Foreign exchange controls

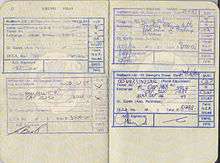

Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country.

| Foreign exchange |

|---|

| Exchange rates |

|

| Markets |

| Assets |

| Historical agreements |

|

| See also |

Common foreign exchange controls include:

- banning the use of foreign currency within the country

- banning locals from possessing foreign currency

- restricting currency exchange to government-approved exchangers

- fixed exchange rates

- restricting the amount of currency that may be imported or exported

Today, countries with foreign exchange controls are known as "Article 14 countries", after the provision in the International Monetary Fund's Articles of Agreement, which allows exchange controls only for "transitional economies".

Foreign exchange controls used to be common in most countries. For example, many western European countries implemented exchange controls in the years immediately following World War II. The measures were gradually phased out, however, as the post-war economies on the continent steadily strengthened; the United Kingdom, for example, removed the last of its restrictions in October 1979. By the 1990s, there was a trend toward free trade and globalization and economic liberalization.

Often, foreign exchange controls can result in the creation of black markets in currencies. This leads to a situation where the actual demand for foreign currency is greater than that which is available on the official market. As such, it is unclear whether governments have the ability to enact effective exchange controls.[1]

Countries with current foreign exchange controls

Countries that formerly had exchange controls

- Argentina - between 2011 and 2015

- Egypt - until 1995

- Finland - until 1990

- Israel - until 1994

- Republic of China - until 1987

- United Kingdom - until 1979[11]

In France, exchange controls started after the First World War. It then reappeared between 1939 and 1967. After a very short interruption, exchange controls were restored in 1968, relaxed in 1984, and finally abolished in 1989.[12]

See also

- Currency transaction tax

- Financial transaction tax

- Spahn tax

- Sterling Area

- Tobin tax

References

- "The Use of Foreign Exchange Controls to Promote Economical Stability". earnforex.com. Retrieved 8 July 2013.

- "Argentina Tightens Currency Controls After Fernandez Victory". 2019-10-28. Retrieved 2019-12-13.

- "The Central Bank of The Bahamas". Centralbankbahamas.com. Retrieved 2013-06-14.

- "Individual Provisions of Foreign Exchange Legislation". 15 June 2015. Retrieved 11 June 2019.

- https://www.export.gov/article?id=China-Foreign-Exchange-Controls

- https://www.ft.com/content/b69166fa-ee01-11e7-b220-857e26d1aca4

- "Exchange Control Frequently Asked Questions". Retrieved 18 April 2018.

- "Foreign Investment Laws and Regulations in Nepal". 27 September 2012. Retrieved 5 May 2015.

- "Exchange Control Legislation". 27 September 2012. Retrieved 25 March 2017.

- Annual Report on Exchange Arrangements and Exchange Restrictions 1979 - International Monetary Fund - Google Books. Books.google.com. 2000-02-29. ISBN 9781557758989. Retrieved 2013-06-14.

- UK Exchange Controls end, New York Times, 24 October 1979 Retrieved 26 September 2018

- La politique de change de la France des années 1980 Archived 2011-10-11 at the Wayback Machine, sur aesplus.net (consulté le 1er mai 2011)