PayMe

| |

| Developer(s) | HSBC |

|---|---|

| Initial release | 8 February 2017 |

| Operating system | iOS, Android |

| Available in | English, Simplified Chinese, Traditional Chinese |

| Type | Mobile payment |

| Website |

payme |

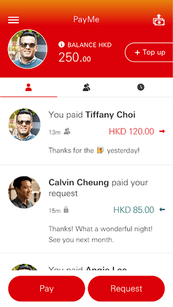

PayMe (officially known as PayMe from HSBC) is a peer-to-peer payments service based in Hong Kong launched by HSBC. It allows Hong Kong users to transfer money to one another using a mobile phone app, by linking their credit card or bank account, whether they are issued by HSBC or other local banks.[1]

As of July 2018, the service has over 1 million active users in Hong Kong.[2]

History

On the first day of the launch, the app experienced a heavy traffic which made users unable to register the service, media sites hence named the app "Play Me". The bank apologised and promised to improve the service.[3][4]

In April 2018, the app was awarded the FinTech Grand Award by the Hong Kong ICT Awards, an award created by the Office of the Government Chief Information Officer of the Hong Kong Government.[5][6]

On 21 June, 2018, PayMe introduced their new top up method, by allowing users to link their local bank account, rather than just linking a Visa and Mastercard credit card.[7] In the same time, the app also lifts its top up limit to HKD$ 30,000 and HKD$ 50,000 to users who verified their identity with a residential address.[8][9]

On 25 June, 2018, PayMe announced their collaboration with HKTVmall to provide their first online shopping payment service.[10]

Features

PayMe was introduced as a standalone mobile app, which features as a P2P social payment app.[11] Users first registers when a Facebook account or with an Hong Kong mobile phone number. It then asks to link a credit card or local bank account (does not need to be a HSBC account) for topping up their balance, and a bank account for receiving the money.

The social networking interaction component, similar to Venmo in the United States, allows users to send, request money, and split bills with others.[12] When the user makes a transaction, the detail will be posted on the social timeline, and available for other users to see other's recent transaction. The transaction information may be set to visible to public or private. Transaction fee is not needed, and if a user does not have enough funds in the account when making a transaction, it will automatically withdraw the necessary funds from the registered bank account or card.[13]

The app encourages users to add friends, by searching available contacts in the app. If a user makes a transaction to a non-PayMe user, a sharable payment link will be created and can be distributed through social media such as WhatsApp.[14] When the user opens the link, they can choose to collect the money by inputting their bank account, or receive it by creating a new PayMe account.[15]

References

- ↑ "Fund transfers made easy as HSBC rolls out P2P app". The Standard. Retrieved 2018-06-22.

- ↑ "HSBC payment app users surpass 1m". The Standard. Retrieved 2018-07-18.

- ↑ "Pay me? Play me!". EJ Insight. 2017-02-09. Retrieved 2018-06-22.

- ↑ Writer, Staff. "HSBC's social payment app faces launch troubles". Marketing Interactive. Retrieved 2018-06-22.

- ↑ "Payments app takes two prizes | News and insight | HSBC Holdings plc". HSBC.com. Retrieved 2018-06-22.

- ↑ "Local ICT achievements commended at Hong Kong ICT Awards 2018 (with photos)". www.info.gov.hk. Retrieved 2018-06-22.

- ↑ "You can now top up your PayMe up to HKD30,000!". PayMe from HSBC | What's New. Retrieved 2018-06-22.

- ↑ "HSBC strikes back in mobile payment war, lifts PayMe top-up to HK$50K". South China Morning Post. Retrieved 2018-06-22.

- ↑ "HSBC e-payment app raises top-up limit to HK$50,000". The Standard. Retrieved 2018-06-22.

- ↑ "HSBC joins the fray for online payments with TV shopping service". South China Morning Post. Retrieved 2018-06-26.

- ↑ "HSBC to launch new mobile P2P payment platform in the 'next few days'". South China Morning Post. Retrieved 2018-06-22.

- ↑ "HSBC targets Hong Kong millennials with new social payment app". FinTech Futures. Retrieved 2018-06-22.

- ↑ "HSBC joins rush to launch peer payment app". China Daily Asia. Retrieved 2018-06-22.

- ↑ "HSBC Introduces a social P2P payment app to Hong Kong" (PDF). HSBC. Retrieved 22 June 2018.

- ↑ "Fund transfers made easy as HSBC rolls out P2P app". The Standard. Retrieved 2018-06-22.