Boost ETP

| |

| Subsidiary | |

| Industry | Financial services |

| Founded | 2012 |

| Headquarters |

London, EC2 United Kingdom |

Key people |

Ian 'Hector' McNeil (CO-CEO), Nik Bienkowski (CO-CEO) |

| Products |

Exchange-traded products Exchange-trade commodities Asset management |

| Parent | WisdomTree Investments |

| Website | Boostetp.com |

Boost ETP is an independent boutique Exchange Traded Products (ETP) provider, based in London, United Kingdom. Boost ETP is the first asset management firm in Europe to offer 3x leveraged ETPs and 3x short ETPs.[1] The first Boost ETP products became available on 6 December 2012 on the London Stock Exchange.[2]

History & Motivation

Boost ETP LLP was set up by Ian 'Hector' McNeil and Nik Bienkowski, former Managing Partners of ETF Securities.[3][4][5] On 11 December 2012 McNeil and Bienkowski were invited to the London Stock Exchange to formally open the London markets in order to mark the launch of 20 new ETPs offered by Boost ETP.[6]

Leveraged ETFs / ETPs have been part of the investment scene in North America since ProShares introduced "Ultra ProShares"[7] in 2006 and have since grown rapidly.[8] Even though this was preceded by the introduction of the world's first leveraged ETFs in Sweden in 2005 by XACT[9] the European market remained underdeveloped. The ETF market in Europe is generally seen to be five to ten years behind the American market,[10] a theory that appears to be consistent with leveraged ETPs. Due to the offerings of companies like PowerShares and Direxion the US ETF market has a range of 3x leveraged and inverse ETFs, this is not the case in Europe. Having spotted an opportunity to create niche value Boost ETP was set up in order to satisfy European demand for 3x leveraged and short ETPs.[11]

In 2014, WisdomTree Investments acquired a majority stake (75%) in Boost ETP. WisdomTree will invest $20 million in Boost ETP to give it working capital to build out its European business.[12]

Product Structure

Boost ETP's swap-based model incorporates features from both "unfunded" and "funded" swap operating models. When Boost ETP issues a product to an investor the capital received is transferred to the swap counterparty. However, as the products are three times leveraged the counterparty is offering 3 times the exposure whilst only receiving one third of the value of the swap, meaning that the swap is both funded and unfunded.

Traditionally speaking ETFs are broken into two categories:

- Asset-backed (physical replication).

Broadly speaking this is a type of ETF that invests its capital directly into the underlying asset it is attempting to replicate.[13] A physical ETF attempting to replicate a given equity index will (in theory) purchase all of the shares in that index, aggregate them into a 'basket' and then sell shares of the basket to investors. In cases where there are too many shares in an index to purchase efficiently the ETF issuer will use a method called "stratified sampling" whereby the issuer purchases a sample of the index that is closely correlated to the overall index.[14] - Synthetic.

This method consists of an ETF manager entering into a swap contract with an investment bank that agrees to pay the index return in exchange for a small fee and any returns on collateral held in the ETF portfolio.[15] As of May 2011 synthetic ETFs outnumber physical ETFs by a ratio of around 2:1[16] and have grown in popularity due to reduced fees associated with synthetic structures, which in turn, lends itself to delivering superior tracking error, or in layman's terms; synthetic ETFs track their underlying asset more closely. This synthetic replication is done with the use of complex derivative strategies or swaps.

Types of swaps:

- Funded swaps: this means that the capital raised by the ETP issuer is handed directly over to the swap counterparty.

- Unfunded swaps: in this case the capital raised by the ETP issuer is not handed over to the swap counterparty, the capital is generally given to an independent custodian who keeps the capital in a ring-fenced account.

Key Partners

Authorized Participants

Boost ETP's partners are some of the largest participants in the Exchange Traded Products market. BNP Paribas, Virtu Financial, Flow Traders, ABN Amro and UBS act as Authorized Participants for its London Stock Exchange-listed range.[17]

Market Makers

Boost ETP has a variety of Market Makers[18]

- BNP Paribas

- CitiGroup

- Flow Traders

- GETCO

- IMC

- Jane Street

- Knight Capital

- Merrill Lynch

- Morgan Stanley

- Nomura

- Peel Hunt

- Susquehanna

- UBS

- Unicredit

- Virtu Financial

- Winterflood

Leveraged Exchange Traded Products / Exchange Traded Funds

Leveraged Exchange Traded Products (ETPs) are a specific type of ETP/ETF that aim to achieve returns that are more sensitive to market movements than standard ETPs/ETFs.

In a similar fashion to vanilla exchange traded products investors that take on leveraged ETPs/ETFs expose themselves to the performance of an underlying asset. However, unlike a standard ETP/ETF, a leveraged product will return a multiple of the return of the underlying asset to the investor. Common leverage factors are 2x, 3x and 5x meaning that the product will return 200%, 300% or 500% of the daily performance of the underlying asset.[19]

Leveraged ETFs / ETPs

Leveraged ETFs / ETPs are generally split into two categories:

- Leveraged ETFs / ETPs

These ETPs will result in a direct multiple of the return of an underlying asset. Therefore, a 3x leveraged ETP tracking the FTSE 100 will amplify the daily return of the underlying index by a multiple of 3. If the underlying index returns 1% the ETP will return 3%, if the underlying index returns -1% the ETP will return -3%.[20]

- Inverse ETFs / ETPs

Conversely, a 3x short ETP will return three times the inverse of the index it is tracking. If the underlying index returns 1% the ETP will return -3%, if the underlying index returns -1% the ETP will return 3%. The fact that the value of inverse ETPs rises during a declining market environment makes these investments very popular in bear markets.[21]

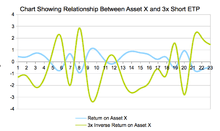

Rebalancing method

Most leveraged ETPs employ a method of daily rebalancing in order to deliver the correct multiple of index returns on that day. This can result in beta slippage whereby the movements in the underlying index can affect the overall value of the ETP by a disproportionate amount.[22]

Boost ETP Products

Equity linked ETPs:

- Boost FTSE 100 1x Short Daily ETP LSE : SUK1

- Boost FTSE 100 2x Leverage Daily ETP LSE : 2UKL

- Boost FTSE 100 2x Short Daily ETP LSE : 2UKS

- Boost FTSE 100 3x Leverage Daily ETP LSE: 3UKL

- Boost FTSE 100 3x Short Daily ETP LSE: 3UKS

- Boost FTSE 250 1x Short Daily ETP LSE : 1MCS

- Boost FTSE 250 2x Leverage Daily ETP LSE : 2MCL

- Boost EURO STOXX® 50 3x Leverage Daily ETP LSE: 3EUL

- Boost EURO STOXX® 50 3x Short Daily ETP LSE: 3EUS

- Boost LevDAX® 3x Daily ETP LSE: 3DEL

- Boost LevDAX® 3x Daily ETP (£) LSE: 3LDE

- Boost ShortDAX® 3x Daily ETP LSE: 3DES

- Boost ShortDAX® 3x Daily ETP (£) LSE: 3SDE

- Boost S&P 500® 3x Leverage Daily ETP LSE: 3USL

- Boost S&P 500® 3x Short Daily ETP LSE: 3USS

- Boost NASDAQ 100® 3x Leverage Daily ETP LSE: QQQ3

- Boost NASDAQ 100® 3x Short Daily ETP LSE: QQQS

Commodity linked ETPs:

- Boost Natural Gas 2x Leverage Daily ETP LSE : 2NGL

- Boost Natural Gas 2x Short Daily ETP LSE : 2NGS

- Boost Natural Gas 3x Leverage Daily ETP LSE: 3NGL

- Boost Natural Gas 3x Short Daily ETP LSE: 3NGS

- Boost WTI Oil 3x Leverage Daily ETP (£) LSE: 3LOI

- Boost WTI Oil 3x Leverage Daily ETP LSE: 3OIL

- Boost WTI Oil 3x Short Daily ETP (£) LSE: 3SOI

- Boost WTI Oil 3x Short Daily ETP LSE: 3OIS

- Boost Gold 1x Short Daily ETP LSE : 1GOS

- Boost Gold 2x Leverage Daily ETP LSE : 2GOL

- Boost Gold 2x Short Daily ETP LSE : 2GOS

- Boost Gold 3x Leverage Daily ETP (£) LSE: 3LGO

- Boost Gold 3x Leverage Daily ETP LSE: 3GOL

- Boost Gold 3x Short Daily ETP (£) LSE: 3SGO

- Boost Gold 3x Short Daily ETP LSE: 3GOS

- Boost Silver 2x Leverage Daily ETP LSE : 2SIL

- Boost Silver 2x Short Daily ETP LSE : 2SIS

- Boost Silver 3x Leverage Daily ETP (£) LSE: 3LSI

- Boost Silver 3x Leverage Daily ETP LSE: 3SIL

- Boost Silver 3x Short Daily ETP (£) LSE: 3SSI

- Boost Silver 3x Short Daily ETP LSE: 3SIS

- Boost Palladium 1x Short Daily ETP LSE : 1PAS

- Boost Palladium 2x Leverage Daily ETP LSE : 2PAL

- Boost Copper 3x Leverage Daily ETP LSE: 3HCL

- Boost Copper 3x Short Daily ETP LSE: 3HCS

Awards

In its first year of existence Boost ETP won the ETF Express "Most Innovative European ETP Provider" for 2013.[23]

Issuers of ETFs

References

- ↑ http://www.boostetp.com/Content/About-Us

- ↑ http://www.mondovisione.com/media-and-resources/news/boost-etp-launches-on-london-stock-exchange-issuer-debuts-with-ftse-based-leve/

- ↑ http://www.efinancialnews.com/story/2013-04-02/mcneil-and-bienkowski-offer-etp-boost

- ↑ http://www.indexuniverse.eu/europe/news/8648-specialised-provider-hits-european-etp-market.html

- ↑ http://www.indexuniverse.com/sections/features/15409-boosting-the-etp-market.html

- ↑ "Archived copy". Archived from the original on 2013-05-29. Retrieved 2013-05-15.

- ↑ http://www.investopedia.com/articles/mutualfund/07/leveraged_etfs.asp

- ↑ http://seekingalpha.com/article/850221-the-38-million-dollar-levered-etf-share

- ↑ http://en.xact.se/Our-ETFs/Leveraged/XACT-Bull/#tab=facts

- ↑ "Archived copy" (PDF). Archived from the original (PDF) on 2013-10-18. Retrieved 2013-05-15.

- ↑ "Archived copy". Archived from the original on 2013-09-24. Retrieved 2013-05-15.

- ↑ Hampson, Rebecca. "WisdomTree Taps Into Europe With Purchase". ETF.com.

- ↑ http://www.recognia.com/news/investor-education/online-brokers-can-teach-clients-about-etfs-vs-etns

- ↑ http://www.etf.db.com/UK/EN/binaer_view.asp?BinaerNr=1224

- ↑ http://www.morningstar.co.uk/uk/etfs/etfsolutions.aspx?docid=324200

- ↑ http://www.indexuniverse.eu/europe/opinion-and-analysis/7862-synthetic-etf-boom-slows.html

- ↑ http://www.etfstrategy.co.uk/boost-etp-source-sign-up-additional-etf-authorised-participants-aps-44723/

- ↑ http://www.boostetp.com/Content/MMs-APs

- ↑ http://www.advisorone.com/2013/04/01/tactical-trading-with-long-short-etps

- ↑ http://www.marketwatch.com/story/profunds-readies-first-leveraged-etfs

- ↑ "Archived copy". Archived from the original on 2013-05-14. Retrieved 2013-05-15.

- ↑ http://www.investopedia.com/articles/exchangetradedfunds/07/leveraged-etf.asp

- ↑ http://www.etfexpress.com/2013/03/26/182154/etfexpress-global-awards-2013-winners