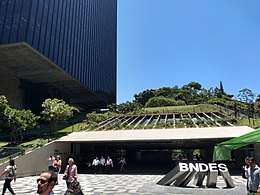

Brazilian Development Bank

The National Bank for Economic and Social Development (Portuguese: Banco Nacional de Desenvolvimento Econômico e Social, abbreviated: BNDES) is a development bank structured as a federal public company associated with the Ministry of Development, Industry, and Trade of Brazil. The stated goal is to provide long-term financing for endeavors that contribute to the country's development. BNDES is one of the largest development banks in the world (after the Chinese Development Bank, which boasts assets of around RMB 7.52 trillion, or around $1.2 tn). Its non-performing loan ratio is also less favorable (2.2%) compared to the CDB's that stands below 1%.

| Government-owned corporation | |

| Industry | Finance and Development |

| Founded | 20 June 1952 |

| Headquarters | Rio de Janeiro, Brazil |

Key people | Gustavo Montezano (Chairman) |

| Total assets | |

Number of employees | 2,000 |

| Parent | Government of Brazil |

| Subsidiaries | BNDESPAR BNDES Ltd. Agência Especial de Financiamento Industrial |

| Website | bndes.gov.br |

Among the objectives of BNDES are the strengthening of the capital structure of private companies, the development of capital markets, the trading of machines and equipment and the financing of exports.

Since its establishment on June 20, 1952, BNDES has financed large-scale industrial and infrastructure endeavors and has played a significant role in the support of investments in agriculture, commerce, and the service industry, as well as in small- and medium-sized private businesses, even though its focus lies on larger firms.[2] The bank has supported social investments aimed at education and health, family agriculture, basic sanitation and mass transportation.

The bank offers financial support lines and programs to companies of any size and sector that have been set up in the country. The partnership with financial institutions with agencies established around the country facilitates the dissemination of credit, enabling greater access to BNDES's financial services.

BNDES has three integral subsidiaries: FINAME, BNDESPAR, and BNDES Limited. Together, the three companies comprise the BNDES System.

Criticism and controversies

BNDES is accused of operating with lobbying of larger firms in a corrupt manner,[3][4][5] Being accused of giving help for "big corporations" instead of "small and medium-sized private businesses" or "Brazilian (...) higher quality of life of its population".

Operating with statutes of "ethical and environmental principles", in 2012, the BNDES approved a 22.5 billion reais loan for the construction of the Belo Monte Dam, a project that displaced of local communities. The plan was strongly criticized by environmental groups and indigenous populations.[6]

In 2013 ~90% of BNDESPAR investments concentrates in five industries.[3] In recent BNDES investments, lobby irregularities and conflict of interest arrives with JBS S.A.[4][7] OGX/EBX Group,[8] GPA (company),[9] and others.

The bank has been criticised for supporting the international expansion of some private firms.[2]

Economists around the world recognize that Brazil has its own development bank, a key financial organization, bigger than the World Bank. As the Nobel Prize economist J. Stiglitz opinion, "... the BNDES is a huge development bank (...) People don’t realize this, but Brazil has actually shown how a single country can create a very effective development bank (...) that actually promotes real development without all the conditionality and all the trappings around the old institutions".[10] Despite the recognition of financial volume, effective infrastructure and organization, the bank is used by only a few industries. The concentration of financial volume in few and perhaps questionable industries contradicts the bank's development and diffusion goals. The concentration contrasts greatly with Brazilian's per capita income and its many small and medium-sized enterprises.

External links

References

- "Performance in 2016". BNDES. Retrieved 27 November 2017.

- Fernando J. Cardim de Carvalho (January 2013). "Relative insulation". D+C Development and Cooperation/ dandc.eu.

- "BNDESPAR CONCENTRATES 89% OF ITS INVESTMENTS IN FIVE INDUSTRIES"

- "BNDES $7.5 billion bet on Friboi", O Estado de S. Paulo, February 15, 2010, www.estadao.com.br/noticias Archived September 2, 2013, at the Wayback Machine

- www.bloomberg.com/news/2013-07-03 about Eike Batista's fortune gained with help from BNDES, and BNDES loss.

- "Brazil's BNDES approves $10.8 bln loan for Amazon Belo Monte dam". Reuters. November 26, 2012. Retrieved 17 July 2014.

- ISTOÉ about "BNDES feeding JBS": "Archived copy". Archived from the original on 2014-02-01. Retrieved 2014-01-19.CS1 maint: archived copy as title (link)

- infomoney.com.br of 2013 July, about BNDES operations with EBX and CCX, OGX, MMX and MPX.

- Veja (magazine) about "new GPA", a business in which the BNDES should not be

- Goodman, Amy; González, Juan. "Nobel Economist Joseph Stiglitz Hails New BRICS Bank Challenging U.S.-Dominated World Bank & IMF". www.democracynow.org/2014/7/17/nobel_economist_joseph_stiglitz_hails_new. Retrieved 26 July 2014.