Tyro Payments

Tyro Payments Limited is an Australian financial "fintech" institution (neobank) specialising in merchant credit, debit and EFTPOS acquiring.

Logo used from 2019 | |

Formerly | MoneySwitch Limited |

|---|---|

| Public | |

| Traded as | ASX: TYR |

| Industry | |

| Predecessor | MoneySwitch Limited |

| Founded | February 3, 2003 |

| Founders |

|

| Headquarters | , |

Area served | Australia |

Key people |

|

| Services | |

| Revenue |

|

| |

| |

| Total assets |

|

| Total equity |

|

Number of employees | 450 (2019) |

| Website | tyro |

| Footnotes / references "Tyro Annual Report 2019l" (PDF). Tyro Payments. Retrieved 19 December 2019. | |

History

Tyro was founded in 2003 by Peter Haig, Andrew Rothwell and Paul Wood as MoneySwitch Ltd. Tyro was the first new entrant into the Australian EFTPOS business since 1996.[1] It was the second company in Australia to be granted a Specialist Credit Card Institution (SCCI) licence[2] after GE Capital.

In 2015, Tyro was granted a "banking licence", ie became an "Authorised Deposit taking Institution (ADI)".[3]

Growth

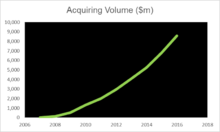

In 2012, Tyro exceeded $3.5b of card transaction volume.[4]

On 1 March 2016, Tyro completed an equity capital raising of $100,127,532.00 at a price per share of $1.0361 led by Tiger Global, TDM Asset Management, and Atlassian co-founder Mike Cannon-Brookes.[5]

In Financial Year 2016, Tyro grew to $8.6b of transaction volume, a growth of 26% compared to the prior year.[6]

In the first half of Financial Year 2017, Tyro processed $5.3b in payments, a growth rate of 23%, and generated revenue of $59m, a growth of 28%. Tyro's employee base grew by 40% to 344 people.[7]

In February 2017, Tyro announced a partnership with Afterpay.[8]

Strategy

Tyro self-describes its strategy to compete with the major banks as "nextgen banking" focusing on Small and Medium Enterprises (SMEs).[9][10][11][12]

As part of that, Tyro is lobbying for a more open data exchange in the traditional banking industry.[13]

Tyro is a regular contributor to the national discussion of financial services regulation[14][15][16] and it participates on the Prime Minister's advisory panel.[17]

On 1 April 2017, Tyro received the authority to call itself a "bank."[18]

New CEO

In October 2016, Tyro appointed Gerd Schenkel, founder of UBank and Telstra Digital as its new CEO. Gerd resigned in June 2017. In January 2018, Tyro appointed Robbie Cooke as CEO. Cooke was formerly managing director of Tatts Group [20]

Awards

Tyro has been awarded "Deloitte Technology Fast 50" in 2012, 2013, and 2014; "Deloitte Fast 500 Asia Pacific" in 2012, 2013, 2014, and 2015; "BRW Fast 100" in 2010, 2011, 2012, and 2013.[21]

In 2016 Tyro was named "43rd most innovative fintech in the world" by the KPMG H2 Fintech100 survey.[22] Also in 2016, Tyro's founders won the "2016 NSW Pearcey Tech Entrepreneur of the year" award.[23]

See also

References

- "Submission to the Financial System Inquiry" (PDF). Fsi.gov.au. Retrieved 5 December 2018.

- "Pages - List of Authorised Deposit-taking Institutions". Apra.gov.au. Retrieved 26 November 2015.

- "Archived copy". Archived from the original on 30 July 2014. Retrieved 1 November 2016.CS1 maint: archived copy as title (link)

- "Independent eftpos provider Tyro surpasses $3.5 billion in transactions". SmartCompany.com.au. 28 January 2013. Retrieved 5 December 2018.

- "Investors & Advantages Of Investing In EFTPOS". Tyro.com. Retrieved 5 December 2018.

- "Tyro Annual Report 2016" (PDF). Tyro.com. Retrieved 5 December 2018.

- "Tyro Interim Financial Results 2017" (PDF). Tyro.com. Retrieved 5 December 2018.

- "Afterpay and Tyro announce SME payments partnership". Australian Financial Review. 8 February 2017. Retrieved 5 December 2018.

- Mitchell, James; Mitchell, James (16 May 2016). "Big four could become big three: Tyro Payments". Investordaily.com.au. Retrieved 5 December 2018.

- Shapiro, Shaun Drummond, Jonathan (30 November 2015). "Tyro's Jost Stollman wants to beat the big banks at small lending". The Sydney Morning Herald. Retrieved 5 December 2018.

- "Archived copy". Archived from the original on 4 November 2016. Retrieved 1 November 2016.CS1 maint: archived copy as title (link)

- "Fintech specialists say 'NextGen banking' may replace Big Four". Cio.com.au. Retrieved 5 December 2018.

- "Tyros New Boss Gerd Schenkel Says Fintech Revolution Mostly Hype". Myaccount.news.com.au. Retrieved 5 December 2018.

- "Payments and Infrastructure : Standards for Card Payments" (PDF). Rba.gov.au. Retrieved 5 December 2018.

- "Payments and Infrastructure : Past Regulatory Reviews" (PDF). Rba.gov.au. Retrieved 5 December 2018.

- "Payments and Infrastructure : Review of Card Payments Regulation" (PDF). Rba.gov.au. Retrieved 5 December 2018.

- "Turnbull Launches Fintech Expert Advisory Committee". Myaccount.news.com.au. Retrieved 5 December 2018.

- "Tyro". Facebook.com. Retrieved 5 December 2018.

- Yoo, Tony (22 February 2017). "Tyro now lets customers make payments with voice commands via Apple Siri". Business Insider Australia. Retrieved 5 December 2018.

- "Tatts' Robbie Cooke to join new bank Tyro". Australian Financial Review. 22 January 2018. Retrieved 5 December 2018.

- "Our Story In Credit Card Payment Processing". Tyro.com. Retrieved 5 December 2018.

- "Archived copy". Archived from the original on 29 October 2016. Retrieved 28 October 2016.CS1 maint: archived copy as title (link)

- "2018 NSW Tech Entrepreneur of the Year Award » Pearcey". Pearcey.org.au. Retrieved 5 December 2018.