BancorpSouth

| |

| Public company | |

| Traded as |

NYSE: BXS S&P 400 component |

| Industry | Banking |

| Headquarters | Tupelo, Mississippi |

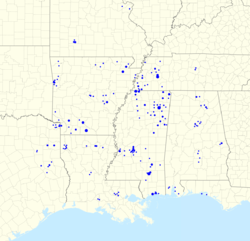

Area served | Alabama, Arkansas, Florida, Louisiana, Mississippi, Missouri, Tennessee, Texas, and Illinois |

Key people |

James D. Rollins III, Chairman & CEO Chris A. Bagley, President & COO John G. Copeland, CFO |

| Revenue |

|

|

| |

| Total assets |

|

| Total equity |

|

Number of employees | 3,947 (2017) |

| Website |

bancorpsouth |

|

Footnotes / references [1] | |

BancorpSouth Bank is a bank holding company headquartered in Tupelo, Mississippi with operations in Alabama, Arkansas, Florida, Louisiana, Mississippi, Missouri, Tennessee, Texas, and Illinois.

History

In 1876, Raymond Trice and Company received a charter to create a bank in its hardware store in Verona, Mississippi.

In 1886, the banking operation was moved to Tupelo, Mississippi and was renamed the Bank of Lee County, Mississippi. Soon after, it was renamed to the Bank of Tupelo.

In 1966, the bank was renamed the Bank of Mississippi.

In 1987, the bank acquired First Mississippi National Bank.

In 1992, the bank acquired Volunteer Bank of Jackson.

In 1997, the bank changed its name to BancorpSouth.[2]

In 1998, the bank acquired Alabama Bancorp.[3]

In 1999, the company acquired Stewart, Sneed, Hewes Insurance.[4]

In 2000, the bank acquired First United Bankshares.[5]

In 2002, the bank acquired Pinnacle Bancshares.[6]

In 2003, the company acquired Wright & Percy Insurance as well as Ramsey, Krug, Farrell and Lensing.[7][8]

In 2004, the bank acquired Business Bank of Baton Rouge, Louisiana, and Premier Bank of Brentwood, Tennessee.[9]

In 2005, the bank acquired American State Bank of Jonesboro, Arkansas.[10]

In October 2006, the bank acquired City Bancorp of Springfield, Missouri for $170 million with half consisting of BancorpSouth stock and the remainder in cash.[11]

In January 2014, the bank acquired Ouachita Bancshares Corp. of Monroe, Louisiana and Central Community Corporation of Temple, Texas. Ouachita Bancshares Corp. was purchased for 3,675,000 shares of BancorpSouth's common stock plus $22.875 million in cash. Central Community Corporation was purchased for 7,250,000 shares of BancorpSouth's common stock plus $28.5 million in cash. After nearly four years and multiple extension of completion dates, the bank received the necessary approvals in late 2017 to close the transactions. Both mergers were completed effective January 15, 2018. [12]

In July 2017, BancorpSouth reorganized to eliminate redundant corporate infrastructure and activities. BancorpSouth, Inc. was merged with and into its wholly owned bank subsidiary, BancorpSouth Bank. The reorganization left BancorpSouth Bank as the surviving entity. This left BancorpSouth Bank being regulated by the Federal Deposit Insurance Corporation and the Mississippi Department of Banking and Consumer Finance. Before the reorganization, BancorpSouth, Inc. was regulated by the Federal Reserve Board as a bank holding company. [13]

In April 2018, BancorpSouth acquired Icon Capital Corporation and its wholly-owned subsidiary Icon Bank of Texas, National Association of Houston, Texas for 4,125,000 shares of BancorpSouth's common stock plus $17.5 million in cash. [14] The merger was completed on October 1, 2018 and folds in seven (7) open full-service banking offices as well as two (2) not yet opened full-service banking offices into BancorpSouth's footprint. [15]

References

- ↑ "BancorpSouth Inc. 2017 Form 10-K Annual Report". U.S. Securities and Exchange Commission.

- ↑ McKenzie, Danny (December 5, 1998). "Bank of Mississippi becomes BancorpSouth Bank". Northeast Mississippi Daily Journal.

- ↑ Cummins, John (June 23, 1998). "BancorpSouth to acquire Alabama Bancorp". Northeast Mississippi Daily Journal.

- ↑ "BancorpSouth Merging with Stewart Sneed Hewes". American City Business Journals. April 26, 1999.

- ↑ Kline, Alan (August 25, 2000). "BancorpSouth Deal With 1st United OK'd". American Banker. (subscription required)

- ↑ "BancorpSouth acquires Pinnacle". American City Business Journals. March 1, 2002.

- ↑ "BancorpSouth to acquire fourth insurance firm". American City Business Journals. July 14, 2003.

- ↑ "BancorpSouth completes acquisition". American City Business Journals. May 16, 2003.

- ↑ "BancorpSouth to acquire Brentwood, Baton Rouge banks". American City Business Journals. September 17, 2004.

- ↑ "BancorpSouth expands in Arkansas with purchase of American State Bank". American City Business Journals. September 17, 2004.

- ↑ "BancorpSouth announces merger with Missouri bank". American City Business Journals. October 31, 2006.

- ↑ "BancorpSouth's (BXS) Ouachita & Central Community Deals OK'dk". Nasdaq. December 28, 2017.

- ↑ "BancorpSouth, Inc. Announces Corporate Entity Restructuring". PR Newswire. July 27, 2017.

- ↑ "BancorpSouth Bank To Acquire Icon Capital Corporation In Houston, Texas". PR Newswire. April 18, 2018.

- ↑ "BancorpSouth Completes Merger with Icon Capital Corporation". PR Newswire. October 1, 2018.

External links

- Business data for BancorpSouth Bank: Google Finance

- Yahoo! Finance

- Bloomberg

- Reuters

- SEC filings