Al Mada (holding)

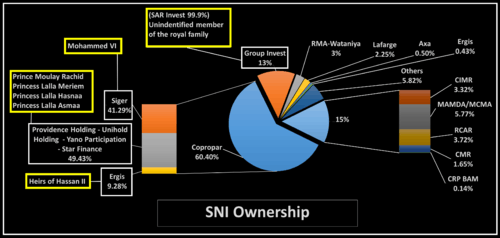

Société Nationale d'Investissement (SNI) (National Investment Company) or Al Mada, is a large private Moroccan holding company mainly owned by the Moroccan royal family.[3] Headquartered in Casablanca (Morocco), the company was established in 1966. SNI operates in different fields such as banking, telecommunication, renewable energy businesses and food industry among others.[4]

| Industry | Conglomerate |

|---|---|

| Predecessor | ONA Group |

| Founded | 1966 |

| Founder | Moroccan state and royal family |

| Headquarters | 60, rue d'Alger , 20000 Casablanca Morocco |

Key people | Hassan Bouhemou Mounir Majidi (Director of SIGER) Mohammed VI |

| Revenue | |

| Total assets | |

| Total equity | |

| Owner | Mohammed VI Members of the Alaouite royal family |

| Website | www |

The conglomerate also holds stakes in the country’s largest private companies: AttijariWafa (Banking), Managem (mining), Nareva (energy firm), Lafarge Ciments, and Marjane (supermarket chain). SNI is investing in other African countries (Cameroon, Ivory Coast, Rwanda, Gabon, etc.).[3]

The holding company used to be the majority shareholder of the now defunct ONA Group, until the activities of the latter were absorbed into the SNI and subsequently disposed of.

In 2012, the company's consolidated turnover was MAD53 billion (US$5.3 billion) and its net income was MAD5 billion (US$500 million).

History

Created in 1966, SNI has been listed in Casablanca Stock exchange since 1994.

In 2009, The conglomerate registered a consolidated net income of MAD2.3 billion. The company invested nearly MAD5.52 billion, mainly by acquiring 10% of Attijariwafa Bank's capital from the Spanish bank Santander.[5]

Despite the unfavourable global context, the company's performance increased 365% in 2009, with a turnover of MAD3.42 billion, compared to the previous year.

Restructuring and merger with ONA Group

The company planned a merger with ONA (Omnium Nord-Africain), to diversify their investments’ portfolio, in 2009. The merger was only announced by the boards of the two companies in March 26, 2010.[6] With this merger, the group shifted from its conglomerate structure controlling the activities of its subsidiaries to an investment fund company incubating, developing and disposing of companies and projects present in the Moroccan economy. The reorganisation gave the group’s subsidiaries a larger autonomy in the management of their affairs.[7]

As a result of the SNI-ONA merger, both companies have been delisted from the Casablanca stock market, forming a new investment holding company. They later list their subsidiaries on the stock exchange market once they reach maturity growth.

According to the Casablanca Stock Exchange chief executive, Karim Hajji, the SNI-ONA merger “willl improve greatly the liquidity of Casablanca bourse and spur other companies to relinquish their majority controls and sell shares to investors via the bourse."[8]

On February 22, 2013, the group agreed to sell its stakes in Centrale Laitière (dairy firm) to French partner Danone for $727.23 million.[9]

On November 30, 2014, the SNI appointed Hassan Ouriagli as the new CEO to replace Hassan Bouhemou.[10]

In 2015, the net profit attributable to shareholders dropped from MAD3.31 billion to MAD3.56 billion.[11]

In 2016, the group registered a 34% rise in net profit, following the merger with Lafarge Ciments and Holcim Maroc.[12]

Activities and partnerships

The group has a large footprint on the Moroccan economy, estimated to be worth 3% of GDP. It holds investments in companies holding #1 positions in banking and mass retail. Its main activities encompass financial services with Attijariwafa Bank, mass distribution with Marjane, telecom with Inwi and mining with Managem Group. Societe Nationale d'Investissement has invested as well in renewable energy, tourism and real estate. It has partnered as well with foreign investors such as Lafarge in Lafarge Maroc and Arcelor Mittal in Sonasid.[13]

It has exited in 2012 and 2013 from the historic ONA Group agri-business activities, by selling its stakes in leader companies in edible oil, milk and dairy, sugar and biscuits to international leaders such as Sofiprotéol, Danone, Wilmar International and Mondelēz International.[14]

Partnership with Lafarge & Holcim Maroc

In 2016, SNI partnered with Lafarge Ciment and Holcim Maroc. The partnership is composed of two separate parts:[15]

- The merging of Lafarge Ciments and Holcim Maroc produced LafargeHolcim Maroc, the second listed cement-manufacturers in Africa.

- The creation of a common development subsidiary in Sub-Saharan French speaking Africa.

This operation is beneficial for both partners as they progress towards a Pan-African investment fund. It created the first industrial market capitalization in Casablanca for an amount of MAD40 billion (EUR3.7 billion).[15]

Partnership’s implementation process:

- Merging of Holcim Maroc and Lafarge Ciment

- Assigning 50 percent to SNI of LafargeHolcim Maroc shares

- Contributing the new shares held by SNI and LafargeHolcim Maroc to Lafarge Maroc to retain the major part of the shares and control

The partnership also resulted in the creation of a common development subsidiary called LH Maroc Afrique, that targets the Sub-Saharan French speaking Africa (Burkina Faso, Ivory Coast, Gabon, Mauritania and Mali…).[15]

Subsidiaries

Attijariwafa Bank

SNI initially held 48% stake in Attijariwafa bank. In January 2015, The conglomerate hired the Goldman Sachs and Rothschild banks to advise them on finalizing the deal of selling 19% of Attijariwafa bank to reduce SNI’s debt.[16]

Nareva

Nareva holding is fully owned by SNI and focuses on renewable and coal energy.[17]

Cosumar

In 2013, SNI started collaborating with Cosumar only to resell the majority of its shares in 2014. In 2015, the firm completely sold the remaining shares to the stock market.[18]

Centrale Laitière and Bimo

SNI sold its share of 37.7% in Centrale Laitiére to the French firm Danone. It also sold its 50% share of Bimo to Kraft Foods.[9]

Lesieur Cristal

In 2014, the group sold its remaining stakes of Lesieur in a public sale.[19]

Other Subsidiaries

Société Nationale d'Investissement (SNI) owns several other firms :[20][21]

- Agma Lahlou-Tazi

- Lafarge Maroc

- Managem

- Marjane

- Nareva

- ONAPAR

- OPTORG

- SOMED

- SONASID

- Sotherma

- Wafa Assurance

- Wafa Cash

- Wafa Capital

- Wana Corporate (Inwi)

- Aviation unit called Africaplane[22]

Monopoly Status and Corruption Allegations

The Societe National d'Investissement and its former holding arm (Omnium Nord Africain) have been accused of monopolistic market practices and of corruption on several occasions. The fact that the largest shareholder remains the Moroccan Royal family to this day has enabled the SNI to use significant political and economic pressure on its rivals and acquisition targets. Recent Wikileaks cables[23] divulged on December 2010 reveal the reports of US diplomats casting doubts on the integrity of the dealings of the SNI (and ONA) and on the transparency of the King's business affairs.

See also

- ONA Group

- List of Moroccan companies

References

- "Attijariwafa bank" (PDF). Archived from the original (pdf) on 3 March 2016. Retrieved 1 July 2013.

- "SNI_2012" (PDF). cdvm.gov.ma. Archived from the original (PDF) on 25 December 2013. Retrieved 24 December 2013.

- "Morocco's new African ambition | Morocco: The new Morocco report | The Report Company". www.the-report.com. Retrieved 2017-05-19.

- "Societe Nationale d'Investissement S.A.: Private Company Information - Bloomberg". www.bloomberg.com. Retrieved 2017-05-19.

- "Santander vend 10% de ses parts d'Attijariwafa Bank". yabiladi.com.

- "Radical shift in strategy". www.moroccobusinessnews.com. Retrieved 2017-08-24.

- "ONA, SNI merger audacious operation". www.moroccobusinessnews.com. Retrieved 2017-05-19.

- "Merger of ONA-SNI to energise Casablanca bourse: CEO". Reuters. 2017-04-07. Retrieved 2017-05-22.

- "Morocco's SNI sells stakes in dairy, biscuit companies". Reuters. 2017-02-22. Retrieved 2017-05-22.

- "SNI: L'empreinte Ouriagli". fr.le360.ma (in French). Retrieved 2017-05-22.

- "UPDATE 1-Moroccan royal holding firm SNI reports 7.7 pct drop in 2015 profit". Reuters. 2017-03-31. Retrieved 2017-05-22.

- "Morocco's SNI says 2016 profit up 34 pct - local media". Reuters. 2017-03-29. Retrieved 2017-05-22.

- "Arcelor Raises Interest in Morocco Steelmaker Sonasid in Association with SNI and Local Partners". www.businesswire.com. Retrieved 2017-05-22.

- DairyReporter.com. "Danone ups stake in Moroccan dairy Central Laitière to 90%". DairyReporter.com. Retrieved 2017-05-22.

- "SNI Reinforces Historical Partnership with LafargeHolcim | Newsroom | Baker McKenzie". Retrieved 2017-05-22.

- News, Morocco World (2015-02-09). "Morocco's SNI Plans to Sell Stakes at Attijariwafa Bank". Morocco World News. Retrieved 2017-05-22.

- "UPDATE 1-Nareva-led group wins $1.2 bln wind power deal". af.reuters.com. Retrieved 2017-05-22.

- "La SNI: un holding (presque) sans sucre". Al Huffington Post. Retrieved 2017-05-22.

- "Morocco's SNI to sell its 23.6 pct stake in Lesieur". Reuters. 2017-05-17. Retrieved 2017-05-22.

- "UPDATE 1-Moroccan royal holding firm SNI reports 7.7 pct drop in 2015 profit". Reuters. 2017-03-31. Retrieved 2017-05-22.

- "UPDATE 1-Moroccan royal holding firm SNI's 2014 profit falls 42 pct". Reuters. 2017-03-30. Retrieved 2017-05-22.

- "African Aerospace - SNI establishes own passenger charter unit". africanaerospace.aero. Retrieved 2017-05-22.

- "US embassy cables: Moroccan sacking exposes king's business role". the Guardian.