China–United States trade war

The China–United States trade war (Chinese: 中美贸易战; pinyin: Zhōngměi Màoyìzhàn) is an ongoing economic conflict between the world's two largest national economies, China and the United States. President Donald Trump in 2018 began setting tariffs and other trade barriers on China with the goal of forcing it to make changes to what the U.S. says are "unfair trade practices".[1] Among those trade practices and their effects are the growing trade deficit, the theft of intellectual property, and the forced transfer of American technology to China.[2]

| China–United States trade war | |||||||

|---|---|---|---|---|---|---|---|

.jpg) President Donald Trump and Vice Premier Liu He sign the Phase One Trade Deal in January 2020 | |||||||

| Simplified Chinese | 中美贸易战 | ||||||

| Traditional Chinese | 中美貿易戰 | ||||||

| |||||||

| China–United States trade dispute | |||||||

| Simplified Chinese | 中美贸易争端 | ||||||

| Traditional Chinese | 中美貿易爭端 | ||||||

| |||||||

Since the 1980s, Trump has advocated tariffs to reduce the U.S. trade deficit and promote domestic manufacturing, saying the country was being "ripped off" by its trading partners; imposing tariffs became a major plank of his presidential campaign. Although some economists and politicians argue that the United States' persistent trade deficit is problematic, many economists argue that it is not a problem,[3] and few advocate tariffs as a solution.[4][5][6][7]

In the United States, the trade war has brought struggles for farmers and manufacturers and higher prices for consumers. In other countries it has also caused economic damage, though some countries have benefited from increased manufacturing to fill the gaps. It has also led to stock market instability. The governments of several countries, including China and the United States, have taken steps to address some of the damage caused by a deterioration in China–United States relations and tit-for-tat tariffs.[8][9][10][11]

The trade war has been criticized internationally, including by U.S. businesses and agricultural organizations, though most farmers continued to support Trump. Among U.S. politicians the response has been mixed, and most agree that pressure needs to be put on China.[12] As of late November 2019, none of the leading Democratic candidates for president said they would remove the tariffs, including Joe Biden and Elizabeth Warren, both of whom agreed the U.S. had to confront what they see as China's unfair trade policies.[13]

Background

The United States and China are the world's two largest economies; the US has a larger nominal GDP, whereas China has a larger GDP when measured in terms of PPP. China is the world's largest exporter and the United States is the world's largest importer. They have so far been important pillars for the global economy.

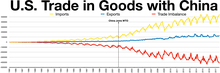

By 1984, the United States had become China's third-largest trading partner, and China became America's 14th largest. However, the annual renewal of China's MFN (most favored nation) status was constantly challenged by anti-Chinese pressure groups during US congressional hearings. For example, U.S. imports from China almost doubled within five years from $51.5 billion ($84.2 billion in 2019 dollars) in 1996 to $102 billion ($148 billion in 2019 dollars) in 2001.[14] The American textile industry lobbied Congress for, and received, tariffs on Chinese textiles according to the WTO Agreement on Textiles and Clothing. In reaction to the 1989 Tiananmen Square protests' suppression, the Bush I administration and Congress imposed administrative and legal constraints on investment, exports, and other trade relations with China.[15]

In 1991, China only accounted for 1% of total US manufacturing spending.[16] The Clinton presidency from 1992 started with an executive order (128590) that linked renewal of China's MFN status with seven human rights conditions, including "preservation of Tibetan indigenous religion and culture" and "access to prisons for international human rights organizations"—Clinton reversed this position a year later. Other challenges to Sino-American relations in this decade included the Cox Committee investigations against supposed nonprofit involvement in "promoting communism", the persecution of Taiwanese-American scientist Wen Ho Lee for unproven allegations of espionage for the PRC, and the 1999 United States bombing of the Chinese embassy in Belgrade. But relations warmed after the September 2001 initiation of the War on Terror.[17] U.S. President George W. Bush visited in China on his first international trip since the September 11 attacks and China offered strong public support for the War on Terror in APEC China 2001.[18][19] Bush was an advocate of China's entry into the World Trade Organization.[20] When the U.S. needed to issue a huge volume of bonds to the 2007–2008 financial crisis, it relied on China, raised US debt and trade deficit.[21][22]

China joins the World Trade Organization

With the United States–China Relations Act of 2000, China was allowed to join WTO in 2001 and was given a most favoured nation (MFN) status.[23][24] President Bill Clinton in 2000 pushed Congress to approve the U.S.-China trade agreement and China's accession to the WTO, saying that more trade with China would advance America's economic interests.

However, his administration had accused the Chinese of failing to comply with global trade rules and demanded that the Chinese first resolve a list of outstanding trade grievances with Washington, including opening its markets and protecting copyrights and patents. Among the key issues were that China was a major source of pirated musical compact disks and video laser disks, along with virtually all the computer software sold in China. On intellectual property rights, there was no enforcement of China's written laws, and as a result the piracy and theft of American-produced music, videos and software was costing American companies $1 billion a year by 1994 ($1.73 billion in 2019 dollars).[25]

By 2000, Clinton said he was optimistic on achieving a fair agreement: "Economically, this agreement is the equivalent of a one-way street. It requires China to open its markets—with a fifth of the world’s population, potentially the biggest markets in the world—to both our products and services in unprecedented new ways," said Clinton. In a speech that year, he stated his hopes:

For the first time, our companies will be able to sell and distribute products in China made by workers here in America without being forced to relocate manufacturing to China, sell through the Chinese government, or transfer valuable technology—for the first time. We’ll be able to export products without exporting jobs.[26]

As a new member, China agreed to rapidly lower import tariffs and open its markets, although many trade officials doubted it would stand by those promises.[27] China did cut tariffs after it joined the WTO, but it nonetheless continued to steal U.S. intellectual property (IP) and forced American companies to transfer technology to access the Chinese market, which were violations of WTO rules.[27]

In 2008, the WTO issued a formal ruling against China for requiring foreign automakers operating there to buy most components from local suppliers or face higher tariffs, 25 percent, instead of the normal 10 percent. The WTO agreed that it amounted to an unfair discrimination against foreign parts, a violation of global trade rules.[28] The original complaint was filed in 2006 by the European Union, the United States and Canada, by which time there had already been accusations against China for using a combination of subsidies, tax incentives and an undervalued currency to gain an unfair advantage over foreign companies operating in China.[28]

China lowered its average import tariffs to 10% by 2005 from the 40% it maintained in the 1990s.[27] In 2005 Chinese exports to the U.S. increased 31 percent, but imports from the U.S. rose only 16 percent. And while the U.S. trade deficit with China was $90.2 billion in 2001 ($130 billion in 2019 dollars), it nearly doubled by 2005.[27] In the four years after joining the WTO, China in general complied with many of its legal obligations, including passing laws and meeting deadlines. However, it was slow to enforce intellectual property rights and add transparency to its industrial rules and regulations, which made it difficult for U.S. businesses to access its market.[27] By 2019 the estimated costs to the U.S. economy from Chinese IP theft was between $225 billion and $600 billion annually.[29]

The Obama administration confronted other issues in 2010, when it opened an investigation into whether the Chinese government was subsidizing its alternative energy companies, such as solar and wind turbine, in violation of WTO guidelines that it agreed to. It was one of the first challenges of China's alleged efforts to control major growing industries.[30] As explained by Obama's Trade Representative, Ron Kirk, "Green technology will be an engine for the jobs of the future, and this administration is committed to ensuring a level playing field for American workers."[30]

United Steelworkers President Leo Gerard said that those subsidies were in "direct violation" of WTO rules.[31] Along with disallowed subsidies, Gerard pointed out that U.S. firms establishing joint ventures with Chinese companies must surrender technologies and designs as a condition of doing business:

As they steal the technology and force the companies to China, they are locking down research and development. If we are not going to do solar panels and fluorescent bulbs and wind turbines here, the next generation of R and D will not be here.[31]

When President Obama met with Chinese paramount leader Hu Jintao in 2011, officials were concerned that China was not acting in the free trade spirit it agreed to when it joined the WTO 10 years earlier. They proclaimed that China was still restricting foreign investment, avoiding national treatment of foreign firms, failing to protect intellectual property rights, and distorting trade with its government subsidies.[32] There were also complaints by various lawmakers who wanted the administration to act against what they said was China's manipulating its currency, worried that it would allow China to underprice its exports and put American and other nations' manufacturing at a great disadvantage.[33] The U.S.-China Business Council in 2014 said that China was restricting investment in more than 100 industrial sectors, including agriculture, petrochemicals and health services, while the U.S. was restricting investment outright in just five sectors.[34]

A number of senators and congressmen wanted the White House to place tariffs on some of the underpriced Chinese imports, stating that if the administration wouldn't do so, they threatened to mandate some tariffs on their own.[33] In a general poll sponsored by Allstate Insurance and the National Journal in 2010, thirty-six percent of the American population would support tariffs on imports and would penalize companies that moved jobs overseas.[33]

By 2018, U.S. manufacturing jobs had decreased by almost 5 million since 2000, with the decline accelerating.[35][36][37]

Trump administration's complaints

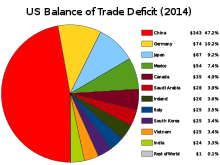

Since the 1980s, President Trump has frequently advocated tariffs to reduce the U.S. trade deficit and promote domestic manufacturing, saying the country was being "ripped off" by its trading partners, and imposing tariffs was a major plank of his presidential campaign.[38][39][40][41][42] In early 2011, he stated that because China has manipulated their currency, "it is almost impossible for our companies to compete with Chinese companies."[43] At the time, Alan Tonelson, of the U.S. Business and Industry Council, said the degree of Chinese undervaluation was at least 40%, claiming that tariffs were the only way to fix this: "Nothing else has worked, nothing else will work."[43] In 2017, the U.S. had a $336 billion trade deficit with China and a $566 billion trade deficit overall.[44]

.jpg)

In supporting tariffs as president, he said that China was costing the American economy hundreds of billions of dollars a year because of unfair trade practices. After imposing tariffs, he denied entering into a trade war, claiming the "trade war was lost many years ago by the foolish, or incompetent, people who represented the U.S." He said that the U.S. has a trade deficit of $500 billion a year, with intellectual property (IP) theft costing an additional $300 billion. "We cannot let this continue," he said.[45][46] Former White House Counsel, Jim Schultz, said that "through multiple presidential administrations — Clinton, Bush and Obama — the United States has naively looked the other way while China cheated its way to an unfair advantage in the international trade market."[47]

Among the unfair trade practices asserted by the Trump administration is the theft of U.S. intellectual property (IP).[29] James Andrew Lewis, senior vice president at the Center for Strategic and International Studies, claims that IP has been taken through espionage, theft and forced technology transfers due to mandatory joint ventures.[48] Estimated cost to the U.S. from IP theft is between $225 billion and $600 billion annually.[29]

Technology is considered the most important part of the U.S. economy.[49] According to U.S. Trade Representative Robert E. Lighthizer, China maintains a policy of "forced technology transfer," along with practicing "state capitalism," including buying U.S. technology companies and using cybertheft to gain technology.[49] As a result, officials in the Trump administration were, by early 2018, taking steps to prevent Chinese state-controlled companies from buying American technology companies and were trying to stop American companies from handing over their key technologies to China as a cost of entering their market.[49] According to political analyst Josh Rogin: "There was a belief that China would develop a private economy that would prove compatible with the WTO system. Chinese leadership has made a political decision to do the opposite. So now we have to respond."[49]

Lighthizer said that the value of the tariffs imposed was based on U.S. estimates of the actual economic damage caused by alleged theft of intellectual property and foreign-ownership restrictions that require foreign companies to transfer technology.[50][51] Such forced Joint ventures give Chinese companies illicit access to American technology.[62]

Over half of the members of the American Chamber of Commerce in the People's Republic of China thought that leakage of intellectual property was an important concern when doing business there.[63] For example, American auto makers must establish a joint venture majority-owned by a Chinese partner, after which the Chinese company receives rights to use the American company's intellectual property in order to produce domestic product based on it.[64][65]

Former director of the National Security Agency Keith B. Alexander called Chinese industrial espionage "the greatest transfer of wealth in history"[66] and, in August 2017, Robert Lighthizer investigated China's alleged unfair trade practices.[67][68][69]

Initiating steel and aluminum tariff actions in March 2018, Trump said "trade wars are good, and easy to win,"[70] but as the conflict continued to escalate through August 2019, Trump stated, "I never said China was going to be easy."[71][72]

Peter Navarro, White House Office of Trade and Manufacturing Policy Director, explained that the tariffs are "purely defensive measures" to reduce the trade deficit.[73] He says that the cumulative trillions of dollars that Americans transfer overseas as a result of yearly deficits are then used by those countries to buy America's assets, as opposed to investing that money in the U.S. "If we do as we're doing . . . those trillions of dollars are in the hands of foreigners that they can then use to buy up America."[74]

European Commission allegations

The European Commission filed a complaint with the World Trade Organization over these rules in 2018, arguing that foreign companies are forced or induced to transfer IP to their Chinese partner, and establish research and development in China, as "performance requirements" to receive government approval in sectors such as electric vehicles. The EU believes that this violates WTO rules requiring fair treatment of domestic and foreign companies.[75]

China's response and counter-allegations

The Chinese government has denied forced transfer of IP is a mandatory practice, and acknowledged the impact of domestic R&D performed in China.[76] Former U.S. treasury secretary Larry Summers assessed that Chinese leadership in some technological fields was the result of "huge government investment in basic science" and not "theft" of U.S. properties.[77] In March 2019, the National People's Congress endorsed a new foreign investment bill, to take effect in 2020, which explicitly prohibits the forced transfer of IP from foreign companies, and grants stronger protection to foreign intellectual property and trade secrets. China had also planned to lift restrictions on foreign investment in the automotive industry in 2022. AmCham China policy committee chair Lester Ross felt that the draft text of the bill felt "rushed" and "broad", and also showed concern for a portion of the bill that grants the country power to retaliate against countries that impose restrictions on Chinese companies.[65][78][79]

The Chinese government has blamed the American government for starting the conflict and said that U.S. actions were making negotiations difficult. They say the trade war has had a negative effect on the world and that the U.S. government's real goal is to stifle China's growth.[80]

Hong Kong economics professor Lawrence J. Lau argues that a major cause is the growing battle between China and the U.S. for global economic and technological dominance. He argues, "It is also a reflection of the rise of populism, isolationism, nationalism and protectionism almost everywhere in the world, including in the US."[81]

Chronology

2018

- January 22: Trump announced tariffs on solar panels and washing machines.[84] About 8% of American solar panel imports in 2017 came from China.[85] Imports of residential washing machines from China totaled about $1.1 billion in 2015.[86]

- March 1: Trump announced steel and aluminum tariffs on imports from all countries.[87] The United States had imported about 3% of its steel from China.[88]

- March 22: Trump asked the United States trade representative (USTR) to investigate applying tariffs on US$50–60 billion worth of Chinese goods.[89][90][91] He relied on Section 301 of the Trade Act of 1974 for doing so, stating that the proposed tariffs were "a response to the unfair trade practices of China over the years", including theft of U.S. intellectual property.[92][89] Over 1,300 categories of Chinese imports were listed for tariffs, including aircraft parts, batteries, flat-panel televisions, medical devices, satellites, and various weapons.[93][94]

- April 2: Ministry of Commerce of China responded by imposing tariffs on 128 products it imports from America, including aluminum, airplanes, cars, pork, and soybeans (which have a 25% tariff), as well as fruit, nuts, and steel piping (15%).[95][96][97] U.S. commerce secretary Wilbur Ross said that the planned Chinese tariffs only reflected 0.3% of U.S. gross domestic product, and Press Secretary Sarah Huckabee Sanders stated that the moves would have "short-term pain" but bring "long-term success".[45][46][98][99] On April 5, 2018, Trump responded saying that he was considering another round of tariffs on an additional $100 billion of Chinese imports as Beijing retaliates.[100] The next day the World Trade Organization received request from China for consultations on new U.S. tariffs.[101]

.jpg)

- May 15: Vice Premier and Politburo member Liu He, top economic adviser to president of China and General Secretary Xi Jinping, visited Washington for further trade talks.[91][102]

- May 20: Chinese officials agreed to "substantially reduce" America's trade deficit with China[102] by committing to "significantly increase" its purchases of American goods. As a result, Treasury Secretary Steven Mnuchin announced that "We are putting the trade war on hold".[103] White House National Trade Council director Peter Navarro, however, said that there was no "trade war," but that it was a "trade dispute, fair and simple. We lost the trade war long ago."[104]

- May 21: Trump tweeted that "China has agreed to buy massive amounts of ADDITIONAL Farm/Agricultural Products," although he later clarified the purchases were contingent upon the closure of a "potential deal."[105]

- May 29: The White House announced that it would impose a 25% tariff on $50 billion of Chinese goods with "industrially significant technology;" the full list of products affected to be announced by June 15.[106] It also planned to impose investment restrictions and enhanced export controls on certain Chinese individuals and organizations to prevent them from acquiring U.S. technology.[107] China said it would discontinue trade talks with Washington if it imposed trade sanctions."[108]

- June 15: Trump declared that the United States would impose a 25% tariff on $50 billion of Chinese exports. $34 billion would start July 6, 2018, with a further $16 billion to begin at a later date.[109][110][111] China's Commerce Ministry accused the United States of launching a trade war and said China would respond in kind with similar tariffs for US imports, starting on July 6.[112] Three days later, the White House declared that the United States would impose additional 10% tariffs on another $200 billion worth of Chinese imports if China retaliated against these U.S. tariffs.[91] The list of products included in this round of tariffs was released on July 11, 2018, and was set to be implemented within 60 days.[113]

- June 19: China retaliates, threatening its own tariffs on $50 billion of U.S. goods, and stating that the United States had launched a trade war. Import and export markets in a number of nations feared the tariffs would disrupt supply chains which could "ripple around the globe."[114]

- July 6: American tariffs on $34 billion of Chinese goods came into effect. China imposed retaliatory tariffs on US goods of a similar value. The tariffs accounted for 0.1% of the global gross domestic product.[115][116] On July 10, 2018, U.S. released an initial list of the additional $200 billion of Chinese goods that would be subject to a 10% tariff.[117] Two days later, China vowed to retaliate with additional tariffs on American goods worth $60 billion annually.[118]

- August 8: The Office of the United States Trade Representative published its finalized list of 279 Chinese goods, worth $16 Billion, to be subject to a 25% tariff from August 23.[91][119][120] In response, China imposed 25% tariffs on $16 billion of imports from the US, which was implemented in parallel with the US tariffs on August 23.[121]

- August 14: China filed a complaint with the World Trade Organization (WTO), stating that US tariffs on foreign solar panels clash with WTO ruling and have destabilized the international market for solar PV products. China stated that the resulting impact directly harmed China's legitimate trade interests.[122]

- August 22: US treasury undersecretary David Malpass and Chinese commerce vice-minister Wang Shouwen met in Washington, D.C. in a bid to reopen negotiations. Meanwhile, on August 23, 2018, the US and China's promised tariffs on $16 billion of goods took effect,[123] and on August 27, 2018, China filed a new WTO complaint against the US regarding the additional tariffs.[124]

- September 17: The US announced its 10% tariff on $200 billion worth of Chinese goods would begin on September 24, 2018, increasing to 25% by the end of the year. They also threatened tariffs on an additional $267 billion worth of imports if China retaliates,[125] which China promptly did on September 18 with 10% tariffs on $60 billion of US imports.[126][127] So far, China has either imposed or proposed tariffs on $110 billion of U.S. goods, representing most of its imports of American products.[125]

- November 10, 2018 - White House National Trade Council director Peter Navarro alleged that a group of Wall Street billionaires are conducting an influence operation on behalf of the Chinese government by weakening the president and the U.S. negotiating position, and urged them to invest in the rust belt.[128][129]

- November 30: President Trump signed the revised U.S.–Mexico–Canada Agreement in Buenos Aires, Argentina. The USMCA contains a "rules of origin" provision for automobile that was "touted by the Trump administration as a tool to keep out Chinese inputs and encourage production and investment in the US and North America."[130] Jorge Guajardo, former Mexican ambassador to China said "One thing the Chinese have had to acknowledge is that it wasn't a Trump issue; it was a world issue. Everybody's tired of the way China games the trading system and makes promises that never amount to anything."[131]

- December 1: The planned increases in tariffs were postponed. The White House stated that both parties will "immediately begin negotiations on structural changes with respect to forced technology transfer, intellectual property protection, non-tariff barriers, cyber intrusions and cyber theft."[132][133] According to the Trump Administration, "If at the end of [90 days], the parties are unable to reach an agreement, the 10 percent tariffs will be raised to 25 percent."[134][135] The U.S. trade representative's office confirmed the hard deadline for China's structural changes is March 1, 2019.[136][137]

- December 4: New York Fed president John Williams said that he believed the US economy will stay strong in 2019.[138] Williams expects that increases in the interest rates will be necessary to maintain the economy. He stated, "Given this outlook of strong growth, strong labor market and inflation near our goal and taking account all the various risks around the outlook, I do expect further gradual increases in interest rates will best sponsor a sustained economic expansion."[138]

- December 11: Trump announced China was buying a "tremendous amount" of U.S. soybeans. Commodities traders saw no evidence of such purchases, and over the next six months soybean exports to China were about one quarter what they were in 2017, before the trade conflict began.[139] China reportedly considered purchases of American farm goods as contingent upon closing a comprehensive trade deal.[140]

2019

- May 5: Trump stated that the previous tariffs of 10% levied in $200 billion worth of Chinese goods would be raised to 25% on May 10.[141] With notification by USTR, the Federal Register on May 9 published the modification of duty on or after 12:01 a.m. Eastern Time Zone May 10 to 25% for the products of China covered by the September 2018 action.[142] The stated reason being that China reneged upon already agreed upon deals.[143]

- May 15: Trump signed executive order 13873, which sought to restrict the export of U.S. information and communications technology to "foreign adversaries" under national security grounds. The order did not make any references to specific companies or nations, but it was heavily implied that the order was meant to support United States allegations of espionage via Chinese telecommunications firms.[144][145]

- June 1: China will raise tariffs on $60 billion worth of US goods.[146]

- June 29: During the G20 Osaka summit, Trump announces he and Xi Jinping agreed to a "truce" in the trade war after extensive talks. Prior tariffs are to remain in effect, but no future tariffs are to be enacted "for the time being" amid restarted negotiations. Additionally, Trump said he would allow American companies to sell their products to Huawei, but the company would remain on the U.S. trade blacklist.[147] However, the extent of how much this plan to temporarily exempt Huawei from previous bans would be implemented later became unclear and, in the weeks later, there was no clear indication of the reversal of Huawei bans.[148][149]

- June 29: After a meeting with Chinese leader Xi Jinping, Trump announces "China is going to be buying a tremendous amount of food and agricultural product, and they're going to start that very soon, almost immediately."[150] China disputed making such a commitment and one month later no such purchases had materialized.[140][151]

- July 11: Trump tweeted "China is letting us down in that they have not been buying the agricultural products from our great Farmers that they said they would." People familiar with the trade negotiations said China had made no firm commitments to purchase farm goods unless it was part of a comprehensive trade agreement.[140]

- July 17: China announced an accelerated decrease in holdings of US treasury holdings, targeting 25% of its current holdings of $1.1 trillion.[152]

- August 1: Trump announced on Twitter that additional 10% tariff will be levied on the "remaining $300 billion of goods".[153]

- August 5: The central bank of China (PBOC) let the Renminbi fall over 2% in three days to the lowest point since 2008 as it was hit by strong sales due to the threat of tariffs.[154]

- August 5: The U.S. Department of Treasury officially declared China as a Currency Manipulator, reportedly under personal pressure from Trump.[155] In July 2019 the IMF found the yuan to be correctly valued, while the dollar was overvalued, and some analysts found that market forces, rather than Chinese intervention, had recently caused the yuan to lose value.[154][156] China denied manipulating its currency, citing currency market reaction to Trump's announcement of tariff increases days earlier.[157]

- August 5: China ordered state-owned enterprises to stop buying US agricultural products,[158] totaling $20 billion per year before the trade war.[159] Zippy Duvall, president of the American Farm Bureau Federation, called the move "a body blow to thousands of farmers and ranchers who are already struggling to get by," adding, "Farm Bureau economists tell us exports to China were down by $1.3 billion during the first half of the year. Now, we stand to lose all of what was a $9.1 billion market in 2018, which was down sharply from the $19.5 billion U.S. farmers exported to China in 2017."[160][161]

- August 13: Trump delayed some of the tariffs. $112 billion worth will still take place on September 1 (which means that on September 1, $362 billion total worth, including the newly imposed $112 billion, of Chinese products will face a tariff), but the additional, not yet imposed, $160 billion will not take effect until December 15.[162] Trump and his advisors Peter Navarro, Wilbur Ross and Larry Kudlow conceded the tariffs were postponed to avoid harming American consumers during the Christmas shopping season.[163]

- August 23: Chinese Ministry of Finance announced new rounds of retaliative tariffs on $75 billion worth of U.S. goods, effective beginning September 1.[164]

- August 23: Trump tweeted that he "hereby ordered" American companies to "immediately start looking for an alternative to China". Aides and analysts clarified that the tweet was without legal force.[165] Furthermore, tariffs are to be raised from 25% to 30% on the existing $250 billion worth of Chinese goods beginning on October 1, 2019, and from 10% to 15% on the remaining $300 billion worth of goods beginning on December 15, 2019.[166]

- August 26: At the G7 summit, Trump stated, "China called last night our top trade people and said ‘let’s get back to the table’ so we will be getting back to the table and I think they want to do something. They have been hurt very badly but they understand this is the right thing to do and I have great respect for it."[167] Chinese Foreign Ministry spokesman Geng Shuang said he was unaware of such a call[168] and Trump aides later conceded the call didn't occur but the president was trying to project optimism.[169]

- August 28: Americans for Free Trade, an umbrella group for 161 trade associations across numerous industries,[170] sent Trump a letter asking him to postpone all scheduled tariff increases.[171] The next day, Trump said "badly run and weak companies are smartly blaming these small Tariffs instead of themselves for bad management."[172]

- September 1: New USA and Chinese tariffs previously announced went into effect at 12:01 pm EST. China imposed 5% to 10% tariffs on one-third of the 5,078 goods it imports from America, with tariffs on the remainder scheduled for December 15.[173] The United States imposed new 15% tariffs on about $112 billion of Chinese imports, such that more than two-thirds of consumer goods imported from China were then subject to tariffs.[174]

- September 4: The Office of the U.S. Trade Representative and Chinese state media confirmed that deputy-level meetings in mid-September would lead to ministerial-level talks in coming weeks.[175][176] At the same time, the United States Department of Commerce issued preliminary antidumping duty determinations on fabricated structural steel from Canada, China, and Mexico. Furthermore, China was found liable for dumping up to 141.38% of fabricated structural steel into the United States and thereby prompted the U.S. Customs and Border Protection to collect cash deposits in the same rate, as instructed by the Commerce Department.[177]

- September 6: The People's Bank of China announces a 0.5 percent reduction in its reserve requirement ratio in response to the slowing of China's economic growth rates caused by the trade war.[178]

- September 11: After China announced it was exempting 16 American product types from tariffs for one year, Trump announced he would delay until October 15 a tariff increase on Chinese goods previously scheduled for October 1. Trump asserted he granted the delay at the request of Chinese vice premier Liu He.[179][180]

- September 12: Bloomberg News and Politico reported that Trump advisors were increasingly concerned that the trade war was weakening the American economy going into the 2020 election campaign and were discussing ways to reach a limited interim deal.[181][182] The Wall Street Journal reported China was seeking to narrow the scope of negotiations to place national security matters on a separate track from trade issues.[183]

- September 26: The Wall Street Journal reported that Chinese retaliatory tariffs on lumber and wood products had caused hardwood lumber exports to China to fall 40% during 2019, resulting in American lumber mills slashing employment.[184]

- October 7: Citing human rights issues, the United States Department of Commerce puts 20 Chinese public security bureaus and eight high tech companies, such as HikVision, SenseTime and Megvii, on the Export Administration Regulations entities blacklist. Like Huawei, which was sanctioned on an identical blueprint for national security reasons, the entities will need U.S. government approval before they can purchase components from U.S. companies.[185]

- October 11: Trump announced that China and the United States had reached a tentative agreement for the "first phase" of a trade deal, with China agreeing to buy up to $50 billion in American farm products, and to accept more American financial services in their market, with the United States agreeing to suspend new tariffs scheduled for October 15. The deal was expected to be finalized in coming weeks. [186][187][188] At the same time, Chinese announcements did not express the same confidence,[189] though a few days later the Chinese Foreign Ministry said that the two sides had the same understanding and had reached an agreement.[190]

- December 13: Both countries announce an initial deal where new tariffs to be mutually imposed on December 15 would not be implemented. China says it "will buy more high quality of American agricultural products", while the United States says it will halve the existing 15% tariffs.[191] Few details were publicly released, with most characterizations of the deal coming from the United States in vague terms.[192][193]

- December 31: The Wall Street Journal reported that the language of the phase one deal was expected to be released after the January 15 signing, and that Lighthizer said some details would be classified.[194]

2020

.jpg)

- January 3: Reuters reported that in December 2019 the American manufacturing sector fell into its deepest slump in over a decade, attributing the decline to the U.S.-China trade war.[195]

- January 15: China's Vice Premier Liu He and U.S. President Donald Trump signed the US–China Phase One trade deal in Washington DC.[196][197] The "Economic and Trade Agreement between the United States of America and the People’s Republic of China" is set to take effect from 14 February 2020 and focusses on intellectual property rights (Chapter 1), technology transfer (Chapter 2), food and agricultural products (Chapter 3), financial services (Chapter 4), exchange rate matters and transparency (Chapter 5), and expanding trade (Chapter 6), with reference also being made to bilateral evaluation and dispute resolution procedures in Chapter 7.[198] Unlike other trade agreements, the US–China Phase One agreement did not rely on arbitration through an intergovernmental organization like the World Trade Organization, but rather through a bilateral mechanism.[199][200]

- February 17: China grants tariff exemptions on 696 US goods to support purchases.[201]

- March 5: The United States Trade Representative granted exemptions to tariffs on various types of medical equipment, after calls from American lawmakers and others to remove tariffs on these products in light of the 2020 coronavirus pandemic in the United States.[202][203]

Effects

In April 2018, China announced that it would eliminate laws that required global automakers and shipbuilders to work through state-owned partners.[204] President of China and General Secretary Xi Jinping reiterated those pledges,[205] affirming a desire to increase imports, lower foreign-ownership limits on manufacturing and expand protection to intellectual property, all central issues in Trump's complaints about their trade imbalance.[206] Trump thanked Xi for his "kind words on tariffs and automobile barriers" and "his enlightenment" on intellectual property and technology transfers. "We will make great progress together!" the president added.[206]

By early July 2018, there were negative and positive results already showing up in the economy as a result of the tariffs, with a number of industries showing employment growth while others were planning on layoffs.[207] Regional commentators noted that consumer products were the most likely to be affected by the tariffs. A timeline of when costs would rise was uncertain as companies had to figure out if they could sustain a tariff hike without passing on the costs to consumers.[208]

American farmers were particularly hard-hit by China's retaliatory trade actions. According to the American Farm Bureau, agricultural exports from the US to China decreased from $24 billion in 2014 to $9.1 billion in 2018, including decreases in sales of pork, soybeans, and wheat. Farm bankruptcies have increased, and agricultural equipment manufacturer Deere & Company cut its profit forecast twice between January and August 2019.[209] Yet despite the negative effects, polls in July 2019 showed that most farmers continued to support Trump, as 78% of them said they believed the trade war will ultimately benefit U.S. agriculture.[210]

To alleviate the difficulties faced by farmers, the Trump administration allocated $28 billion in relief, mostly in direct payments, in two tranches through July 2019. With the second $16 billion tranche, Trump tweeted, "Farmers are starting to do great again, after 15 years of a downward spiral. The 16 Billion Dollar China 'replacement' money didn't exactly hurt!"[211][212] The Government Accountability Office announced in February 2020 that it would examine the program, amid reports that aid was being improperly distributed.[213]

Trump stated that he would spend the tens of billions of dollars in tariffs from China to buy products from "Great Patriot Farmers" and distribute the food to starving people in nations around the world.[214][215] According to an August 2019 USDA report, as American wheat exports "plunged", Canadian wheat exports "rocketed" from 32% to more than 60% of Chinese wheat imports during the most recent marketing year.[209][216] Farm equipment manufacturers were negatively affected by the reluctance of farmers to invest in new equipment, with sales dropping significantly during the first quarter of 2019.[217]

According to a January 14, 2019 article in the Wall Street Journal, despite US-imposed tariffs, in 2018 China's annual trade surplus was $323.32 billion, a record high.[218] On February 6, 2018, The New York Times reported that in 2017 the trade deficit had also reached a record high.[219] In March 2019, the U.S. Department of Commerce stated that in 2018 the U.S. trade deficit reached $621 billion, the highest it had been since 2008.[220] According to a study by the National Retail Federation of the United States, a 25% tariff on Chinese furniture alone would cost US consumers an additional $4.6 billion in annual payments.[221]

Analysis conducted by the Peterson Institute for International Economics found that China imposed uniform tariffs averaging 8% on all its importers in January 2018, before the trade war began. By June 2019, tariffs on American imports had increased to 20.7%, while tariffs on other nations declined to 6.7%.[222] The analysis also found that average American tariffs on Chinese goods increased from 3.1% in 2017 to 24.3% by August 2019.[223]

Economic growth has slowed worldwide amid the trade war.[224] The International Monetary Fund's World Economic Outlook report released in April 2019 lowered the global economic growth forecast for 2019 from 3.6% expected in 2018 to 3.3%, and said that economic and trade frictions may further curb global economic growth and continue weaken the investment.[225] According to Capital Economics, China's economic growth has slowed as a result of the trade war, though overall the Chinese economy "has held up well", and China's share of global exports has increased.[226] U.S. economic growth has also slowed.[224]

Analysis by Goldman Sachs in May 2019 found that the consumer price index for nine categories of tariffed goods had increased dramatically, compared to a declining CPI for all other core goods.[227]

In August 2019, Trump trade advisor Peter Navarro asserted tariffs were not hurting Americans. Citing extensive evidence to the contrary, Politifact rated Navarro's assertion "Pants on Fire."[228]

Surveys of consumer sentiment and small business confidence showed sharp declines in August 2019 on uncertainty caused by the trade war.[229][230] The closely-followed Purchasing Managers' Index for manufacturing from the Institute for Supply Management showed contraction in August, for the first time since January 2016; the ISM quoted several executives expressing anxiety about the continuing trade war, citing shrinking export orders and the challenges of shifting their supply chains out of China. The IHS Markit manufacturing purchasing managers' index also showed contraction in August, for the first time since September 2009.[231] The day the ISM report was released, Trump tweeted, "China’s Supply Chain will crumble and businesses, jobs and money will be gone!"[232][233]

Analysis conducted by Moody's Analytics estimated that through August 2019 300,000 American jobs had either been lost or not created due to the trade war, especially affecting manufacturing, warehousing, distribution and retail.[234]

By September 2019, American manufacturers were reducing their capital investments and delaying hiring due to uncertainty caused by the trade war.[235]

A November 2019 United Nations analysis reported that "the U.S. tariffs on China are economically hurting both countries".[236]

In December 2019, the South China Morning Post reported that, due to the trade war and the Chinese government's crackdown on shadow banking, Chinese manufacturing investments are expanding at the lowest rate since records began.[237]

The Wall Street Journal reported in February 2020 that the USTR was granting fewer tariff waivers to American firms, down from 35% of requests for the first two tranches of tariffs in 2018 to 3% for the third tranche in 2019. The USTR was not explaining to applicants why their waiver requests were being denied. The Journal cited one firm that laid off employees and suspended an expansion plan because its waiver requests were denied. Jonathan Gold, a vice president of the National Retail Federation, stated that some companies were frustrated by a perception that the "phase one" deal with China signed in January 2020 had reduced trade policy uncertainty despite the deal holding existing tariffs in place, with the exception of the fourth tranche tariff rate being reduced from 15% to 7.5%.[238]

Overall effects on U.S. economy

The Congressional Budget Office (CBO) reported their estimates of the U.S. economic impact of tariffs (applied to China primarily but other countries as well) in August 2019. By 2020, tariffs would reduce the level of real U.S. GDP by about 0.3%, reduce real consumption by 0.3%, reduce real private investment by 1.3%, and reduce real household income by $580 (about 1%). Real U.S. exports would be 1.7% lower and real imports would be 2.6% lower. CBO explained tariffs reduce U.S. economic activity in three ways: 1) Consumer and capital goods become more expensive; 2) Business uncertainty increases, thereby reducing or slowing investment; and 3) Other countries impose retaliatory tariffs, making U.S. exports more expensive and thus reducing them. CBO estimated the U.S. had imposed tariffs on 11% of imports by January 2018. As of July 25, 2019, retaliatory tariffs had been imposed on 7% of all U.S. goods exports. CBO expects the negative consequences will remain but have a smaller impact in 2029, as businesses adjust their supply chains (i.e., source from countries not affected by tariffs).[239]

Stock market

Uncertainty due to the trade war has caused turbulence in the stock market,[240][241] with investors "rattled" by the conflict.[242]

On December 4, 2018, the Dow Jones Industrial Average logged its worst day in nearly a month as it declined nearly 600 points, to which some argue is in part due to the trade war.[243]

On August 14, 2019 the Dow dropped 800 points, partly caused by increasing trade tensions between the U.S. and China.[244] Nine days later, on August 23, the Dow dropped 223 points in five minutes after Trump "hereby ordered" American companies to immediately seek alternatives to doing business in China; and the Dow was down 623 points for the day.[245]

Domestic politics

Analysts speculated that the trade war could affect the 2020 United States presidential election, as tariffs have negatively affected farmers, an important constituency for Trump.[246][247] Xi may also face domestic political pressure.[247]

Other countries

Globally, foreign direct investment has slowed.[248] The trade war has hurt the European economy, particularly Germany, even though trade relations between Germany and China and between Germany and the U.S. remain good.[249] The Canadian economy has seen negative effects as well.[250] Like the U.S., Britain, Germany, Japan, and South Korea were all showing "a weak manufacturing performance" as of 2019.[251] Several Asian governments have instituted stimulus measures to address damage from the trade war, though economists said this may not be effective.[252]

A trade group predicted that demand for semiconductor devices would decline by 12 per cent, as a direct result of the trade war.[253]

Some countries have benefited economically from the trade war, at least in some sectors, due to increasing exports to the United States and China to fill the gaps left by decreasing trade between these two economies. Beneficiaries include Vietnam, Chile, Malaysia, and Argentina.[254] Vietnam is the biggest beneficiary, with technology companies moving manufacturing there.[254][255] South Korea has also benefited from increased electronics exports, Malaysia from semiconductor exports, Mexico from motor vehicles, and Brazil from soybeans.[254] However, US-ASEAN Business Council CEO Alex Feldman warned that even these countries may not benefit long-term, saying that "It's in everyone's interest to see this spat get resolved and go back to normal trade relations between the US and China."[256] Several Taiwanese companies have been expanding production in Taiwan, including Quanta Computer, Sercomm and Wistron, creating over 21,000 jobs.[257] Nintendo has reportedly moved some Nintendo Switch production from China to Southeast Asia.[258]

The trade war has indirectly caused some companies to go bankrupt. One of them, Taiwanese LCD panel manufacturer Chunghwa Picture Tubes (CPT), went bankrupt as a result of an excess supply of panels and a subsequent collapse in prices, which was aided by vulnerability to the trade war (caused by overexpansion in China), a slowing Taiwanese and global economy and a slowdown in the electronics sector.[257][259]

Reactions

Chinese domestic reactions

The state-controlled Communist Party newspaper People's Daily has stated that China will be able to withstand the trade war, and that Trump's policies are affecting American consumers.[260]

In September 2019, Lu Xiang, an analyst at the Chinese Academy of Social Sciences, expressed pessimism about the outcome of upcoming talks, called Trump "unpredictable", and said, "We can only try to find sensible clues in his nonsense."[251]

Domestic reporting on the trade war is censored in China.[261]

The trade war is a common subject on Chinese social media, with one popular Internet meme referencing Thanos, a villain from Marvel Comics and the Marvel Cinematic Universe who wipes out half of all life in the universe using the Infinity Gauntlet, joking that Trump will similarly wipe out half of China's investors.[262][263]

United States domestic reactions

Congress

Senate Democratic leader Chuck Schumer praised President Trump's higher tariffs against China's alleged taking advantage of the U.S. and said "Democrats, Republicans, Americans of every political ideology, every region in the country should support these actions." Other Democratic senators who supported Trump's actions include Bob Menendez, Sherrod Brown and Ron Wyden[264][265][266][267][268] Bipartisan support from the House of Representatives for Trump's actions came from Nancy Pelosi[269][270][271] and Brad Sherman[272] Kevin Brady[264] and Ted Yoho.[272]

Other senators from both parties have criticized Trump for the trade war, including Charles E. Grassley,[273] Tim Kaine,[274] Mark Warner,[274] Elizabeth Warren,[275] and Ron Wyden.[12]

Other Republican senators have given more measured statements. Mitch McConnell said that "nobody wins a trade war" but that there was hope the tactics would "get us into a better position, vis-à-vis China". John Cornyn said that "there's a lot of concern".[276] Joni Ernst said in May 2019 that the "tariffs are hurtful" to farmers, but that they "do want us to find a path forward with China" and said, "We hope that we can get a deal soon".[277]

U.S. industry

In 2018, following announcements of escalation of tariffs by the U.S. and China, representatives of several major U.S. industries expressed their fears of the effects on their businesses. Some mayors representing towns with a heavy reliance on the farming sector also expressed their concerns.[278] In September 2018, a business coalition announced a lobbying campaign called "Tariffs Hurt the Heartland" to protest the proposed tariffs.[279] as the tariffs on Chinese steel, aluminum, and certain chemicals contributed to rising fertilizer and agricultural equipment costs in the United States.[280] A report by Logisym found that, despite the rising prices, demand for freight services increased and imports from China into the U.S. grew from US$38,230 million to US$50,032 million. Some commentators have noted that despite the fear of falling trade, increased imports and freight services signaled a growth of demand for goods from China.[281]

Over 600 companies and trade associations wrote to Trump in mid-2019 to ask him to remove tariffs and end the trade war, saying that increased tariffs would have "a significant, negative, and long-term impact on American businesses, farmers, families, and the US economy".[282]

On May 20, 2019, the Footwear Distributors and Retailers of America, an industry trade association for footwear, issued an open letter to President Trump, part of which read: "On behalf of our hundreds of millions of footwear consumers and hundreds of thousands of employees, we ask that you immediately stop this action", referring to the trade war.[283][284]

Americans for Free Trade, a coalition of over 160 business organizations, wrote a letter to Trump in August 2019 requesting that he postpone all tariff rate increases on Chinese goods, citing concerns about cost increases for U.S. manufacturers and farmers. The coalition includes the National Retail Federation, the Consumer Technology Association, Association of Equipment Manufacturers, the Toy Association and American Petroleum Institute, among others.[285]

In August 2019, Roger Johnson of the National Farmers Union — representing about 200,000 family farmers, ranchers and fishers — stated that the trade war was creating problems for American farmers, specifically highlighting the fall in soybean exports from the U.S. to China, elaborating, "instead of looking to solve existing problems in our agricultural sector, this administration has just created new ones. Between burning bridges with all of our biggest trading partners and undermining our domestic biofuels industry, President Trump is making things worse, not better."[286] In the same month, the American Farm Bureau Federation — representing large agribusiness — said that the announcement of new tariffs "signals more trouble for American agriculture."[287]

Due to the trade war, Chinese investment needed by American aircraft manufacturer ICON Aircraft was cut in August 2019. This necessitated laying off 40% of the company workforce and cutting ICON A5 aircraft production to fewer than five aircraft per month, from a target of 20 aircraft per month.[288]

Scott Paul, president of the Alliance for American Manufacturing, is a proponent of the increased U.S. tariffs.[278] After China–US trade talks ended in July 2019 with no resolution in sight, Paul said the talks were "failing American workers," adding, "a regurgitated pledge to buy more ag products and more talks in September? Trump would have ripped any Democrat for that outcome..."[289]

On CNBC's Mad Money, John Ferriola, the CEO and president of Nucor, America's largest steel producer and its largest metal recycler, argued that the tariffs were not unfair, but were "simply leveling the playing field." Ferriola added that not only the "European Union, but most countries in the world, have a 25 percent or greater VAT, (Value-added tax), on products going into their countries from the United States. So if we impose a 25 percent tariff, all we are doing is treating them exactly as they treat us."[290] In the European Union, value-added tax is refunded only to manufacturers within a recognized VAT zone. European law does not recognize the U.S. income tax system as a VAT. Ferriola further claimed that even with the tariffs on steel, the cost of an average $36,000 car would go up about $160, less than half of 1 percent, while a can of beer would only cost an extra penny more.[290]

In September 2019, Matthew Shay, president and CEO of the National Retail Federation, said that the trade war had "gone on far too long" and had harmful effects on American businesses and consumers. He urged the Trump administration to end the trade war and find an agreement to remove all the tariffs.[251]

Others

In an April 2018 article in Forbes, Harry G. Broadman, a former U.S. trade negotiator, argued that while the Trump administration's position that the Chinese do not abide by fair, transparent and market-based rules for global trade was broadly correct, employing unilateral tariffs is a self-defeating approach and the administration should instead pursue a coalition-based trade strategy.[291] Through August 2019, The Washington Post factchecker counted 166 instances of Trump making assertions about the trade deficit noting that he was incorrectly characterizing the trade deficit with China which actually reflects more imports than exports.[292]

Economic analyst Zachary Karabell has argued that the administration's tariff-based approach would not work as it would not "reverse what has already been transferred and will not do much to address the challenge of China today, which is no longer a manufacturing neophyte" and also argued that the assertion that more rigorous intellectual property protections would "level the playing field" was problematic.[293] He recommended instead that the U.S. focus on its relative advantages of economic openness and a culture of independence.[293]

The day Trump announced his steel and aluminum tariffs on imports from all nations, including China, the conservative, pro-business Wall Street Journal editorial board denounced the action as "the biggest policy blunder of his Presidency," adding, "This tax increase will punish American workers, invite retaliation that will harm U.S. exports, divide his political coalition at home, anger allies abroad, and undermine his tax and regulatory reforms."[294]

Economists at financial firm Morgan Stanley expressed uncertainty about the how the trade war would end, but warned in June 2019 that it could lead to a recession.[295]

The former Vice President Joe Biden said: "While Trump is pursuing a damaging and erratic trade war, without any real strategy, China is positioning itself to lead the world in renewable energy."[296]

An August 2019 Harvard CAPS/Harris Poll found that while 67% of registered voters thought China should be confronted for its trade policies, 74% said American consumers were shouldering most of the burden of tariffs.[297]

Economist Panos Mourdoukoutas states that China is fighting the trade war under a "false impression," that because it was now one of the world's largest economies, it had reached "power parity" with the U.S., which would result in a win-win deal. He states that such an assumption was a "big mistake": "'Interdependence' between an emerging economy, which is still relying on commodity exports and technology imports for its growth, and a mature developed country, meant [China] has long way to go before it turns into power parity."[298]

International

U.S. allies have warned Trump about escalating tariffs.[299] At the 45th G7 summit, UK Prime Minister Boris Johnson said, "We don't like tariffs on the whole."[299] European Council President Donald Tusk said the trade war risked causing a global recession.[300]

The Chilean vice minister for trade, Rodrigo Yanez, told CNBC that "It's very important for Chile that a trade deal between the U.S. and China is signed soon"[301]

On June 1, 2018, after similar action by the United States, the European Union launched WTO legal complaints against China's alleged forced ownership-granting and usage of technology that is claimed to discriminate against foreign firms and undermine the intellectual property rights of EU companies. They are allegedly forced to establish joint ventures in order to gain access to the Chinese market. The European commissioner for trade Cecilia Malmström said "We cannot let any country force our companies to surrender this hard-earned knowledge at its border. This is against international rules that we have all agreed upon in the WTO."[302] American, European and Japanese officials have discussed joint strategy and taken actions against unfair competition by China.[303][304][305]

At the 2018 G20 summit, the trade war as on the agenda for discussion.[306]

See also

- Japan–South Korea trade dispute

- Trump tariffs

- Anti-American sentiment in China

- Anti-Chinese sentiment in the United States

- Chinese espionage in the United States

- Congressional-Executive Commission on China

- Protectionism in the United States

- Rare earths trade dispute

- Second Cold War

References

- Swanson, Ana (July 5, 2018). "Trump's Trade War With China Is Officially Underway". The New York Times. Retrieved May 26, 2019.

- "Findings of the Investigation into China's Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974", Office of the U.S. Trade Representative, March 22, 2018

- "The U.S. Trade Deficit: How Much Does It Matter?". Council on Foreign Relations.

- Sarkar, Shrutee (March 14, 2018). "Economists united: Trump tariffs won't help the economy". Reuters. Retrieved August 26, 2019.

- Boak, Josh (December 5, 2018). "AP FACT CHECK: Economists say Trump off on tariffs' impact". AP NEWS.

- Stewart, James B. (March 8, 2018). "What History Has to Say About the 'Winners' in Trade Wars". NYTimes.com.

- "How Donald Trump's 25% tariff on China could start trade war - Apr. 18, 2011". money.cnn.com.

- "China–US trade war: Sino-American ties being torn down brick by brick". www.aljazeera.com. Retrieved August 18, 2019.

- "For the U.S. and China, it's not a trade war anymore — it's something worse". Los Angeles Times. May 31, 2019. Retrieved August 18, 2019.

- "NDR 2019: Singapore will be 'principled' in approach to China–US trade dispute; ready to help workers". CNA. Retrieved August 18, 2019.

- Rappeport, Alan; Bradsher, Keith (August 23, 2019). "Trump Says He Will Raise Existing Tariffs on Chinese Goods to 30%". The New York Times. Retrieved August 25, 2019.

- Higgins, Sean (August 1, 2019). "Trump's China tariff hike draws mixed reception from lawmakers".

- "'Trade Wars are Good, and Easy to Win'", Bloomberg Businessweek, Nov. 18, 2019 pp.32-36

- "Foreign Trade - U.S. Trade with China". Census.gov. Retrieved July 6, 2012.

- Kent, Ann (2001). "States Monitoring States: The United States, Australia, and China's Human Rights, 1990-2001" (PDF). Human Rights Quarterly. The Johns Hopkins University Press. 23 (3): 583–624. doi:10.1353/hrq.2001.0037.

- Feenstra, Robert; Ma, Hong; Sasahara, Akira; Xu, Yuan (January 18, 2018). "Reconsidering the 'China shock' in trade". VoxEU.org.

- Wang, Dong (2011). "China's Trade Relations with the United States in Perspective". Journal of Current Chinese Affairs. German Institute of Global and Area Studies. 39 (3): 165–210. doi:10.1177/186810261003900307.

- "Bush arrives in Shanghai for APEC". CNN. October 17, 2001.

- "APEC unites against terror". CNN. October 22, 2001.

- "Bush backs China's WTO entry despite standoff". CNN. April 6, 2001. Archived from the original on May 15, 2011.

- TAKAHASHI, TETSUSHI; CHO, YUSHO (February 8, 2018). "The master of China's US debt might be the next vice president". The Nikkei. Retrieved January 20, 2020.

- "How Trade Policies Lead to U.S. Debt". Washington Crossing Advisors. August 19, 2019. Retrieved January 20, 2020.

- "Normalizing Trade Relations With China Was a Mistake". The Atlantic. June 8, 2018.

- "President Grants Permanent Trade Status to China". www.whitehouse.archives.gov. December 27, 2001.

- "U.S. May Thwart China's Trade Goal", New York Times, July 24, 1994

- "Text of Clinton's Speech on China Trade Bill", Federal News Service, March 9, 2000

- "Accession has brought change to China and WTO", New York Times, Nov. 7, 2005

- "WTO Challenges China on Tariffs", Washington Post, July 19, 2008

- "How much has the US lost from China's IP theft?", CNN Business, March 23, 2018

- "U.S. to investigate Chinese subsidies to alternative energy companies", Washington Post, Oct. 15, 2010

- "Steelworkers union targets China on green-energy exports", Washington Post, Sept. 9, 2010

- "Wisconsin firm learns ups and downs of doing business in China", Washington Post, Feb. 26, 2011

- "Time to stand up to China on trade", Washington Post, Sept. 15, 2010

- "U.S. companies feel a chill in China, even as many still rake in profits", Washington Post, July 4, 2014

- Guiltford, Gwynn (May 3, 2018). "The epic mistake about manufacturing that's cost Americans millions of jobs". Quartz.

- Houseman, Susan N. (September 7, 2018). "Is Automation Really to Blame for Lost Manufacturing Jobs?". Foreign Affairs.

- Bartash, Jeffry (May 14, 2018). "China really is to blame for millions of lost U.S. manufacturing jobs, new study finds". Market Watch.

- Zarroli, Jim (June 8, 2018). "As U.S. Flexes Its Muscles On Trade, Other Countries Are Beginning To Push Back". NPR.org. Retrieved August 26, 2019.

- Tankersley, Jim; Landler, Mark (May 15, 2019). "Trump's Love for Tariffs Began in Japan's '80s Boom". NYTimes.com.

- Long, Heather (July 28, 2015). "Donald Trump wants to be the 'jobs president.' But how?". CNNMoney.

- "Donald Trump's top 10 campaign promises". PolitiFact.

- Zarroli, Jim (June 8, 2018). "As U.S. Flexes Its Muscles On Trade, Other Countries Are Beginning To Push Back". NPR.org. Retrieved August 26, 2019.

- "How 'The Donald' could incite a trade war", CNN Money, April 18, 2011

- Kruzel, John. "Did the U.S. have a $500 billion deficit with China in 2017?".

- Smith, David (April 4, 2018). "Trump plays down US-China trade war concerns: 'When you're $500bn down you can't lose'". The Guardian. Retrieved May 28, 2018.

- Lovelace Jr., Berkeley (April 4, 2018). "Commerce Secretary Wilbur Ross: China tariffs amount to only 0.3% of US GDP". CNBC. Retrieved May 28, 2018.

- "Trump's trade war with China will be worth the fight", CNN Business, August 23, 2019

- "Section 301: US investigates allegations of forced technology transfers to China", East Asia Forum, October 3, 2017

- "The United States is finally confronting China’s economic aggression", Washington Post, March 25, 2018

- Clark, Grant (December 4, 2018). "What Is Intellectual Property, and Does China Steal It?". Bloomberg. Retrieved June 4, 2019.

- "USTR Releases Annual Reports on China's and Russia's WTO Compliance". United States Trade Representative. Retrieved June 4, 2019.

- McLaughlin, David; Strohm, Chris Strohm (November 1, 2018). "China State-Owned Company Charged With Micron Secrets Theft". Bloomberg News. Retrieved December 5, 2018.

- Ciaccia, Chris (November 29, 2018). "China is using 'economic espionage' and 'theft' to grab US technology". Fox News. Retrieved December 5, 2018.

- Segal, Adam (January 16, 2019). "China's Innovation Wall". Foreign Affairs.

- {{unbulleted list|"Strategic Tariffs Against China Are Critical Part of Trade Reform to Create More Jobs and Better Pay", AFL-CIO press release, March 22, 2018|"Trump takes aim at China's bad intellectual property practices". The Hill. August 16, 2017.|Schneider, Howard (October 10, 2017). "Some U.S. businesses urge caution in China intellectual property trade push". Washington: Reuters. Retrieved May 26, 2019.|Benner, Katie (October 10, 2018). "Chinese Officer Is Extradited to U.S. to Face Charges of Economic Espionage". The New York Times. ISSN 0362-4331. Retrieved May 31, 2019.|Sanger, David E.; Benner, Katie (December 20, 2018). "U.S. Accuses Chinese Nationals of Infiltrating Corporate and Government Technology". The New York Times. ISSN 0362-4331. Retrieved May 31, 2019.|Liedtke, Paul Wiseman and Michael. "Here are 5 cases where the U.S. says Chinese companies and workers stole American trade secrets". Chicago Tribune. Retrieved May 31, 2019.

- "Chinese stealth fighter jet may use US technology". The Guardian. January 23, 2011.|"China Hacked F-22, F-35 Stealth Jet Secrets". Washington Free Beacon. March 24, 2016.|"Chinese theft of sensitive US military technology is still a 'huge problem,' says defense analyst". CNBC. November 8, 2017.|"U.S. Charges Alleged Chinese Government Spy With Stealing U.S. Trade Secrets". NPR. October 10, 2018.|"PENTAGON: Chinese Hackers Have Stolen Data From 'Almost Every Major US Defense Contractor'". Business Insider. May 7, 2013.|"Chinese Hackers Stole U.S. Weapons System Designs". The Heritage Foundation. June 12, 2013.|"China's Mysterious Predator Clone Is Finally Out In The Open". Business Insider. November 8, 2012. }}

- "Grassley on Chinese Espionage: It's called cheating. And it's only getting worse". United States Senate. November 28, 2018.

- Grove, Andrew. "Andy Grove: How America Can Create Jobs", Bloomberg News, July 1, 2010

- "Andy Grove’s Warning to Silicon Valley", New York Times, March 26, 2016.

- Branstetter, Lee G. (June 2018). "China's Forced Technology Transfer Problem— And What to Do About It" (PDF). www.piie.com.

- "Chinese Intelligence Officers Accused of Stealing Aerospace Secrets". New York Times. October 30, 2018.

- [52][53][54][55][56][57][58][59][60][61][61]

- Oh, Sunny. "Why is the U.S. accusing China of stealing intellectual property?". MarketWatch. Retrieved June 3, 2019.

- Zhou, Yu (January 28, 2019). "U.S. trade negotiators want to end China's forced tech transfers. That could backfire". Washington Post. Retrieved June 3, 2019.

- "China to make forced technology transfer illegal to woo foreign investors". South China Morning Post. March 6, 2019. Retrieved June 1, 2019.

- "NSA Chief: Cybercrime constitutes the "greatest transfer of wealth in history"". Foreign Policy. July 9, 2012.

- Aleem, Zeeshan (August 21, 2017). "Trump's new attack on the Chinese economy, explained". Vox. Retrieved May 26, 2019.

- Blair, Dennis; Alexander, Keith. "China's Intellectual Property Theft Must Stop", The New York Times, August 15, 2017

- Pham, Sherisse (March 23, 2018). "How much has the US lost from China's intellectual property theft?". CNNMoney.

- Swanson, Ana (March 2, 2018). "Trump Calls Trade Wars 'Good' and 'Easy to Win'". NYTimes.com.

- Haberman, Maggie; Baker, Peter (August 15, 2019). "Citing Economy, Trump Says That 'You Have No Choice but to Vote for Me'". NYTimes.com.

- Analysis by Stephen Collinson and Donna Borak. "Trump's China trade war spirals as 2020 looms". CNN.

- "Trump tariffs on Chinese goods fulfill campaign promise: Peter Navarro, Fox Business, June 19, 2018

- "Peter Navarro talks trade and tariffs", CNBC, March 15, 2018

- "EU expands WTO case against Chinese technology transfers". Reuters. December 20, 2018. Retrieved June 3, 2019.

- "U.S. and China clash over 'technology transfer' at WTO". Reuters. May 29, 2018. Retrieved June 1, 2019.

- Belvedere, Matthew J. (June 27, 2018). "Larry Summers praises China's state investment in tech, saying it doesn't need to steal from US". CNBC. Retrieved June 1, 2019.

- V., Harini (December 24, 2018). "China is reportedly considering a law to crack down on forced tech transfers". CNBC. Retrieved June 1, 2019.

- Cheng, Evelyn (March 15, 2019). "China scrambled to show it'll change how it treats foreign firms — that may not be enough for Trump". CNBC. Retrieved June 1, 2019.

- Cheng, Evelyn (June 2, 2019). "'The US has backtracked': China releases official document blaming America for the trade war".

- Lawrence J. Lau, "The China–US Trade War and Future Economic Relations." China and the World (Lau Chor Tak Institute of Global Economics and Finance, 2019): 1-32. quote p. 3 online.

- Presidential Executive Order Regarding the Omnibus Report on Significant Trade Deficits, White House, 3/31/2016

- Presidential Executive Order on Establishing Enhanced Collection and Enforcement of Antidumping and Countervailing Duties and Violations of Trade and Customs Laws, White House, 3/31/2016

- Ailworth, Jacob M. Schlesinger and Erin. "U.S. Imposes New Tariffs, Ramping Up 'America First' Trade Policy". WSJ.

- "• Share of solar equipment imports United States by source country | Statista". www.statista.com.

- "U.S. slaps duties on washing machines made in China". stltoday.com.

- "Trump announces steel and aluminum tariffs Thursday over objections from advisers and Republicans". Washington Post.

- "Analysis | Winners and losers from Trump's tariffs". Washington Post.

- Diamond, Jeremy. "Trump hits China with tariffs, heightening concerns of global trade war". CNN. Retrieved March 22, 2018.

- "Trump's Rumored Tariff Plan Sparks Fears of Sino-U.S. Trade War - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "China Strikes Back With Second Tranche of Tariffs - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "Statement from President Donald J. Trump on Additional Proposed Section 301 Remedies". White House. Retrieved April 7, 2018.

- Office of the United States Trade Representative, April 2018, Under Section 301 Action, USTR Releases Proposed Tariff List on Chinese Products

- Swanson, Ana (April 3, 2018). "White House Unveils Tariffs on 1,300 Chinese Products". The New York Times. ISSN 0362-4331. Retrieved April 4, 2018.

- Biesheuvel, Thomas (April 4, 2018). "As China Fires Back in Trade War, Here Are the Winners and Losers". Bloomberg. Retrieved April 4, 2018.

- Rauhala, Emily (April 4, 2018). "China fires back at Trump with the threat of tariffs on 106 U.S. products, including soybeans". The Washington Post. ISSN 0190-8286. Retrieved April 4, 2018.

- Chang, Eunyoo (July 6, 2018). "Global Soybean Trade Suffers from the US-China Trade War". Tridge. Retrieved July 6, 2018.

- "White House sees 'short-term pain' as Trump stokes China trade war". Politico. Retrieved May 28, 2018.

- Sheetz, Michael (April 4, 2018). "Trump: 'We are not in a trade war with China, that war was lost many years ago'". CNBC. Retrieved May 28, 2018.

- "Beijing to 'Fight Back at All Costs' Against New Trump Tariffs - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "WTO Says It Has Received China Complaint Over Proposed U.S. Tariffs". k.caixinglobal.com. Retrieved August 9, 2018.

- "U.S., China Strike Trade Deal, Ending Threat of Protective Tariffs - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "US, China putting trade war on hold after progress in talks". AP News. Retrieved May 21, 2018.

- Elis, Niv (May 30, 2018). "Navarro contradicts Mnuchin's assertion that trade war with China is on hold". The Hill.

- "Trump: China agrees to buy massive amount of ag products". May 21, 2018.

- "Update: Beijing Lashes Out at U.S. for Backtracking on Tariff Cancellation - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "White House Announces Tariffs, Trade Restrictions To Be Placed On China". NPR. Retrieved May 30, 2018.

- "Stark China warning to US over trade". BBC News. June 3, 2018. Retrieved June 3, 2018.

- "Trump announces tariffs on $50 billion worth of Chinese goods". CNN. June 15, 2018. Retrieved June 15, 2018.

- "Trump imposes import taxes on Chinese goods, and warns of 'additional tariffs'". The Washington Post. June 15, 2018. Retrieved June 15, 2018.

- Wei, Han; Qi, Zhang (June 15, 2018). "Trade War Back on Stage With New U.S. Tariffs - Caixin Global". Caixin. Retrieved August 9, 2018.

- "China: 'The US has launched a trade war'". CNN. June 15, 2018. Retrieved June 16, 2018.

- "US releases $200bn list of Chinese products for possible new tariffs". RT International. Retrieved July 11, 2018.

- "Trump threatens China with new tariffs on another $200 billion of goods". CNN. June 19, 2018. Retrieved June 19, 2018.

- "China hits back after US imposes tariffs worth $34 bn". BBC. July 6, 2018. Retrieved July 6, 2018.

- "Update: Sino-U.S. Trade War Begins - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "Update: U.S. Names Products Targeted by $200 Billion in New Tariffs - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- "China Vows Retaliatory Tariffs on $60 Billion in U.S. Goods - Caixin Global". www.caixinglobal.com. Retrieved August 9, 2018.

- Swanson, Ian (August 7, 2018). "Trump to hit China with $16B in tariffs on Aug. 23". The Hill. Retrieved August 8, 2018.

- Lawder, David. "U.S. finalizes next China tariff list targeting $16 billion in imports". Reuters. Retrieved August 8, 2018.

- Martina, Michael. "U.S., China impose further tariffs, escalating trade war". Reuters. Retrieved August 23, 2018.

- Stanway, David; Xu, Muyu (August 15, 2018). "China says U.S. solar tariffs violate trade rules, lodges WTO complaint". Shanghai/Beijing: Reuters. Retrieved May 26, 2019.

- Donnan, Shawn; Jacobs, Jennifer; Niquette, Mark; Han, Miao (August 23, 2018). "US, China each impose $16 billion of fresh tariffs as talks resume". livemint.com. Retrieved November 20, 2018.

- "China initiates WTO dispute complaint against additional US tariffs on Chinese imports". Retrieved November 20, 2018.

- Chen, Yawen; Lawder, David (September 18, 2018). "China says Trump forces its hand, will retaliate against new U.S. tariffs". Reuters. Retrieved September 23, 2018.

- "China's Tariffs on the US – List 3". Asiapedia. Dezan Shira and Associates.

- "China hits back: It will impose tariffs on $60 billion worth of US goods effective Sept. 24". CNBC. September 18, 2018.

- "Economic Policy and National Security". C-SPAN. November 9, 2018.

- "White House adviser Peter Navarro calls Wall Street executives 'unregistered foreign agents' for weighing in on U.S.-China trade talks". Reuters. November 10, 2018.

- "Trump has cleared deck for China trade war by striking new Nafta deal, say analysts". Bloomberg. October 1, 2018.

- "Trump, a global loner, finds his China trade war complaints draw a crowd". Washington Post. December 14, 2018. Archived from the original on December 17, 2018.