Fifth Third Bank

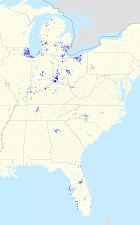

Fifth Third Bank (5/3 Bank) is a bank headquartered in Cincinnati, Ohio, at Fifth Third Center. It is the principal subsidiary of Fifth Third Bancorp, a diversified bank holding company. One of the largest consumer banks in the Midwestern United States,[2] it operates 1,154 branches and 2,469 automated teller machines in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina. Fifth Third Bank is incorporated in Ohio.[3] It was state-chartered until late 2019, when it obtained a national charter.[2]

Fifth Third Bank corporate headquarters in Downtown Cincinnati | |

| Fifth Third Bank | |

| Public company | |

| Traded as | NASDAQ: FITB S&P 500 Index component |

| ISIN | US3167731005 |

| Industry | Banking Financial services |

| Founded | June 17, 1858 (as Bank of the Ohio Valley) |

| Headquarters | Cincinnati, Ohio, USA |

Area served | Ohio, Kentucky, Indiana, Illinois, Michigan, Tennessee, West Virginia, Florida, Georgia, North Carolina |

Key people | Greg D. Carmichael, Chairman & CEO |

| Total assets | |

| Total equity | |

Number of employees | 19,869 (2019) |

| Website | www |

| Footnotes / references [1] | |

The name "Fifth Third" is derived from the names of the bank's two predecessor companies, Third National Bank and Fifth National Bank, which merged in 1909.

The company is ranked 384th on the Fortune 500.[4] It is on the list of largest banks in the United States.

History

On June 17, 1858, the Bank of the Ohio Valley opened in Cincinnati. On June 23, 1863, the Third National Bank was organized. On April 29, 1871, the banks merged.

On June 1, 1908, Third National Bank and Fifth National Bank merged to become the Fifth-Third National Bank of Cincinnati; the hyphen was later dropped. The merger took place when prohibitionist ideas were gaining popularity, and it is legend that "Fifth Third" was better than "Third Fifth", which could have been construed as a reference to three fifths of alcohol.[5] The name went through several changes until March 24, 1969, when it was changed to Fifth Third Bank.

In 1994, the bank acquired Louisville, Kentucky-based Cumberland Federal Bancorp for $149 million in stock.[6]

In 1995, the bank acquired 12 branches in Dayton, Ohio, from PNC Financial Services.[7] The bank also acquired Kentucky Enterprise Bancorp.[8]

In 1998, the company acquired the Columbus, Ohio-based[9] W. Lyman Case & Company, an originator of commercial real estate loans.[10]

In 1999, the company acquired Enterprise Federal Bancorp, one of the biggest thrifts in the Cincinnati area with 11 branches, for $96.3 million.[11]

In March 1999, the company acquired Emerald Financial of Strongsville, Ohio, which owned 15 branches in Cleveland, Ohio, for $204 million.[12]

In April 1999, the bank acquired Ashland Bankshares and its subsidiary Bank of Ashland, both based in Kentucky, for $80 million.[13][14]

In June 1999, the bank acquired South Florida Bank Holding, which owned four branches.[15]

In July 1999, the company acquired Peoples Bank Corporation of Indianapolis for $228 million in stock.[16]

In April 2001, the company acquired Grand Rapids, Michigan-based Old Kent Bank, which owned over 300 branches in Indiana, Illinois, and Michigan.[17][18]

In 2002, the company acquired Tennessee-based Franklin Financial for $240 million.[19][20]

In 2004, the company acquired First National Bankshares of Naples, Florida.[21]

In November 2007, the bank acquired R-G Crown Bank of Casselberry, Florida, which owned 30 branches in Florida and three branches in Georgia, for $288 million.[22]

In June 2008, the bank acquired First Charter Bank of Charlotte, North Carolina, with 57 branches in North Carolina and two branches in Atlanta.[23][24]

On May 5, 2008, Fifth Third acquired nine branches in Atlanta, Georgia from First Horizon National Corporation.[25]

On October 31, 2008, the bank acquired the assets of the failed Florida-based Freedom Bank from the Federal Deposit Insurance Corporation.[26]

In November 2008, the United States Department of the Treasury invested $3.4 billion in the company as part of the Troubled Asset Relief Program and in February 2011, the company repurchased the investment from the Treasury.[27][28]

On March 30, 2009, the company sold 51% of its credit card processing business to Advent International, a private equity firm.[29][30] In 2011, the joint venture changed its name to Vantiv[31] and in 2018, it merged with to Worldpay Inc.[32]

In March 2009, the bank was rumored to be one of the front-runners, alongside Huntington Bancshares, to buy the National City Corp. branches in the Pittsburgh and Erie, Pennsylvania, regions that were being sold by PNC Financial Services as part of the National City acquisition by PNC.[33] However, PNC sold the branches to First Niagara Bank.

On October 28, 2014, the company announced plans to move its Michigan regional headquarters and 150 employees from Southfield, Michigan to 62,000 sq ft (5,800 m2) in One Woodward Avenue in downtown Detroit.[34]

In April 2016, the bank sold 17 branches in the Pittsburgh area to FNB Corporation.[35]

In November 2017, the company acquired Louisville-based Epic Insurance Solutions Agency and human resources firm Integrity HR.[36]

In February 2018, the company acquired Coker Capital Advisors, a mergers and acquisitions advisory firm.[37]

In March 2019, the company acquired Chicago-based MB Financial.[38]

2018 shooting incident

On September 6, 2018, a gunman named Omar Enrique Santa-Perez entered the lobby area of the company headquarters in downtown Cincinnati, shooting and killing three people and wounding two others before being shot and killed by the Cincinnati Police.[39][40]

In February 2020, the company warned customers of a data breach.[41]

Controversies

2014 discrimination settlement

In August 2014, the company settled with the United States Department of Justice, resolving allegations that the bank engaged in a pattern of discrimination on the basis of disability and receipt of public assistance, in violation of the Equal Credit Opportunity Act. The company was required to pay $1.5 million to eligible mortgage loan applicants who were asked to provide a letter from their doctor to document the income they received from Social Security Disability Insurance.[42]

2020 CFPB Fraudulent Account Investigation

On March 9th, 2020, the Consumer Financial Protection Bureau announced a lawsuit against the bank for allegedly opening unauthorized accounts and enrolling consumers in unauthorized products and services.[43]

Naming rights

| Wikimedia Commons has media related to Fifth Third Bank. |

Fifth Third owns the naming rights to:

- Fifth Third Field, a baseball stadium in Toledo, Ohio and home of the Toledo Mud Hens, the Triple-A minor league baseball affiliate of the Detroit Tigers.

- Fifth Third Ballpark, a baseball stadium in Comstock Park, Michigan and home of the West Michigan Whitecaps, a Class A minor league baseball team playing in the Midwest League, affiliated with the Detroit Tigers.

- Fifth Third Arena, an indoor arena on the campus of the University of Cincinnati, used by that school's basketball program

- Fifth Third Bank Stadium, home of the Kennesaw State University (Georgia) Owls and home of the Kennesaw State Owls football team.

- The company owned the naming rights to the Camping World Stadium in Orlando, Florida for Orlando City Soccer Club games in 2013.

- The company owned the naming rights to Northwestern Medicine Field, home of the Arizona Diamondbacks-affiliated Kane County Cougars of the Class-A Midwest League, from 2012 to 2016.

References

- "Fifth Third Bancorp 2019 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- Cowley, Stacy (March 9, 2020). "Fifth Third Bank Opened Fraudulent Accounts, Consumer Bureau Says". The New York Times.

Until late last year, it operated as a state-chartered bank and was primarily overseen by state regulators and the Federal Reserve Bank of Cleveland. In November, Fifth Third became nationally chartered and fell under the supervision of the Office of the Comptroller of the Currency.

- "10-K". 10-K. Retrieved 1 June 2019.

- "Fifth Third Bancorp". Fortune.

- Brickey, Homer (April 2, 2002). "That funny name for a bank has grown on us". The Blade.

- "FIFTH THIRD BANCORP TO BUY CUMBERLAND FEDERAL". The New York Times. Reuters. January 12, 1994.

- "FIFTH THIRD BANK TO ADD 12 PNC BRANCHES IN OHIO". The New York Times. Associated Press. May 17, 1995.

- "Ohio-Kentucky Bank Merger". The New York Times. Reuters. August 29, 1995.

- "Company Overview of W. Lyman Case & Company". Bloomberg. Retrieved September 7, 2018.

- "FIFTH THIRD BANK OF OHIO AGREES TO BUY W. LYMAN CASE". The New York Times. Bloomberg News. March 20, 1998.

- "Fifth Third gets Feds' OK for Enterprise acquisition". American City Business Journals. February 9, 1999.

- "FIFTH THIRD BANCORP IN DEAL FOR EMERALD FINANCIAL". The New York Times. March 2, 1999.

- "Fifth Third completes Ashland buy". American City Business Journals. April 16, 1999.

- "List of Fifth Third Bank's 9 Acquisitions". TechCrunch.

- "Institution History for SOUTH FLORIDA BANK HOLDING CORPORATION (1840717)". Federal Financial Institutions Examination Council.

- "FIFTH THIRD BANCORP OF OHIO ACQUIRES A BANK IN INDIANA". The New York Times. Bloomberg News. July 13, 1999.

- ELIASOHN, MICHAEL (April 3, 2001). "Fifth Third Bank completes acquisition of Old Kent". The Herald-Palladium.

- "Fifth Third buys Old Kent". CNN. November 20, 2000.

- Sarles, Judy (July 24, 2002). "Fifth Third to buy Franklin Financial in $240 million deal". American City Business Journals.

- "FIFTH THIRD AGREES TO ACQUIRE FRANKLIN FINANCIAL". The New York Times. Associated Press. July 25, 2002.

- "Fifth Third announces acquisition of First National Bankshares". American City Business Journals. August 2, 2004.

- Rajan, Amitha (May 21, 2007). "Fifth Third Bancorp to buy R-G Crown Bank for $288 mln". Reuters.

- McLaughlin, Tim (August 16, 2007). "Fifth Third to buy First Charter". Reuters.

- "Fifth Third Bank closes First Charter deal, enters North Carolina". American City Business Journals. June 9, 2008.

- Davis, Paul (September 26, 2007). "First Horizon to Sell Sites in Unfundable Expansion". American Banker.

- "Fifth Third Bank Acquires All the Deposits of Freedom Bank, Bradenton, Florida" (Press release). Federal Deposit Insurance Corporation. October 31, 2008.

- Protess, Ben (February 2, 2011). "Fifth Third Repays Bailout Funds". The New York Times.

- "Fifth Third Bancorp repays TARP debt". American City Business Journals. February 2, 2011.

- Lagorio, Juan (March 30, 2009). "Fifth Third sells most of payments unit to Advent". Reuters.

- Lattman, Peter; Fitzpatrick, Dan (March 30, 2009). "Fifth Third to Sell 51% Stake in Its Payment Unit to Advent". The Wall Street Journal.

- "Fifth Third Processing Solutions Changes Name to Vantiv" (Press release). PR Newswire. June 15, 2011.

- "Vantiv and Worldpay Complete Combination to Form Worldpay, Inc" (Press release). PR Newswire. January 16, 2018.

- Sabatini, Patricia (March 21, 2009). "FNB won't buy National City units". Pittsburgh Post-Gazette.

- Pinho, Kirk (October 28, 2014). "Fifth Third Bank to move 150 employees downtown as part of $85M investment in Detroit". Crain Communications.

- "First National Bank Finalizes Acquisition of 17 Pittsburgh-Area Fifth Third Bank Locations" (Press release). PR Newswire. April 25, 2016.

- Watkins, Steve (November 1, 2017). "Fifth Third completes acquisition of insurance agency, HR firm". American City Business Journals.

- Watkins, Steve (February 5, 2018). "Fifth Third acquires M&A advisory firm". American City Business Journals.

- "Fifth Third Bancorp Completes Merger With MB Financial, Inc" (Press release). Business Wire. March 22, 2019.

- "Cincinnati police ID gunman behind Fifth Third shooting as Omar Enrique Santa-Perez". WCPO-TV. September 6, 2018.

- Anstead, Abby (September 6, 2018). "Three dead, shooter dead in 'horrific' shooting at Fifth Third Bank headquarters Downtown". WCPO-TV.

- Coolidge, Alexander (February 11, 2020). "Fifth Third warns customers of data breach by former employees". Cincinnati Enquirer.

- "Justice Department Reaches Settlement with Fifth Third Mortgage Company to Resolve Allegations of Discrimination Against Recipients of Disability Income" (Press release). United States Department of Justice. August 7, 2014.

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-files-suit-against-fifth-third-for-allegedly-opening-unauthorized-accounts-enrolling-consumers-in-unauthorized-products/