Brad Katsuyama

| Brad Katsuyama | |

|---|---|

| Born |

Bradley Katsuyama 1978 (age 39–40) Markham, Ontario, Canada |

| Residence | New York City, United States |

| Nationality | Canadian |

| Alma mater | Wilfrid Laurier University |

| Occupation | Business executive |

| Organization | IEX |

| Board member of | IEX |

Bradley 'Brad' Katsuyama (born 1978) is a Canadian financial services executive.[1] He is working as the CEO and co-founder of the IEX, the Investors Exchange.[2] He left RBC in 2012 to co-found IEX under the premise that it would be a fairer stock trading venue than other exchanges.[3]

Through his work with IEX, Katsuyama is the focus of Flash Boys,[4] a 2014 non-fiction book by Michael Lewis about high-frequency trading (HFT) in the financial markets.[5]

Early life and education

Born in 1978, Katsuyama is a native of Markham, Ontario, Canada. He is a graduate of Wilfrid Laurier University in Waterloo, Ontario,[3][1] where he attended Lazaridis School of Business and Economics.

Career

RBC and pre-IEX career

Before founding IEX, Katsuyama worked for many years at the Royal Bank of Canada (RBC), where he was formerly the Global Head of Electronic Sales and Trading. In this role, he was responsible for multiple global teams including: electronic sales, electronic trading, algorithmic trading, market structure strategy, client implementation and product management. His prior management roles at RBC were Head of US Cash Equity Trading, Head of US Hedge Fund Coverage, and Head of US Technology Trading.[6]

HFT problems, discovery and response

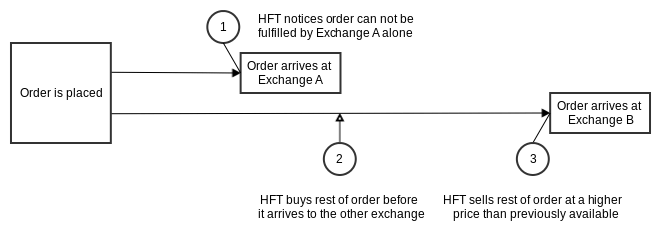

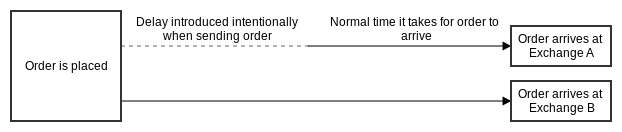

While at RBC, he noticed that placing a single large order that can be fulfilled only through many different stock exchanges was being taken advantage of by predatory stock scalpers. Scalpers, noticing the order would not be able to be fulfilled by one single exchange, would instead buy the securities on the other exchanges, so that by the time the rest of the large order arrived to those exchanges the scalpers could sell the securities at a higher price. All these events would happen in milliseconds not perceivable to humans but perceivable to computers. He instead led a team that implemented THOR, a securities' order-management system where large orders are split into many different sub-orders with each sub-order arriving at the same time to all the exchanges through the use of intentional delays.[7]

Post-RBC and IEX founding

Following Katsuyama's discovery of certain unfair high-frequency trading practices, he decided to improve the business of the stock market, leaving RBC in 2012 to start-up a fairer stock trading venue.[3] The Investors Exchange, IEX was born from his RBC departure. IEX is an emerging stock exchange, organized as an alternative trading system, also known as a dark pool. Company representatives have stated their intention to convert to a public exchange upon reaching sufficient trading volume. It opened for its first day of trading on October 25, 2013.[8] William O'Brien, at the time president of competing business BATS Global Markets, during a much watched and discussed debate on CNBC, asserted in April 2014 the IEX was trying to build its business by generating 'fear', 'mistrust' and 'accusations'.[9]

Through his work with IEX, Katsuyama is the focus of Flash Boys,[4] a 2014 non-fiction book by financial writer Michael Lewis about high-frequency trading (HFT) in the financial markets.[5] Lewis praised IEX as an appropriate and beneficial response to HFT abuses. Since the publishing of Flash Boys and the opening of IEX, several U.S. authorities have confirmed they are looking into certain practices used by high-frequency traders. The FBI, the U.S. Securities and Exchange Commission, the U.S. Justice Department and the Attorney General of New York State all have investigations underway.[3][5]

IEX approvals

The SEC approved the IEX to be an official exchange on June 17, 2016,[10][11][12] with Katsuyama remaining IEX CEO.[13][14] On October 24, 2017, IEX Group Inc. received regulatory approval from the SEC to list companies. IEX said it would begin listings in early 2018, with a focus on getting companies to switch over from other stock exchanges, by undercutting listing fees of rivals.[13][13] Katsuyama remains chairman of the IEX board.[15]

Personal life

Katsuyama lives in New York with his wife Ashley and his two sons, Brandon and Rylan.[1][3]

See also

References

- 1 2 3 "Canadian says 'moral compass' led him to solve unfair gaming of stock markets by high-frequency traders". Financial Post - business.financialpost.com/. 2014-03-31. Retrieved 2014-05-08.

- ↑ "IEX Group - About Us | A Market That Works For Investors". Iextrading.com. Retrieved 2014-04-03.

- 1 2 3 4 5 "Canadian Brad Katsuyama's 'overwhelming' life as hero of Michael Lewis's Flash Boys". The Globe and Mail - theglobeandmail.com. 2014-04-04. Retrieved 2014-05-08.

- 1 2 Lewis, Michael (2014). Flash Boys: Cracking the Money Code. London, UK: Allen Lane. ISBN 9780241003633.

- 1 2 3 Lewis, Michael (March 31, 2014). "The Wolf Hunters of Wall Street". The New York Times. New York City, New York, United States. Retrieved 2014-04-11.

- ↑ "IEX Trading Executive Team". iextrading.com. Retrieved 2014-05-08.

- ↑ "Trading chief exits RBC - Financial News". Efinancialnews.com. 2012-09-19. Retrieved 2014-04-03.

- ↑ "How IEX is Combating Predatory Types of High Frequency Traders". Forbes. 2014-04-23. Retrieved 2014-05-08.

- ↑ "Dow Jones & Co. MarketWatch - 'Epic' debate on high-frequency trading between Michael Lewis, Brad Katsuyama and William O'Brien". marketwatch.com. Retrieved 2014-05-11.

- ↑ Matt, Levine (16 September 2015). "The 'Flash Boys' Exchange Is Growing Up". Bloomberg. Retrieved 16 September 2015.

- ↑ Popper, Nathaniel. "IEX Group, Critical of Wall St., Gains Approval for Stock Exchange". The New York Times. Retrieved 18 June 2016.

- ↑ Bullock, Nicole (June 17, 2016). "IEX trading venue wins battle to become an exchange". Financial Times. United Kingdom. Retrieved October 28, 2017.

- 1 2 3 Osipovich, Alexander (October 26, 2017). "Startup Exchange Cleared to Take on NYSE, Nasdaq for Stock Listings". Wall Street Journal. New York City, United States. Retrieved October 26, 2017.

- ↑ Osipovich, Alexander (November 14, 2016). "IEX Looks to Snatch NYSE, Nasdaq Listings With New Hire". Wall Street Journal. New York City, United States. Retrieved October 26, 2017.

- ↑ Executive Team, IEX, retrieved October 26, 2017