Credit card debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt accumulates and increases via interest and penalties when the consumer does not pay the company for the money he or she has spent.

The results of not paying this debt on time are that the company will charge a late payment penalty (generally in the US from $10 to $40) and report the late payment to credit rating agencies. Being late on a payment is sometimes referred to as being in "default". The late payment penalty itself increases the amount of debt the consumer has.

When a consumer has been late on a payment, it is possible that other creditors, even creditors the consumer was not late in paying, may increase the interest rates the consumer is paying. This practice is called universal default.

Research shows that people with credit card debt are more likely to forgo needed medical care than others, and the likelihood of forgone medical care increases with the magnitude of credit card debt.[1]

Statistics

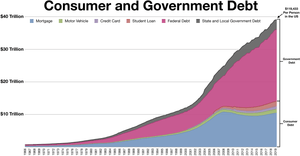

Quarterly credit card debt in the United States Ssince 1986 (in billions):[2]

- Q3 2016: $927.1

- Q3 2014: $833.8

- Q4 2012: $828.8

- Q4 2011: $834.4

- Q1 2011: $776.6

- Q4 2010: $833.1

- Q4 2008: $984.2

- Q4 2000: $688.2

- Q4 1990: $245.9

- Q3 1986: $133.5

Credit card debt in other countries:

- United Kingdom (March 2009) £64.7 billion[3]

- Australia (2010) $50 billion (AUD)[4]

Declines in credit card debt are often misinterpreted because they fail to include information about charge-offs. The possible causes for a decline in credit card debt are consumers paying down their debt, credit card companies writing charged-off debt off their books, or a combination of the two. Inclusion of charged-off debt can therefore significantly impact debt trends and the characterization of a nation's financial health. For example, the $10.3 billion decrease in outstanding credit card debt in Q3 2010 relative to the previous quarter might at first glance seem to be a significant consumer pay down. However, considering that the Q3 credit card charge-off rate was $16.9 billion,[2] consumers actually increased their overall debt by $6.6 billion during this quarter.

Consumers also commonly pay down a large portion of their credit card debt in the first fiscal quarter of the year as this tends to be the time when people receive holiday bonuses and tax refunds.[5] However, credit card debt tends to increase throughout the rest of the year.[2]

Credit card debt is said to be higher in industrialized countries.[6] The average U.S. college graduate begins his or her post-college days with more than $2,000 in credit card debt.[7] The median credit card debt in the U.S. is $3,000 and number of cards held is two.[8]

Relieving credit card debt

Account holders can request a reduction in their annual percentage rate (APR). A survey conducted by the U.S. Public Interest Research Group in March 2002 found that among its fifty participants, including people of all credit backgrounds, who contacted their credit card issuers, 56 percent received a lower APR. On average the percentage went from 16 percent to 10.47 percent.[9]

Due to the start of the Great Recession in December 2007, multiple credit card debt relief options became widely popular for consumers living in the U.S. with unsecured debt totaling over $5,000.

The various debt relief options available in the U.S. include:

- Debt settlement

- Debt consolidation

- Credit counseling

- Chapter 7 bankruptcy and Chapter 13 bankruptcy

Although each of these debt relief options deals with credit card debt specifically, they are also able to deal with other types of debt including personal loans, medical debt, accounts in collections and more (depending on the specific program type). Still, these programs have not been enough to help enough Americans get out of debt, resulting in a government call-to-action by economists for a massive debt bailout.[10]

Bankruptcy concerns

Sometimes the late fees, high annual percentage rates (APRs), and universal default overcome consumers who frequently do not pay off their debt, and the customer declares bankruptcy. If a customer files for bankruptcy, the credit card companies are required to forgive all or much of the debt, unless such discharge of debt is successfully challenged by one or more creditors, or blocked by a bankruptcy judge on legal grounds irrespective of creditors' challenges.

Because forgiveness of debt reduces likelihood of profit and continued survival, the companies are generally willing to offer another deal to the consumers in danger of bankruptcy. This deal consists of reduced APRs, removal of past late fees and penalty charges, and reaging the accounts so that the credit agencies see them as late accounts.

Political aspects

Some credit card companies made lobbying efforts at the federal level to tighten American bankruptcy law, making it harder to have credit card debts canceled.[11]

See also

- Maxed Out – 2006 documentary about credit card debt and the national deficit.

References

- Lucie Kalousova, Sarah A. Burgard (2013). "Debt and Foregone Medical Care". Journal of Health and Social Behavior. 54 (2): 204–20. doi:10.1177/0022146513483772. PMID 23620501.

- "2016 Credit Card Debt Study: Trends & Insights". WalletHub.com. Retrieved 2017-01-15.

- British Bankers' Association Archived 2010-04-27 at the Wayback Machine

- Scott Murdoch (January 13, 2012). "Caution on cards as credit bill peaks". The Australian. Melbourne. Retrieved 2012-01-15.

- Sandra Guy (June 16, 2011). "Consumers paying down debt more slowly". Sun-Times Media, LLC. Archived from the original on January 20, 2012. Retrieved 2011-06-23.

- Hansjörg Herr, Milka Kazandziska (Feb 15, 2011). Macroeconomic Policy Regimes in Western Industrial Countries. Routledge. Retrieved 2014-04-15.

- "Topic Galleries - chicagotribune.com". Chicago Tribune.

- Tyson, Eric. "How Significant a Problem is Credit Card Debt in America? - Eric Tyson".

- "Learn How To Lower Credit Card Interest Rate - Bankrate.com".

- Jennifer Ablan and Matthew Goldstein (October 3, 2011). "Economists Call For Massive Debt Relief To Jumpstart Economy". Reuters. Retrieved 2011-11-20.

- "JS Online: Bankruptcy laws may be tightening". Jan 1, 2005. Archived from the original on January 5, 2005.