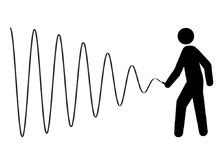

Bullwhip effect

The bullwhip effect is a distribution channel phenomenon in which forecasts yield supply chain inefficiencies. It refers to increasing swings in inventory in response to shifts in customer demand as one moves further up the supply chain. The concept first appeared in Jay Forrester's Industrial Dynamics (1961)[1] and thus it is also known as the Forrester effect. It has been described as “the observed propensity for material orders to be more variable than demand signals and for this variability to increase the further upstream a company is in a supply chain”.[2] The bullwhip effect was named for the way the amplitude of a whip increases down its length. The further from the originating signal, the greater the distortion of the wave pattern. In a similar manner, forecast accuracy decreases as one moves upstream along the supply chain. For example, many consumer goods have fairly consistent consumption at retail but this signal becomes more chaotic and unpredictable as the focus moves away from consumer purchasing behavior.

In the 1990s, Hau Lee, a Professor of Engineering and Management Science at Stanford University, helped incorporate the concept into supply chain vernacular using a story about Volvo. Suffering a glut in green cars, sales and marketing developed a program to move the excess inventory. While successful in generating the desired market pull, manufacturing did not know about the promotional plans. Instead, they read the increase in sales as an indication of growing demand for green cars and ramped up production.[3]

Research indicates a fluctuation in point-of-sale demand of +/- five percent will be interpreted by supply chain participants as a change in demand of up to +/- forty percent. Much like cracking a whip, a small flick of the wrist (a shift in point of sale demand) can cause a large motion at the end of the whip (manufacturer's response).

Causes

Because customer demand is rarely perfectly stable, businesses must forecast demand to properly position inventory and other resources. Forecasts are based on statistics, and they are rarely perfectly accurate. Because forecast errors are given, companies often carry an inventory buffer called "safety stock".

Moving up the supply chain from end-consumer to raw materials supplier, each supply chain participant has greater observed variation in demand and thus greater need for safety stock. In periods of rising demand, down-stream participants increase orders. In periods of falling demand, orders fall or stop, thereby not reducing inventory. The effect is that variations are amplified as one moves upstream in the supply chain (further from the customer). This sequence of events is well simulated by the beer distribution game which was developed by MIT Sloan School of Management in the 1960s.

- Disorganisation

- Lack of communication

- Free return policies

- Order batching

- Price variations

- Demand information

The causes can further be divided into behavioral and operational causes.

Behavioural causes

Previous control-theoretic models have identified as causes the tradeoff between stationary and dynamic performance[4] as well as the use of independent controllers[5]. In accordance with Dellaert, Udenio and Vatamidou (2017)[6], one of the main behavioural causes that contribute to the bullwhip effect is the under-estimation of the pipeline[7]. In addition, the complementary bias, over-estimation of the pipeline, also has a negative effect under such conditions. Nevertheless, it has been shown that when the demand stream is stationary, the system is relatively robust to this bias. In such situations, it has been found that biased policies (both under-estimating and over-estimating the pipeline) perform just as well as unbiased policies.

Other behavioural causes include:

- Misuse of base-stock policies

- Mis-perceptions of feedback and time delays

- Panic ordering reactions after unmet demand

- Perceived risk of other players' bounded rationality

Human factors influencing the behavior in supply chains are largely unexplored. However, studies suggest that people with increased need for safety and security seem to perform worse than risk-takers in a simulated supply chain environment. People with high self-efficacy experience less trouble handling the bullwhip-effect in the supply chain.[8]

Operational causes

Demand forecast updating is accomplished individually by all members of a supply chain. Each member updates its own demand forecast based on the orders collected from its “downstream” customer. The more members in the chain, the less these forecast updates reflect actual demand from end customers.

Order batching takes place when each member collect order quantities from their downstream customer and rounds up or down to meet production constrains such as equipment setup times or truckload quantities. The more members who conduct such rounding of order quantities, the more likely a distortion occurs of the original quantities that were demanded.

Price fluctuations as a result of inflationary factors, quantity discounts, or sales tend to stimulate customers to buy larger quantities than they require. This behaviour appears to add variability to quantities ordered and uncertainty to forecast.

Rationing and gaming is when a retailer tries to limit order quantities by providing only a percentage of the order placed by the buyer. As the buyer knows that the retailer is delivering only a fraction of the order placed, he attempts to “game” the system by making an upward adjustment to the order quantity. Rationing and gaming generate inconsistencies in the ordering information that is being received. [9]

Other operational causes include:

- Dependent demand processing

- Forecast errors

- Adjustment of inventory control parameters with each demand observation

- Lead time variability (forecast error during replenishment lead time)

- Lot-sizing/order synchronization

- Consolidation of demands

- Transaction motive

- Quantity discounts

- Trade promotion and forward buying

- Anticipation of shortages

- Allocation rule of suppliers

- Shortage gaming

- Lean and JIT style management of inventories and a chase production strategy

Consequences

In addition to greater safety stocks, the described effect can lead to either inefficient production or excessive inventory, as each producer needs to fulfill the demand of its customers in the supply chain. This also leads to a low utilization of the distribution channel.

In spite of having safety stocks there is still the hazard of stock-outs which result in poor customer service and lost sales. In addition to the (financially) hard measurable consequences of poor customer services and the damage to public image and loyalty, an organization has to cope with the ramifications of failed fulfillment which may include contractual penalties. Moreover, repeated hiring and dismissal of employees to manage the demand variability induces further costs due to training and possible lay-offs.

Countermeasures

In manufacturing, this concept is called kanban. This model has been successfully implemented in Wal-Mart's distribution system. Individual Wal-Mart stores transmit point-of-sale (POS) data from the cash register back to corporate headquarters several times a day. This demand information is used to queue shipments from the Wal-Mart distribution center to the store and from the supplier to the Wal-Mart distribution center. The result is near-perfect visibility of customer demand and inventory movement throughout the supply chain. Better information leads to better inventory positioning and lower costs throughout the supply chain.

Another recommended strategy to limit the bullwhip effect is order smoothing[5]. Previous research has demonstrated that order smoothing and the bullwhip effect are concurrent in industry[10]. It has been proved that order smoothing is beneficial for the system’s performance when the demand is stationary. However, its impact is limited to the worst-case order amplification when the demand is unpredictable. Having said that, dynamic analysis reveals that order smoothing can degrade performance in the presence of demand shocks. The opposite bias (i.e., over-reaction to mismatches), on the other hand, degrades the stationary performance but can increase dynamic performance; controlled over-reaction can aid the system reach its new goals quickly. The system, nevertheless, is considerably sensitive to that behaviour; extreme over-reaction significantly reduces performance. Overall, unbiased policies offer in general good results under a large range of demand types. Although these policies do not result in the best performance under certain criteria. It is always possible to find a biased policy that outperforms an unbiased policy for any one performance metric.

The concept of "cumulative quantities" is a method that can tackle and even avoid the bull-whip-effect. This method is developed and practised mainly in the German automotive industry, with its expanded supply chains[11] and is established in several EDI-formats between OEMs and their suppliers.

Methods intended to reduce uncertainty, variability, and lead time:

- Vendor-managed inventory (VMI)

- Just in time replenishment (JIT)

- Demand-driven MRP

- Strategic partnership

- Information sharing

- Smooth the flow of products

- Coordinate with retailers to spread deliveries evenly

- Reduce minimum batch sizes

- Smaller and more frequent replenishments

- Eliminate pathological incentives

- Every day low price policy

- Restrict returns and order cancellations

- Order allocation based on past sales instead of current size in case of shortage

See also

References

- Forrester, Jay Wright (1961). Industrial Dynamics. MIT Press.

- Lee, H.; Padmanabhan, V.; Whang, S. (1997). "Information distortion in a supply chain: The bullwhip effect". Management Science. 43 (4): 546–558. doi:10.1287/mnsc.43.4.546.CS1 maint: multiple names: authors list (link)

- Managing a Supply Chain is Becoming a Bit Like Rocket Science, The Economist, 31 January 2002

- Hoberg, K.; Thonemann, U. (2014). "Modeling and analyzing information delays in supply chains using transfer functions". International Journal of Production Economics. 156: 132–145. doi:10.1016/j.ijpe.2014.05.019.CS1 maint: multiple names: authors list (link)

- Disney, S. (2008). "Supply chain aperiodicity, bullwhip and stability analysis with Jury's inners". IMA Journal of Management Mathematics. 19 (2): 101–116. doi:10.1093/imaman/dpm033.

- Udenio, Maximiliano; Vatamidou, Eleni; Fransoo, Jan C.; Dellaert, Nico (2017-10-03). "Behavioral causes of the bullwhip effect: An analysis using linear control theory". IISE Transactions. 49 (10): 980–1000. doi:10.1080/24725854.2017.1325026. ISSN 2472-5854. S2CID 53692411.

- Sterman, J. (1989). "Modeling managerial behavior: Misperceptions of feedback in a dynamic decision making experiment". Management Science. 35 (3): 321–339. doi:10.1287/mnsc.35.3.321. hdl:1721.1/2184.

- Brauner P., Runge S., Groten M., Schuh M., Ziefle M. (2013). Human Factors in Supply Chain Management. Lecture Notes in Computer Science Volume 8018, 2013, pp 423-432

- "Opentextbooks".

- Bray, R.L.; Mendelson, H. (2015). "Production smoothing and the bullwhip effect". Manufacturing & Service Operations Management. 17 (2): 208–220. doi:10.1287/msom.2014.0513.CS1 maint: multiple names: authors list (link)

- Herlyn W.: The Bullwhip Effect in Expanded Supply Chains and the Concept of Cumulative Quantities, epubli Verlag, Berlin, 2014, S. 513-528, ISBN 978-3-8442-9878-9

- Lee, Hau L; Padmanabhan, V.; Whang, Seungjin (1997). "The Bullwhip Effect in Supply Chains". Sloan Management Review. 38 (3): 93–102.

- Mason-Jones, Rachel; Towill, Dennis R. (2000). "Coping with Uncertainty: Reducing "Bullwhip" Behaviour in Global Supply Chains". Supply Chain Forum. 1: 40–44. doi:10.1080/16258312.2000.11517070. S2CID 7920876.

- Bean, Michael (2006). "Bullwhips and Beer: Why Supply Chain Management is so Difficult". Cite journal requires

|journal=(help)

Literature

- Bray, Robert L., and Haim Mendelson. "Information transmission and the bullwhip effect: An empirical investigation." Management Science 58.5 (2012): 860-875.

- Cannella S., and Ciancimino E. (2010). On the bullwhip avoidance phase: supply chain collaboration and order smoothing. International Journal of Production Research, 48 (22), 6739-6776

- Chen, Y. F., Z. Drezner, J. K. Ryan and D. Simchi-Levi (2000), Quantifying the Bullwhip Effect in a Simple Supply Chain: The Impact of Forecasting, Lead Times and Information. Management Science, 46, 436—443.

- Chen, Y. F., J. K. Ryan and D. Simchi-Levi (2000), The Impact of Exponential Smoothing Forecasts on the Bullwhip Effect. Naval Research Logistics, 47, 269—286.

- Chen, Y. F., Z. Drezner, J. K. Ryan and D. Simchi-Levi (1998), The Bullwhip Effect: Managerial Insights on the Impact of Forecasting and Information on Variability in a Supply Chain. Quantitative Models for

- Disney, S.M., and Towill, D.R. (2003). On the bullwhip and inventory variance produced by an ordering policy. Omega, the International Journal of Management Science, 31 (3), 157-167.

- Herlyn, W., "The Bullwhip Effect in Expanded Supply Chains and the Concept of Cumulative Quantities", in: Blecker et al. (Eds.): "Innovative Methods in Logistics and Supply Chain Management", p. 513-528, epubli GmbH, Berlin, 2014, ISBN 978-3-8442-9878-9

- Lee, H.L., Padmanabhan, V., and Whang, S. (1997). Information distortion in a supply chain: the bullwhip effect. Management Science, 43 (4), 546-558.

- Lee, H.L. (2010). Taming the bullwhip. Journal of Supply Chain Management 46 (1), pp. 7–7.

- Supply Chain Management, S. Tayur, R. Ganeshan and M. Magazine, eds., Kluwer, pp. 417–439.

- Selwyn, B. (2008) Bringing Social Relations Back In: (re)Conceptualising the 'Bullwhip Effect' in global commodity chains. International Journal of Management Concepts and Philosophy, 3 (2)156-175.

- Tempelmeier, H. (2006). Inventory Management in Supply Networks—Problems, Models, Solutions, Norderstedt:Books on Demand. ISBN 3-8334-5373-7.