint: ref=harv (link)

- Letwin, William (2003) [1963]. Origins of Scientific Economics: English Economic Thought, 1660–1776. Routledge Library Editions. 9. Abingdon: Routledge. ISBN 978-0-415-31329-2.CS1 maint: ref=harv (link)

- Porter, Roy (1998). London: A Social History. Harvard University Press. ISBN 978-0-674-53839-9.CS1 maint: ref=harv (link)

External links

Chisholm, Hugh, ed. (1911). . Encyclopædia Britannica (11th ed.). Cambridge University Press.

| Parliament of England | ||

|---|---|---|

| Preceded by John Alford |

Member of Parliament for Bramber with John Radcliffe 1690–1695 William Stringer 1695–1698 1690–1698 |

Succeeded by Sir Henry Furnese |