Funding

Funding is the act of providing financial resources, usually in the form of money, or other values such as effort or time, to finance a need, program, and project, usually by an organization or company. Generally, this word is used when a firm uses its internal reserves to satisfy its necessity for cash, while the term financing is used when the firm acquires capital from external sources.[1]

Sources of funding include credit, venture capital, donations, grants, savings, subsidies, and taxes. Fundings such as donations, subsidies, and grants that have no direct requirement for return of investment are described as "soft funding" or "crowdfunding". Funding that facilitates the exchange of equity ownership in a company for capital investment via an online funding portal as per the Jumpstart Our Business Startups Act (alternately, the "JOBS Act of 2012") (U.S.) is known as equity crowdfunding.

Funds can be allocated for either short-term or long-term purposes.

Economics

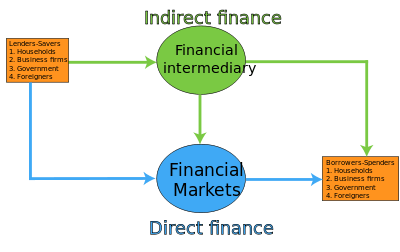

In economics funds are injected into the market as capital by lenders and taken as loans by borrowers. There are two ways in which the capital can end up at the borrower. The lender can lend the capital to a financial intermediary against interest. These financial intermediaries then reinvest the money against a higher rate. The use of financial intermediaries to finance operations is called indirect finance. Lender can also go the financial markets to directly lend to a borrower. This method is called direct finance.[2]

Purpose of Funding

Research funding

It is used for research, in fields of technology or social science. Research funding can split into commercial and non-commercial. Research and development departments of a corporation normally provide commercial research funding. Whereas, non-commercial research funding is obtained from charities, research councils, or government agencies.[3] Organisations that require such funding normally have to go through competitive selections. Only those that have the most potential would be chosen. Funding is vital in ensuring sustainability of certain projects.

Launch a business

Entrepreneurs with a business concept would want to accumulate all the necessary resources including capitals to venture into a market. Funding is part of the process, as some businesses would require large start-up sums that individuals would not have.[4] These start-up funds are essential to kick start a business idea, without it, entrepreneurs would not have the ability to carry out their concepts in the business world.

Uses on investment

Fund management companies gather pools of money from many investors and use them to purchases securities. These funds are managed by professional investment managers, which may generate higher returns with reduced risks by asset diversification.[5] The size of these funds could be a little as a few millions or as much as multibillions. The purpose of these funding activities is mainly aiming to pursue individual or organisation profits.

Methods of Funding

Government Grants

Government could allocate funds itself or through government agencies to projects that benefits the public through selection process to students or researchers and even organisations. At least two external peer-reviewers and internal research award committee review each application. The research awards committee would meet some time to discuss shortlisted applications. A further shortlist and ranking is made. Projects are funded and applicants are informed.[6]

Crowdfunding

Crowdfunding exists in mainly two types, reward-based crowdfunding and equity-based crowdfunding. In the former, small firms could pre-sell a product or service to start a business whereas in the latter, backers buys certain amount of shares of a firm in exchange of money.[7] As for reward-based crowdfunding, project creators would set a funding target and deadline. Anyone who is interested can pledge on the projects. Projects must reach its targeted amount in order for it to be carried out. Once the projects ended with enough funds, projects creators would have to make sure that they fulfil their promises by the intended timeline and delivery their products or services.[8]

Raise from investors

To raise capital, you require them from investors who are interested in the investments. You have to present those investors with high-return projects. By displaying high-level potentials of the projects, investors would be more attracted to put their money into those projects. After certain amount of time, usually in a year’s time, rewards of the investment will be shared with investors. This makes investors happy and they may continue to invest further.[9] If returns do not meet the intended level, this could reduce the willingness of investors to invest their money into the funds. Hence, the amounts of financial incentives are highly weighted determinants to keep the funding remain at a desirable level.

Withdrawal of funding

Withdrawal of funding, or defunding, occurs when funding previously given to an organisation ceases, especially in relation to Governmental funding.[10]

See also

| Look up funding in Wiktionary, the free dictionary. |

References

- ↑ Business Dictionary(2009) [Online] Available at: http://www.businessdictionary.com/definition/funding.html (Accessed: 20 October 2014).

- ↑ Mishkin, Frederic. The Economics of Money, Banking and Financial Markets(Global, Tenth Edition). Pearson Education Limited. p. 68. ISBN 978-0273765738.

- ↑ Imperial College London(2014) Types of research funding [Online] Available at: http://www3.imperial.ac.uk/researchsupport/funderinformation/typesofresearchfunding (Accessed:15 October 2014)

- ↑ GOV.UK(2013) Start Your Own Business [Online] Available at: https://www.gov.uk/starting-up-a-business/get-funding (Accessed: 18 October 2014)

- ↑ U.S. Securities and Exchange Commission( 2010) Mutual Fund [Online] Available at: https://www.sec.gov/answers/mutfund.htm (Accessed: 19 October 2014)

- ↑ Stroke Association(2009) Research funding process [Online] Available at: http://www.stroke.org.uk/research/research-funding-process (Accessed: 21 October 2014)

- ↑ Clifford, C.(2014) Crowdfunding Generates More Than $60,000 an Hour (Infographic) [Online] Available at: http://www.entrepreneur.com/article/234051 (Accessed: 22 October 2014)

- ↑ Kickstarter, Inc.(2010) "Seven things to know about Kickstarter" [Online] Available at: https://www.kickstarter.com/hello?ref=footer (Accessed: 23 October 2014)

- ↑ Raise Capital(2011) "Business talk - How to raise capital for a hedge fund" [Online] Available at: http://www.raise-capital.com/raise-capital-for-hedge-fund.php (Accessed: 24 October 2014)

- ↑ "The definition of defund". www.dictionary.com. Retrieved 7 October 2018.