Chapter 9, Title 11, United States Code

| Bankruptcy in the United States |

|---|

|

| Bankruptcy in the United States |

| Chapters |

| Aspects of bankruptcy law |

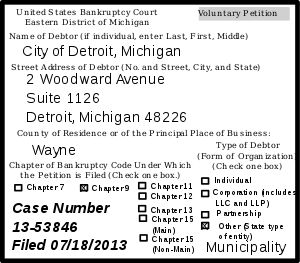

Chapter 9, Title 11, United States Code is a chapter of the United States Bankruptcy Code, available exclusively to municipalities and assisting them in the restructuring of their debt. On July 18, 2013, Detroit, Michigan became the largest city in the history of the United States to file for Chapter 9 Bankruptcy protection. Jefferson County, Alabama, in 2011 and Orange County, California, in 1994 are also notable examples. "The term 'municipality' denotes a political subdivision or public agency or instrumentality of a State."[1]

History

| Year | Filings |

|---|---|

| 2006 | 5 |

| 2007 | 6 |

| 2008 | 4 |

| 2009 | 12 |

| 2010 | 6 |

| 2011 | 13 |

| 1st half 2012 | 7 |

From 1937 to 2008 there were fewer than 600 municipal bankruptcies.[2] As of June 2012 the total was around 640.[3] In 2012 there were twelve chapter 9 bankruptcies in the United States, and five petitions have been filed in 2013.[4] Since 2010, 61 petitions have been filed.[5]

Previous to the creation of Chapter 9 bankruptcy, the only remedy when a municipality was unable to pay its creditors was for the creditors to pursue an action of mandamus, and compel the municipality to raise taxes.[6] During the Great Depression, this approach proved impossible, so in 1934, the Bankruptcy Act was amended to extend to municipalities.[7][8] The 1934 Amendment was declared unconstitutional in Ashton v. Cameron County Water District.[9]

However, a revised act remedying the constitutional deficiencies was passed again by Congress in 1937 and codified as Chapter X of the Bankruptcy Act (later redesignated as Chapter IX).[10] This revised act was upheld as constitutional by the Supreme Court in United States v. Bekins.[11]

Chapter IX was largely unchanged until it was amended in 1976 in response to New York City's financial crisis.[12] The changes made in 1976 were adopted nearly identically in the modern 1978 Bankruptcy Code as Chapter 9.

In 1988, Chapter 9 was amended by Congress to provide statutory protection from § 552(a) lien stripping provisions to revenue bonds issued by municipalities. This was addressed with the classification of these bonds as "special revenues" under the newly minted § 928(a) and § 922(d) exemption of special revenues from the automatic stay provisions of § 362.[13]

To prevent overlap with Chapter 11, § 101(41) of the U.S. Bankruptcy Code (11 U.S.C. § 101(41)) defines the term "person" to exclude many "governmental units" as defined in § 101(27), and "municipality" as defined in § 101(40).

Features of Chapter 9

While in many ways similar to other forms of bankruptcy reorganization (esp. Chapter 11),[14] Chapter 9 has a number of unique characteristics. Because municipalities are entities of State governments, the power of the bankruptcy court is limited to some extent by the Tenth Amendment to the United States Constitution.[15]

Collective bargaining

Municipalities' ability to re-write collective bargaining agreements is much greater than in a corporate Chapter 11 bankruptcy[16] and can trump state labor protections,[17] allowing cities to renegotiate unsustainable pension or other benefits packages negotiated in flush times.[18]

Authorization for filing of municipal bankruptcies

Section 109(c) of the U.S. Bankruptcy Code provides that a municipality may be a debtor in a Chapter 9 bankruptcy case only if the municipality is specifically authorized to be a debtor by State law, or by a governmental officer or organization empowered by State law to authorize the municipality to be a debtor.[19] In 23 states, Chapter 9 authorization laws are either unclear or otherwise prohibited for municipalities. Three states (Colorado, Illinois and Oregon) grant a very limited authorization to file for bankruptcy. Illinois, for example, only grants Chapter 9 authorization to the Illinois Power Agency.

A total of 12 states authorize Chapter 9 upon conditions met and further action of state, officials or other entity; and the remainder (12) specifically authorize bankruptcy.[20][21]

Notable Chapter 9 bankruptcies

Partial list of municipal bankruptcies

Note: Larger bankruptcies are in bold

- Copperhill, Tennessee, March 1988[22]

- Hamilton Creek Metropolitan District, a quasi-municipal corporation in Summit County, Colorado, 1989[23]

- Orange County, California, 1994, $1.7 billion[24] (largest municipal bankruptcy until November 2011, and $3 billion when adjusted for inflation[25] ), on interest rate-related losses[26] (see Robert Citron).

- Lipscomb, Alabama April 1991[27]

- North Bonneville, Washington October 1991[28]

- North Courtland, Alabama December 1992[29]

- Kinloch, Missouri June 1994[30]

- Prichard, Alabama, 1999, due to inability to pay pensions.[31]

- Desert Hot Springs, California, 2001, due to losing a housing discrimination lawsuit.[32][33]

- Millport, Alabama, 2005, due to loss of sales tax revenues after factory closing.[34]

- Los Osos, California, 2006, debt related to a wastewater facility.[35]

- Moffett, Oklahoma, 2007, due to loss of ability to issue traffic tickets.[36]

- Gould, Arkansas, 2008,[37] due to spending money withheld to pay employee income taxes.

- Vallejo, California, 2008, due to inability to pay pension obligations.[38]

- Westfall Township, Pike County, Pennsylvania, 2009, due to losing a lawsuit[39]

- Prichard, Alabama, 2009, due to inability to pay pensions and especially state mandated pension increases.[40]

- Central Falls, Rhode Island, August 2011, due to inability to pay obligations, especially pensions.[41]

- Jefferson County, Alabama, November 2011, over $4 billion in debt (largest Chapter 9 bankruptcy until 2013 Detroit bankruptcy filing,)[24] from sewer revenue bonds tainted by an interest rate swap bribery scandal with JPMorgan and county commissioner Larry Langford, and bond insurance credit rating collapse in the late-2000s subprime mortgage crisis, followed by the occupation tax being declared unlawful in Alabama.[26][42] (see Jefferson County, Alabama: Sewer construction and bond swap controversy)

- Stockton, California, June 28, 2012, Stockton filed for Chapter 9 bankruptcy.[43]

- San Bernardino, California on August 1, 2012 [44]

- Detroit, Michigan, 2013, investigations ongoing, estimated to be between $18–20 billion[45][46][47] (see Detroit bankruptcy for the most current information)

Municipalities placed under receivership

The city of Central Falls, Rhode Island petitioned to be put into receivership in 2010, as Rhode Island does not generally permit Chapter 9 filings. The state appointed receiver or overseer assumed all financial responsibilities from the mayor. Rhode Island's receivership law was rewritten to allow the receiver the ability to file a petition for Chapter 9 federal bankruptcy and Central Falls has done that.[48]

Hospital and health care district Chapter 9 bankruptcies

A hospital or health care district is a governmental entity, generally with taxing authority, that owns and operates medical facilities. Some examples of health care district Chapter 9 bankruptcies are:

- Valley Health System, California[49]

- West Contra Costa Healthcare District, California[50]

- Hardeman County Memorial Hospital, Quanah, Texas [51]

- Mendocino Coast Healthcare District, California [52]

Other entities that declared Chapter 9 bankruptcy

- San Jose Unified School District, 1983.[53]

- Washington Public Power Supply System (WPPSS), 1983, due to halt in construction of planned nuclear reactors.

- The West Jefferson Amusement and Public Park Authority owner of VisionLand Park now known as Alabama Adventure Theme Park, 2002, due to business that could not support its debt.[54]

- Pierce County Housing Authority, 2008, in Pierce County, Washington, residents' lawsuits due to mold in properties.[55]

- Sarpy County Sanitation Improvement District, 2009, in Sarpy County, Nebraska, due to reduced real estate development.[56]

- New York City Off-Track Betting Corporation, December 2009, in New York City, due to mismanagement.[57]

- Connector 2000 Association, operator of the Southern Connector, 2010, due to toll collections being less than expected.[58]

Chapter 9 bankruptcy petitions that were filed but voluntarily dismissed

- Richmond Unified School District, California, 1991[59] After the District filed its petition, the state loaned the District funds to bridge its budget gap, and also appointed an administrator to take over management of the District. The administrator requested that the bankruptcy court dismiss the petition, and this was granted.

- Mammoth Lakes, California on July 3, 2012 [60] The city lost a $43 million lawsuit, but its bankruptcy case was voluntarily dismissed after Mammoth Lakes reached a settlement.

Petitions for Chapter 9 relief that were denied

- In 1991, the petition for relief filed by the city of Bridgeport, Connecticut, was denied.[61] The case was dismissed because the bankruptcy court concluded that Bridgeport, although financially distressed, was not insolvent within the meaning of the eligibility criteria of Chapter 9.

- In 2010, the city of Hamtramck, Michigan requested permission from the Governor under Michigan's authorizing law to file a petition for Chapter 9 Bankruptcy,[62] but was denied. Instead of bankruptcy, the treasury advised that Hamtramck be offered a selection of loan options.[63]

- Washington Park, Illinois December 2010. Washington Park briefly emerged from bankruptcy and then filed a new petition for bankruptcy which was rejected by the judge, who stated there was no Illinois state law enabling a municipality to file a Chapter 9 bankruptcy petition.[64][65]

- Boise County, Idaho, March 2011, due to judgment against the county for violating the Fair Housing Act.[66] The bankruptcy petition was dismissed by the judge after concluding the municipality had “sufficient surplus moneys” to satisfy the judgment and continue operations.[67]

- Harrisburg, Pennsylvania, October 2011, approximately $400 million in debt, due in part to a failed trash incinerator.[68] The bankruptcy judge dismissed the bankruptcy petition on the grounds that not all necessary branches of the municipal government had authorized the filing of the petition.[69]

Notable defaults that did not result in Chapter 9 bankruptcy

- Cleveland, Ohio, 1978, dispute with city creditors over sale of a utility.[70]

Notable bankruptcies that were declared ineligible for Chapter 9 bankruptcy

- The Las Vegas Monorail Company was declared a private entity, not an eligible governmental entity, in 2010.[71][72]

See also

- Community Act 47, Financially Distressed Municipalities Act, Commonwealth of Pennsylvania.

- Super Chapter 9

References

- ↑ )(

- ↑ MuniNetGuide: Vallejo Bankruptcy Filing Garners Attention in Municipal Finance Circles Archived January 6, 2009, at the Wayback Machine.

- ↑ Wozniacka, Gosia (2012-06-27). "Stockton bankruptcy is hard hit for city retirees". Boston.com. Retrieved 2013-07-20.

- ↑ USAtoday, July 22, 2013, Page B1, "Detroit woes rattle muni bond market" by Matt Krantz

- ↑ Governing, September 14, 2017, Bankrupt Cities, Municipalities List and Map

- ↑ Ashton v. Cameron County Water Improvement Dist., 298 U.S. 513, 534 (1936) (Cardozo, J., dissent)

- ↑ Pub. L. No. 251, 73d Cong., 2d Sess., 48 Stat. 798 (1934).

- ↑ Public Law Research Institute: Municipal Bankruptcy: State Authorization Under the federal Bankruptcy Code Archived 2008-12-12 at the Wayback Machine.

- ↑ 298 U.S. 513, 56 S. Ct. 892, 80 L. Ed. 1309 (1936).

- ↑ An Act to Amend an Act Entitled An Act to Establish a Uniform System of Bankruptcy Throughout the United States,, Pub. L. No. 302, 75th Cong., 1st Sess., 50 Stat. 653 (1937).

- ↑ 304 U.S. 27 (1938)(holding the Municipal Corporation Bankruptcy Act constitutional under both the Fifth and the Tenth Amendments)

- ↑ An Act to Amend Chapter IX of the Bankruptcy Act to Provide by Voluntary Reorganization Procedures for the Adjustment of the Debts of Municipalities, Pub. L. No. 94-260, 94th Cong., 2d Sess., 90 Stat. 315 (1976).

- ↑ See Steven Lessard & Richard Ngo, Riding the Juice Train to Bankruptcy: Ch. 9 Eligibility After In re Las Vegas Monorail Company, NORTON JOURNAL OF BANKRUPTCY LAW & PRACTICE, Vol. 20, No.3, Article 4 (2011); see also An Act to Amend the Bankruptcy Law to Provide for Special Revenue Bonds and for Other Purposes, PUB. L. NO. 100-597 (1988); Municipal Bankruptcy Amendments, Pub L. No 100597 (1988); 4 COLLIER ON BANKRUPTCY ¶ 902.01A, 902-3 (15th ed. 1996)

- ↑ Chapter 9 incorporates the provisions of numerous sections from other chapters of the Bankruptcy Code. See Title 11, United States Code, Section 901.

- ↑ John Knox; Marc A. Levinson (2009). Municipal Bankruptcy: Avoiding and Using Chapter 9 in Times of Fiscal Stress (PDF). Orrick, Herrington & Sutcliffe, LLP. pp. 21–22.

- ↑ In re City of Vallejo, 08-26813-A-9 (E. Dist. Calif.).

- ↑ "Contracts Now Seen as Being Rewritable". The New York Times. 2009-03-31.

- ↑ Pamela A. MacLean All Articles (2009-03-17). "In a First, Bankruptcy Judge Rules Calif. City Can Void Union Contracts". Law.com. Retrieved 2013-07-20.

- ↑ See 11 U.S.C. § 109.

- ↑ "Municipal Bankruptcy State Laws". www.governing.com. Retrieved 2017-06-12.

- ↑ Municipal Bankruptcy: State Authorization Under the Federal Bankruptcy Code, PLRI Archived 2008-12-12 at the Wayback Machine.

- ↑ Bishop-Henchman, Joseph. "Municipal Bankruptcies Since 1988". Tax Foundation. Retrieved 3 February 2018.

- ↑ HAMILTON CREEK METROPOLITAN DISTRICT v. BONDHOLDERS COLORADO BONDSHARES

- 1 2 Van Anglen, Jim; Condon, Bernard (November 9, 2011). "Alabama county files for largest municipal bankruptcy". CBS News. Montgomery, Alabama. Associated Press. Retrieved 2011-11-10.

- ↑ Federal Reserve Bank of Minneapolis Community Development Project. "Consumer Price Index (estimate) 1800–". Federal Reserve Bank of Minneapolis. Retrieved January 2, 2018.

- 1 2 Church, Steven; Selway, William; McCarty, Dawn (November 9, 2011). "Jefferson County Alabama Files Bankruptcy". Bloomberg.com. New York City: Bloomberg L.P. Retrieved 2011-11-10.

- ↑ Bishop-Henchman, Joseph. "Municipal Bankruptcies Since 1988". Tax Foundation. Retrieved 3 February 2018.

- ↑ Bishop-Henchman, Joseph. "Municipal Bankruptcies Since 1988". Tax Foundation. Retrieved 3 February 2018.

- ↑ Bishop-Henchman, Joseph. "Municipal Bankruptcies Since 1988". Tax Foundation. Retrieved 3 February 2018.

- ↑ Bishop-Henchman, Joseph. "Municipal Bankruptcies Since 1988". Tax Foundation. Retrieved 3 February 2018.

- ↑ Analysis of Factors Associated with the Municipal Bankruptcy of Pichard, Alabama

- ↑ The City of Desert Hot Springs filed Chapter 9 bankruptcy papers in late December, making it the first California city in at least 25 years to seek bankruptcy protection

- ↑ California City files for bankruptcy protection

- ↑ Millport making a comeback

- ↑ After 6 years, Los Osos CSD bankruptcy plan approved Archived 2011-09-27 at the Wayback Machine.

- ↑ Oklahoma: Speed Trap Town Goes Bankrupt

- ↑ Bankruptcy filed, tiny town hopes to rise again Archived 2009-02-06 at the Wayback Machine.

- ↑ Vallejo's path to bankruptcy - Vallejo Times Herald

- ↑ "Westfall, Pennsylvania Files For Bankruptcy Protection". Huffington Post. 16 June 2009. Retrieved 8 October 2013.

- ↑ Prichard files for bankruptcy protection again Archived 2009-11-02 at the Wayback Machine.

- ↑ Rhode Island's Central Falls files for bankruptcy

- ↑ Selway, William (September 16, 2011). "Jefferson County's Journey From Sewer-Bond Scandal to Settlement: Timeline". Bloomberg.com. New York City: Bloomberg L.P. Retrieved 2011-11-10.

- ↑ "Stockton, California files for bankruptcy". Reuters. June 28, 2012.

- ↑ "Chapter 9 Bankruptcy". City of San Bernardino, California. Retrieved 8 October 2013.

- ↑ Dolan, Matthew. "Detroit Files Biggest U.S. Municipal Bankruptcy - WSJ.com". Online.wsj.com. Retrieved 2013-07-20.

- ↑ Davey, Monica; Walsh, Mary Williams (July 18, 2013). "Billions in Debt, Detroit Tumbles Into Insolvency". The New York Times. Retrieved July 19, 2013.

- ↑ Case no. 13-53846-swr, U.S. Bankr. Court for the Eastern District of Michigan (Detroit Div.). Exited bankruptcy December 11, 2014.

- ↑ "Rhode Island city overseer starts by firing mayor". Archived from the original on 2014-12-02. Retrieved 2018-07-18.

- ↑ Hospitals file for Chapter 9 bankruptcy : North County Times - Californian

- ↑ Rauber, Chris (2006-10-02). "Doctors Medical Center files for Chapter 9 bankruptcy protection".

- ↑ "Chapter 9 Bankruptcy Hits Hardeman County Hospital in Texas". Becker's Hospital Review. 27 March 2013. Retrieved 8 October 2013.

- ↑ "California Health Care District Files for Bankruptcy". The Bond Buyer. 13 November 2012. Retrieved 8 October 2013.

- ↑ SAN JOSE SCHOOLS CAN CUT PAY, U.S. BANKRUPTCY COURT RULES

- ↑ VisionLand debt prompts Chapter 9 filing

- ↑ Pierce County's low-cost housing filing for bankruptcy Archived 2008-10-12 at the Wayback Machine.

- ↑ Sarpy County SID Files For Bankruptcy Archived 2010-12-26 at the Wayback Machine.

- ↑ New York City Off-Track Betting Corporation Facts Archived 2009-12-07 at the Wayback Machine.

- ↑ Connector 2000 Association Files Chapter 9 Bankruptcy

- ↑ In re Richmond Unified Sch. Dist., 133 B.R. 221, 224 (Bankr. N.D. Cal. 1991)

- ↑ "The Daily Docket: Mammoth Lakes Enters Bankruptcy". Wall Street Journal. 5 July 2012. Retrieved 8 October 2013.

- ↑ "Bridgeport – Distressed but not Insolvent". Business-finance-restructuring.weil.com. Retrieved 2013-07-20.

- ↑ Letter requesting permission from the Governor of Michigan for Hamtramck to declare bankruptcy

- ↑ CORRECT: Michigan Forbids City To Seek Municipal Bankruptcy Archived November 20, 2010, at the Wayback Machine.

- ↑ Judge throws out Ill. village's bankruptcy case

- ↑ Judge denies Washington Park's bankruptcy bid

- ↑ "Boise County files for bankruptcy". Archived from the original on 2011-03-11. Retrieved 2018-07-18.

- ↑ Judge rejects Boise County’s bankruptcy filing

- ↑ Tavernise, Sabrina (12 October 2011). "City Council in Harrisburg Files Petition of Bankruptcy". The New York Times. Retrieved 16 October 2011.

- ↑ Judge Rejects Harrisburg Bankruptcy Move

- ↑ Three Decades After Cleveland Defaulted on Its Debts, Cities Face Recession Budget Woes Archived 2008-12-17 at the Wayback Machine.

- ↑ Las Vegas Monorail Determined Ineligible for Chapter 9 Bankruptcy Archived 2010-05-31 at the Wayback Machine.

- ↑ Steven Lessard & Richard Ngo, Riding the Juice Train to Bankruptcy: Chapter 9 Eligibility After In Re Las Vegas Monorail Company, NORTON ANNUAL SURVEY OF BANKRUPTCY LAW, Vol. 20, No.3, Article 4 (2011).

External links

- GASB Accounting and Financial Reporting for Chapter 9 Bankruptcies

- Number of Ch. 9 filings by year data from the American Bankruptcy Institute

- Ohio Local Government Fiscal Emergency/Fiscal Watch Law Fact Sheet

- Municipal Bankruptcy in Perspective, A Joint Publication of PAR and BGR

- Michigan Public Act 72 of 1990, Local Government Fiscal Responsibility Act, and the Appointment of Emergency Financial Managers

- Chapter 9, Title 11, United States Code at the Cornell University Law School Legal Information Institute

- Municipal Bankruptcy in Alabama - Kerem Deal

- AN EXAMINATION OF MUNICIPAL FINANCE REFORM REGARDING MUNICIPAL BANKRUPTCIES IN THE UNITED STATES - Kerem Deal

- Administrative Office of the U.S. Courts Bankruptcy Basics -- Municipality Bankruptcy