Real wages

.png)

Real wages are wages adjusted for inflation, or, equivalently, wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages.

Because it has been adjusted to account for changes in the prices of goods and services, real wages provide a clearer representation of an individual's wages in terms of what they can afford to buy with those wages – specifically, in terms of the amount of goods and services that can be bought. However, real wages suffer the disadvantage of not being well defined, since the amount of inflation (which can be calculated based on different combinations of goods and services) is itself not well defined. Hence real wage defined as the total amount of goods and services that can be bought with a wage, is also not defined. This is because changes in the relative prices

Despite difficulty in defining one value for the real wage, in some cases a real wage can be said to have unequivocally increased. This is true if: After the change, the worker can now afford any bundle of goods and services that he could just barely afford before the change, and still have money left over. In such a situation, real wage increases no matter how inflation is calculated. Specifically, inflation could be calculated based on any good or service or combination thereof, and real wage has still increased. This of course leaves many scenarios where real wage increasing, decreasing or staying the same depends upon how inflation is calculated. These are the scenarios where the worker can buy some of the bundles that he could just barely afford before and still have money left, but at the same time he simply cannot afford some of the bundles that he could before. This happens because some prices change more than others, which means relative prices have changed.

The use of adjusted figures is used in undertaking some forms of economic analysis. For example, to report on the relative economic successes of two nations, real wage figures are more useful than nominal figures. The importance of considering real wages also appears when looking at the history of a single country. If only nominal wages are considered, the conclusion has to be that people used to be significantly poorer than today. However, the cost of living was also much lower. To have an accurate view of a nation's wealth in any given year, inflation has to be taken into account and real wages must be used as one measuring stick.

An alternative is to look at how much time it took to earn enough money to buy various items in the past, which is one version of the definition of real wages as the amount of goods or services that can be bought. Such an analysis shows that for most items, it takes much less work time to earn them now than it did decades ago, at least in the United States.[1]

Real wages are a useful economic measure, as opposed to nominal wages, which simply show the monetary value of wages in that year.

Example

Consider an example economy with the following wages over three years. Also assume that the inflation in this economy is 2% per year:

- Year 1: $20,000

- Year 2: $20,400

- Year 3: $20,808

Real Wage = W/i (W= wage, i= inflation, can also be subjugated as interest).

If the figures shown are real wages, then wages have increased by 2% after inflation has been taken into account. In effect, an individual making this wage actually has more ability to buy goods and services than the previous year. However, if the figures shown are nominal wages then real wages are not increasing at all. In absolute dollar amounts, an individual is bringing home more money each year, but the increases in inflation actually zeroes out the increases in their salary. Given that inflation is increasing at the same pace as wages, an individual cannot actually afford to increase their consumption in such a scenario.

Trends

Following the recession of 2008 real wages globally have stagnated[2] with a world average real wage growth rate of 2% in 2013. Africa, Eastern Europe, Central Asia, and Latin America have all experienced real wage growth of under 0.9% in 2013, whilst the developed countries of the OECD have experienced real wage growth of 0.2% in the same period. Asia has consistently experienced strong real wage growth of over 6% from 2006 to 2013.[3] The International Labour Organisation has stated that this has resulted in "a declining share of GDP going to labour while an increasing share goes to capital, especially in developed economies."[2]

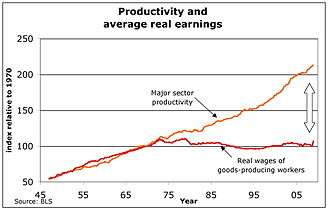

The Economic Policy Institute has blamed "intentional policy choices" by governments for real wage stagnation in this period. Stating "the abandonment of full employment as a main objective of economic policymaking, declining union density, various labor market policies and business practices, policies that have allowed CEOs and finance executives to capture ever larger shares of economic growth, and globalization policies"[4] have resulted in stagante real wages in a time of increasing productivity.

United States

The Economic Policy Institute stated wages have stagnated in the United States since the mid 1970s, failing to keep up with productivity. According to them, between 1973 and 2013, productivity grew 74.4% and hourly compensation grew 9.2%[5], contradicting economic theory that those two should rise equally together.[6]. However, the Heritage Foundation says these claims rest on misinterpreted economic statistics. According to them, productivity grew 100% between 1973 and 2012 while employee compensation, which accounts for worker benefits as well as wages, grew 77%.[7] The Economic Policy Institute and the Heritage Foundation used different inflation adjusting methods in their studies.

Between June 2016 and June 17, wages in the United States grew by 2.5%. Factor in inflation, and that level is close to 1% growth for the period.[8]

European Union

The countries of Belgium, France, Germany, Italy and the United Kingdom have experienced strong real wage growth following European integration in the early 1980s.[6] However, according to OECD between 2007 and 2015 the United Kingdom saw a real wage decline of 10.4%, equal only to Greece.[9][10]

See also

References

- ↑ "Time Well Spent: The Declining Real Cost of Living in America" by W. Michael Cox and Richard Alm, pp. 2–24 of the 1997 Annual Report of the Federal Reserve Bank of Dallas.

- 1 2 "Global wage growth stagnates, lags behind pre-crisis rates". International Labour Organisation. 5 December 2014. Retrieved 11 June 2016.

- ↑ "Comparing how wages have changed in different regions of the world". 2014-12-05. Retrieved 2016-07-10.

- ↑ Mishel, Lawrence (6 January 2016). "Causes of Wage Stagnation". Economic Policy Institute. Retrieved 11 June 2016.

- ↑ https://www.epi.org/publication/charting-wage-stagnation/. Missing or empty

|title=(help) - ↑ https://gregmankiw.blogspot.com/2006/08/how-are-wages-and-productivity-related.html. Missing or empty

|title=(help) - ↑ https://www.heritage.org/jobs-and-labor/report/productivity-and-compensation-growing-together. Missing or empty

|title=(help) - ↑ Rushe, Dominic (2017-07-07). "US jobs report shows sharp recovery in June but wage growth remains slow". The Guardian. Retrieved 2017-07-10.

- ↑ https://www.theguardian.com/money/2016/jul/27/uk-joins-greece-at-bottom-of-wage-growth-league-tuc-oecd

- ↑ http://www.keepeek.com/Digital-Asset-Management/oecd/employment/oecd-employment-outlook-2016_empl_outlook-2016-en#.WQd9fNryuUk