Islamic Development Bank

| |

| Abbreviation | IDB |

|---|---|

| Motto | Together We Build a Better Future[1] |

| Formation | 1975 |

| Type | Development bank |

| Location | |

Membership | 57 countries |

Key people | Bandar Al Hajjar, President |

Employees | 932 |

| Website | Official website |

The Islamic Development Bank (IDB) (Arabic: البنك الإسلامي للتنمية ) is a multilateral development financing institution located in Jeddah, Saudi Arabia. It was founded in 1973 by the Finance Ministers at the first Organisation of the Islamic Conference (now called the Organisation of Islamic Cooperation) with the support of the king of Saudi Arabia at the time (Faisal), and began its activities on 20 October 1975.[2] There are 57 shareholding member states.[3]

On the 22 May 2013, IDB tripled its authorized capital to $150 billion to better serve Muslims in member and non-member countries.[4] The Bank has received credit ratings of AAA from Standard & Poor's,[5] Moody's,[6] and Fitch.[7] Saudi Arabia holds about one quarter of the bank's paid up capital[8] The IDB is an observer at the United Nations General Assembly.

Membership

The present membership of the Bank consists of 57 countries. The basic condition for membership is that the prospective member country should be a member of the Organisation of Islamic Cooperation (OIC), pay its contribution to the capital of the Bank and be willing to accept such terms and conditions as may be decided upon by the IDB Board of Governors.

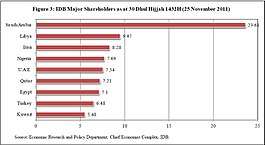

Ranked on the basis of paid-up capital (as of August 2015),[8] major shareholders include:

- Saudi Arabia (26.57%)

- Algeria (10.66%)

- Iran (9.32%)

- Egypt (9.22%)

- Turkey (8.41%)

- United Arab Emirates (7.54%)

- Kuwait (7.11%)

- Pakistan (3.31%)

- Libya (3.31%)

- Indonesia (2.93%)

IDB Group

IDB has evolved into a group of five Entities, consisting of Islamic Development Bank (IDB), Islamic Research & Training Institute (IRTI), Islamic Corporation for Development of the Private Sector (ICD), Islamic Corporation for Insurance of Investment and Export Credit (ICIEC) and International Islamic Trade Finance Corporation (ITFC).

Activities of the Group

IDB Group is engaged in a wide range of specialized and integrated activities such as:

• Project financing in the public and private sectors;

• Development assistance for poverty alleviation;

• Technical assistance for capacity-building;

• Economic and trade cooperation among member countries;

• Trade financing;

• SME financing;

• Resource mobilization;

• Direct equity investment in Islamic financial institutions;

• Insurance and reinsurance coverage for investment and export credit;

• Research and training programs in Islamic economics and banking;

• Awqaf investment and financing;

• Special assistance and scholarships for member countries and Muslim communities in non-member countries;

• Emergency relief; and

• Advisory services for public and private entities in member countries.

Projects and programs

Completed

- The Gao Bridge in Mali: Until a few years ago, crossing the Niger River at Gao was done by a ferry that might or might not be operating. This hindered progress and discouraged trade. The Gao Bridge financed by the IDB connected the once isolated Gao Region in eastern Mali to the heartland.[9]

- Khanarc Canal in northeast Azerbaijan: Built around 70 years ago, the Samur-Absheron Canal carries water from the Samur River to irrigate farms in northeastern Azerbaijan and supply the national capital, Baku, with drinking water. Years of neglect meant that the canal was inefficient – it lost much of the water it carried – and did not have the capacity to meet existing demand for irrigation or, still less, to allow for expansion. A loan from the IDB helped the Government of the Republic of Azerbaijan rebuild the canal.[10]

Ongoing

- Modernising road planning and designing in Yemen: The deserts and mountains of Yemen make building and maintaining roads a challenge. The network of paved roads is limited and many remote communities are still isolated. A good road network is essential to bring rural areas into the mainstream and to boost development.[11]

- Scholarship Programs: The Bank's fund and implement its scholarship programmes as part of its overall effort in the development of human resources of its member countries and those of the Muslim communities in non-member countries. There are three scholarship programmes offered by IDB:

- Scholarship Programme for Muslim Communities in Non-Member Countries

- M.Sc Scholarship Programme in Science and Technology for IDB Least Developed Member Countries

- Merit Scholarship Programme for High Technology[12]

Criticism

Dr Ali had previously declared that IDB was responsible for the smooth functioning of al-Quds Intifada Fund and al-Aqsa Fund, both established during an Arab summit in Cairo in October 2000. According to the final communiqué of the summit, “Al-Quds Intifada Fund will have a capital of 200 million dollars to be allocated for disbursement to the families of Palestinian martyrs fallen in the Intifada.”[13][14]

However, a Wikileaks cable clearly shows that the US State Department investigated the IDB's links to these two funds and found no "evidence sufficient to corroborate Israeli and press allegations of IDB links to terrorism".[15]

See also

| Organisation of Islamic Cooperation |

|---|

| Economy |

| Education |

| Member states |

| Parliamentary Union |

References

- ↑ "UN Secretary General Praises IDB Group's Role in Supporting Member Countries' Plans and Programs". Retrieved 4 February 2016.

- ↑ Epstein, Matthew (September 2003). "Saudi Support for Islamic Extremism in the United States" (PDF). Islam Daily. Retrieved 22 April 2012.

- ↑ "About IDB". Islamic Development Bank. Retrieved May 25, 2018.

- ↑ Islamic Development Bank triples authorised capital| reuters.com|2013/05/22

- ↑ "Capital Markets". ISDB. Retrieved 25 May 2018.

- ↑ "Moody's rating" (PDF). ISDB. Retrieved 25 May 2018.

- ↑ "Fitch rating" (PDF). ISDB. Retrieved 25 May 2018.

- 1 2 "IDB Group in Brief". Retrieved 25 August 2015.

- ↑ "The Gao Bridge in Mali" (PDF). Retrieved 25 May 2018.

- ↑ "Kanarch Canal Transforms Agriculture" (PDF). ISDB. June 2011. Retrieved 2 April 2014.

- ↑ "Modernising road planning and designing in Yemen" (PDF). Retrieved 25 May 2018.

- ↑ "Islamic Development Bank". Retrieved 27 January 2016.

- ↑ "Jihad Economics and Islamic Banking". Retrieved 27 January 2016.

- ↑ Dave Clark. "Banking on terrorism in Australia". Retrieved 27 January 2016.

- ↑ >Silverberg, Kristen (March 23, 2007). "INSTRUCTIONS ON RESOLUTION REQUESTING OBSERVER STATUS FOR THE ISLAMIC DEVELOPMENT BANK GROUP". Wikileaks cable.

- Taylor & Francis Group; Dean, Lucy (2003), The Middle East and North Africa 2004: 2004 (Illustrated ed.), Routledge, ISBN 1-85743-184-7