Christen Ager-Hanssen

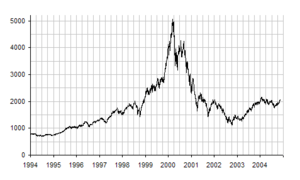

Christen Eugen Ager-Hanssen (born July 29, 1962) is a Norwegian Internet Entrepreneur & Venture Capitalist and since late 90s based in London according to the press.[1][2][3][4][5] He is a highly controversial Venture Capital & Private Equity professional. Ager-Hanssen has been involved in several high-profile M&A deals and has a special taste for public hostile takeovers.[2][3][6][7] In a cover story in Canadian Business, Canada's leading Business Magazine, Ager-Hanssen was described as Gordon Gekko and a modern-day Viking. «In an age of 37, Ager-Hanssen rose from obscurity to become Norway's richest son, worth more than $2.5 billion in early 2000».[2][3][6][7][8]

Christen Ager-Hanssen | |

|---|---|

| |

| Born | July 29, 1962 |

| Nationality | Norwegian |

| Occupation | Venture Capitalist & Entrepreneur |

Ager-Hanssen is also known for his insight on the Internet Industry and pioneering work in the movement to commercialize the Internet in the first and second part of the 1990s, including early experiments with search engines for the internet, Internet Infrastructure such as early experiments on Satellite Internet access, legal music distribution on Internet¢¢, Internet as the new desktop, Banking and financial services offered on the Internet, e-mail advertising, contributions to the development of the banner ad, practical applications of pay-per-click advertising.[2][3][6][7] Ager-Hanssen is a Venture Capitalist investing in potential unicorns and media companies through his investment vehicle Custos. He is the owner of the biggest newspaper in Sweden, Metro [4][9][10][11][12]

Early life

Christen Ager-Hanssen was born in Halden, Norway. He is son of Norwegian Industrialist and nuclear physicist Henrik Ager-Hanssen (1930-2004) and politician Bjørg Ager-Hanssen. He grew up in Halden, Oslo and Stavanger and later moved to Sweden where he started working for IBM and Kinnevik in Stockholm.[2][5][6][7]

Business career

In the early 1980s Ager-Hanssen was employed by different blue chip computer technology companies such as Burroughs, Digital Equipment Corporation and IBM. Later in the beginning of the 90´s, Ager-Hanssen became a recognized speaker in the field of Business Process Reengineering and Legacy Information Systems impact on organisations and society.[2][5][6]

Investment AB Kinnevik

Ager-Hanssen is a former Investment AB Kinnevik Group Executive and recognized as an Internet commercialization pioneer.[2][7][13] Investment AB Kinnevik is an Investment Company with over 75 years of entrepreneurship and Group companies had a combined market capitalization of SEK 175bn in November 2012[14]

Within the Kinnevik Group he was also active as a Senior Executive in Tele2 AB and its international expansion. Ager-Hanssen founded several Internet startup together with Investment AB Kinnevik including Netsys Technology Group, Webware and Polarsearch, one of the first search engines in Scandinavia.[2] Ager-Hanssen is one among the dozen people within Kinnevik Group mentioned in the press that later become entrepreneurs in their own capacity.[6][7][15]

Stock trader

Ager-Hanssen has been a very active and profiled stock trader/investor on the Swedish stock exchange with investment in many blue chip companies. In 1999, Dagens Industri described him as a stock trader who made huge profits from being a brilliant stock trader rather than making profit from his own investment portfolio. His investment portfolio was at the time valued at SEK 1.7 Billion.[2][5]

Venture Capital

Joint Venture with the National Pension Fund of Sweden

In early 1998 Ager-Hanssen made a bid for NetSys Technology Group including Webware and Polarsearch together with the National Pension Fund of Sweden. The bid was successful and ended up with Ager-Hanssen controlling 60% of the company through a new established Joint Venture with the National Pension Fund of Sweden. Kinnevik and other shareholders made a successful exit.[2][16] In June 1998 Ager-Hanssen made a successful hostile cash bid on the publicly traded company Verimation AB. The bid was MSEK 120 and Ager-Hanssen thereafter delisted the company and integrated the business into the Joint Venture with the Pension Fund. Verimation had developed one of the first email systems in the world branded as Memo.[2][3] Memo had at the time approximately 2.5 million end user client and was well established among Fortune 500 companies.Later the same year NetSys Technology Group was valued to more than MUSD 388.[3]

Early 2000, just before the Dot-com Bubble burst, Ager-Hanssen choose to divest his shares in the Joint Venture with the Pension Fund. The profit from the divestment was used to fuel his investment activities. The National Pension Fund was not so lucky with the timing and lost more than MSEK 350 on the investment in the Joint Venture. Their lack of competence was criticised lengthily in the Swedish press and the Fund tried to escape the spotlight by blaming Ager-Hanssen. The story was front page news in all major Swedish Newspaper[17] Later the same year NetSys Technology Group was valued to more than MUSD 388.[3]

Cognition

Late 1998, Ager-Hanssen founded a Venture Capital company called Cognition where he organised most of his internet related Investment.[2][5][6] He employed several high profile individuals among others Ulf Sundqvist,[6] former trade minister in Finland and Mrs Gillian Nott a former Financial Service Authority director. As non-executive chairman he appointed Ron Sandler who was the former Lloyd's of London chief executive and also a former NatWest executive.[6] and Gillian Nott a former Financial Service Authority director. Sandler commented on the appointment in Financial Times

"When I went to NatWest six months ago, the world looked like a certain world. Now it has changed substantially," he said. "In contrast to companies like Cognition, old financial services megaliths appear very slow moving and quite bureaucratic."[18]

Cognition was valued by HSBC in beginning of 2000 to approximately 1 Billion GBP and planned for an Initial public offering (IPO) on London Stock Exchange. The company never floated because of the Dot-com bubble.[6][18]

Conflict Management

According to The Telegraph Ager-Hanssen runs a Conflict Management business for eccentric billionaires[4]

Custos

Custos is an Investment Firm controlled by Ager-Hanssen[4]

Investments

Media Industry

Metro Media House

Ager-Hanssen´s Investment Company Custos acquired Metro (Swedish newspaper) from Investment AB Kinnevik in February 2017.[24] Swedish Metro was the original disrupter in the media Industry and The world’s first free newspaper launched as early as 1995. Metro is today the biggest newspaper in Sweden and the company have interests in music, fashion, recruitment, health, E-sport and loyalty programs. At the time of the acquisition, Ager-Hanssen was quoted "All of Metro’s business culture is based on surprising the market and doing business that shake up the industry, this fits perfectly with our ambitions in the media sector"[25][26][27][28][29][30]

Johnston Press Plc

In August 2017[31] it was reported that Ager-Hanssen whose private equity firm Custos Group owns the Metro freesheet in Sweden (Swedens biggest newspaper) had acquired a strategic stake in the 250-year-old publisher Johnston Press plc with the plans to use their digital assets in the same way as Metro, bartering exposure online for equity in start-ups.

Johnston Press plc owns titles such as i (The i Newspaper is a National Newspaper in United Kingdom. It represent 20% of the quality news in the country.), The Yorkshire Post and The Scotsman.Johnston Press is a leading multimedia business in UK with news brands that reach national, regional and local audiences. The Group have a portfolio of hundreds of publications and websites. Ager-Hanssen revealed his plan to use Johnston Press audience of more than 32million people to help kickstart new ventures.[9][10][11][12][32][33] In October 2017 it was reported that activist investor Ager-Hanssen had become the biggest shareholder in Johnston Press plc and that he planned to oust the board and the CEO.[34] Alex Salmond former first minister in Scotland was according to the press lined up[35] to become chairman of Johnston Press in an audacious plan to shake up its board. Ager-Hanssen demanded new management, more investment in journalism and a revamped digital strategy.[36]

Dead hand proxy

The attempted boardroom coup at Johnston Press was thwarted by a controversial “poison pill” defence. Ager-Hanssen branded Johnston Press’s dead hand proxy put “a grotesque abuse of fiduciary duty”. Johnston Press is believed to be the first example of an activist coming up against such a poison pill in the UK. Ager-Hanssen commented on the poison pill in The Telegraph: The poison pill cynically deprives shareholders of their fundamental right to change the board as they see fit. That power has been stolen from them. This is nothing short of corporate theft of power in which only the directors can decide who replaces them. The board seeks to play shareholder and bondholder interests off of one another in the hope that the balance of power can remain in the hands of a few cozy fat cats.[37][38][39][40][41] In the beginning of May 2018 the CEO of Johnston Press, Ashley Highfield stepped down and Ager-Hanssen declared that he now would increase his stake in the 250-year-old publisher.[42][43][44][45][46][47]

Airline and leisure industry

In 2005 Ager-Hanssen and Porter invested together in the airline and travel industry. They acquired among others a controlling stake in the close to bankrupt publicly listed company FlyMe Europe AB (FLY-B.SK). FlyMe Europe was a low-cost carrier based in Gothenburg with an aim to become one of the leading low-cost carriers in Europe.[48][49][50][51][52]

FlyMe Europe

Ager-Hanssen and Porters first step in achieving their goal to become a leading low-cost carrier in Europe was to convince the owner of the biggest Danish carrier Sterling European Airlines A/S and Maersk Air, Icelandic Billionaire Palmi Haraldsson, to join their plan. Haraldsson agreed and acquired a strategic holding in FlyMe Europe. Haraldsson had already invested MDKK 500 in Sterling European Airlines and an undisclosed amount in Maersk Air and Iceland Express and saw an opportunity in bringing it all together in a listed holding company such as FlyMe Europe. Having together secured a majority stake and voting control in FlyMe they changed the board and raised MSEK 272 to fuel FlyMe Europe's international expansion and to position the company for the consolidation in the Airline Industry.[51][52][53][54]

Low-cost Carrier Consolidation

In late 2005, Haraldsson accepted an offer from FL Group ehf to divest his holding in Sterling Airlines(the merged entity of Sterling European Airlines and Maersk) for DKK 1.5 Billion. FL Group, led by Hannes Smárason,had at the time a 16% strategic holding in the second largest low-cost carrier in Europe, EasyJet as well as holdings in American Airlines.[52][55][56]

_05.jpg)

Ager-Hanssen and Haraldsson continued the consolidation discussion with FL Group's CEO, Smárason and FL Group's majority owner Baugur represented by Icelandic Billionaire Jón Ásgeir Jóhannesson. The plan was according to the press for Sterling Airlines to do a so-called reverse takeover based on a valuation on Sterling Airlines A/S of DKK 2.0 Billion.[57][58][59] After a short pre due diligence of Sterling in June/July 2006 the board of FlyMe and Ager-Hanssen decided not to proceed with the acquisitions of Sterling.[55][56]

The decision not to acquire Sterling disturbed Haraldsson and Smárason's take-over plan and they got very upset. The decision not to acquire Sterling made it impossible for Ager-Hanssen/Porter to continue a business relationship with Haraldsson and in September 2006 they acquired Haraldsson's shares in FlyMe Europe. This led to a battle between the airlines with no winners. The battle was described in detail in the press.[59] [60][61][62] [63][64][65]

Both airlines later went bankrupt because the owners would not support the companies with additional capital.

Global Supply Systems

Ager-Hanssen and Porter also had a controlling stake in the English-based freight operator Global Supply Systems (GSS).[52] GSS was launched in 2001 as a British all-cargo carrier whose principal business was providing aircraft on long-term leases to other airlines on an ACMI (Aircraft, Crew, Maintenance, Insurance) basis. Global Supply Systems was joint venture with Atlas Air Worldwide. Atlas air is operating the world's largest fleet of modern Boeing 747 all-cargo aircraft and was a 49% partner in GSS. In 2007 Porter and Ager-Hanssen's GSS signed a 5-year contract with British Airways (BA) which at the time was described as the largest-ever freighter investment made by BA with total operating costs of over $1 billion. Porter and Ager-Hanssen controlled 51% of GSS through Riverdon Ltd.[66][67]

In 2007, FlyMe acquired a strategic minority stake in GSS with the plan to become the first airline in the world to produce low cost long haul flights from Scandinavia to US and Thailand.[67] Global Supply System was divested in 2009.

Ticket

Ager-Hanssen and Porter continued to invest in the Leisure industry and acquired a strategic stake in one of the leading Scandinavian travel agencies and the publicly listed company Ticket and changed the board through an hostile takeover.[52][68] Ticket was divested in 2008.

Telecom & Technology Industry

Ager-Hanssen has had several investment's in the Telecom Industry. Among the more well known is his early investment in Glocalnet, which is today owned by Telenor Ager-Hanssen's Cognition invested MSEK 80 together with Brummer & Partner and Nomura. Main part of the placement, MSEK 50 out of MSEK 80 was done by Ager-Hanssen.[69][70] Later Ager-Hanssen sold his share in Glocalnet to Inter-Ikea.[71]

Other Telecom Investments held by Ager-Hanssen were among others Utfors, a broadband operator today also owned by Telenor, and investments in Tele2 as well as Millicom.

Oil Industry - Upstream and Downstream

Ager-Hanssen invested in 2005 together with his business partner John Robert Porter in Nordic Oil. Nordic Oil was chaired by the founder and former CEO of Statoil, Arve Johnsen. The company aimed to expand both upstream and downstream.[72] Some of the asset of the company included 105 gas stations in Sweden branded Pump and a lubricant retail business in Scandinavia . In 2006 Nordic Oil signed a deal with the Hinduja Group to re-establish the Gulf brand to the Scandinavian Market with a plan to rebrand all of its gas station.[73] Ager-Hanssen and Porter divested the business in 2007.[74]

Business Partners

Ager-Hanssen works with blue-chip executives, politician and billionaires such as John Robert Porter, son of Tesco heiress Lady Shirley Porter - a man who had made a fortune from Demon, Britain's first internet provider as well as from his divestment of Verifone to Hewlett Packard in 1997. Ager-Hanssen and Porter have several business interest together and have been business partners since the late 90s.[4][6]

Adventurer

Ager-Hanssen is often described as an adventurer, being the only person in the world to be successful in water skiing on one ski from Norway to Denmark[4][19]

Bibliography

- Chisten Ager-Hanssen and Jenny Hedelin: HQgate - den okända dramatiken bakom Sveriges mest uppmärksammade bankkrasch - English title: HQgate - the unknown drama behind Sweden's most notable bank crash, Ekerlids, Stockholm 2017, ISBN 9789188193438

References

- , Verdens Gang, Norges rikeste i en fei

- Peterssohn, Thomas (14 October 1999). "Norsk aktieklippare vill bygga nytt Kinnevik". Dagens Industri. Sweden. p. Cover Page.

- , Canadian Business - Cover Story.

- Williams, Christopher (2017-10-28). "Norway's former dotcom wonder Christen Ager-Hanssen: 'I want to be the next Murdoch for the new age of newspapers'". The Telegraph. Retrieved 13 May 2018.

- "Archived copy". Archived from the original on 2013-10-12. Retrieved 2013-05-28.CS1 maint: archived copy as title (link), Rogalands Avis, Den ukjente mangemillionæren

- Wängelin, Jan (29 March 2000). "Han skall till börsen och visa musklarna". Dagens Industri. Sweden. p. Cover and 21–22.

- , Stavanger Aftenblad - Rikere enn Røkke

- Berg, Ronny (3 February 2001). "Norgest rikeste för det brast". Verdens Gang. Norway. p. Cover and 33–36.

- "Scandinavian media investor plots Johnston Press debt rescue". The Telegraph. Retrieved 2017-08-24.

- "Johnston Press shares soar 16% as new investor lays out bold plans". The Independent. 2017-08-11. Retrieved 2017-08-24.

- "Norwegian billionaire outlines plans for Johnston Press". Prolific North. Retrieved 2017-08-24.

- "Swedish newspaper owner takes a stake in the i publisher Johnston Press". The Telegraph. Retrieved 2017-08-24.

- "Archived copy" (PDF). Archived from the original (PDF) on 2016-03-03. Retrieved 2013-05-06.CS1 maint: archived copy as title (link), Investment AB Kinnevik Annual Report 1997.

- "Archived copy" (PDF). Archived from the original (PDF) on 2013-01-16. Retrieved 2013-05-08.CS1 maint: archived copy as title (link), Investment AB Kinnevik November 2012

- , Stenbecks plantskola styr Mediesveriget.

- "Archived copy" (PDF). Archived from the original (PDF) on 2013-01-16. Retrieved 2013-05-08.CS1 maint: archived copy as title (link), Kinnevik Annual Report 1998.

- Genborg, Kenny (22 February 1999). "Kaxig Norrman utmaner IT-jätte". Göteborgs Posten. Sweden. pp. 27–29.

- , Financial Times.

- , Mail on Sunday - The Fallen Viking Hero.

- Backe Madsen, Lars (25 May 2002). "Korsgaard på halsen". Dagens Näringsliv. Norway. p. Cover and 20–25.

- Bergelin, Harald (22 January 2011). "The Good, the Bad and Ugland". Dagens Näringsliv. Norway. p. Cover Story and 50–57.

- Skaalmo, Goran (20 January 2001). "Someren med Ager-Hanssen". Dagens Näringsliv. Norway. p. Cover Story and 20–25.

- Archived 2008-05-05 at the Wayback Machine, Nettavisen, Fem år siden bobletoppen

- "Investmentbolaget Kinnevik säljer Metro Sverige". Affärsvärlden. Retrieved 12 May 2018.

- "The Qviberg sphere to acquire Metro". Mynewsdesk.com. MynewsDesk. Retrieved 12 May 2018.

- Wendel, Johan (2017-02-15). "Mats Qviberg vill återskapa Jan Stenbecks anda". Dagens Industri. Retrieved 12 May 2018.

- Rislund, Nicklas (2017-05-13). "Metro: "Outsider, underdog – det är vi"". Dagens Media. Retrieved 13 May 2018.

- "Här är Qvibergs plan efter köpet av Metro". 2017-03-01. Retrieved 13 May 2018.

- "Omstridd finansman köper gratistidning". Dagens Nyheter. 2017-02-16. Retrieved 13 May 2018.

- Helmertz, Fredrik (2017-03-30). "Jag är vassare än Stenbeck". Svenska Dagbladet. Retrieved 13 May 2018.

- Williams, Christopher (2017-08-09). "Swedish newspaper owner takes a stake in the i publisher Johnston Press". The Telegraph. Retrieved 12 May 2018.

- Ripegutu, Halvor (2017-10-25). "Ager-Hanssen i ellevill kamp for kontrollen over britisk medieselskap". Nettavisen201. Retrieved 12 May 2018.

- "Norway's former dotcom wonder Christen Ager-Hanssen: 'I want to be the next Murdoch for the new age of newspapers'". The Telegraph. 2017-10-28.

- Williams, Christopher. "Johnston Press investor to launch bid to oust chairman". The Telegraph. Retrieved 12 May 2018.

- Williams, Christopher (2017-11-01). "Alex Salmond joins rebellion to oust Johnston Press board with chairman bid". The Telegraph. Retrieved 12 May 2018.

- Cameron, Greig (2017-11-03). "Activist investor lines up Salmond to be chairman of Johnston Press". The Sunday Times. Retrieved 12 May 2018.

- Williams, Christopher (2017-10-21). "Poison pill' stops the presses on boardroom coup attempt at Johnston Press". The Telegraph. Retrieved 12 May 2018.

- Williams, Christopher (2017-11-06). "Johnston Press faces showdown with rebel shareholder in vote to install Alex Salmond as chairman". The Telegraph. Retrieved 12 May 2018.

- Glackin, Michael (2017-10-22). "Johnston could celebrate centenary with a game of musical chairs". The Sunday Times.

- Frean, Alexandra (2017-10-16). "Empire builder prepares for battle over Johnston Press". The Sunday Times. Retrieved 12 May 2018.

- Callum, Jones (2017-11-08). "You cannot stop me, warns Johnston Press investor". The Sunday Times. Retrieved 12 May 2018.

- Glackin, Michael (2018-05-06). "Christen Ager-Hanssen to increase stake in Johnston Press". The Sunday Times. Retrieved 12 May 2018.

- Austin, Simon (2018-05-09). "Ager-Hanssen welcomes exit of 'disaster' Highfield from Johnston Press". Prolific North. Retrieved 12 May 2018.

- Sharman, David (2018-05-09). "JP accused of 'rearranging deckchairs' as investor plans to up stake". Holdthefrontpage.co.uk. Retrieved 12 May 2018.

- Reuters Staff (2018-05-01). "Johnston Press finance chief to take charge as CEO quits". Reuters.

- Glackin, Michael (2018-03-18). "Johnston Press activist Christen Ager-Hanssen puts Alex Salmond Scotsman plan on hold". The Sunday Times. Retrieved 12 May 2018.

- Andrew, Lynch (2018-04-29). "Cashley' does the decent thing". The Sunday Times. Retrieved 12 May 2018.

- Archived 2016-03-04 at the Wayback Machine, GP - Sterling-och-Maersk-nya-partners?.

- , Dagens Næringsliv - Ager-Hanssen flyr igjen

- , Dagens Industri - Kuppmakere

- , Hegnar.no - Fly med Ager-Hanssen

- , Affarsvarlden.

- , Dagens Industri - Islansk Milijardær med smak för svenska företag

- Archived 2013-07-03 at Archive.today, Nettavisen - FlyMe to the moon

- , Berlingske - Sterling klar til nyt islandsk salg

- , The Local- FlyMe plans Nordic takeover

- , SVT, Flyme vill bilda nordisk lågprisjätte

- , Flyme köper Sterling

- , E24, Ønsker lavprisgigant

- , E24, Nordman i svensk fykamp

- , Hegnar.no - Nordman vant svensk flykamp

- , Privataaffarer - Ägarturbulens-sänkte-Flyme

- , Dagens Næringsliv - Går for Jumbo

- , Sydsvenskan - Norrman ny huvudägare i Flyme

- , Helsingborgs Blad - Norrman ny huvudägare i Flyme

- "Archived copy". Archived from the original on 2013-06-28. Retrieved 2013-05-13.CS1 maint: archived copy as title (link), BA World Cargo invests over $1 billion in freighter fleet (25/07/2007)

- , Veckans Affärer, Lågpris till Asien

- , DagensPS.

- "Archived copy" (PDF). Archived from the original (PDF) on 2015-10-03. Retrieved 2013-05-12.CS1 maint: archived copy as title (link), Press-release Glocalnet.

- , Press-release in English Glocalnet.

- , Dagens Industri, Inter Ikea new big shareholder in Glocaclnet.

- , Rogalands Avis, Madlagutt vill pumpe billigt

- "Archived copy" (PDF). Archived from the original (PDF) on 2012-10-02. Retrieved 2013-05-08.CS1 maint: archived copy as title (link), Gulf Oil, Orange Disc.

- , Dagens Industri - Ager-Hanssen säljer Nordic Oil