Prospect theory

The prospect theory is an economics theory developed by Daniel Kahneman and Amos Tversky in 1979.[1] It challenges the expected utility theory, developed by John von Neumann and Oskar Morgenstern in 1944, and earned Daniel Kahneman the Nobel Memorial Prize in Economics in 2002. It is the founding theory of behavioral economics and of behavioral finance, and constitutes one of the first economic theories built using experimental methods.

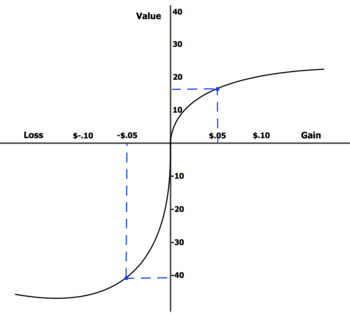

Based on results from controlled studies, it describes how individuals assess in an asymmetric manner their loss and gain perspectives. For example, for some individuals, the pain from losing $1,000 could only be compensated by the pleasure of earning $2,000. Thus, contrary to the expected utility theory, which models the decision that perfectly rational agents would make, the prospect theory aims to describe the actual behavior of people.

In the original formulation of the theory, the term prospect referred to the predictable results of a lottery. However, the prospect theory can also be applied to the prediction of other forms of behaviors and decisions.

Overview

The prospect theory starts with the concept of loss aversion, an asymmetric form of risk aversion, from the observation that people react differently between potential losses and potential gains. Thus, people make decisions based on the potential gain or losses relative to their specific situation (the reference point) rather than in absolute terms; this is referred to as reference dependence.

- Faced with a risky choice leading to gains, individuals are risk-averse, preferring solutions that lead to a lower expected utility but with a higher certainty (concave value function).

- Faced with a risky choice leading to losses, individuals are risk-seeking, preferring solutions that lead to a lower expected utility as long as it has the potential to avoid losses (convex value function).

These two examples are thus in contradiction with the expected utility theory, which only considers choices with the maximum utility.

The theory continues with a second concept, based on the observation that people attribute excessive weight to events with low probabilities and insufficient weight to events with high probability. For example, individuals may unconsciously treat an outcome with a probability of 99% as if its probability was 95%, and an outcome with probability of 1% as if it had a probability of 5%. Under- and over-weighting of probabilities is importantly distinct from under- and over-estimating probabilities, a different type of cognitive bias observed for example in the overconfidence effect.

Model

The theory describes the decision processes in two stages:[2]

- During an initial phase termed editing, outcomes of a decision are ordered according to a certain heuristic. In particular, people decide which outcomes they consider equivalent, set a reference point and then consider lesser outcomes as losses and greater ones as gains. The editing phase aims to alleviate any framing effects.[3] It also aims to resolve isolation effects stemming from individuals' propensity to often isolate consecutive probabilities instead of treating them together. The editing process can be viewed as composed of coding, combination, segregation, cancellation, simplification and detection of dominance.

- In the subsequent evaluation phase, people behave as if they would compute a value (utility), based on the potential outcomes and their respective probabilities, and then choose the alternative having a higher utility.

The formula that Kahneman and Tversky assume for the evaluation phase is (in its simplest form) given by:

where is the overall or expected utility of the outcomes to the individual making the decision, are the potential outcomes and their respective probabilities and is a function that assigns a value to an outcome. The value function that passes through the reference point is s-shaped and asymmetrical. Losses hurt more than gains feel good (loss aversion). This differs from expected utility theory, in which a rational agent is indifferent to the reference point. In expected utility theory, the individual does not care how the outcome of losses and gains are framed. The function is a probability weighting function and captures the idea that people tend to overreact to small probability events, but underreact to large probabilities. Let denote a prospect with outcome with probability and outcome with probability and nothing with probability . If is a regular prospect (i.e., either , or , or ), then:

However if and either or , then:

It can be deduced from the first equation that and . The value function is thus defined on deviations from the reference point, generally concave for gains and commonly convex for losses and steeper for losses than for gains. If is equivalent to then is not preferred to , but from the first equation it follows that , which leads to , therefore:

This means that for a fixed ratio of probabilities the decision weights are closer to unity when probabilities are low than when they are high. In prospect theory, is never linear. In the case that , and prospect dominates prospect , which means that , therefore:

As , , but since , it would imply that must be linear, however dominated alternatives are brought to the evaluation phase since they are eliminated in the editing phase. Although direct violations of dominance never happen in prospect theory, it is possible that a prospect A dominates B, B dominates C but C dominates A.

Example

To see how prospect theory can be applied, consider the decision to buy insurance. Assume the probability of the insured risk is 1%, the potential loss is $1,000 and the premium is $15. If we apply prospect theory, we first need to set a reference point. This could be the current wealth or the worst case (losing $1,000). If we set the frame to the current wealth, the decision would be to either

1. Pay $15 for sure, which yields a prospect-utility of ,

OR

2. Enter a lottery with possible outcomes of $0 (probability 99%) or −$1,000 (probability 1%), which yields a prospect-utility of .

According to prospect theory,

- , because low probabilities are usually overweighted;

- , by the convexity of value function in losses.

The comparison between and is not immediately evident. However, for typical value and weighting functions, , and hence . That is, a strong overweighting of small probabilities is likely to undo the effect of the convexity of in losses, making the insurance attractive.

If we set the frame to -$1,000, we have a choice between and . In this case, the concavity of the value function in gains and the underweighting of high probabilities can also lead to a preference for buying the insurance.

The interplay of overweighting of small probabilities and concavity-convexity of the value function leads to the so-called fourfold pattern of risk attitudes: risk-averse behavior when gains have moderate probabilities or losses have small probabilities; risk-seeking behavior when losses have moderate probabilities or gains have small probabilities.

Below is an example of the fourfold pattern of risk attitudes. The first item in each quadrant shows an example prospect (e.g. 95% chance to win $10,000 is high probability and a gain). The second item in the quadrant shows the focal emotion that the prospect is likely to evoke. The third item indicates how most people would behave given each of the prospects (either Risk Averse or Risk Seeking). The fourth item states expected attitudes of a potential defendant and plaintiff in discussions of settling a civil suit.[4]

| Example | Gains | Losses |

|---|---|---|

| High probability (certainty effect) | 95% chance to win $10,000 or 100% chance to obtain $9,499. So, 95% × $10,000 = $9,500 > $9,499. Fear of disappointment. Risk averse. Accept unfavorable settlement of 100% chance to obtain $9,499 | 95% chance to lose $10,000 or 100% chance to lose $9,499. So, 95% × −$10,000 = −$9,500 < −$9,499. Hope to avoid loss. Risk seeking. Rejects favorable settlement, chooses 95% chance to lose $10,000 |

| Low probability (possibility effect) | 5% chance to win $10,000 or 100% chance to obtain $501. So, 5% × $10,000 = $500 < $501. Hope of large gain. Risk seeking. Rejects favorable settlement, chooses 5% chance to win $10,000 | 5% chance to lose $10,000 or 100% chance to lose $501. So, 5% × −$10,000 = −$500 > −$501. Fear of large loss. Risk averse. Accept unfavorable settlement of 100% chance to lose $501 |

Probability distortion is that people generally do not look at the value of probability uniformly between 0 and 1. Lower probability is said to be over-weighted (that is a person is over concerned with the outcome of the probability) while medium to high probability is under-weighted (that is a person is not concerned enough with the outcome of the probability). The exact point in which probability goes from over-weighted to under-weighted is arbitrary, however a good point to consider is probability = 0.33. A person values probability = 0.01 much more than the value of probability = 0 (probability = 0.01 is said to be over-weighted). However, a person has about the same value for probability = 0.4 and probability = 0.5. Also, the value of probability = 0.99 is much less than the value of probability = 1, a sure thing (probability = 0.99 is under-weighted). A little more in depth when looking at probability distortion is that π(p) + π(1 − p) < 1 (where π(p) is probability in prospect theory).[5]

Applications

Economics

Some behaviors observed in economics, like the disposition effect or the reversing of risk aversion/risk seeking in case of gains or losses (termed the reflection effect), can also be explained by referring to the prospect theory.

An important implication of prospect theory is that the way economic agents subjectively frame an outcome or transaction in their mind affects the utility they expect or receive. Narrow framing is a derivative result which has been documented in experimental settings by Tversky and Kahneman,[6] whereby people evaluate new gambles in isolation, ignoring other relevant risks. This phenomenon can be seen in practice in the reaction of people to stock market fluctuations in comparison with other aspects of their overall wealth; people are more sensitive to spikes in the stock market as opposed to their labor income or the housing market.[7] It has also been shown that narrow framing causes loss aversion among stock market investors.[8] And their work, that of Tversky and Kahneman, is largerly responsible for the advent of behavioral economics, and is used extensively in mental accounting.[9]

Software

The digital age has brought the implementation of prospect theory in software. Framing and prospect theory has been applied to a diverse range of situations which appear inconsistent with standard economic rationality: the equity premium puzzle, the excess returns puzzle and long swings/PPP puzzle of exchange rates through the endogenous prospect theory of Imperfect Knowledge Economics, the status quo bias, various gambling and betting puzzles, intertemporal consumption, and the endowment effect. It has also been argued that prospect theory can explain several empirical regularities observed in the context of auctions (such as secret reserve prices) which are difficult to reconcile with standard economic theory.[10]

Politics

Given the necessary degree of uncertainty for which prospect theory is applied, it should came as no surprise that it and other psychological models are applied extensively in the context of political decision-making.[11] Both rational choice and game theoretical models generate significant predictive power in the analysis of international relations (IR). But prospect theory, unlike the alternative models, (1) is "founded on empirical data", (2) allows and accounts for dynamic change, (3) addresses previously-ignored modular elements, (4) emphasizes the situation in the decision-making process, (5) "provides a micro-foundational basis for the explanation of larger phenomena", and (6) stresses the importance of loss in utility and value calculations.[12] Moreover, again unlike other models, prospect theory "asks different sorts of questions, seeks different evidence, and reaches different conclusions."[12] There exist, however, shortcomings inherent in prospect theory's political application, such as the dilemma regarding an actor's perceived position on the gain-loss domain spectrum, and the dissonance between ideological and pragmatic (i.e. 'in the lab' versus 'in the field') assessments of an actor's propensity towards seeking or avoiding risk.[13]

That said, prospect theory is still used and foremost employed by IR theorists today, on predominantly security-related matters.[13] For example, in war-time, policy-makers, when in a perceived domain of loss, are more likely to take risks that would otherwise have been avoided, e.g. "gambling on a risky rescue mission", or implementing radical domestic reform to support military efforts.[13] Or, with regards to domestic governance, politicians are more likely to cast a radical economic policy as ensuring 90% employment rather than 10%, because framing it as the former puts the citizenry in a "domain of gain," which is thereby conducive to greater populace satisfaction.[13] On a broader scale: Consider an administration debating the implementation of a controversial reform, and that such an implementation yields a small chance for a widespread revolt. "[T]he disutility induced by loss aversion," even with minute probabilities of this insurrection, will dissuade the government from moving forward with the reform.[11]

Limits and extensions

The original version of prospect theory gave rise to violations of first-order stochastic dominance. That is, prospect A might be preferred to prospect B even if the probability of receiving a value x or greater is at least as high under prospect B as it is under prospect A for all values of x, and is greater for some value of x. Later theoretical improvements overcame this problem, but at the cost of introducing intransitivity in preferences. A revised version, called cumulative prospect theory overcame this problem by using a probability weighting function derived from rank-dependent expected utility theory. Cumulative prospect theory can also be used for infinitely many or even continuous outcomes (for example, if the outcome can be any real number). An alternative solution to overcome these problems within the framework of (classical) prospect theory has been suggested as well.[14]

Critics from the field of psychology argued that even if Prospect Theory arose as a descriptive model, it offers no psychological explanations for the processes stated in it.[15] Furthermore, factors that are equally important to decision making processes have not been included in the model, such as emotion.[16]

A relatively simple ad hoc decision strategy, the priority heuristic, has been suggested as an alternative model. While it can predict the majority choice in all (one-stage) gambles in Kahneman and Tversky (1979), and predicts the majority choice better than cumulative prospect theory across four different data sets with a total of 260 problems,[17] this heuristic, however, fails to predict many simple decision situations that are typically not tested in experiments and it also does not explain heterogeneity between subjects.[18]

An international survey in 53 countries, published in Theory and Decision in 2017 confirmed that prospect theory describes decisions on lotteries well, not only in Western countries, but across many different cultures.[19] The study also found cultural and economic factors influencing systematically average prospect theory parameters.

A study published in Nature Human Behaviour in 2020 replicated research on prospect theory and concluded that it successfully replicated: "We conclude that the empirical foundations for prospect theory replicate beyond any reasonable thresholds."[20]

See also

Notes

- Shafir & LeBoeuf 2002.

-

- Kahneman, Daniel; Tversky, Amos (1979). "Prospect Theory: An Analysis of Decision under Risk" (PDF). Econometrica. 47 (2): 263–291. CiteSeerX 10.1.1.407.1910. doi:10.2307/1914185. ISSN 0012-9682. JSTOR 1914185.CS1 maint: ref=harv (link)

- Tversky & Kahneman 1986.

- Kahneman 2011, p. 317.

- Baron 2006, pp. 264–266.

- Tversky, Amos; Kahneman, Daniel (1986). "Rational Choice and the Framing of Decisions*". The Journal of Business. 59 (4): 251–278. CiteSeerX 10.1.1.463.1334. doi:10.1007/978-3-642-74919-3_4.

- Barberis, Nicholas; Heung, Ming; Thaler, Richard H. (2006). "Individual preferences, monetary gambles, and stock market participation: a case for narrow framing". American Economic Review. 96 (4): 1069–1090. CiteSeerX 10.1.1.212.4458. doi:10.1257/aer.96.4.1069.

- Benartzi, Shlomo; Thaler, Richard (1995). "Myopic loss aversion and the Equity Premium Puzzle". The Quarterly Journal of Economics. 110 (1): 453–458. CiteSeerX 10.1.1.353.2566. doi:10.2307/2118511. JSTOR 2118511.

- Pesendorfer, Wolfgang. 2006. "Behavioral Economics Comes of Age: A Review Essay on Advances in Behavioral Economics." Journal of Economic Literature, 44 (3): 712-721.

- Rosenkranz, Stephanie; Schmitz, Patrick W. (2007). "Reserve Prices in Auctions as Reference Points". The Economic Journal. 117 (520): 637–653. doi:10.1111/j.1468-0297.2007.02044.x. hdl:1874/14990. ISSN 1468-0297.

- Vieider, Ferdinand M.; Vis, Barbara (June 25, 2019). "Prospect Theory and Political Decision Making". Oxford Research Encyclopedia of Politics. doi:10.1093/acrefore/9780190228637.001.0001/acrefore-9780190228637-e-979. Retrieved June 21, 2020.

- McDermott, Rose (April 2004). "Prospect Theory in Political Science: Gains and Losses from the First Decade". Political Psychology. 25: 289–312 – via JSTOR.

- Mercer, Jonathan (June 15, 2005). "PROSPECT THEORY AND POLITICAL SCIENCE". Annual Review of Political Science. 8 (1): 1–21. doi:10.1146/annurev.polisci.8.082103.104911. ISSN 1094-2939.

- Rieger, M. & Wang, M. (2008). Prospect Theory for continuous distributions. Journal of Risk and Uncertainty, 36, 1, 83–102.

- Staddon, John (2017) Scientific Method: How science works, fails to work or pretends to work. Taylor and Francis.

- Newell, Benjamin, R.; Lagnado, David, A.; Shanks, David, R. (2007). Straight choices: The psychology of decision making. New York: Psychology Press. ISBN 978-1841695891.

- Brandstätter, E., Gigerenzer, G., & Hertwig, R. (2006). The priority heuristic: Making choices without trade-offs. Psychological Review, 113, 409–432.

- Rieger, M. & Wang, M. (2008). What is behind the Priority Heuristic? – A mathematical analysis and comment on Brandstätter, Gigerenzer and Hertwig. Psychological Review, 115, 1, 274–280.

- Rieger, M. O., Wang, M., & Hens, T. (2017). Estimating cumulative prospect theory parameters from an international survey. Theory and Decision, 82(4), 567-596.

- Ruggeri, Kai; Alí, Sonia; Berge, Mari Louise; Bertoldo, Giulia; Bjørndal, Ludvig D.; Cortijos-Bernabeu, Anna; Davison, Clair; Demić, Emir; Esteban-Serna, Celia; Friedemann, Maja; Gibson, Shannon P. (2020). "Replicating patterns of prospect theory for decision under risk". Nature Human Behaviour: 1–12. doi:10.1038/s41562-020-0886-x. ISSN 2397-3374.

Further reading

- Easterlin, Richard A. "Does Economic Growth Improve the Human Lot?", in Abramovitz, Moses; David, Paul A.; Reder, Melvin Warren (1974). Nations and Households in Economic Growth: Essays in Honor of Moses Abramovitz. Academic Press. ISBN 978-0-12-205050-3. Retrieved March 10, 2016.

- Frank, Robert H. (1997). "The frame of reference as a public good". The Economic Journal. 107 (445): 1832–1847. CiteSeerX 10.1.1.205.3040. doi:10.1111/j.1468-0297.1997.tb00086.x. ISSN 0013-0133.CS1 maint: ref=harv (link)

- Kahneman, Daniel (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux. ISBN 978-1-4299-6935-2. Retrieved March 10, 2016.CS1 maint: ref=harv (link)

- Kahneman, Daniel; Tversky, Amos (1979). "Prospect Theory: An Analysis of Decision under Risk" (PDF). Econometrica. 47 (2): 263–291. CiteSeerX 10.1.1.407.1910. doi:10.2307/1914185. ISSN 0012-9682. JSTOR 1914185.CS1 maint: ref=harv (link)

- Tversky, Amos; Kahneman, Daniel (1992). "Advances in prospect theory: Cumulative representation of uncertainty". Journal of Risk and Uncertainty. 5 (4): 297–323. CiteSeerX 10.1.1.320.8769. doi:10.1007/BF00122574. ISSN 0895-5646.CS1 maint: ref=harv (link)

- Lynn, John A. (1999). The Wars of Louis XIV 1667-1714. Routledge. ISBN 9780582056299. Retrieved March 10, 2016.

- McDermott, Rose; Fowler, James H.; Smirnov, Oleg (2008). "On the Evolutionary Origin of Prospect Theory Preferences". The Journal of Politics. 70 (2): 335–350. doi:10.1017/S0022381608080341. ISSN 0022-3816.CS1 maint: ref=harv (link)

- Post, Thierry; van den Assem, Martijn J; Baltussen, Guido; Thaler, Richard H (2008). "Deal or No Deal? Decision Making under Risk in a Large-Payoff Game Show". American Economic Review. 98 (1): 38–71. doi:10.1257/aer.98.1.38. ISSN 0002-8282.CS1 maint: ref=harv (link)

- Baron, Jonathan (2006). Thinking and Deciding (4th ed.). Cambridge University Press. ISBN 978-1-139-46602-8. Retrieved March 10, 2016.CS1 maint: ref=harv (link)

- Tversky, Amos; Kahneman, Daniel (1986). "Rational Choice and the Framing of Decisions" (PDF). The Journal of Business. 59 (S4): S251. CiteSeerX 10.1.1.463.1334. doi:10.1086/296365.CS1 maint: ref=harv (link)

- Shafir, Eldar; LeBoeuf, Robyn A. (2002). "Rationality". Annual Review of Psychology. 53 (1): 491–517. doi:10.1146/annurev.psych.53.100901.135213. ISSN 0066-4308. PMID 11752494.CS1 maint: ref=harv (link)

- Dacey, Raymond; Zielonka, Piotr (2013). "High volatility eliminates the disposition effect in a market crisis". Decyzje. 10 (20): 5–20. doi:10.7206/DEC.1733-0092.9.