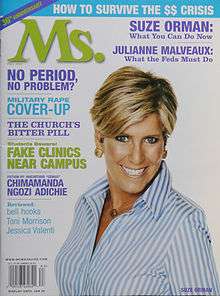

Suze Orman

| Suze Orman | |

|---|---|

Orman at the TIME 100 Gala, May 4, 2010. | |

| Born |

Susan Lynn Orman June 5, 1951 Chicago, Illinois, U.S. |

| Residence | Florida (primary), New York City, and San Francisco[1] |

| Nationality | American |

| Education | Bachelor of Arts in Social Work |

| Alma mater | University of Illinois at Urbana-Champaign (1976) |

| Occupation | |

| Known for | The Suze Orman Show |

| Net worth | $30 million (2018) |

| Spouse(s) |

Kathy Travis (m. 2010) |

| Signature | |

|

| |

Susan Lynn "Suze" Orman (/ˈsuːzi/ SOO-zee; born June 5, 1951 in Chicago) is an American author, financial advisor, motivational speaker, and television host. She earned a degree in social work then worked as a financial advisor for Merrill Lynch. In 1983, she became a vice president of retail customer investments at Prudential Bache Securities. In 1987, she founded the Suze Orman Financial Group. In 2002, her program The Suze Orman Show began airing on CNBC. In 2006, she won a Gracie Award for Outstanding Program Host on The Suze Orman Show.[2] She has written several books on the topic of personal finance.

Early life and education

Orman was born on the South Side of Chicago on June 5, 1951, to Jewish parents of Russian and Romanian origin.[3] Her mother worked as a secretary for a local rabbi, while her immigrant father from Kiev[4] worked in a chicken factory[5][6][7] and managed his Morry's delicatessen [8] in Hyde Park.[9][10][11]

She attended the University of Illinois at Urbana-Champaign and received a B.A. in social work in 1976.[12] In 2009, Orman received an honorary doctorate of humane letters from the University of Illinois at Urbana-Champaign.[12]

Career

After finishing school, Orman moved to Berkeley, California, where she worked as a waitress. In 1980, she borrowed $52,000 from friends and wellwishers to open a restaurant.[13][14][15][16]

Still an investment novice, she invested that money through a representative at Merrill Lynch, who promptly lost her entire investment in trading options. Later, Orman trained as an account executive for Merrill Lynch, where she learned that the type of investment her broker had put her in was not suitable for her needs, as option trading is considered a high-risk but high-reward investment suitable only for high net worth individuals. It was explained to her that because her broker was the highest producing representative in the office, his actions went unchecked. While still employed at the firm, she successfully sued Merrill Lynch for a prior investment loss of $50,000. After completing her training with Merrill Lynch, she remained at the firm until 1983, when she left to become a vice president of investments at Prudential Bache Securities.

In 1987, Orman resigned from Prudential and founded the Suze Orman Financial Group, in Emeryville, California.[17][18] While there, she published a booklet, The Facts on Single Premium Whole Life, which compared single-premium whole life, universal life, and single-premium deferred annuities; she distributed copies of the booklet for free to anyone who requested one.[19] She was director of the firm until 1997.[15]

Orman published three books between 1997-99: The 9 Steps to Financial Freedom (1997), You Earned it Don't Lose it (1999), and The Courage to be Rich (1999). Other books by Orman include: The Road to Wealth (2001) and The Laws of Money, The Lessons of Life (2003).[20]

The Suze Orman Show began airing on CNBC in 2002. In February 2008, Orman gave away copies of her book Women and Money for free following an appearance on The Oprah Winfrey Show, generating almost two million downloads.[21] Orman has been featured on the Food Network's Paula's Party. In January 2011, Orman appeared on Oprah's Allstars. In January 2012, Orman's six-episode TV series America's Money Class with Suze Orman premiered on OWN: Oprah Winfrey Network.[22]

Orman writes a financial advice column for O, The Oprah Magazine.[23] She is the former author of Yahoo!'s "Money Matters" and has written for the Costco Connection Magazine. She contributes to The Philadelphia Inquirer, Lowes MoneyWorks, and Your Business at Home Magazine.[24][25]

While she has proven herself a wealth of information about credit and very general financial issues, Orman's understanding of comprehensive financial planning has been questioned by many in the industry. Senior MarketWatch columnist Chuck Jaffe, for example, states that Orman "scores very high on the personality index, but very low on the knowledge and understanding of the complex issues that face a lot of her audience. She's giving generic, simple solutions to people's most difficult problems, and judging from her [own personal investment] portfolio she's taking them on a path she really hasn't traveled herself."[26]

Orman's final episode of The Suze Orman Show aired on March 28, 2015, so Orman could develop a new series, Suze Orman's Money Wars, for Warner Bros. Telepictures Productions.[27] Orman hoped the show would premiere in the fall of 2016.[28]

Suze Orman "Approved" prepaid debit card

In 2012, Orman introduced a prepaid debit card, backed by Bancorp Bank, aimed at budget-challenged consumers. In personal appearances, she claimed the card would contribute to improving the cardholder's FICO score, even though only one credit agency – TransUnion – had reviewed the proposal and had agreed only to "examine data from [the] cards". The website for the debit card claimed, "I am proud to say that the Approved card is the first prepaid card in history to share information with TransUnion, a major credit bureau."[29] Two years later, the program was quietly ended.[30]

Personal life

In February 2007, Orman stated that she is a lesbian.[31][32][33] Orman has been married to Kathy Travis since 2010.[34]

In 2008, Orman donated money to the Democratic Party.[35][36] In an interview with Larry King, she said that she favors the policies of the Democratic Party and Barack Obama, especially regarding people in same-sex relationships.[37]

In an April 2008 online interview with The Young Turks, Orman said that her net worth was more than US $10 million.[38]

Bibliography

Books

- You've Earned It, Don't Lose It: Mistakes You Can't Afford to Make When You Retire (with Linda Mead) (1995)[39]

- The Nine Steps To Financial Freedom (1997)[40]

- The Courage to Be Rich (1999)

- The Road to Wealth (2001)

- The Laws of Money, the Lessons of Life... (2003)

- The Money Book for the Young, Fabulous and Broke (2005)

- Women and Money: Owning the Power to Control Your Destiny (2007)

- Suze Orman's 2009 Action Plan (2009)

- Suze Orman's 2010 Action Plan (March 2010)

- The Money Class: Learn to Create Your New American Dream (March 2011)

Multimedia

Orman is also creator of a number of non-book products, primarily CD-ROM-based services that offer education and various financial services usually in conjunction with her books and writings.

- Suze Ormans FICO Kit – First offered in 2002 in conjunction with Fair Isaac Corporation.

- Suze Orman's Will & Trust Kit – Introduced in 2005 with her personal trust attorney.

- Suze Orman's Insurance Kit – Introduced in 2007.

- Suze Orman's Protection Portfolio – First introduced in 2002, in third version.

- Suze Orman's Identity Theft Kit – First offered in 2008, in conjunction with TrustedID.

- Suze Orman's Save Yourself Retirement Program – Introduced September 2009, in conjunction with TD Ameritrade.

- Suze Orman's Search Scammer

See also

References

- ↑ "Q&A with personal finance guru Suze Orman". San Francisco Chronicle. 25 October 2008.

- ↑ Curry, Ann (March 2, 2006). "Dateline wins Gracie Award". MSNBC.

- ↑ Strauss, Elissa (October 17, 2007). "Suze Orman's Spiritual Side". The Jewish Daily Forward. The Forward Association, Inc.

- ↑ "Millennial Money Moves". The Suze Orman Show. February 7, 2015. CNBC.com.

- ↑ Dominus, Susan (2009-05-17). "Suze Orman Is Having a Moment". The New York Times.

- ↑ "If you knew Suze…". Kiplinger's Personal Finance Magazine. 1998.

- ↑ "News - Suze Orman". The Jewish Journal. Retrieved 2007-11-01.

- ↑ Spiselman, Anne. "Morry's Deli". Chicago Reader. Retrieved 2016-09-05.

in the mid-1970s—when you might have found college student Suze Orman working behind the counter for her dad, the original owner...

- ↑ Cantor, Danielle. "Successful Women: Suze Orman". Jewish Woman. Jewish Women International (Fall 2004). Archived from the original on 2008-09-23. Retrieved 2007-05-30.

- ↑ Bloom, Nate (2004-06-11). "Celebrity Jews: Briefly noted". jewishsf.com. San Francisco Jewish Community Publications Inc. Retrieved 2007-05-30.

- ↑ Iwata, Edward (1999-05-04). "Personal finance guru Suze Orman is keepin' it real despite her astounding success". San Francisco Chronicle. Retrieved 2007-05-30.

- 1 2 Post to Wall. "Suze Orman receives honorary degree, addresses University graduates". Dailyillini.com. Retrieved 2012-06-16.

- ↑ "History from Orman's website". Suzeorman.com. Archived from the original on 2012-07-01. Retrieved 2012-06-16.

- ↑ Women & money: owning the power to control your destiny. Random House, Inc. 2007. pp. 27–28. ISBN 0-385-51931-1.

- 1 2 Andriani, Lynn (2003-02-24). "The Dollars and Sense of Suze Orman". Publishers Weekly. Archived from the original on 2008-09-20. Retrieved 2008-01-25.

- ↑ Orman, Suze (2008-06-05). Women and Money (TV-program). PBS pledge programming: PBS. Archived from the original on 2008-06-15.

- ↑ "How Emeryville became a boom town". USA Today. June 13, 1988. p. 8B.

- ↑ Goldinger, Jay (May 9, 1989). "Catastrophic Coverage Raises Some Questions". The Times-Picayune. New Orleans, Louisiana. p. E4.

- ↑ Goldinger, Jay (September 19, 1989). "Closed-end Funds Offer Good Value for the Investor". The Times-Picayune. New Orleans, Louisiana. p. D3.

- ↑ Suze Orman, WorldCat.org; accessed 2013-01-06.

- ↑ Dominus, Susan (2009-05-17). "Suze Orman Is Having a Moment". The New York Times.

- ↑ "America's Money Class with Suze Orman", channelguidemag.com, 2012-01-09.

- ↑ Orman, Suze (January 6, 2010) Easy Money, CNN.com; accessed January 17, 2013.

- ↑ Orman, Suze. Moving Past Fear and Toward Success" Archived 2008-01-21 at the Wayback Machine., Your Business at Home Magazine, Volume 3, Issue 1, January 2008, pg. 36.

- ↑ "Internationally Acclaimed Personal Finance Expert; Host of CNBC The Suze Orman Show". KeySpeakers.com. Archived from the original on 2009-02-02.

- ↑ Chuck Jaffe (Mar 8, 2007). "Outing Suze Orman's portfolio". MarketWatch.

- ↑ Littleton, Cynthia (November 25, 2014). "Suze Orman to Exit CNBC for 'Money Wars' Series with Telepictures". Variety. Retrieved 8 March 2015.

- ↑ Stuever, Hank; Stuever, Hank (2015-03-27). "So long, 'Suze Orman Show,' TV's only sane space in a money-crazed culture". The Washington Post. ISSN 0190-8286. Retrieved 2017-05-10.

- ↑ The truth behind Suze Orman's devit card NBC News

- ↑ Suze Orman's prepaid debit cards are quietly discontinued New York Times 2014/06/17

- ↑ Lo, Malinda. "Suze Orman Comes Out" Archived 2007-10-01 at the Wayback Machine., AfterEllen.com, 2007-02-25.

- ↑ "Money maven Suze Orman comes out" Archived 2007-10-24 at the Wayback Machine., The Advocate, 2007-02-23.

- ↑ "Your New Trump". Suze Orman Show. CNBC.com. 2011-01-22.

- ↑ Moral, Cheche V. (February 26, 2012). "Helping people who can take care of themselves is not helping the Philippines". Philippine Daily Inquirer.

- ↑ "NEWSMEAT ▷ Suze Orman's Federal Campaign Contribution Report". Newsmeat.com. Archived from the original on 2012-05-12. Retrieved 2012-06-16.

- ↑ Profile Archived 2011-06-22 at the Wayback Machine., newsmeat.com; accessed May 19, 2015.

- ↑ "Larry King Live" (transcript). CNN. 2008-01-02.

- ↑ Solomon, Deborah. "She's So Money", Sunday New York Times magazine; 2007-02-25: 'Despite her rallying cry to "buy term and invest the rest" Orman owns significant amounts of permanent insurance (mostly whole life) for estate planning purposes and because 2008 taught us that guarantees are an important part of constructing a portfolio. She has never come out and said so because she fears it would damage her reputation as a financial advisor and TV guru after villainizing permanent insurance and the people who sell it.'

- ↑ Rowe, Jeff (January 23, 1995). "New on the Bookshelf". The Orange County Register. Orange County, California. p. D4.

- ↑ "Financial Writer Wants to Let Freedom Ring". The Times-Picayune. New Orleans, Louisiana. April 18, 1997. p. E3. Retrieved May 19, 2015.

External links

| Wikimedia Commons has media related to Suze Orman. |

- Suze Orman Official Site Suze Orman Financial Group Web site

- Suze Orman on IMDb

- Suze Orman at The Interviews: An Oral History of Television

- Suze Orman Show, CNBC Suze Orman Show

- Suze Orman on YouTube