European Central Bank

| |||

| Headquarters | Frankfurt, Germany | ||

|---|---|---|---|

| Coordinates | 50°06′32″N 8°42′12″E / 50.1089°N 8.7034°E | ||

| Established | 1 June 1998 | ||

| President | Mario Draghi | ||

| Central bank of | |||

| Currency |

Euro (€) EUR (ISO 4217) | ||

| Reserves |

0.526 trillion euro in total

| ||

| Bank rate |

0.00% (Main refinancing operations)[1] 0.25% (Marginal lending facility)[1] | ||

| Interest on reserves | -0.40% (Deposit facility)[1] | ||

| Preceded by |

19 central banks

| ||

| Website | www.ecb.europa.eu | ||

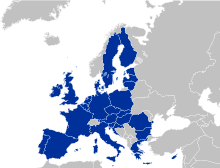

The European Central Bank (ECB) is the central bank for the euro and administers monetary policy of the euro area, which consists of 19 EU member states and is one of the largest currency areas in the world. It is one of the world's most important central banks and is one of the seven institutions of the European Union (EU) listed in the Treaty on European Union (TEU). The capital stock of the bank is owned by the central banks of all 28 EU member states.[2] The Treaty of Amsterdam established the bank in 1998, and it is headquartered in Frankfurt, Germany. As of 2015 the President of the ECB is Mario Draghi, former governor of the Bank of Italy, former member of the World Bank,[3] and former managing director of the Goldman Sachs international division (2002–2005).[3][4] The bank primarily occupied the Eurotower prior to, and during, the construction of the new headquarters.

The primary objective of the ECB, mandated in Article 2 of the Statute of the ECB,[5] is to maintain price stability within the Eurozone. Its basic tasks, set out in Article 3 of the Statute,[5] are to set and implement the monetary policy for the Eurozone, to conduct foreign exchange operations, to take care of the foreign reserves of the European System of Central Banks and operation of the financial market infrastructure under the TARGET2 payments system and the technical platform (currently being developed) for settlement of securities in Europe (TARGET2 Securities). The ECB has, under Article 16 of its Statute,[5] the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the amount must be authorised by the ECB beforehand.

The ECB is governed by European law directly, but its set-up resembles that of a corporation in the sense that the ECB has shareholders and stock capital. Its capital is €11 billion held by the national central banks of the member states as shareholders.[2] The initial capital allocation key was determined in 1998 on the basis of the states' population and GDP, but the capital key has been adjusted.[2] Shares in the ECB are not transferable and cannot be used as collateral.

History

The European Central Bank is the de facto successor of the European Monetary Institute (EMI).[6] The EMI was established at the start of the second stage of the EU's Economic and Monetary Union (EMU) to handle the transitional issues of states adopting the euro and prepare for the creation of the ECB and European System of Central Banks (ESCB).[6] The EMI itself took over from the earlier European Monetary Co-operation Fund (EMCF).[7]

The ECB formally replaced the EMI on 1 June 1998 by virtue of the Treaty on European Union (TEU, Treaty of Maastricht), however it did not exercise its full powers until the introduction of the euro on 1 January 1999, signalling the third stage of EMU.[6] The bank was the final institution needed for EMU, as outlined by the EMU reports of Pierre Werner and President Jacques Delors. It was established on 1 June 1998.[8]

The first President of the Bank was Wim Duisenberg, the former president of the Dutch central bank and the European Monetary Institute.[8] While Duisenberg had been the head of the EMI (taking over from Alexandre Lamfalussy of Belgium) just before the ECB came into existence,[8] the French government wanted Jean-Claude Trichet, former head of the French central bank, to be the ECB's first president.[8] The French argued that since the ECB was to be located in Germany, its president should be French. This was opposed by the German, Dutch and Belgian governments who saw Duisenberg as a guarantor of a strong euro.[9] Tensions were abated by a gentleman's agreement in which Duisenberg would stand down before the end of his mandate, to be replaced by Trichet.[10]

Trichet replaced Duisenberg as President in November 2003.

There had also been tension over the ECB's Executive Board, with the United Kingdom demanding a seat even though it had not joined the Single Currency.[9] Under pressure from France, three seats were assigned to the largest members, France, Germany, and Italy; Spain also demanded and obtained a seat. Despite such a system of appointment the board asserted its independence early on in resisting calls for interest rates and future candidates to it.[9]

When the ECB was created, it covered a Eurozone of eleven members. Since then, Greece joined in January 2001, Slovenia in January 2007, Cyprus and Malta in January 2008, Slovakia in January 2009, Estonia in January 2011, Latvia in January 2014 and Lithuania in January 2015, enlarging the bank's scope and the membership of its Governing Council.[7]

On 1 December 2009, the Treaty of Lisbon entered into force, ECB according to the article 13 of TEU, gained official status of an EU institution.

In September 2011, when German appointee to the Governing Council and Executive board, Jürgen Stark, resigned in protest of the ECB's "Securities Market Programme" which involved the purchase of sovereign bonds by the ECB, a move that was up until then considered as prohibited by the EU Treaty. The Financial Times Deutschland referred to this episode as "the end of the ECB as we know it" referring to its perceived "hawkish" stance on inflation and its historical Bundesbank influence.[11]

On 1 November 2011, Mario Draghi replaced Jean-Claude Trichet as President of the ECB.

In April 2011, the ECB raised interest rates for the first time since 2008 from 1% to 1.25%,[12] with a further increase to 1.50% in July 2011.[13] However, in 2012–2013 the ECB sharply lowered interest rates to encourage economic growth, reaching the historically low 0.25% in November 2013.[1] Soon after the rates were cut to 0.15%, then on 4 September 2014 the central bank reduced the rates by two thirds from 0.15% to 0.05%, the lowest rates on record.[14]

In November 2014, the bank moved into its new premises.

Mandate and tasks

Mandate and inflation target

The primary objective of the European Central Bank, set out in Article 127(1) of the Treaty on the Functioning of the European Union, is to maintain price stability within the Eurozone.[15] The Governing Council in October 1998[16] defined price stability as inflation of under 2%, “a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%” and added that price stability ”was to be maintained over the medium term”. (Harmonised Index of Consumer Prices)[17] Unlike for example the United States Federal Reserve System, the ECB has only one primary objective but this objective has never been defined in statutory law, and the HICP target can be termed ad-hoc.

The Governing Council confirmed this definition in May 2003 following a thorough evaluation of the ECB's monetary policy strategy. On that occasion, the Governing Council clarified that “in the pursuit of price stability, it aims to maintain inflation rates below, but close to, 2% over the medium term”.[16] All lending to credit institutions must be collateralised as required by Article 18 of the Statute of the ESCB.[18] The Governing Council clarification has little force in law.

Without prejudice to the objective of price stability, the Treaty also states that "the ESCB shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union".[19]

Tasks

To carry out its main mission, the ECB's tasks include:

- Defining and implementing monetary policy

- Managing foreign exchange operations

- Maintaining the payment system to promote smooth operation of the financial market infrastructure under the TARGET2 payments system[20] and being currently developed technical platform for settlement of securities in Europe (TARGET2 Securities).

- Consultative role: by law the ECB's opinion is required on any national or EU legislation that falls within the ECB's competence

- Collection and establishment of statistics

- International cooperation

- Issuing banknotes: the ECB holds the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the amount must be authorised by the ECB beforehand (upon the introduction of the euro, the ECB also had exclusive right to issue coins).[20]

- Financial stability and prudential policy

- Banking supervision: since 2013 the ECB has been put in charge of supervising systemically relevant banks

Organization

The ECB has four decision-making bodies, that take all the decisions with the objective of fulfilling the ECB's mandate:

- the Executive Board,

- the Governing Council,

- the General Council, and

- the Supervisory Board.

Decision-making bodies of the ECB

The Executive Board

The Executive Board is responsible for the implementation of monetary policy (defined by the Governing Council) and the day-to-day running of the bank.[21] It can issue decisions to national central banks and may also exercise powers delegated to it by the Governing Council.[21] Executive Board members are assigned a portfolio of responsibilities by the President of the ECB[22]. The Executive Board normally meets every Tuesday.

It is composed of the President of the Bank (currently Mario Draghi), the Vice-President (currently Luis de Guindos) and four other members.[21] They are all appointed for non-renewable terms of eight years.[21] Member of the Executive Board of the ECB are appointed "from among persons of recognised standing and professional experience in monetary or banking matters by common accord of the governments of the Member States at the level of Heads of State or Government, on a recommendation from the Council, after it has consulted the European Parliament and the Governing Council of the ECB".[23]

José Manuel González-Páramo, a Spanish member of the Executive Board since June 2004, was due to leave the board in early June 2012 and no replacement had been named as of late May 2012.[24] The Spanish had nominated Barcelona-born Antonio Sáinz de Vicuña, an ECB veteran who heads its legal department, as González-Páramo's replacement as early as January 2012 but alternatives from Luxembourg, Finland, and Slovenia were put forward and no decision made by May.[25] After a long political battle and delays due to the European Parliament's protest over the lack of gender balance at the ECB[26], Luxembourg's Yves Mersch, was appointed as González-Páramo's replacement.[27]

The Governing Council

The Governing Council is the main decision-making body of the Eurosystem.[28] It comprises the members of the Executive Board (six in total) and the governors of the National Central Banks of the euro area countries (19 as of 2015).

Since January 2015, ECB publishes on its website a summary of the Governing Council deliberations ("accounts").[29] These publications came as a partial response to recurring criticism against the ECB's opacity [30]. However in contrast with other central banks, the ECB still does not disclose individual voting records of the governors seating in its Council.

| Name | Role | Terms of office | ||

| Executive Board

of the ECB |

President | 1 November 2011 | 31 October 2019 | |

| Vice-President | 1 June 2018 | 31 May 2026 | ||

| Member of the Executive Board | 15 December 2012 | 14 December 2020 | ||

| Member of the Executive Board | 27 January 2014 | 26 January 2022 | ||

| Member of the Executive Board | 1 January 2012 | 31 December 2019 | ||

| Member of the Executive Board

& Chief Economist |

1 June 2011 | 31 May 2019 | ||

| National Governors | 11 June 2018 | 10 June 2024 | ||

| 1 May 2011 | 31 April 2019 | |||

| 11 March 2011 | 1 January 2019 | |||

| 20 June 2014 | ||||

| 1 November 2015 | ||||

| September 2008 | August 31, 2019 | |||

| 12 January 2010 | ||||

| 12 July 2018 | ||||

| 7 June 2010 | ||||

| 1 July 2013 | ||||

| 7 June 2012 | ||||

| 2001 | ||||

| 1 July 2011 | ||||

| 1 November 2011 | ||||

| 11 April 2014 | ||||

| 3 November 2015 | ||||

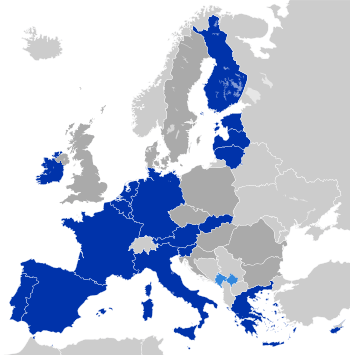

The General Council

The General Council is a body dealing with transitional issues of euro adoption, for example, fixing the exchange rates of currencies being replaced by the euro (continuing the tasks of the former EMI).[32] It will continue to exist until all EU member states adopt the euro, at which point it will be dissolved.[32] It is composed of the President and vice-president together with the governors of all of the EU's national central banks.[33][34]

The Supervisory Board

The Supervisory Board meets twice a month to discuss, plan and carry out the ECB’s supervisory tasks.[35] It proposes draft decisions to the Governing Council under the non-objection procedure. It is composed of Chair (appointed for a non-renewable term of five years), Vice-Chair (chosen from among the members of the ECB's Executive Board) four ECB representatives and representatives of national supervisors. If the national supervisory authority designated by a Member State is not a national central bank (NCB), the representative of the competent authority can be accompanied by a representative from their NCB. In such cases, the representatives are together considered as one member for the purposes of the voting procedure.[35]

It also includes the Steering Committee, which supports the activities of the Supervisory Board and prepares the Board’s meetings. It is composed by the Chair of the Supervisory Board, Vice-Chair of the Supervisory Board, one ECB representative and five representatives of national supervisors. The five representatives of national supervisors are appointed by the Supervisory Board for one year based on a rotation system that ensures a fair representation of countries.[35]

| Composition of the Supervisory board of the ECB[36] | |

| Name | Role |

| Chair | |

| Vice Chair | |

| ECB Representative | |

| ECB Representative | |

| ECB Representative | |

| ECB Representative | |

Capital subscription

The ECB is governed by European law directly, but its set-up resembles that of a corporation in the sense that the ECB has shareholders and stock capital. Its initial capital was supposed to be €5 billion[37] and the initial capital allocation key was determined in 1998 on the basis of the member states' populations and GDP,[2][38] but the key is adjustable.[39] The euro area NCBs were required to pay their respective subscriptions to the ECB's capital in full. The NCBs of the non-participating countries have had to pay 7% of their respective subscriptions to the ECB's capital as a contribution to the operational costs of the ECB. As a result, the ECB was endowed with an initial capital of just under €4 billion. The capital is held by the national central banks of the member states as shareholders. Shares in the ECB are not transferable and cannot be used as collateral.[40] The NCBs are the sole subscribers to and holders of the capital of the ECB.

Today, ECB capital is about €11 billion, which is held by the national central banks of the member states as shareholders.[2] The NCBs’ shares in this capital are calculated using a capital key which reflects the respective member’s share in the total population and gross domestic product of the EU. The ECB adjusts the shares every five years and whenever a new country joins the EU. The adjustment is made on the basis of data provided by the European Commission.

All national central banks (NCBs) that own a share of the ECB capital stock as of 1 January 2015 are listed below. Non-Euro area NCBs are required to pay up only a very small percentage of their subscribed capital, which accounts for the different magnitudes of Euro area and Non-Euro area total paid-up capital.[2]

| NCB | Capital Key (%) | Paid-up Capital (€) |

|---|---|---|

| National Bank of Belgium | 2.4778 | 268,222,025.17 |

| Deutsche Bundesbank | 17.9973 | 1,948,208,997.34 |

| Bank of Estonia | 0.1928 | 20,870,613.63 |

| Central Bank of Ireland | 1.1607 | 125,645,857.06 |

| Bank of Greece | 2.0332 | 220,094,043.74 |

| Bank of Spain | 8.8409 | 957,028,050.02 |

| Bank of France | 14.1792 | 1,534,899,402.41 |

| Bank of Italy | 12.3108 | 1,332,644,970.33 |

| Central Bank of Cyprus | 0.1513 | 16,378,235.70 |

| Bank of Latvia | 0.2821 | 30,537,344.94 |

| Bank of Lithuania | 0.4132 | 44,728,929.21 |

| Central Bank of Luxembourg | 0.2030 | 21,974,764.35 |

| Central Bank of Malta | 0.0648 | 7,014,604.58 |

| De Nederlandsche Bank | 4.0035 | 433,379,158.03 |

| Oesterreichische Nationalbank | 1.9631 | 212,505,713.78 |

| Banco de Portugal | 1.7434 | 188,723,173.25 |

| Bank of Slovenia | 0.3455 | 37,400,399.43 |

| National Bank of Slovakia | 0.7725 | 83,623,179.61 |

| Bank of Finland | 1.2564 | 136,005,388.82 |

| Total | 70.3915 | 7,619,884,851.40 |

| Non-Euro area: | ||

| Bulgarian National Bank | 0.8590 | 3,487,005.40 |

| Czech National Bank | 1.6075 | 6,525,449.57 |

| Danmarks Nationalbank | 1.4873 | 6,037,512.38 |

| Croatian National Bank | 0.6023 | 2,444,963.16 |

| Hungarian National Bank | 1.3798 | 5,601,129.28 |

| National Bank of Poland | 5.1230 | 20,796,191.71 |

| National Bank of Romania | 2.6024 | 10,564,124.40 |

| Sveriges Riksbank | 2.2729 | 9,226,559.46 |

| Bank of England | 13.6743 | 55,509,147.81 |

| Total | 29.6085 | 120,192,083.17 |

Reserves

In addition to capital subscriptions, the NCBs of the member states participating in the euro area provided the ECB with foreign reserve assets equivalent to around €40 billion. The contributions of each NCB is in proportion to its share in the ECB's subscribed capital, while in return each NCB is credited by the ECB with a claim in euro equivalent to its contribution. 15% of the contributions was made in gold, and the remaining 85% in US dollars and Japanese yen.

Languages

The internal working language of the ECB is generally English, and press conferences are usually held in English. External communications are handled flexibly: English is preferred (though not exclusively) for communication within the ESCB (i.e. with other central banks) and with financial markets; communication with other national bodies and with EU citizens is normally in their respective language, but the ECB website is predominantly English; official documents such as the Annual Report are in the official languages of the EU.[41][42]

ECB independence framework

The European Central Bank (and by extension, the Eurosystem) is often considered as the "most independent central bank in the world".[43][44][45][46] In general terms, this means that the Eurosystem tasks and policies can be discussed, designed, decided and implemented in full autonomy, without pressure, or need for instructions from any external body. The main justification for the ECB independence is that such institutional setup helps maintaining price stability.[47][48]

ECB Independence

In practice, the ECB's independence is pinned by four key principles:[49]

- Political independence: The Community institutions and bodies and the governments of the member states may not seek to influence the members of the decision-making bodies of the ECB or of the NCBs in the performance of their tasks. Symmetrically, EU institutions and national governments are bound by the treaties to respect the ECB's independence.

- Operational and legal independence: the ECB has all required competences to achieve its price stability mandate and thereby can steer monetary policy in full autonomy and by means of high level of discretion. The ECB's governing council deliberates with a high degree of secrecy, since individual voting records are not disclosed to the public (leading to suspicions that Governing Council members are voting along national lines.[50][51]) In addition to monetary policy decisions, the ECB has the right to issue legally binding regulations, within its competence and if the conditions laid down in Union law are fulfilled, it can sanction non-compliant actors if they violate legal requirements laid down in directly applicable Union regulations. The ECB's own legal personality also allows the ECB to enter into international legal agreements independently from other EU institutions, and be party of legal proceedings. Finally, the ECB can organise its internal structure as it sees fit.

- Personal independence: the mandate of ECB board members is purposefully very long (8 years) and Governors of national central banks have a minimum renewable term of office of five years.[47] In addition, ECB board members and are vastly immune from judicial proceedings.[52] Indeed, removals from office can only be decided by the Court of Justice of the European Union (CJEU), under the request of the ECB's Governing Council or the Executive Board (i.e. the ECB itself). Such decision is only possible in the event of incapacity or serious misconduct. National governors of the Eurosystem' national central banks can be dismissed under national law (with possibility to appeal) in case they can no longer fulfil their functions or are guilty of serious misconduct.

- Financial independence: the ECB is the only body within the EU whose statute guarantees budgetary independence through its own resources and income. The ECB uses its own profits generated by its monetary policy operations and cannot be technically insolvent. The ECB's financial independence reinforces its political independence. Because the ECB does not require external financing and symmetrically is prohibited from direct financing to public institutions, this shields it from potential pressure from public authorities.

ECB transparency

In addition to its independence, the ECB is subject to limited transparency obligations in contrast to EU Institutions standards and other major central banks. Indeed, as pointed out by Transparency International, "The Treaties establish transparency and openness as principles of the EU and its institutions. They do, however, grant the ECB a partial exemption from these principles. According to Art. 15(3) TFEU, the ECB is bound by the EU’s transparency principles “only when exercising [its] administrative tasks” (the exemption – which leaves the term “administrative tasks” undefined – equally applies to the Court of Justice of the European Union and to the European Investment Bank)."[53]

In practice, there are several concrete examples where the ECB is less transparent than other institutions:

- Voting secrecy: while other central banks publish the voting record of its decision makers, the ECB's Governing Council decisions are made in full discretion. Since 2014 however, the ECB publishes "accounts" of its monetary policy meetings,[54] but those remain rather vague and do not include individual votes.

- Access to documents: The obligation for EU bodies to make documents freely accessible after a 30-year embargo applies to the ECB. However, under the ECB’s Rules of Procedure the Governing Council may decide to keep individual documents classified beyond the 30-year period.

- Disclosure of securities: The ECB is less transparent than the Fed when it comes to disclosing the list of securities being held in its balance sheet under monetary policy operations such as QE.[55]

ECB's democratic accountability

In return to its high degree of independence and discretion, the ECB is accountable to the European Parliament (and to a lesser extent to the European Court of Auditors, the European Ombudsman and the Court of Justice of the EU (CJEU). Although no interinstitutional agreement exists between the European Parliament and the ECB to regulate the ECB's accountability framework, it as been inspired by a resolution of the European Parliament adopted in 1998[56] which was then informally agreed with the ECB and incorporated into the Parliament's rule of procedure.[57]

The accountability framework involves five main mechanisms:

- Annual report: the ECB is bound to publish reports on its activities and has to address its annual report to the European Parliament, the European Commission, the Council of the European Union and the European Council.[58] In return, the European Parliament evaluates the past activities to the ECB via its annual report on the European Central Bank (which is essentially a non legally-binding list of resolutions).

- Quarterly hearings: the Economic and Monetary affairs Committee of the European Parliament organises a hearing (the "Monetary Dialogue") with the ECB every quarter,[59] allowing members of parliament to address oral questions to the ECB president.

- Parliamentary questions: all Members of the European Parliament have the right to address written questions[60] to the ECB president. The ECB president provides a written answer in about 6 weeks.

- Appointments: The European Parliament is consulted during the appointment process of executive board members of the ECB.[61]

- Legal proceedings: the ECB' own legal personality allows civil society or public institutions to file complains against the ECB to the Court of Justice of the EU.

In 2013, an interinstitutional agreement was reached between the ECB and the European Parliament in the context of the establishment of the ECB's Banking Supervision. This agreement sets broader powers to the European Parliament then the established practice on the monetary policy side of the ECB's activities. For example, under the agreement, the Parliament can veto the appointment of the Chair and Vice-Chair of the ECB's supervisory board, and may approve removals if requested by the ECB.[62]

The ECB's response to the euro crisis

From late 2009 a handful of mainly southern eurozone member states started being unable to repay their national Euro-denominated government debt or to finance the bail-out of troubled financial sectors under their national supervision without the assistance of third parties. This so-called European debt crisis began after Greece's new elected government stopped masking its true indebtedness and budget deficit and openly communicated the imminent danger of a Greek sovereign default.

Foreseeing a possible a sovereign default in the eurozone, the general public, international and European institutions, and the financial community reassessed the economic situation and creditworthiness of some Eurozone member states, in particular Southern countries. Consequently, sovereign bonds yields of several Eurozone countries started to aise sharply. This provoked a self-fulfilling panic on financial markets: the more Greek bonds yields rose, the more likely a default became possible, the more bond yields increased in turn.[63][64][65][66][67][68][69]

This panic was also aggravated because of the inability of the ECB to react and intervene on sovereign bonds markets for two reasons. First, because the ECB's legal framework normally forbids the purchase of sovereign bonds (Article 123. TFEU).[70] This prevented the ECB from implementing quantitative easing like the Federal Reserve and the Bank of England did as soon as 2008, which played an important role in stabilizing markets. Secondly, a decision by the ECB made in 2005 introduced a minimum credit rating (BBB-) for all Eurozone sovereign bonds to be eligible as collateral to the ECB's open market operations. This meant that if a private rating agencies were to downgrade a sovereign bond below that threshold, many banks would suddenly become illiquid because they would lose access to ECB refinancing operations. According to former member of the governing council of the ECB Athanasios Orphanides, this change in the ECB's collateral framework "planted the seed" of the euro crisis.[71]

Faced with those regulatory constraints, the ECB led by Jean-Claude Trichet in 2010 was reluctant to intervene to calm down financial markets. Up until May 6th 2010, Trichet formally denied at several press conferences[72] the possibility of the ECB to embark into sovereign bonds purchases, even though Greece, Portugal, Spain and Italy faced waves of credit rating downgrades and increasing interest rate spreads.

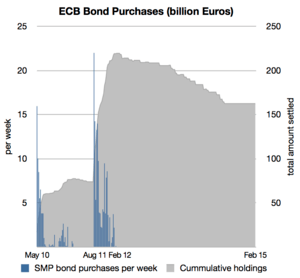

Securities Market Programme

On 10 May 2010, the ECB announced[73] the launch of a "Securities Market Programme" (SMP) which involved the discretionary purchase of sovereign bonds in secondary markets. Extraordinarily, the decision was taken by the Governing Council during a teleconference call only three days after the ECB's usual meeting of May 6th (when Trichet still denied the possibility of purchasing sovereign bonds). The ECB justified this decision by the necessity to "address severe tensions in financial markets." The decision also coincided with the EU leaders decision of May 10 to establish the European Financial Stabilisation mechanism, which would serve as a crisis fighting fund to safeguard the euro area from future sovereign debt crisis.[74]

The's ECB bond buying focused primarily on Spanish and Italian debt.[75] They were intended to dampen international speculation against those countries, and thus avoid a contagion of the Greek crisis towards other Eurozone countries. The assumption is that speculative activity will decrease over time and the value of the assets increase.

Although SMP did involve an injection of new money into financial markets, all ECB injections were "sterilized" through weekly liquidity absorption. So the operation was neutral for the overall money supply.[76]

When the ECB buys bonds from other creditors such as European banks, the ECB does not disclose the transaction prices. Creditors profit of bargains with bonds sold at prices that exceed market's quotes.

As of 18 June 2012, the ECB in total had spent €212.1bn (equal to 2.2% of the Eurozone GDP) for bond purchases covering outright debt, as part of the Securities Markets Programme.[77] Controversially, the ECB made substantial profits out of this programme.[78] The profits were largely redistributed to Eurozone countries.[79]

ECB reaction to the Irish banking crisis

In November 2010, it became clear that Ireland would not be able to afford to bailout its failing banks, and Anglo Irish Bank in particular which needed around 30 billions euros, a sum the government obviously neither could it borrow from financial markets when its bond yields were soaring to comparable levels with the Greek bonds. Instead, the governments issued a 31bn EUR "promissory note" (an IOU) to Anglo – which it had nationalized. In turn, the bank supplied the promissory note as collateral to the Central Bank or Ireland as collateral, so it could access emergency liquidity assistance (ELA). This way, Anglo was able to repay its bondholders. The operation became very controversial, as it basically shifted Anglo's private debts onto the government's balance sheet.

It became clear later that the ECB played a key role in making sure the Irish Government did not let Anglo default on its debts, in order to avoid a financial instability risks. In 15 October and 6 November 2010, the ECB President Jean-Claude Trichet sent two secret letters[80] to the Irish finance Minister which essentially informed the Irish government of the possible suspension of ELA's credit lines, unless the Government requested a financial assistance programme to the Eurogroup under condition of further reforms and fiscal consolidation. Over 2012 and 2013, the ECB repeatedly insisted that the promissory note should be repaid in full, and refused the Government's proposal to swap the notes with a long-term (and less costly) bond until February 2013.[81] In addition, the ECB insisted that no debt restructuring (or bail-in) should be applied to the nationalized banks bondholders, a measure which could have saved Ireland 8 billions euros.[82]

In short, fearing a new financial panic, the ECB took extraordinary measures to avoid at all cost debt restructuring in Ireland, which resulted in higher public debt in Ireland.[83]

Long-term refinancing operation

Soon after Mario Draghi took over the presidency of the ECB, the bank announced on 8 December 2011 a new round of 1% interest loans with a term of three years (36 months) – the Long-term Refinancing operations (LTRO).

Thanks to this operation, 523 Banks tapped as much as €489.2 bn (US$640 bn). The loans were not offered to European states, but government securities issued by European states would be acceptable collateral as would mortgage-backed securities and other commercial paper that have a sufficient rating by credit agencies. Observers were surprised by the volume of the loans made when it was implemented.[84][85][86] By far biggest amount of €325bn was tapped by banks in Greece, Ireland, Italy and Spain.[87] This way the ECB tried to make sure that banks have enough cash to pay off €200bn of their own maturing debts in the first three months of 2012, and at the same time keep operating and loaning to businesses so that a credit crunch does not choke off economic growth. It also hoped that banks would use some of the money to buy government bonds, effectively easing the debt crisis.[88]

On 29 February 2012, the ECB held a second 36-month auction, LTRO2, providing eurozone banks with further €529.5 billion in low-interest loans.[89] This second long term refinancing operation auction saw 800 banks take part.[90] Net new borrowing under the February auction was around €313 billion – out of a total of €256bn existing ECB lending €215bn was rolled into LTRO2.[90]

Outright Monetary Transactions

In July 2012, in the midst of renewed fears about sovereigns in the eurozone, Draghi stated in a panel discussion in London that the ECB "...is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough."[91] This statement led to a steady decline in bond yields for eurozone countries, in particular Spain, Italy and France. In light of slow political progress on solving the eurozone crisis, Draghi's statement has been seen as a key turning point in the fortunes of the eurozone.

Following up on Draghi's speech, the Governing Council of the European Central Bank (ECB) announced on 2 August 2012, that it "may undertake outright open market operations of a size adequate to reach its objective"[92] in order to "safeguarding an appropriate monetary policy transmission and the singleness of the monetary policy". The technical framework of these operations was formulated on 6 September 2012 when the ECB announced the launch of the Outright Monetary Transactions programme (OMT).[93] On the same date, the bank's Securities Markets Programme (SMP) was terminated.

While the duration of the previous SMP was temporary,[94] OMT has no ex-ante time or size limit.[95] However, the activation of the purchases remains conditioned to the adherence by the benefitting country to an adjustment programme to the ESM. To date, OMT was never actually implemented by the ECB. However it is considered that its announcement (together with the "whatever it takes" speech) significantly contributed in stabilizing financial markets and ended the sovereign debt crisis.

Quantitative Easing

Although the sovereign debt crisis was almost solved by 2014, the ECB started to face a repeated decline in the Eurozone inflation rate, indicated that the economy was going towards a deflation. Responding to this threat, the ECB announced on 4 September 2014 the launch of two bond buying purchases programmes: the Covered Bond Purchasing Programme (CBPP3) and Asset-Backed Securities Programme (ABSPP).[96]

On 22 January 2015, the ECB announced an extension of those programmes within a full-fledge "quantitative easing" programme which also included sovereign bonds, to the tune of 60 billion euros per month up until at least September 2016. The programme was started on 9 March 2015. The program was repeatedly extended s to reach about €2,500 billons and is currently expected to last until at least end of 2018.[97]

Powers and objectives during the European banking crisis

The European debt crisis has revealed some relative weaknesses in the sovereign debt of such member countries as Portugal, Ireland, Greece and Spain.[98]

Rescue operations involving sovereign debt have included temporarily moving bad or weak assets off the balance sheets of the weak member banks into the balance sheets of the European Central Bank.[99] Such action is viewed as monetisation and can be seen as an inflationary threat, whereby the strong member countries of the ECB shoulder the burden of monetary expansion (and potential inflation) to save the weak member countries.[99] Most central banks prefer to move weak assets off their balance sheets with some kind of agreement as to how the debt will continue to be serviced.[99] This preference has typically led the ECB to argue that the weaker member countries must:

- Allocate considerable national income to servicing debts.[99]

- Scale back a wide range of national expenditures (such as education, infrastructure, and welfare transfer payments) to make their payments.[99]

The European Central Bank had stepped up the buying of member nations debt.[100] In response to the crisis of 2010, some proposals have surfaced for a collective European bond issue that would allow the central bank to purchase a European version of US Treasury bills.[101][102] To make European sovereign debt assets more similar to a US Treasury, a collective guarantee of the member states' solvency would be necessary.[lower-alpha 1] But the German government has resisted this proposal, and other analyses indicate that "the sickness of the euro" is due to the linkage between sovereign debt and failing national banking systems. If the European central bank were to deal directly with failing banking systems sovereign debt would not look as leveraged relative to national income in the financially weaker member states.[102]

On 17 December 2010, the ECB announced that it was going to double its capitalisation.[103] (The ECB's most recent balance sheet before the announcement listed capital and reserves at €2.03 trillion.)[104] The 16 central banks of the member states would transfer assets to the ledger of the ECB.

In 2011, the European member states may need to raise as much as US$2 trillion in debt.[103] Some of this will be new debt and some will be previous debt that is "rolled over" as older loans reach maturity. In either case, the ability to raise this money depends on the confidence of investors in the European financial system.[104] The ability of the European Union to guarantee its members' sovereign debt obligations have direct implications for the core assets of the banking system that support the Euro.[103]

The bank must also co-operate within the EU and internationally with third bodies and entities. Finally, it contributes to maintaining a stable financial system and monitoring the banking sector.[105] The latter can be seen, for example, in the bank's intervention during the subprime mortgage crisis when it loaned billions of euros to banks to stabilise the financial system.[106] In December 2007, the ECB decided in conjunction with the Federal Reserve System under a programme called Term auction facility to improve dollar liquidity in the eurozone and to stabilise the money market.[107]

In late May 2012, looking ahead to further challenges with Greece, Bundesbank chief and ECB council member Jens Weidmann pointed out that the council could veto "emergency liquidity assistance" (ELA) to, for instance, Greece through a two–third majority of the council. If Greece chose to default on its debts yet wanted to stay in the Euro, the ELA would be one of the ways to accommodate the country's and its banks' liquidity needs or, alternatively, to precipitate departure.[24]

On Wednesday, February 24, 2016, as part of the Bundesbank's annual news conference, Bundesbank president and European Central Bank Governing Council member, Jens Weidmann, dismissed deflation in light of the ECB's current stimulus program, pointing out the healthy condition of the German economy and that the euro area isn't that bad off, on the eve of the March 9–10, 2016 meetings.[108]

Monetary policy tools

The principal monetary policy tool of the European central bank is collateralised borrowing or repo agreements.[109] These tools are also used by the United States Federal Reserve Bank, but the Fed does more direct purchasing of financial assets than its European counterpart.[110] The collateral used by the ECB is typically high quality public and private sector debt.[109]

The criteria for determining "high quality" for public debt have been preconditions for membership in the European Union: total debt must not be too large in relation to gross domestic product, for example, and deficits in any given year must not become too large.[76] Though these criteria are fairly simple, a number of accounting techniques may hide the underlying reality of fiscal solvency—or the lack of same.[76]

In central banking, the privileged status of the central bank is that it can make as much money as it deems needed.[111] In the United States Federal Reserve Bank, the Federal Reserve buys assets: typically, bonds issued by the Federal government.[111] There is no limit on the bonds that it can buy and one of the tools at its disposal in a financial crisis is to take such extraordinary measures as the purchase of large amounts of assets such as commercial paper.[111] The purpose of such operations is to ensure that adequate liquidity is available for functioning of the financial system.[111]

Regulatory reliance on credit ratings

Think-tanks such as the World Pensions Council have also argued that European legislators have pushed somewhat dogmatically for the adoption of the Basel II recommendations, adopted in 2005, transposed in European Union law through the Capital Requirements Directive (CRD), effective since 2008. In essence, they forced European banks, and, more importantly, the European Central Bank itself e.g. when gauging the solvency of financial institutions, to rely more than ever on standardised assessments of credit risk marketed by two non-European private agencies: Moody's and S&P.

Difference with US Federal Reserve

In the United States, the Federal Reserve System purchases Treasury securities in order to inject liquidity into the economy. The Eurosystem, on the other hand, uses a different method. There are about 1,500 eligible banks which may bid for short-term repo contracts of two weeks to three months duration.[112]

The banks in effect borrow cash and must pay it back; the short durations allow interest rates to be adjusted continually. When the repo notes come due the participating banks bid again. An increase in the quantity of notes offered at auction allows an increase in liquidity in the economy. A decrease has the contrary effect. The contracts are carried on the asset side of the European Central Bank's balance sheet and the resulting deposits in member banks are carried as a liability. In layman terms, the liability of the central bank is money, and an increase in deposits in member banks, carried as a liability by the central bank, means that more money has been put into the economy.[lower-alpha 2]

To qualify for participation in the auctions, banks must be able to offer proof of appropriate collateral in the form of loans to other entities. These can be the public debt of member states, but a fairly wide range of private banking securities are also accepted.[113] The fairly stringent membership requirements for the European Union, especially with regard to sovereign debt as a percentage of each member state's gross domestic product, are designed to insure that assets offered to the bank as collateral are, at least in theory, all equally good, and all equally protected from the risk of inflation.[113]

Location

The bank is based in Ostend (East End), Frankfurt am Main. The city is the largest financial centre in the Eurozone and the bank's location in it is fixed by the Amsterdam Treaty.[114] The bank moved to new purpose-built headquarters in 2014 that were designed by a Vienna-based architectural office, Coop Himmelbau.[115] The building is approximately 180 metres (591 ft) tall and will be accompanied with other secondary buildings on a landscaped site on the site of the former wholesale market in the eastern part of Frankfurt am Main. The main construction began in October 2008,[115][116] and it was expected that the building will become an architectural symbol for Europe. While it was designed to accommodate double the number of staff who operate in the former Eurotower,[117] that building has been retained since the ECB took responsibility for banking supervision and more space was hence required.[118]

See also

Notes

- ↑ The European dilemma may be imagined as follows. In the US, if tax collections from California are weak, the total federal debt is financed through tax collections in other states, through federal taxes. California may default on its state debt, but the federal government bypasses California in directly taxing California citizens to finance the federal debt. There is only one legal authority taxing, paying for, and backing the federal debt. Federal expenditures are determined by the federal government. Therefore California cannot leverage more money out of the federal system other than by means of the normal constitutional procedures in the House and Senate. If the federal government transfers additional money to California it is because of federal policy, not because California's state debt is threatening the backing of the US dollar. Consider this hypothetical: If the US federal reserve carried state debts on its balance sheets the system would be more similar to the ECB. If California stated to default on its debt a hole would appear on the Fed's balance sheets where it carried California bonds. To make good this loss, the Fed would have to raise capital from the more solvent states, giving rise to the political issue that California's "lack of responsibility" was forcing other states to jump in and save California's public debt. This, one might worry, could turn into a license to California to ignore fiscal restraints and in effect transfer money from the "more responsible states" to the "least responsible states." Even though California's state finances are faltering in 2010, this is not an issue for the Federal Reserve, because of the federal system of taxation and unified backing of the federal debt. In Europe, the ECB could push for greater political and fiscal integration, which would make the member states more explicitly responsible for backing each other's debts and potentially lead to greater political integration. Speculative attacks on the sovereign debt that backs the euro have in effect revealed the weaknesses in the EU's political and fiscal structure.

- ↑ The process is similar, though on a grand scale, to an individual who every month charges $10,000 on his or her credit card, pays it off every month, but also withdraws (and pays off) an additional $10,000 each succeeding month for transaction purposes. Such a person is operating "net borrowed" on a continual basis, and even though the borrowing from the credit card is short term, the effect is a stable increase in the money supply. If the person borrows less, less money circulates in the economy. If he or she borrows more, the money supply increases. An individual's ability to borrow from his or her credit card company is determined by the credit card company: it reflects the company's overall judgment of its ability to lend to all borrowers, and also its appraisal of the financial condition of that one particular borrower. The ability of member banks to borrow from the central bank is fundamentally similar.

References

- 1 2 3 4 "ECB: Key interest rates". Retrieved 14 September 2014.

- 1 2 3 4 5 6 "Capital Subscription". European Central Bank. Retrieved 1 January 2015.

- 1 2 Foley, Stephen (18 November 2011). "What price the new democracy? Goldman Sachs conquers Europe". London: The Independent.

- ↑ Robert Reich (July 17, 2015). "How Goldman Sachs Profited from the Greek Debt Crisis". The Huffington Post.

- 1 2 3 Statute of the ECB

- 1 2 3 "ECB: Economic and Monetary Union". ECB. Retrieved 15 October 2007.

- 1 2 "European Central Bank". CVCE. 2016-08-07. Retrieved 18 February 2014.

- 1 2 3 4 "ECB: Economic and Monetary Union". Ecb.int. Retrieved 26 June 2011.

- 1 2 3 "The third stage of Economic and Monetary Union". CVCE. 2016-08-07. Retrieved 18 February 2014.

- ↑ "The powerful European Central Bank [E C B] in the heart of Frankfurt/Main – Germany – The Europower in Mainhattan – Enjoy the glances of euro and europe....03/2010....travel round the world....:)". UggBoy♥UggGirl [PHOTO // WORLD // TRAVEL]. Flickr. 6 March 2010. Retrieved 14 October 2011.

- ↑ Proissl, von Wolfgang (9 September 2011). "Das Ende der EZB, wie wir sie kannten" [The end of the ECB, as we knew it]. Kommentar. Financial Times Deutschland (in German). Archived from the original on 15 October 2011.

- ↑ Blackstone, Brian (2011). "ECB Raises Interest Rates – MarketWatch". marketwatch.com. Retrieved 14 July 2011.

- ↑ "ECB: Key interest rates". 2011. Retrieved 29 August 2011.

- ↑ "Draghi slashes interest rates, unveils bond buying plan". Europe News.Net. 4 September 2014. Retrieved 5 September 2014.

- ↑ wikisource consolidation

- 1 2 THE EUROPEAN CENTRAL BANK HISTORY, ROLE AND FUNCTIONS BY HANSPETER K. SCHELLER SECOND REVISED EDITION 2006, ISBN 92-899-0022-9 (print) ISBN 92-899-0027-X (online) page 81 at the pdf online version

- ↑ "Powers and responsibilities of the European Central Bank". European Central Bank. Archived from the original on 16 December 2008. Retrieved 10 March 2009.

- ↑ THE EUROPEAN CENTRAL BANK HISTORY, ROLE AND FUNCTIONS BY HANSPETER K. SCHELLER SECOND REVISED EDITION 2006, ISBN 92-899-0022-9 (print) ISBN 92-899-0027-X (online) page 87 at the pdf online version

- ↑ "ECB: Monetary Policy". Retrieved 14 September 2014.

- 1 2 Fairlamb, David; Rossant, John (12 February 2003). "The powers of the European Central Bank". BBC News. Retrieved 16 October 2007.

- 1 2 3 4 "ECB: Governing Council". ECB. ecb.int. 1 January 2002. Retrieved 28 October 2011.

- ↑ "Distribution of responsibilities among the Members of the Executive Board of the ECB" (PDF). line feed character in

|title=at position 39 (help) - ↑ Article 11.2 of the ESCB Statute

- 1 2 Marsh, David, "Cameron irritates as euro’s High Noon approaches", MarketWatch, 28 May 2012. Retrieved 29 May 2012.

- ↑ "Tag: José Manuel González-Páramo". Financial Times Money Supply blog entries. 18–23 January 2012. Retrieved 14 September 2014.

- ↑ Davenport, Claire. "EU parliament vetoes Mersch, wants woman for ECB". U.S. Retrieved 2018-10-03.

- ↑ "Mersch Named to ECB After Longest Euro Appointment Battle". Bloomberg. 23 November 2012. Retrieved 14 September 2014.

- ↑ "ECB: Decision-making bodies". Retrieved 14 September 2014.

- ↑ "Monetary policy accounts published in 2016".

- ↑ "Subscribe to read". Financial Times. Retrieved 2018-09-23.

- ↑ "Members of the Governing Council". Retrieved 22 September 2018.

- 1 2 "ECB: Governing Council". ECB. ecb.int. 1 January 2002. Retrieved 28 October 2011.

- ↑ "Composition of the European Central Bank". CVCE. Retrieved 18 February 2014.

- ↑ "ECB: General Council". European Central Bank. Retrieved 4 January 2015.

- 1 2 3 "Supervisory Board". European Central Bank. Retrieved 3 December 2015.

- ↑ "ECB Text: SSM Supervisory Board Members Appointed". Frankfurt: MNI Deutsche Börse. 7 March 2015. Retrieved 12 May 2016.

- ↑ Article 28.1 of the ESCB Statute

- ↑ Article 29 of the ESCB Statute

- ↑ Article 28.5 of the ESCB Statute

- ↑ Article 28.4 of the ESCB Statute

- ↑ Buell, Todd (29 October 2014). "Translation Adds Complexity to European Central Bank's Supervisory Role: ECB Wants Communication in English, But EU Rules Allow Use of Any Official Language". The Wall Street Journal. Retrieved 11 October 2015.

- ↑ Athanassiou, Phoebus (February 2006). "The Application of multilingualism in the European Union Context" (PDF). ECB. p. 26. Retrieved 11 October 2015.

- ↑ Bank, European Central. "The European Central Bank: independent and accountable". European Central Bank. Retrieved 2017-11-05.

- ↑ Bank, European Central. "The role of the Central Bank in the United Europe". European Central Bank. Retrieved 2017-11-05.

- ↑ Papadia, Francesco; Ruggiero, Gian Paolo (1999-02-01). "Central Bank Independence and Budget Constraints for a Stable Euro". Open Economies Review. 10 (1): 63–90. doi:10.1023/A:1008305128157. ISSN 0923-7992.

- ↑ Wood, Geoffrey. "Is the ECB Too Independent?". WSJ. Retrieved 2017-11-05.

- 1 2 "Independence". European Central Bank. Retrieved 1 December 2012.

- ↑ Bank, European Central. "Why is the ECB independent?". European Central Bank. Retrieved 2017-11-05.

- ↑ EU, Transparency International (2017-03-28). "Transparency International EU - The global coalition against corruption in Brussels". transparency.eu. Retrieved 2017-11-05.

- ↑ Friedrich Heinemann and Felix Huefner (2004) 'Is the view from the Eurotower purely European? National divergence and ECB interest rate policy', Scottish Journal of Political Economy 51(4):544-558.

- ↑ Jose Ramon Cancelo, Diego Varela and Jose Manuel Sanchez-Santos (2011) 'Interest rate setting at the ECB: Individual preferences and collective decision making', Journal of Policy Modeling 33(6): 804-820. DOI.

- ↑ "PRIVILEGES AND IMMUNITIES OF THE EUROPEAN CENTRAL BANK" (PDF). European Central Bank. 2007.

- ↑ EU, Transparency International (2017-03-28). "Transparency International EU - The global coalition against corruption in Brussels". transparency.eu. Retrieved 2017-11-05.

- ↑ Bank, European Central. "ECB to adjust schedule of meetings and to publish regular accounts of monetary policy discussions in 2015". European Central Bank. Retrieved 2017-11-05.

- ↑ "The Eurosystem – Too opaque and costly? | Bruegel". bruegel.org. Retrieved 2017-11-07.

- ↑ "Report on democratic accountability in the third phase of European Monetary Union - Committee on Economic and Monetary Affairs and Industrial Policy - A4-0110/1998". www.europarl.europa.eu. Retrieved 2018-10-08.

- ↑ Bank, European Central. "The evolution of the ECB's accountability practices during the crisis". European Central Bank. Retrieved 2018-10-08.

- ↑ "Accountability". European Central Bank. Retrieved 15 October 2007.

- ↑ "Monetary dialogue | ECON Policies | ECON | Committees | European Parliament". www.europarl.europa.eu. Retrieved 2017-10-06.

- ↑ "Questions to the ECB | Documents | ECON | Committees | European Parliament". www.europarl.europa.eu. Retrieved 2017-10-06.

- ↑ "Executive Board" (PDF). Banque de France. 2005. Retrieved 23 July 2012.

- ↑ "Interinstitutional Agreement between the European Parliament and the European Central Bank on the practical modalities of the exercise of democratic accountability and oversight over the exercise of the tasks conferred on the ECB within the framework of the Single Supervisory Mechanism" (PDF). line feed character in

|title=at position 94 (help) - ↑ George Matlock (16 February 2010). "Peripheral euro zone government bond spreads widen". Reuters. Retrieved 28 April 2010.

- ↑ "Acropolis now". The Economist. 29 April 2010. Retrieved 22 June 2011.

- ↑ Brian Blackstone; Tom Lauricella; Neil Shah (5 February 2010). "Global Markets Shudder: Doubts About U.S. Economy and a Debt Crunch in Europe Jolt Hopes for a Recovery". The Wall Street Journal. Retrieved 10 May 2010.

- ↑ "Former Iceland Leader Tried Over Financial Crisis of 2008", The New York Times, 5 March 2012. Retrieved 30 May 2012.

- ↑ "Greek/German bond yield spread more than 1,000 bps". Financialmirror.com. 28 April 2010. Missing or empty

|url=(help) - ↑ "Gilt yields rise amid UK debt concerns". Financial Times. 18 February 2010. Retrieved 15 April 2011. (registration required)

- ↑ "The politics of the Maastricht convergence criteria | vox – Research-based policy analysis and commentary from leading economists". Voxeu.org. 15 April 2009. Retrieved 1 October 2011.

- ↑ Bagus, The Tragedy of the Euro, 2010, p.75.

- ↑ Orphanides, Athanasios (2018-03-09). "Monetary policy and fiscal discipline: How the ECB planted the seeds of the euro area crisis". VoxEU.org. Retrieved 2018-09-22.

- ↑ Bank, European Central. "Introductory statement with Q&A". European Central Bank. Retrieved 2018-10-03.

- ↑ Bank, European Central. "ECB decides on measures to address severe tensions in financial markets". European Central Bank. Retrieved 2018-09-22.

- ↑ "Mixed support for ECB bond purchases". Retrieved 2018-09-22.

- ↑ McManus, John; O'Brien, Dan (5 August 2011). "Market rout as Berlin rejects call for more EU action". Irish Times.

- 1 2 3 "WOrking paper 2011 / 1 A Comprehensive approach to the EUro-area debt crisis" (PDF). Zsolt Darvas. Corvinus University of Budapest. February 2011. Retrieved 28 October 2011.

- ↑ "The ECB's Securities Market Programme (SMP) – about to restart bond purchases?" (PDF). Global Markets Research – International Economics. Commonwealth Bank. 18 June 2012. Retrieved 21 April 2013.

- ↑ "The ECB as vulture fund: how central banks speculated against Greece and won big - GUE/NGL - Another Europe is possible". www.guengl.eu. Retrieved 2018-09-25.

- ↑ "How Greece lost billions out of an obscure ECB programme". Positive Money Europe. 2018-07-25. Retrieved 2018-09-25.

- ↑ Bank, European Central. "Irish letters". European Central Bank. Retrieved 2018-10-03.

- ↑ Reilly, Gavan. "Report: ECB rules out long-term bond to replace promissory note". TheJournal.ie. Retrieved 2018-10-03.

- ↑ "Chopra: ECB refusal to burn bondholders burdened taxpayers". The Irish Times. Retrieved 2018-10-03.

- ↑ O'Connell, Hugh. "Everything you need to know about the promissory notes, but were afraid to ask". TheJournal.ie. Retrieved 2018-10-03.

- ↑ Mario Draghi; President of the ECB; Vítor Constâncio; Vice-President of the ECB (8 December 2011). "Introductory statement to the press conference (with Q&A)" (Press conference). Frankfurt am Main: European Central Bank. Retrieved 22 December 2011.

- ↑ Nelson D. Schwartz; David Jolly (21 December 2011). "European Bank in Strong Move to Loosen Credit". The New York Times. Retrieved 22 December 2011.

the move, by the European Central Bank, could be a turning point in the Continent's debt crisis

- ↑ Floyd Norris (21 December 2011). "A Central Bank Doing What It Should" (Analysis). The New York Times. Retrieved 22 December 2011.

- ↑ Wearden, Graeme; Fletcher, Nick (29 February 2012). "Eurozone crisis live: ECB to launch massive cash injection". The Guardian. London. Retrieved 29 February 2012.

- ↑ Ewing, Jack; Jolly, David (21 December 2011). "Banks in the euro zone must raise more than 200bn euros in the first three months of 2012". New York Times. Retrieved 21 December 2011.

- ↑ Wearden, Graeme; Fletcher, Nick (29 February 2012). "Eurozone crisis live: ECB to launch massive cash injection". Guardian. London. Retrieved 29 February 2012.

- 1 2 "€529 billion LTRO 2 tapped by record 800 banks". Euromoney. 29 February 2012. Retrieved 29 February 2012.

- ↑ Bank, European Central. "Verbatim of the remarks made by Mario Draghi". European Central Bank. Retrieved 2018-09-25.

- ↑ "Introductory statement to the press conference (with Q&A)".

- ↑ Ewing, Jack; Erlanger, Steven (6 September 2012). "Europe's Central Bank Moves Aggressively to Ease Euro Crisis". The New York Times.

- ↑ European Central Bank Decision of the ECB of 14 May 2010.

- ↑ "ECB press conference, 6 September 2012". Retrieved 14 September 2014.

- ↑ European Central Bank. "Introductory statement to the press conference (with Q&A)". European Central Bank. Retrieved 2018-09-25.

- ↑ "Draghi fends off German critics and keeps stimulus untouched". Financial Times. 27 April 2017.

- ↑ Minder, Raphel (24 November 2010). "Fears Mount Over Spain and Risks to the Euro". The New York Times. Retrieved 24 November 2010.

- 1 2 3 4 5 Buite, Willem (7 September 2010). "Greece and the fiscal crisis in the EMU" (PDF). NBER. Retrieved 30 October 2011.

- ↑ "Euro zone bonds rally after ECB debt buying". Irish Times. 2 December 2010. (subscription required)

- ↑ Walker, Marcus (17 December 2010). "Closer Fiscal Union: A Collective Guarantee". Wall Street Journal.

- 1 2 Nixon, Simon (7 December 2010). "A Way Around European Bonds". Wall Street Journal.

- 1 2 3 Walker, Marcus & Forelle, Charles (17 December 2010). "Bailout Deal Fails to Quell EU rifts". Wall Street Journal.

- 1 2 "Aggregated balance sheet of euro area monetary financial institutions, excluding the Eurosystem". ECB.int.

- ↑ "The European Central Bank (ECB)". Europa (web portal). Retrieved 16 October 2007.

- ↑ Lander, Mark (14 August 2007). "Credit Squeeze Puts Europe's Bank in Spotlight". New York Times. Retrieved 16 October 2007.

- ↑ "ECB press release on dollar liquidity". ECB.

- ↑ "Bundesbank President Dismisses Deflation, Increases Tension At ECB". Fast Company. 24 February 2016.

- 1 2 "All about the European debt crisis: In SIMPLE terms". rediff business. rediff.com. 19 August 2011. Retrieved 28 October 2011.

- ↑ "Open Market Operation – Fedpoints – Federal Reserve Bank of New York". Federal Reserve Bank of New York. newyorkfed.org. August 2011. Retrieved 29 October 2011.

- 1 2 3 4 Ben S. Bernanke (1 December 2008). "Federal Reserve Policies in the Financial Crisis" (Speech). Greater Austin Chamber of Commerce, Austin, Texas: Board of Governors of the Federal Reserve System. Retrieved 23 October 2011.

To ensure that adequate liquidity is available, consistent with the central bank's traditional role as the liquidity provider of last resort, the Federal Reserve has taken a number of extraordinary steps.

- ↑ In practice, 400–500 banks participate regularly.

Samuel Cheun; Isabel von Köppen-Mertes; Benedict Weller (December 2009), The collateral frameworks of the Eurosystem, the Federal Reserve System and the Bank of England and the financial market turmoil (PDF), ECB, retrieved 24 August 2011 - 1 2 Bertaut, Carol C. (2002). "The European Central Bank and the Eurosystem" (PDF). New England Economic Review (2nd quarter): 25–28.

- ↑ "Treaty of Amsterdam amending the Treaty on European Union, the Treaties establishing the European Communities and certain related acts" (published 23 December 2014). 11 October 1997. Protocol on the institutions with the prospect of enlargement of the European Union, Article 2, sole article, (i). Retrieved 4 January 2015.

- 1 2 "Winning design by Coop Himmelb(l)au for the ECB's new headquarters in Frankfurt/Main". European Central Bank. Archived from the original on 24 September 2007. Retrieved 2 August 2007.

- ↑ "Launch of a public tender for a general contractor to construct the new ECB premises". European Central Bank. Retrieved 2 August 2007.

- ↑ Dougherty, Carter. "In ECB future, a new home to reflect all of Europe". Int. Her. Trib. Archived from the original on 19 September 2008. Retrieved 2 August 2007.

- ↑ European Central Bank. "Overview". Ecb.europa.eu. Retrieved September 2015. Check date values in:

|accessdate=(help)

External links

| Wikimedia Commons has media related to European Central Bank. |

| Wikisource has original text related to this article: |

- European Central Bank, official website.

- The origins and development of the European organisations: The European Central Bank, CVCE.eu website.

- European Central Bank: history, role and functions, ECB website.

- Statute of the European Central Bank (2012)